Starting your trading journey with a modest capital base requires a smart strategy, beginning with your choice of currency pairs. The best pairs to trade with a small account are consistently the major pairs, like EUR/USD, due to their low volatility and tight spreads. These characteristics are crucial for protecting your limited capital while you learn the ropes. Finding a reliable online forex broker is the first step, but understanding which markets to trade is what will sustain you. This guide breaks down the safest and most stable forex pairs, explaining why they are ideal for beginners and how to manage risk effectively to build your account steadily.

Key Takeaways

- Focus on Major Pairs: Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY are the undisputed best pairs to trade with a small account because of their high liquidity, low spreads, and predictable movements.

- Volatility is Your Enemy (at First): With a small account, capital preservation is key. Low-volatility pairs prevent catastrophic losses from sudden market swings, giving you more room for error as you learn.

- Spreads Eat Profits: The spread is a direct cost to your trade. Pairs with the lowest spreads, like EUR/USD, ensure that more of your successful trades are profitable, which is vital when your profit margins are small.

- Risk Management is Non-Negotiable: Choosing the right pair is a risk management strategy in itself. Combine this with proper position sizing and stop-loss orders to protect your capital.

- Master One Before Moving On: Many traders fail by trying to trade too many markets at once. Pick one or two of the best forex pairs for small account traders, learn their behavior inside and out, and only then consider expanding.

| Pair | Liquidity | Volatility | Spread | Why It’s One of the Best Pairs to Trade with a Small Account |

|---|---|---|---|---|

| EUR/USD | Very High | Low | Very Low | Extremely stable, most traded pair, and respects technical analysis well. |

| GBP/USD | High | Moderate | Low | Offers clear trends but with slightly more movement for profit potential. |

| USD/JPY | High | Low | Low | Known for its smooth trends and being less prone to erratic spikes. |

| AUD/USD | High | Low-Moderate | Low | Moves logically and is influenced by commodity prices, offering clear analysis. |

| EUR/GBP | Moderate | Low | Low | Often ranges, making it suitable for cautious strategies with defined risk. |

Why Pair Choice Matters for Small Accounts

When you’re starting with a small account—whether it’s $100, $500, or even $1,000—every single decision carries more weight. Your choice of which currency pair to trade is one of the first, and most critical, of those decisions. It’s not about finding the pair that moves the most; it’s about finding the one that gives you the highest probability of survival. Think of it as learning to drive. You wouldn’t start in a Formula 1 car; you’d start in a reliable, predictable sedan. The same logic applies here. The best pairs to trade with a small account in forex are those that are forgiving. They have enough liquidity to ensure you can get in and out of trades easily, their spreads are tight so transaction costs don’t drain your balance, and their volatility is low enough that a single unexpected move won’t wipe you out. This foundation is crucial for building both your capital and your confidence.

What Makes a Pair Ideal for Small Funds?

Identifying the best pairs to trade with small account for beginners involves looking for a specific set of characteristics. It’s a formula that balances opportunity with safety. From my experience, traders who ignore these factors are the ones who blow through their first, second, and even third accounts. Let’s break down the essential ingredients that make a currency pair suitable for a trader with limited capital.

High Liquidity

Liquidity is the lifeblood of efficient trading. It refers to the ease with which a currency pair can be bought or sold without causing a significant change in its price. For a small account trader, high liquidity is a safety net. It means there are always tons of buyers and sellers at every price level. This leads to tighter spreads (the difference between the buy and sell price), which is your primary transaction cost. A pair like EUR/USD has immense liquidity, so the spread is often just a fraction of a pip. An exotic pair, like USD/TRY, has far less liquidity, and the spread can be massive, eating into your potential profits before the trade even has a chance to move in your favor.

Low Volatility

While volatility is necessary to make money, too much of it is the enemy of a small account. Volatility is a measure of how much a pair’s price fluctuates. Highly volatile pairs like GBP/JPY or other exotic crosses can move hundreds of pips in a single session. With a small account, you can’t afford the wide stop-loss needed to withstand such swings. A sudden spike could easily trigger your stop for a significant loss. The best forex pairs for small account traders, like USD/CHF or EUR/USD, tend to move more predictably and in smaller increments. This allows you to set tighter, more effective stop-losses and manage your risk with much greater precision.

Tight Spreads

This cannot be overstated. The spread is a guaranteed loss you take on every trade. The wider the spread, the more the price has to move in your favor just for you to break even. When your account is small and your position sizes are small, a wide spread can represent a huge percentage of your potential profit. For example, if you’re aiming for a 10-pip profit, a 3-pip spread means you’ve given up 30% of your earnings before you even start. The major pairs offer the lowest spreads in the industry, making them the most cost-effective and logical choice for anyone trading with limited funds. This is a core reason why they are considered the best pairs to trade with a small account.

EUR/USD: The Ultimate Beginner Pair

If there were a hall of fame for currency pairs, EUR/USD would be the first inductee. It is, without question, the top choice and the most recommended of the best pairs to trade with small account for beginners. Representing the two largest economies in the world, the Eurozone and the United States, it accounts for over 20% of all forex transactions. This unrivaled popularity provides benefits that are perfectly aligned with the needs of a new trader. Its immense liquidity ensures that spreads are razor-thin, often below one pip with most brokers. This minimizes your trading costs, which is a significant advantage for a small account.

Furthermore, the EUR/USD is known for its smooth price action. It tends to respect key technical levels—support, resistance, and trendlines—more reliably than other pairs. This makes chart analysis more straightforward and less prone to the chaotic, unpredictable spikes that can plague less liquid pairs. For a beginner, this predictability is a blessing. It allows you to practice your strategies in a more controlled environment, where the principles of technical analysis are clearly visible. Its low-to-moderate volatility means you can use sensible stop-loss levels without fear of being prematurely knocked out of a good trade by random noise. It truly is the training ground for aspiring forex traders.

GBP/USD & USD/JPY: Stable Alternatives

Once you’ve grown comfortable with EUR/USD, or if you’re looking for a bit more movement without venturing into truly dangerous territory, GBP/USD and USD/JPY are excellent next steps. They are still firmly in the category of the best pairs to trade with a small account, but they offer slightly different characteristics.

GBP/USD (“Cable”)

The “Cable” is another highly liquid major pair, and it’s known for having stronger, more defined trends than the EUR/USD. While it is more volatile, this can be an advantage. The movements are often clearer, offering better profit potential if you catch the right trend. However, this increased volatility requires slightly wider stops and careful risk management. It’s a great pair for practicing trend-following strategies, but you must respect its potential to move quickly, especially around UK and US news releases. For a trader with a small account, this means ensuring your position size is small enough to handle a 30-40 pip stop-loss without risking more than 1-2% of your capital. It remains one of the best pairs to trade with a small account in forex because its movements, while larger, are still largely logical and technically driven.

USD/JPY (“The Gopher”)

Often seen as a safe-haven pair, the USD/JPY is known for its exceptionally smooth price action. It has a reputation for moving in clean, prolonged trends with very shallow pullbacks. This makes it a favorite among traders who dislike the choppy, whipsaw nature of some other pairs. Its volatility is typically lower than both EUR/USD and GBP/USD, making it another fantastic choice for capital preservation. One of its unique characteristics is its inverse correlation with US stock indices; during times of market risk aversion, the Japanese Yen often strengthens. Understanding this relationship can provide an additional layer of analysis. For beginners, the clarity of its trends makes it one of the most visually straightforward pairs to analyze, solidifying its place among the best forex pairs for small account holders.

Mistakes to Avoid (Pairs to Skip)

Just as important as knowing which pairs to trade is knowing which to avoid, especially when your capital is on the line. I’ve seen countless enthusiastic beginners jump into the market, drawn by the allure of massive pip movements, only to have their accounts decimated in a matter of days. The primary mistake is choosing pairs that are fundamentally unsuitable for a small account. These are the pairs you should steer clear of until you are well-capitalized and highly experienced.

Exotic Pairs

Exotic pairs consist of a major currency paired with the currency of an emerging economy (e.g., USD/MXN, EUR/TRY, USD/ZAR). The appeal is their incredible volatility; these pairs can move thousands of pips in a week. But this is a siren’s call for a small account. Their liquidity is thin, which means spreads are enormous, sometimes 50 pips or more. A single trade can have a huge entry cost. Worse, they are prone to violent, unpredictable gaps and spikes, often driven by local political or economic instability. A stop-loss offers little protection when the price can gap 200 pips against you overnight. They are the polar opposite of the best pairs to trade with a small account.

Volatile Crosses

Cross pairs that don’t involve the USD can also be treacherous. Certain crosses, particularly those involving the British Pound (GBP) like GBP/JPY, GBP/NZD, and GBP/AUD, are famously volatile. They are nicknamed “the beasts” or “widow-makers” for a reason. While they offer huge profit potential, they demand extremely wide stops and a deep understanding of the correlated movements of two independent economies. For a small account, guessing the direction of one currency is hard enough; betting on the relative strength of two volatile currencies is a recipe for disaster. Stick to the majors, where at least one side of the equation (the USD) provides a degree of stability and predictability.

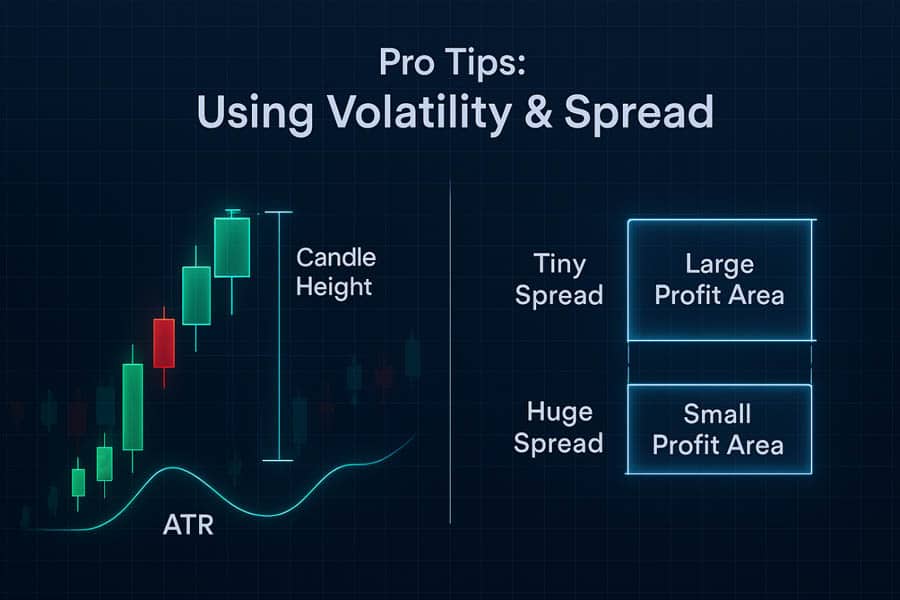

Pro Tips: Using Volatility & Spread

Simply knowing which pairs are good is not enough; you need to know how to use their characteristics to your advantage. Understanding volatility and spreads on a practical level is what separates hopeful amateurs from calculating traders. The goal is to make informed decisions, not just follow a list. This is a key step in mastering the best pairs to trade with a small account.

Analyzing Volatility with ATR

The Average True Range (ATR) is a simple indicator available on every trading platform, and it should become your best friend. It doesn’t tell you direction, but it tells you the average price range of a pair over a given period. Before entering a trade, look at the 14-period ATR on the 1-hour or 4-hour chart. For EUR/USD, this might be 10-15 pips. For GBP/JPY, it could be 30-40 pips. This number gives you a data-driven basis for setting your stop-loss. A good rule of thumb is to place your stop at 1.5x or 2x the ATR value. If a 2x ATR stop-loss would mean risking more than 2% of your account, your position size is too big, or the pair is too volatile for your account size. This simple check can save you from countless oversized losses.

Putting Spreads into Perspective

Always be aware of the spread before you place a trade. Many platforms show it in real-time. Let’s say you’re day trading and aiming for a 12-pip profit on EUR/USD, and the spread is 0.8 pips. That means your cost is about 6.7% of your potential profit. Now, imagine trying the same trade on an exotic pair with a 15-pip spread. You would need to make 27 pips just to get the same 12-pip net profit. The difference is staggering. For a small account, every pip counts. Choosing the best forex pairs for small account traders means choosing the ones with the lowest transaction costs, giving you a statistical edge over time.

How to Analyze and Master a Pair

Truly understanding a currency pair is like getting to know a personality. Each has its own rhythm, its own quirks, and its own typical reactions to news and events. Many successful traders focus exclusively on one or two pairs for years, and this mastery is what gives them their edge. This is the professional approach to trading the best pairs to trade with a small account. Instead of spreading your attention thin across a dozen markets, focus your energy on becoming an expert in one.

Step 1: Choose Your Pair

Start with EUR/USD. There’s no reason to complicate it. It’s the most liquid, cheapest to trade, and most predictable market. Dedicate yourself to it for at least a few months.

Step 2: Study its Behavior

Open the charts and just watch. What does it do during the London session? The New York session? How does it behave during the quiet Asian session? Identify its typical daily range using the ATR. Look at how it reacts to major news events like the US Non-Farm Payrolls (NFP) or Federal Reserve interest rate decisions. You’ll start to notice patterns. Maybe it tends to reverse at whole numbers (e.g., 1.0800, 1.0900) or respect Fibonacci levels consistently. This is the “screen time” that builds intuition.

Step 3: Demo Trade with a Strategy

Before risking real money, apply a simple strategy on a demo account. It could be a moving average crossover, a support and resistance bounce strategy, or a simple trend-following system. The goal isn’t to make millions in demo money; it’s to test your strategy and your understanding of the pair’s behavior. Did the trade play out as you expected? If not, why? This process of analysis and refinement is invaluable and costs you nothing. This disciplined practice on the best pairs to trade with small account for beginners will build the habits needed for long-term success.

Step 4: Go Live with Micro Lots

Once you’ve achieved some consistency on a demo account, it’s time to go live. But start small—as small as possible. Use micro lots (0.01) so that you’re risking mere cents per pip. This introduces real emotions—the fear of loss and the greed for more—but in a controlled, low-stakes environment. The goal here is not to make a profit; it’s to learn to manage your emotions while executing your strategy flawlessly. Scaling up only comes after you’ve proven you can be consistently profitable, even on a tiny scale. This methodical approach is the hallmark of professional trading.

Unlock Your Trading Potential with Opofinance

Choosing the right broker is as important as choosing the right pair. Opofinance, an ASIC-regulated broker, provides the tools and security you need to trade the best pairs to trade with a small account effectively.

- Advanced Trading Platforms: Access the markets on your terms with MT4, MT5, cTrader, and the intuitive OpoTrade platform.

- Innovative AI Tools: Gain a competitive edge with our AI Market Analyzer, AI Coach, and instant AI Support.

- Social & Prop Trading: Learn from the community with Social Trading or prove your skills through our Prop Trading program.

- Secure & Flexible Transactions: Enjoy peace of mind with safe and convenient deposit and withdrawal methods, including crypto payments with zero fees.

Start your trading journey with a trusted partner. Explore Opofinance today!

Conclusion

Embarking on your forex journey with limited capital doesn’t have to be a disadvantage. By making smart, defensive choices from the very beginning, you can build a solid foundation for future success. The key is to focus on the best pairs to trade with a small account: the majors. Pairs like EUR/USD, GBP/USD, and USD/JPY offer the ideal blend of high liquidity, low spreads, and manageable volatility. This allows you to protect your precious capital while you hone your skills, master a strategy, and build the confidence needed to navigate the markets for the long term.

Can I trade gold (XAU/USD) with a small account?

While it’s possible, it’s generally not recommended for beginners. Gold is extremely volatile and can require a much larger stop-loss than currency pairs, making it very risky for a small account. Stick to the major forex pairs first.

How many pairs should I trade with a $100 account?

One. With a $100 account, your focus should be 100% on capital preservation and learning. Pick one of the best forex pairs for a small account, like EUR/USD, and master it before even thinking about adding another.

Are minor pairs ever a good option for small accounts?

Rarely. Minor pairs (crosses without the USD) like EUR/GBP can sometimes have low volatility, but they often have wider spreads than the majors. For the best combination of low cost and stability, majors are almost always the superior choice for beginners.

What is the best time of day to trade these pairs?

The best time is during the London and New York session overlap (approximately 8 AM to 12 PM EST). This is when liquidity and volume are at their highest, leading to the tightest spreads and the most reliable price movements.

How does news impact the best pairs to trade with a small account?

Major news events, like interest rate decisions or employment reports, cause significant volatility even in stable pairs. It’s often wise for small account traders to avoid trading in the minutes immediately before and after a major news release to avoid unpredictable spikes.