Let’s talk about a fundamental truth in trading. Success isn’t just about having the best strategy or being a genius at reading charts. If it were, every smart person who tried trading would be rich. The real secret, the one that separates the consistently profitable from the crowd, is mastering your own mind. So, what is emotional intelligence in trading? It’s the crucial ability to recognize, understand, and manage your emotions to make disciplined, logical decisions instead of impulsive ones. It’s the skill that keeps you steady when fear or greed tries to take the wheel. Many traders, even those with a great regulated forex broker, find that their biggest obstacle is their own emotional reaction to the market. This article is your deep dive into why emotional intelligence in trading psychology is non-negotiable and provides 7 concrete, actionable strategies to build this vital skill.

Key Takeaways for the Smart Trader

- Psychology is Paramount: Your long-term profitability hinges more on your emotional control than your technical analysis. Mastering emotional intelligence in trading is the primary goal.

- Tame the Big Four: The emotions that most frequently wreck trading accounts are Fear, Greed, Overconfidence, and Impatience. Learning to manage them is your job.

- EQ is a Skill, Not a Gift: You can actively develop your emotional intelligence. It’s like a muscle; the more you train it with specific practices, the stronger it gets.

- Your Plan is Your Fortress: A detailed trading plan with iron-clad rules for risk, entries, and exits is your ultimate defense against emotional trading. It’s your pre-written script for when the pressure is on.

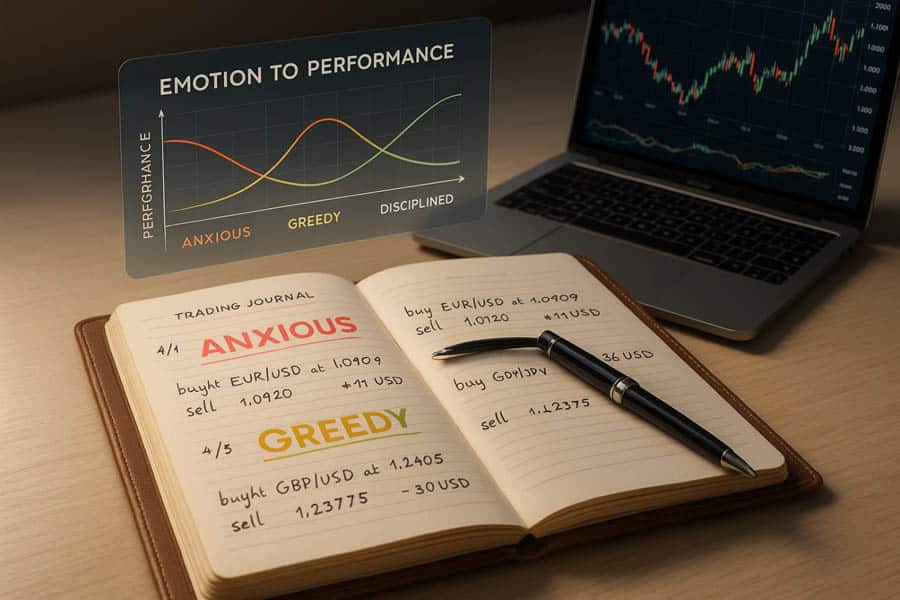

- Journaling is Your Mirror: A journal that tracks your emotions alongside your trades is the most powerful tool for self-discovery and improvement. It reveals the “why” behind your wins and losses.

- Discipline Pays More Than Genius: The market rewards emotional discipline far more than raw intellect. This is the core of effective emotional intelligence for traders.

Read More: Cognitive Biases in Trading

The Undeniable Role of Emotional Intelligence in Trading

It’s easy to think of trading as a sterile environment of numbers and data. But the moment your own hard-earned money is on the line, it becomes one of the most emotionally charged arenas you can enter. Acknowledging and preparing for this psychological reality is the first real step toward becoming a professional. A high level of emotional intelligence in trading is what allows you to navigate this pressure cooker successfully, day in and day out.

Why Trading Is a Psychological Minefield

Every click of the mouse, every open position, is directly linked to a potential financial gain or loss. This isn’t just data on a screen; it’s your money. This simple fact triggers deep-seated, primal emotions. The fear of loss can feel physically real, causing your heart to race and your palms to sweat. The rush of a winning trade can create a sense of euphoria, making you feel invincible. I’ve seen incredibly bright people, who could analyze any chart with precision, completely fall apart in a live market. They knew exactly what their strategy dictated, but they couldn’t bring themselves to execute it because fear or greed was screaming louder. This is where the battle for success is truly won or lost, and where strong emotional intelligence for traders makes all the difference.

How EQ Directly Impacts Your Bottom Line

High emotional intelligence in trading leads to better, more rational, and more profitable decisions. It’s that simple. When you can feel a wave of panic rising because a trade has gone slightly against you, a high EQ allows you to pause, breathe, and consult your trading plan instead of immediately hitting the close button. When you feel the intoxicating pull of greed after a big win, a high EQ reminds you to stick to your predetermined position size for the next trade, rather than doubling down recklessly. A trader with low emotional control is a puppet of the market’s every move, prone to chasing prices, revenge trading after a loss, and generally making impulsive decisions that slowly but surely bleed their account dry. Strong emotional intelligence in trading psychology is what turns you from a reactive gambler into a proactive and methodical business owner.

The True Differentiator: Discipline Over Brains

There’s a famous quote by trader Victor Sperandeo that I believe every trader should have on their desk: “The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading.” This hits the nail on the head. The world is full of brilliant people who lose money in the markets. They can develop complex algorithms and understand macroeconomic theory inside and out, but they lack the self-control to manage their own impulses when it matters most. The ultimate edge isn’t a higher IQ; it’s a superior EQ. It’s the quiet discipline to do nothing when there are no good setups and the fortitude to follow your plan when your emotions are in turmoil.

The Core Components of Emotional Intelligence for Traders

Emotional intelligence isn’t just a vague concept; it’s composed of several distinct, learnable skills. By understanding and working on each of these components, you can build a robust psychological foundation that will support your entire trading career. This is the essence of building powerful emotional intelligence in trading.

Self-Awareness: Your Internal Radar

This is the starting point for everything. Self-awareness is your ability to accurately identify your own emotional state in the heat of the moment. It’s about asking, “What am I feeling right now, and how is it affecting my judgment?” Are you feeling impatient because the market has been slow? Are you feeling euphoric and overconfident after a win? I learned the hard way that one of my biggest triggers was taking a loss on a trade I felt “certain” about. That feeling of being “wronged” by the market led to frustration and terrible follow-up trades. Without the self-awareness to recognize that pattern, I would have continued to repeat it. This is a foundational pillar of emotional intelligence for traders.

Self-Regulation: The Power to Pause

Once you’re aware of an emotion, self-regulation is your ability to manage it effectively. It’s the critical skill of controlling your impulses and acting with discipline. It’s the internal strength that stops you from chasing a “hot” stock that everyone is talking about when it doesn’t fit your strategy. It’s the calm resolve that allows you to accept a planned loss, close the trade, and walk away without immediately trying to “win back” your money. This isn’t about suppressing emotion—that’s a recipe for disaster. It’s about acknowledging the feeling (“I am feeling very greedy right now”) and then making a conscious choice to follow your logical trading plan instead of the emotion. This skill is at the heart of emotional intelligence in trading psychology.

Motivation: Your Inner Fuel

Trading is a tough business. You will face losses, drawdowns, and periods of intense self-doubt. Intrinsic motivation is the deep, internal drive that pushes you to persevere through these challenges. It’s a genuine passion for mastering the craft of trading, separate from the desire for quick money or a flashy lifestyle. This powerful motivation is what fuels the “boring” but essential work: spending hours backtesting, meticulously filling out your trade journal, and constantly educating yourself. A trader motivated only by money will likely quit when they hit their first major losing streak. A trader with strong internal motivation sees losses as tuition paid to the market and setbacks as valuable data for future success.

Empathy: Reading the Market’s Mood

This might seem out of place, but empathy is a secret weapon for a trader. In this context, it’s the ability to understand the collective emotional state of the market. Are other traders panicking? Are they overcome with irrational exuberance? Recognizing these waves of mass emotion can give you a significant edge. For example, when you see a massive sell-off on very little news, you can infer that fear is driving the market. An empathetic trader can see this collective panic not as a threat, but as an opportunity, potentially positioning themselves to buy when sentiment is at its worst. It’s about understanding the psychology of the crowd, a key skill in your emotional intelligence in trading toolkit.

Resilience: The Art of Bouncing Back

Resilience is your ability to recover from setbacks. In trading, mistakes and losses are not possibilities; they are certainties. Resilience is what allows you to take a loss, analyze it objectively for any lessons, and then move on to the next trade with a clear mind and unwavering confidence in your strategy. A trader without resilience will let one bad trade ruin their entire week, leading to fear-based errors and a downward spiral. A resilient trader understands that their long-term success is determined by the consistent application of their edge over hundreds of trades, not the outcome of any single event.

Read More: The Mindset of a Successful Trader

7 Actionable Strategies for Emotional Intelligence in Trading

Understanding the theory is important, but true growth comes from practice. Cultivating emotional intelligence in trading requires a deliberate and consistent effort. Here are seven practical, no-fluff strategies that you can start implementing today to build your psychological edge.

1. Forge and Follow an Iron-Clad Trading Plan

This is non-negotiable. Your trading plan is your business plan, your map, and your anchor in emotional seas. A vague idea of what you’re looking for is not a plan. A detailed plan removes the need for subjective, emotional decision-making in the moment. It should be a written document covering:

- Pre-Market Checklist: What news events are scheduled? What is the overall market sentiment?

- Exact Entry Criteria: What specific technical or fundamental conditions must be met before you enter a trade? Write it down like a recipe: “If the 50 EMA crosses above the 200 EMA AND the RSI is below 50, then I will look for a long entry.”

- Position Sizing Rules: How much will you risk per trade? This should be a fixed percentage of your capital (e.g., 1%). This is your primary defense.

- Trade Management Rules: Where will your initial stop-loss go? At what point will you move your stop to break-even? When will you take partial profits?

- Exit Criteria: What signals the end of the trade, both for a win and a loss?

When the market is chaotic, you don’t think, you simply execute the plan. This disciplined execution is a cornerstone of strong emotional intelligence for traders.

2. Practice Mindful Trading and Presence

Mindfulness is the practice of being fully present and aware, without emotional judgment. This is incredibly powerful for a trader. Before you start your trading day, take five minutes. Close your eyes. Focus only on the sensation of your breath. When your mind wanders (and it will), gently guide it back to your breath. This trains your brain to stay focused and calm. If you feel stress or anxiety rising during a trade, step away from the screen for 60 seconds. Take three slow, deep breaths. This creates a “circuit breaker” between the emotional trigger and a potentially disastrous impulsive action. It gives your rational brain a chance to come back online.

3. Maintain a Brutally Honest Trading Journal

This was the single biggest game-changer in my own journey. A journal is your personal feedback loop. But it has to be more than just numbers. For every trade, you must log your psychological state. Create columns for:

- Pre-Trade Mindset: “Felt calm and objective,” “Felt impatient, forcing a trade,” “Felt overconfident after yesterday’s win.”

- Feelings During the Trade: “Panicked when it went against me by 10 pips,” “Felt greedy and moved my profit target further away,” “Stayed calm and let the trade play out.”

- Post-Trade Reflection: “Relieved I closed it, even though it was a mistake,” “Frustrated with the loss,” “Satisfied that I followed my plan perfectly, despite the loss.”

Review this journal every weekend. You will quickly see patterns. You’ll see that your biggest losses almost always come when you log emotions like “impatient” or “overconfident.” This data is pure gold for developing the self-awareness needed for high emotional intelligence in trading.

4. Implement Rigid Risk Management

The best way to control your emotions is to control your risk. If you know that the absolute most you can lose on any single trade is a small, manageable amount (like 1% of your account), it dramatically reduces the fear associated with trading. Automate this with hard stop-loss orders. The moment you enter a trade, you place your stop-loss. This decision is made when you are logical and calm. It removes the future emotional agony of deciding whether to cut a growing loss. Furthermore, define your position size before you trade. Don’t just buy a random number of shares or lots. Calculate the exact size based on your entry point and stop-loss level to ensure you are only risking your predetermined 1%.

5. Leverage Technology as a Discipline Partner

Use technology to enforce the discipline you are still building. Automated trading systems (Expert Advisors or EAs) are the ultimate tool for this, as they execute your strategy with zero emotional deviation. But even if you are a discretionary trader, you can use technology to your advantage. Set price alerts for your key levels so you don’t have to be glued to the screen, which breeds anxiety. Use trading platform tools that calculate position size automatically. Use apps that can block you from trading platforms after a certain number of losses or a certain time of day. Let technology be your partner in maintaining discipline.

6. Build a Supportive Trading Network

Trading in isolation is tough. It’s just you and the screen, which can amplify negative emotions. Find a community. This could be a trusted online forum, a local meetup group, or a professional trading community. Find a mentor—someone more experienced who can offer perspective. I found that just being able to talk to a fellow trader after a difficult day and hear them say, “I’ve been there, it’s part of the process,” was incredibly powerful. It normalizes the struggle and provides the emotional support and accountability needed to stay on track. This external perspective is invaluable for developing balanced emotional intelligence for traders.

7. Focus on Process, Not Profits

This is a crucial mental shift. Your goal for any given day or week should not be to “make money.” Your goal should be to “execute your plan flawlessly.” The market controls the outcome of any single trade, but you control your actions. By focusing entirely on your process—on following your rules, managing your risk, and journaling your trades—you detach your ego from the financial result. When you have a losing day but you followed your plan perfectly, you can still consider it a successful day. This process-oriented mindset builds true, lasting confidence and is a hallmark of high emotional intelligence in trading.

Read More: Trading Psychology in Forex: Mastering Emotions for Success

How to Measure Your Emotional Intelligence Growth

Improving your emotional intelligence in trading psychology isn’t just a feeling; you can track your progress with tangible metrics. This turns a vague goal into a concrete project. Here’s how to measure if your efforts are paying off.

Track Your Unplanned Trades

At the end of each week, go through your trading journal and count the number of trades you took that were not part of your plan. These are the impulsive, FOMO-driven, or revenge-trading entries. Your goal is to see this number consistently decrease over time. Seeing it go from five unplanned trades one week to just one a few weeks later is a clear sign of growing self-regulation.

Grade Your Plan Adherence

Create a simple grading system for yourself. For every single trade, rate how well you followed your plan on a scale of 1 to 5, where 5 is “flawless execution” and 1 is “total emotional chaos.” Be brutally honest. At the end of the week, calculate your average score. Your objective is to steadily increase this average. This metric shifts your focus from profit/loss to quality of execution, which is exactly where it should be.

Analyze Your Journal’s Language

Every month, take 30 minutes to read through the emotional comments in your journal. In the beginning, you might see words like “panicked,” “anxious,” “angry,” “stupid,” and “frustrated.” As your emotional intelligence in trading grows, you should see a shift towards more neutral and objective language like “concerned but calm,” “followed plan,” “accepted loss,” and “patiently waiting.” This linguistic shift is a powerful indicator of a changing mindset.

Opofinance Services

To successfully apply these strategies, you need a trading environment that is reliable, advanced, and supportive. An ASIC-regulated broker like Opofinance provides the robust infrastructure necessary for disciplined trading.

- Advanced Trading Platforms: Gain an edge by choosing from a suite of top platforms, including MT4, MT5, cTrader, and the exclusive OpoTrade platform, to match your trading style.

– Innovative AI Tools: Leverage the power of artificial intelligence with the AI Market Analyzer for deep market insights, an AI Coach to help refine your trading habits, and instant AI Support.

- Social & Prop Trading: Connect with a global community through social trading or test your skills by trading firm capital through their proprietary trading programs.

- Secure & Flexible Transactions: Deposit and withdraw funds with confidence using secure methods, including cryptocurrencies. Opofinance charges zero fees on these transactions, ensuring more of your money works for you.

Ready to trade on a platform built for the modern, intelligent trader? Explore the advanced tools and secure environment at Opofinance today!

Conclusion: Your Mind is Your Greatest Asset

In the end, your journey to becoming a successful trader is an internal one. You can have the world’s best strategy, but if you don’t have the mental and emotional discipline to execute it, you will struggle. Emotional intelligence in trading is not a ‘soft skill’; it is the bedrock of a sustainable career. It is the invisible force that allows you to manage risk, stick to your plan, and navigate the market’s inherent uncertainty with grace and logic. The best part is that this is not a trait you’re born with. It is a skill that can be built, brick by brick, through conscious practice. Your greatest asset in the market is not your strategy, but your mind. Start strengthening it today. Pick one strategy, like journaling your emotions, and commit to it for a month. This commitment to mastering your emotional intelligence in trading psychology will pay the highest dividends of all.

Can emotional intelligence really be learned, or is it a fixed personality trait?

Yes, emotional intelligence is widely recognized by psychologists as a flexible skill set that can be developed and improved over time through conscious practice, self-reflection, and techniques like mindfulness and journaling.

How long does it take to develop emotional intelligence for trading?

There is no fixed timeline, as it’s an ongoing process of self-improvement. However, traders who actively work on it by using a journal and sticking to a plan often see significant improvements in their discipline and decision-making within a few months.

Is it better to use automated trading to avoid emotions entirely?

Automated trading can be an excellent tool for enforcing discipline, but it’s not a complete substitute for emotional intelligence. The trader still needs the psychological fortitude to create, test, and stick with the automated system without constant emotional tinkering.

What is the single most important component of EQ for a new trader?

For a new trader, self-awareness is the most critical starting point. You cannot manage emotions you don’t recognize. The first step is to become aware of how fear and greed are impacting your decisions in a live market environment.

Can high emotional intelligence guarantee trading profits?

No, nothing can guarantee profits in trading. However, high emotional intelligence dramatically increases your probability of success. It allows you to consistently apply a profitable strategy, manage risk effectively, and avoid the catastrophic mistakes that wipe out most aspiring traders.