Imagine predicting market trends with the precision of a seasoned trader—Elliott Wave Strategy makes it possible, transforming your trading approach into a masterful art of market anticipation. Unlock the secrets of the financial markets and empower your trading decisions with a comprehensive understanding of the Elliott Wave Strategy. Whether you’re a novice or an experienced trader, this guide will transform your approach to market analysis and forecasting. To apply this strategy effectively, choosing the right broker for forex is crucial, as it ensures you have access to the necessary tools and real-time data for accurate analysis and decision-making.

Introduction to Elliott Wave Strategy

The Elliott Wave Strategy is a transformative technical analysis method that reveals the underlying patterns of the financial markets. By identifying and interpreting repetitive wave patterns driven by investor psychology, this strategy empowers traders to forecast market trends and make profitably informed decisions. Tired of unpredictable market swings that leave your portfolio vulnerable? The Elliott Wave Strategy provides a structured path to navigate market volatility with confidence and precision. In this article, we delve deep into the core principles, applications, strengths, and limitations of the Elliott Wave Strategy, ensuring you gain a thorough understanding of this powerful analytical tool.

Incorporating insights from a regulated forex broker can enhance your trading strategies, providing additional resources and support.

Historical Background

Ralph Nelson Elliott, an American accountant and visionary, introduced the Elliott Wave Principle in the 1930s. Through meticulous analysis of historical market data, Elliott discovered that market movements were not random but followed identifiable patterns influenced by the collective behavior of investors. His groundbreaking work, “The Wave Principle,” laid the foundation for a strategy that has since become a cornerstone in technical analysis.

Elliott’s discovery revolutionized the way traders interpret market movements, offering a systematic approach to understanding trends.

Read More: Elliott Wave vs Price Action

Core Principles of Elliott Wave Strategy

The Elliott Wave Strategy is built upon several foundational principles that collectively describe how market trends develop and reverse.

Wave Structure

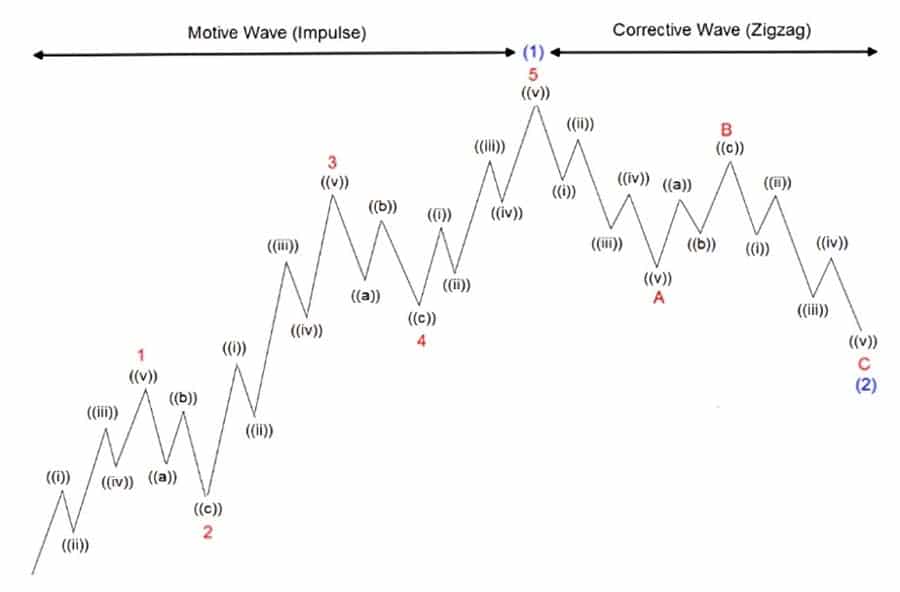

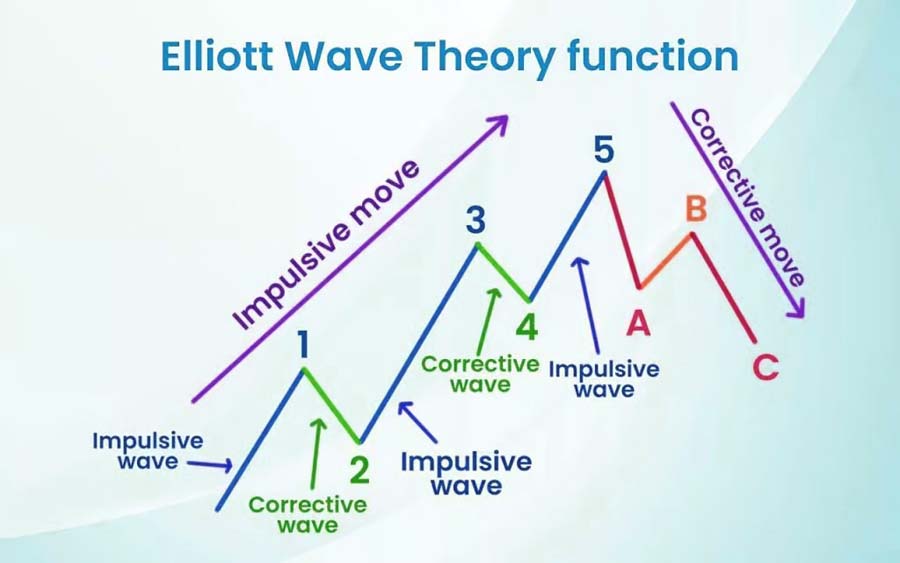

At the heart of the Elliott Wave Strategy is the concept that market movements can be broken down into a series of waves. These waves are categorized into two main types:

- Impulse Waves: These are five-wave patterns that move in the direction of the primary trend. They consist of three advancing waves (waves 1, 3, and 5) and two corrective waves (waves 2 and 4).

- Corrective Waves: Following the impulse waves, corrective waves typically form a three-wave pattern (labeled A, B, and C) that moves against the primary trend, allowing the market to consolidate and prepare for the next impulse wave.

Understanding the wave structure is crucial for accurate wave counting and forecasting.

Fractal Nature

Elliott Wave Patterns are fractal, meaning they repeat at various degrees or scales. Whether analyzing minute-by-minute charts or long-term monthly charts, similar wave structures can be identified. This fractal nature allows traders to apply the strategy across different timeframes, enhancing its versatility.

The fractal nature of Elliott Wave Strategy makes it adaptable to any trading style or timeframe.

Wave Degrees

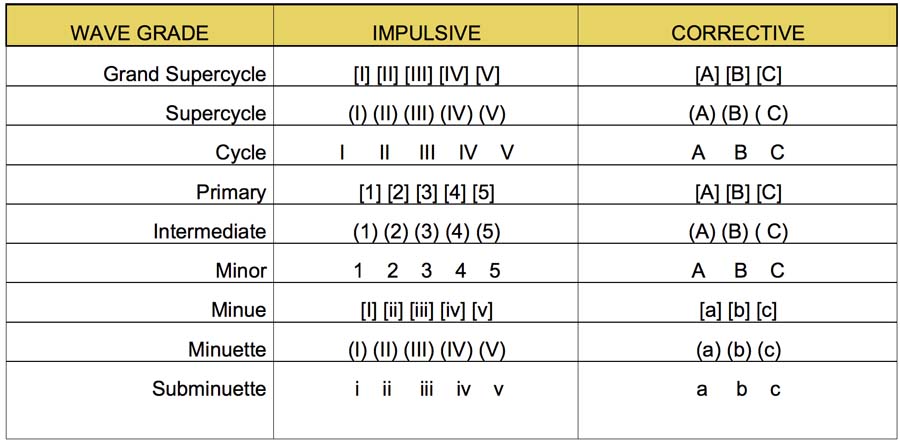

The Elliott Wave Strategy identifies nine degrees of waves, each representing different scales of market movements. Understanding these degrees is crucial for accurate wave counting and forecasting. Below is a detailed explanation of each wave degree and how they interact within the fractal nature of the theory:

1. Grand Supercycle

- Duration: Centuries

- Description: Represents the largest wave degree, encompassing the complete economic and social cycles. Grand Supercycles consist of multiple Supercycles and are rarely observed within a trader’s lifetime.

- Interaction: Grand Supercycle waves contain multiple Supercycle waves, each following the same Elliott Wave patterns, demonstrating the fractal nature.

2. Supercycle

- Duration: Decades

- Description: These waves span several decades and represent major economic shifts. Supercycles break down into Cycle waves.

- Interaction: Each Supercycle wave contains several Cycle waves, maintaining the fractal repetition of wave structures.

3. Cycle

- Duration: 5-25 years

- Description: Cycle waves are significant market movements within a Supercycle, often corresponding to major bull and bear markets.

- Interaction: Cycle waves consist of Primary waves, each adhering to the Elliott Wave patterns, further illustrating the fractal principle.

4. Primary

- Duration: 1-5 years

- Description: Primary waves represent medium-term market trends within a Cycle wave. They are more visible to traders and are often the focus of Elliott Wave analysis.

- Interaction: Each Primary wave comprises Intermediate waves, continuing the fractal breakdown.

5. Intermediate

- Duration: 6 months to 1 year

- Description: Intermediate waves capture shorter-term trends within a Primary wave, offering more precise trading opportunities.

- Interaction: These waves contain Minor waves, perpetuating the fractal nature of the Elliott Wave Strategy.

6. Minor

- Duration: 1-3 months

- Description: Minor waves represent short-term movements within an Intermediate wave, useful for tactical trading decisions.

- Interaction: Minor waves break down into Minute waves, maintaining the fractal structure.

7. Minute

- Duration: 1-4 weeks

- Description: Minute waves are very short-term trends within a Minor wave, allowing for detailed trading strategies.

- Interaction: They consist of Sub-Minus waves, continuing the hierarchical wave structure.

8. Sub-Minuette

- Duration: 1-2 weeks

- Description: Sub-Minuette waves are even smaller trends within Minute waves, ideal for day traders seeking quick opportunities.

- Interaction: These waves are part of the smallest wave degrees, reflecting the fractal nature down to the finest scales.

9. Minuette

- Duration: 1-3 days

- Description: The smallest wave degree, capturing intraday movements within Sub-Minuette waves, perfect for high-frequency trading strategies.

- Interaction: Minuette waves embody the ultimate level of detail in Elliott Wave analysis, reinforcing the fractal principle.

Grasping wave degrees is essential for navigating the complexity of market patterns.

Guidelines and Rules

To maintain the integrity of wave patterns, Elliott established specific guidelines:

- Wave 3 is Never the Shortest Impulse Wave: Among the impulse waves, wave 3 cannot be the shortest when compared to waves 1 and 5.

- Wave 2 Does Not Retrace More Than 100% of Wave 1: In corrective waves, wave 2 cannot pull back beyond the start of wave 1.

- Wave 4 Does Not Overlap with Wave 1: In impulse waves, wave 4 should not enter the price territory of wave 1, ensuring clear separation between wave structures.

Adhering to these rules prevents misinterpretation of wave patterns and enhances the reliability of wave counts.

Read More: Elliott Wave vs Neo Wave

Wave Patterns

Understanding the different wave patterns is essential for applying the Elliott Wave Strategy effectively.

Impulse Waves

Impulse waves are the driving force behind market trends. They consist of five distinct waves moving in the direction of the primary trend:

- Wave 1: The initial move upwards or downwards, often unnoticed by the broader market.

- Wave 2: A corrective wave that retraces a portion of wave 1.

- Wave 3: Typically the strongest and longest wave, propelled by increasing investor enthusiasm.

- Wave 4: A corrective phase that consolidates the gains from wave 3.

- Wave 5: The final push in the direction of the trend, often accompanied by divergence in technical indicators.

Impulse waves are the heartbeat of market trends, showcasing the collective momentum of investors.

Corrective Waves

After completing an impulse wave, the market enters a corrective phase characterized by three waves:

- Wave A: A move against the primary trend, signaling the beginning of the correction.

- Wave B: A partial retracement of wave A, often misleading traders into thinking the primary trend will resume.

- Wave C: The final leg against the primary trend, completing the correction and paving the way for the next impulse wave.

Corrective waves are essential for market consolidation and resetting before the next trend cycle.

Applying Elliott Wave Strategy in Trading

Applying the Elliott Wave Strategy involves several steps that help traders interpret market movements and make informed trading decisions.

Wave Counting

Wave Counting is the process of identifying and labeling the waves within a market chart. Accurate wave counting is fundamental to the strategy’s application. Traders must determine the current wave structure to understand the stage of the market cycle. This involves:

- Identifying the primary trend direction.

- Labeling each wave according to its position within the larger pattern.

- Ensuring adherence to the strategy’s guidelines and rules to maintain wave integrity.

Precise wave counting is the cornerstone of successful Elliott Wave analysis.

Forecasting Market Movements

Once the current wave structure is identified, traders can forecast future price movements based on the expected progression of waves. For example:

- In an Impulse Wave: If the market is identified in wave 3, traders can anticipate a continuation of the strong trend, targeting the completion of wave 5.

- In a Corrective Wave: Recognizing that the market is in wave C allows traders to prepare for the resumption of the primary trend with the next impulse wave.

Forecasting market movements with Elliott Wave Strategy provides traders with actionable insights.

Identifying Support and Resistance Levels

The Elliott Wave Strategy, in conjunction with Fibonacci ratios, helps identify critical support and resistance levels. These levels are potential points where price reversals or consolidations may occur. For instance, wave 2 often retraces 61.8% of wave 1, while wave 4 may retrace 38.2% of wave 3. Identifying these retracement levels aids in setting entry and exit points.

Pinpointing support and resistance levels enhances trading precision and strategy execution.

Risk Management

Effective risk management is crucial in trading. The Elliott Wave Strategy assists traders in anticipating potential reversals and trend continuations, allowing them to:

- Set stop-loss orders just beyond key support or resistance levels.

- Determine take-profit targets based on projected wave endpoints.

- Adjust position sizes according to the confidence in wave counts and market conditions.

Proper risk management ensures that traders can protect their investments while capitalizing on market opportunities.

Read More: Elliott Wave vs SMC

Integrating Elliott Wave Strategy with Other Technical Tools

While the Elliott Wave Strategy provides a robust framework for analyzing market trends, integrating it with other technical tools can enhance its effectiveness:

- Fibonacci Retracement and Extension: These tools help identify potential price levels where waves may end or reverse, providing additional confirmation for wave counts.

- Technical Indicators: Indicators like the Relative Strength Index (RSI), Moving Averages, and MACD complement wave analysis by offering insights into market momentum and potential overbought or oversold conditions.

- Chart Patterns: Recognizing traditional chart patterns (e.g., head and shoulders, triangles) alongside wave structures can improve the accuracy of market forecasts.

Combining Elliott Wave Strategy with other technical tools creates a more comprehensive analysis, reducing the likelihood of false signals and enhancing trading decisions.

Strengths of Elliott Wave Strategy

The Elliott Wave Strategy offers several advantages that make it a valuable tool for traders:

- Flexibility Across Timeframes: Its fractal nature allows Elliott Wave analysis to be applied to various timeframes, making it suitable for both short-term traders and long-term investors.

- Psychological Insight: By encapsulating investor sentiment within wave structures, the strategy provides a psychological dimension to market analysis, offering deeper insights into market behavior.

- Comprehensive Framework: The hierarchical wave structure allows for detailed analysis, accommodating multiple layers of market movements within a single framework.

- Predictive Power: When applied correctly, the Elliott Wave Strategy can effectively forecast significant market movements, aiding traders in making proactive decisions.

The multifaceted strengths of Elliott Wave Strategy make it an indispensable tool in a trader’s arsenal.

Criticisms and Limitations

Despite its strengths, the Elliott Wave Strategy is not without its criticisms and limitations:

- Subjectivity in Wave Counting: One of the primary criticisms is the inherent subjectivity in identifying and labeling waves. Different analysts may interpret the same market data differently, leading to inconsistent forecasts.

- Complexity: The strategy’s complexity, with its numerous rules and guidelines, can be daunting for beginners, potentially leading to misapplication and errors in analysis.

- Reliance on Market Patterns: Critics argue that markets are influenced by countless factors, making it challenging for any single strategy to consistently predict movements accurately.

- Lack of Empirical Evidence: While many traders find value in Elliott Wave analysis, there is limited empirical research validating its effectiveness compared to other technical analysis tools.

- Overfitting: Some analysts may be tempted to fit wave counts to past data excessively, reducing the strategy’s predictive power for future movements.

Acknowledging these limitations is essential for traders to apply Elliott Wave Strategy judiciously and in conjunction with other analytical tools.

Practical Strategies for Traders

To effectively utilize the Elliott Wave Strategy, traders can adopt several practical strategies that enhance its application and reliability.

Combining with Fibonacci Retracements

Fibonacci retracement levels are integral to Elliott Wave analysis. Traders use these levels to identify potential support and resistance areas within wave structures. Common Fibonacci levels used include 38.2%, 50%, and 61.8%. For example:

- Wave 2 Retracement: Often retraces 61.8% of Wave 1.

- Wave 4 Retracement: Typically retraces around 38.2% of Wave 3.

Aligning wave counts with Fibonacci levels validates wave interpretations and sets accurate entry and exit points.

Using Technical Indicators

Incorporating technical indicators can provide additional confirmation for wave counts and market trends:

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions, signaling potential reversals within wave structures.

- Moving Averages: Assist in identifying trend direction and potential support or resistance areas.

- MACD (Moving Average Convergence Divergence): Offers insights into momentum changes, complementing wave analysis.

Using these indicators alongside Elliott Wave Strategy enhances the robustness of market analysis and reduces reliance on subjective wave counts alone.

Chart Patterns and Elliott Waves

Recognizing traditional chart patterns within Elliott Wave structures can improve forecasting accuracy. For instance:

- Head and Shoulders: Often forms at the end of a five-wave impulse sequence, signaling a potential trend reversal.

- Triangles: Common within corrective waves, indicating a period of consolidation before the continuation of the primary trend.

Integrating chart patterns with wave analysis provides a multifaceted approach to understanding market dynamics.

Pro Tips for Advanced Traders

For those looking to elevate their Elliott Wave analysis, consider these advanced strategies:

- Multilevel Wave Analysis: Examine wave structures across multiple timeframes to gain a more comprehensive view of market trends.

- Volume Confirmation: Use trading volume to confirm the strength of impulse waves, ensuring that price movements are supported by significant trading activity.

- Dynamic Stop-Loss Placement: Adjust stop-loss orders based on the evolving wave structure to protect gains and minimize losses effectively.

- Psychological Profiling: Incorporate sentiment analysis tools to gauge the collective mood of the market, aligning wave counts with prevailing investor psychology.

- Algorithmic Wave Counting: Utilize automated tools and software to assist in wave identification, reducing the potential for human error and enhancing precision.

- Extensions and Truncations: Understand how waves can extend or truncate, affecting the overall wave structure. Extensions occur when a wave (typically wave 3) is longer than expected, while truncations happen when wave 5 does not surpass wave 3. Identifying these scenarios helps traders adjust their strategies accordingly.

- Wave Equality: Recognize the concept of wave equality, where waves of the same degree often exhibit similar characteristics in terms of length and duration. This consistency aids in predicting future wave movements based on historical patterns.

Implementing these pro tips can significantly enhance the accuracy and effectiveness of your Elliott Wave analysis.

Opofinance Services

When applying the Elliott Wave Strategy, partnering with a regulated forex broker can provide invaluable support. Opofinance, an ASIC regulated broker for forex trading, offers exceptional services tailored to traders’ needs.

Why Choose Opofinance?

- Social Trading Service: Engage with a vibrant community of traders, sharing insights and strategies to enhance your trading performance. Opofinance’s social trading platform allows you to follow and replicate the trades of successful traders, fostering a collaborative trading environment.

- Featured on the MT5 Brokers List: Opofinance is officially recognized on the MT5 brokers list, ensuring reliability and advanced trading capabilities. The MetaTrader 5 platform offers robust charting tools, customizable indicators, and automated trading features that complement the forex Elliott Wave Strategy.

- Safe and Convenient Deposits and Withdrawals: Experience seamless transactions with secure methods designed for your convenience. Opofinance provides a variety of deposit and withdrawal options, ensuring that your funds are handled safely and efficiently.

Choosing Opofinance as your online forex broker ensures a secure and supportive trading environment, empowering you to apply Elliott Wave Strategy with confidence.

Proven Excellence with Opofinance

Opofinance stands out as a premier regulated forex broker, renowned for its commitment to trader success. By offering advanced tools, a supportive community, and secure financial transactions, Opofinance empowers traders to implement the Elliott Wave Strategy effectively. Whether you’re leveraging the Elliott Wave Indicator or engaging in social trading, Opofinance provides the resources and reliability you need to trade profitably.

Partnering with Opofinance enhances your ability to navigate the complexities of the financial markets, ensuring you have the support and tools necessary to execute the Elliott Wave Strategy successfully.

Conclusion

The Elliott Wave Strategy offers a nuanced and structured approach to understanding and forecasting market movements. By dissecting price action into identifiable wave patterns, traders gain insights into the underlying psychological forces driving the markets. Its fractal nature allows for versatility across different timeframes, making it a valuable tool for various trading styles.

However, the strategy’s effectiveness hinges on the trader’s proficiency in wave counting and interpretation. The inherent subjectivity and complexity of the theory necessitate continuous learning, practice, and the integration of complementary technical tools to enhance reliability. While criticisms regarding its subjectivity and lack of empirical validation persist, many traders find the Elliott Wave Strategy indispensable for its ability to provide a comprehensive framework for market analysis.

Incorporate Elliott Wave Strategy into your trading strategy with the support of a regulated forex broker like Opofinance to maximize your trading potential.

Key Takeaways

- Structured Analysis: The Elliott Wave Strategy breaks down market movements into predictable wave patterns, enhancing forecasting accuracy.

- Fractal Flexibility: Its ability to be applied across various timeframes makes it suitable for different trading styles.

- Integration is Key: Combining the Elliott Wave Strategy with tools like Fibonacci retracements and technical indicators strengthens market analysis.

- Continuous Learning: Mastery of wave counting and adherence to guidelines are essential for effective application.

- Risk Management: Utilizing the Elliott Wave Strategy aids in setting strategic stop-loss and take-profit points, ensuring disciplined trading.

Embrace the power of Elliott Wave Strategy to navigate the complexities of the financial markets with confidence and precision.

What are the common mistakes traders make when using the Elliott Wave Strategy?

Traders often miscount waves by overlooking or mislabeling them, leading to incorrect market predictions. Overreliance on subjective interpretation without confirming with technical indicators can also result in flawed analysis. Additionally, failing to account for extensions or truncations can distort the wave structure, impacting the strategy’s effectiveness.

Understanding common pitfalls can help you avoid errors and apply the strategy more effectively.

How does market volatility impact the effectiveness of the Elliott Wave Strategy?

High market volatility can create more pronounced and frequent wave patterns, potentially making it easier to identify Elliott Wave Patterns. However, excessive volatility may also lead to rapid wave extensions and truncations, complicating wave counting and forecasting. Traders must adapt their strategies to account for varying volatility levels to maintain the strategy’s accuracy..

Explore how different market conditions influence wave patterns and strategy outcomes.

Can the Elliott Wave Strategy be combined with automated trading systems?

Yes, the Elliott Wave Strategy can be integrated with automated trading systems. Utilizing algorithmic trading tools and the Elliott Wave Indicator can streamline wave identification and execution, enhancing precision and efficiency. However, it’s essential to regularly monitor and adjust automated settings to align with current market conditions and ensure the strategy remains effective.

Learn about integrating the strategy with algorithmic trading to enhance execution efficiency.