In the world of trading, finding the right strategy is essential for success. The debate between Elliott Wave vs. SMC (Smart Money Concepts) has become increasingly popular as traders look for ways to gain a competitive edge in the market. This guide provides a comprehensive analysis of these two powerful approaches, helping you decide which might be the best fit. Whether you’re looking for the best trading strategy for beginners or aiming to understand the difference between Elliott Wave and SMC, this article will break down the core concepts, pros and cons, and use cases of each method. Plus, with advanced risk management tips and insights into avoiding common mistakes, you’ll be well-equipped to maximize your trading potential.

Why Choose Between Elliott Wave Theory and SMC?

Both Elliott Wave Theory and Smart Money Concepts have unique advantages and challenges. Elliott Wave Theory offers a structure-based, predictive approach, while SMC is more adaptable, focusing on real-time analysis and institutional moves. We’ll explore these differences in detail, covering everything from understanding market conditions to pro tips for advanced traders. Additionally, we’ll highlight how Opofinance, an ASIC-regulated forex broker, provides robust tools for implementing these strategies.

Introduction to Elliott Wave and Price Action

What is Elliott Wave Theory?

Elliott Wave Theory was developed by Ralph Nelson Elliott in the 1930s. This structure-based approach posits that market prices move in predictable patterns (waves), driven by crowd psychology. The Elliott Wave Theory patterns consist of cycles that traders can analyze and predict. These patterns allow traders to forecast market movements and make strategic decisions, providing one of the best trading strategies for those comfortable with detailed analysis.

What is Smart Money Concepts (SMC)?

Smart Money Concepts (SMC) is a method focused on understanding price movements by analyzing institutional trading behaviors. By identifying liquidity zones, order blocks, and Break of Structure (BOS), SMC traders align their actions with institutional investors, often called “smart money.” SMC’s observation-based approach allows traders to react quickly to market changes, making it suitable for beginners who prefer a simpler, real-time analysis approach.

Purpose of This Guide

This article aims to guide traders in choosing the right approach by offering a clear comparison of Elliott Wave Theory vs. SMC. Whether you’re just starting or have experience in forex trading strategies, this breakdown will help you make an informed choice that aligns with your trading style and objectives.

Read More: Elliott Wave vs Price Action

Understanding Elliott Wave Theory

History and Origin

Elliott Wave Theory was created by Ralph Nelson Elliott, who believed that markets follow repetitive cycles based on crowd psychology. His insights into market cycles and wave structures helped define this strategy, which has become widely used among technical analysts today.

Core Concepts of Elliott Wave Theory

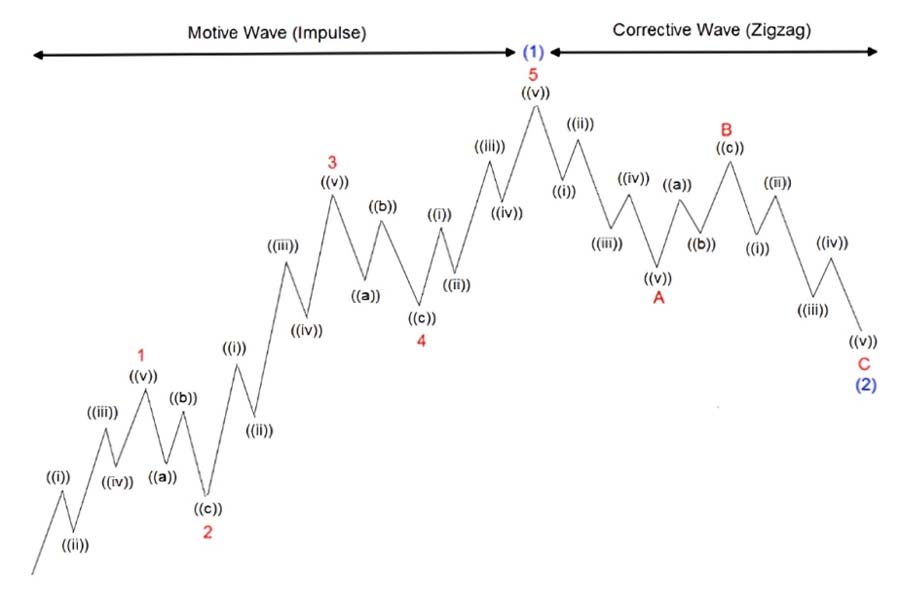

- Wave Structure: Elliott Wave Theory classifies market movements into:

- Impulse Waves: Five-wave patterns that indicate a primary market trend.

- Corrective Waves: Three-wave patterns that move against the trend, representing temporary retracements or reversals.

- Wave Count and Patterns: The 5-3 wave count structure helps traders identify market trends. Traders analyze these waves to forecast potential future movements in the asset’s price.

- Wave Degrees and Timeframes: Each wave pattern is part of a larger structure, allowing analysis across different timeframes. The fractal nature of Elliott Wave Theory makes it versatile for both short-term and long-term trading.

Key Rules and Guidelines

- Wave Alternation: In an impulse pattern, if wave two is sharp, wave four will typically be flat.

- Wave Equality: Waves 1 and 5 tend to be similar in length.

- Fibonacci Ratios: The use of Fibonacci retracements helps predict wave lengths and potential reversal points, making it an essential tool for Elliott Wave traders.

For traders looking to predict future market movements, Elliott Wave Theory provides structured insights, making it a preferred choice for those seeking to identify long-term trends.

Understanding Smart Money Concepts (SMC)

What is Smart Money Concepts?

SMC revolves around analyzing price action through the lens of institutional trading. Smart Money Concepts trading strategies focus on identifying institutional activities, helping traders follow the “smart money” by observing price levels, order blocks, and structural changes.

Core Principles of SMC

- Liquidity Zones: These are price levels where institutions place orders. Liquidity zones form around support and resistance levels, providing areas where traders can align with institutional interests.

- Break of Structure (BOS): BOS signals a shift in market structure, alerting traders to potential reversals.

- Order Blocks: Price zones where institutions place significant orders, acting as strong support or resistance levels. Identifying order blocks helps SMC traders time their entries with institutional moves.

Popular SMC Strategies

- Breakout Trading: Traders look for breakouts after consolidation as signals of institutional involvement.

- Trend Following: By observing BOS and liquidity zones, traders can follow institutional trends.

- Reversal Patterns: Identifying reversal signals through BOS allows traders to capitalize on new trends.

For traders aiming to react quickly to market moves, SMC provides a simplified approach that adapts well to volatile and range-bound conditions.

Read More: Elliott Wave Strategy

Comparative Analysis: Elliott Wave vs. SMC

When choosing between Elliott Wave Theory and Smart Money Concepts (SMC), it’s essential to understand the key distinctions that define each approach. This comparative analysis breaks down these differences in-depth, covering their theoretical foundations, complexity, ideal market conditions, advantages, disadvantages, and suitability for different trading styles. The goal is to help traders assess which strategy aligns best with their objectives and trading environment.

Key Differences Between Elliott Wave and SMC

1. Core Philosophy and Approach

| Aspect | Elliott Wave Theory | Smart Money Concepts (SMC) |

| Theory | Elliott Wave Theory is structure-based, focusing on identifying cyclical, repetitive price patterns within financial markets. These patterns are thought to be influenced by crowd psychology, following a wave-like sequence. | SMC focuses on real-time price action, aiming to track the behavior of institutional traders (often referred to as “smart money”). It seeks to identify levels of liquidity and market structure shifts that signal institutional involvement. |

| Primary Approach | Predictive in nature; attempts to forecast future market direction based on established wave patterns and market cycles. | Observation-based; emphasizes reacting to market movements rather than predicting them, aligning trades with large institutional players through price levels and structural signals. |

Explanation: Elliott Wave Theory is rooted in the idea that market movements follow identifiable patterns, enabling traders to predict future movements with wave analysis. In contrast, Smart Money Concepts are more reactive and focus on price action in real time, allowing traders to observe and respond to the actions of institutional players, such as banks and hedge funds, rather than relying on predefined structures.

2. Complexity

| Aspect | Elliott Wave Theory | Smart Money Concepts (SMC) |

| Difficulty Level | High; requires a strong understanding of wave structures, pattern recognition, and Fibonacci ratios. Misinterpretations in wave counting are common, making it challenging for beginners. | Moderate; SMC focuses on liquidity zones, Break of Structure (BOS), and order blocks. Although simpler than Elliott Wave, accurately interpreting these concepts still requires practice and experience. |

| Learning Curve | Steep; traders must practice extensively to accurately identify and count waves, and interpret patterns across different timeframes. | Lower learning curve; SMC concepts are generally easier to grasp, particularly for those new to trading, but mastering it still takes time and patience. |

Explanation: Elliott Wave Theory’s complexity lies in its detailed rules for wave structure, pattern identification, and Fibonacci integration, making it better suited for traders who enjoy in-depth analysis. SMC, on the other hand, is more straightforward, focusing on liquidity levels and structural breaks, which are easier to observe and interpret in real time.

3. Ideal Market Conditions

| Market Condition | Elliott Wave Theory | Smart Money Concepts (SMC) |

| Trending Markets | Highly effective; Elliott Wave’s structure-based approach excels in identifying and predicting trends, making it ideal for trending markets. | Moderate; while SMC can be used in trending markets, it doesn’t offer the same predictive power as Elliott Wave. However, it can still capture trend continuations by observing Break of Structure. |

| Range-Bound Markets | Less effective; Elliott Wave Theory often struggles in choppy, range-bound markets where clear patterns are hard to identify. | Highly effective; SMC thrives in range-bound conditions, as it focuses on liquidity zones and structural shifts, which are more prevalent in sideways or consolidating markets. |

| Volatile Markets | Challenging to apply; volatile markets often disrupt Elliott Wave patterns, making wave counts difficult to interpret. | Very effective; SMC adapts well to volatility by allowing traders to quickly adjust to institutional moves and structural changes. |

Explanation: Elliott Wave Theory is best suited for stable, trending markets where patterns are more likely to adhere to the 5-3 structure. In contrast, SMC’s adaptability makes it highly effective in volatile or range-bound markets, where quick price reversals and institutional moves create more trading opportunities.

4. Advantages and Disadvantages

| Criteria | Elliott Wave Theory | Smart Money Concepts (SMC) |

| Advantages | – Predictive power in trending markets due to wave analysis. – Helps traders forecast long-term market direction. – Can be applied to different timeframes, from short-term intraday to long-term trades. | – Simple and adaptable; SMC is less complex and easier to use, particularly for short-term traders. – Effective in various market conditions, including volatile and range-bound markets. – Aligns trades with institutional players, offering improved accuracy. |

| Disadvantages | – Complex; accurate wave counting requires practice and experience. – Limited effectiveness in volatile or non-trending markets. – Traders may misinterpret wave counts, leading to incorrect predictions. | – Lacks Elliott Wave’s predictive depth; SMC is more reactive and relies on real-time observation. – Short-term focus; not ideal for traders seeking long-term trend analysis. – SMC’s reliance on liquidity zones and order blocks can result in false signals. |

Explanation: Elliott Wave Theory offers strong predictive capabilities for long-term trend analysis, but its complexity and limitations in volatile markets can be drawbacks. SMC is favored for its simplicity and adaptability, making it ideal for a range of market conditions, although it does not provide the same level of trend forecasting as Elliott Wave.

5. Suitability for Different Trader Types

| Trader Type | Elliott Wave Theory | Smart Money Concepts (SMC) |

| Beginners | Challenging; steep learning curve and complex rules make it difficult for beginners. | Suitable; SMC’s concepts like order blocks and liquidity zones are generally simpler, making it more accessible for beginners. |

| Intermediate Traders | Suitable; with some experience, traders can use Elliott Wave to enhance their trend predictions. | Very suitable; intermediate traders can refine SMC strategies to improve accuracy and alignment with institutional moves. |

| Advanced Traders | Ideal; experienced traders benefit from Elliott Wave’s predictive capabilities and can use wave extensions, subdivisions, and channeling for advanced analysis. | Ideal; advanced traders can combine SMC with other indicators like volume analysis and moving averages to improve entries and exits. |

| Scalpers and Day Traders | Less ideal; wave counting and pattern identification are time-consuming, making Elliott Wave less suitable for quick trades. | Highly effective; SMC’s real-time adaptability suits short-term trades and fast-moving markets. |

Explanation: Elliott Wave Theory’s complexity makes it better suited for experienced traders or those focused on long-term trends, while SMC’s simplicity and adaptability make it accessible to beginners and highly effective for day traders and scalpers.

Read More:

Comparative Summary Table

To help summarize the main distinctions between these strategies, here’s an overview of how Elliott Wave Theory and SMC stack up against each other across key criteria:

| Comparison Criteria | Elliott Wave Theory | Smart Money Concepts (SMC) |

| Core Philosophy | Structure-based, predictive | Observation-based, real-time |

| Complexity | High; requires in-depth analysis | Moderate; based on price action and structure |

| Best Market Conditions | Trending markets | Volatile or range-bound markets |

| Trading Style Suitability | Long-term trend analysis | Short-term and adaptable for various markets |

| Pros | Strong predictive power, effective in trends | Simple, real-time adaptability, versatile |

| Cons | Complex, less effective in volatility | Lacks predictive power, can yield false signals |

| Best for Trader Level | Intermediate to advanced | Beginners to advanced |

| Ideal for Scalping and Day Trading | Less effective | Highly effective |

Explanation: This comparative summary highlights Elliott Wave Theory’s strength in trending markets and predictive capabilities, which make it ideal for traders focused on long-term strategies. On the other hand, SMC’s adaptability, simplicity, and focus on real-time market behavior make it particularly effective for volatile and short-term markets, making it accessible to beginners and suited for short-term trading styles.

Choosing between Elliott Wave and SMC depends on your trading goals and market conditions. Elliott Wave is ideal for structured trend analysis, while SMC suits traders looking for real-time market reactions.

Common Mistakes in Elliott Wave and SMC

To avoid common pitfalls, it’s essential to recognize some mistakes traders make when using these strategies.

Common Mistakes in Elliott Wave

- Incorrect Wave Counting: Misinterpreting wave structures can lead to poor decision-making.

- Over-Reliance on Fibonacci: While useful, Fibonacci ratios should be used in conjunction with other indicators.

- Ignoring Market Conditions: Elliott Wave Theory struggles in highly volatile or range-bound markets.

Common Mistakes in SMC

- Misinterpreting BOS and Order Blocks: Misreading key levels can lead to poorly timed trades.

- Overtrading in Volatile Markets: SMC traders should be cautious during rapid price movements to avoid false breakouts.

- Lack of Stop-Loss Usage: Setting stop-loss orders based on key levels is crucial in SMC to avoid significant losses.

Avoiding these mistakes requires practice and discipline, so traders should focus on continuous learning and refinement.

Risk Management Tips

Risk management is essential in both Elliott Wave and SMC trading. Here are strategies specific to each approach:

Elliott Wave Risk Management

- Set Stop-Loss Based on Wave Structure: Place stop-losses below corrective wave lows in uptrends or above corrective wave highs in downtrends.

- Use Fibonacci Levels to Gauge Risk: Setting stop-loss orders at key Fibonacci levels helps protect against unexpected market reversals.

SMC Risk Management

- Place Stop-Losses Around Order Blocks: Protect your position by setting stop-losses near identified order blocks.

- Risk Small Amounts per Trade: SMC can involve rapid price shifts, so manage your risk by limiting the percentage of capital per trade.

For beginners and experienced traders alike, effective risk management can help sustain long-term profitability.

Pro Tips for Experienced Traders

For seasoned traders looking to enhance their skills with Elliott Wave Theory and Smart Money Concepts (SMC), these advanced tips can help refine strategy and improve trade accuracy. By leveraging the unique strengths of each method, experienced traders can increase their confidence in executing high-probability trades.

Pro Tips for Mastering Elliott Wave Theory

- Use Wave Extensions and Subdivisions: Recognizing smaller waves within the larger wave patterns allows for more precise analysis. Look for wave extensions in impulse waves to anticipate potential trend continuations.

- Channeling for Wave Structure Confirmation: Drawing channels around impulse waves can help confirm trend direction and provide visual boundaries, making it easier to identify trend reversals or continuations.

- Apply Fibonacci Ratios Beyond Basics: Advanced Elliott Wave traders can use additional Fibonacci levels, like 161.8% and 261.8%, to project wave targets or identify potential support/resistance zones.

Pro Tips for Optimizing SMC Strategies

- Combine Order Blocks with Volume Analysis: Observing volume spikes within order blocks helps validate institutional activity, enhancing entry accuracy and filtering out false signals.

- Use BOS and Liquidity Grabs for Confirmation: Liquidity grabs around BOS (Break of Structure) levels indicate potential fakeouts. Relying on this combination minimizes risks in volatile markets and enhances trade timing.

- Identify Institutional Order Flow Patterns: Track how institutions accumulate or distribute positions over time by analyzing repeated order blocks and BOS patterns on higher timeframes, providing insight into larger market trends.

By implementing these pro tips for Elliott Wave and SMC strategies, advanced traders can gain a deeper understanding of market dynamics and refine their strategies for greater profitability and control.

Opofinance Services: Ideal for Elliott Wave and SMC Traders

Opofinance, an ASIC-regulated forex broker, offers a secure, feature-rich platform for traders looking to implement Elliott Wave and SMC strategies effectively. Here’s why Opofinance is a solid choice:

- Trusted Regulation: As an ASIC-regulated broker, Opofinance ensures high standards of security and compliance, giving traders peace of mind.

- Advanced Charting and Analysis Tools: Equipped with powerful tools essential for both Elliott Wave and SMC analysis, including customizable charts, technical indicators, and real-time data.

- MetaTrader 5 (MT5) Access: Listed on the MT5 brokers list, Opofinance provides access to MT5’s advanced order types, charting, and analytical capabilities.

- Social Trading for Learning: Beginners can follow experienced traders, gaining insights into real-time application of Elliott Wave and SMC strategies.

- Convenient Deposits and Withdrawals: Flexible, secure options for fast deposits and withdrawals, ensuring easy access to funds.

With these features, Opofinance supports both beginners and seasoned traders in honing their strategies, making it a trusted platform for successful trading.

Conclusion

Deciding between Elliott Wave Theory and Smart Money Concepts (SMC) depends largely on your trading style, experience level, and market conditions. Each approach has unique strengths, making them suitable for different types of traders and environments. Elliott Wave Theory is ideal for those who prefer a structured, predictive approach, especially in trending markets where wave patterns can indicate potential future price movements. However, it requires considerable skill and patience, as accurate wave counting and understanding of Fibonacci levels can be challenging.

SMC, on the other hand, is an adaptable and simpler approach that focuses on real-time price action and institutional behavior. Its emphasis on identifying liquidity zones, order blocks, and Break of Structure (BOS) allows traders to align their moves with those of institutional players, making it particularly effective in volatile or range-bound markets. This real-time adaptability makes SMC an attractive choice for beginners, scalpers, and those who prefer a more flexible, observation-based strategy.

For traders looking to leverage the strengths of both methods, a hybrid approach can be highly effective. Combining Elliott Wave’s trend analysis with SMC’s real-time precision allows traders to build a comprehensive strategy. For instance, you might use Elliott Wave to establish a market direction and then apply SMC techniques to pinpoint entry and exit points based on institutional zones. This combination brings the predictive power of Elliott Wave and the responsive nature of SMC together, creating a balanced trading approach suitable for a variety of market conditions.

Ultimately, whether you choose Elliott Wave, SMC, or a combination of both, practicing each strategy in different market conditions is key. Consider using tools provided by reliable brokers like Opofinance, an ASIC-regulated forex broker, which offers advanced charting, real-time analysis, and social trading features to help traders refine their skills in a secure environment. Developing a trading strategy that aligns with your style and goals, along with disciplined risk management, will set a strong foundation for long-term trading success.

Key Takeaways

- Elliott Wave for Long-Term Trends: Ideal for structured, predictive trend analysis in stable markets. Suitable for experienced traders who can manage its complexity.

- SMC for Real-Time Adaptability: Perfect for traders looking to react to live market changes. Focuses on liquidity zones and Break of Structure (BOS), making it effective in volatile or range-bound markets.

- Complexity vs. Simplicity: Elliott Wave offers depth but requires experience, while SMC is simpler and beginner-friendly, focusing on institutional moves without extensive technical requirements.

- Blending Both Approaches: Combining Elliott Wave’s trend predictions with SMC’s precise entry points creates a balanced, versatile strategy adaptable across market conditions.

- Essential Risk Management: Use wave structure for stop-losses in Elliott Wave and liquidity zones in SMC. Strong risk management keeps your strategy resilient.

A tailored approach using Elliott Wave, SMC, or both can boost your trading precision, confidence, and long-term success.

What is the main difference between Elliott Wave and SMC?

Elliott Wave is predictive, using structured patterns to forecast market trends, while SMC is observation-based, focusing on real-time analysis of institutional moves.

Can beginners use Elliott Wave Theory effectively?

While Elliott Wave is challenging, beginners willing to learn wave patterns and practice can use it effectively. Many find SMC easier to start with due to its simplicity.

How do I know which strategy is right for me?

Consider your goals: use Elliott Wave for long-term trend analysis and SMC for short-term or volatile market conditions. Practicing with both approaches can help you decide which aligns best with your style.

One Response

I just like the helpful information you supply for your articles.

I will bookmark your blog and check again right here frequently.

I am fairly sure I’ll learn lots of new stuff right here!

Good luck for the following!