Cognitive biases in trading are predictable, systematic errors in thinking that cause investors and traders to make irrational decisions. These mental shortcuts, hard-wired into our brains for survival, lead to distorted judgments in the high-stakes environment of financial markets. They are not random mistakes but consistent patterns of flawed logic that cause traders to deviate from their strategies when trading with their forex broker. This guide explains how cognitive biases affect trading, identifies the most common ones that drain your capital, and provides actionable strategies for overcoming cognitive biases in trading, helping you win the crucial battle against your own mind.

Key Takeaways for the Aspiring Trader

Before we dive deep, here’s what you absolutely need to grasp. Understanding these points is the first step toward trading with your mind, not just your emotions.

- Biases Are a Feature, Not a Bug: These mental shortcuts are part of being human. The goal isn’t to eliminate them but to recognize and manage them so they don’t control your trading account.

- Your Plan is Your Shield: The single most effective tool against emotional and biased decisions is a detailed, non-negotiable trading plan. It’s your rulebook, written when you were rational, for your future, emotional self to follow.

- Losses Are a Business Expense: The most destructive biases often stem from a fear of taking small, manageable losses. Learning to accept losses as a standard cost of doing business is non-negotiable for long-term survival.

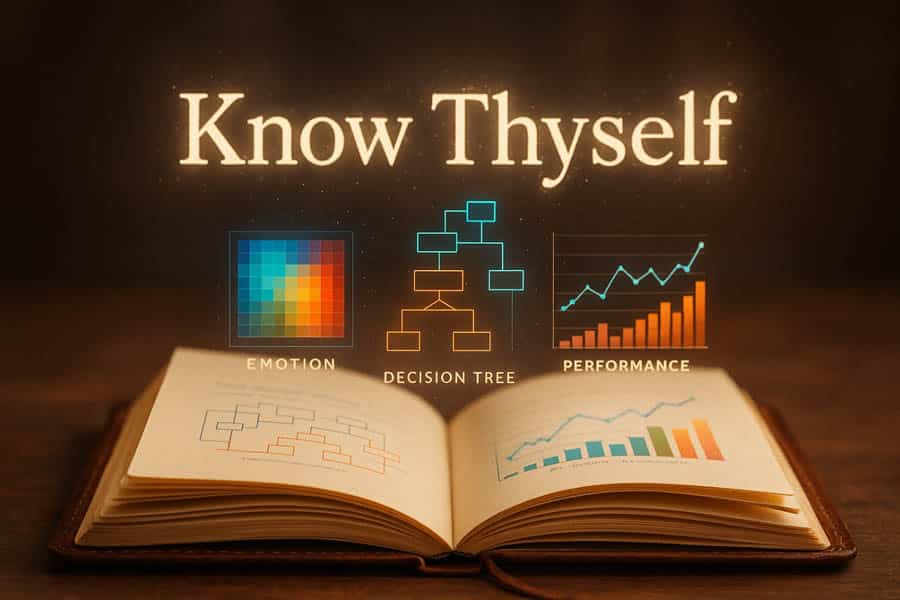

- Self-Awareness is Your Superpower: The most successful traders are masters of self-analysis. Through journaling and mindfulness, they identify their unique psychological triggers and build systems to counteract them. Overcoming cognitive biases in trading starts with introspection.

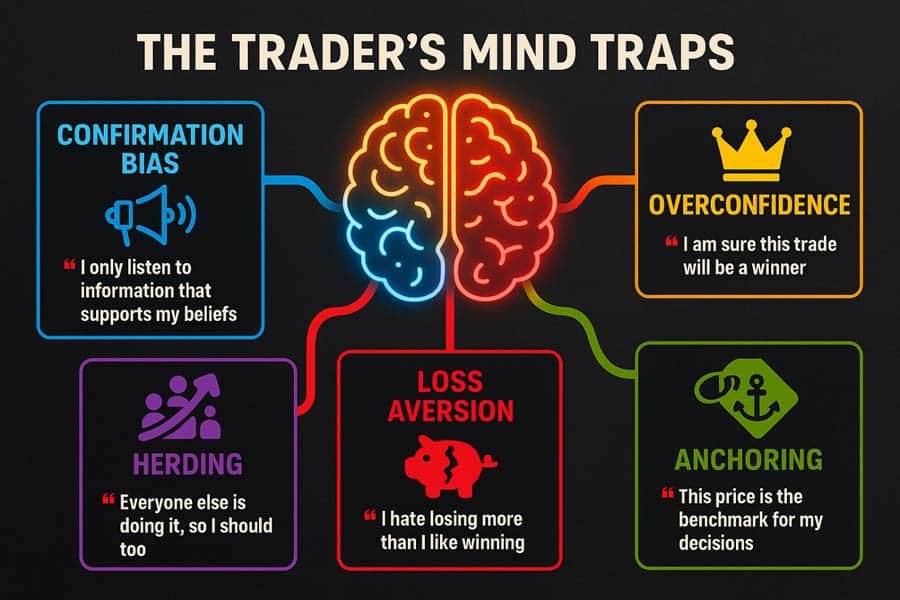

The Most Common Cognitive Biases That Cost Traders Money

To defeat an enemy, you must know it intimately. These biases are the invisible puppet masters pulling the strings on your trades. They operate in the background, feeling like intuition but acting like sabotage. Recognizing how these common cognitive biases in trading show up in real-time is your first line of defense. They are the primary reason why knowing a strategy isn’t enough; you must also know yourself.

Confirmation Bias: The Echo Chamber of Your Beliefs

Confirmation bias is our natural tendency to seek, interpret, and favor information that validates our pre-existing beliefs while actively ignoring or devaluing contradictory evidence. Once you’ve decided a trade is a “good idea,” your brain will work overtime to prove you right. Experience teaches that this bias is a silent account killer because it builds a wall between you and market reality.

How it manifests: You go long on a stock. It starts to drop. Instead of consulting your trading plan, you scour news feeds for positive stories about the company, visit forums where other bulls are reinforcing your position, and fixate on a single technical indicator that supports your view, all while ignoring five other indicators screaming “sell.” You are creating a personalized echo chamber that filters out dissenting opinions. The primary way how cognitive biases affect trading like this is by preventing you from cutting a loss when your strategy dictates you should.

Practical Tip: Before entering any trade, force yourself to play devil’s advocate. You must find and write down at least three solid reasons why this trade could fail. This disciplined practice of seeking disconfirming evidence directly counteracts the bias and leads to more objective decision-making.

Read More: Trading Psychology in Forex: Mastering Emotions for Success

Loss Aversion: The Paralyzing Fear of Realizing a Loss

Loss aversion is the principle that the psychological pain of a loss is about twice as powerful as the pleasure of an equivalent gain. This means you’ll do more to avoid losing $100 than you will to gain $100. In trading, this creates a catastrophic reluctance to close a losing position. A paper loss doesn’t feel real, but clicking “close” makes it permanent and forces you to admit you were wrong.

How it manifests: Your trade hits your predetermined stop-loss level. Instead of exiting as your plan demands, you think, “I’ll just move the stop a little further down; it might turn around.” You are choosing the hope of avoiding a realized loss over the discipline of risk management. This single behavior is responsible for more blown accounts than perhaps any other. This is one of the most powerful and common cognitive biases in trading.

Practical Tip: Use hard stop-loss orders. As soon as you enter a trade, place the stop-loss order with your broker. Do not use mental stops. A hard stop automates the decision, removing your emotional, loss-averse self from the equation at the critical moment.

Overconfidence Bias: The Victor’s Curse

After a winning streak, it’s human nature to feel like you’ve got the Midas touch. This is the overconfidence bias: an inflated sense of your own skill and predictive ability. You start to attribute your success to your own genius rather than a combination of a good strategy, luck, and favorable market conditions. This is a particularly dangerous state of mind for a trader.

How it manifests: You’ve just had five winning trades in a row. On the sixth trade, you feel certain. So, you double your position size, ignore a few of your entry rules because you “have a good feeling,” and take on far more risk than your plan allows. The market doesn’t care about your winning streak. When this “sure thing” trade turns against you, the oversized loss can wipe out all your previous gains and more. This is a classic example of how cognitive biases affect trading performance.

Practical Tip: Stick to your risk management rules religiously, especially after a big win. Your risk per trade (e.g., 1% of your account) should be constant. A winning streak is the time for more caution, not more aggression.

Anchoring Bias: Getting Stuck on an Irrelevant Number

Anchoring bias is our cognitive tendency to latch onto the first piece of information we receive (the “anchor”) and use it as the reference point for all future judgments. In trading, the most common anchor is your entry price. Once you buy, that price becomes psychologically significant, even though it’s completely irrelevant to the market’s next move.

How it manifests: You buy a forex pair at 1.1250. It drops to 1.1200. The market structure has turned bearish, but you are anchored to your entry price. Your thought process becomes, “I’ll sell when it gets back to my breakeven point.” You are making a decision based on a past event, not on current market information. The market has no memory of your entry price.

Practical Tip: When analyzing an open trade, hide your entry price from your chart. Evaluate the current price action, support/resistance levels, and indicator signals as if you had no position. Would you enter a new short position right now? If the answer is yes, it’s a strong sign you should exit your long.

Recency Bias: Chasing Yesterday’s News

Recency bias is the tendency to give more weight to the latest information and to extrapolate recent events into the future. If a market has been screaming upwards for three days, we assume it will continue screaming upwards tomorrow. We allow short-term noise to drown out the long-term signal. This is a prominent cognitive bias in trading volatile markets.

How it manifests: A stock has been in a steady, year-long uptrend. A negative news report causes a sharp two-day sell-off. Infected by recency bias, you panic and sell your position, convinced the trend is over. More often than not, this is just a temporary pullback, and you’ve just sold at the worst possible time, right before the primary trend resumes.

Practical Tip: Always use multiple time-frame analysis. If you’re trading on a 1-hour chart, always check the 4-hour and daily charts to maintain perspective on the primary trend. This keeps recent, lower-timeframe noise in its proper context.

Hindsight Bias: The “I Knew It All Along” Fallacy

Hindsight bias is looking back on a past event and believing it was easily predictable when, in reality, it was not. After a market crash, it’s easy to look at the chart and say, “The signs were all there.” This is a deceptive bias because it prevents you from learning and fosters overconfidence.

How it manifests: You look at a past winning trade and think, “I knew that was going to be a home run.” This reinforces the belief that you can predict the future with high accuracy, leading to excessive risk-taking later. Conversely, you might look at a loss and say, “That was a freak, unpredictable event,” which stops you from analyzing what you could have done better in terms of risk management.

Practical Tip: In your trading journal, before you enter a trade, write down your thesis and also what would invalidate it. When you review the trade later, compare the outcome to your original thesis, not a revised “I knew it all along” version of history.

Read More: How to Overcome Greed in Forex Trading

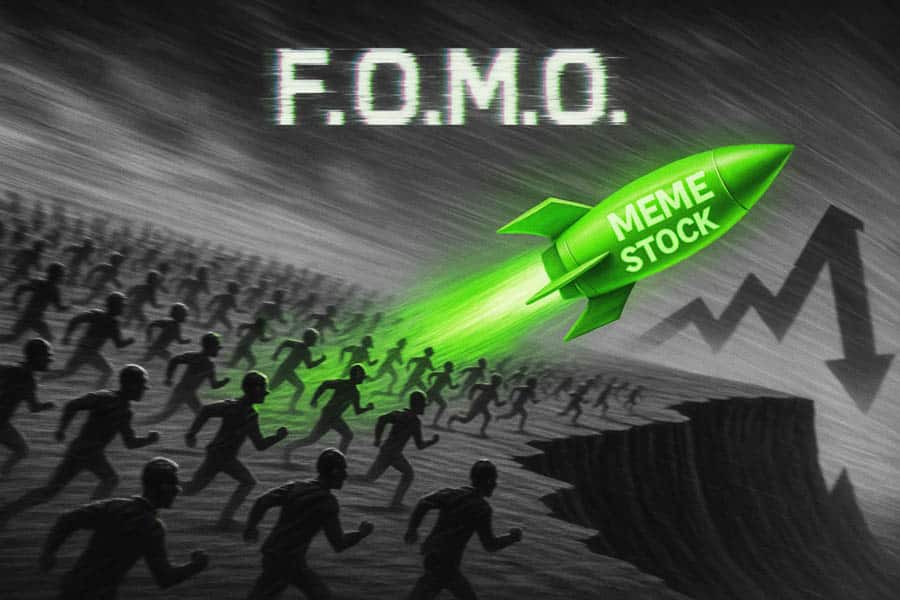

Herding Behavior: Following the Crowd Off a Cliff

Driven by a deep-seated fear of missing out (FOMO), herding is the tendency to follow the actions of a larger group rather than performing your own analysis. When a “meme stock” or cryptocurrency is soaring, and social media is filled with stories of instant wealth, the psychological pressure to join the herd can be immense.

How it manifests: You see a massive green candle on a chart. You jump onto Twitter and see everyone celebrating. You abandon your trading plan and buy at the market price, fearing you’ll miss the rest of the move. Unfortunately, the crowd is almost always late to the party. You’re often buying at the point of maximum risk, just as the early, smart money is selling their positions to the herd.

Practical Tip: Develop a mechanical entry system. You are only allowed to enter a trade if a specific, pre-defined set of criteria (e.g., price above 20-period moving average, RSI below 70, etc.) are met. If those conditions aren’t there, you are forbidden from trading, no matter how tempting the move looks.

Illusion of Control & Availability Bias

These two often work together. The Illusion of Control is believing you have more influence over events than you do (e.g., using a “lucky” indicator setting). The Availability Bias is over-relying on information that is easily recalled, often because it’s recent or emotionally vivid. A dramatic news story about a company’s struggles (availability) might lead you to short it, believing you have a special insight (illusion of control), even if the price action doesn’t support the trade.

The Real-World Impact: How Biases Manifest Daily

Understanding these biases in isolation is one thing. Seeing how they combine to create destructive trading behaviors is another. Recognizing these patterns in yourself is a critical step in overcoming cognitive biases in trading. These aren’t abstract concepts; they are what’s happening in your brain during your trading day.

The Trap of Revenge Trading

After taking a frustrating loss, you feel an intense urge to jump right back into the market to “win your money back.” This is revenge trading, and it’s a toxic cocktail of Loss Aversion (you can’t stand the pain of the loss) and Overconfidence (you believe you can force a win from the market). Your decision-making becomes purely emotional, detached from any rational strategy. You’ll take low-probability setups, widen your stops, and oversize your positions, digging a deeper and deeper hole. This is a clear demonstration of how cognitive biases affect trading by turning one small, disciplined loss into a series of large, emotional ones.

Practical Tip: Institute a mandatory “cooling-off” period. If you take a loss that exceeds a certain amount or feels particularly emotional, you must close your platform and walk away for at least one hour. No exceptions. This breaks the emotional feedback loop and prevents impulsive decisions.

The Agony of FOMO (Fear of Missing Out)

You see a market moving aggressively without you. Every tick upwards feels like a personal insult. This is FOMO, a direct result of Herding Behavior and Recency Bias. You see the recent price action and assume it will continue forever, and you see others profiting and feel you’re being left behind. The result is “chasing the market”—entering a trade long after a move has started, at the worst possible price, with the highest level of risk. Your entry is based on emotion, not on a valid setup from your trading plan.

Practical Tip: Never buy a “green candle” at the market price. Instead of chasing, be patient. If you believe in the trend, wait for a pullback to a logical support level or moving average. If you don’t get the pullback, you don’t get the trade. This discipline prevents you from buying at the top.

Read More: How to Overcome Fear in Forex Trading

Actionable Strategies for Overcoming Cognitive Biases in Trading

Knowledge is not power; applied knowledge is. Now that we’ve identified the enemy, we need a battle plan. These strategies are not quick fixes; they are disciplined habits that, over time, build a psychological fortress around your capital. This is the practical core of overcoming cognitive biases in trading.

1. Develop a Non-Negotiable Trading Plan

Your trading plan is the constitution for your trading business. It’s a document you create when you are objective and rational, to be executed without question when you are emotional and in the heat of battle. It is your primary defense against impulse. A vague plan is useless; it must be excruciatingly specific.

What to include:

- Pre-Session Routine: How will you prepare for the trading day? (e.g., check economic calendar, review key charts).

- Market Selection: Which markets will you trade and why?

- Setup Checklist: A list of exact, objective criteria that must be met for a trade to be considered valid. (e.g., “Price must be above the 50 EMA on the daily chart, and the 1-hour chart must show a bullish engulfing candle”).

- Entry Trigger: The precise event that gets you into the trade.

- Risk Management Rules: Your fixed risk per trade (e.g., 1%), how you will calculate position size, and your maximum daily loss limit.

- Trade Management: Rules for where your initial stop-loss goes, and rules for if/when you will move it to breakeven.

- Exit Strategy: Clear rules for taking profits. Is it a fixed target? A trailing stop? An opposing signal?

Following this plan is not optional. It is the only way to separate your decision-making process from the destructive influence of cognitive biases in trading.

2. Keep a Religiously Detailed Trading Journal

A journal is a tool for forced self-awareness. It’s where you move from being the actor in your trading drama to being the objective observer. It allows you to connect outcomes with behaviors and identify the specific biases that are costing you money.

What to track beyond the basics:

- Screenshot of the Setup: A picture is worth a thousand words. Annotate it with your reasons for entry.

- Your Emotional State (1-5): Rate your level of fear, greed, or anxiety before, during, and after the trade.

- “Did I Follow My Plan?” (Yes/No): This is the most important field. If the answer is no, you must write a detailed explanation of why you deviated.

- Post-Trade Review: After the trade is closed, write a paragraph on what you did well and what you could improve. Was the loss a “good” loss (followed the plan) or a “bad” loss (broke the rules)?

Weekly, review your journal to find patterns. “I notice that I break my rules on Tuesdays.” or “Every time I lose a trade, my next trade is always oversized.” This data is pure gold for overcoming cognitive biases in trading.

3. Practice Active Self-Awareness and Mindfulness

You cannot fight what you cannot feel. Mindfulness is the practice of creating a small gap between an emotional impulse and a physical action. In trading, this gap is where good decisions are made.

Practical Techniques:

- The 90-Second Rule: When you feel a strong emotion (fear after a sudden drop, greed after a fast spike), recognize that the physiological lifespan of that emotion is about 90 seconds. Step back from the screen. Stand up, breathe deeply, and let the initial chemical rush pass before you make a decision.

- Pre-Session Check-in: Before you trade, ask yourself: “Am I mentally fit to trade?” If you’re stressed, tired, or angry about something outside of trading, you are at a high risk of making biased decisions. Sometimes the best trade is no trade at all.

4. Leverage Automation and Objective Tools

Use technology to enforce the discipline you might lack in the moment. Automation takes your emotional, fallible self out of the most critical decisions.

How to use it:

- Hard Stops and Take-Profits: As mentioned, this is non-negotiable. Set them the moment you enter a trade. This automates your exit plan and protects you from Loss Aversion and fear-based profit-taking.

- Use Analytics Software: Connect your account to a third-party journaling service. It will analyze your data objectively and show you hard truths, such as “You lose 80% of the time when you trade against the trend,” free from your personal biases.

5. Commit to Continuous, Focused Learning

The market and your own psychology are constantly evolving. A commitment to being a lifelong student is essential. Your education should focus as much on psychology as it does on strategy.

What to focus on:

- Read Books on Trading Psychology: Dedicate regular time to reading classics like “Trading in the Zone” by Mark Douglas.

- Review, Review, Review: Once a month, do a deep dive into your journal and trading plan. Is the plan still working? Are old biases creeping back in? This constant review is crucial for managing the long-term challenge of cognitive biases in trading.

6. Seek Objective Feedback and Accountability

It’s nearly impossible to see your own blind spots. An external, objective perspective is invaluable. This creates accountability and can highlight a bias you didn’t even know you had.

How to get it:

- Find a Mentor or Trading Community: Find a small, serious group of traders or a mentor. Share your journal (the “why,” not just the P&L) and be open to constructive criticism. Having to explain your actions to someone else is a powerful filter against bad decisions.

- Create an Accountability System: If you struggle with a specific rule, create a penalty. “If I risk more than 1% on a trade, I am not allowed to trade for the rest of the day.” This creates a real consequence for breaking your rules.

Opofinance Services

To implement these strategies effectively, you need a brokerage partner that provides the right tools and a secure environment. Opofinance, an ASIC-regulated broker, is built for traders serious about mastering their craft and overcoming cognitive biases in trading.

- Advanced Trading Platforms: Execute your plan with precision on industry-leading platforms like MT4, MT5, and cTrader, or use the proprietary OpoTrade platform.

- Innovative AI Tools: Get an analytical edge with an AI Market Analyzer for objective data, an AI Coach to help spot behavioral patterns, and instant AI Support.

- Social & Prop Trading: Reduce the emotional pressure of trading your own capital. Learn from the community with Social Trading or prove your skills and trade firm capital through Prop Trading.

- Secure & Flexible Transactions: Manage your capital with ease. Opofinance offers secure and convenient deposit and withdrawal methods, including crypto, with zero fees from the broker.

Ready to trade with a broker that supports your journey toward disciplined trading? Explore Opofinance today.

Conclusion: Winning the Inner Battle

The path to consistent trading profitability is paved with self-awareness. The market is just an environment; the real challenge is mastering the cognitive biases in trading that reside within you. Success is not about finding a perfect, no-loss strategy. It’s about building a robust psychological framework that allows your well-researched strategy to operate as designed. By accepting that these biases are part of you, and by using practical tools like a trading plan, a journal, and mindfulness, you can manage their influence. You can move from being a victim of your psychology to being a disciplined manager of risk, which is the true definition of a successful trader.

Which cognitive bias is the most damaging for new traders?

Loss aversion is often the most destructive for beginners. The intense fear of realizing a loss causes them to hold onto losing trades far too long, turning small, manageable mistakes into account-ending disasters.

Can cognitive biases ever be helpful in trading?

In almost all cases, no. Cognitive biases are, by definition, systematic flaws in logic. While gut feelings can sometimes seem to work, relying on them instead of a tested strategy is a form of bias itself (like the illusion of control) and is not a sustainable path to success.

How long does it take to overcome trading biases?

Overcoming biases is an ongoing process, not a destination. It requires constant vigilance. While a trader can become proficient at managing them within months through discipline, even seasoned professionals must actively use tools like trading plans and journals to keep them in check.

What is the difference between an emotional mistake and a cognitive bias?

An emotional mistake is a reactive error, like closing a trade in a panic. A cognitive bias is the underlying, systematic thought pattern that enables that emotional mistake. For example, loss aversion (the bias) creates the fear that leads to the panic sale (the emotional mistake).