Imagine, for a moment, that you’re a seasoned explorer charting unknown territories of the forex market. You’re always seeking that reliable method to anticipate crucial turning points – the market reversals that hold the power to either maximize your gains or trigger significant losses. This is where understanding and mastering CHoCH, or “Change of Character,” within the Smart Money Concept (SMC) framework, becomes your unrivaled advantage.

This isn’t just another technical indicator you’ll quickly forget; it’s a groundbreaking method to understand the strategic moves made by large institutional traders, the “smart money” that influences the market’s most pivotal price shifts. This detailed guide goes far beyond basic explanations, providing a unique and comprehensive understanding of CHoCH. You will discover how it interacts with market structure, order flow, and the underlying institutional logic, giving you a powerful edge in the fast-paced forex world. For those looking for a dependable and regulated forex broker that values advanced trading concepts, understanding CHoCH is absolutely crucial for making informed trading decisions.

Building Your Foundation: Market Structure – The Core of Your Strategy

Before we unleash the true potential of CHoCH, it’s essential to establish a strong foundation by fully grasping the fundamentals of market structure. Consider it to be the blueprint on which all price movements are based. The market does not move randomly; rather, it moves in consistent and predictable ways, creating repeatable patterns of highs, lows, and trends. Understanding these basic components is absolutely critical for success. If you fail to master the foundation, then it will be impossible to effectively use advanced strategies like CHoCH.

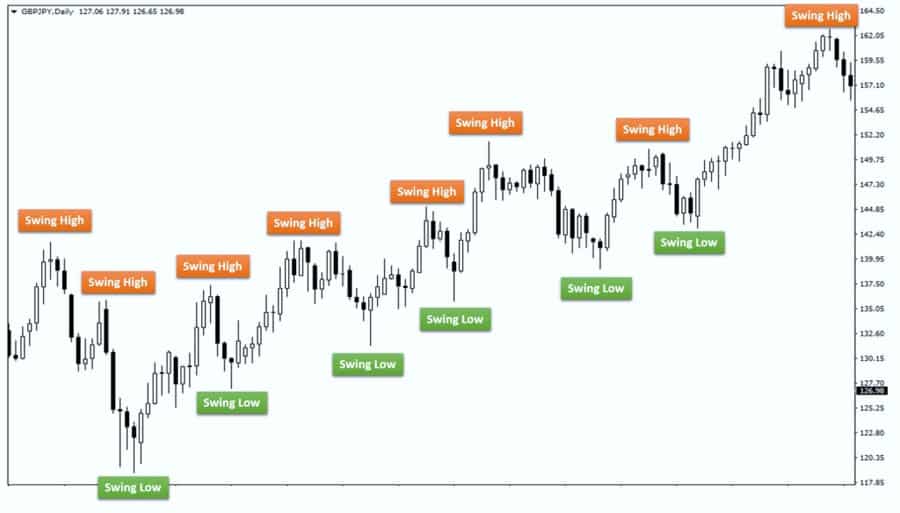

Understanding the Swings: Highs & Lows

- Swing Highs: Picture a summit that marks the highest point price reaches before a decline. Swing highs are not merely any random high; they are significant points where buying power diminishes, and selling pressure starts to take over. They are clear indicators that a possible downward movement might be about to begin.

- Swing Lows: Now imagine a valley, and this represents a swing low. It’s the point where selling pressure is diminishing, and buying interest starts to grow. These, like swing highs, aren’t just random low points; instead, they are significant areas where the market might begin to move upwards.

Analyzing Market Trends: The Market’s Directional Bias

- Bullish Trends: Envision a staircase rising towards the sky—this is a bullish trend. Here you have a series of consistently higher swing highs and higher swing lows. Every new high and low is set above the previous, showing that buyers are clearly in control and that the price is likely to continue its climb.

- Bearish Trends: Think of the same staircase descending downwards. This is how you visualize a bearish trend, with lower swing highs and lower swing lows. Sellers are in control, and they are pushing the market downwards, creating an overall downtrend.

- Consolidation/Ranging: Now, imagine a ship rocking gently from side to side on calm water, this is consolidation. The market will move sideways within a defined range, showing no clear bullish or bearish direction. Identifying these ranges is vital because they usually come before significant breakouts or trend reversals.

Actionable Tip: Train your eyes to spot the subtle differences between swing highs and lows, not just in the main trend, but also within smaller market structures. This will enhance your ability to spot CHoCH patterns.

Comprehending market structure is like having a comprehensive map of a foreign city; without one, you are wandering aimlessly, without a clear direction. Identifying the existing market trend – whether it is bullish, bearish, or ranging – provides the context needed to predict future market moves. This fundamental understanding becomes the very base on which you apply advanced techniques such as CHoCH, and it also allows you to interpret the critical market signals, leading to more informed trading decisions.

Read More: The Smart Money Concept

Deconstructing CHoCH: Revealing the Underlying Dynamics

So, what exactly is CHoCH within the Smart Money Concept framework? It is far more than just a basic fluctuation or random price reversal. It is a strategic and significant shift in the way that market participants are behaving, which suggests that a trend reversal is about to take place. CHoCH, which stands for “Change of Character,” occurs when price breaks a critical level in market structure *against* the current trend.

Unlike a normal pullback, a CHoCH suggests a shift in market control from the existing trend, signaling a loss of dominance. Imagine it as an alarm bell ringing, indicating a potential change in the overall direction, providing a strategic moment for you to make the required adjustments to your trades.

Key Elements of a CHoCH

- Strategic Shift: A CHoCH is not a minor price swing; instead, it is a deliberate change in market behavior and structure.

- Shifting Control: It demonstrates a transfer of power from one side (either the buyers or the sellers) to the other, creating a unique opportunity to get into potential reversals.

- Early Indicator: A CHoCH acts as a warning sign that a trend shift is approaching, so you can prepare accordingly, and implement a high-probability trading strategy.

It’s crucial to remember that many traders often fall into a trap by mistaking any simple price reversal as a CHoCH. However, when we talk about Smart Money Concepts, we are talking about precision and calculated actions taken by institutional players. A CHoCH is not a candle close above a resistance level; it’s a deeper, more significant shift validated by a clear break in market structure. A clear understanding of this distinction is critical when you’re using CHoCH in your trading strategies.

Insight: CHoCH patterns are often more reliable when they are observed near key support and resistance areas, indicating a higher likelihood of a genuine reversal.

CHoCH vs. BOS: Recognizing Crucial Distinctions

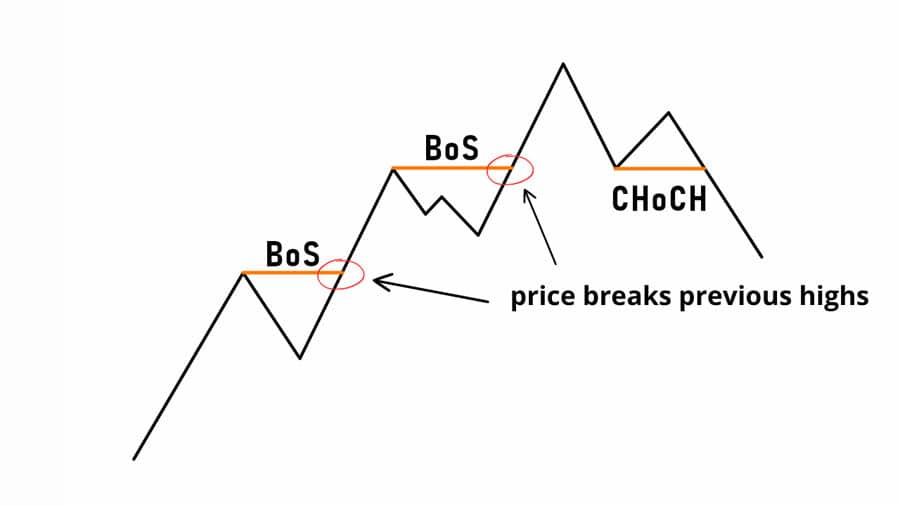

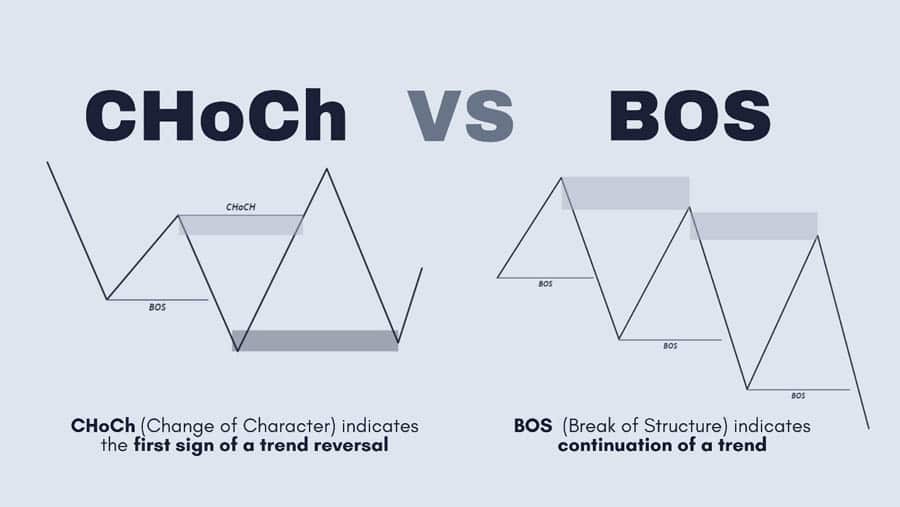

A common area of confusion for many traders lies in the distinction between CHoCH and BOS (Break of Structure). While both these terms involve price movements that cross existing market structure, their meanings and implications for traders are incredibly different. A BOS will validate the continuation of the existing trend, while a CHoCH indicates a potential trend reversal.

Break of Structure (BOS): Confirming Trend Continuation

- Directional Harmony: A BOS happens when the price breaks a key structural level *in the same direction* as the existing trend. For instance, a break above the previous swing high in a bullish trend represents a BOS.

- Trend Confirmation: This signals that the existing trend will likely continue and validates the current price action.

- Riding the Trend: Traders use BOS to identify favorable entry points to follow the current market trend.

Change of Character (CHoCH): Anticipating a Reversal

- Directional Conflict: A CHoCH appears when price breaks a significant structure level *against* the prevailing trend. For example, a break below a previous swing low during a bullish trend is a CHoCH.

- Trend Weakness: It signals that the existing trend may be losing momentum, hinting that a change in market control could take place, signaling a potential reversal.

- Strategic Entries: Traders use CHoCH to identify high-probability entry points to take advantage of the anticipated trend shift.

In simpler terms, if the market is trending, and the price moves past a previous high, then it is likely to be a BOS, which indicates a continuation of the current trend. Conversely, if the price breaks past an important low after a bullish move, then you are likely to be looking at a CHoCH, indicating the bulls are losing strength and that the bears might be taking charge. Understanding when to prioritize CHoCH over BOS is crucial for making the correct decisions. You would use a BOS to ride an existing trend and you would use a CHoCH to enter a trend reversal. Both of these are essential and valuable concepts for all traders.

Analogy: Think of a BOS as a green light signaling the continuation of the trend, while a CHoCH is like a yellow light, indicating that you should be prepared for a possible change in direction.

Pinpointing CHoCH: Your Step-by-Step Guide

Identifying a CHoCH on a chart is not simply a visual exercise; it’s a precise method that requires a systematic approach, as well as a keen eye for market details. First, you must identify the existing trend and then carefully monitor the price behavior around those key swing points. Think of it as becoming a market detective, looking for clues on the chart.

Step 1: Identifying the Prevailing Trend

Directional Analysis: You must first determine if the market is trending upwards, downwards, or if it is consolidating. This is the critical first step in recognizing the current market direction.

Step 2: Locating Key Swing Points

Significant Levels: Identify key swing highs and swing lows, because these are the reference points that are needed for any CHoCH to be correctly identified.

Step 3: Identifying the Structural Break

Trend Conflict: Look for a price break that goes *against* the direction of the existing trend. In a bullish trend, look for a break below a significant swing low. If the trend is bearish, look for a break above a significant swing high.

Step 4: Confirming with Additional Tools

Multiple Confirmations: Always combine the CHoCH signal with other confirming indicators, like trend lines, or support and resistance zones to reduce the chance of any false signals.

When analyzing the different timeframes, it’s important to always use multiple timeframes. Start with the higher timeframes, such as the 4-hour or daily, to see the bigger overall structure, then transition to lower timeframes such as the 15-min or 1-hour chart to time your entries. Also, remember that confluence is the key to success. Never rely only on the CHoCH alone, and always use it with other tools.

Advanced Technique: Look for divergence between price and momentum indicators to add further confirmation to your CHoCH signals.

Synergizing CHoCH with Supply and Demand Zones

Once you’ve learned how to identify CHoCH, combining this knowledge with supply and demand zones will further improve your trading strategies. These zones will show you where the market has significant buying or selling pressure. When CHoCH patterns emerge within these zones, they create the perfect setup for high-probability trades.

Supply Zones: Areas of Increased Selling Pressure

Potential Sell Zones: Supply zones often appear near previous swing highs, where selling pressure is likely to increase and where the market might be about to go downwards.

Demand Zones: Areas of Increased Buying Pressure

Potential Buy Zones: Demand zones are usually found near the previous swing lows. These are the zones where buying pressure is expected to surge, and where the market could potentially turn upwards.

CHoCH and Zones: Increasing Trade Probability

Higher Probability Setups: A CHoCH that happens within a supply or demand zone increases the likelihood of a significant reversal.

Liquidity Grabs & Stop Hunts: Identifying Institutional Footprints

Market Manipulation: Always watch out for areas where the large market participants will try to manipulate the price to trigger stop losses before a CHoCH can develop. These are common techniques from large institutions trying to take advantage of smaller retail traders.

For example, let’s say a bearish trend is occurring, then a CHoCH signals a bullish move. If this CHoCH occurs at a well-known demand zone, then the probability of the reversal is much greater. Similarly, a bearish CHoCH within a supply zone adds confidence to your trading setup. Always be mindful of liquidity grabs and stop hunts, because these often precede CHoCH patterns. Understanding these actions, will better prepare you for trading in these markets.

Read More: ICT Market Structure Shift

Example of a CHoCH occurring within a demand zone. Observe the bullish CHoCH as it approaches the demand zone, which could be the start of an upward move.

Real-World Application: Chart Analysis Examples

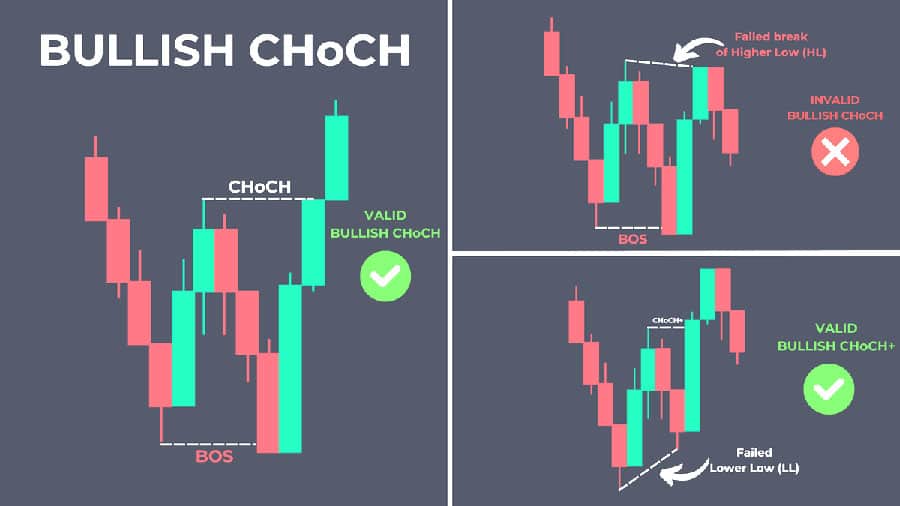

Now, let’s combine theory with real-world examples. Consider a bullish market, where the price has been forming a series of higher highs and higher lows, which is a sign of a strong uptrend. Then, the price starts to drop creating a lower low, which breaks below a significant swing low, signaling a CHoCH.

Bullish Market Scenario

Uptrend Confirmation: Price consistently creates higher highs and higher lows, indicating an upward trend.

Bearish Signal: The price then creates a lower low, breaking below the previous swing low, signaling a bearish CHoCH and a potential move toward a downtrend.

Bearish Market Scenario

Downtrend Confirmation: Price creates lower highs and lower lows, which is a sign of an overall downtrend.

Bullish Signal: The price creates a higher high, breaking the swing high, indicating a bullish CHoCH and a potential reversal to an upward trend.

If we flip this around and look at a bearish market, where the price is making lower highs and lower lows, a CHoCH would be seen when the price forms a higher high, breaking through a recent swing high. These scenarios illustrate how CHoCH patterns can show up on the charts, providing you with better tools to identify them when you trade.

Example of a Bullish CHoCH. See how the trend changes from downtrend to uptrend when a higher high breaks the downtrend structure.

Example of a Bearish CHoCH. Observe that the trend goes from uptrend to downtrend, after price breaks the key low of the uptrend.

Risk Management: Protecting Your Trading Capital

Trading without a proper risk management strategy is similar to embarking on a dangerous journey without the right equipment. When you’re utilizing CHoCH signals, you need to minimize your potential losses and protect your trading capital, using a carefully planned strategy. Stop-loss placement is essential for this. When placing your stop losses, always position them strategically above or below the swing high or low of the CHoCH pattern, ensuring trades close automatically if the market goes against your prediction.

Strategically Positioning Stop-Loss Orders

CHoCH Based Stops: Always position your stop losses slightly above the swing high or below the swing low of the CHoCH.

Proper Position Sizing

Capital Protection: You must allocate a small and fixed percentage (1-2%) of your trading capital to every single trade you open.

Setting Realistic Profit Targets

Risk-Reward Ratio: Your profit targets should match your risk reward ratios, and aim to gain more than what you are willing to risk.

Maintaining Discipline

Emotional Control: Always stick to your risk management plan and never allow your emotions to influence your decisions.

Also, always make sure that position sizes and profit targets are established prior to opening any trade. If you do not, then you risk making imprecise and inaccurate trading decisions. Do not let your emotions dictate your trading decisions. You must stick to your trading plan. By doing so, you will be able to protect your capital and reduce the anxiety that can come with any uncertainty.

Read More: Bos in smart money concept

Common Trading Errors: Avoiding Pitfalls & Misconceptions

One of the most common mistakes many traders make is mistaking a simple pullback for a real CHoCH and jumping into trades before the actual signal appears. A true CHoCH requires a clear break of market structure and is not just any simple pullback. Also, traders will often over rely on CHoCH alone, without considering wider market factors, leading to trades with limited potential.

Confusing Retracements for CHoCH Signals

Valid Breaks: Always confirm that the structure has been broken and that you are seeing a true CHoCH pattern.

Over-Reliance on CHoCH

Multiple Confirmations: CHoCH needs to be combined with other technical tools and indicators.

Ignoring Wider Market Analysis

Market Context: Take into consideration all relevant news, economic releases, and market sentiment before acting.

Impatience & Undisciplined Trading

Strategic Approach: Never rush into trades and only act when you have found a high-probability setup.

To overcome these common issues, always make sure that you are validating CHoCH signals with various other tools and techniques. Look beyond the charts, and also analyze any underlying conditions, and never let your emotions take control of your decisions. By being disciplined and patient, you will be able to improve your overall trading outcomes.

Advanced Trading Strategies: Refining Your CHoCH Approach

For traders who are looking for that extra edge, mastering the nuances of CHoCH can unlock higher potential rewards. Consider combining volume and momentum indicators to further refine your entry and exit points along with your CHoCH signals. High-volume breakouts are very reliable indicators of a significant shift in the market. Use tools such as the RSI and MACD to accurately pinpoint your entry and exit points, creating a higher quality trade.

Validating with Volume

Spikes in Volume: Always observe if there is a high amount of volume when a CHoCH pattern occurs.

Integrating Momentum Indicators

RSI and MACD: Use the RSI and MACD to find those opportune entry and exit points, and identify potential overbought and oversold conditions.

Utilizing Fundamental Analysis

Economic Calendar: Combine CHoCH with fundamental analysis to gain more insights into any underlying market drivers.

Rigorous Testing of Strategies

Backtesting and Paper Trading: Before applying advanced techniques in the real world, always test them with demo accounts.

Important Note: Always keep learning, as the market is always changing.

Remember that combining fundamental analysis with CHoCH signals will also enable you to better predict how the market might behave. This will lead to more accurate and informed trading decisions. By including these advanced strategies, you will be able to take your trading skills to the next level.

Opofinance Services

Opofinance is a regulated forex broker, that is licensed by ASIC, ensuring a high level of security and reliability.

Opofinance is listed as one of the top MT5 brokers, offering access to advanced trading technology.

Our platform provides fast and seamless deposit and withdrawal options, for smooth and hassle-free transactions.

Take advantage of our social trading service and connect with other expert traders, while improving your overall trading skills.

Ready to transform your trading journey? Click here to explore the world of possibilities at opofinance.com and start trading today!

Concluding Thoughts

Mastering the concept of CHoCH is crucial for traders looking to gain an edge in the forex markets. By understanding its role in the Smart Money Concept, you will be able to better read the market signals and you will be able to make informed trading decisions. Differentiating between CHoCH and BOS will further improve your strategies, and when you also use supply and demand zones, then you’ll be well on your way to a successful trading career. Remember that risk management is the foundation of your trading strategy. With the right skills, patience and discipline, you will be able to improve your skills and see significant improvement over time.

Key Takeaways

Signaling Reversals: CHoCH is a reliable way to identify potential trend reversals, by breaking through key levels in market structure.

CHoCH and BOS: Always distinguish a CHoCH, which indicates a trend reversal, from a BOS which indicates a trend continuation.

Timeframe Importance: Always use higher timeframes to determine market structure, and use lower timeframes to improve entry timing.

Supply and Demand: Combining CHoCH with supply and demand zones can lead to a significant increase in trade accuracy.

Risk Management: A strict risk-management strategy with well-defined stop losses is critical to protecting your capital.

Avoid Common Mistakes: Always be aware of common pitfalls and misconceptions, which is key to long-term success.

Advanced Techniques: Always improve your strategies with volume, momentum indicators, and fundamental data analysis.

Discipline and Dedication: Remember that consistency, dedication and discipline are needed to achieve your goals.

How can a trader ensure the reliability of CHoCH signals and avoid false positives, leading to costly errors?

False CHoCH signals often lack a significant structure break, and are usually not backed by a high trading volume. Always seek confirmation from additional indicators, and when possible, try to analyze higher timeframes. In the event that institutional involvement is difficult to confirm, then it may be a low-probability setup. When you trade with the smart money concept, these steps are crucial.

Is CHoCH equally effective across all market conditions, and are there limitations to its use?

CHoCH can be utilized in a variety of markets, but make sure to adjust your strategies depending on the conditions you’re facing. It is very useful for recognizing trend reversals, but in volatile conditions, it may not be as reliable unless backed by additional signals and a high degree of confluence, including additional indicators and strong order flow. Remember that market conditions are always dynamic.

How long does it take for a CHoCH pattern to develop, and what factors influence its formation timeframe?

The time it takes for a CHoCH pattern to develop is dependent on market conditions and the timeframes that you are using. CHoCH patterns can take minutes in lower timeframes, and in days or weeks on higher timeframes. It’s best to focus on the structure of the price movement and the overall market context, rather than simply relying on the specific duration of the pattern.

Can CHoCH be used in combination with other technical analysis tools for better results?

Absolutely. Combining CHoCH with other technical analysis tools such as Fibonacci retracements, trend lines, and moving averages can create stronger signals and improve your trading performance. When you use these tools in conjunction, you are more likely to identify high probability trades. The smart money concept is used to confirm trends, and is more effective when combined with other trading tools.

How does volume analysis improve the validity of CHoCH patterns and why it is important?

Analyzing volume can improve your CHoCH analysis because higher volume spikes will usually occur with a true CHoCH. When combined, these signals can improve your overall reliability and improve your trade outcomes. Volume is another tool for traders to use when confirming the smart money concept in their trading.

What are some of the key differences between identifying CHoCH on higher versus lower timeframes?

Identifying CHoCH on higher timeframes, such as the daily or 4-hour charts, will give you a better indication of the overall trend. Lower timeframes, such as the 15-minute or 1-hour charts, will allow you to pinpoint more accurate entry points, improving your timing. Using multiple timeframes to look for CHoCH patterns is the best way to achieve trading success.