Are you striving to elevate your trading strategy to the next level? Understanding the synergy between Elliott Wave and Fibonacci can transform your market predictions. This comprehensive guide delves into elliott wave and fibonacci, exploring their integration to enhance trading accuracy. Whether you’re a novice or an experienced trader, learning how to use fibonacci with elliott wave alongside a reliable regulated forex broker can significantly boost your trading success. Dive in to discover strategies that can refine your approach and lead to more informed trading decisions, ensuring you stay ahead in the competitive world of forex trading.

Brief Overview of Elliott Wave and Fibonacci

Introduce the Concepts of Elliott Wave Theory and Fibonacci Ratios

Elliott Wave Theory and Fibonacci ratios are pivotal tools in technical analysis. Elliott Wave Theory, developed by Ralph Nelson Elliott, identifies repetitive wave patterns in market trends, reflecting investor psychology. Fibonacci ratios, derived from the Fibonacci sequence, provide critical levels of support and resistance, helping traders predict potential price movements.

Importance of the Combination

Combining Elliott Wave and Fibonacci enhances the precision of market predictions. Traders leverage the wave patterns to understand the market structure while using Fibonacci levels to identify entry and exit points. This powerful combination leads to more accurate forecasts and better trading outcomes by aligning market trends with mathematically derived price projections.

Objective of the Guide

This guide aims to equip you with the knowledge to seamlessly integrate elliott wave and fibonacci retracement strategy into your trading. By mastering both techniques, you’ll gain the ability to analyze market trends more effectively and execute trades with greater confidence, ultimately improving your overall trading performance.

Read More: Elliott Wave Strategy

Understanding Elliott Wave Theory

Origins and Development

Ralph Nelson Elliott introduced the wave principle in the 1930s, observing that financial markets move in predictable wave patterns driven by investor sentiment. Over time, Elliott Wave Theory has become a cornerstone in market analysis, offering insights into the cyclical nature of market movements. This theory posits that markets unfold in a series of waves, each reflecting the collective psychology of investors.

Fundamentals of Wave Patterns

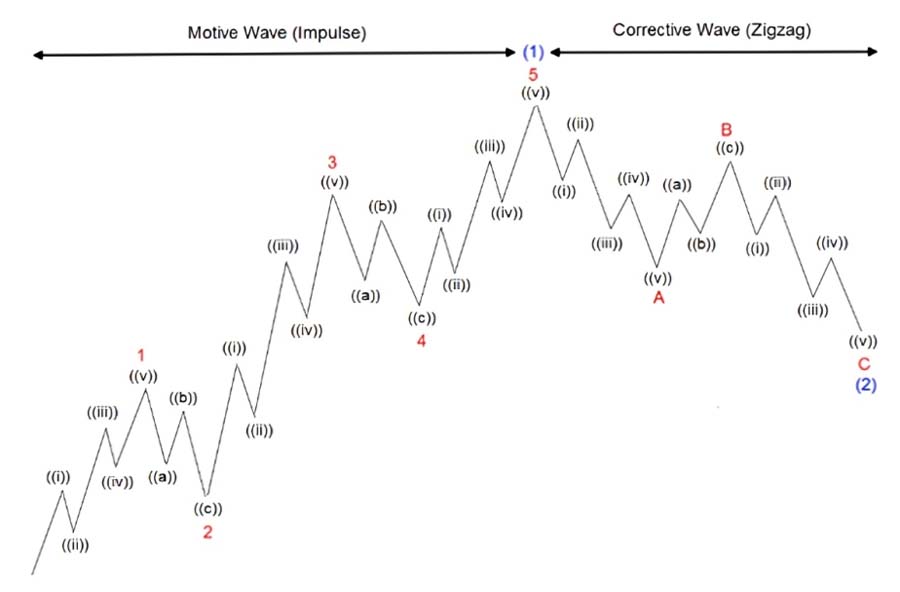

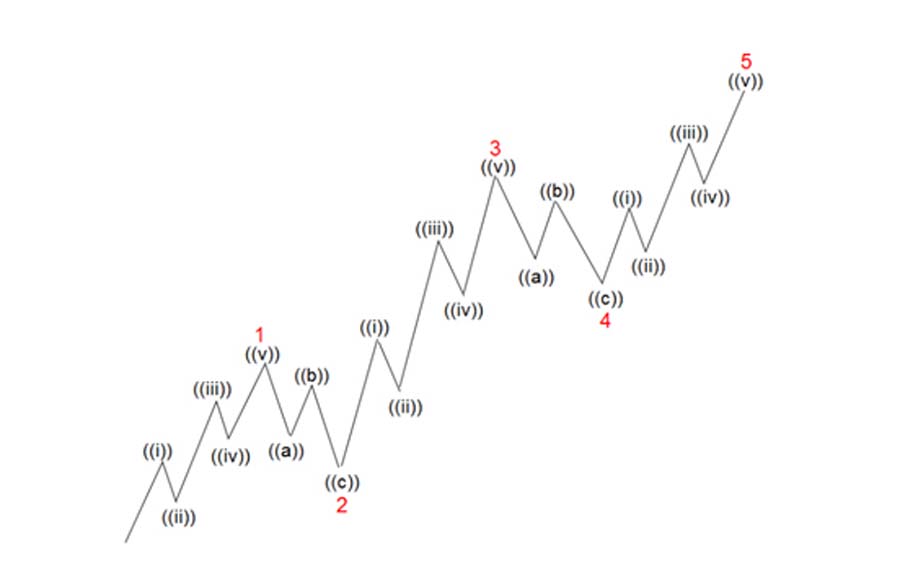

Motive Waves (Impulse and Diagonal)

Motive waves, including impulse and diagonal patterns, depict the primary direction of the trend.

- Impulse Waves: Consist of five sub-waves moving in the direction of the trend. These waves represent the strong momentum driving the market forward.

- Diagonal Waves: Indicate a consolidation phase within the trend, often occurring in wave 1 or wave 5 of the motive wave. They signal a temporary pause before the trend resumes.

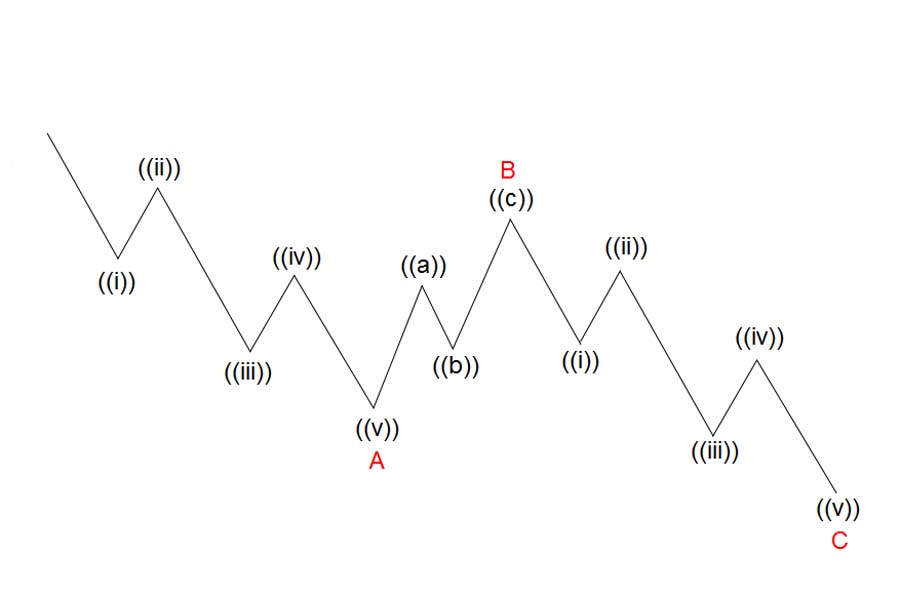

Corrective Waves (Zigzags, Flats, and Triangles)

Corrective waves move against the prevailing trend and are typically composed of three sub-waves.

- Zigzags: Sharp corrections that retrace a significant portion of the previous wave.

- Flats: Corrections that move sideways before continuing the trend.

- Triangles: Consolidation patterns that indicate a continuation of the trend after the correction.

These patterns signify potential reversals or pauses in the market, providing strategic points for traders to enter or exit positions.

Rules and Guidelines of Elliott Wave

- Wave 2 cannot retrace more than 100% of Wave 1.

- Wave 3 is never the shortest among waves 1, 3, and 5.

- Wave 4 does not overlap with the price territory of Wave 1.

Adhering to these rules ensures accurate wave counts and reliable market analysis.

Common Misinterpretations and Challenges

Many traders miscount waves or overlook key rules, leading to incorrect predictions. Understanding the nuances of wave structures and maintaining discipline in wave counting are essential to avoid common pitfalls.

Read More: Elliott Wave vs SMC

Exploring Fibonacci Ratios

Introduction to Fibonacci and the Golden Ratio

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones. The Golden Ratio (1.618) emerges from this sequence and appears frequently in nature and financial markets, providing a mathematical basis for predicting price movements. This ratio is fundamental in identifying harmonious levels within market trends.

Fibonacci Ratios in Trading

Retracement Levels (23.6%, 38.2%, 50%, 61.8%, 78.6%)

- 23.6% & 38.2%: Minor correction levels indicating shallow retracements.

- 50%: A significant psychological level, often acting as strong support or resistance.

- 61.8% & 78.6%: Deeper retracement levels providing critical reversal points.

Extension Levels (100%, 138.2%, 161.8%)

- 100%: Indicates a full retracement.

- 138.2% & 161.8%: Extension levels used to project potential price targets beyond the current trend.

Support and Resistance with Fibonacci

Traders identify support and resistance zones by overlaying Fibonacci retracement and extension levels on price charts. These zones often act as barriers where price movements may reverse or consolidate, aligning with key technical analysis principles.

Combining Fibonacci Ratios with Elliott Wave Theory

Fibonacci’s Role in Validating Elliott Wave Patterns

Fibonacci levels validate Elliott Wave counts by confirming key entry and exit points within wave structures. This validation enhances the reliability of wave analysis, making predictions more robust and aligning trading strategies with market trends. By integrating Fibonacci ratios, traders can pinpoint more precise levels where waves are likely to complete, thereby increasing the accuracy of their trade setups.

Fibonacci Levels and Specific Elliott Waves

Corrective Waves and Retracement Levels

- Wave 2: Typically retraces 50% to 61.8% of Wave 1.

- Wave 4: Often retraces 38.2% to 50% of Wave 3.

These retracement levels help traders identify potential reversal points within corrective waves, ensuring that they enter trades at optimal levels with minimal risk.

Impulse Waves and Extension Targets

- Wave 3: Usually extends to 161.8% of Wave 1.

- Wave 5: Can reach up to 100% or 161.8% of Wave 3.

Fibonacci extensions provide target prices for impulse waves, allowing traders to set precise profit-taking points and manage their trades effectively.

Advanced Integration Techniques

To maximize the benefits of combining elliott wave and fibonacci retracement strategy, consider the following advanced techniques:

- Confluence Zones: Identify areas where multiple Fibonacci levels intersect with Elliott Wave counts. These zones increase the probability of successful trades.

- Wave Overlays: Use Fibonacci extensions to overlay potential wave 3 and wave 5 targets, ensuring that your wave counts align with projected price movements.

- Dynamic Adjustments: Continuously adjust your Fibonacci levels as new waves form, maintaining an accurate and dynamic analysis of the market.

By employing these advanced techniques, traders can enhance the precision and effectiveness of their combined Elliott Wave and Fibonacci strategies.

Guidelines for Combining Techniques

- Identify the Elliott Wave pattern on the chart.

- Apply Fibonacci retracement levels to determine potential reversal points within corrective waves.

- Use Fibonacci extensions to set target prices for impulse waves.

- Confirm wave counts with Fibonacci levels to enhance accuracy.

- Look for confluences between Fibonacci levels and other technical indicators for stronger trade signals.

Following these steps ensures a disciplined approach to combining Elliott Wave and Fibonacci techniques, leading to more reliable and profitable trading decisions.

Practical Application and Analysis Examples

Step-by-Step Guide

- Analyze Market Trends: Use Elliott Wave to identify the current wave structure. Determine whether the market is in a motive or corrective phase.

- Apply Fibonacci Levels: Overlay Fibonacci retracement and extension levels on the identified waves to identify key support and resistance areas.

- Identify Entry Points: Look for confluences between wave patterns and Fibonacci levels. For example, entering a trade at the 61.8% retracement of Wave 2 in a corrective phase.

- Set Targets and Stop-Loss: Use Fibonacci extensions for setting profit targets and retracement levels for placing stop-loss orders, ensuring effective risk management.

- Monitor and Adjust: Continuously monitor the market and adjust your Fibonacci levels and wave counts as new price action unfolds.

This systematic approach allows traders to make informed decisions based on robust technical analysis, enhancing their ability to capitalize on market movements.

Case Study Examples

Real-World Examples in Major Markets (e.g., Forex, Stocks)

Examining historical charts from the Forex and stock markets illustrates how the combined approach of Elliott Wave and Fibonacci can predict significant price movements.

Forex Example: EUR/USD

In a bullish trend, traders identified an Elliott Wave impulse pattern (Wave 1 to Wave 5). Using Fibonacci retracement, they pinpointed Wave 2’s retracement at 61.8%, providing a strategic entry point. The subsequent Wave 3 extended to 161.8%, aligning with Fibonacci extensions, allowing traders to set precise profit targets. This alignment of wave counts with Fibonacci levels resulted in a successful trade, maximizing profits while minimizing risk.

Stock Market Example: Apple Inc. (AAPL)

During a consolidation phase, AAPL exhibited a corrective wave pattern. Fibonacci retracement levels highlighted potential support zones at 38.2% and 50%, where traders entered long positions. The Wave 3 extension to 161.8% confirmed the continuation of the bullish trend, resulting in profitable exits. This case demonstrates how integrating Elliott Wave and Fibonacci strategies can effectively navigate market consolidations and trend continuations.

Successful Trades Using Combined Approach

- Entry: At the confluence of a corrective wave’s Fibonacci retracement and a support zone, ensuring a high-probability trade setup.

- Exit: Near the Fibonacci extension level of the subsequent impulse wave, maximizing profit potential.

- Stop-Loss: Below the next Fibonacci retracement level to mitigate risk and protect capital.

These strategies demonstrate how combining Elliott Wave and Fibonacci can lead to successful trading outcomes by aligning entries and exits with key price projections, enhancing both profitability and risk management.

Challenges and Common Pitfalls

- Overcomplicating Wave Counts: Keeping wave analysis simple and adhering to rules prevents confusion.

- Ignoring Fibonacci Levels: Always integrate Fibonacci analysis to support wave patterns.

- Emotional Trading: Maintaining discipline and following the strategy is crucial to avoid emotional decisions.

- Misidentifying Waves: Incorrectly identifying wave structures can lead to flawed analysis and poor trading decisions.

- Overlooking Market Context: Failing to consider broader market trends and news can result in incomplete analysis.

Awareness of these challenges helps traders navigate the complexities of technical analysis effectively, ensuring more accurate and reliable trading decisions.

Advanced Concepts in Elliott Wave and Fibonacci Analysis

Extensions and Truncations in Waves

Advanced wave structures like extensions and truncations can alter Fibonacci ratios, affecting the accuracy of predictions. Understanding these variations is essential for nuanced analysis. For instance, a wave extension may indicate a stronger trend, while truncation can signal a weakening momentum. Recognizing these patterns allows traders to adjust their strategies accordingly, ensuring they remain aligned with the evolving market dynamics.

Read More: Elliott Wave vs Neo Wave

Fibonacci Time Zones

Fibonacci time projections help predict the timing of market movements by applying Fibonacci intervals to timeframes, enhancing cycle predictions. This tool allows traders to anticipate when significant market shifts might occur, aligning price projections with market timing. By integrating time-based Fibonacci analysis with wave counts, traders can better forecast not only where the market is moving but also when it is likely to make those moves.

Combining with Other Technical Indicators

Relative Strength Index (RSI) and Moving Averages

Integrating RSI and Moving Averages with Elliott Wave and Fibonacci can enhance the accuracy of trade signals by providing additional confirmation. For example, an RSI divergence can signal a potential wave reversal, while moving averages can confirm trend direction. This multi-indicator approach ensures that trading decisions are well-supported and reduces the likelihood of false signals.

Divergence Analysis

Divergence between price and indicators like RSI can support Elliott Wave patterns and Fibonacci targets, signaling potential reversals or continuations. Identifying such divergences allows traders to anticipate changes in market trends more effectively. For instance, if the price is making higher highs while RSI is making lower highs, it may indicate a bearish divergence, suggesting a potential reversal.

Risk Management Strategies

- Setting Stop-Loss Levels: Based on Fibonacci retracement levels to limit potential losses.

- Calculating Trade Size: According to wave and Fibonacci structures to manage risk effectively.

- Diversifying Trades: Spread risk across different assets to mitigate potential losses.

- Using Trailing Stops: Adjust stop-loss orders as the trade progresses to lock in profits while allowing for continued trend movement.

Effective risk management ensures that traders can protect their capital while leveraging technical analysis for profitable trades. By integrating these strategies, traders can maintain a balanced approach, optimizing both their potential rewards and risk exposure.

Opofinance Services

Discover the advantages of trading with Opofinance, an ASIC regulated forex broker. Opofinance offers a robust social trading service, allowing you to follow and replicate successful traders. Featured on the MT5 brokers list, Opofinance ensures safe and convenient deposits and withdrawals, providing a secure trading environment for all investors.

- Advanced Trading Tools: Access to sophisticated charting platforms and automated trading systems that complement Elliott Wave and Fibonacci strategies. These tools enable precise technical analysis and efficient trade execution.

- Exceptional Customer Support: Dedicated support team available 24/5 to assist with any trading inquiries or technical issues. Responsive and knowledgeable support ensures that your trading experience is smooth and hassle-free.

- Competitive Spreads and Low Fees: Enjoy tight spreads and minimal commissions, maximizing your trading profitability. Cost-effective trading conditions enhance your overall return on investment.

- Educational Resources: Comprehensive educational materials, including webinars and tutorials, to enhance your trading knowledge. Continuous learning opportunities empower you to refine your strategies and stay updated with market trends.

- Social Trading Community: Engage with a vibrant community of traders, share insights, and learn from the experiences of others. Collaborative trading environments foster growth and innovation.

User Testimonials

“Using Opofinance has significantly improved my trading strategy. The social trading feature allows me to learn from top traders who expertly use Elliott Wave and Fibonacci techniques.”

— Jane D., Forex Trader

“The safety and convenience of Opofinance’s deposit and withdrawal methods give me peace of mind, allowing me to focus on executing my trading strategies effectively.”

— Mark S., Stock Investor

“Opofinance’s advanced trading tools and exceptional customer support have been invaluable in refining my Elliott Wave and Fibonacci analysis. I highly recommend their services.”

— Sarah K., Experienced Trader

Ready to enhance your trading with the combined power of Elliott Wave and Fibonacci? Join Opofinance today to take advantage of their advanced tools, social trading services, and secure trading environment. Sign up for a demo account and start refining your trading strategies with confidence. Experience the difference of trading with a regulated forex broker that prioritizes your success and security.

Pro Tips for Advanced Traders

- Refine Wave Counts: Regularly review and adjust your wave counts to adapt to changing market conditions. Advanced traders often use multiple wave counts to confirm patterns.

- Use Multiple Timeframes: Analyze different timeframes to gain a comprehensive view of market trends. For example, combine daily and hourly charts to identify both long-term and short-term patterns.

- Incorporate Volume Analysis: Volume can provide additional confirmation for wave patterns and Fibonacci levels. Higher volume during impulse waves can validate the strength of the trend.

- Stay Updated with Market News: Economic events can impact wave structures and Fibonacci retracements, so stay informed. Use an economic calendar to anticipate major market-moving events.

- Leverage Automated Tools: Utilize advanced charting software and automated Elliott Wave labeling tools to enhance accuracy and save time.

- Avoid Overfitting: Resist the temptation to force wave patterns onto every market movement. Ensure that wave counts are justified by market data and not just arbitrary fitting.

- Diversify Strategies: Combine Elliott Wave and Fibonacci with other trading strategies to create a well-rounded approach. Diversification can lead to more consistent trading performance.

- Backtest Strategies: Rigorously backtest your combined Elliott Wave and Fibonacci strategies on historical data to validate their effectiveness. Backtesting provides confidence in your trading approach before applying it in live markets.

Common Mistakes to Avoid

- Ignoring Key Rules of Elliott Wave: Disregarding fundamental rules can lead to incorrect wave counts and flawed analysis.

- Overreliance on Fibonacci Levels: While Fibonacci is powerful, relying solely on these levels without considering other indicators can be risky.

- Failing to Update Analysis: Market conditions change, and failing to update your Elliott Wave and Fibonacci analysis can result in missed opportunities.

- Emotional Decision-Making: Allowing emotions to dictate trading decisions undermines the structured approach of Elliott Wave and Fibonacci strategies.

- Overcomplicating the Analysis: Keeping your analysis straightforward ensures clarity and reduces the risk of errors.

- Neglecting Risk Management: Ignoring proper risk management can lead to significant losses, regardless of the accuracy of your technical analysis.

By implementing these advanced strategies and avoiding common mistakes, traders can enhance their proficiency in using Elliott Wave and Fibonacci for superior trading outcomes.

Conclusion

Recap Key Benefits of the Combined Approach

Integrating Elliott Wave Theory with Fibonacci ratios enhances the precision and reliability of market predictions. This powerful combination provides a structured framework for analyzing trends and identifying optimal trading opportunities, aligning technical analysis with price projections for better trading decisions. By leveraging elliott wave and fibonacci, traders can gain deeper insights into market dynamics, allowing for more strategic and informed trading actions.

Enhanced Market Predictions

The synergy between Elliott Wave and Fibonacci allows traders to not only identify the current market phase but also predict future movements with greater accuracy. This dual approach ensures that traders are well-equipped to anticipate market shifts, capitalize on emerging trends, and manage their trades effectively.

Improved Trade Precision

Proper wave counts and Fibonacci levels work hand-in-hand to pinpoint exact entry and exit points. This precision minimizes guesswork and enhances the likelihood of successful trades, providing a clear roadmap for navigating complex market conditions.

Comprehensive Risk Management

Combining these techniques also fortifies your risk management strategies. By setting stop-loss levels based on Fibonacci retracements and adjusting trade sizes according to wave structures, traders can protect their capital while maximizing profit potential.

Continuous Learning and Adaptation

Risk management and continuous learning are crucial for successful trading. The integration of Elliott Wave and Fibonacci encourages traders to stay informed, adapt to changing market conditions, and refine their strategies continuously. This commitment to growth ensures sustained trading success and resilience in the face of market volatility.

Encouragement for Practice and Application

Practice makes perfect. Backtest your strategies and utilize demo accounts to refine your understanding before committing to live trading. Consistent practice ensures that you can effectively apply Elliott Wave and Fibonacci techniques in real market conditions. Embrace the learning process, stay disciplined, and continuously seek to enhance your trading acumen.

Expanding your knowledge through these resources will deepen your expertise and equip you with the skills needed to master the combined Elliott Wave and Fibonacci approach.

Key Takeaways

- Elliott Wave and Fibonacci are essential tools for technical analysis.

- Combining these techniques leads to more accurate market predictions.

- Proper wave counts and Fibonacci levels enhance trade precision.

- Risk management and continuous learning are crucial for successful trading.

- Opofinance offers reliable services that support advanced trading strategies.

- Advanced integration techniques and pro tips can significantly improve trading outcomes.

- Avoiding common pitfalls ensures a disciplined and effective trading approach.

Can Elliott Wave and Fibonacci be applied to all financial markets?

Yes, the combination of Elliott Wave and Fibonacci ratios is versatile and can be effectively applied to various financial markets, including Forex, stocks, commodities, and cryptocurrencies. Their principles are universal, making them valuable tools across different trading environments.

How do Fibonacci extensions differ from retracements in trading?

Fibonacci retracements identify potential support and resistance levels during price corrections, while Fibonacci extensions project future price targets beyond the current trend, helping traders set profit-taking points. Retracements are used to gauge pullbacks, whereas extensions are used to forecast the continuation of the trend.

What are the best tools to integrate Elliott Wave and Fibonacci analysis?

Advanced charting platforms like MetaTrader 5 (MT5), TradingView, and Thinkorswim offer robust tools for Elliott Wave and Fibonacci analysis, enabling traders to overlay patterns and levels seamlessly. These platforms provide the necessary features to implement and visualize complex trading strategies effectively.