The frantic world of scalping is a high-stakes game of speed and precision. In these ultra-short timeframes, where the goal is to snatch just a handful of pips from the market, the noise can be deafening. False signals, widened spreads during volatile periods, and the sheer speed can quickly drain an account.

From my own years spent staring at 1-minute charts, I can tell you that the key to survival and success lies in identifying true market momentum shifts instantly. The search for the best momentum indicator for scalping isn’t about finding a single magic bullet, but a carefully selected tool applied with a specific, battle-tested strategy. For any trader working with a modern forex broker, mastering these indicators is non-negotiable. This guide cuts through the clutter to reveal the top three indicators that have consistently proven their worth in live trading—the RSI, MACD, and Bollinger Bands. We’ll dive deep into not just what they are, but exactly how to configure and use them to capture those fleeting, profitable moves.

Key Takeaways

- No Single “Best” Indicator: True success comes from mastering a specific indicator and its strategy, not endlessly searching for a perfect one. The best momentum indicator for scalping is the one you know inside and out.

- Rethink Standard Settings: Default indicator settings (like a 14-period RSI) are simply not optimized for the speed required in scalping. We’ll explore faster, more responsive settings tailored for 1-minute and 5-minute charts.

- Confirmation is Crucial: Relying on one indicator is a rookie mistake. Combining a primary indicator for signals with a secondary one for confirmation dramatically improves your win rate by filtering out market noise.

- Volatility is Your Friend: The best indicators for scalping embrace, rather than ignore, volatility to identify high-probability entry and exit points, especially during active sessions like the London-New York overlap.

- Risk Management Governs All: Your risk management strategy—your rules on stop-loss placement, position sizing, and maximum daily drawdown—is more important than any indicator. It’s the ultimate tool that determines long-term profitability.

What Defines a Great Scalping Indicator?

Before we dive into my top picks, it’s crucial we’re on the same page about what we’re looking for. An indicator that’s excellent for a swing trader looking to capture a 200-pip move on the daily chart is utterly useless for a scalper aiming for 10 pips on the 1-minute chart. For our purposes, the contenders for the best momentum indicator for scalping must excel in three key areas: speed, clarity, and responsiveness.

They have to react almost instantly to the most recent price action, providing clean, easy-to-interpret signals that allow for rapid, confident decision-making. This is in stark contrast to longer-term indicators designed to smooth out price action. That smoothing is a feature for position traders, but for a scalper, it’s a bug that makes you miss your entry every single time.

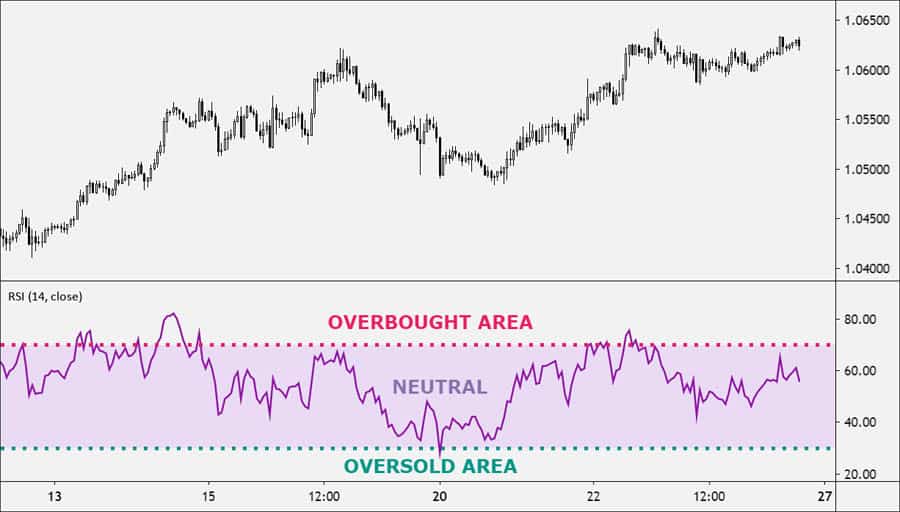

RSI: The Speed Demon

The Relative Strength Index (RSI) is often the first indicator traders learn. I remember plastering it on my first MT4 charts, thinking I’d found the holy grail. I quickly learned that using it with default settings for scalping was a fast way to get chopped to pieces. Its real power for scalping lies in its raw speed and its ability to signal exhaustion in a micro-trend, giving you a heads-up that the momentum is about to shift.

Why RSI Excels for Scalping

For scalpers, the RSI’s simple oscillation between 0 and 100 is an immediate visual cue. When a pair like GBP/JPY makes a sharp, aggressive 20-pip climb in a minute, the RSI will race toward its overbought extreme (typically 70). This doesn’t automatically mean “sell,” a lesson I learned the hard way. It means that the buying pressure is temporarily overextended and may be ripe for a pullback or consolidation—the exact moment a scalper looks to either take profit on a long or initiate a counter-trend short for a quick 5-10 pips. This rapid signaling makes it a core component in any system aiming to use the best momentum indicator for scalping.

The Optimal RSI Settings for Scalping

The standard 14-period RSI is far too slow for scalping on charts like the 1-minute or 5-minute. It averages too much past data, causing its signals to lag hopelessly behind the live price. Through countless hours of backtesting and live trading, I’ve found that a setting between 7 and 9 provides a significant edge. A 9-period RSI is far more responsive to recent price changes, offering earlier signals without being so fast that it gives a signal on every single tick. This simple adjustment transforms the RSI from a sluggish tool into a high-performance engine for scalping.

A Practical RSI Scalping Strategy

A cardinal sin for RSI scalpers is selling the instant the indicator touches the 70 line or buying the moment it hits 30. You’ll find yourself fighting powerful micro-trends and getting stopped out repeatedly. A much more reliable and professional strategy is to wait for confirmation that momentum is actually turning.

- Entry Signal: I only enter a short trade after the RSI has pushed into the overbought zone (above 70) and then crosses back below the 70 line. Conversely, a long trade is only considered after the RSI dips into the oversold zone (below 30) and then crosses back above the 30 line. From personal experience, it’s often wise to wait for the 1-minute candle to close after the cross. This simple act of patience filters out many of the fake-outs designed to trap eager traders.

- Exit Signal: Scalping demands ruthless risk control. My stop-loss is non-negotiable, placed just a few pips above the recent high for a short, or below the recent low for a long. In terms of profit targets, I’m not greedy. I’m often aiming for a 1:1.5 risk-to-reward ratio. If I’m risking 6 pips, I’m looking to take profit at 9 pips. Another effective exit strategy is to close the trade when the RSI approaches the opposite extreme (e.g., exiting a long trade as the RSI nears the 70 level), as this indicates the short-term move may be exhausted.

Read More: How to Use the ATR Indicator in Forex

MACD: The Momentum Confirmer

While the RSI is my go-to for identifying potential turning points, the Moving Average Convergence Divergence (MACD) is the perfect partner for confirming that a new wave of momentum has truly begun. I think of it as my system’s quality control filter. It helps me stay out of trades where momentum is weak or ambiguous, which is critical when seeking the best momentum indicator for scalping, as avoiding bad trades is just as important as finding good ones.

Why MACD is a Scalping Ally

The MACD’s secret weapon for scalpers is its histogram. Many traders are fixated on the crossover of the MACD and signal lines, but this is a lagging signal. The histogram, which visually represents the distance between those two lines, gives a much clearer and earlier picture of momentum. When the bars on the histogram start to shrink toward the zero line, it’s a bright, flashing sign that the current move is losing power, long before the lines themselves cross. It’s like feeling the engine of a car lose power before it actually stalls.

Faster MACD Settings for Quick Trades

Just like with the RSI, the default MACD settings (12, 26, 9) are built for the slow pace of daily charts. Using them for scalping is like trying to race a cargo ship. To adapt the MACD for the fast-paced scalping environment, you need to speed it up. My preferred setting, and one used by many high-frequency traders, is 5, 13, 1. This configuration makes the MACD lines and, more importantly, the histogram react much more quickly to price changes on lower timeframes. This is exactly the responsiveness a scalper needs to confirm a move and get in before it’s over.

An Actionable MACD Strategy

My strategy with the MACD revolves around the histogram and the zero line, which represents the point of equilibrium between bullish and bearish momentum.

- Entry Signal: I look for entries confirmed by the MACD crossing the zero line. A cross above zero indicates bullish momentum is taking control—a strong confirmation for a buy signal. A cross below signals bearish momentum is dominant. The most powerful signals are when this cross is accompanied by strong, growing bars on the histogram, indicating accelerating momentum.

- Confirmation Powerhouse: I never use the MACD in isolation. It’s the ultimate confirmation tool. Let’s say the RSI(9) on EUR/USD gives me a buy signal by crossing back above 30. Before I even think about hitting the buy button, my eyes flick to the MACD(5,13,1). If the histogram is also above the zero line and ticking higher, that’s my green light. I have strong confirmation. If the histogram is still below zero, I pass on the trade. This discipline, born from many painful losses early in my career, has saved me from countless bad trades.

Read More: Stochastic oscillator for scalping

Bollinger Bands: The Volatility Powerhouse

Scalping is a business that thrives on volatility. Without price movement, we can’t make money. Bollinger Bands (BB) are unique because they are constructed around volatility itself, using standard deviations. This makes them an incredibly intuitive framework for a scalper. They dynamically show you what’s “normal” and what’s “extreme” in the current market, which is why they are a top contender for the best momentum indicator for scalping.

Why Bollinger Bands are Top-Tier for Scalping

Bollinger Bands dynamically adapt to what the market is doing right now. When the market is quiet and consolidating, the bands contract into a “squeeze.” When volatility explodes, perhaps during a news release, the bands expand rapidly. This provides two beautiful setups for scalping: trading breakouts from low-volatility squeezes and trading continuations within high-volatility channels. They give you a clear, visual framework for what constitutes a significant price move, helping you differentiate a real breakout from simple noise.

Optimal Bollinger Bands Settings for Scalping

Again, we need to adjust for speed. The standard 20-period moving average in the BB is too slow. For scalping, a 10-period Simple Moving Average with the standard 2 standard deviations is far superior. This setting makes the bands “hug” the price action more tightly, providing earlier signals and a more accurate representation of the immediate volatility on 1-minute and 5-minute charts.

Bollinger Band Scalping Strategies

There are two primary strategies I deploy with Bollinger Bands:

- The Band Squeeze Breakout: This is my favorite setup. When the bands tighten and move almost horizontally, it signals extreme consolidation. This is the market coiling like a spring. The strategy is to wait patiently for this “squeeze” and then enter a trade in the direction of the candle that breaks out with conviction (a long, strong-bodied candle). A tight squeeze on the M5 chart for a major pair can easily precede a 20-30 pip explosive move.

- Walking the Bands: In a strong micro-trend, you’ll see the price repeatedly push against the upper or lower band. A rookie mistake I see all the time is traders trying to short every touch of the upper band in a clear uptrend. This is like stepping in front of a freight train. In a strong trend, these touches are signs of strength, not reversal. The professional strategy is to buy pullbacks to the middle band (the 10-period MA) and ride the trend as it continues to “walk” the outer band.

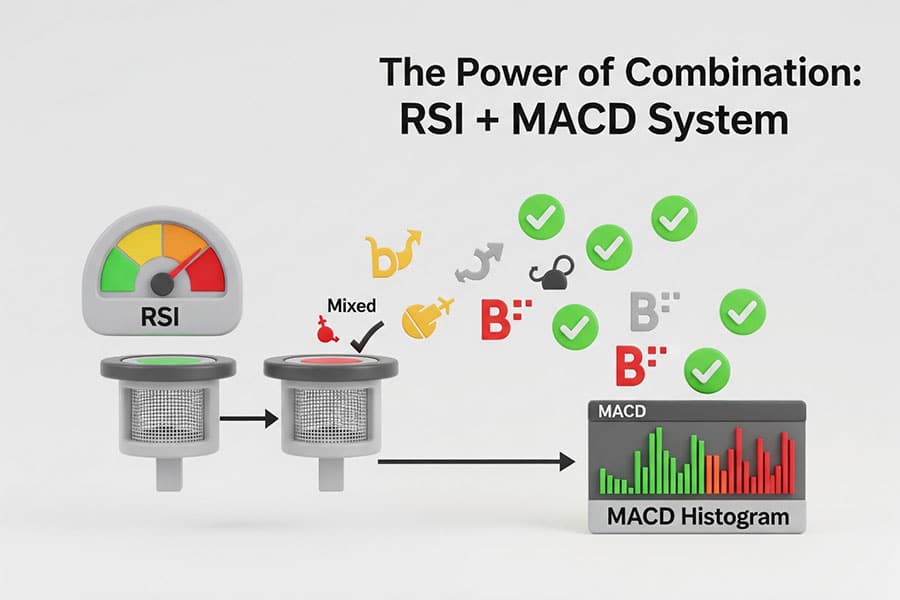

Combining Indicators for a Robust System

Let me be perfectly clear: using any single indicator in isolation is a recipe for a blown account. The real magic happens when you combine them, creating a system where one indicator’s strengths cover the other’s weaknesses. A truly robust system often has the best momentum indicator for scalping acting as a signal, with another confirming it. My go-to combination for its reliability and clarity is the RSI for the entry signal and the MACD for momentum confirmation.

The RSI + MACD Scalping System

Here’s a step-by-step walkthrough of how this powerful system works in a live market:

- Condition: I’m watching my charts, waiting for the RSI(9) to enter an extreme zone (above 70 for overbought, below 30 for oversold). This is my alert. It tells me to pay close attention because a potential trade is setting up.

- Signal: I wait for the RSI to cross back from that extreme zone. For a potential long trade, it must cross back above 30. For a short, it must cross back below 70. This is the primary signal, but I do not execute the trade yet. Patience is a virtue here.

- Confirmation: This is the crucial step. My eyes immediately shift to my MACD(5, 13, 1) indicator. For the long signal I just got from the RSI, I need to see the MACD histogram either already above the zero line or crossing it decisively to the upside. If the histogram is still below zero, the trade is invalid. This confirmation tells me that underlying momentum supports the reversal signal from the RSI.

- Execution: Only when both the RSI signal and the MACD confirmation are aligned do I execute the trade. By layering these conditions, I filter out the vast majority of false RSI signals that occur when momentum just isn’t there to sustain a move. This systematic approach is what separates professional scalping from gambling.

Honorable Mentions

While the RSI, MACD, and Bollinger Bands are my top three, other indicators are popular among scalpers. It’s important to understand why they didn’t make my primary list for the specific purpose of finding the best momentum indicator for scalping.

- Stochastic Oscillator: Very similar to the RSI, the Stochastic also identifies overbought and oversold levels. In my experience, however, it tends to be even more sensitive and “choppy” than a fast-setting RSI, especially in highly volatile pairs. This can lead to more frequent false signals, which is a scalper’s worst enemy. It can work, but it requires an even heavier layer of filtering.

- Volume Weighted Average Price (VWAP): VWAP is a fantastic indicator, and I use it daily, but not as a primary momentum signal. It’s a benchmark that shows the average price traded, weighted by volume. Scalpers use it to gauge if they are getting a “good” price relative to the day’s activity. For instance, buying below VWAP is often seen as favorable. However, it doesn’t provide the rapid “overbought/oversold” momentum signals that are the focus of this particular strategy.

Read More: MACD Indicator for Scalping

Common Mistakes to Avoid When Scalping

Mastering the indicators is only half the battle. I’ve seen talented traders fail because they couldn’t avoid these common pitfalls. Avoiding them is critical if you want to use these tools effectively.

- Indicator-Only Analysis: Never, ever trade based on an indicator alone. I always have the raw price action as my primary focus. Is the trend clear? Are we approaching a major support or resistance level? The indicator should only serve to confirm what the price action is already suggesting.

- Using Default Settings: I can’t stress this enough. Default settings are not designed for the speed of scalping. Failing to adjust your tools for your specific timeframe is a fundamental error. Finding the best momentum indicator for scalping involves finding the best settings for you.

- Ignoring Market Conditions: A strategy that is profitable in a trending market during the London session can get you crushed in a ranging, quiet Asian session. You must be a chameleon, able to identify the current market state and apply the right strategy.

- Poor Risk Management: This is the single biggest destroyer of trading accounts. Even a 90% win rate strategy will fail if you let one bad trade, fueled by ego or a lack of a stop-loss, wipe out all your gains.

The Most Important “Indicator”: Risk Management

Let’s be brutally honest: no indicator is foolproof. You will have losing trades. It’s a non-negotiable cost of doing business as a trader. The ultimate tool that separates the 10% who succeed from the 90% who fail is rigorous, non-emotional risk management. For scalpers, this means ironclad rules.

The 1% rule is a great start—never risk more than 1% of your trading capital on a single trade. More importantly, set a maximum daily loss limit, whether it’s a percentage (e.g., 3%) or a fixed pip count (e.g., -40 pips). Once you hit that limit, you shut down your platform and walk away. This discipline prevents the kind of catastrophic revenge trading that can end a trading career in an afternoon. This is even more important when using leverage, as it can amplify both gains and losses.

Opofinance Services

To effectively implement the fast-paced strategies we’ve discussed, you need a brokerage partner that is built for speed and reliability. Opoforex, a reputable ASIC-regulated forex trading broker, provides the ideal ecosystem for scalpers who demand precision and advanced technology. They offer a suite of services that can give you a tangible edge:

- Advanced Trading Platforms: Execute your trades with minimal latency on industry-leading platforms like MT4, MT5, and cTrader. Opoforex also offers its proprietary OpoTrade platform, designed for an intuitive and efficient trading experience.

- Innovative AI Tools: Gain a competitive edge with cutting-edge artificial intelligence. Utilize the AI Market Analyzer to spot high-probability setups, the AI Coach to refine your strategy based on your trading patterns, and AI Support for instant assistance.

- Social & Prop Trading: Broaden your horizons with their robust Social Trading network, allowing you to learn from and copy the trades of experienced traders. For those ready to scale up, Opofinance also offers proprietary trading programs, giving you access to larger capital.

- Secure & Flexible Transactions: Experience seamless banking with safe and convenient deposit and withdrawal methods. Opofinance supports a range of options, including crypto payments, and prides itself on having zero transaction fees, ensuring that your hard-earned pips stay in your account.

Ready to elevate your scalping with superior technology and a trusted broker?

Explore the tools and platforms at Opofinance today!

Conclusion: Your Path to Scalping Success

In the end, the relentless search for the single best momentum indicator for scalping reveals a more profound truth: success isn’t found in the indicator, but in the trader using it. The RSI, MACD, and Bollinger Bands stand out as my top-tier choices because of their unparalleled blend of speed, clarity, and adaptability to the volatile conditions scalpers live in. By customizing their settings and combining them into a cohesive system, you can build a formidable edge. However, this edge is only truly sharpened through disciplined practice, a commitment to analyzing your trades, and an unwavering adherence to your risk management rules. This is how you transform from someone who simply uses indicators into a consistently profitable scalper.

What is the best timeframe for scalping with momentum indicators?

The 1-minute (M1) and 5-minute (M5) charts are the classic battlegrounds for scalpers. The indicators and settings discussed in this article are specifically optimized for these hyper-short durations, where rapid momentum shifts are most frequent and profitable.

Can I make a living by only scalping?

Absolutely, many professional traders are full-time scalpers. However, it requires an elite level of focus, a meticulously crafted trading plan, iron-clad risk management, and a deep understanding of market microstructure (like order flow and liquidity). It is not a get-rich-quick scheme; it demands significant screen time and emotional discipline.

How do I deal with the high number of false signals in scalping?

The most effective method is to never, ever rely on a single indicator. Use a combination approach, such as pairing an oscillator like the RSI for a primary signal with a trend/momentum tool like the MACD for confirmation. Always filter these signals through the lens of pure price action and market context.

Is scalping better for forex, stocks, or crypto?

Scalping strategies can be applied across all three markets. The critical factor is choosing assets with deep liquidity and tight transaction costs (spreads). This is why major forex pairs (EUR/USD, GBP/USD), high-volume stocks (AAPL, TSLA), and major cryptocurrencies (BTC, ETH) are the preferred instruments for most scalpers.

How much capital do I need to start scalping?

While you can technically start with a small account, it’s vital to have enough capital to manage risk effectively. If your account is too small, following the 1% risk rule might result in profits of mere cents, which is impractical. A capital base that allows your 1% risk per trade to be a meaningful dollar amount is highly recommended to handle the costs and psychology of trading.