Ever felt like you’re watching opportunities vanish in the blink of an eye on those frantic 1-minute charts? You’re not alone. The allure of quick profits in short-term trading is undeniable, but capturing those fleeting moments requires precision and the right tools. The burning question for many aspiring scalpers and day traders is: What are the best RSI settings for a 1-minute chart? The answer, while not a magic bullet, leans towards shorter periods, typically between 4 and 9. These settings offer the heightened sensitivity needed to react to the rapid-fire price movements that define this ultra-short timeframe. This comprehensive guide will delve deep into the nuances of optimizing your Relative Strength Index (RSI) for the 1-minute chart, providing you with actionable strategies and insights to potentially sharpen your edge in the market. Choosing the right forex trading broker is also crucial for executing these fast-paced strategies effectively.

Intro to RSI & 1-Minute Charts

The Relative Strength Index (RSI), a cornerstone of technical analysis, acts as a vital compass for traders navigating the complexities of market momentum. Developed by the ingenious J. Welles Wilder Jr., this momentum oscillator visually represents the velocity and magnitude of recent price changes. Imagine it as a gauge, fluctuating between 0 and 100, offering valuable clues about potential overbought and oversold conditions. These conditions can often foreshadow impending trend reversals or continuations. For those brave souls venturing into the high-octane arena of 1-minute chart trading, the RSI transforms from a helpful indicator into an indispensable ally, providing crucial insights into the immediate shifts in momentum that can determine the success or failure of a trade. Understanding its nuances is paramount for making informed decisions in this fast-paced environment.

RSI: A Momentum Oscillator

Think of the RSI as a sophisticated speedometer for price action. It meticulously measures the strength of recent upward price movements relative to recent downward movements. This calculation allows it to evaluate whether an asset is potentially overbought, meaning its price may have risen too quickly and could be due for a pullback, or oversold, suggesting the price has fallen sharply and might be poised for a rebound. A high RSI reading, typically above 70, suggests overbought conditions, while a low reading, usually below 30, indicates oversold conditions. However, these are not definitive buy or sell signals but rather zones of heightened probability for potential reversals.

RSI for Short-Term Trading

In the frenetic environment of 1-minute charts, where seconds can feel like minutes, and opportunities appear and vanish with lightning speed, the RSI’s ability to provide timely signals is invaluable. Traditional indicators, often relying on longer lookback periods, can suffer from lag, delivering signals too late to capitalize on fleeting price movements. The RSI, when skillfully adjusted for this shorter timeframe, offers the responsiveness needed to identify potential entry and exit points within these compressed intervals. It empowers traders to swiftly assess the strength of immediate price surges or declines, enabling quicker reactions to the market’s ever-changing dynamics. In this realm of micro-movements, where every pip can significantly impact profitability, the RSI’s responsiveness is not just an advantage; it’s often a necessity.

Read More: 1 minute forex trading strategy

Understanding RSI Settings

While the default RSI settings of 14 periods serve as a solid foundation for analyzing longer-term trends, the rapid-fire nature of 1-minute charts demands a more agile and sensitive approach. Mastering the art of adjusting these settings is the key to unlocking the RSI’s full potential for short-term trading endeavors. Understanding the implications of different period settings and threshold levels can significantly impact the signals you receive and, ultimately, your trading outcomes.

Limitations of Default Settings

The standard 14-period RSI calculates momentum by averaging gains and losses over the preceding 14 periods. On a 1-minute chart, this translates to analyzing the price action of the past 14 minutes. While this provides a smoothed perspective, it can often be too sluggish to effectively capture the immediate and often volatile price swings that characterize such short timeframes. Imagine trying to navigate a hairpin turn at high speed with delayed steering – the outcome is rarely desirable. Similarly, by the time the 14-period RSI generates a discernible signal on a 1-minute chart, the opportune moment for entry or exit might have already passed, leading to missed trades or suboptimal entries.

Adjusting for Faster Timeframes

To effectively harness the power of the RSI on a 1-minute chart, the key lies in shortening the lookback period. This adjustment dramatically increases the indicator’s sensitivity to recent price fluctuations, enabling it to generate signals with greater speed and relevance to the immediate market action. Think of it as upgrading your sensor to detect even the slightest tremors. By reducing the period, you amplify the RSI’s responsiveness, allowing it to capture the subtle nuances of short-term price movements that would be completely overlooked by a longer period setting. This fine-tuning is absolutely crucial for scalpers and day traders who operate within these compressed timeframes, seeking to capitalize on the smallest of price discrepancies.

Best RSI Settings for Scalping

For those who thrive in the adrenaline-pumping world of 1-minute scalping, where the objective is to secure small profits from rapid and frequent price changes, the RSI settings require meticulous calibration for peak responsiveness. Finding that delicate balance – the sweet spot – is paramount to avoid being whipsawed by excessive market noise while still effectively capturing genuine and actionable trading signals. This involves carefully considering both the period setting and the overbought/oversold thresholds.

Recommended RSI Period

Experienced scalpers often find optimal performance with RSI periods ranging from 4 to 9 on a 1-minute chart. A shorter period, such as 4 or 5, will exhibit heightened sensitivity, reacting swiftly to even the most minute price fluctuations. This can be advantageous for catching extremely short-term moves, allowing traders to potentially enter and exit positions within seconds. However, this increased sensitivity also comes with a higher risk of encountering false signals, requiring robust confirmation techniques. Conversely, a slightly longer period, such as 7 or 9, offers a marginally smoother reading, potentially filtering out some of the inherent market noise while still providing timely and relevant signals for scalping opportunities. The ideal setting often depends on individual trading style, risk tolerance, and the specific characteristics of the asset being traded. Experimentation and backtesting are crucial to determine the optimal period for your unique approach.

Optimizing Thresholds

The conventional overbought and oversold levels for the RSI are typically set at 70 and 30, respectively. However, on the compressed timeframe of a 1-minute chart, particularly when using a shorter RSI period, these standard thresholds might prove to be too wide, potentially delaying signals or missing opportunities. Consider tightening these thresholds to levels such as 80/20 or even more extreme levels like 85/15. Tighter thresholds will naturally generate more frequent indications of overbought and oversold conditions, aligning more closely with the rapid-paced nature of 1-minute trading. It’s crucial to remember that these thresholds are not absolute guarantees of price reversals but rather zones where the probability of a change in direction is heightened. Therefore, always seek corroboration from other indicators or price action analysis before acting solely on these signals. Adjusting these thresholds is a critical step in fine-tuning the RSI for the specific demands of 1-minute chart analysis.

Read More: What is RSI Indicator

Using RSI on 1-Minute Charts

Understanding the optimal RSI settings is only one piece of the puzzle. The true power of the RSI on a 1-minute chart lies in knowing how to effectively interpret the signals it generates and seamlessly integrate them into a comprehensive trading strategy. This involves developing clear entry and exit rules based on RSI readings and understanding how to combine the RSI with other complementary indicators for enhanced signal confirmation.

Entry & Exit Strategies

On a 1-minute chart, where timing is paramount, identifying potential entry points using the RSI can be achieved by observing specific threshold breaches. For instance, a potential long entry could be considered when the RSI crosses back above the oversold threshold (e.g., 20) after having been below it, suggesting a potential surge in buying pressure. Conversely, a potential short entry could be signaled when the RSI crosses back below the overbought threshold (e.g., 80) after residing above it, indicating potential selling pressure. Similarly, exit strategies can be formulated based on the RSI reaching the opposite extreme, signaling a potential exhaustion of the current move, or when price action itself suggests a weakening of momentum. For example, if you initiated a long position based on an oversold signal, you might consider exiting when the RSI approaches the overbought level or when you observe bearish candlestick patterns forming. Having clearly defined entry and exit rules based on RSI signals is crucial for disciplined trading on the 1-minute chart.

Combining with Other Indicators

Relying solely on the RSI, particularly on the inherently volatile 1-minute chart, can expose traders to whipsaws and an increased risk of false signals. To mitigate this, combining the RSI with other complementary indicators can significantly enhance the accuracy and reliability of trading signals. The Moving Average Convergence Divergence (MACD) can serve as a valuable tool for confirming the prevailing trend direction and identifying potential shifts in momentum. Bollinger Bands, on the other hand, can help pinpoint potential areas of support and resistance and provide insights into market volatility. For example, if the RSI signals an oversold condition concurrently with the price touching the lower Bollinger Band, it adds a layer of confluence to the potential buy signal, increasing its probability of success. This multi-indicator approach provides a more robust and well-rounded framework for making informed trading decisions on the 1-minute chart, reducing reliance on a single indicator’s interpretation.

Advanced RSI Techniques

Beyond the fundamental overbought and oversold signals, the RSI offers a repertoire of more sophisticated techniques that can prove particularly valuable for discerning traders operating on the granular level of 1-minute charts. These advanced techniques, such as divergence trading and analyzing RSI trendline breaks, can provide deeper insights into potential price movements and offer higher-probability trading opportunities.

Divergence Trading

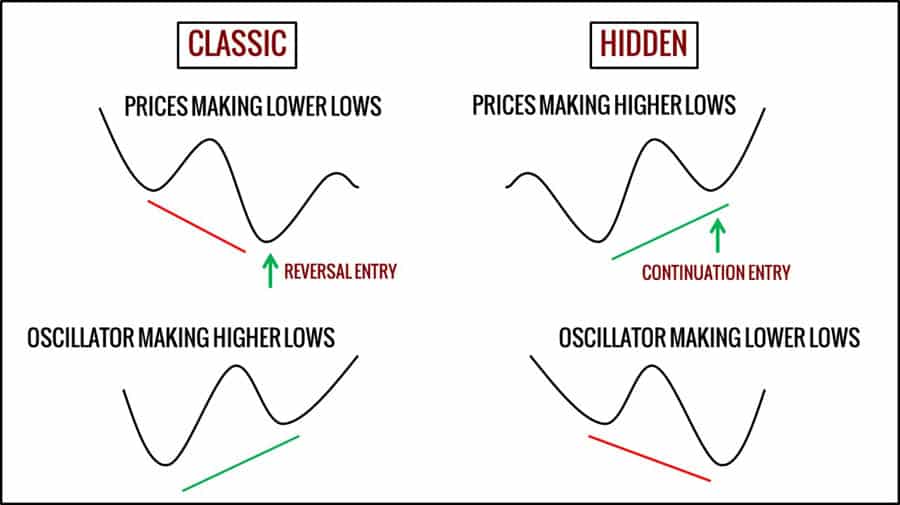

Divergence, a powerful concept in technical analysis, occurs when the price action of an asset and the RSI indicator move in opposing directions, often signaling a potential trend reversal. Bullish divergence materializes when the price establishes lower lows, while the RSI simultaneously forms higher lows. This discrepancy suggests that while selling pressure might be present, its momentum is waning, potentially foreshadowing an upward price reversal. Conversely, bearish divergence occurs when the price makes higher highs, but the RSI registers lower highs. This indicates that despite the upward price movement, buying momentum is weakening, potentially signaling a downward correction. Identifying these divergences on a 1-minute chart can pinpoint high-probability trading setups, particularly when corroborated by other technical indicators or chart patterns. However, it’s crucial to remember that divergence is not a guaranteed signal but rather an indication of a potential shift in momentum, requiring further confirmation before initiating a trade.

RSI Trendline Breaks

Similar to drawing trendlines on price charts to identify potential support and resistance levels, trendlines can also be drawn on the RSI indicator itself. A break of an RSI trendline can often precede a corresponding break in price trend, signaling a potential shift in momentum. For example, a break above a downward trendline on the RSI might suggest increasing buying pressure and a potential upward move in price. Furthermore, observing swing highs and lows on the RSI that align with price swings can offer valuable insights into the underlying momentum. A “swing rejection” occurs when the RSI bounces off a support or resistance level, mirroring a similar rejection in price action. For instance, if the RSI bounces off a support level (a swing low) while the price is also showing signs of support at a key level, it strengthens the bullish outlook. These techniques provide additional layers of analysis for interpreting RSI movements on the 1-minute chart, helping traders identify potential turning points with greater confidence.

Read More: Best ema settings for 1 minute chart

Backtesting & Optimization

Discovering the “best” RSI settings for 1-minute chart trading is not a static endeavor with a universal solution. What proves effective in one market environment or during a specific period might not be optimal in another. Therefore, rigorous backtesting is an indispensable step in the process of fine-tuning your RSI settings to align with your chosen trading instruments and individual trading style. This data-driven approach allows you to objectively evaluate the historical performance of different settings and identify those that have consistently yielded the most favorable results.

Importance of Backtesting

Backtesting involves applying your chosen RSI settings to historical price data to simulate how they would have performed in past market conditions. This process allows you to objectively assess the effectiveness of various period settings and overbought/oversold threshold combinations. By analyzing the historical performance, you can identify the settings that have consistently generated profitable signals and avoid those that have historically led to losses or increased drawdowns. In the context of 1-minute chart trading, where speed and precision are paramount, backtesting provides invaluable insights into the responsiveness and reliability of different RSI configurations, helping you make data-informed decisions about your indicator settings.

Tools for Backtesting

Fortunately, several powerful trading platforms offer robust backtesting capabilities that streamline this crucial process. TradingView, a popular charting platform, provides visual backtesting tools and allows for the creation and testing of custom strategies using its proprietary Pine Script language. MetaTrader, another widely used platform, offers the Strategy Tester, a powerful feature that enables traders to backtest expert advisors (EAs) and custom indicators, including those based on RSI, using historical market data. These tools allow you to simulate trades based on your specific RSI settings and meticulously analyze the resulting performance metrics, such as win rate, profit factor, and drawdown. Leveraging these technological resources is essential for conducting thorough and efficient backtesting of your RSI strategies for 1-minute chart trading.

Avoiding Common Mistakes

Even with meticulously optimized settings, traders can fall prey to common mistakes when utilizing the RSI on the fast-paced 1-minute chart. Being aware of these potential pitfalls can help you avoid costly errors and improve the overall effectiveness of your RSI-based trading strategies. This involves understanding the limitations of the indicator and the importance of considering broader market context.

Don’t Over-Rely on RSI

As previously emphasized, relying solely on the RSI for generating trading signals, particularly on the inherently noisy 1-minute chart, is a risky proposition. Treat the RSI as one valuable piece of the puzzle, not the definitive answer. Always seek confirmation of RSI signals from other technical indicators, discernible price action patterns, or established support and resistance levels before committing capital to a trade. For instance, an oversold RSI reading might be a more compelling buy signal if it coincides with a bullish candlestick pattern forming at a known support level. This multi-faceted approach significantly reduces the likelihood of acting on false signals and improves the overall probability of successful trades.

Consider Market Context

The effectiveness of RSI signals can fluctuate significantly depending on the prevailing market conditions. In a strongly trending market, for example, overbought or oversold signals generated by the RSI might not necessarily indicate an imminent reversal but rather a continuation of the existing trend. Similarly, periods of high market volatility can lead to a surge in the frequency of false signals, as rapid and erratic price swings can push the RSI into overbought or oversold territory without a genuine change in the underlying trend. Therefore, it’s crucial to always consider the broader market context, including the overall trend direction and current volatility levels, when interpreting RSI signals on a 1-minute chart. Adjust your expectations and risk management strategies accordingly to account for these dynamic market conditions.

Pros & Cons of RSI for 1-Minute Trading

Like any tool in a trader’s arsenal, the RSI presents both advantages and disadvantages when applied to the demanding environment of 1-minute chart trading. Understanding these pros and cons is essential for making informed decisions about whether and how to incorporate the RSI into your short-term trading strategies.

Advantages of RSI

The primary advantage of employing the RSI on a 1-minute chart with optimized settings lies in its capacity to generate rapid signals, thereby presenting frequent trading opportunities. For scalpers, whose strategy revolves around capturing small profits from numerous trades throughout the trading day, this responsiveness is particularly appealing. The heightened sensitivity of the RSI allows traders to potentially capitalize on short-lived momentum shifts that might be entirely missed on longer timeframes. This ability to react quickly to intraday price fluctuations can translate into a greater number of potential trading setups, aligning perfectly with the goals of high-frequency trading strategies.

Disadvantages of RSI

The very characteristic that makes the RSI attractive for 1-minute trading – its increased sensitivity – also presents its primary drawback: a higher potential for generating false signals. The rapid and often erratic price movements on a 1-minute chart can trigger overbought or oversold readings that do not accurately reflect the underlying trend, leading to premature entries or exits. Furthermore, the intense pace of decision-making required for 1-minute trading can be psychologically demanding and induce significant stress for some individuals. Finally, the sheer volume of trades executed in a typical 1-minute trading strategy can lead to substantial transaction costs, including brokerage fees and spreads, which can erode profitability if not carefully managed. Therefore, robust risk management strategies and a well-defined trading plan are paramount to mitigate these inherent disadvantages.

Opofinance: Empowering Your Trading Journey

Are you seeking a dependable and regulated broker to put your 1-minute chart RSI strategies into action? Look no further than Opofinance, an ASIC-regulated broker dedicated to providing a secure and efficient trading environment for traders of all levels.

- Stringent ASIC Regulation: Trade with peace of mind knowing that Opofinance adheres to the rigorous regulatory standards set forth by the Australian Securities and Investments Commission (ASIC).

- Official Recognition on MT5 Brokers List: Gain access to the industry-leading MetaTrader 5 platform, a favorite among professional traders for its advanced charting tools and features.

- Secure and Convenient Transactions: Enjoy seamless and secure deposit and withdrawal processes with a wide array of trusted payment options.

- Explore the Power of Social Trading: Connect with and learn from a community of experienced traders, potentially gaining valuable insights and enhancing your own trading strategies through shared knowledge.

Ready to take your trading to the next level? Discover the Opofinance advantage and start trading with confidence today!

Conclusion: Mastering RSI for 1-Minute Trading

Successfully navigating the dynamic and often unpredictable landscape of 1-minute chart trading demands a deep understanding of market momentum and the ability to execute decisions with speed and precision. The RSI, when meticulously configured and skillfully applied, can serve as a potent weapon in your trading arsenal. By carefully adjusting the period settings to optimize responsiveness and strategically combining it with other complementary indicators and advanced analytical techniques, you can significantly enhance your ability to identify and capitalize on profitable opportunities within this fast-paced environment. However, remember that true mastery is a journey that requires consistent practice, unwavering discipline, and an unwavering commitment to continuous learning and refinement of your trading strategies.

Key Takeaways for 1-Minute RSI Trading

- For optimal performance on 1-minute charts, prioritize shorter RSI periods, typically ranging from 4 to 9, to enhance sensitivity to rapid price fluctuations.

- Fine-tune your overbought and oversold thresholds, considering tighter levels such as 80/20 or 70/30, to align with the compressed timeframe.

- Enhance the reliability of RSI signals by strategically combining them with other technical indicators like the MACD or Bollinger Bands for confirmation.

- Explore and master advanced RSI techniques, including divergence trading and the analysis of RSI trendline breaks, to identify higher-probability trading setups.

- Embrace the importance of rigorous backtesting to objectively evaluate and optimize your RSI settings for specific trading instruments and prevailing market conditions.

- Remain acutely aware of the increased potential for false signals and the critical importance of robust risk management when trading on 1-minute charts.

RSI for Swing Trading?

While the RSI is a versatile momentum indicator, its primary application on a 1-minute chart is best suited for scalping or very short-term day trading strategies. Swing trading, which involves holding positions for days or weeks, typically requires analyzing longer timeframe charts (e.g., daily or weekly) and utilizing indicators with longer lookback periods to identify broader trends.

Volatility & RSI Reliability?

Elevated market volatility can substantially impact the reliability of RSI signals on a 1-minute chart. During periods of high volatility, rapid and erratic price swings can generate more frequent and potentially misleading overbought or oversold signals. In such conditions, it becomes even more critical to seek confirmation from other indicators, exercise greater caution with trade entries, and potentially widen your stop-loss orders to accommodate the increased price fluctuations.

Automating RSI Strategies?

Yes, it is technically possible to automate trading strategies based on RSI signals on a 1-minute chart using platforms like MetaTrader with Expert Advisors (EAs). However, automating strategies on such a short timeframe presents significant challenges. The EA needs to be programmed with extreme precision to accurately interpret RSI signals and execute trades with the necessary speed and minimal slippage. Thorough backtesting and optimization are absolutely crucial to ensure the automated strategy performs reliably in live market conditions, as even minor coding errors or delays in execution can have a significant impact on profitability in such a fast-paced environment.

One Response

While online news offers immediacy, interactivity, and vast archives, print newspapers still satisfy needs—sensory, cognitive, social, and practical—that the web alone doesn’t fully address. For many readers, the blend of habit, trust, and the tangible experience keeps the daily paper alive on front porches around the world.