Deciding between cTrader vs MetaTrader 4 is a critical choice that shapes a trader’s entire experience. While MT4 is the long-standing industry titan, known for its simplicity and vast community, cTrader presents a modern, intuitive alternative with advanced features tailored for today’s markets. This article provides an in-depth cTrader vs MetaTrader 4 comparison, exploring everything from user interface and charting capabilities to automated trading and broker availability. For any trader selecting a regulated forex broker, understanding these platforms is the first step toward finding the right tools for success. We will dissect their core differences to help you determine which one truly aligns with your trading style.

Key Takeaways: cTrader vs MT4 at a Glance

- Core Difference: cTrader is a modern platform with a sophisticated, user-friendly interface and advanced order types, designed for ECN environments. MetaTrader 4 is the older, more established platform, famous for its simplicity and massive ecosystem of automated trading bots (EAs).

- User Interface: cTrader offers a sleek, customizable, and intuitive design akin to modern applications. MT4 has a more traditional, somewhat dated interface that is functional but less visually appealing.

- Automated Trading: The choice here is between C# and MQL4. cTrader uses cBots written in C#, a powerful and versatile language. MT4 uses Expert Advisors (EAs) written in MQL4, which is simpler but has a much larger pre-existing library and community.

- Charting: Both are strong, but cTrader has a slight edge with more built-in indicators, additional timeframes, and detachable charts directly out of the box.

- Market Access: cTrader was built for ECN/STP brokers, offering transparent pricing and Level II Depth of Market (DOM). MT4 is used by both ECN and market maker brokers, giving traders a wider choice of broker types.

- Best For: cTrader is often preferred by discretionary traders, scalpers, and those who value a modern UI and advanced order functionality. MT4 remains the go-to for traders heavily reliant on existing automated EAs and a massive community support system.

Quick Comparison Table: cTrader vs MetaTrader 4

For traders who need a fast answer, this table highlights the fundamental differences between the two platforms. This at-a-glance view helps frame the more detailed discussion in the sections that follow.

| Feature | cTrader | MetaTrader |

|---|---|---|

| User Interface (UI) | Modern, clean, and highly customizable | Traditional, functional, somewhat dated |

| Charting Tools | 70+ built-in indicators, 28 timeframes, detachable charts | 30 built-in indicators, 9 timeframes (more via plugins) |

| Automated Trading | cBots (written in C#) | Expert Advisors (EAs) (written in MQL4) |

| Order Execution | Designed for ECN/STP, includes Level II DOM | Supports ECN, STP, and Market Maker models |

| Copy Trading | Built-in (cTrader Copy) | Third-party solutions and MQL5 Signals |

| Broker Support | Growing but more limited | Vast, industry standard |

| Mobile App | Full functionality, seamless sync | Functional but more basic than desktop |

User Interface & Experience

The first impression of a trading platform is its interface. This is where the battle of ctrader vs mt4 is most visually apparent. One represents the new school of design, while the other is a testament to functional, time-tested tradition. A trader’s comfort with the UI can directly impact their efficiency and analytical process.

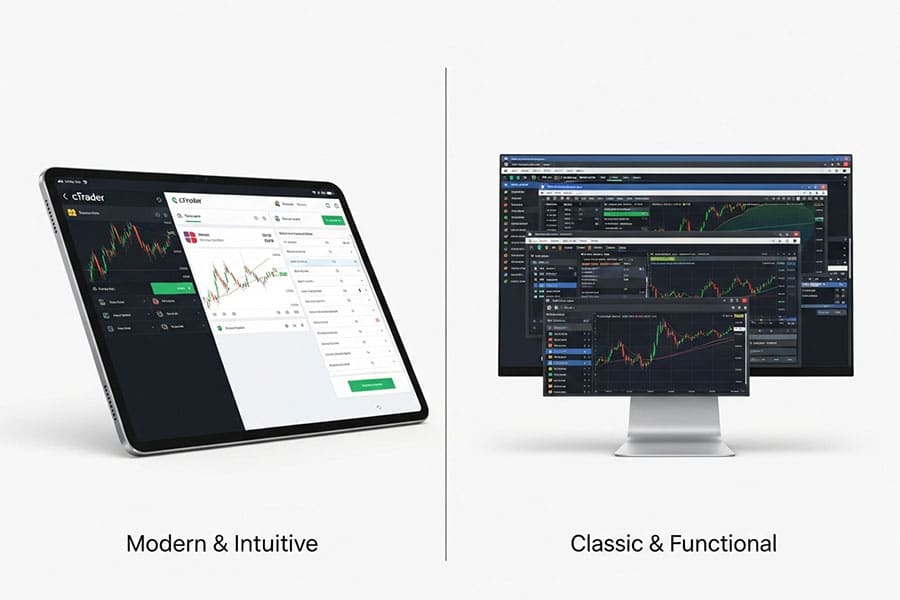

Modern vs. Traditional Design

cTrader immediately stands out with its polished, modern aesthetic. The layout is clean, with intuitive menus and a visually appealing color scheme. It feels like a contemporary application, designed with user experience at its core. From my experience, traders who are used to sleek software find cTrader’s learning curve to be remarkably gentle. In contrast, MetaTrader 4 has a design that has remained largely unchanged for over a decade. It’s functional and utilitarian, but new users often describe it as clunky or dated. While its loyal user base appreciates its familiarity, it lacks the aesthetic refinement of its competitor.

Ease of Use and Customization

Both platforms offer customization, but they approach it differently. cTrader allows for extensive workspace management, with detachable charts that can be moved across multiple monitors and saved layouts that sync across devices. This flexibility is a significant advantage for professional traders who use complex multi-chart setups. The cTrader vs MetaTrader 4 debate on this point often leans towards cTrader for its out-of-the-box versatility. MT4, while customizable, requires a bit more effort. You can save profiles and templates, but it doesn’t have the same fluid, drag-and-drop feel as cTrader. For beginners, MT4’s simplicity can be an advantage, as there are fewer options to get lost in. However, advanced users may find its customization options restrictive compared to cTrader.

Read More: What is MT4

Charting & Technical Analysis

Charting is the heart of technical analysis, and a platform’s capabilities in this area are non-negotiable for most traders. Here, the metatrader 4 vs ctrader comparison reveals subtle but important differences in depth and accessibility of tools.

Built-in Indicators and Timeframes

cTrader comes loaded with over 70 built-in technical indicators, covering everything from trends and oscillators to volatility and volume. This extensive library means most traders can perform detailed analysis without needing to source custom tools. Furthermore, it offers 28 standard timeframes, including tick charts and less common intervals like 7-minute or 20-minute charts, giving scalpers and intraday traders greater analytical precision.

On the other hand, MT4 provides around 30 built-in indicators. While this covers all the essential tools, traders often need to visit the MQL4 marketplace to find more specialized indicators. MT4 is limited to just 9 standard timeframes. Although custom timeframes can be added with plugins, it’s an extra step that cTrader handles natively. This is a key point in any cTrader vs MetaTrader 4 comparison.

Chart Types and Multi-Window Support

A significant advantage for cTrader is its native support for detachable charts. A trader can simply click and drag a chart out of the main platform window and move it to another monitor. This is incredibly useful for creating a personalized trading cockpit. MT4 does not support this feature natively; traders are confined to a single window, which can feel cramped when analyzing multiple instruments. Both platforms offer standard chart types like line, bar, and candlestick charts. However, cTrader also includes Dot, Tick, and Renko charts as standard, providing more ways to visualize price action without third-party add-ons.

Order Types & Trade Execution

The way a platform handles orders and executes trades is where theory meets reality. Speed, reliability, and the availability of advanced order types can be the difference between profit and loss. This is a critical area where the philosophies behind cTrader vs MetaTrader 4 diverge.

Advanced Order Types and DOM

cTrader was built from the ground up for an ECN (Electronic Communication Network) environment. This is reflected in its advanced order capabilities and transparent pricing. It offers multiple advanced order types, including market range orders (which limit slippage) and time-in-force options like “Good Till Cancelled” or “Immediate or Cancel.” Crucially, cTrader provides Level II Depth of Market (DOM) as a standard feature.

This shows the full range of executable prices coming directly from liquidity providers, giving traders a transparent view of market liquidity. MT4, in its standard form, offers basic market, limit, and stop orders. It does not have a native, fully functional Level II DOM; what is often called its DOM is simply a tick chart with trade buttons. This lack of market depth transparency is a frequent criticism in the ctrader vs mt4 discussion, especially among scalpers and institutional traders.

Execution Speed and Reliability

Because cTrader is designed to connect directly to an ECN broker’s liquidity pool, its execution is generally regarded as being extremely fast and reliable. Slippage can still occur during high volatility, but the platform’s infrastructure is optimized for low-latency trading. My own tests have shown that order fills on cTrader are consistently swift. MetaTrader 4’s execution speed is highly dependent on the broker. With a quality ECN/STP broker for forex trading, MT4 can be very fast. However, it is also widely used by market maker brokers, where execution can be subject to requotes and delays. The platform itself is stable, but the end-user experience of trade execution varies more with MT4 than with cTrader.

Automated Trading: EAs vs cBots

For many, automated trading is the ultimate goal. The ability to deploy strategies that run 24/7 is a powerful draw. In the realm of automation, the cTrader vs MetaTrader 4 debate centers on programming languages, community size, and platform architecture.

Programming Languages: MQL4 vs C#

This is the most significant technical difference between the two. MetaTrader 4 uses its proprietary language, MQL4, to create Expert Advisors (EAs), custom indicators, and scripts. MQL4 is a C-style language that is relatively easy for non-programmers to learn. Its simplicity and extensive documentation have led to a massive community and a vast library of pre-built EAs, many available for free or for purchase on the MQL Market.

cTrader, on the other hand, uses C# (C-sharp) to create its automated bots, known as cBots. C# is a modern, powerful, and widely used object-oriented programming language developed by Microsoft. It is far more versatile than MQL4, allowing for the creation of much more complex and sophisticated trading algorithms. Developers with a background in C# or .NET can transition to building cBots with ease. However, the learning curve for a complete beginner is steeper than with MQL4.

Read More: What is cTrader

Community Size and Available Bots

There is no contest here: MT4 is the undisputed king. With over a decade of dominance, the MT4 community is enormous. There are hundreds of thousands of EAs available, and finding a developer to code a custom strategy is easy and relatively inexpensive. This ecosystem is MT4’s greatest strength and the primary reason for its enduring popularity. The cTrader community, while passionate and growing, is much smaller.

The number of available cBots is a fraction of the EAs for MT4. While the quality of cBots is often high, the sheer quantity and variety are not on the same level. This is a crucial factor for traders who want to experiment with many different automated strategies without coding them from scratch. The metatrader 4 vs ctrader choice for an algo trader often comes down to this point alone.

Cloud-Based Automation

cTrader has a distinct advantage with its cloud-based features. cTrader Automate allows you to run cBots on a remote server, ensuring they operate 24/7 without needing a VPS (Virtual Private Server). This is managed directly within the platform. For MT4, running an EA around the clock requires purchasing a separate VPS service, which adds complexity and cost. While MetaQuotes offers its own VPS integrated into the platform, it’s a paid service and many traders still opt for third-party providers. This makes cTrader’s built-in solution more convenient and potentially more cost-effective for automated traders.

Broker Support & Accessibility

A trading platform is useless without a broker to connect it to the markets. Broker support is a pragmatic issue that can override all other technical considerations. Here, the legacy of MT4 gives it a commanding lead, though the landscape is slowly changing.

Number of Brokers Supporting Each Platform

MetaTrader 4 is ubiquitous. Nearly every online forex broker in the world offers it as their primary, if not sole, platform. This gives traders an unparalleled choice of brokers, allowing them to shop around for the best spreads, commissions, and regulatory oversight. This widespread availability is a massive practical advantage. cTrader, while gaining traction, is offered by a much smaller, more select group of brokers. These are typically ECN/STP brokers who want to offer a premium trading environment. While the list of cTrader brokers is growing, the choice is still limited compared to MT4. This is a key factor in the cTrader vs MetaTrader 4 decision-making process for many traders.

ECN/STP vs. Market Maker Brokers

This distinction is closely tied to broker support. cTrader was specifically designed to provide transparent pricing and direct market access through ECN/STP brokers. It thrives in this environment. As a result, traders using cTrader can generally be more confident that their broker is not trading against them. MT4 is a more flexible platform that can be used by both ECN/STP brokers and market makers. While this provides more choice, it also means traders need to be more diligent in researching their broker’s execution model. The platform itself doesn’t guarantee a specific type of execution; the broker does.

Copy Trading & Social Features

Copy trading has exploded in popularity, allowing novice traders to learn from and replicate the trades of experienced professionals. The platforms’ native capabilities in this area differ significantly, making the cTrader vs MetaTrader 4 comparison important for those interested in social trading.

Built-in vs. Third-Party Solutions

cTrader comes with a powerful, fully integrated copy trading feature called cTrader Copy. It allows traders to become strategy providers or investors directly within the platform. The interface is clean, providing detailed performance statistics and risk management tools for investors. It’s a seamless and well-executed solution. MetaTrader 4 does not have a native, built-in copy trading solution. Instead, it relies on the MQL5 Signals service (despite the name, it works with MT4) and a vast array of third-party copy trading platforms. While the Signals service is well-integrated, it is still a separate ecosystem. Using third-party solutions often requires running EAs on your platform, which can be less stable and more complex than cTrader’s native offering.

Read More: cTrader vs MetaTrader 5

Costs & Commissions

While the platforms themselves are usually free to the end-user, the associated costs of trading can vary. These costs are primarily determined by the broker, but the platform’s architecture can influence them.

Spreads, Commissions, and Platform Fees

Neither cTrader nor MT4 typically involves a direct fee for the trader; the broker pays a licensing fee to the platform developer. The main costs are spreads and commissions. Because cTrader is predominantly used by ECN brokers, the pricing model is usually a combination of very tight raw spreads plus a fixed commission per trade. This is often more transparent and can be cheaper for high-volume traders. MT4 is used with various pricing models.

You can find ECN-style accounts with raw spreads and commissions, or standard accounts with wider spreads and no commission. The choice is greater, but traders must compare carefully. In the grand scheme, the ctrader vs mt4 cost difference is more about the broker’s business model than the platform itself.

Security & Reliability

When your capital is on the line, the stability and security of your trading platform are paramount. Both platforms have a strong track record, but they are built on different technological foundations.

Platform Stability and Updates

MetaTrader 4 is renowned for its stability. It’s a lightweight application that runs smoothly even on older hardware. Its long history means most bugs have been ironed out, and it is considered exceptionally reliable. However, its developer, MetaQuotes, is actively pushing users towards its successor, MetaTrader 5. As a result, major feature updates for MT4 are rare, with development focused primarily on maintenance and security patches.

cTrader is also a very stable and secure platform. As a more modern application, it receives regular updates that introduce new features and enhancements, not just fixes. Spotware, the developer of cTrader, is actively invested in improving the platform, which is reassuring for long-term users. The ongoing development makes the cTrader vs MetaTrader 4 choice a question of legacy stability versus modern evolution.

Device Compatibility & Mobile Trading

In today’s world, trading is no longer confined to a desktop. A powerful and intuitive mobile experience is essential. Both platforms offer solutions for trading on the go, but the quality of the experience differs.

Desktop, Web, and Mobile Features

Both cTrader and MT4 are available on desktop (Windows), web, and mobile (iOS and Android). The cTrader Web platform is particularly impressive, mirroring the look, feel, and functionality of the desktop version almost perfectly. Its mobile app is also modern and feature-rich, allowing for advanced charting and order management on a small screen. Crucially, workspaces and preferences sync seamlessly across all cTrader devices. The MT4 web terminal is functional but more basic than its desktop counterpart. The mobile app is widely used and reliable for placing trades and basic monitoring, but it lacks the advanced charting tools and analytical depth of the desktop version. The experience feels less cohesive across devices compared to cTrader.

Pros & Cons: cTrader vs MetaTrader 4

To simplify the decision, here is a breakdown of the key advantages and disadvantages of each platform. This summary encapsulates the essence of the cTrader vs MetaTrader 4 debate.

cTrader: Advantages and Disadvantages

- Pros: Modern and intuitive user interface, advanced order types and Level II DOM, superior charting with more timeframes and indicators, native detachable charts, integrated copy trading (cTrader Copy), uses the powerful C# programming language.

- Cons: Limited broker selection compared to MT4, smaller community and fewer pre-built automated bots (cBots), steeper learning curve for non-programmers learning C#.

MetaTrader 4: Advantages and Disadvantages

- Pros: Massive broker availability, enormous community and marketplace for Expert Advisors (EAs), simple and easy-to-learn MQL4 language, extremely stable and lightweight, trusted industry standard.

- Cons: Dated user interface, limited built-in charting tools and timeframes, no native Level II DOM, copy trading relies on third-party solutions, lack of significant feature updates.

Which Platform Is Best for You?

Ultimately, the best platform is the one that aligns with your specific needs as a trader. There is no single correct answer in the metatrader 4 vs ctrader showdown. The choice depends on your trading style, technical skills, and priorities.

Recommendations for Different Trader Types

- For Beginners: MT4’s simplicity and vast educational resources can be less intimidating. However, a tech-savvy beginner might prefer cTrader’s modern interface.

- For Manual & Discretionary Traders: cTrader is often the superior choice. Its advanced charting, superior order types, and transparent DOM provide a richer trading experience for those who analyze and execute trades manually.

- For Scalpers: cTrader’s low-latency infrastructure and Level II DOM give it a clear edge for high-frequency scalping strategies that rely on speed and market depth.

- For Algo Traders: This is the toughest choice. If you want access to a vast library of existing EAs or want to hire affordable developers, MT4 is unmatched. If you are a proficient C# programmer and want to build highly complex, custom algorithms, cTrader’s Automate feature is more powerful.

Explore Advanced Trading with Opofinance

As an ASIC-regulated broker, Opofinance empowers traders with a suite of powerful tools and platforms to navigate the markets effectively.

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the proprietary OpoTrade app.

- Innovative AI Tools: Leverage our AI Market Analyzer, AI Coach, and 24/7 AI Support for smarter insights.

- Social & Prop Trading: Engage with the community through social trading and explore our prop trading opportunities.

- Secure & Flexible Transactions: Enjoy safe, convenient deposits and withdrawals, including crypto payments with zero fees.

Take your trading to the next level. Discover Opofinance today.

Conclusion: The Final Verdict

The cTrader vs MetaTrader 4 debate is not about which platform is objectively “better,” but which is better for *you*. MetaTrader 4 remains the industry workhorse due to its unparalleled broker access and immense library of automated EAs. It is a reliable, no-frills platform that gets the job done. cTrader is the modern challenger, offering a superior user experience, more advanced trading tools, and greater transparency. It excels for discretionary traders who demand the best in charting and execution. Our advice: test both with a demo account.

Is cTrader more professional than MT4?

Many professional and institutional traders prefer cTrader for its advanced features like Level II DOM, sophisticated order types, and C# programming environment, which are considered more professional-grade tools. However, many professionals still use MT4 due to its vast ecosystem.

Can I use the same Expert Advisor on both platforms?

No. EAs are written in MQL4 for MetaTrader 4, while cTrader uses cBots written in C#. The code is not compatible, and a strategy must be completely rewritten to work on the other platform.

Which platform is better for analyzing multiple charts?

cTrader is generally better for multi-chart analysis due to its native support for detachable charts, which can be moved freely across multiple monitors. This feature is not available in MT4, making complex workspace setups more difficult.

Are brokers phasing out MetaTrader 4?

While MetaQuotes, the developer, is heavily promoting its successor, MT5, brokers are not actively phasing out MT4. Its immense popularity and user base mean that most brokers will continue to offer and support it for the foreseeable future.

Does cTrader have better mobile trading?

Yes, many traders find cTrader’s mobile app to be superior. It offers a more modern design and more comprehensive functionality that closely mirrors the desktop and web versions, providing a more seamless cross-device trading experience.