As a trader, you know that crafting a winning strategy is only half the battle. The other, equally important half is having absolute confidence in your broker’s ability to manage your funds. You need to know that you can deposit your capital easily to seize market opportunities and, more importantly, withdraw your profits smoothly and securely when you choose to.

Opofinance, a modern and forward-thinking Forex and CFD broker, understands this better than most. With a special focus on the needs of traders, they have built a funding system that is remarkably flexible, fast, and secure.

This is your complete, all-in-one guide to managing your money in the Opofinance app. We’ll break down every deposit and withdrawal method, provide detailed step-by-step instructions, and share critical security tips to keep your funds safe. Let’s dive in and make you a master of your financial operations.

Funding Your Account: The Many Ways to Deposit at Opofinance

One of the first things you’ll notice about Opofinance is the incredible variety of payment methods they offer. They understand that different traders have different needs and preferences, so they’ve provided a wide array of options to ensure everyone can fund their account with ease.

Read More: How to View Your Transaction History and Financial Activities in

Cryptocurrencies: The Top Choice for Modern Traders

In today’s fast-paced world, cryptocurrencies have become the preferred funding method for many traders due to their speed, security, and low transaction fees.

- USDT (Tether) on the TRC20 Network: This is the undisputed king of funding methods. Why is it so popular?

- Price Stability: Tether is pegged to the US Dollar, so you don’t have to worry about its value changing dramatically during your transfer.

- Blazing Speed: The TRC20 (Tron) network is known for its fast transaction times.

- Low Fees: Sending USDT on this network is incredibly cheap.

- The minimum deposit for USDT is just $1, making it perfect for beginners or those who want to start with a small amount of capital.

- Other Major Cryptos: Opofinance also supports other popular coins like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), though these typically have a slightly higher minimum deposit of around $15.

Electronic Payment Systems: The Trusted and Traditional Route

If you’re not comfortable with crypto or prefer more traditional digital wallets, Opofinance has you covered.

- Perfect Money & Advcash: These are two well-established and reliable e-payment systems. They are great options for instant deposits, charge no commission, and also have a low minimum deposit of just $1.

- TopChange: This method is specifically designed to be convenient for users in certain regions, like Iran, allowing for more localized funding options. This shows Opofinance’s commitment to understanding the specific needs of its user base.

Other Payment Methods

The list doesn’t stop there. Opofinance also accepts Visa and MasterCard credit/debit cards, direct Bank Wire Transfers, and Fasapay. This incredible diversity means that virtually any trader, anywhere, can find a method that works for them.

The Complete Guide to Depositing Funds into Your Opofinance Account

Depositing funds is your first practical step to start trading. You need to transfer capital into your Opofinance account to buy and sell in the financial markets. This process must be fast, so you don’t miss out on time-sensitive market opportunities, and secure, so you can entrust your capital to the platform with peace of mind. Below, we break down the entire deposit process in detail.

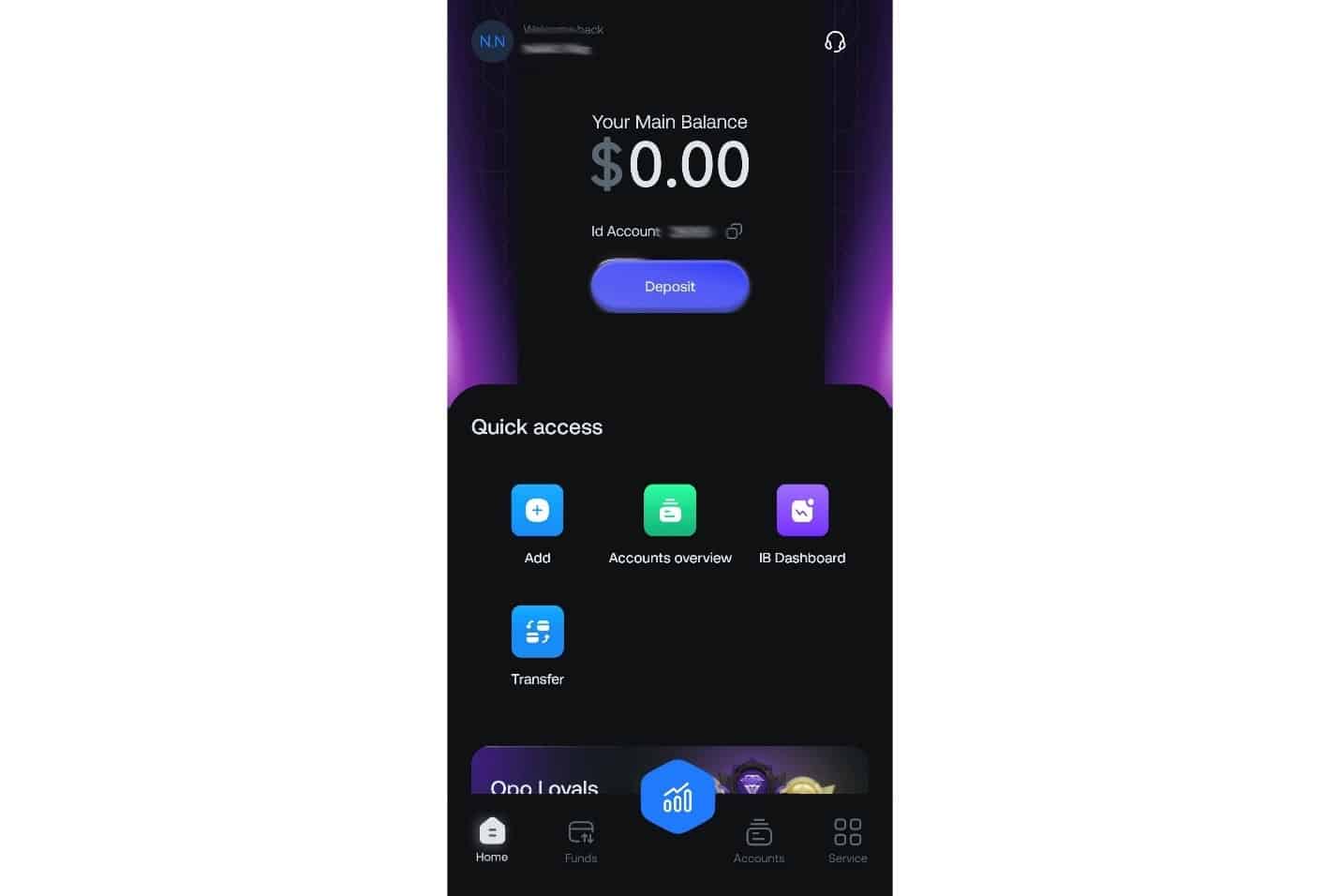

Step 1: Finding the “Funds” Section in the App

After opening the Opofinance app and logging in with your username and password, you will land on the main dashboard. To perform any financial transaction, you need to navigate to its dedicated section.

On the menu bar located at the bottom of the screen, you will see several primary icons. The option you need is labeled “Funds.” This is typically represented by an icon resembling a wallet, making it very easy to spot. Tap on this icon.

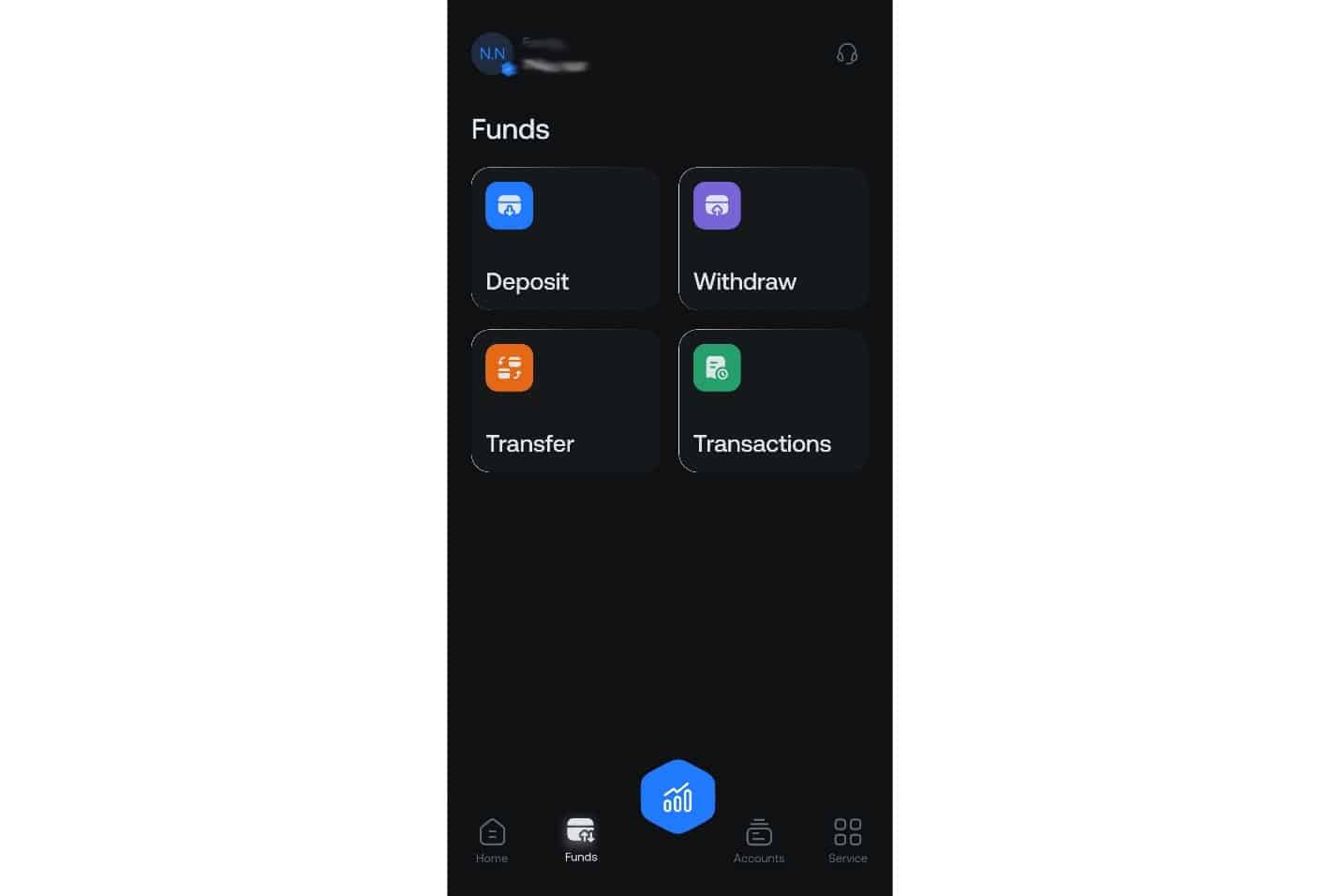

By tapping “Funds,” you enter your account’s financial command center. On this new screen, the three main operations you can perform with your money are clearly displayed:

- Deposit: To add money to your account.

- Withdraw: To take money out of your account.

- Transfer: To move money between your different accounts within Opofinance (we’ll cover this more in the withdrawal section).

Our current goal is to deposit money, so tap on the large and clear “Deposit” button.

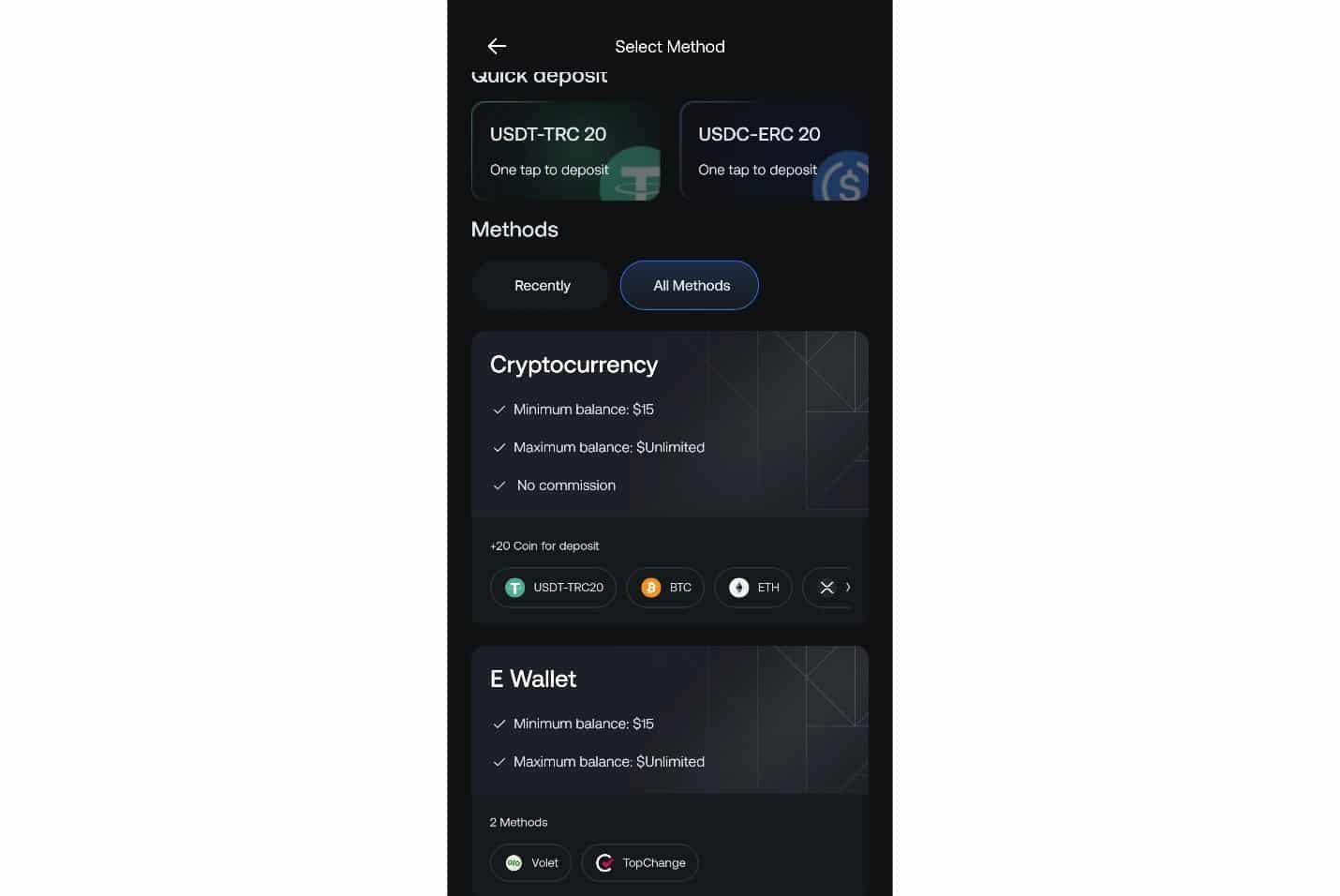

Step 2: Understanding and Choosing the Best Deposit Method for You

After clicking “Deposit,” the app will take you to a page listing all available methods for funding your account. This variety is a major advantage, as it allows you to choose the best option based on your location, resources, and required speed. These methods fall into two main categories:

Group 1: Cryptocurrencies

In recent years, this has become the most popular and efficient method for international money transfers due to its high speed, low fees, and independence from traditional banking systems. Opofinance supports several major cryptocurrencies:

- Tether (USDT): This is a “stablecoin,” meaning its value is always pegged to the US dollar. This is incredibly important because, unlike Bitcoin or Ethereum whose prices fluctuate, when you send 100 USDT, the recipient receives exactly 100 USDT (minus a negligible network fee). This stability makes Tether the ideal instrument for funding trading accounts.

- Opofinance specifically supports USDT on the TRC20 network. This network (part of the Tron blockchain) is renowned for its blazing-fast transaction speeds (often under a minute) and extremely low fees (typically less than $1, regardless of the transfer amount), making it the best choice for most users.

Bitcoin (BTC) and Ethereum (ETH): While deposits with the world’s most famous cryptocurrencies are also possible, their network fees are generally higher and transaction confirmation times are longer compared to USDT on the TRC20 network

Group 2: Electronic Wallets (E-Wallets)

These services function like online bank accounts. You first fund your e-wallet account and then use it to deposit into Opofinance. This method is also very fast. Opofinance supports reputable services like Volet (formerly known as Advcash) and TopChange. To use this method, you must first create an account on the respective e-wallet’s website.

Key Points to Remember:

- Minimum Deposit: For most methods, the minimum deposit amount is $15. This low threshold allows traders with smaller capital to participate.

- Deposit Commission: Here’s the great news: Opofinance itself charges zero commission for deposits. This means if you deposit $100, the full $100 will be credited to your account. Note, however, that the transfer network (e.g., TRC20) or e-wallet service may charge its own small transaction fee, which is unrelated to Opofinance.

Read More: Choosing a Forex Broker

Step-by-Step Guide: Depositing with Tether (USDT-TRC20)

Since using Tether on the TRC20 network is the best, fastest, and cheapest method for most users, we will walk you through this process in detail. Let’s imagine we want to deposit $100 into our account.

Step 1: Select the USDT-TRC20 Method

On the “Select Method” screen, navigate to the “Cryptocurrency” section and tap on “USDT-TRC20”.

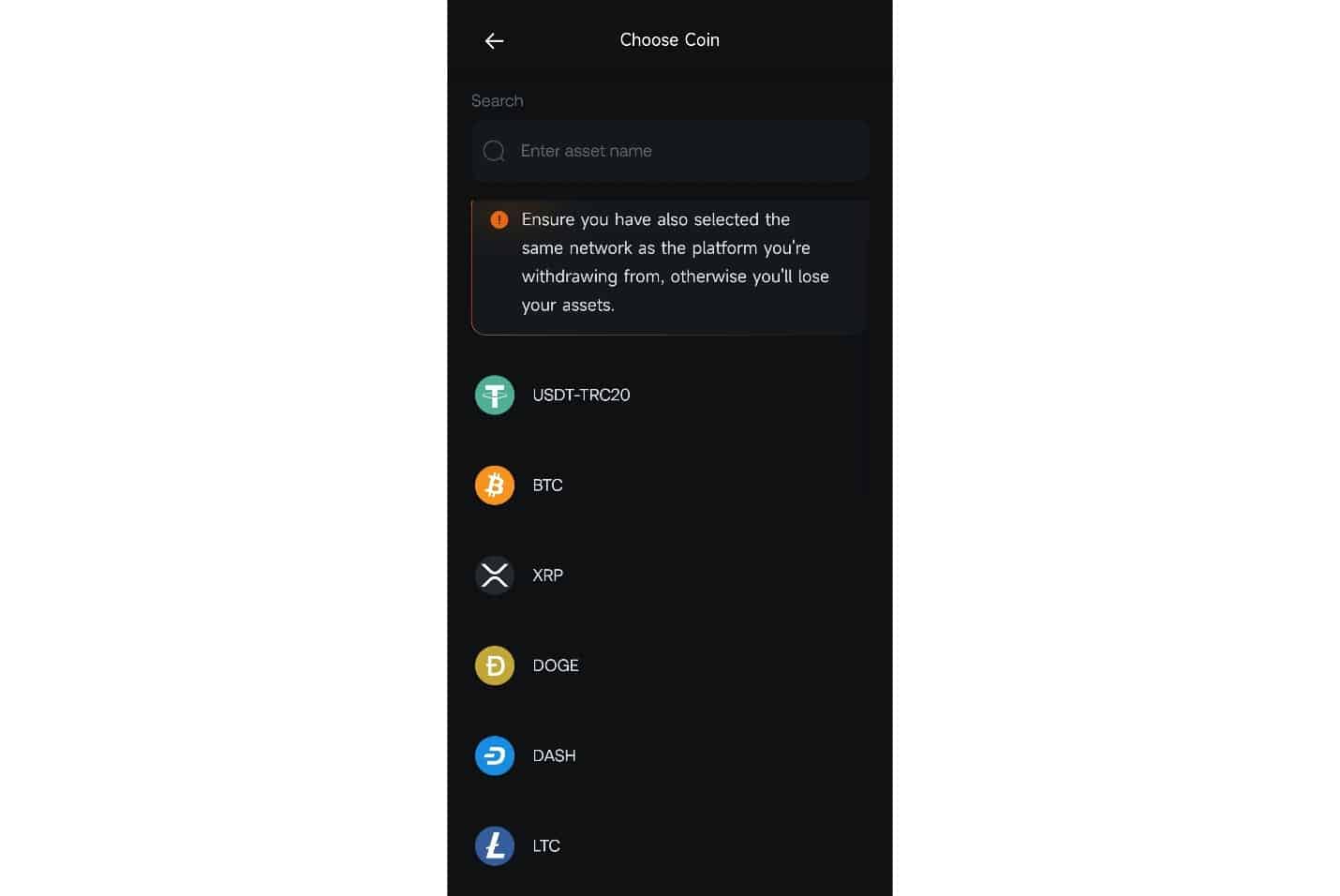

Step 2: Get Your Unique Wallet Address

At this stage, Opofinance displays the most critical piece of information you need: your Tether wallet address. This is a long string of letters and numbers (e.g., TX123…abc). This code is your unique account number for receiving USDT on the TRC20 network within Opofinance. Any Tether sent to this address will be directly credited to your account.

To avoid any mistakes when entering this long address, you have two simple options:

- Copy Button: Next to the address, there is a button to copy it. Tapping this saves the entire address accurately to your phone’s clipboard.

- QR Code: The app also displays a square black-and-white image known as a QR Code. This is a graphical version of the same text address.

Step 3: Go to Your Source Platform (Exchange or Personal Wallet)

Now that you have copied the Opofinance wallet address, you need to go to where your Tether is currently stored. This could be a crypto exchange (like Binance, KuCoin, etc.) or a software wallet (like Trust Wallet).

In your exchange or wallet app, find and click on the “Withdraw” or “Send” option.

Step 4: Configure the Transfer on Your Source Platform

On the withdrawal screen of your exchange, you will be asked for a few pieces of information:

- Destination Address: In this field, paste the address you copied from Opofinance in Stage 2. Never, ever type this address manually. A single mistake will lead to the loss of your funds.

- Amount: Enter the amount you wish to send (e.g., 100).

- Network: This is the most critical part of the entire process. The exchange will ask you which “highway” or “network” you want to send the Tether on. Since the address you received from Opofinance belongs to the TRC20 network, you must select the TRC20 (Tron) option here.

CRITICAL WARNING: Selecting the wrong network is catastrophic. Imagine sending a package to an address in New York City, but labeling it for a delivery company that only operates in Los Angeles. The package will never arrive and will be lost forever. The same rule applies in the crypto world. If your destination address is TRC20 but you mistakenly select the ERC20 network (Ethereum), your Tether will be sent into a black hole on the blockchain and will be permanently lost. No one—not Opofinance, not your exchange—can recover it. Perform this step with extreme care.

Step 5: Final Confirmation and Awaiting Deposit

After entering all the information correctly and selecting the TRC20 network, your exchange will show you a summary of the transaction, including the network fee. Confirm the transaction.

Once confirmed, your transfer is broadcast to the blockchain network. Depending on network congestion, it typically takes 1 to 5 minutes for the transaction to be fully confirmed. As soon as it’s confirmed, Opofinance’s automated system will detect your deposit and add the funds to your account balance. You will receive a notification of the successful deposit and can see your new balance in the “Funds” section.

Read More: OpoFinance Deposit and Withdrawal Tutorial

Part 2: How to Withdraw Funds from Your Opofinance Account

Withdrawing funds is the most rewarding part of trading—it’s when you realize your profits or access your capital. For security reasons, the withdrawal process is slightly different from the deposit process and includes an extra layer of protection for your assets. Opofinance has designed this process to be both secure and user-friendly.

An Essential Preliminary Step: Transferring Funds to Your “Main Wallet”

Before you can request a withdrawal, you must perform one important action. Within the Opofinance platform, your capital can exist in two main places:

- Trading Account: This is the account (e.g., your MetaTrader 4 account) that you actively use for buying and selling. Money in this account is exposed to market risk.

- Main Wallet: This wallet acts as a separate, secure holding area within the platform. Money held here is safe from active trading and market fluctuations.

This separation is a smart security and risk management feature. By separating your trading account from your main wallet, you can better manage your risk. To withdraw funds, the platform requires you to first move the desired amount from the “battlefield” (your trading account) to the “secure base” (your main wallet).

How to perform this internal transfer:

- Go to the “Funds” section.

- This time, select the “Transfer” option.

- On the transfer screen, you will see “From” and “To” fields.

- In the “From” field, select the trading account containing the money.

- In the “To” field, select “Wallet” or “Main Wallet”.

- Enter the amount you plan to withdraw and confirm the transfer.

This internal transfer is instant and completely free of charge. Your funds are now ready for withdrawal.

Step 1: Entering the Withdrawal Section

Now that the money is in your main wallet, return to the “Funds” section and confidently tap on the “Withdraw” button.

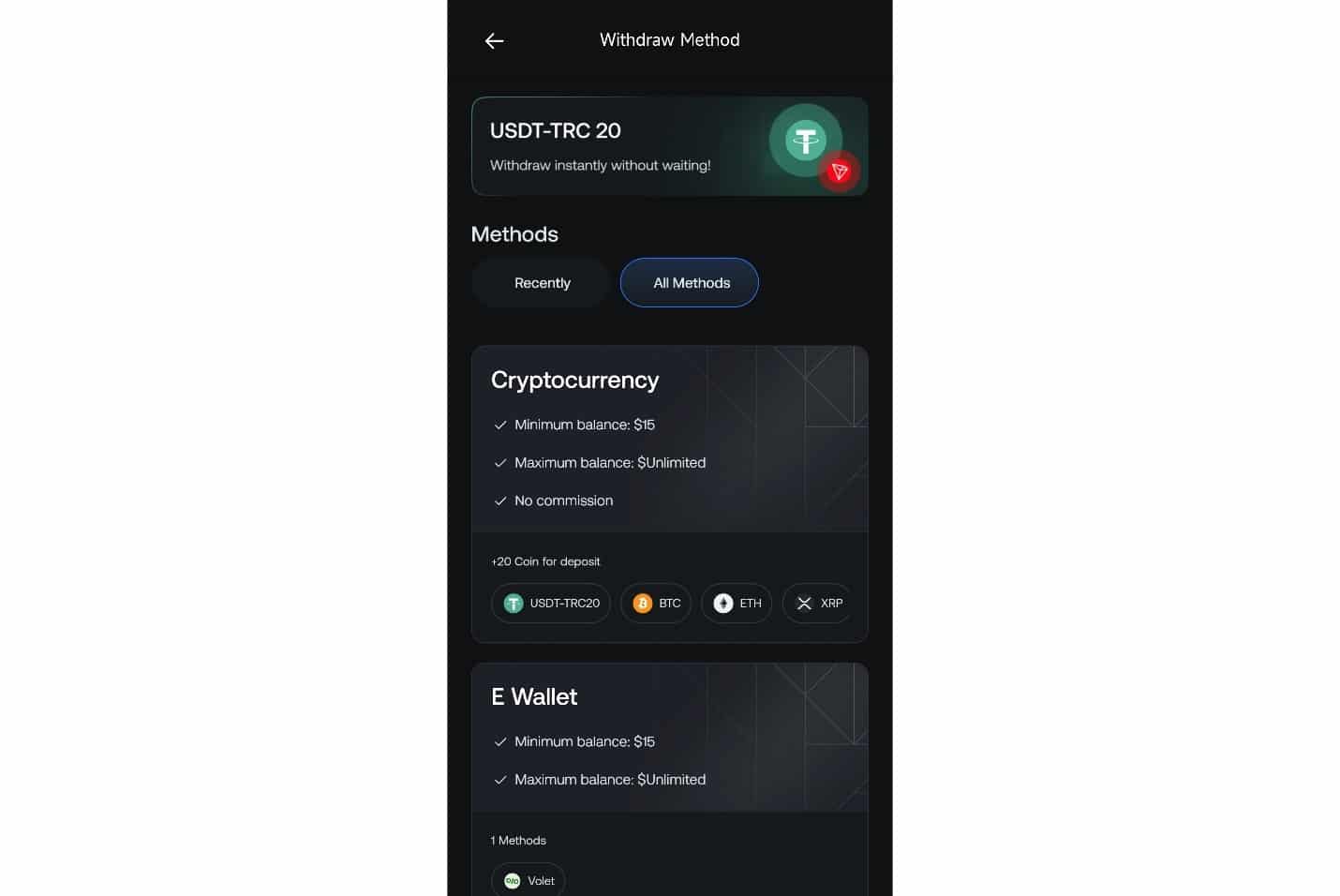

Step 2: Selecting Your Withdrawal Method

A screen similar to the deposit page will appear, listing the available withdrawal methods. You can generally withdraw funds using the same methods you used to deposit:

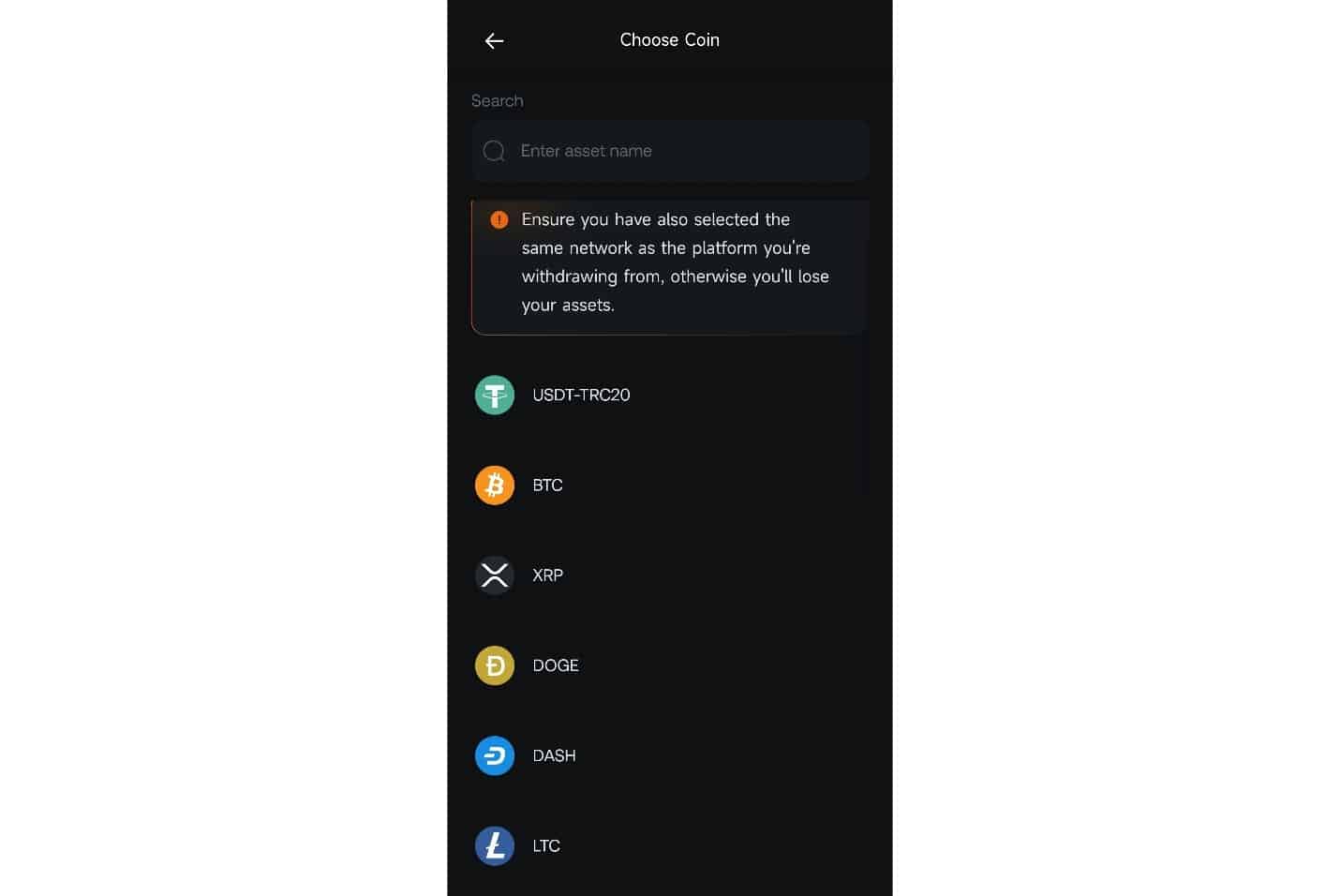

- Cryptocurrencies: Such as Tether (USDT-TRC20), Bitcoin, etc.

- E-Wallets: Such as Volet.

Step-by-Step Guide: Withdrawing via Tether (USDT-TRC20)

Let’s assume you want to withdraw $200 of your profits as Tether to your personal wallet at an exchange.

Stage 1: Select the USDT-TRC20 Method

On the “Withdraw Method” screen, choose “USDT-TRC20”.

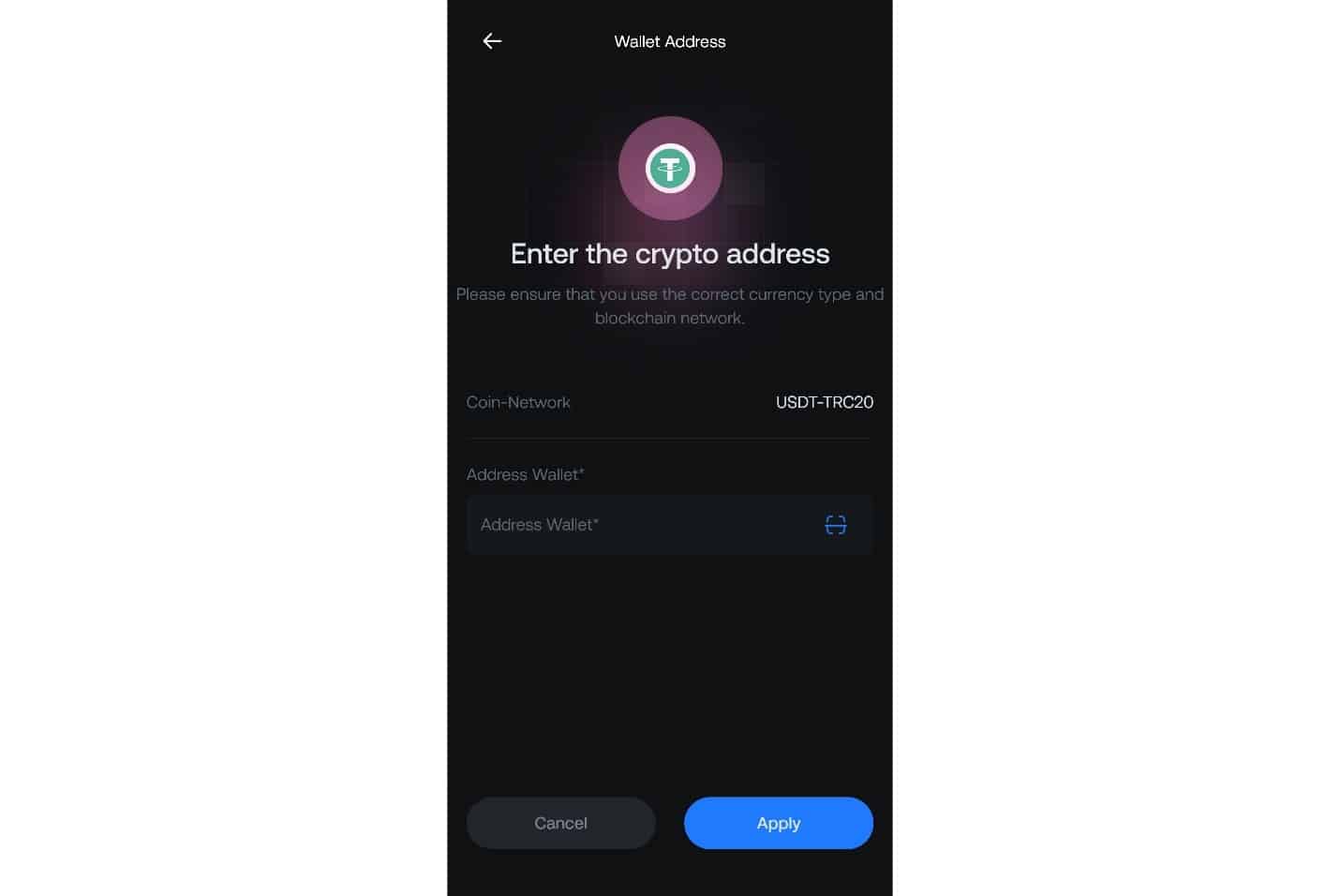

Stage 2: Enter Critical Withdrawal Information

In this step, the app will ask you for two vital pieces of information:

- Destination Wallet Address: This time, you must provide the address of your own personal Tether wallet. To do this, go to the exchange or wallet where you want to receive the funds, navigate to its “Deposit” section for Tether (USDT), select the TRC20 network, and copy the address provided by that platform. Then, return to the Opofinance app and paste that address into this field.

Security Tip: After pasting the address, always double-check the first 4 and last 4 characters against the original address in your exchange to ensure it was copied correctly. Sending funds to the wrong address is also irreversible.

- Amount: Enter the amount you wish to withdraw in USD (e.g., 200).

Stage 3: Identity Verification via Email Security PIN

This is where Opofinance’s robust security layer comes into play. After you enter the details and tap the confirmation button, the process does not execute immediately. To ensure the withdrawal request was initiated by you (the account owner) and not a hacker, Opofinance sends a one-time 6-digit PIN to the email address you registered with.

You must:

- Temporarily leave the Opofinance app and open your email inbox.

- Open the email from Opofinance.

- Note or copy the 6-digit PIN.

- Return to the Opofinance app and enter this code into the designated field.

- Finally, press the “Confirm” button.

This feature, a form of Two-Factor Authentication (2FA), dramatically increases your account’s security. Even if someone knows your app password, they can never withdraw a single dollar without access to your email account.

Stage 4: Request Processing and Status Tracking

After you enter the correct PIN, your withdrawal request is officially submitted to the Opofinance finance team. Unlike automated deposits, all withdrawal requests are manually reviewed and approved by financial specialists to prevent fraud and money laundering.

This manual review is why withdrawals are not instant. However, Opofinance is committed to processing all withdrawal requests within 24 business hours. In practice, many requests, especially those submitted during business hours, are completed within a few hours.

To track the status of your request, you can go to the “Transactions” or “Transaction History” section in the “Funds” menu. Here, you will see the status of your request, which will typically be one of the following:

- Pending: Your request has been submitted and is in the queue for review.

- Processing: The finance team is currently executing your transaction.

- Completed: The funds have been successfully sent to your destination address

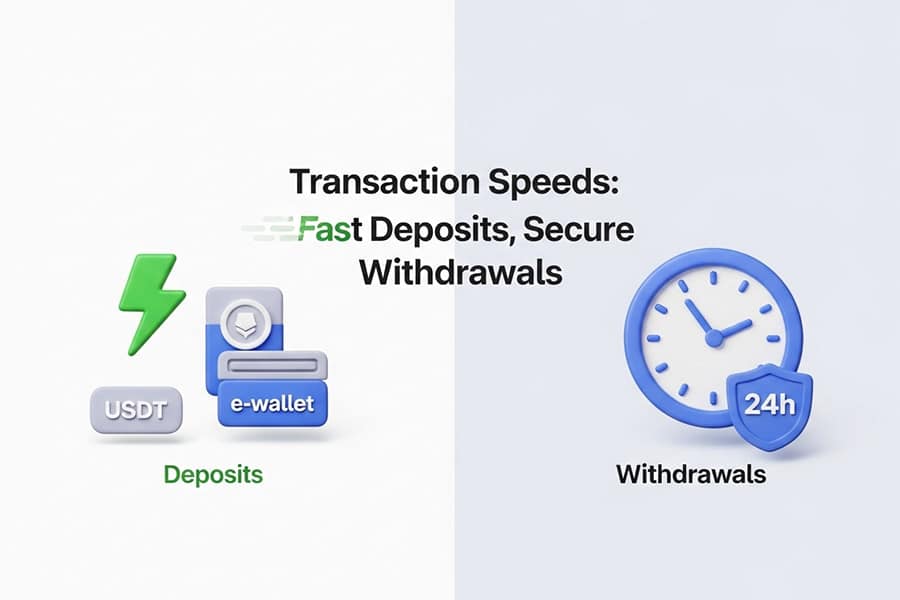

Transaction Processing Times

Deposit Speeds: Impressively Fast

- Instant Deposits: USDT (after 3-10 mins on the blockchain), Perfect Money, Advcash, and TopChange are all credited instantly or near-instantly.

- Delayed Deposits: Credit card payments can take 1-3 business days, while bank wires can take 1-5 business days.

Withdrawal Speeds: A Balance of Speed and Security

Because of the manual security checks, withdrawals take a bit longer.

- 24-Hour Processing: All cryptocurrency and e-payment withdrawals are processed within a maximum of 24 hours. In practice, many requests are completed much faster.

- Factors that affect speed include the time of your request (requests before 10 AM server time are more likely to be processed the same day) and the day of the week (business days are faster).

Your Security is a Top Priority

Opofinance adheres to strict international security standards, including Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

- Identity Verification (KYC): You will need to provide a valid ID (passport, national ID card) and proof of address (utility bill, bank statement) to fully activate your account for withdrawals.

- Security PIN System: Every withdrawal requires the email-verified PIN, providing a powerful layer of protection.

- Data Encryption: The app and website use top-tier SSL 256-bit encryption to protect your data.

- Constant Monitoring: Smart systems continuously monitor transactions for suspicious activity.

A Superior User Experience: Why the Opofinance App Shines

The Opofinance app consistently receives high ratings (4.1/5 in app stores) for a reason.

- Simple Navigation: The interface is clean and intuitive. Everything is where you expect it to be.

- Multi-Account Management: Easily switch between and manage multiple trading accounts (Standard, ECN, Social Trading) all in one place.

- Advanced Features:

- Direct TradingView Connection: Analyze charts on the world’s leading charting platform and execute trades seamlessly.

- OPO AI: An innovative AI system designed to provide market insights and personalized trading suggestions.

- Professional Customer Support: The support team is available 24/7 (with slightly different hours on weekends) and provides assistance in multiple languages, including English, Arabic, and Farsi.

Conclusion: A Smart Choice for Managing Your Trading Funds

Opofinance has successfully created a funding ecosystem that is comprehensive, secure, and user-friendly.

- Unmatched Flexibility: With over 15 payment methods, you are never locked into one option.

- Exceptional Speed: Instant deposits and 24-hour withdrawals create a smooth, efficient experience.

- Multi-Layered Security: From robust KYC to the essential withdrawal PIN, your funds are well-protected.

- User-Centric Design: The app is easy to use, and support is always available, especially with consideration for regional needs like Farsi language support and local payment methods.

- Full Transparency: Clear fee structures and no hidden costs build trust and confidence.

By providing such a reliable and efficient platform for deposits and withdrawals, Opofinance allows you to put your worries about fund management aside and focus on what truly matters: your trading strategy.

What are the fastest deposit methods available in the app?

For the quickest funding, you can use cryptocurrencies like USDT (which is credited in 5-10 minutes after blockchain confirmation) or e-payment systems such as Perfect Money and Advcash, which are all processed nearly instantly.

What is the minimum amount I can withdraw using USDT (TRC20)?

The minimum withdrawal amount for USDT on the TRC20 network is $15. This is designed to be a reasonable amount, accessible for most traders looking to take out their profits.

How long does it take to receive my funds after requesting a withdrawal?

All cryptocurrency and e-payment withdrawals are processed within a maximum of 24 hours. The exact time can be faster depending on when the request is made, with those submitted before 10 AM server time often processed the same day.