In the ever-fluctuating world of forex trading, mastering the best trading strategy for XAUUSD (Gold/US Dollar) can be your ticket to financial prosperity. As one of the most popular and volatile currency pairs, XAUUSD offers exciting opportunities for traders seeking to capitalize on the precious metal’s market movements. This comprehensive guide, designed for those exploring a broker for forex trading, will unveil the best trading strategy for XAUUSD, combining technical analysis, fundamental factors, and risk management techniques to help you navigate the golden waters of forex trading.

The best trading strategy for XAUUSD involves a multi-faceted approach that includes:

- Analyzing key technical indicators

- Understanding fundamental drivers of gold prices

- Implementing effective risk management techniques

- Utilizing specific entry and exit strategies

- Adapting to market conditions

By mastering these elements, you’ll be well-equipped to tackle the challenges and seize the opportunities presented by the XAUUSD market. Let’s dive deep into the world of gold trading and uncover the strategies that can lead you to forex success.

Understanding the XAUUSD Market

Before delving into specific strategies, it’s crucial to understand the unique characteristics of the XAUUSD market:

Volatility and Liquidity

XAUUSD is known for its high volatility, which can lead to significant price swings in short periods. This volatility presents both opportunities and risks for traders. The market is also highly liquid, allowing for easy entry and exit of positions.

Read More: Best Trading Strategy for EURUSD

Market Hours

Unlike other forex pairs, XAUUSD trading is available 23 hours a day, five days a week. This extended trading time allows for more opportunities but also requires careful monitoring of global events that can impact gold prices.

Factors Influencing Gold Prices

Several factors influence gold prices, including:

- Economic indicators

- Geopolitical events

- Central bank policies

- US dollar strength

- Inflation rates

- Supply and demand dynamics

Understanding these factors is crucial for developing a successful XAUUSD trading strategy.

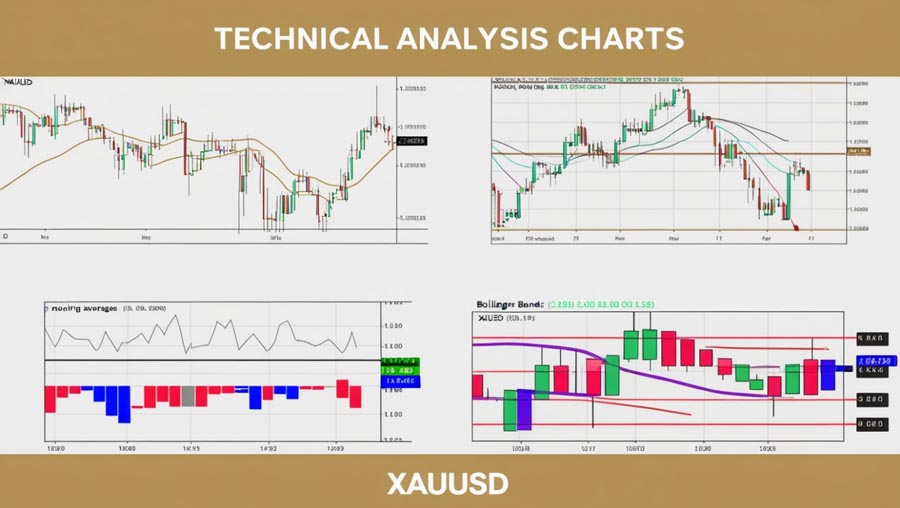

Technical Analysis: The Foundation of XAUUSD Trading

Technical analysis forms the backbone of any effective XAUUSD trading strategy. Here are key technical tools and indicators to incorporate into your approach:

Moving Averages

Moving averages help identify trends and potential support/resistance levels. Consider using:

- 50-day and 200-day Simple Moving Averages (SMA)

- Exponential Moving Averages (EMA) for faster response to price changes

Relative Strength Index (RSI)

The RSI is an excellent tool for identifying overbought and oversold conditions in the XAUUSD market. Look for:

- RSI values above 70 (overbought)

- RSI values below 30 (oversold)

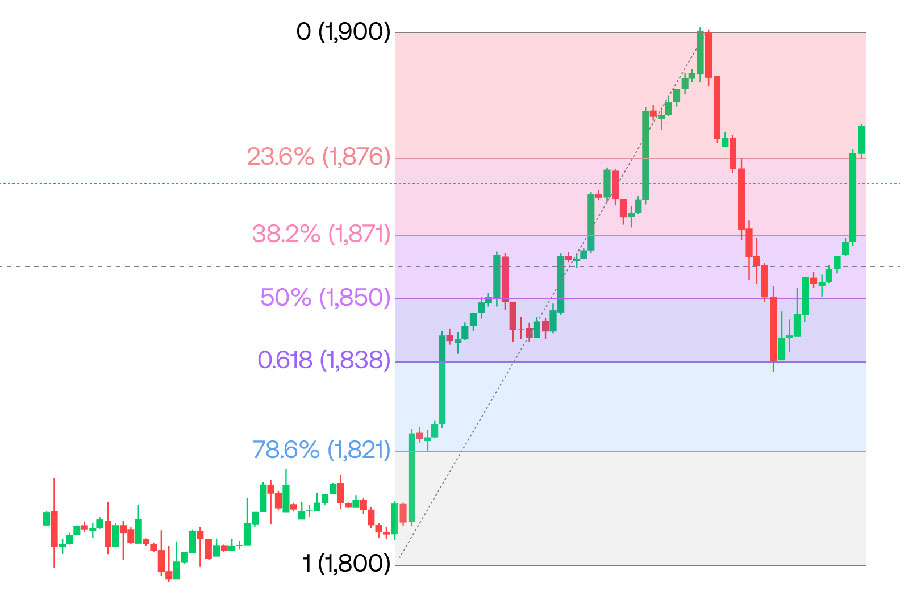

Fibonacci Retracements

Fibonacci retracements can help identify potential reversal points and support/resistance levels. Key Fibonacci levels to watch include:

- 38.2%

- 50%

- 61.8%

Bollinger Bands

Bollinger Bands help identify market volatility and potential breakout opportunities. Watch for:

- Price touching or breaking the upper or lower bands

- Squeeze formations indicating potential volatility increases

Read More: best trading strategy for us30

Fundamental Analysis: The Driving Force Behind Gold Prices

While technical analysis provides the tools, fundamental analysis offers insights into the underlying factors driving gold prices. Key fundamental aspects to consider include:

Economic Indicators

Monitor important economic indicators such as:

- GDP growth rates

- Unemployment figures

- Inflation data

These indicators can significantly impact gold prices and the US dollar’s strength.

Geopolitical Events

Stay informed about global political tensions, trade disputes, and conflicts that can drive investors towards gold as a safe-haven asset.

Central Bank Policies

Keep an eye on central bank decisions, particularly those of the Federal Reserve. Interest rate changes and monetary policy shifts can have a substantial impact on gold prices.

US Dollar Strength

As gold is priced in US dollars, the strength of the dollar plays a crucial role in XAUUSD price movements. Monitor the Dollar Index (DXY) for insights into potential gold price trends.

Read More: best trading strategy for crude oil

Popular Trading Strategies for XAUUSD

While there’s no one-size-fits-all approach to trading XAUUSD, several strategies have proven effective for many traders. Let’s explore some of the most popular methods:

1. Trend Following Strategy

Trend following is a classic approach that works well with XAUUSD due to the pair’s tendency to form strong trends.

Key elements:

- Use moving averages to identify trends (e.g., 50-day and 200-day SMAs)

- Enter long positions when price is above the moving averages and short when below

- Implement trailing stops to protect profits as the trend progresses

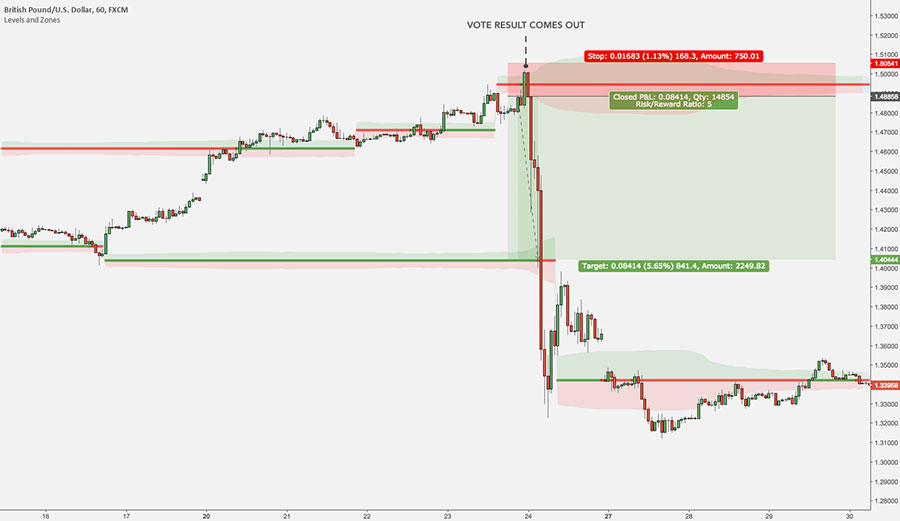

2. Breakout Trading Strategy

Breakout trading capitalizes on XAUUSD’s volatility, especially during significant economic events.

How it works:

- Identify key support and resistance levels

- Wait for price to break through these levels with increased volume

- Enter trades in the direction of the breakout

- Set stop-loss orders just beyond the breakout point

3. Range Trading Strategy

During periods of consolidation, XAUUSD can trade within a defined range, offering opportunities for range traders.

Strategy basics:

- Identify upper (resistance) and lower (support) boundaries of the range

- Buy near support and sell near resistance

- Use oscillators like RSI or Stochastic to confirm overbought/oversold conditions

- Set tight stop-losses outside the range

4. News Trading Strategy

Given gold’s sensitivity to economic and geopolitical events, news trading can be particularly effective for XAUUSD.

Approach:

- Focus on high-impact news events (e.g., Fed rate decisions, NFP reports)

- Analyze potential outcomes and their impact on gold prices

- Use pending orders to enter trades as news breaks

- Implement wide stop-losses to account for increased volatility

5. Fibonacci Retracement Strategy

Fibonacci retracements work well with XAUUSD, helping traders identify potential reversal points.

Implementation:

- Draw Fibonacci retracement levels on significant price swings

- Look for price reactions at key levels (38.2%, 50%, 61.8%)

- Combine with other technical indicators for confirmation

- Enter trades when price respects a Fibonacci level and shows signs of reversal

6. Gold-Dollar Correlation Strategy

This strategy exploits the inverse relationship between gold prices and the US dollar.

How it works:

- Monitor the US Dollar Index (DXY)

- Look for divergences between DXY and XAUUSD

- Enter long XAUUSD positions when DXY shows weakness and vice versa

- Use economic indicators affecting dollar strength as additional filters

7. Moving Average Convergence Divergence (MACD) Strategy

The MACD indicator can be particularly effective for identifying trend changes in XAUUSD.

Strategy outline:

- Use standard MACD settings (12, 26, 9)

- Look for MACD line crossovers with the signal line

- Confirm with histogram direction changes

- Enter trades in the direction of the new trend

- Set stop-losses below recent swing lows/highs

Remember, the effectiveness of these strategies can vary depending on market conditions and individual trading styles. It’s crucial to thoroughly test and adapt these strategies to your own risk tolerance and trading goals. Many successful XAUUSD traders combine elements from multiple strategies to create a comprehensive trading plan that works across various market conditions.

Risk Management: Protecting Your Golden Gains

No XAUUSD trading strategy is complete without robust risk management techniques. Implement these practices to safeguard your trading capital:

Position Sizing

Limit your risk per trade to a small percentage of your total trading capital, typically 1-2%. This approach helps protect your account from significant drawdowns.

Stop-Loss Orders

Always use stop-loss orders to limit potential losses. Place stops at logical levels based on technical analysis, such as below key support levels or moving averages.

Take-Profit Levels

Set realistic take-profit levels based on technical and fundamental factors. Consider using trailing stops to lock in profits as the trade moves in your favor.

Risk-Reward Ratio

Aim for a positive risk-reward ratio, ideally 1:2 or higher. This means your potential profit should be at least twice your potential loss for each trade.

Entry and Exit Strategies: Timing Your XAUUSD Trades

Knowing when to enter and exit trades is crucial for successful XAUUSD trading. Consider these strategies:

Breakout Trading

Look for price breakouts above key resistance levels or below support levels. Confirm breakouts with increased volume and other technical indicators.

Trend-Following

Identify strong trends using moving averages and enter trades in the direction of the trend. Use pullbacks to support levels as potential entry points.

Range Trading

During periods of consolidation, look for opportunities to buy at support levels and sell at resistance levels within the established range.

Candlestick Patterns

Use candlestick patterns such as engulfing patterns, doji, and hammer/shooting star formations to identify potential reversal points and entry opportunities.

Adapting to Market Conditions: Flexibility is Key

The best trading strategy for XAUUSD must be adaptable to changing market conditions. Consider these approaches:

Scaling In and Out

Instead of entering or exiting positions all at once, consider scaling in or out of trades to manage risk and take advantage of price movements.

Multiple Time Frame Analysis

Analyze XAUUSD on multiple time frames to gain a comprehensive view of the market. This approach can help identify both short-term trading opportunities and long-term trends.

Combining Strategies

Don’t rely on a single strategy. Combine different approaches based on market conditions to increase your chances of success.

Advanced Techniques for XAUUSD Trading Success

To take your XAUUSD trading to the next level, consider incorporating these advanced techniques:

Correlation Analysis

Study the correlation between gold and other assets, such as silver, oil, and major currency pairs. This analysis can provide additional insights for your trading decisions.

Sentiment Analysis

Monitor market sentiment through tools like the Commitment of Traders (COT) report and retail sentiment indicators. These can offer valuable insights into potential market reversals.

Algorithmic Trading

Consider developing or using algorithmic trading systems to execute your XAUUSD strategy. This approach can help eliminate emotional decision-making and ensure consistent execution.

News Trading

Develop strategies for trading XAUUSD around major economic releases and geopolitical events. These high-impact moments can offer significant profit potential for well-prepared traders.

Conclusion: Mastering the Golden Path to Forex Success

Mastering the best trading strategy for XAUUSD requires a combination of technical expertise, fundamental understanding, and disciplined risk management. By integrating the techniques and approaches outlined in this guide, you’ll be well-equipped to navigate the volatile yet rewarding world of gold trading in the forex market.

Remember, success in XAUUSD trading doesn’t come overnight. It requires continuous learning, practice, and adaptation to ever-changing market conditions. Stay informed, remain disciplined, and always be prepared to refine your strategy based on market feedback and performance.

As you embark on your journey to forex success with XAUUSD trading, keep these key points in mind:

- Combine technical and fundamental analysis for a comprehensive trading approach

- Implement robust risk management techniques to protect your trading capital

- Develop flexible entry and exit strategies that adapt to different market conditions

- Continuously educate yourself on market dynamics and advanced trading techniques

- Practice patience and discipline in executing your trading plan

With dedication and the right strategy, you can unlock the potential of XAUUSD trading and turn the precious metal into a valuable asset in your forex trading portfolio. Happy trading, and may your XAUUSD strategies lead you to golden profits!

How does seasonality affect XAUUSD trading?

Seasonality can play a role in XAUUSD price movements. Historically, gold prices tend to exhibit certain patterns throughout the year. For example, demand for gold jewelry often increases during the Indian wedding season and Chinese New Year, potentially impacting prices. Additionally, the summer months sometimes see reduced trading volume, which can affect volatility. However, it’s important to note that while seasonal trends can provide some insights, they should not be relied upon exclusively. Always combine seasonal analysis with other technical and fundamental factors for a more comprehensive trading approach.

How can I effectively backtest my XAUUSD trading strategy?

Backtesting is crucial for validating the effectiveness of your XAUUSD trading strategy. To backtest effectively:

Use reliable historical data that includes price, volume, and relevant economic indicators.

Define clear entry and exit rules based on your strategy.

Account for transaction costs and slippage to simulate real trading conditions.

Test your strategy over different time periods and market conditions.

Analyze key performance metrics such as win rate, profit factor, and maximum drawdown.

Use statistical methods to assess the strategy’s robustness and reliability.

Consider forward testing or paper trading before implementing the strategy with real capital.

Remember that past performance doesn’t guarantee future results, but thorough backtesting can help identify potential strengths and weaknesses in your XAUUSD trading strategy.

What role does the gold-to-silver ratio play in XAUUSD trading?

The gold-to-silver ratio is an important metric that many XAUUSD traders monitor. This ratio represents how many ounces of silver it takes to purchase one ounce of gold. When the ratio is high, it may indicate that gold is overvalued relative to silver, potentially signaling a future decline in gold prices or an increase in silver prices. Conversely, a low ratio might suggest that gold is undervalued. Traders often use this ratio as part of their broader analysis to identify potential trading opportunities or to confirm trends in the precious metals market.

2 Responses

Absolutely indited subject matter, appreciate it for information .

Most valuable Article about XAUUSD Trading Strategy.