Imagine unlocking the potential to control vast sums of money with just a fraction of it. In the dynamic world of Forex trading, margin and leverage are the keys that can turn this imagination into reality. These two fundamental concepts empower traders to maximize their market exposure, but they also come with significant risks if not managed properly. Understanding the difference between margin and leverage in Forex is crucial for both novice and seasoned traders aiming to navigate the complexities of the foreign exchange market successfully. Whether you’re partnering with a regulated Forex broker or exploring the offerings of a top-tier online Forex broker, grasping these concepts can make the difference between profitable trades and costly mistakes. This comprehensive guide delves deep into margin vs leverage in Forex trading, providing clear definitions, practical examples, and expert tips to enhance your trading strategy and risk management.

What is Margin in Forex Trading?

Learn how margin acts as the foundation of successful Forex trading.

Definition of Margin

Margin in Forex trading refers to the amount of money a trader must deposit with their broker to open and maintain a trading position. Think of it as a security deposit that ensures you can cover potential losses on your trades. Unlike the traditional use of margin in investing, where it typically involves borrowing funds to increase the size of an investment, in Forex trading, margin is the actual capital set aside by the trader.

Margin is essential for leveraging your trades, allowing you to control larger positions without needing to commit the full amount of capital upfront.

Key Types of Margin

- Initial Margin: This is the upfront amount required to open a new trade. For example, if you want to open a position worth $100,000 and your broker requires a 1% initial margin, you’ll need to deposit $1,000.

- Maintenance Margin: Once a trade is open, the maintenance margin is the minimum amount of equity you must maintain in your account to keep the position open. If your account equity falls below this level, you may receive a margin call.

- Free Margin vs. Used Margin:

- Free Margin: The portion of your account equity that is not tied up in margin for open positions and is available for opening new trades.

- Used Margin: The amount of your account equity that is currently being used to maintain open positions.

Role of Margin in Forex

Margin plays a pivotal role in Forex trading by enabling traders to engage in larger trades than their account balance would typically allow. It serves as a buffer against potential losses, ensuring that both the trader and the broker are protected. Effective margin management is crucial for sustaining long-term trading success, as it helps in maintaining adequate equity levels to withstand market volatility.

What is Leverage in Forex Trading?

Understand how leverage empowers traders to control larger positions in Forex trading.

Definition of Leverage

Leverage in Forex trading is a financial tool that allows traders to control a large position with a relatively small amount of capital. It is expressed as a ratio, such as 1:50, 1:100, or even 1:500, indicating the multiple of your investment that you can control. For instance, with a leverage of 1:100, a trader can control a $100,000 position with just $1,000 of their own money.

Leverage is a double-edged sword—it can significantly amplify both your potential profits and your potential losses.

How Leverage Works

Leverage works by borrowing capital from your broker to increase your market exposure. Here’s a breakdown:

- High Leverage: Allows traders to control larger positions with smaller capital, potentially leading to higher profits. However, it also increases the risk of substantial losses.

- Low Leverage: Limits the size of positions, reducing both potential profits and losses. It is generally considered safer, especially for novice traders.

Examples of Leverage Usage

- High Leverage Scenario: A trader with a $1,000 account using 1:500 leverage can control a $500,000 trade. If the market moves 0.2% in the trader’s favor, the profit would be $1,000. Conversely, a 0.2% adverse move would result in a $1,000 loss, potentially wiping out the entire account.

- Low Leverage Scenario: The same $1,000 account with 1:50 leverage can control a $50,000 trade. A 0.2% favorable movement yields a $100 profit, while a 0.2% adverse move results in a $100 loss, preserving the majority of the account balance.

Regulatory Limits

Regulatory bodies impose limits on leverage to protect traders from excessive risk:

- ASIC (Australia): Caps leverage at 1:30 for major currency pairs.

- ESMA (European Union): Limits leverage to 1:30 for major pairs and lower for more volatile instruments.

- CFTC (USA): Restricts leverage to 1:50 for major currencies.

These regulations aim to promote responsible trading and reduce the likelihood of significant losses for retail traders.

Key Differences Between Margin and Leverage

Conceptual Difference

- Margin: The actual funds required to open and maintain a trading position. It represents the portion of your account equity set aside as collateral.

- Leverage: The ratio that determines how much larger your trading position can be compared to your margin. It essentially allows you to amplify your market exposure.

Interdependence

Margin and leverage are intrinsically linked. The margin requirement set by your broker dictates the level of leverage you can employ. For example, a lower margin requirement enables higher leverage, allowing you to control larger positions with the same amount of capital.

Impact on Trading

- Margin: Primarily concerns the funding and maintenance of trades. Proper margin management ensures that you have sufficient equity to sustain your positions and avoid margin calls.

- Leverage: Influences the size of your trades and the potential for profit or loss. Higher leverage increases both the opportunity for significant gains and the risk of substantial losses.

Comparative Analysis

| Aspect | Margin | Leverage |

| Definition | Funds required to open and maintain a position | Ratio that amplifies trading power |

| Role | Acts as collateral for trades | Increases market exposure and potential returns |

| Impact | Ensures sufficient equity to sustain positions | Magnifies both profits and losses |

| Relationship | Determines available leverage | Inversely affects margin requirements |

Understanding these differences is crucial for effective risk management and strategic trading.

Relationship Between Margin and Leverage

The relationship between margin and leverage is inverse and mathematically interconnected. As leverage increases, the required margin decreases, allowing traders to open larger positions with less capital. Conversely, higher margin requirements reduce the available leverage.

Mathematical Relationship

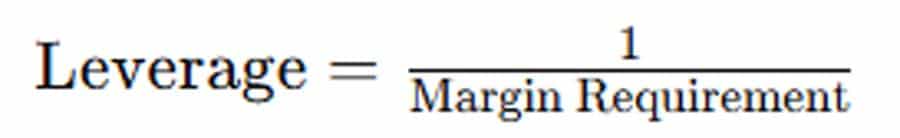

The basic formula connecting margin and leverage is:

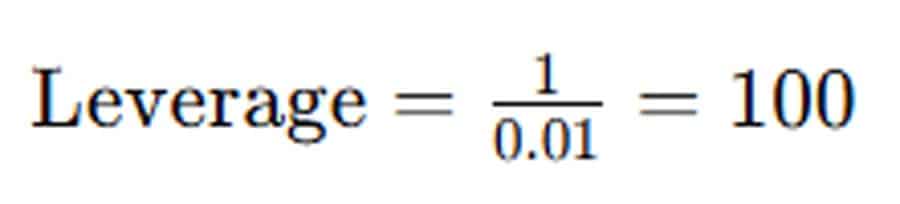

For example, if the margin requirement is 1%, the leverage is:

Thus, a 1% margin requirement equates to 1:100 leverage.

Inverse Correlation

- Higher Leverage: Results in lower margin requirements. For instance, 1:500 leverage requires only 0.2% margin.

- Lower Leverage: Requires higher margin. For example, 1:50 leverage necessitates a 2% margin.

Broker Calculations

Brokers calculate both margin and leverage based on their internal policies and regulatory guidelines. They determine the maximum leverage they offer and set margin requirements accordingly to ensure that both the trader and the broker are protected against excessive risk.

Traders must be aware of how their broker calculates and applies margin and leverage to make informed trading decisions.

Advantages and Risks of Using Leverage

Explore the dual nature of leverage—unlocking rewards while managing risks.

Advantages

- Increased Market Exposure: Leverage allows traders to control larger positions with a smaller amount of capital, enhancing the potential for higher returns.

- Higher Potential Returns: By amplifying the size of trades, leverage can significantly boost profits from favorable market movements.

- Capital Efficiency: Traders can diversify their investments across multiple positions without needing to allocate large amounts of capital to each trade.

Risks

- Amplified Losses: Just as leverage can magnify profits, it can also exacerbate losses. A small adverse market movement can lead to substantial losses, potentially exceeding the initial investment.

- Margin Calls: High leverage increases the likelihood of margin calls, where traders must deposit additional funds to maintain their positions or face forced liquidation.

- Overtrading: The availability of high leverage can tempt traders to engage in excessive trading, increasing exposure to market volatility and risk.

- Psychological Stress: The potential for large swings in account equity due to leverage can lead to emotional decision-making and impaired judgment.

Balanced Leverage Use

To mitigate these risks, it is essential to use leverage judiciously and align it with your risk tolerance and trading experience. Employing disciplined risk management strategies can help leverage become a powerful tool rather than a hazard.

Read More: Margin in Forex

What is a Margin Call?

Definition and Causes

A margin call is a broker’s demand for a trader to deposit additional funds or securities into their account to bring the account equity up to the required maintenance margin level. Margin calls occur when the account’s equity falls below the maintenance margin due to adverse market movements or excessive use of leverage.

Why Margin Calls Occur

- Adverse Market Movements: Significant losses from open positions can erode account equity below the maintenance margin.

- Excessive Use of Leverage: High leverage amplifies both gains and losses, increasing the likelihood of a margin call.

- Insufficient Funding: Failing to maintain adequate funds in the account to cover potential losses can trigger margin calls.

Impact on Traders

When a margin call is triggered, traders must act quickly to restore their account to the required level. Failure to do so may result in:

- Forced Liquidation: Brokers may automatically close open positions to prevent further losses, often at unfavorable prices.

- Loss of Capital: Significant portions of the trader’s capital can be lost rapidly due to forced liquidations.

Preventive Measures

- Monitor Equity-to-Margin Ratio: Regularly check your account balance and margin levels to ensure they remain within safe limits.

- Set Stop-Loss Orders: Implementing stop-loss orders can limit potential losses on trades, reducing the risk of a margin call.

- Avoid Over-Leveraging: Use leverage levels that align with your risk tolerance and trading strategy to minimize the chances of margin calls.

- Maintain Adequate Funds: Keep sufficient funds in your trading account to absorb potential losses without triggering margin calls.

Proactive margin management is essential to prevent margin calls and protect your trading capital.

Practical Examples and Case Studies

Example 1: High Leverage with a Small Margin

Scenario: A trader has a $2,000 account balance and decides to use 1:500 leverage.

- Position Size: $2,000 * 500 = $1,000,000

- Market Movement: If the currency pair moves 0.1% against the trader.

- Loss Calculation: $1,000,000 * 0.001 = $1,000

- Account Balance After Loss: $2,000 – $1,000 = $1,000

Outcome: A relatively small adverse movement results in a 50% loss of the account balance. If the market continues to move against the position, the trader could face a margin call or complete account depletion.

Example 2: Managing a Trade with Conservative Leverage

Scenario: Another trader has a $2,000 account and uses 1:50 leverage.

- Position Size: $2,000 * 50 = $100,000

- Market Movement: The same 0.1% adverse movement.

- Loss Calculation: $100,000 * 0.001 = $100

- Account Balance After Loss: $2,000 – $100 = $1,900

Outcome: The loss is only 5% of the account balance, allowing the trader to maintain sufficient equity and continue trading without immediate risk of a margin call.

Case Study: Successful Leverage Management

Trader Profile: Jane, an experienced Forex trader with a $10,000 account, opts for a 1:100 leverage ratio.

- Position Size: $10,000 * 100 = $1,000,000

- Strategy: Jane employs strict risk management, limiting each trade to a maximum of 2% risk.

- Outcome: By controlling risk per trade and avoiding over-leveraging, Jane consistently grows her account while minimizing the impact of adverse market movements.

Lesson: Effective leverage management, combined with disciplined trading strategies, can lead to sustainable growth and reduced risk exposure.

Read More: The Hidden Dangers of Overleveraged Trading

Tips for Risk Management with Margin and Leverage

Master essential tips to manage risk with margin and leverage in Forex trading.

Leverage Management

- Choose Appropriate Leverage: Beginners should start with lower leverage ratios (e.g., 1:10 or 1:20) to gain experience without exposing themselves to excessive risk.

- Adjust Leverage Based on Market Conditions: Increase leverage cautiously during stable market periods and reduce it during high volatility.

Setting Stop-Loss Orders

- Limit Potential Losses: Implement stop-loss orders on every trade to cap potential losses and protect your account equity.

- Automate Risk Control: Use trailing stops to lock in profits as the market moves in your favor while maintaining downside protection.

Diversifying Trades

- Spread Risk Across Multiple Positions: Avoid concentrating all your margin in a single trade. Diversify across different currency pairs or trading strategies to mitigate risk.

- Avoid Correlated Trades: Be cautious of opening multiple positions that are highly correlated, as they can amplify losses during adverse market movements.

Understanding Broker Requirements

- Know Your Broker’s Policies: Familiarize yourself with your broker’s margin requirements, leverage limits, and margin call procedures to ensure compliance and preparedness.

- Stay Informed About Regulatory Changes: Regulatory bodies may adjust margin and leverage rules. Stay updated to adapt your trading strategy accordingly.

Regularly Monitor Your Account

- Track Equity and Margin Levels: Keep a close eye on your account’s equity, used margin, and free margin to ensure they remain within safe limits.

- Use Trading Platforms with Real-Time Monitoring: Leverage tools that provide real-time updates on your account status and margin utilization.

Effective risk management is the cornerstone of successful Forex trading, enabling traders to navigate market fluctuations with confidence.

Pro Tips for Advanced Traders

- Employ Tiered Leverage Strategies: Utilize different leverage levels for various trading strategies. For instance, use higher leverage for short-term trades and lower leverage for long-term positions.

- Optimize Margin-to-Equity Ratio: Regularly assess and adjust your margin-to-equity ratio to maintain optimal leverage levels and reduce risk exposure.

- Leverage Automated Risk Management Tools: Implement automated systems that monitor and adjust leverage and margin usage in real time, ensuring adherence to your risk management protocols.

- Stay Ahead with Continuous Education: Advanced traders should continually educate themselves on market trends, leverage techniques, and margin management strategies to stay competitive.

- Utilize Hedging Strategies: Protect your positions by employing hedging techniques that can offset potential losses, thereby maintaining a balanced margin and leverage profile.

- Analyze Historical Data: Study past market movements and leverage impacts to refine your trading strategies and anticipate potential risks.

These advanced strategies can enhance your trading performance, allowing you to leverage your expertise and market knowledge effectively.

Read More: Mastering Leverage Trading Risk Management

OpoFinance Services: A Trusted Trading Partner

When selecting a regulated Forex broker, choosing a reliable partner is paramount to your trading success. OpoFinance stands out in the competitive Forex market with its comprehensive and secure trading services:

- ASIC Regulation: OpoFinance is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a safe and transparent trading environment that adheres to strict financial standards.

- Social Trading Services: Engage with a community of experienced traders through OpoFinance’s social trading platform. Copy successful strategies, share insights, and collaborate to enhance your trading performance.

- Featured on MT5 Brokers List: Officially listed on the MetaTrader 5 (MT5) platform, OpoFinance offers access to advanced trading tools, charts, and automated trading systems to optimize your trading experience.

- Safe and Convenient Deposits and Withdrawals: Manage your funds effortlessly with OpoFinance’s secure and flexible deposit and withdrawal methods, ensuring your transactions are both safe and hassle-free.

- Competitive Spreads and Low Commissions: Benefit from tight spreads and minimal commissions, maximizing your trading profitability.

- 24/7 Customer Support: Receive prompt and professional assistance from OpoFinance’s dedicated customer support team, available around the clock to address your trading needs.

Choose OpoFinance as your trusted Forex trading broker and elevate your trading journey with unparalleled support and services! Get Started Now

Conclusion

Grasping the difference between margin and leverage in Forex trading is fundamental to mastering the foreign exchange market. Margin serves as the collateral that secures your trades, while leverage amplifies your market exposure, enabling you to control larger positions with limited capital. Both concepts are intertwined, influencing your trading capacity and risk profile. By understanding and effectively managing margin and leverage, you can enhance your trading strategies, maximize potential returns, and safeguard against significant losses. Remember, successful Forex trading hinges on the delicate balance between leveraging opportunities and mitigating risks through informed and disciplined margin management.

Key Takeaways

- Margin vs Leverage: Margin is the collateral required to open and maintain trades, whereas leverage is the ratio that amplifies your market exposure.

- Interconnected Concepts: Margin requirements determine the level of leverage available, with lower margin enabling higher leverage.

- Risk Management: Effective management of margin and leverage is crucial to prevent margin calls and mitigate potential losses.

- Regulatory Compliance: Adhering to regulatory limits on leverage ensures safer trading practices and reduces exposure to excessive risk.

- Strategic Utilization: Employing appropriate leverage levels aligned with your trading strategy and risk tolerance enhances trading performance and sustainability.

How does leverage affect trading outcomes in the Forex market?

Leverage magnifies both gains and losses in Forex trading. While it allows traders to control larger positions with a smaller capital outlay, improper use of leverage can lead to significant losses that exceed the initial investment. Effective leverage management is essential to balance potential rewards with manageable risk levels.

Can margin and leverage vary between different Forex brokers?

Yes, margin requirements and leverage ratios can vary significantly between different Forex brokers. These variations are often influenced by the broker’s policies, regulatory environment, and the specific financial instruments offered. It’s crucial to review and understand your broker’s margin and leverage settings to align them with your trading strategy and risk tolerance.

What happens if my account balance falls below the margin requirement?

If your account balance drops below the required maintenance margin, your broker will issue a margin call. This requires you to deposit additional funds or close existing positions to restore the required equity level. Failure to meet a margin call can result in the forced liquidation of your positions, potentially leading to substantial losses.