The core difference between an ECN and a Standard account lies in how your trades are executed and what you pay for them. An ECN account offers direct market access with raw, ultra-low spreads and a fixed commission per trade, making it ideal for experienced traders. A Standard account, typically offered by a market maker or an online forex broker, bundles the cost into a wider spread with no separate commission, offering simplicity for beginners. This article will delve deep into the nuances of the ecn vs standard account debate, comparing their costs, execution models, and suitability for different trading styles to help you make a decisive choice in 2025.

Key Takeaways:

- Cost Structure: ECN accounts charge a commission on top of raw market spreads, while Standard accounts build the broker’s fee into a wider spread.

- Execution Model: ECN provides direct access to a network of liquidity providers (No Dealing Desk), whereas Standard accounts often involve the broker acting as the counterparty (Dealing Desk).

- Ideal User: ECN accounts are generally better for high-volume, experienced traders, and scalpers who prioritize tight spreads and fast execution. Standard accounts are more suited for beginners and infrequent traders due to their simplicity and predictable costs.

- Transparency: ECN accounts offer greater market transparency with full depth of market data, which is typically unavailable with Standard accounts.

- The Right Choice: The decision in the ecn vs standard account dilemma hinges entirely on your individual trading strategy, frequency, capital, and experience level.

What is an ECN Account?

Before you can confidently weigh an ecn vs standard account, it’s crucial to understand the engine running behind the scenes. ECN stands for Electronic Communication Network. Think of it as a sophisticated digital marketplace, a central hub where a diverse group of participants—banks, financial institutions, and individual traders—all connect to buy and sell currencies. The ECN broker simply acts as a conduit, passing your order directly into this network without any interference. This model is fundamentally different from the traditional brokerage setup and is built on the principles of speed and direct access.

The process is seamless. When you place a trade on an ECN platform, your order is instantly matched against the best available bid or ask price within the network of liquidity providers. Because this network is a competitive environment with multiple participants quoting prices, the resulting spreads can be incredibly tight, sometimes narrowing to zero for major currency pairs during high liquidity periods. There is no “dealing desk” to intercept or potentially manipulate the order flow. This direct-to-market execution is the hallmark of a true ECN environment.

Key Characteristics of an ECN Account

An ECN account is defined by a set of distinct features that cater to a specific type of trader. These characteristics are not just bullet points on a feature list; they fundamentally shape the trading experience.

- Raw, Tight Spreads: The most celebrated feature. ECN accounts provide access to raw interbank market spreads. This means you are seeing the actual bid and ask prices from liquidity providers, which can be as low as 0.0 pips. This is a significant advantage for strategies sensitive to price, like scalping.

- Commissions: There’s no free lunch. To compensate for providing this direct access and not marking up the spread, brokers charge a fixed commission per trade. This is a transparent, volume-based fee, typically charged per “lot” traded (e.g., $3.50 per lot to open and $3.50 to close).

- Ultra-Fast Execution: With no dealing desk intervention, orders are executed at lightning speed. This minimizes the risk of slippage—the difference between the expected price of a trade and the price at which the trade is actually executed. For active traders, this speed is a critical advantage.

- Transparency: ECN brokers provide full market depth, often referred to as Level II pricing. This allows traders to see the full order book, including the buy and sell orders from other market participants. This level of transparency in the ecn vs standard account discussion is a major plus for the ECN model.

- Anonymity: All transactions within the ECN are anonymous. The liquidity providers cannot see the identity of the trader behind the order, ensuring that all orders are filled based purely on the best price available, free from any potential bias.

Read More: Choosing a Forex Broker

What is a Standard Account?

The Standard account is the most common and widely offered trading account by forex brokers. It’s often the default option and serves as the entry point for the majority of new traders. The defining feature of a Standard account is its business model, which is typically that of a “market maker.” This means the broker often takes the other side of a client’s trade, effectively creating the “market” for that trader. While this might sound concerning, for a regulated and reputable broker for forex trading, it is a standard industry practice designed to provide constant liquidity and a simpler trading experience.

When you place a trade with a Standard account, you are trading against the broker. If you buy, the broker sells to you. If you sell, the broker buys from you. The broker makes its profit not from a separate commission, but from the spread—the difference between the bid and ask price—which they control and typically widen slightly compared to the raw market rate. This all-inclusive cost structure is the main appeal of the Standard account, especially for those new to the complexities of trading costs. The choice between an ecn or standard account often starts with understanding this fundamental difference in operation.

Key Characteristics of a Standard Account

A Standard account offers a different set of features tailored for simplicity and accessibility, which are crucial points of comparison in the ecn account vs standard account debate.

- Wider, Fixed or Variable Spreads: The broker’s fee is built directly into the spread. This spread can be fixed (it doesn’t change regardless of market conditions) or variable (it widens or narrows based on volatility and liquidity). In either case, it will be wider than the raw spreads found on an ECN account.

- Commission-Free Trading: This is the primary marketing pitch for Standard accounts. You don’t see a separate commission fee deducted from your account for each trade. The cost is less direct but is still present within the spread. This simplicity is highly attractive to beginners.

- Execution Speed: Execution is generally fast, but because the broker is the counterparty, there is a risk of “re-quotes.” This happens when the price moves in the split second you click to trade, and the broker offers you a new price, which you must accept or decline. This can be a significant issue during volatile market news.

- Simplicity: The cost structure is straightforward. What you see is what you get. You don’t need to calculate commissions, making it much easier to figure out your potential profit and loss on a trade, a clear advantage for newcomers trying to decide between an ecn vs standard account.

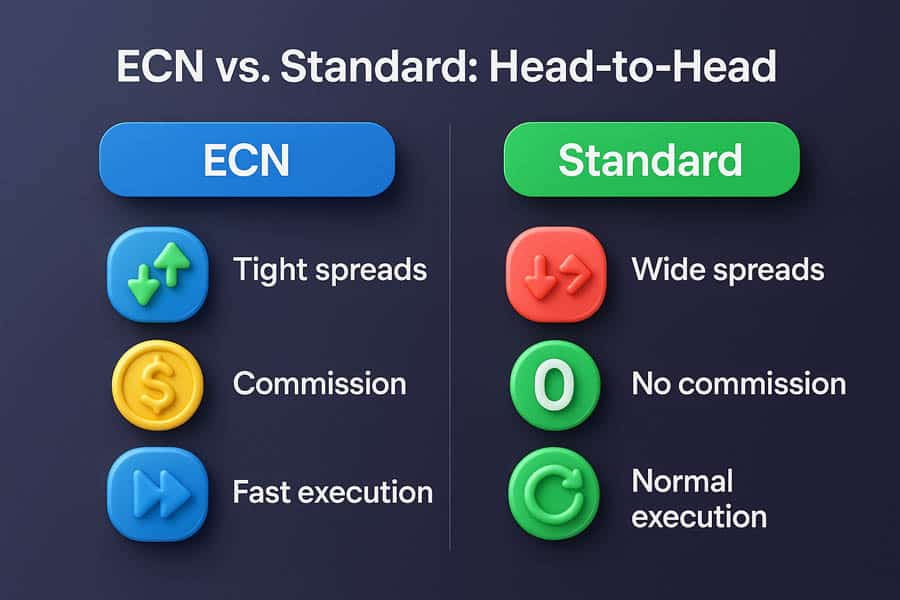

ECN vs. Standard Account: Head-to-Head Comparison

To truly grasp the differences and make an informed choice, a direct comparison is essential. Seeing the features side-by-side illuminates the practical implications of choosing one account over the other. This table breaks down the core distinctions in the great ecn vs standard account face-off.

| Feature | ECN Account | Standard Account |

|---|---|---|

| Spreads | Raw market spreads, starting from 0.0 pips. Highly variable. | Wider spreads that are either fixed or variable, with the broker’s markup included. |

| Trading Costs | Raw Spread + Fixed Commission per trade. | Wider Spread only (commission is built-in). |

| Execution Speed & Slippage | Ultra-fast execution with minimal slippage due to direct market access. No re-quotes. | Generally fast, but can be slower. Higher risk of re-quotes and slippage during high volatility. |

| Dealing Desk Involvement | No Dealing Desk (NDD). Orders are passed directly to the network. | Often involves a Dealing Desk (DD). The broker is the counterparty to the trade. |

| Market Transparency | High. Full market depth (Level II pricing) shows the order book. | Low. Traders only see the bid/ask prices offered by the broker. |

| Minimum Deposit | Typically higher (e.g., $200 or more) due to the technology involved. | Generally lower (e.g., $10-$100), making it more accessible. |

| Ideal Trader Profile | Experienced traders, scalpers, day traders, algorithmic traders. | Beginner traders, infrequent traders, and those who prefer cost simplicity. |

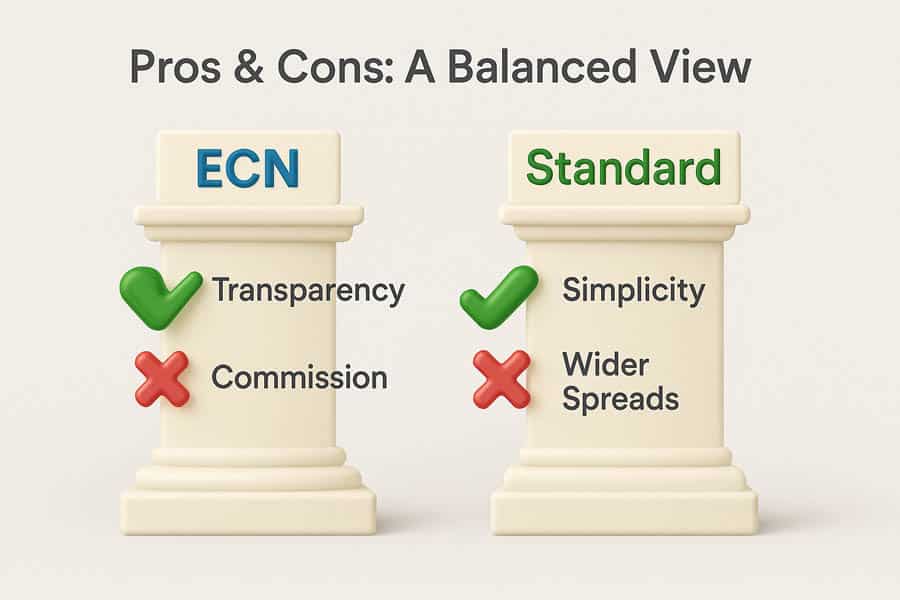

Pros and Cons: A Balanced View

No account type is universally perfect. Each has strengths and weaknesses that make it more or less suitable depending on your needs. A balanced, unbiased look at these pros and cons is essential before you commit your capital. The choice between an ecn or standard account requires weighing these factors carefully against your personal trading style.

Advantages and Disadvantages of an ECN Account

The ECN account is often lauded as the professional’s choice, but its features come with certain trade-offs. Its strengths lie in providing a trading environment that closely mirrors that of institutional players.

Pros:

- Lower Overall Costs for Active Traders: While there’s a commission, the combination of raw spreads and a fixed commission is almost always cheaper for frequent, high-volume traders compared to the consistently wider spreads of a Standard account.

- Superior Execution Environment: The lightning-fast speed and absence of re-quotes are invaluable for strategies like scalping and news trading, where every millisecond and every pip counts.

- Full Transparency: Access to Level II data gives you a much clearer picture of market sentiment and liquidity, allowing for more sophisticated trading decisions.

- No Conflict of Interest: Since the broker makes money from commissions regardless of whether you win or lose, there is no inherent conflict of interest. The broker wants you to trade more, and successful traders tend to trade more. This alignment of interests is a significant factor in the ecn account vs standard account comparison.

Cons:

- Commission on Every Trade: The separate commission fee can be psychologically challenging for some traders to track. It also makes calculating the break-even point of a trade slightly more complex.

- Higher Minimum Deposit: The barrier to entry is typically higher. Brokers need to cover the costs of maintaining the sophisticated ECN technology and liquidity provider relationships, which is reflected in higher minimum deposits.

- Complexity for New Traders: The concept of raw variable spreads plus commissions, along with interpreting Level II data, can be overwhelming for someone just starting their trading journey.

Advantages and Disadvantages of a Standard Account

The Standard account’s primary virtue is its simplicity. It’s designed to remove barriers and make it easy for anyone to start trading, but this simplicity comes at a cost.

Pros:

- Simplicity and Ease of Use: The “all-in” spread makes cost calculation incredibly simple. This allows new traders to focus on learning market analysis and strategy without being bogged down by complex fee structures.

- No Separate Commission: The absence of a per-trade commission fee is psychologically appealing and makes it easier to see your net profit or loss directly on the platform.

- Lower Minimum Deposit: These accounts are highly accessible, often allowing you to start trading with a very small amount of capital. This is a huge draw for beginners who want to test the waters with minimal risk.

Cons:

- Higher Trading Costs Overall: For anyone trading with any regularity, the wider spreads will almost always result in higher total costs over time compared to an ECN account. This is a critical point in the ecn vs standard account analysis.

- Potential for Slower Execution and Re-quotes: The dealing desk model can lead to delays and re-quotes, especially during volatile markets. This can be incredibly frustrating and can lead to missed trading opportunities or unfavorable entry prices.

- Potential Conflict of Interest: Since the broker is your counterparty, in a pure market-maker model, your loss is their gain. While reputable, regulated brokers manage this conflict professionally, the potential for it still exists, unlike in a true ECN setup.

Read More: Types of Brokers in Forex Trading

Which Account Should You Choose?

We’ve reached the most important part of the discussion: applying this knowledge to your specific situation. The answer to the “ecn or standard account” question is not universal; it’s personal. Your trading style, experience level, and even your trading frequency will dictate the right choice. Let’s break it down into practical recommendations.

For the Beginner Trader

For those just starting out, the Standard account is almost always the recommended starting point. The journey into forex trading is steep enough without adding unnecessary complexity. A Standard account offers a gentle learning curve. The primary reason is its simplicity. You can focus on mastering the basics—chart analysis, risk management, and developing a trading plan—without having to simultaneously calculate commission costs.

The lower minimum deposit also means you can begin with a smaller, more manageable amount of capital, reducing the stress of potential early losses. Think of the Standard account as your training wheels; it provides a stable and predictable environment to build your skills and confidence before you consider upgrading. The debate over ecn vs standard account for a novice clearly favors the latter.

For the Experienced & Active Trader

If you have been trading for a while, understand market dynamics, and trade regularly, the ECN account becomes a much more compelling proposition. Experienced traders have moved beyond the basics and are now focused on optimizing their strategy and minimizing costs. The cost-effectiveness of an ECN account is its biggest draw here.

Over hundreds or thousands of trades, the savings from tighter spreads, even after accounting for commissions, can be substantial and significantly boost your bottom line. Furthermore, experienced traders can leverage the advanced features of an ECN environment, such as Level II data, to refine their entry and exit points. The superior execution speed and absence of re-quotes are critical for maintaining the integrity of a well-honed strategy. For this profile, the ecn account vs standard account choice leans heavily towards ECN.

For the Scalper and Day Trader

For scalpers and active day traders, the choice is clear: the ECN account is not just better, it’s often essential. Scalping involves entering and exiting dozens, sometimes hundreds, of trades per day to profit from very small price movements. This strategy is extremely sensitive to the spread.

A wide spread, like that on a Standard account, can completely wipe out the tiny profits a scalper aims for. The raw, razor-thin spreads of an ECN account are a prerequisite for scalping to be viable. Similarly, the ultra-fast execution is non-negotiable. Any delay or re-quote could turn a winning trade into a losing one in a matter of seconds. Therefore, in the ecn vs standard account showdown for high-frequency traders, ECN wins by a landslide.

For the Swing Trader or Infrequent Trader

If your trading style is more relaxed, such as swing trading (holding positions for several days or weeks) or you only place a handful of trades per month, the choice becomes less clear-cut, and a Standard account might still be perfectly suitable. For a swing trader, the entry price is important, but a difference of a pip or two in the spread is less critical compared to the overall profit target of hundreds of pips.

Since you are not trading frequently, the cumulative cost of the wider spread is less impactful. The simplicity and lack of commission fees might be preferable for someone who doesn’t want to overcomplicate their trading process. In this scenario, the convenience of a Standard account could easily outweigh the marginal cost benefits of an ECN account. This highlights that the ecn vs standard account decision is truly strategy-dependent.

How to Choose the Right Broker

Selecting the right account type is only half the battle; pairing it with the right broker is just as crucial. Regardless of whether you choose an ecn vs standard account, the broker’s reliability is paramount. Always prioritize brokers that are regulated by top-tier authorities. Regulation provides a safety net and ensures the broker adheres to strict standards of financial conduct and transparency.

Many reputable brokers today offer clients a choice between ECN and Standard accounts, recognizing that different traders have different needs. This flexibility is a good sign. The ultimate test, however, is to experience the conditions firsthand. Before funding a live account, always open a demo account. Use it to test the platform’s stability, execution speeds, and the typical spreads during various market sessions for both the ECN and Standard options. This practical, hands-on experience is invaluable and will provide the final piece of the puzzle, allowing you to make your ecn vs standard account choice with complete confidence.

Read More: Best Forex Broker With Lowest Spread

Opofinance Services

When selecting a broker that offers diverse account types, consider Opofinance, an ASIC-regulated broker that caters to every kind of trader. Whether you’re leaning towards an ECN or a standard account, Opofinance provides a robust and secure environment to execute your strategy. Key benefits include:

- Advanced Trading Platforms: Choose your ideal interface from a suite of powerful platforms, including MT4, MT5, cTrader, and the proprietary OpoTrade app.

- Innovative AI Tools: Gain a competitive edge with cutting-edge tools like the AI Market Analyzer, a personal AI Coach, and instant AI Support.

- Social & Prop Trading: Engage with the community through social trading or test your skills to get funded with proprietary trading opportunities.

- Secure & Flexible Transactions: Enjoy peace of mind with safe and convenient deposit and withdrawal methods, including crypto payments, all with zero fees from Opofinance.

Explore a trading environment built for modern demands. Discover the Opofinance advantage today!

Conclusion

The ecn vs standard account debate doesn’t have a single winner. The best choice is deeply personal. An ECN account is the professional’s tool, offering lower costs and superior execution for active, experienced traders. A Standard account is the accessible entry point, providing simplicity and predictable costs for beginners and infrequent traders. By analyzing your own trading frequency, strategy, and experience level, you can confidently select the account that aligns perfectly with your goals and sets you on the right path for your trading journey.

Is it possible to lose more than your deposit with an ECN account?

This depends on the broker’s negative balance protection policy. Most regulated brokers, regardless of account type, offer this protection, which prevents you from losing more than your account balance. Always confirm this feature with your broker.

Can a broker offer both ECN and Standard accounts?

Yes, many modern brokers offer a range of account types to cater to a diverse client base. Offering both ECN and Standard accounts is a sign of a versatile broker that understands different traders’ needs.

Are the spreads on an ECN account always lower than on a Standard account?

The raw spread on an ECN account is almost always lower. However, during extreme market volatility or illiquidity, ECN spreads can widen significantly. A fixed-spread Standard account might temporarily offer a better rate in such rare scenarios, but on average, ECN spreads are tighter.

Is algorithmic trading or using Expert Advisors (EAs) better on an ECN account?

Yes, absolutely. Algorithmic strategies and EAs thrive on fast, precise execution and low spreads. The ECN environment, with no re-quotes and minimal slippage, is far superior for automated trading systems.

How do I calculate my total cost on an ECN account?

To calculate your total cost for a round-trip trade (open and close), you add the spread cost to the commission cost. For example, if the spread is 0.2 pips on a 1-lot trade of EUR/USD (value of $2) and the commission is $7 round-trip, your total cost is $9.