Finding the best lot size for your forex account isn’t about a magic number; it’s about a personalized strategy. The ideal lot size is one that aligns perfectly with your account equity, your risk tolerance—typically 1-2% of your capital per trade—and the specific parameters of each trade, like your stop loss distance. It’s the cornerstone of responsible risk management, a crucial skill when engaging with any online forex broker. For a trader with a $500 account, the best lot size for their strategy will be vastly different from a trader with a $10,000 account. This guide will walk you through exactly how to determine the perfect lot size for any account size, ensuring you can trade with confidence while protecting your capital. We’ll explore the formulas, provide concrete examples for various account balances, and demystify the relationship between lot size, leverage, and your long-term success in the markets.

Key Takeaways

- No One-Size-Fits-All: The best lot size for your account is dynamic and depends on your account balance, risk tolerance, and the specifics of each trade.

- The 1-2% Rule is King: Never risk more than 1-2% of your trading account on a single trade. This is the foundation of sustainable trading.

- Calculation is Key: Use a simple formula—

Lot Size = (Account Risk $) / (Stop Loss in Pips * Pip Value)—to determine your precise position size for every trade. - Start Small: New traders and those with smaller accounts (under $1,000) should almost exclusively use micro (0.01) and nano (0.001) lots to manage risk effectively.

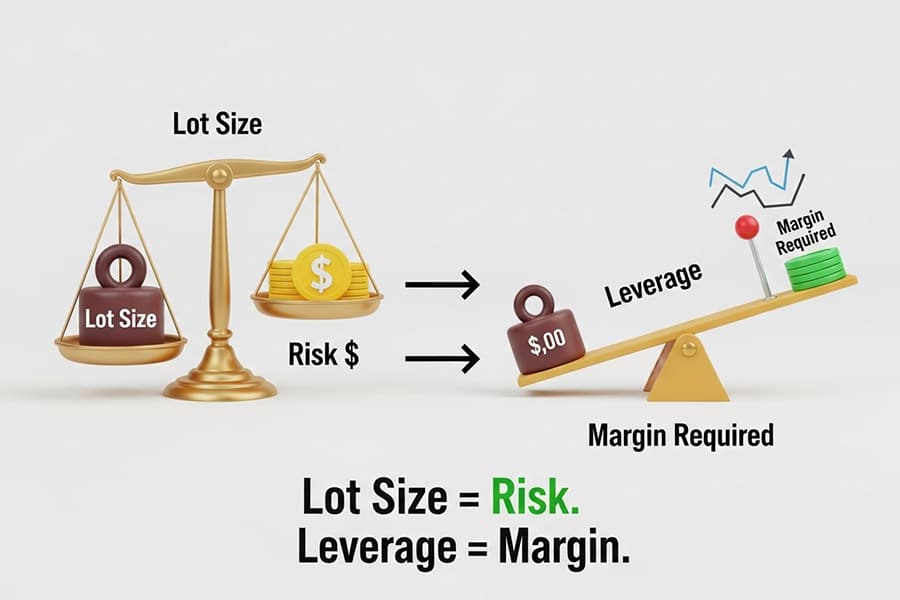

- Lot Size, Not Leverage: Your lot size determines your risk, not your leverage. Leverage is a tool that affects margin, but your position size dictates how much you stand to win or lose.

Understanding Forex Lot Sizes: A Primer

Before we can pinpoint the best lot size for your specific situation, it’s essential to grasp what a lot is and why it’s arguably the most critical variable you control in every trade. Getting this wrong is like trying to build a house on a foundation of sand; it’s only a matter of time before things come crashing down. From my own journey, I can tell you that mastering position sizing was the turning point from erratic results to consistent growth.

What is a Lot in Forex Trading?

In the simplest terms, a lot in forex trading is a standardized unit of measurement. It defines the volume or quantity of a currency you are buying or selling. Just as you buy eggs by the dozen or gasoline by the gallon, currencies are traded in lots. Brokers offer various lot sizes to accommodate traders with different capital levels, which allows for greater accessibility and more precise risk management.

Why Lot Size Is Critical for Risk Management

Your chosen lot size directly determines how much money you risk on a trade. A larger lot size means that each pip movement in the exchange rate has a greater monetary value. Therefore, a small price move against your position could lead to a significant loss if your lot size is too large for your account. Conversely, a correctly sized lot ensures that even if a trade hits your stop loss, the resulting loss is a small, manageable percentage of your total capital, allowing you to trade another day.

- Standard Lot (1.0): A standard lot represents 100,000 units of the base currency. For most currency pairs, each pip movement with a standard lot is worth approximately $10. This size is typically reserved for institutional traders or retail traders with very large, well-capitalized accounts. Using a standard lot on a small account is the fastest way to a margin call.

- Mini Lot (0.10): A mini lot is one-tenth of a standard lot, representing 10,000 units of the base currency. With a mini lot, each pip movement is worth about $1. Mini lots offer more flexibility and are a popular choice for intermediate traders who have built up a moderately sized account.

- Micro Lot (0.01): A micro lot is one-tenth of a mini lot, representing 1,000 units of the base currency. Here, each pip move is worth approximately $0.10 (10 cents). Micro lots are the go-to for many retail traders, especially those starting out. They are essential for finding the best lot size for accounts under a few thousand dollars, as they allow for highly granular risk control.

- Nano Lot (0.001): A nano lot represents 100 units of the base currency, where each pip is worth about $0.01 (1 cent). While not offered by all brokers, nano lots are invaluable for traders with very small accounts (e.g., under $100) or those testing a new strategy with minimal risk. They provide the ultimate level of precision in position sizing.

Read More: what lot size is good for $100 Forex account?

The Core Principle: The 1-2% Risk Rule

The most important rule in trading, one that has saved my account more times than I can count, is the percentage risk model. The industry standard, and a rule you should treat as absolute, is to risk no more than 1-2% of your account balance on any single trade. A 1% risk is ideal for beginners, while more experienced traders might push it to 2% on high-conviction setups. This principle is the bedrock upon which you will determine the best lot size for your trades.

How to Apply the Percentage Risk Model

Applying this rule is straightforward. You simply decide on a percentage you are comfortable risking and apply it to your current account balance. If your account grows, the dollar amount you risk per trade increases. If you experience a drawdown and your account shrinks, the dollar amount you risk automatically decreases. This dynamic adjustment is a built-in protective mechanism that prevents you from chasing losses and helps preserve your capital during losing streaks.

Calculating Your Risk Per Trade in Dollars

Let’s make this tangible. To find your maximum risk in dollars for any given trade, you use this simple calculation:

Account Balance x Risk Percentage = Risk in Dollars ($)

For example:

- If you have a $500 account and a 2% risk rule: $500 x 0.02 = $10 risk per trade.

- If you have a $5,000 account and a 1% risk rule: $5,000 x 0.01 = $50 risk per trade.

- If you have a $10,000 account and a 2% risk rule: $10,000 x 0.02 = $200 risk per trade.

This dollar amount is the only thing you need to know before moving on to calculate your exact lot size. It is your line in the sand; it’s the maximum you will allow yourself to lose on that specific trade idea.

How to Calculate the Perfect Lot Size

With your risk per trade defined in dollars, you can now calculate the precise lot size for your trade. This isn’t guesswork; it’s a mathematical formula that ensures your risk is always aligned with your plan. Forgetting to do this calculation is a cardinal sin in trading. It’s the equivalent of a pilot taking off without checking the fuel gauge.

Step 1: Determine Your Account Risk ($)

As we just covered, this is the first and most crucial step. Based on your account balance and chosen risk percentage (1-2%), calculate the maximum dollar amount you are willing to lose on this trade. For this example, let’s say you have a $2,000 account and have decided on a conservative 1.5% risk.

Your Account Risk = $2,000 x 0.015 = $30.

Step 2: Define Your Stop Loss in Pips

Your stop loss is not an arbitrary number; it should be determined by your technical analysis of the chart. It’s placed at a logical level where your trade idea would be invalidated. This could be below a recent swing low for a long position or above a swing high for a short position. The distance between your entry price and your stop-loss price is your stop loss in pips.

Let’s assume you’re looking to buy EUR/USD at 1.0750 and your analysis indicates a safe place for your stop loss is at 1.0720.

Your Stop Loss in Pips = 1.0750 – 1.0720 = 0.0030 = 30 pips.

Step 3: Calculate the Pip Value for the Pair

The pip value varies depending on the currency pair you are trading and your account’s currency. For pairs where the USD is the quote currency (the second currency listed, like in EUR/USD, GBP/USD, AUD/USD), the pip value is straightforward when using standard lot sizes:

- Standard Lot (1.0): $10/pip

- Mini Lot (0.10): $1/pip

- Micro Lot (0.01): $0.10/pip

For our calculation, we will use the pip value for a micro lot ($0.10) as a baseline, as it simplifies the final formula.

Step 4: Use the Lot Size Formula

Now, we combine all the pieces into one formula to find the perfect position size:

Lot Size = (Account Risk $) / (Stop Loss in Pips * Pip Value)

Let’s plug in our numbers:

- Account Risk $: $30

- Stop Loss in Pips: 30 pips

- Pip Value (for a 0.01 lot): $0.10

Lot Size in Micro Lots = $30 / (30 pips * $0.10)

Lot Size in Micro Lots = $30 / $3

Lot Size in Micro Lots = 10

Since one micro lot is 0.01, a lot size of 10 micro lots is 0.10, which is one mini lot. So, the best lot size for this specific trade on a $2,000 account is 0.10.

Using a Forex Lot Size Calculator for Speed

While understanding the manual calculation is vital for your development as a trader, in practice, most traders use a position size calculator. These tools are widely available online and are often built directly into trading platforms. You simply input your account currency, account balance, risk percentage, stop loss in pips, and the currency pair, and it instantly provides the correct lot size. This eliminates the chance of manual error and speeds up your execution process.

Read More: What is Lot Size in Forex?

Best Lot Size for Small Accounts (Under $1,000)

Trading with a small account presents unique challenges, primarily the psychological pressure and the limited room for error. When your capital is under $1,000, your primary objective is not to get rich quick, but to preserve your capital while honing your skills. This makes finding the best lot size for your trades an exercise in extreme discipline. The micro and nano lot are your best friends here.

Best Lot Size for a $50 Forex Account

With a $50 account, your margin for error is razor-thin. Many would argue this amount is too small to trade effectively, but if it’s what you have, it can be done with meticulous risk management.

Risking 2% ($1): The Nano Lot Advantage

A 2% risk on a $50 account is just $1. Let’s say you identify a trade on GBP/JPY with a 25-pip stop loss. Using our formula:

- Account Risk: $1

- Stop Loss: 25 pips

- Pip Value (for a 0.001 nano lot): ~$0.01

Lot Size (in nano lots) = $1 / (25 pips * $0.01) = $1 / $0.25 = 4 nano lots.

Your ideal lot size would be 0.004. If your broker only offers micro lots (0.01), you cannot safely take this trade, as even the smallest position size would expose you to ~$2.50 of risk, which is 5% of your account—far too high. This illustrates why nano lots are crucial for such small balances.

Impact of Leverage on a $50 Account

Leverage on a $50 account allows you to open a position in the first place, but it doesn’t change the risk calculation. A broker might offer 500:1 leverage, but using it to open a large position would wipe out your account with a tiny price movement against you. Leverage is a tool for entry, not a justification for oversized risk.

Best Lot Size for a $100 Forex Account

Doubling the account to $100 provides a little more breathing room, but the principles remain the same. Conservative risk management is non-negotiable.

Without Leverage: Nano Lots for Max Safety

Risking 2% on a $100 account gives you $2 to play with per trade. Let’s imagine a EUR/USD trade with a 20-pip stop loss.

- Account Risk: $2

- Stop Loss: 20 pips

- Pip Value (for a 0.01 micro lot): $0.10

Lot Size (in micro lots) = $2 / (20 pips * $0.10) = $2 / $2 = 1 micro lot.

In this case, a 0.01 lot size is perfect. It adheres strictly to your 2% risk rule. This demonstrates that with a $100 account, you can begin to comfortably use micro lots for trades with reasonably tight stop losses.

With Leverage: Using Micro Lots Strategically

Leverage simply ensures you have enough margin to place that 0.01 lot trade. The actual risk is still defined by your stop loss placement and your position size. Don’t be tempted to use leverage to open a 0.05 lot, thinking you’ll make five times the profit. You’re also risking five times as much, and a single loss could cripple your account.

Best Lot Size for a $200 Forex Account

At the $200 level, you can start to feel a bit more comfortable, but discipline remains your shield. Finding the best lot size for this account still revolves almost exclusively around micro lots.

Risking 2% ($4): Transitioning to Micro Lots

With a $200 balance, a 2% risk equates to $4 per trade. This opens up more possibilities for using micro lots across various trade setups.

Example Trade on EUR/USD with a $200 Balance

Let’s say you want to short the EUR/USD, and your analysis requires a 40-pip stop loss.

- Account Risk: $4

- Stop Loss: 40 pips

- Pip Value (0.01 lot): $0.10

Lot Size (in micro lots) = $4 / (40 pips * $0.10) = $4 / $4 = 1 micro lot.

Your position size is 0.01. What if your stop loss was tighter, say 20 pips?

Lot Size = $4 / (20 pips * $0.10) = $4 / $2 = 2 micro lots, or 0.02.

This shows that as your account grows, you gain the flexibility to either take trades with wider stops or slightly increase your position size on trades with tighter stops, all while maintaining the same $4 risk.

Best Lot Size for a $500 Forex Account

A $500 account is a significant milestone for a new trader. It’s a balance that allows for consistent application of the 2% rule using micro lots without feeling overly constrained.

Risking 2% ($10): The Viability of Micro Lots

Risking 2% of a $500 account means your maximum loss per trade is $10. This is a healthy amount that provides considerable flexibility with micro lots.

Consider a trade on AUD/USD with a 50-pip stop loss.

- Account Risk: $10

- Stop Loss: 50 pips

- Pip Value (0.01 lot): $0.10

Lot Size (in micro lots) = $10 / (50 pips * $0.10) = $10 / $5 = 2 micro lots.

The best lot size for this trade is 0.02. You are well within your risk parameters.

Can You Use Mini Lots on a $500 Account?

Let’s test this high-risk scenario. To use a mini lot (0.10), where the pip value is about $1, your stop loss would have to be incredibly tight.

Using the same $10 risk:

Stop Loss in Pips = $10 / $1 (pip value for 0.10 lot) = 10 pips.

This means you could only risk $10 on a mini lot trade if your stop loss was 10 pips or less. While possible in some scalping strategies, a 10-pip stop is often too tight for most market conditions and can lead to being stopped out prematurely by normal market noise. Therefore, for a $500 account, sticking to micro lots is the far wiser and more sustainable approach.

Read More: what is position sizing in forex

Best Lot Size for Medium Accounts

Once your account crosses the $1,000 threshold and moves towards $10,000, you enter a new phase of trading. You now have enough capital to use more diverse position sizing strategies, including the introduction of mini lots. However, the core principles do not change. Finding the best lot size for your account is still about rigorous risk management.

Best Lot Size for a $1,000 Forex Account

Reaching $1,000 is a fantastic achievement. You now have enough capital to generate more meaningful dollar returns per trade while still keeping risk firmly in check.

Risking 2% ($20): Confidently Using Micro Lots

A 2% risk on a $1,000 account is $20. This allows for very flexible use of micro lots. For a trade with a 40-pip stop loss, your calculation would be:

- Lot Size (micro lots) = $20 / (40 pips * $0.10) = $20 / $4 = 5 micro lots (0.05).

This is a comfortable and effective position size for this account level.

Introducing Mini Lots into Your Strategy

With $20 of risk, can you use a mini lot (0.10)? Let’s check.

- Stop Loss in Pips = $20 / $1 (pip value for 0.10 lot) = 20 pips.

Yes. If you have a trade setup that requires a stop loss of 20 pips or less, you can now safely use a 0.10 lot size. This is a significant step, as it allows you to participate in the market with more size, but only when the trade structure permits it. Never force a trade to fit a lot size; always adjust the lot size to fit the trade.

Best Lot Size for a $5,000 Forex Account

With a $5,000 account, mini lots become your primary tool. You have the capital to withstand the larger pip values associated with mini lots and can construct a portfolio of several positions without over-leveraging your account.

Risking 2% ($100): The Flexibility of Mini Lots

Risking 2% of $5,000 gives you a substantial $100 risk budget per trade. This is where your earning potential starts to become significant.

Let’s plan a trade on GBP/USD with a 50-pip stop loss.

- Account Risk: $100

- Pip Value (for 0.10 lot): ~$1

- Stop Loss: 50 pips

Lot Size (in mini lots) = $100 / (50 pips * $1) = $100 / $50 = 2 mini lots (0.20).

The best lot size for this trade is 0.20. It’s a meaningful position that can yield a good profit if the trade works out, while the loss is capped at a very reasonable 2% of your capital.

Balancing Multiple Positions with Proper Sizing

With a $5,000 account, you might want to have two or three positions open simultaneously. It’s crucial that the total risk of all open positions does not exceed a certain threshold, typically 4-5% of your account. So, if you have one position open with a 2% risk ($100), your next position should also be sized for a maximum of 2% risk, bringing your total exposure to 4%.

Best Lot Size for a $10,000 Forex Account

A $10,000 account signifies a serious commitment to trading. At this level, you have significant flexibility and can even begin to incorporate standard lots in very specific scenarios. The best lot size for this account allows for a professional and diversified approach.

Risking 2% ($200): Combining Mini & Standard Lots

A 2% risk on a $10,000 account allows for a $200 risk per trade.

- Using Mini Lots: For a trade with a wider, 80-pip stop, your size would be:

Lot Size (mini lots) = $200 / (80 pips * $1) = 2.5 mini lots (0.25). - Using Standard Lots: Can you use a standard lot (1.0)? The pip value is ~$10.

Stop Loss in Pips = $200 / $10 (pip value for 1.0 lot) = 20 pips.

This means you could use a full standard lot if your trade setup has a very tight 20-pip stop loss. This might be suitable for a scalping or news trading strategy, but for most swing or day trades, sticking to multiple mini lots (e.g., 0.20, 0.30, 0.40) provides better flexibility.

Advanced Sizing for a Diversified Portfolio

With a $10,000+ account, you can run a more complex portfolio. You might have a long-term position on USD/JPY sized at 0.10 with a wide stop, a day trade on EUR/USD at 0.30 with a medium stop, and a short-term scalp on GBP/USD at 0.50 with a tight stop. In each case, the lot size is calculated independently to ensure each trade’s risk is capped at, for example, 1% ($100), keeping your total risk managed and diversified across different assets and timeframes.

Common Lot Size Mistakes to Avoid

From my experience, I’ve seen aspiring traders make the same few mistakes over and over again. These errors are almost always related to improper position sizing and a misunderstanding of risk. Avoiding them is just as important as knowing how to calculate the correct lot size.

Mistake #1: Using a Fixed Lot Size

This is a classic rookie error. A trader decides they will always trade with a 0.10 lot size, regardless of the trade setup. This is a recipe for disaster. A 0.10 lot on a trade with a 20-pip stop has a $20 risk. The same 0.10 lot on a trade with a 100-pip stop has a $100 risk. Your lot size must be dynamic, adapting to your stop loss distance to keep your dollar risk constant.

Mistake #2: Ignoring Leverage’s Sword

Many traders see high leverage (e.g., 500:1) offered by a forex trading broker and think it’s a target. They use it to open the largest position possible. Leverage is a double-edged sword; it amplifies both profits and losses. The true purpose of leverage is to allow you to control a reasonably sized position with a smaller amount of margin, not to take on gigantic risk. Your risk should be defined by the 1-2% rule, not by your maximum available leverage.

Mistake #3: Not Adjusting Size

As your account grows, your lot sizes should grow with it. If you turn $1,000 into $2,000 but are still using lot sizes calculated for a $1,000 account, you are not maximizing your returns. Conversely, and more importantly, if your account drops from $1,000 to $700, you must reduce your lot size to reflect the new, smaller balance. Failing to do so accelerates your drawdown.

Mistake #4: “Revenge Trading”

After a frustrating loss, it’s tempting to jump back into the market with a massive lot size to “win back” what you lost. This is called revenge trading. It’s an emotional decision, not a logical one, and it almost always leads to further, more catastrophic losses. Stick to your plan. If you lose a 1% risk trade, your next trade should still be for 1% risk.

Lot Size vs. Leverage: The Real Story

There is a great deal of confusion among traders about the relationship between lot size and leverage. Let’s clear it up. They are related, but they control two very different things.

Lot Size = Risk

Leverage = Margin

How Leverage Affects Your Margin

Leverage is what allows you to open a position that is larger than your account balance. For example, to open a 0.10 mini lot of EUR/USD (worth €10,000) with a 100:1 leverage, you only need to put up 1/100th of the position’s value as margin. So, you’d need about $100 in your account as a good-faith deposit (margin) to open that trade. Without leverage, you would need the full $10,000.

Why Higher Leverage Doesn’t Mean Bigger Lots

Just because your broker gives you enough leverage to open a 5.0 standard lot position doesn’t mean you should. Your risk is determined by your lot size and stop loss. Using the proper best lot size for your account, calculated with the 1-2% rule, ensures your risk is controlled. Leverage simply ensures you have enough margin to open that correctly-sized position. A trader with a $1,000 account and 30:1 leverage and another with 500:1 leverage should, in theory, be using the exact same lot sizes if they follow the same risk management rules. The difference is simply how much of their capital is tied up as margin.

Opofinance Services

For traders seeking a robust and secure trading environment, Opofinance stands out as an excellent choice. As an ASIC-regulated broker, it provides a high level of trust and security for your funds. Whether you are determining the best lot size for a small or large account, Opofinance provides the tools and conditions necessary for success.

- Advanced Trading Platforms: Choose your ideal trading environment from a suite of top-tier platforms, including the industry-standard MT4 and MT5, the advanced cTrader, and the user-friendly OpoTrade app.

- Innovative AI Tools: Gain a competitive edge with cutting-edge artificial intelligence. Utilize the AI Market Analyzer for deep insights, the AI Coach to refine your strategy, and AI-powered support for instant assistance.

- Social & Prop Trading: Engage with a community of traders through social trading features or test your skills and get funded through their prop trading program.

- Secure & Flexible Transactions: Experience peace of mind with safe and convenient deposit and withdrawal methods. Opofinance supports a variety of options, including crypto payments, and prides itself on having zero transaction fees, ensuring more of your money stays in your account.

Ready to trade with a broker that empowers your strategy?

Explore the features and open an account with Opofinance today!

Final Verdict: Your Lot Size Is Your Best Defense

In the end, the quest for the best lot size for your forex account leads back to a single, powerful truth: disciplined risk management is your greatest defense and your clearest path to profitability. There is no secret lot size that guarantees wins. Instead, the secret is the consistent and unwavering application of a risk management formula that protects your capital above all else. By treating every trade as a mathematical risk calculation rather than a gamble, you shift the odds in your favor. Your lot size is the variable that puts you in control, allowing you to survive inevitable losing streaks and thrive during winning ones. Master this, and you’ve mastered the most important aspect of trading.

Can I trade with a 0.01 lot size on a $100 account?

Yes, absolutely. A 0.01 (micro) lot is often the ideal size for a $100 account. For a trade with a 20-pip stop loss, a 0.01 lot would risk $2, which is exactly 2% of your account, adhering perfectly to standard risk management rules.

What is the minimum lot size in forex?

The smallest available lot size is typically a nano lot (0.001), which represents 100 units of the base currency. However, not all brokers offer nano lots. The most common minimum lot size offered by the majority of brokers is the micro lot (0.01).

How does my chosen currency pair affect lot size?

The currency pair primarily affects the pip value, which is a key component of the lot size calculation. For pairs where the USD is the quote currency (e.g., EUR/USD, GBP/USD), pip values are straightforward. For other pairs, like cross-currency pairs (e.g., EUR/JPY) or exotics, the pip value will fluctuate, making a position size calculator essential for accurate risk management.

Should I change my lot size based on market volatility?

Yes, indirectly. Higher market volatility often requires you to use a wider stop loss to avoid being prematurely stopped out by erratic price swings. Because your stop loss in pips is a key part of the lot size formula, a wider stop will naturally result in you using a smaller lot size to keep your dollar risk constant (e.g., at 1-2% of your account).

What is the biggest mistake traders make with lot sizes?

The single biggest mistake is using a fixed lot size for every trade instead of calculating it based on a fixed percentage risk. This leads to inconsistent risk exposure, where some trades risk a small fraction of the account while others risk a dangerously large portion.