Are you ready to automate your forex trading and potentially boost your profits? The answer is yes! This guide dives into the world of algorithmic trading and shows you exactly how to create forex trading robot. Whether you’re an experienced coder or just getting started, this article will equip you with the knowledge and tools you need to create forex trading bot that fits your trading strategy. We will explore the essentials needed to create forex trading robot. This comprehensive guide provides valuable insights and actionable steps to how to create your own forex trading robot, ensuring you are well-equipped to navigate the complexities of algorithmic trading.

Let’s face it: manual forex trading can be exhausting and emotionally draining. Sticking to a strategy requires discipline, and market volatility can trigger impulsive decisions. Hours spent glued to charts could be better spent elsewhere. The constant pressure can lead to burnout and inconsistent results.

Imagine a system that trades flawlessly based on your rules, 24/7, without emotion or fatigue. A system that backtests strategies with incredible speed and identifies opportunities you might miss. This is the power of a forex trading robot, also known as an Expert Advisor (EA). Many are interested in how to create forex trading bot to achieve this level of automation.

This article will walk you through the process of building your own forex trading robot, covering the essential steps from conceptualization to testing and deployment. We will also touch on popular platforms and coding languages used in the process, so you can make your first forex trading bot. You’ll learn precisely how to create your own forex trading robot.

What is a Forex Trading Robot (EA)?

A Forex Trading Robot, also known as an Expert Advisor (EA), is essentially a sophisticated software program specifically designed to automate your carefully defined forex trading strategies. These robots operate seamlessly within popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), executing trades autonomously based on a set of pre-programmed rules, precise parameters, and complex algorithms. In essence, they are tireless digital traders working on your behalf.

These intelligent robots are capable of performing a wide range of functions, including analyzing real-time market data, identifying potential trading opportunities based on your strategy, and executing trades automatically, all without any manual intervention required. By fully automating these critical tasks, traders can significantly save time, mitigate emotional influences on decision-making (a common pitfall of manual trading), and potentially substantially increase their overall profitability.

The level of sophistication found in these robots can vary considerably, ranging from basic programs that simply execute straightforward trading strategies to highly advanced systems that incorporate complex algorithms, intricate risk management protocols, and even sophisticated machine learning techniques. Understanding how to create forex trading robot begins with grasping these core functionalities.

Read More: create forex trading robot

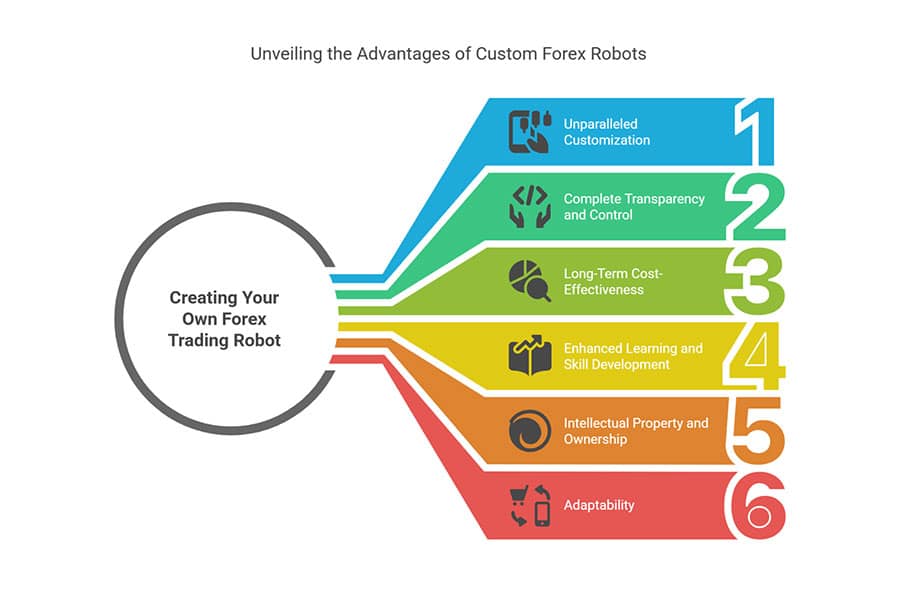

Why Create Your Own Forex Trading Robot? The Benefits of Customization

While a vast array of pre-built or commercially available forex robots are readily available for purchase, taking the initiative to build your own custom robot offers several distinct advantages:

Unparalleled Customization: This is perhaps the most significant advantage. You have the ability to tailor the robot precisely to your specific trading strategy, personal risk tolerance levels, and preferred currency pairs. This ensures you possess a unique forex trading bot that is perfectly aligned with your individual trading style and objectives. It gives you more control than simply acquiring a pre-made bot.

Complete Transparency and Control: When you build your own robot, you retain complete and unfettered control over the underlying code. You gain an in-depth understanding of exactly how the robot operates, eliminating the “black box” effect often associated with commercially available EAs, where the internal logic remains hidden.

Long-Term Cost-Effectiveness: Developing your own robot can prove to be more cost-effective in the long run compared to the ongoing expenses associated with purchasing and maintaining often expensive commercial EAs, which may require recurring subscription fees or updates.

Enhanced Learning and Skill Development: The actual process of designing, building, and debugging your own robot provides you with an invaluable opportunity to deepen your understanding of both the intricacies of forex trading and the fundamentals of programming. The quest to learn how to create your own forex trading robot becomes a significant learning experience.

Intellectual Property and Ownership: You have full ownership of your custom-built robot, and you are free to modify, enhance, and improve it over time as market conditions evolve or as you refine your trading strategy. The ability to create forex trading robot and own the result provides significant flexibility and long-term value.

Adaptability: You can adapt your robot to changing market conditions more easily compared to relying on updates from commercial EA providers. This agility is crucial for staying competitive.

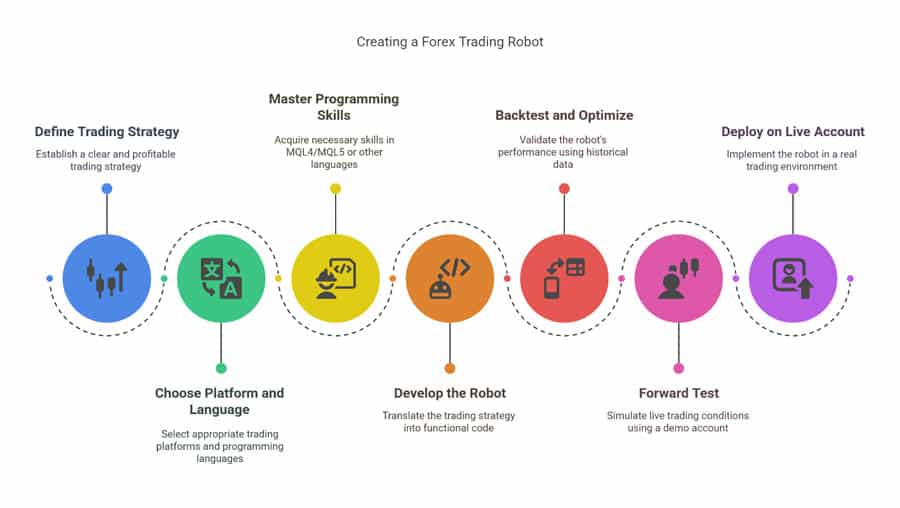

Essential Steps to Create Forex Trading Robot: A Practical Guide

The journey of creating a successful forex trading robot involves a series of well-defined steps:

Read More: trading bots pros and cons

1. Define Your Trading Strategy: The Foundation of Your Robot

This initial step is undeniably the most critical. Before you even begin to write a single line of code, you must possess a meticulously defined and demonstrably profitable trading strategy. This serves as the blueprint for your robot. To effectively create forex trading bot, your strategy must be robust and well-documented. Carefully consider the following aspects:

Targeted Market Selection: Identify the specific currency pairs your robot will focus on trading.

Optimal Timeframe Analysis: Determine the most appropriate timeframe the robot should analyze (e.g., 5-minute, 1-hour, daily charts).

Technical Indicator Selection: Choose the specific technical indicators the robot will utilize to generate trading signals (e.g., Moving Averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD)).

Precise Entry Rules: Define the exact conditions that must be met in order for the robot to initiate a trade. Be as specific as possible, providing clear and unambiguous rules (e.g., “Enter a long position when the 50-period moving average crosses decisively above the 200-period moving average”).

Well-Defined Exit Rules: Establish the precise conditions that must be met for the robot to exit a trade, considering both profit-taking and loss-limiting scenarios. Implement mechanisms like take-profit orders to secure gains and stop-loss orders to protect capital.

Robust Risk Management Protocols: Determine the maximum amount of capital you are willing to risk on each individual trade. Implement a position sizing strategy that takes into account your account balance, risk tolerance, and market volatility.

Dynamic Money Management Techniques: Establish rules for compounding profits by increasing position sizes as your account grows, or conversely, reducing position sizes during periods of drawdown to preserve capital.

Your carefully formulated trading strategy must undergo rigorous backtesting using historical market data in order to accurately evaluate how the proposed create forex trading bot would have performed under various historical market conditions. This validation step is crucial.

2. Choose Your Trading Platform and Programming Language: Tools of the Trade

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): The Industry Standards: These platforms remain the dominant choices for developing and deploying forex trading robots, boasting a large user base and extensive resources. They utilize proprietary programming languages known as MQL4 (for MT4) and MQL5 (for MT5). These languages are specifically designed for creating trading robots and custom indicators. They provide a rich set of built-in functions for accessing real-time market data, placing orders directly, and efficiently managing trades. If you are serious about learning how to create your own forex trading robot, these platforms are excellent starting points.

Alternative Platform Options: While MT4 and MT5 are the most popular, alternative platforms such as cTrader and TradingView also support algorithmic trading to varying degrees.

Versatile Programming Languages: Although MQL4 and MQL5 are the most commonly used, you can also leverage the power of other versatile programming languages like Python (using specialized libraries such as MetaTrader5 or backtrader) to connect seamlessly to trading platforms through their respective APIs (Application Programming Interfaces). This approach offers greater flexibility and access to a wider range of analytical tools.

For novice programmers and those new to algorithmic trading, utilizing MQL4 or MQL5 within the familiar MetaTrader environment is generally considered the most accessible and straightforward way to embark on your journey to create forex trading bot.

3. Master MQL4/MQL5 (or Your Chosen Language): Acquiring the Necessary Skills

If you are new to the world of programming, this phase will likely present the most significant initial challenges. However, numerous online resources and learning materials are readily available to assist you in developing your programming skills:

Official MQL4/MQL5 Documentation: The Definitive Resource: The official MetaTrader documentation serves as an invaluable resource for understanding the syntax, functions, and capabilities of the MQL4 and MQL5 languages.

Online Courses: Structured Learning Paths: Platforms like Udemy, Coursera, and YouTube offer structured courses that guide you through the fundamentals of MQL4 and MQL5 programming, often providing hands-on exercises and real-world examples.

Active Community Forums: Collaborative Learning: MQL5.com hosts a vibrant and supportive community forum where you can connect with experienced developers, ask questions, share your code, and receive valuable assistance.

Hands-on Practice: The Key to Mastery: The most effective way to learn any programming language is through consistent practice. Start by writing simple scripts to familiarize yourself with the syntax and concepts, and then gradually work your way up to more complex and sophisticated robots as your skills improve. To effectively create forex trading bot, you must dedicate time to practicing your coding skills.

4. Develop Your Robot: Translating Strategy into Code

This crucial stage involves translating your carefully defined trading strategy into functional code. Here’s a breakdown of the key components that comprise a typical forex trading robot:

Initialization Section: This initial section of the code executes only once when the robot is first attached to a chart. Its primary purpose is to initialize variables, set up any required technical indicators, and perform any other necessary setup tasks before the robot begins actively trading.

Tick Function (or OnTick): The Core Logic: This function is the heart of your robot, executing automatically every time a new tick of price data arrives. Within this function, the core logic of your robot resides. It analyzes incoming market data, checks for the presence of trading signals based on your defined strategy, and initiates the placement of orders when appropriate.

Order Management System: This critical section of the code handles all aspects of order placement, modification, and deletion. It ensures that orders are placed accurately according to your predefined trading rules, and that crucial stop-loss and take-profit levels are correctly set to manage risk and secure profits.

Robust Error Handling Routines: Implementing comprehensive error handling is essential to catch unexpected events, gracefully handle exceptions, and prevent your robot from crashing or malfunctioning in unforeseen circumstances.

Clear and Concise Code Comments: Writing clear, concise, and informative comments throughout your code is crucial for maintainability and debugging. Comments explain the purpose of each section of code, making it easier to understand, modify, and troubleshoot your robot in the future.

5. Backtest and Optimize Your Robot: Validating Performance

Backtesting involves running your robot on extensive historical market data to simulate its performance over a prolonged period. MetaTrader provides a built-in strategy tester, enabling you to meticulously backtest your robots across various currency pairs, timeframes, and historical data ranges.

Data Quality is Paramount: Ensure you utilize high-quality historical data, free from errors or gaps, to obtain accurate and reliable backtesting results.

Account for Realistic Spreads and Commissions: Incorporate realistic spread values and commission rates into your backtesting simulations to reflect the true cost of trading.

Employ Walk-Forward Optimization Techniques: This advanced technique involves optimizing your robot’s parameters on one segment of historical data and then evaluating its performance on a subsequent, out-of-sample segment. This helps to prevent overfitting.

Avoid the Pitfalls of Overfitting: Be extremely cautious to avoid overfitting your robot to the historical data. Overfitting occurs when your robot performs exceptionally well on the backtesting data but fails to replicate those results in live trading.

Parameter Optimization: Fine-Tuning for Success: Experiment with different parameter settings within your robot, such as moving average periods, take-profit levels, and stop-loss levels, to fine-tune its performance and identify the optimal configuration. Backtesting allows you to understand how to create forex trading bot that performs reliably.

6. Forward Test Your Robot: Simulating Live Trading

Forward testing, also known as demo testing, involves deploying your robot on a demo trading account with real-time market data but without risking any actual capital. This allows you to observe the robot’s performance in a live trading environment without any financial risk.

Demo Account Setup: Open a demo trading account with your chosen forex broker.

Realistic Trading Conditions: Ensure that the demo account provides trading conditions that closely mirror those of a live trading account, including realistic spreads, commissions, and leverage ratios.

Continuous Performance Monitoring: Closely monitor your robot’s performance on the demo account, paying attention to its profitability, drawdown, and overall behavior. Make adjustments as needed to optimize its performance.

Extended Testing Periods: Run your robot on the demo account for an extended period, spanning several weeks or even months, to obtain a reliable indication of its long-term performance and identify any potential weaknesses.

7. Deploy Your Robot on a Live Account: Taking the Plunge

Once you have gained sufficient confidence in your robot’s performance through rigorous backtesting and forward testing, you can finally deploy it on a live trading account. Start with a small allocation of capital and gradually increase it as the robot consistently demonstrates its profitability and reliability.

Leverage a Virtual Private Server (VPS): Consider using a VPS to ensure that your robot operates continuously, 24 hours a day, 7 days a week, without any interruptions. A VPS is a remote computer that is always online and provides a stable environment for your robot to run.

Maintain Close Monitoring: Continuously monitor your robot’s performance on the live account, paying close attention to its trading activity and overall profitability. Be prepared to manually intervene if necessary in case of unexpected market conditions or technical issues.

Stay Informed and Adapt: Stay up-to-date with the latest market news, economic events, and regulatory changes that could potentially impact your robot’s performance. Be prepared to adjust your robot’s parameters or strategy as needed to adapt to changing market dynamics.

Pro Tips for Advanced Traders: Elevating Your Algorithmic Trading

- Implement advanced risk management techniques: Consider using techniques such as position sizing based on volatility (ATR), correlation analysis to diversify risk, and dynamic stop-loss levels.

- Incorporate machine learning algorithms: Explore using machine learning algorithms such as neural networks and support vector machines to identify complex patterns in the market and improve the robot’s predictive capabilities.

- Develop a robust backtesting framework: Create a comprehensive backtesting framework that includes realistic market conditions, transaction costs, and slippage.

- Use multiple timeframes: Incorporate multiple timeframes into your trading strategy to gain a more complete view of the market.

- Automate the optimization process: Automate the optimization process to continuously fine-tune your robot’s parameters and adapt to changing market conditions.

Read More: What is Forex Trading Robot

Opofinance Services

Elevate your forex trading experience with Opofinance, a regulated broker committed to providing top-tier services and innovative tools. Opofinance ensures a seamless and secure trading environment.

- Advanced Trading Platforms: Trade on MT4, MT5, cTrader, and OpoTrade for a versatile and powerful trading experience.

- Innovative AI Tools: Utilize AI Market Analyzer, AI Coach, and AI Support to enhance your trading strategies and decision-making.

- Social & Prop Trading: Connect with other traders and explore proprietary trading opportunities.

- Secure & Flexible Transactions: Enjoy safe and convenient deposit and withdrawal methods, including crypto payments, with zero fees from Opofinance.

Start trading with confidence today! opofinance.com

Conclusion

Creating a forex trading robot is a challenging but ultimately rewarding endeavor. By diligently following the steps outlined in this guide, you can develop a robot that effectively automates your trading strategy, potentially freeing up your time and significantly improving your trading profitability. Remember to begin with a well-defined and thoroughly backtested trading strategy, dedicate time to learning a relevant programming language, rigorously backtest and forward test your robot before deploying it live, and continuously monitor its performance and make adjustments as needed. With unwavering dedication, persistence, and a commitment to continuous learning, you can successfully create forex trading robot that helps you achieve your financial objectives.

Key Takeaways

- Building your own forex robot provides significant advantages in terms of customization, transparency, and long-term cost-effectiveness.

- A carefully defined and thoroughly backtested trading strategy is absolutely essential before you begin coding your robot.

- MQL4/MQL5 within the MetaTrader environment serves as an excellent starting point for beginners venturing into algorithmic trading.

- Rigorous backtesting and forward testing are crucial steps to validate your robot’s performance and identify any potential weaknesses before risking real capital.

- Continuous monitoring, ongoing optimization, and a willingness to adapt to changing market conditions are necessary for achieving long-term success in algorithmic trading.

How much does it cost to create your own forex trading robot?

The total cost to create forex trading robot can vary significantly, depending on several factors. If you choose to code the robot yourself, the primary cost will be the investment of your time in learning the necessary programming skills and developing the code. However, if you decide to hire a freelance programmer or a professional development firm, the costs can range from a few hundred dollars to several thousand dollars, depending on the complexity of the trading strategy and the scope of the project. Additional costs to consider include potential subscriptions for historical market data feeds and the ongoing expenses associated with maintaining a virtual private server (VPS) to host your robot.

Can I use a forex trading robot if I’m a beginner trader with limited experience?

While utilizing a pre-built or commercially available forex trading robot might seem appealing for beginner traders, it’s crucial to thoroughly understand the robot’s underlying trading strategy, risk management parameters, and operational characteristics before entrusting it with your capital. Creating your own forex trading bot as a beginner, while potentially challenging, can provide a deeper and more comprehensive understanding of the intricate workings of algorithmic trading. It’s advisable to begin with simpler trading strategies and gradually increase the complexity of your robot as you gain more experience and confidence. Regardless of whether you use a pre-built or custom-built robot, always remember to rigorously test it on a demo trading account before deploying it with real money. The insights gained from learning how to create your own forex trading robot will be beneficial regardless.

How much time will it take to successfully create your own forex trading robot from scratch?

The amount of time required to successfully create forex trading bot depends heavily on several factors, including your existing programming skills, the complexity of your chosen trading strategy, and the amount of time you can realistically dedicate to the project on a consistent basis. A relatively simple robot that implements a straightforward trading strategy might take a few weeks to develop, test, and optimize. However, a more complex robot that incorporates advanced algorithms, sophisticated risk management protocols, or machine learning techniques could easily require several months of dedicated effort. Furthermore, continuous testing, ongoing optimization, and debugging are essential processes that require a significant and ongoing time investment to ensure the long-term reliability and profitability of your robot.