In the ever-evolving world of financial markets, traders are constantly seeking that elusive edge to outperform the competition. Enter the powerful combination of Fair Value Gap (FVG) and Order Block confluence trading – a strategy that has been gaining significant traction among professional traders and savvy investors alike. For those working with a regulated forex broker, this advanced approach combines two potent market concepts to identify high-probability trading opportunities with precision timing.

In this comprehensive guide, we’ll dive deep into the world of FVG and Order Block confluence trading, revealing how you can harness these techniques to potentially skyrocket your trading performance. Whether you’re a seasoned trader looking to refine your skills or a newcomer eager to learn cutting-edge strategies, this article will equip you with the knowledge and tools to take your trading to the next level.

The Confluence Arsenal: Mastering FVG and Order Block Synergy

1. Understanding the Foundations: FVG and Order Blocks Explained

Before we delve into the confluence strategy, it’s crucial to grasp the individual concepts of Fair Value Gaps and Order Blocks in greater detail.

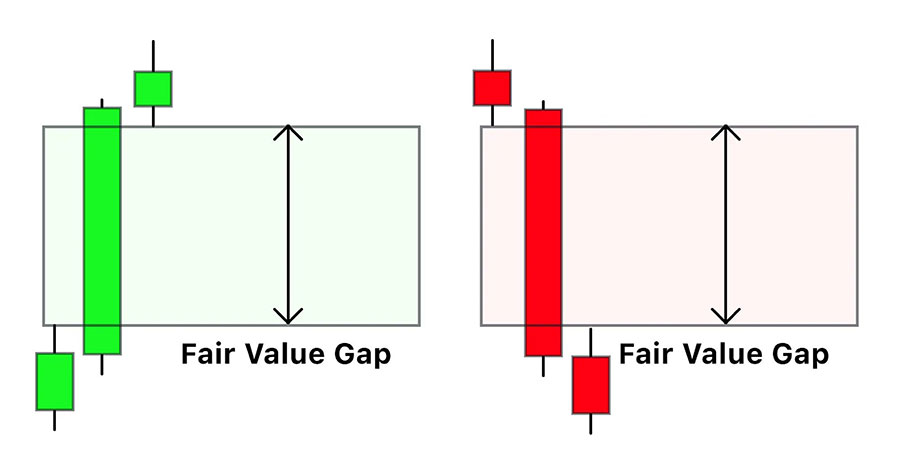

Fair Value Gaps (FVGs)

Fair Value Gaps are areas on a price chart where there’s a significant imbalance between buyers and sellers, resulting in a rapid price movement that leaves a “gap” in the market structure. These gaps often occur during periods of high volatility or when important news impacts the market.

Key characteristics of FVGs:

- Appear as spaces between the bodies of consecutive candlesticks

- Represent potential areas for price correction

- Can be bullish (price moves up rapidly) or bearish (price moves down rapidly)

To identify an FVG, look for a situation where the low of a candle is higher than the high of the previous candle (for bullish FVGs) or where the high of a candle is lower than the low of the previous candle (for bearish FVGs). This gap in price action indicates a rapid move that left unfilled orders, creating an imbalance in the market.

FVGs are significant because they often act as magnets for price action. The market tends to be drawn back to these areas to “fill the gap” and restore balance. This characteristic makes FVGs valuable for both entry and exit points in trades.

It’s important to note that not all FVGs are created equal. The strength of an FVG can be influenced by factors such as:

- The size of the gap: Larger gaps generally have more significance.

- The timeframe: FVGs on higher timeframes tend to be more powerful.

- The market context: FVGs that form at key support or resistance levels often have more impact.

- Volume: Higher volume during the formation of an FVG can indicate stronger market conviction.

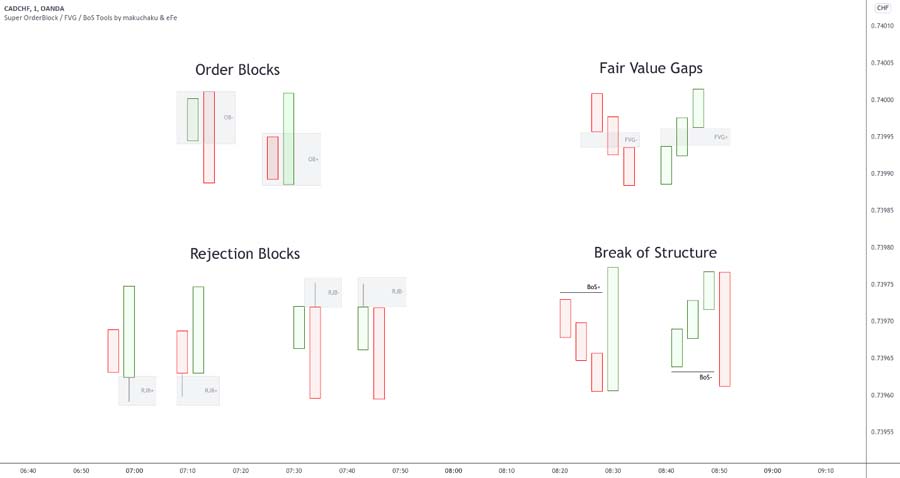

Order Blocks

Order Blocks are zones on a chart where large institutional orders have been placed, often leading to significant price reversals. These areas represent strong supply or demand and can act as powerful support or resistance levels.

Key characteristics of Order Blocks:

- Form just before a strong move in price

- Often feature a strong initial candle followed by consolidation

- Serve as potential entry or exit points for trades

To identify an Order Block, look for the last opposing candle before a strong momentum move. For example, in an uptrend, the last bearish candle before a series of bullish candles would be considered a bullish Order Block. Conversely, in a downtrend, the last bullish candle before a series of bearish candles would be a bearish Order Block.

The theory behind Order Blocks is that they represent areas where large market participants (institutions, banks, etc.) have placed significant orders. When price returns to these levels, these big players are likely to defend their positions, leading to potential reversals or continuations of the trend.

Several factors can enhance the significance of an Order Block:

- The strength of the move following the Order Block: A more explosive move indicates stronger orderflow.

- The number of times price respects the Order Block: Multiple touches can reinforce its importance.

- The timeframe: Higher timeframe Order Blocks generally carry more weight.

- The market structure: Order Blocks at key swing highs or lows are often more significant.

Understanding both FVGs and Order Blocks is crucial because they provide insight into market structure and potential areas of future price action. However, their true power is unleashed when they occur in confluence.

2. The Magic of Confluence: When FVGs Meet Order Blocks

Confluence in trading refers to the alignment of multiple factors or indicators that support a particular trade idea. When Fair Value Gaps (FVGs) and Order Blocks align, they create a powerful confluence that can significantly increase the probability of a successful trade.

Benefits of FVG and Order Block Confluence

- Increased Accuracy in Trade Entries and Exits: Confluence helps pinpoint precise entry and exit points.

- Higher Probability of Successful Trades: Combining FVGs and Order Blocks boosts the likelihood of favorable outcomes.

- Better Risk-to-Reward Ratios: Aligning multiple factors can enhance the potential returns relative to the risk taken.

- Clearer Market Structure Analysis: This confluence provides a more comprehensive view of market dynamics.

The Power of Confluence

The effectiveness of this confluence lies in combining two different market phenomena:

- Fair Value Gaps (FVGs): Represent short-term imbalances and potential areas for price to return to.

- Order Blocks: Indicate longer-term institutional interest and potential areas of strong support or resistance.

When these two align, both short-term market dynamics and longer-term institutional interest point to the same area. This can manifest in several ways:

a) FVG Forms Within an Existing Order Block

- Scenario: An FVG develops within the boundaries of an Order Block.

- Outcome: Often leads to a strong reaction when price returns to this area due to the combined short-term and long-term interest.

b) Order Block Forms Near an Unfilled FVG

- Scenario: An Order Block is established close to an unfilled FVG.

- Outcome: Reinforces the significance of the FVG, increasing the likelihood of a price reaction in this area.

c) Multiple FVGs Align with an Order Block

- Scenario: Several FVGs from different timeframes converge at an Order Block.

- Outcome: Creates a particularly strong confluence zone, amplifying the potential for a significant price movement.

Strategic and Tactical Integration

The beauty of this confluence strategy is in its integration of short-term tactical approaches (FVGs) with longer-term strategic views (Order Blocks). This multi-faceted analysis helps traders make more informed decisions and potentially improve their risk management. By leveraging the strengths of both FVGs and Order Blocks, traders can navigate market complexities with greater precision and confidence.

3. 7 Game-Changing Strategies for FVG and Order Block Confluence Trading

Let’s dive into the practical application of this powerful combination with seven strategies that can potentially transform your trading results.

Strategy 1: The Perfect Storm Setup

Look for situations where an FVG forms within an established Order Block. This “perfect storm” scenario often leads to explosive price movements.

Steps to implement:

- Identify a strong Order Block on your preferred timeframe

- Wait for price to return to the Order Block area

- Look for an FVG to form within the Order Block

- Enter the trade when price reacts to the FVG, with a stop loss beyond the Order Block

Strategy 2: The Multi-Timeframe Approach

Enhance your confluence analysis by examining FVGs and Order Blocks across multiple timeframes.

Implementation:

- Identify Order Blocks on a higher timeframe (e.g., daily)

- Look for FVGs on a lower timeframe (e.g., 4-hour or 1-hour) within those Order Blocks

- Fine-tune entries using even lower timeframes (e.g., 15-minute or 5-minute)

Strategy 3: The Breakout Confirmation

Use FVG and Order Block confluence to confirm breakouts and avoid false moves.

Steps:

- Identify a key resistance or support level

- Look for an Order Block forming near this level

- Wait for an FVG to appear, signaling a potential breakout

- Enter the trade when price breaks through the level with increased volume

Strategy 4: The Reversal Predictor

Spot potential market reversals by combining FVG and Order Block analysis.

Implementation:

- Identify an overextended trend

- Look for an opposing Order Block forming at a key level

- Wait for an FVG to form within or near the Order Block

- Enter a counter-trend trade with a tight stop loss

Strategy 5: The Risk Management Optimizer

Use FVG and Order Block confluence to optimize your risk management and position sizing.

Steps:

- Identify the confluence zone of an FVG and Order Block

- Set your stop loss just beyond the Order Block

- Calculate position size based on the distance to your stop loss

- Set multiple take-profit levels based on FVG projections

Read More: Mastering The Silver Bullet Forex Strategy

Strategy 6: The Trend Continuation Filter

Enhance your trend-following strategies by incorporating FVG and Order Block confluence.

Implementation:

- Identify the prevailing trend

- Look for pullbacks to Order Blocks in the direction of the trend

- Wait for FVGs to form within these Order Blocks

- Enter trades in the direction of the main trend with confirmation from price action

Strategy 7: The Volume Confirmation Technique

Add an extra layer of confirmation to your FVG and Order Block confluence trades by incorporating volume analysis.

Steps:

- Identify an FVG and Order Block confluence zone

- Analyze volume patterns as price approaches this zone

- Look for a spike in volume as price reacts to the confluence area

- Enter trades only when volume confirms the price action

5. Advanced Tips for Mastering FVG and Order Block Confluence Trading

To enhance your trading strategy, consider these advanced techniques:

1. Develop a Scoring System

Create a checklist or scoring system to rate confluence setups. Consider factors like:

- Timeframe: Higher timeframes score more points.

- Number of FVGs: More FVGs indicate stronger setups.

- Order Block Clarity: Clear, substantial Order Blocks are better.

- Trend Alignment: Align setups with the overall market trend.

- Confirming Factors: Include key support/resistance levels, trend lines, and volume.

- Volume: Higher volume near confluence zones strengthens setups.

Read More: Mastering Fair Value Gap Scalping

2. Use Algorithmic Analysis

Implement algorithms to scan for FVG and Order Block confluences across assets and timeframes. Consider software that:

- Identifies FVGs and Order Blocks: Scans multiple timeframes.

- Calculates Confluence Zones: Finds overlapping areas based on criteria.

- Alerts High-Scoring Setups: Notifies when optimal setups are found.

- Backtests Strategies: Tests the strategy on historical data.

3. Incorporate Other Technical Tools

Combine FVG and Order Block confluence with other indicators:

- Moving Averages: Confirm trends and identify support/resistance.

- Fibonacci Retracements: Align with FVGs and Order Blocks.

- RSI: Identify overbought or oversold conditions.

- Bollinger Bands: Provide insight into volatility and potential reversals.

4. Keep a Detailed Trading Journal

Track your trades to identify patterns and improve. Include:

- Setup Screenshots: Document FVG and Order Block identification.

- Confluence Score: Based on your scoring system.

- Entry and Exit Points: Record your decisions.

- Trade Outcome: Note profit/loss and lessons learned.

- Market Conditions: Include relevant fundamental factors.

5. Master the Art of Patience

Patience is key in confluence trading. Develop the discipline to:

- Wait for Criteria: Ensure confluence criteria are met before trading.

- Allow Trades to Play Out: Avoid premature exits.

- Resist Forcing Trades: Don’t trade when high-quality setups are scarce.

6. Understand Market Microstructure

Deepen your understanding of market mechanics, including:

- Order Flow Dynamics: Large orders impact price movement.

- Liquidity Pools: Major liquidity levels in the market.

- Market Maker Behavior: How market makers affect price action.

7. Develop a Holistic Trading Approach

Build a well-rounded strategy by including:

- Risk Management: Beyond simple stop losses.

- Psychology: Maintain discipline and emotional control.

- Fundamental Analysis: Understand the impact on technical setups.

- Continuous Learning: Stay updated and refine your skills.

By integrating these advanced techniques with your FVG and Order Block confluence strategy, you can enhance trading performance and achieve more consistent results. Continuous practice, analysis, and strategy refinement are essential for trading mastery.

Read More: Mastering The ICT Turtle Soup Trading Strategy

Conclusion

FVG and Order Block confluence trading represents a powerful approach to navigating financial markets with increased precision and confidence. By mastering these techniques and implementing the seven game-changing strategies outlined in this guide, you’ll be well-equipped to identify high-probability trading opportunities and potentially boost your trading performance.

Remember, success in trading requires more than just technical knowledge. Discipline, emotional control, and continuous learning are equally crucial. As you incorporate FVG and Order Block confluence into your trading arsenal, remain committed to refining your skills, adapting to market changes, and maintaining a balanced approach to risk management.

With dedication and practice, you can harness the power of FVG and Order Block confluence to unlock new levels of trading success. Stay curious, remain disciplined, and always strive for excellence in your trading journey.

What is the main advantage of combining FVG and Order Block analysis?

The primary advantage is increased accuracy in identifying high-probability trading setups. By combining these two powerful concepts, traders can pinpoint areas of strong market interest with greater precision.

How often do FVG and Order Block confluence setups occur?

The frequency of these setups varies depending on the market and timeframe. Generally, they are not extremely common, which is part of what makes them valuable. Quality setups might appear a few times a week on a given instrument.

Can FVG and Order Block confluence trading be automated?

While it’s possible to create algorithms that identify potential FVG and Order Block confluence areas, the final trading decision often benefits from human analysis of the overall market context.

Is this strategy suitable for day trading?

Yes, FVG and Order Block confluence can be applied to various trading styles, including day trading. However, it’s often more effective on higher timeframes where institutional activity is more pronounced.

How can I practice FVG and Order Block confluence trading without risking real money?

Many brokers offer demo accounts where you can practice these strategies with virtual money. Additionally, you can paper trade by keeping a journal of hypothetical trades based on your analysis.