Feeling the pressure of fast markets when scalping? It’s tough spotting reliable signals when prices move in the blink of an eye, often leading to missed chances or frustrating losses. While finding a good forex trading broker helps, success in scalping hinges on reading immediate price action. That’s where understanding the best candlestick patterns for scalping comes in. These visual patterns cut through the noise, offering clues about market sentiment right now. This article breaks down the essential candlestick patterns scalpers rely on, showing you how to spot them and use the best candlestick patterns for scalping effectively in your strategy.

Intro to Scalping and Candlesticks

Before we jump into the specific patterns, let’s quickly get on the same page about what scalping involves and why candlesticks are such a fantastic tool for this fast-paced trading style, especially when hunting for the best candlestick patterns for scalping.

What is Scalping?

Think of scalping as the sprinting of the trading world. It’s a style focused on making a high volume of trades to capture small, consistent profits. Scalpers aren’t aiming for home runs; they’re looking for base hits, over and over again. Positions are often held for mere seconds or minutes, capitalizing on tiny price movements. Success requires intense concentration, rapid decision-making, and usually, an environment with very low transaction costs (spreads) and quick execution. It’s about frequency and precision.

Why Use Candlesticks for Scalping?

Candlestick charts are practically tailor-made for scalpers. Here’s why they’re so popular:

- Instant Insights: Candlesticks give you a visual snapshot of price action for a specific period immediately. No waiting for indicators to catch up; you see the open, high, low, and close right away.

- Market Mood Ring: The shape and color of a candle tell a story about the battle between buyers and sellers. Long bodies show strength, long wicks show rejection – it’s visual sentiment analysis at a glance, perfect for quick reads.

- Pure Price Action: Scalping lives and dies by price action. Candlesticks are price action, distilled into an easy-to-understand format, making them ideal for identifying those fleeting best candlestick patterns for scalping.

The Importance of Short Timeframes

Scalpers live on the fast lanes – typically the 1-minute (M1) and 5-minute (M5) charts. Why? Because these charts zoom right into the micro-movements where scalping opportunities hide. While looking at a slightly longer timeframe (like the 15-minute or hourly) can give you a sense of the overall current or support/resistance, the actual scalping trades are triggered by signals spotted on these super short charts. Learning to spot reliable patterns quickly here is key. This makes finding the best candlestick pattern for 5 minute chart scalping a crucial skill.

Understanding Candlestick Basics Briefly

Let’s do a super quick recap of what makes up a candlestick before we dive into the patterns scalpers love. Understanding this foundation is crucial for effectively identifying the best candlestick patterns for scalping.

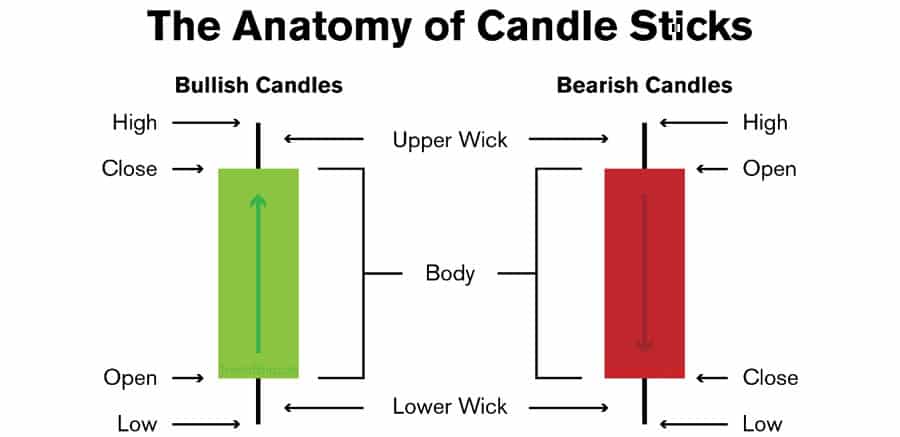

Anatomy of a Candlestick

Every candle tells you four key price points over its time period (like one minute):

- Body: The rectangle part. Shows the distance between the opening price and closing price. Usually green/white if price closed higher, red/black if it closed lower.

- Wicks (Shadows): The lines sticking out from the top and bottom of the body. The top wick shows the highest price hit; the bottom wick shows the lowest price hit during that period.

- Open: Price at the start of the candle’s time period.

- High: The absolute peak price reached.

- Low: The absolute bottom price reached.

- Close: Price at the very end of the candle’s time period.

What Candlesticks Reveal about Sentiment

Think of each candle as a mini-story. A long green body? Buyers were likely in control. A long red body? Sellers dominated. Long wicks mean there was a fight – price went high or low but got pushed back, indicating rejection or uncertainty. Tiny bodies (like in a Doji) often signal indecision, a pause before the next move. Getting this language helps decode the market’s mood second by second, essential for using scalping strategies using candlestick patterns.

Best Candlestick Patterns for Scalping Strategies

Alright, let’s get to the good stuff: the specific patterns that scalpers often watch for. Remember, context is everything, but these patterns can provide valuable entry and exit signals when used correctly. These are often considered the most profitable candlestick patterns for scalping when applied within a solid framework, representing some of the best candlestick patterns for scalping overall.

Hammer and Hanging Man

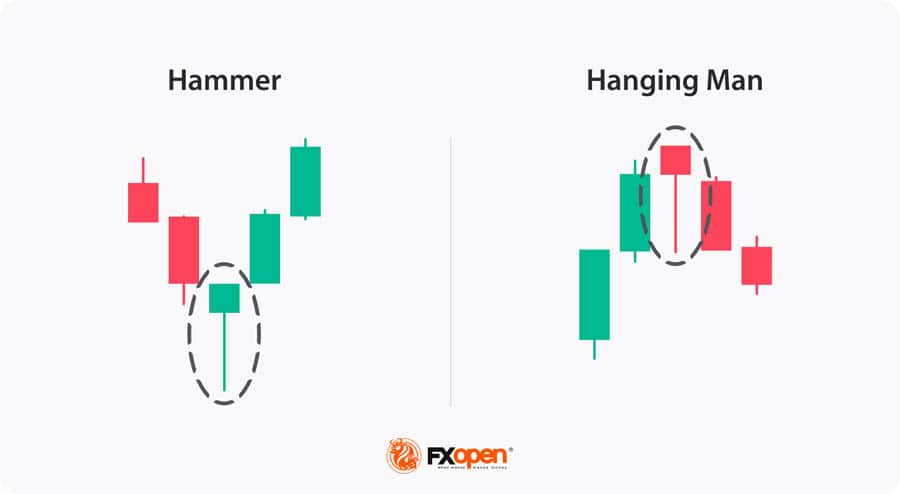

These look identical but tell different stories based on where they appear. They’re single candles hinting at a possible reversal.

Identification Criteria

Picture a small body near the top, with a long lower wick (at least twice the body’s height) and barely any upper wick. If it shows up after a price drop (downtrend), it’s a Hammer. If it appears after a price rise (uptrend), it’s a Hanging Man.

Scalping Implications

A Hammer suggests sellers tried to push prices down, but buyers came in strong, closing near the high. For a scalper, this could signal a potential bullish reversal – maybe look for a long entry if the price breaks above the Hammer’s high (stop below its low). A Hanging Man, though looking the same, suggests selling pressure emerged even though the trend was up. It hints that the buying momentum might be fading. Scalpers might eye a short entry if the price drops below the Hanging Man’s low (stop above its high). Confirmation from the next candle is always wise!

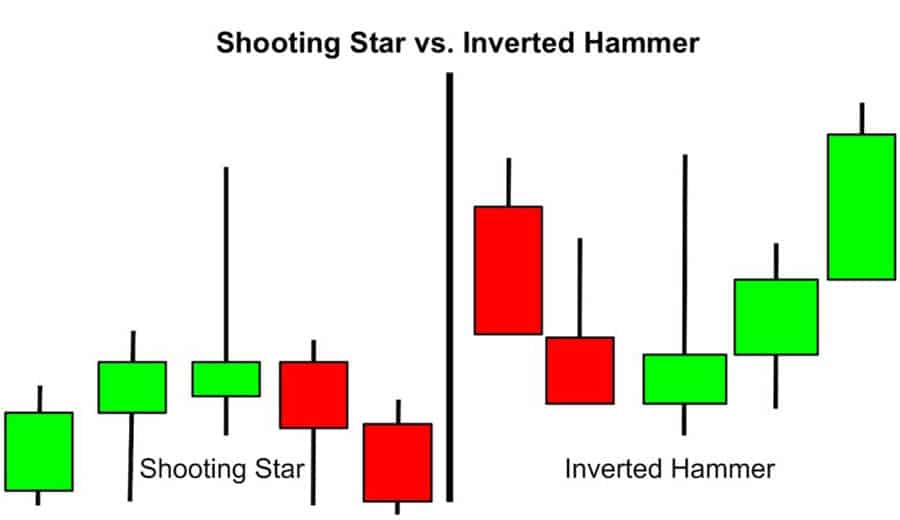

Inverted Hammer and Shooting Star

Flip the Hammer/Hanging Man upside down, and you get these two. Again, context is key.

Identification Criteria

These have a small body near the bottom of the candle, a long upper wick (at least twice the body), and little to no lower wick. An Inverted Hammer forms after a downtrend; a Shooting Star forms after an uptrend.

Scalping Implications

The Inverted Hammer shows buyers tried to rally but got pushed back down. In a downtrend, this can surprisingly signal that some buying interest is present. Scalpers might wait for the next candle – if it closes strongly above the Inverted Hammer’s high, it confirms bullish potential. The Shooting Star after an uptrend is more straightforwardly bearish: buyers pushed up, sellers smacked them back down. It’s a warning sign of a potential top. Scalpers might look for short entries below the Shooting Star’s low, placing a stop above its high. These are popular candidates for the best candlestick pattern for 5 minute chart scalping when looking for tops and bottoms.

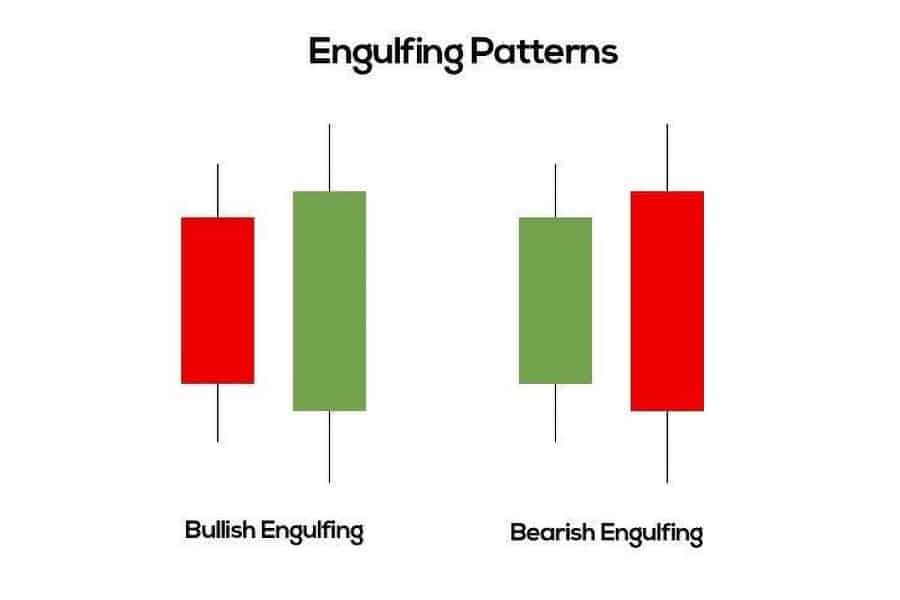

Engulfing Patterns (Bullish and Bearish)

These are powerful two-candle reversal patterns that show a decisive shift in control.

Identification Criteria

A Bullish Engulfing happens after a downtrend: a small bearish candle is completely swallowed (body-wise) by the next, larger bullish candle. A Bearish Engulfing happens after an uptrend: a small bullish candle is engulfed by the next, larger bearish candle’s body.

Scalping Implications

Engulfing patterns scream “momentum shift!” The Bullish Engulfing shows buyers have overwhelmed sellers – a potential bottom is forming. Scalpers might go long above the high of the big bullish candle, stop below its low. The Bearish Engulfing shows sellers took charge – a potential top. Scalpers might go short below the low of the big bearish candle, stop above its high. Their clear signal makes them favourites among the most profitable candlestick patterns for scalping.

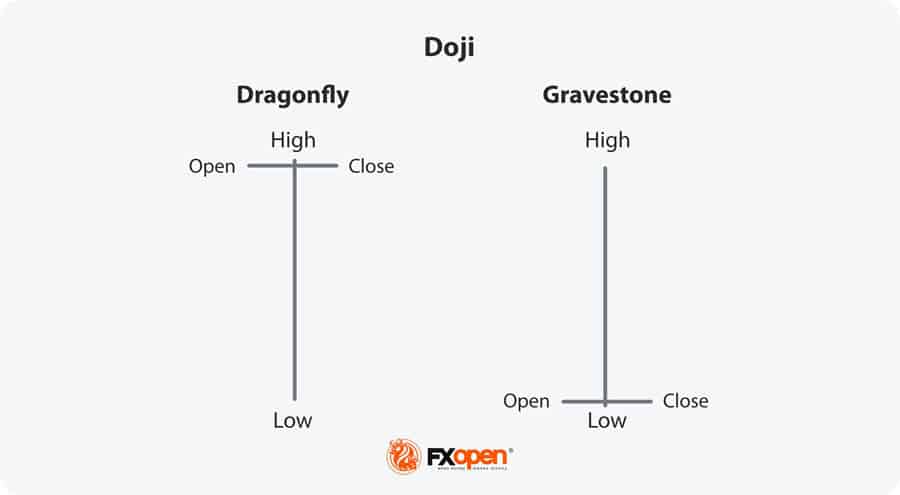

Doji Variations

Doji candles are all about indecision – the market taking a breather.

Identification Criteria

The hallmark of a Doji is that the open and close prices are almost identical, resulting in a tiny (or non-existent) body. It often looks like a plus sign or a cross. Key variations include:

- Dragonfly Doji: Long lower wick, no upper wick (open=high=close). Buyers defended lower prices.

- Gravestone Doji: Long upper wick, no lower wick (open=low=close). Sellers defended higher prices.

Scalping Implications

A Doji signals equilibrium and potential change. After a move up or down, a Doji suggests the dominant force is pausing. It’s not an entry signal itself, but a heads-up. A Dragonfly after a drop hints at bullish potential (if confirmed by the next candle). A Gravestone after a rise hints at bearish potential (if confirmed). A standard Doji just shows balance; scalpers often watch for the price to break out of the Doji’s high/low range for a quick entry signal.

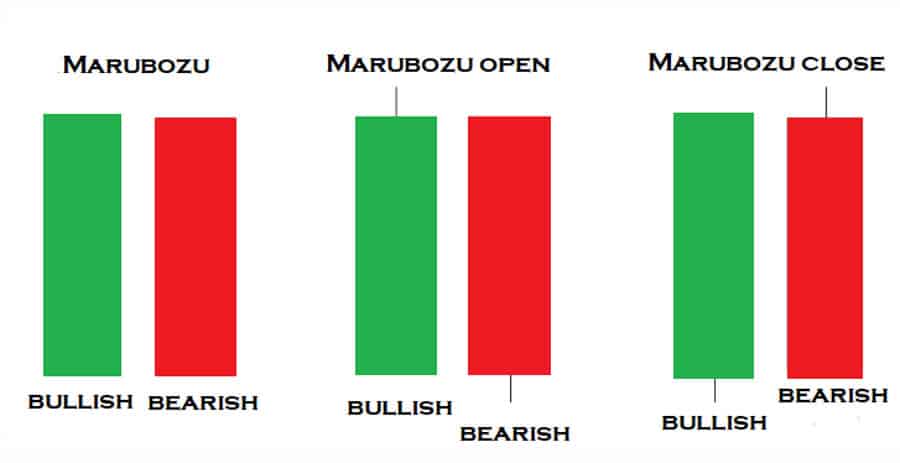

Marubozu (Bullish and Bearish)

These represent total control by one side – pure momentum.

Identification Criteria

A Marubozu is a long candle with no wicks (or maybe tiny ones). A Bullish Marubozu (green/white) opens at its low and closes at its high. A Bearish Marubozu (red/black) opens at its high and closes at its low.

Scalping Implications

These show extreme conviction. In scalping, they often suggest the current micro-trend will continue, at least briefly. Seeing a Bullish Marubozu in a quick uptrend might offer a chance for a very short continuation scalp. Same logic applies to a Bearish Marubozu in a downtrend. The caution for scalpers is entering after a huge Marubozu – you might be buying the peak or selling the bottom just before a pullback. Some use smaller Marubozu candles breaking consolidation.

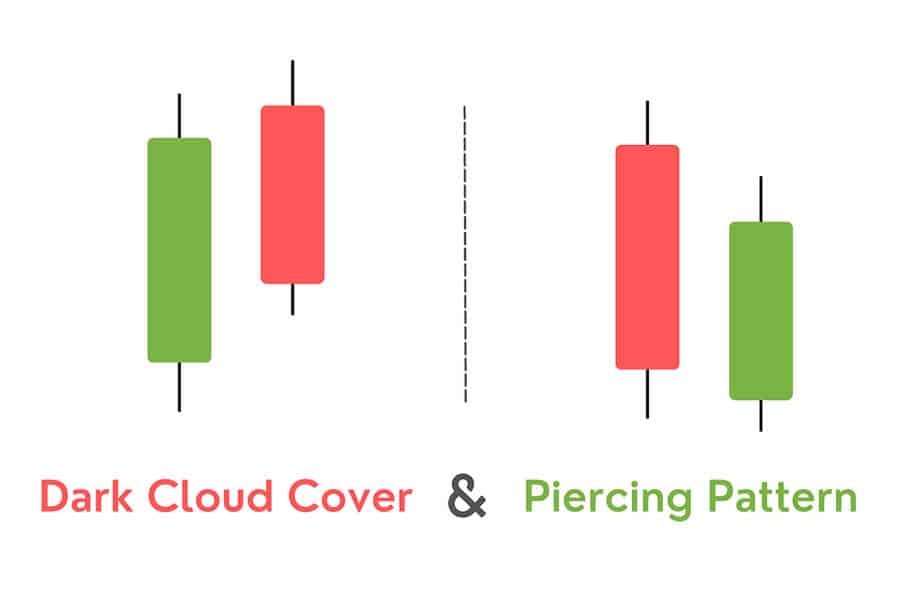

Piercing Line and Dark Cloud Cover

These two-candle patterns are like slightly weaker versions of the Engulfing patterns, signalling potential reversals.

Identification Criteria

The Piercing Line appears after a downtrend. First a bearish candle, then a bullish candle that opens lower but manages to close more than halfway up the body of the first candle. Dark Cloud Cover appears after an uptrend. First a bullish candle, then a bearish candle that opens higher but closes more than halfway down the body of the first candle.

Scalping Implications

The Piercing Line suggests buyers are starting to push back. Scalpers might see it as an early sign of a bottom, potentially entering long if price clears the high of the second candle. Dark Cloud Cover suggests sellers are gaining traction. Scalpers might interpret it as an early top warning, considering shorts if price breaks the low of the second candle. They fit well into many scalping strategies using candlestick patterns.

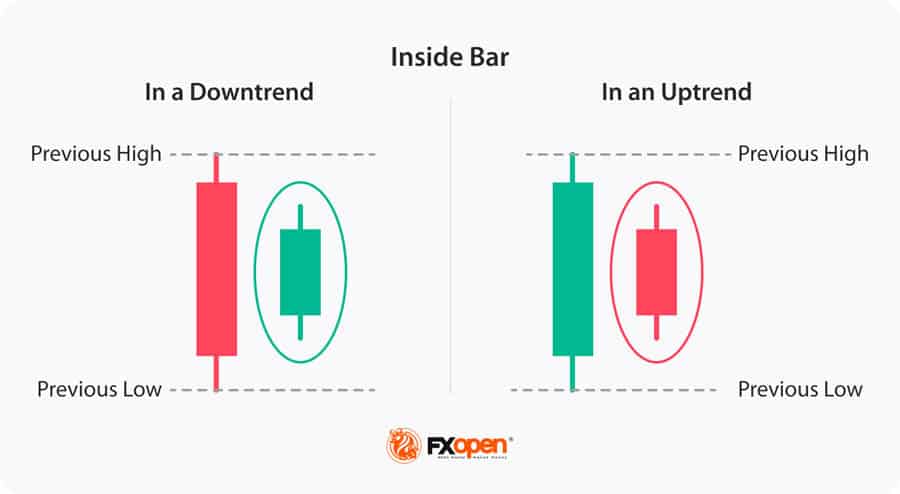

Inside Bar

This pattern signals a pause, a coiling spring often ready for a breakout.

Identification Criteria

An Inside Bar is simply a candle whose entire price range (high to low) fits inside the range of the candle immediately before it (the “mother bar”).

Scalping Implications

Inside Bars mean volatility has temporarily shrunk. Scalpers love this because it often precedes a volatility expansion – a breakout. The strategy is straightforward: anticipate a break of the mother bar’s high or low. A break above suggests a potential long scalp; a break below suggests a potential short scalp. Stops are typically placed just on the other side of the mother bar. Inside Bar breakouts are a classic tactic when seeking the best candlestick patterns for scalping volatility bursts.

How to Use Candlesticks in Scalping Effectively

Spotting the best candlestick patterns for scalping is great, but making money requires more. It’s about using them smartly within a plan, constantly refining your approach to find the best candlestick patterns for scalping in your specific market conditions.

Identifying Patterns on Short Timeframes

Finding reliable patterns on M1 or M5 charts amidst the ‘noise’ takes practice. Here are some tips:

- Screen Time: There’s no substitute for practice. Use a demo account to train your eyes to spot your chosen patterns quickly and accurately.

- Keep it Simple: Don’t try to track ten patterns at once initially. Master one or two high-probability ones first.

- Clean Charts: Resist adding too many indicators that obscure the candles themselves. Price action should be primary.

- Location, Location, Location: A perfect Hammer pattern forming at a major support level is far more significant than one appearing randomly mid-range. Context dramatically increases reliability.

Entry and Exit Signals Based on Patterns

Patterns give you potential triggers. Generally:

- Bullish Patterns (Hammer, Bullish Engulfing): Look to enter long when the price breaks slightly above the high of the pattern.

- Bearish Patterns (Shooting Star, Bearish Engulfing): Look to enter short when the price breaks slightly below the low of the pattern.

- Inside Bar: Enter on the break of the mother bar’s high (long) or low (short).

Scalping exits are usually quick: either a small, fixed profit target (like 5-10 pips, depending on the market) or a tight trailing stop loss to lock in gains on fast moves.

The Importance of Context

This can’t be stressed enough: patterns don’t work in a vacuum, especially in scalping. Always consider:

- The Micro-Trend: Is the M5 or M15 chart generally pointing up or down? Trading patterns with this tiny trend is usually safer than fighting it.

- Key Levels: Is the pattern forming right at a known support or resistance line, a pivot point, or bouncing off a moving average? These areas act like magnets and rejection points, making patterns there more meaningful. Finding the best candlestick patterns for scalping often involves finding them at these key junctures.

Read More: strongest candlestick patterns

Confirmation is Key

Don’t just jump in the moment you see a pattern! Seek confirmation to avoid false signals, which are common on low timeframes.

- The Next Candle: Did the candle after your pattern confirm the expected direction? (e.g., a bullish candle after a Hammer).

- Volume Boost: Did volume increase significantly on the pattern candle or the breakout candle? This shows conviction.

- Indicator Support: Does an indicator agree? (e.g., RSI leaving oversold territory as a Bullish Engulfing forms).

Waiting for a little confirmation often filters out weaker setups and helps focus on the truly best candlestick patterns for scalping.

Combining Candlesticks with Other Tools

The sharpest scalping strategies using candlestick patterns blend them with other technical tools for a clearer picture. This combination helps pinpoint the best candlestick patterns for scalping with higher probability.

Using Indicators for Confirmation

Indicators can act as great filters or confirmation sources:

- Volume: Absolutely crucial. High volume on a reversal pattern (like the engulfing candle) or a breakout candle adds significant weight. Low volume suggests hesitation.

- RSI/Stochastics: Check if the market is overbought or oversold when a reversal pattern appears. A Shooting Star with RSI above 70 is stronger than one appearing mid-range. Look for divergence too!

- MACD: Can confirm shifts in momentum suggested by candles. A bullish MACD crossover aligning with a Piercing Line adds confluence.

- Moving Averages (MAs): Use them as dynamic support/resistance. A Hammer bouncing perfectly off the 20-period EMA on an M5 chart? That’s a stronger signal. Their slope also helps define the micro-trend.

- Bollinger Bands: Price hitting the upper band plus a Bearish Engulfing? Potential short setup. Price hitting the lower band plus a Hammer? Potential long setup.

Integrating Volume Analysis

Let’s emphasize volume again. For scalpers using candlesticks, volume provides crucial context. A strong reversal pattern like a Bullish Engulfing should ideally happen on higher-than-average volume – it shows real participation driving the reversal. A breakout from an Inside Bar on pathetic volume is suspect. Conversely, if a trend seems to be losing steam (price keeps rising, but volume is dropping), a subsequent bearish reversal pattern might be more reliable.

Developing a Complete Scalping Strategy

A full strategy is a rulebook. It clearly defines:

- Your chosen patterns (the best candlestick patterns for scalping that resonate with your trading style and tested performance).

- Timeframes (e.g., M5 for signals, M15/H1 for overall direction).

- Market conditions (e.g., only trade during specific sessions, only near key levels).

- Confirmation checklist (e.g., Pattern + Volume Spike + MA Bounce).

- Exact entry trigger.

- Strict exit rules (stop-loss placement, profit target logic).

- Risk management rules (percent risk per trade).

Risk Management for Candlestick Scalping

Scalping is fast and furious. Without iron-clad risk management, even the best candlestick patterns for scalping won’t save you. Discipline here is paramount.

Setting Stop-Loss Orders

This is non-negotiable. Every scalp trade needs a stop-loss set before you enter. Where to place it?

- Just below the low of bullish patterns (Hammer, Bullish Engulfing, Piercing Line).

- Just above the high of bearish patterns (Shooting Star, Bearish Engulfing, Dark Cloud Cover).

- Just outside the opposite side of the mother bar for Inside Bar breakouts.

The challenge is setting it tight enough to limit risk but wide enough to avoid getting stopped out by random noise before your pattern plays out.

Position Sizing Techniques

Because you’re trading frequently, you must manage your size meticulously. The golden rule: risk only a tiny fraction of your capital on any single trade, typically 0.5% to 1% maximum. Calculate your position size based on the distance between your entry and stop-loss, ensuring that if the stop is hit, you only lose that predefined small percentage. This protects you from the inevitable losing streaks.

Risk-Reward Ratio Considerations

Honestly, achieving a positive risk-reward ratio (e.g., aiming to make more than you risk) on every scalp can be tough. Often, scalpers aim for small, high-probability wins, meaning the reward might be equal to or even slightly less than the risk. If this is your approach, you need a high win rate (well over 50%) to be consistently profitable. Focusing on the very best candlestick patterns for scalping combined with strong confirmation helps achieve this high strike rate.

Tips for Successful Candlestick Scalping

Beyond patterns and indicators, successful scalping involves mindset and environment. Finding the best candlestick patterns for scalping is just one piece of the puzzle.

Read More:mastering scalping in forex

Choosing the Right Broker

Your broker is your partner (or adversary!) in scalping. Key factors:

- Tight Spreads: Every pip counts. Look for ECN-style accounts with raw spreads + commission, often cheaper overall for frequent trading.

- Lightning Execution: Slippage (getting a worse price than expected) kills scalping profits. Fast, reliable execution is critical.

- Stable Platform: Downtime or freezes during active scalping is disastrous.

- Trust and Regulation: Always opt for a well-regarded, regulated forex broker.

The Need for Practice and Backtesting

You can’t learn to scalp from an article alone. It takes serious screen time:

- Demo Trading: Practice identifying patterns, executing trades, and managing stops in real-time market conditions without risking real money.

- Backtesting: Manually or using software, test your specific candlestick strategy rules on historical data. Does it show an edge? This helps refine rules for identifying the most profitable candlestick patterns for scalping within your system and confirm which are truly the best candlestick patterns for scalping for you.

Common Mistakes to Avoid

Scalpers often fall into these traps:

- Over-Trading: Forcing trades when no clear signal exists.

- Revenge Trading: Trying to immediately make back money after a loss (usually leads to bigger losses).

- Ignoring Context: Trading patterns against strong obvious S/R or trend context.

- Skipping Confirmation: Trading a pattern the instant it forms without waiting for any validation.

- Sloppy Risk Management: No stops, risking too much, inconsistent sizing.

link

Opofinance Services

Seeking a brokerage environment that supports demanding strategies like scalping? Opofinance, regulated by ASIC, offers a suite of tools and features tailored for today’s active traders:

- Advanced Trading Platforms: Access popular choices like MT4 and MT5, alongside the feature-rich cTrader and the intuitive OpoTrade platform, ensuring you have the right environment for your analysis and execution.

- Innovative AI Tools: Gain an edge with AI-driven insights from the AI Market Analyzer, personalized feedback via the AI Coach, and responsive AI Support for your queries.

- Social & Prop Trading Options: Connect with the trading community through social trading features or explore opportunities to trade firm capital via proprietary trading programs.

- Secure & Flexible Transactions: Manage your funds easily with secure deposit and withdrawal methods, including cryptocurrency options. Opofinance aims for smooth transactions with zero fees applied from their side (note: intermediary banks or crypto networks might impose their own fees).

Read More:scalping vs swing trading

Elevate your trading with a broker focused on technology and trader support.

Discover what Opofinance offers!

Conclusion

Scalping is a high-octane discipline requiring sharp focus and quick reflexes. Candlestick patterns are invaluable tools in this arena, offering real-time insights into market psychology. Recognizing the best candlestick patterns for scalping, like Engulfing bars, Hammers, or Inside Bars, provides crucial signals. However, these patterns shine brightest when used within a structured strategy that includes context analysis (trend, S/R), confirmation from volume or indicators, and unwavering risk management. Master these elements through practice and discipline, and focusing on the best candlestick patterns for scalping can significantly enhance your performance and potential profitability.

Key Takeaways

- Scalping targets small, frequent profits on short timeframes (M1, M5).

- Candlesticks offer immediate visual price action and sentiment clues, vital for scalping.

- Popular scalping patterns: Hammer/Hanging Man, Engulfing, Doji, Inside Bar, Shooting Star/Inverted Hammer – key components when looking for the best candlestick patterns for scalping.

- Context (trend, S/R levels) and Confirmation (volume, indicators) drastically improve pattern reliability.

- Strict risk management (stops, position sizing) is absolutely essential for survival in scalping.

- Combining patterns with other tools creates more robust scalping strategies using candlestick patterns.

- Success requires practice, discipline, and a suitable low-spread, fast-execution broker to effectively trade the best candlestick patterns for scalping.

Can I scalp profitably using only candlestick patterns?

While candlesticks are powerful, relying exclusively on them for scalping is quite risky. The ‘noise’ on short timeframes can generate many misleading patterns. Most successful scalpers combine candlestick signals with confirming evidence – like volume surges, bounces off key support/resistance, or alignment with indicators (MAs, RSI) – to increase the probability of their trades.

What is the biggest challenge when using candlesticks for scalping?

The main difficulty lies in rapidly distinguishing genuine, high-probability patterns from random fluctuations or ‘noise’ on very fast charts (like the 1-minute). Additionally, the sheer speed needed to identify a pattern, confirm it, decide on the trade, and execute it before the small opportunity vanishes requires significant practice, focus, and often, low-latency trading infrastructure.

How does market volatility affect candlestick scalping?

Volatility is a double-edged sword for scalpers. High volatility can mean more frequent and larger quick price swings, potentially offering more scalping opportunities. However, it also widens spreads, increases the risk of slippage (getting filled at a worse price), and can cause more ‘whipsaws’ or false signals that stop you out. Low volatility, conversely, might offer fewer opportunities and lead to choppy markets where patterns fail more often. Scalpers must constantly adapt their approach (e.g., adjusting stop distances or target sizes) based on the current volatility regime when trying to implement the best candlestick patterns for scalping.