Picture this: you’re navigating the turbulent seas of financial markets, searching for reliable signs to guide your trading decisions. Enter the Falling Three Methods Candlestick Pattern, a beacon for traders aiming to decode bearish trends with precision. This powerful pattern isn’t just another chart formation; it’s a strategic tool that can significantly enhance your trading performance. Whether you’re a novice stepping into the realm of forex trading or a seasoned investor refining your strategies with a regulated forex broker, understanding the Falling Three Methods Pattern can transform your approach to the markets. Unlock unparalleled insights and leverage this pattern to anticipate market movements, manage risks, and maximize profits.

In this comprehensive guide, we’ll delve deep into the Falling Three Methods Candlestick Pattern, exploring its definition, structure, formation, and practical applications. We’ll also address frequently asked questions, debunk common misconceptions, and provide advanced strategies to ensure you harness its full potential. Let’s embark on this journey to elevate your trading strategy and achieve consistent success.

What is the Falling Three Methods Candlestick Pattern?

Discover the core structure and significance of the Falling Three Methods candlestick pattern.

Definition and Significance

The Falling Three Methods Candlestick Pattern is a sophisticated bearish continuation pattern that signals the persistence of a downtrend in financial markets. Comprising five consecutive candles, this pattern is a staple in bearish continuation candlestick patterns and is highly regarded for its reliability in confirming downward momentum. Traders use this pattern to anticipate further declines, allowing them to execute informed short-selling strategies or tighten their stop-loss orders on existing positions.

Significance in Technical Analysis: The Falling Three Methods Pattern serves as a critical indicator in technical analysis, providing traders with a clear signal of sustained bearish sentiment. Its ability to confirm downtrends makes it invaluable for risk management and strategic positioning, especially in volatile markets like forex trading and cryptocurrency.

Historical Background and Origin

Rooted in traditional Japanese candlestick charting techniques developed in the 18th century, the Falling Three Methods Pattern has been a cornerstone in technical analysis for centuries. Japanese rice traders initially used candlestick patterns to forecast market movements, and over time, these techniques have been refined and adopted globally. The Falling Three Methods Pattern, with its distinct five-candle formation, has consistently proven its efficacy across various market conditions and financial instruments.

Understanding the historical context of this pattern underscores its enduring relevance and the depth of market psychology it captures, making it an essential tool for modern traders seeking to gain an edge in the markets.

Read More: Three Inside Up Candlestick Pattern

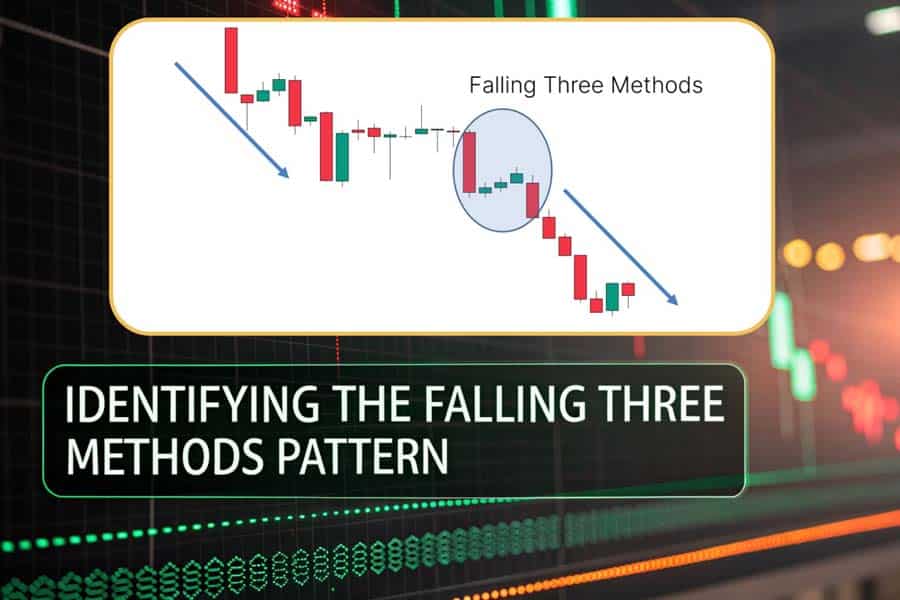

Identifying the Falling Three Methods Pattern

Learn how to accurately identify the Falling Three Methods candlestick pattern.

Structure and Components

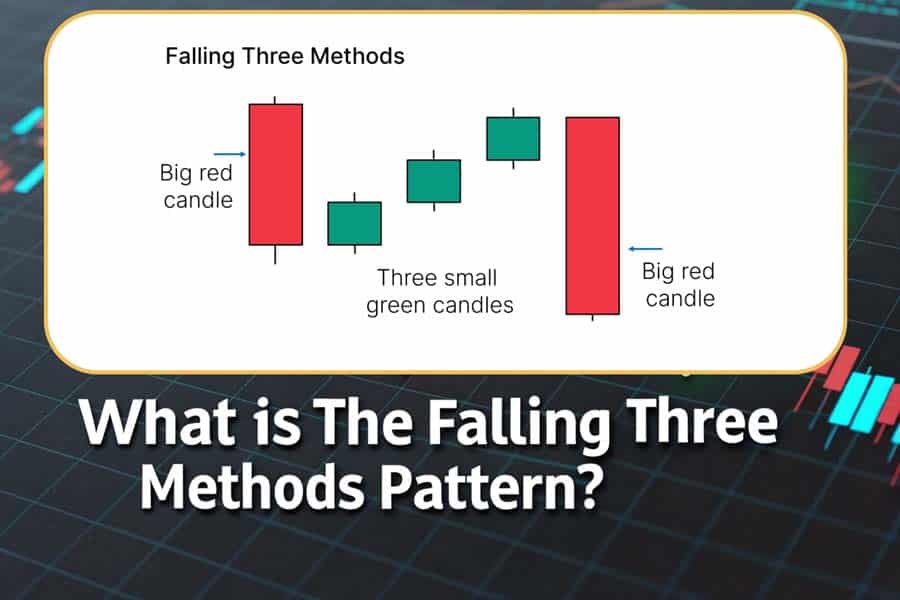

The Falling Three Methods Pattern is characterized by a specific five-candle formation that signals a continuation of an existing downtrend. Here’s a detailed breakdown of its structure:

- First Candle: A substantial bearish candle that establishes the prevailing downtrend, reflecting strong selling pressure.

- Three Small Candles: These candles represent a consolidation phase or a temporary pause in the trend. They are typically bullish or neutral but remain within the range set by the first bearish candle.

- Fifth Candle: Another significant bearish candle that closes below the first candle’s close, confirming the continuation of the downtrend.

Key Characteristics:

- Consolidation Phase: The three small candles should trade within the range of the initial bearish candle, indicating a brief respite before the downtrend resumes.

- Volume Patterns: Trading volume typically decreases during the consolidation phase and surges with the fifth bearish candle, reinforcing the pattern’s validity.

Visual Representation: Accurate identification of this pattern often involves annotated diagrams on advanced charting platforms like MetaTrader 5, which highlight the five-candle formation and the necessary price movements.

Visual Representation with Annotated Diagrams

Pro Tip: Utilize advanced charting tools available on platforms like MetaTrader 5 to visualize and identify the Falling Three Methods Pattern accurately. Annotated diagrams can help in distinguishing this pattern from similar formations, ensuring precise analysis.

Formation and Interpretation

Step-by-Step Formation Process

Grasping the formation process of the Falling Three Methods Pattern is crucial for accurate identification and interpretation:

- Initiation with a Bearish Candle: The pattern begins with a strong bearish candle, signaling robust selling pressure and the continuation of the downtrend.

- Consolidation Phase: This is followed by three smaller candles that may be bullish or neutral, reflecting a temporary balance between buyers and sellers. These candles should remain within the range established by the initial bearish candle.

- Confirmation with a Bearish Breakout: The pattern concludes with a fifth bearish candle that breaks below the first candle’s close, confirming the continuation of the downtrend.

Market Psychology Behind the Pattern: The Falling Three Methods Pattern encapsulates the battle between bulls and bears. Initially, sellers dominate, driving prices sharply downward. The consolidation phase represents a momentary hesitation or attempt by bulls to reverse the trend. However, the resurgence of selling pressure in the final bearish candle signifies that bears have regained control, reaffirming the downtrend.

Common Scenarios and Contexts

This pattern typically appears in trending markets where the overarching direction is bearish. It is most reliable in markets with clear, sustained downward movements, as opposed to volatile or sideways markets where false signals are more prevalent. Traders often seek the Falling Three Methods Pattern in high-volume environments, such as major forex pairs or large-cap stocks, where liquidity and volume support the pattern’s validity.

Pro Tip: Always consider the broader market context and prevailing trends when identifying the Falling Three Methods Pattern to enhance its reliability and effectiveness.

Read More: Three Inside Down Candlestick Pattern

Trading Strategies Using the Falling Three Methods Pattern

Unlock actionable trading strategies with the Falling Three Methods candlestick pattern.

Falling Three Methods Trading Strategy

Incorporating the Falling Three Methods Pattern into your trading strategy can significantly enhance your ability to predict market movements and execute profitable trades. Here’s how to effectively utilize this pattern:

- Entry Points:

- Sell Order: Place a sell order immediately after the fifth bearish candle closes below the range of the first bearish candle.

- Confirmation: Ensure that the pattern is accompanied by increased volume to confirm the strength of the selling pressure.

- Exit Points:

- Profit Targets: Set profit targets based on previous support levels or use technical indicators like Fibonacci retracements to determine realistic exit points.

- Trailing Stops: Implement trailing stops to lock in profits as the trade moves in your favor, providing flexibility and protection against sudden market reversals.

Risk Management and Stop-Loss Considerations

Effective risk management is paramount when trading the Falling Three Methods Pattern. Here are key strategies to mitigate potential losses:

- Stop-Loss Placement: Set a stop-loss order above the highest point of the three small consolidation candles. This ensures that if the pattern fails, your loss is limited to a predefined amount.

- Position Sizing: Adjust the size of your trade based on your risk tolerance and the volatility of the asset. Proper position sizing helps in managing exposure and preventing significant losses.

- Diversification: Avoid placing all your trades based on a single pattern. Diversify your trading strategies to spread risk across different patterns and market conditions.

Examples of Successful Trades Utilizing This Pattern

Example 1: Forex Market A trader analyzing the EUR/USD pair on a daily chart identifies a clear Falling Three Methods Pattern after a sustained downtrend. The fifth bearish candle closes below the first candle’s close with increased volume, prompting the trader to place a sell order. The trader sets a stop-loss above the consolidation phase and a profit target at the next support level. The trade executes successfully as the price continues to decline, resulting in a profitable position.

Example 2: Cryptocurrency Market In the volatile cryptocurrency market, a trader observes Bitcoin forming the Falling Three Methods Pattern on the hourly chart. By confirming the pattern with RSI divergence and increased volume, the trader initiates a short position. As the price drops further, the trader employs a trailing stop to secure profits, capitalizing on Bitcoin’s downward momentum.

Pro Tip: Analyze historical charts to identify past instances of the Falling Three Methods Pattern and study the subsequent price movements to refine your trading strategy.

Common Misconceptions and Pitfalls

Myths Surrounding the Falling Three Methods Pattern

Several misconceptions can hinder traders from effectively utilizing the Falling Three Methods Pattern:

- Myth 1: It’s Always Reliable: While the pattern is highly effective in trending markets, it is not foolproof and can produce false signals in volatile or sideways markets.

- Myth 2: It Guarantees Profits: The pattern provides a probabilistic advantage, not a certainty. Proper risk management is essential to mitigate potential losses.

- Myth 3: It Works in Isolation: Relying solely on the Falling Three Methods Pattern without considering other technical indicators or market factors can reduce its effectiveness.

Common Mistakes Traders Make When Interpreting the Pattern

- Ignoring Volume Confirmation: Failing to consider trading volume can lead to misinterpretation of the pattern’s strength.

- Misidentifying the Consolidation Phase: Confusing the three small candles with a potential trend reversal rather than a consolidation can result in incorrect trade decisions.

- Overlooking Market Context: Not considering broader market trends or economic indicators can weaken the pattern’s predictive power.

- Improper Stop-Loss Placement: Setting stop-loss orders too tight or too loose can either prematurely close profitable trades or expose the trader to excessive losses.

- Overtrading: Entering too many trades based on the pattern without sufficient confirmation can lead to diminished returns and increased risk.

Tips for Accurate Identification and Analysis

- Use Multiple Indicators: Combine the Falling Three Methods Pattern with other technical indicators like RSI, MACD, or Moving Averages to confirm signals.

- Analyze Multiple Time Frames: Assess the pattern across different time frames to gauge its significance and reliability.

- Stay Informed on Market News: Keep abreast of economic events and news that can impact market sentiment and the pattern’s effectiveness.

- Maintain Discipline: Adhere to your trading plan and avoid emotional decision-making to ensure consistent application of the pattern.

- Continuous Education: Regularly update your knowledge on technical analysis and trading strategies to enhance your ability to interpret patterns accurately.

Pro Tip: Develop a checklist that includes volume confirmation, additional indicators, and market context to systematically evaluate the Falling Three Methods Pattern before making trading decisions.

Advanced Techniques and Enhancements

Elevate your trading strategies with advanced techniques and the Falling Three Methods pattern.

Combining with Other Technical Indicators for Improved Accuracy

To bolster the reliability of the Falling Three Methods Pattern, advanced traders often integrate it with other technical indicators:

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions, adding context to the pattern’s signals.

- Moving Averages: Using indicators like the 50-day or 200-day moving averages can provide additional trend confirmation.

- MACD (Moving Average Convergence Divergence): Assists in identifying momentum shifts that complement the pattern’s signals.

- Bollinger Bands: Offer insights into price volatility and potential breakouts.

- Volume Oscillators: Enhance volume analysis to confirm the strength of the pattern.

Example: A trader identifies the Falling Three Methods Pattern and confirms a bearish signal with an RSI reading above 70 (overbought) and a bearish crossover in MACD, strengthening the decision to initiate a short position.

Integrating with Broader Trading Strategies

The Falling Three Methods Pattern can be seamlessly incorporated into broader trading strategies, enhancing overall effectiveness:

- Trend Following Strategies: Use the pattern to confirm continuation in existing trends, aligning with trend-following principles.

- Swing Trading: Identify entry and exit points based on the pattern’s signals, optimizing swing trades within the prevailing trend.

- Risk Management Frameworks: Integrate the pattern into a comprehensive risk management plan, ensuring disciplined trading practices.

- Algorithmic Trading: Develop automated trading systems that detect the Falling Three Methods Pattern and execute trades based on predefined criteria.

- Scalping: Apply the pattern in shorter time frames to capture quick profits from small price movements.

Pro Tip: Align the Falling Three Methods Pattern with your overarching trading strategy to create a cohesive and effective approach, maximizing the pattern’s benefits.

Read More: Rising three methods candlestick pattern

Customizing the Pattern for Different Trading Styles

Different trading styles can adapt the Falling Three Methods Pattern to suit their specific needs:

- Day Traders: Focus on shorter time frames (e.g., 15-minute or hourly charts) to capture intra-day trends and execute quick trades.

- Swing Traders: Utilize daily or weekly charts to identify patterns that span several days or weeks, aligning with medium-term trends.

- Position Traders: Apply the pattern to longer time frames (e.g., weekly or monthly charts) for strategic, long-term trading decisions.

- Scalpers: Use minute charts to identify rapid price movements and exploit small market inefficiencies.

Customization Tips:

- Adjust Time Frames: Select the time frame that aligns with your trading style and objectives.

- Modify Confirmation Criteria: Tailor the additional indicators and confirmation criteria based on your preferred trading approach.

- Adapt Risk Management: Implement risk management techniques that complement your trading style, such as tighter stop-losses for scalpers or wider stops for position traders.

Pro Tip: Experiment with different time frames and confirmation techniques to find the optimal settings that complement your unique trading style, enhancing the pattern’s effectiveness.

Pro Tips for Advanced Traders

Elevate your trading game with these advanced strategies when utilizing the Falling Three Methods Candlestick Pattern:

- Combine with Leading Indicators: Use indicators like Bollinger Bands or Ichimoku Clouds to gain a more nuanced understanding of market conditions and strengthen the pattern’s signals.

- Monitor Market Sentiment: Keep an eye on sentiment indicators and news flow to anticipate potential shifts that could impact the pattern’s reliability.

- Implement Advanced Risk Management: Utilize techniques such as position scaling, hedging, and dynamic stop-loss adjustments to manage risk more effectively.

- Leverage Algorithmic Tools: Employ algorithmic trading tools and automated alerts to identify and act on the Falling Three Methods Pattern swiftly and accurately.

- Continuous Learning and Adaptation: Stay updated with the latest market trends, trading strategies, and technical analysis techniques to refine your approach and maintain an edge in the markets.

- Backtest Extensively: Use historical data to backtest your strategies incorporating the Falling Three Methods Pattern, ensuring their robustness across different market conditions.

- Diversify Across Assets: Apply the pattern across a diverse range of assets to spread risk and capitalize on multiple trading opportunities.

- Stay Disciplined: Adhere strictly to your trading plan and avoid emotional decision-making, ensuring consistent application of advanced strategies.

Pro Tip: Regularly review and analyze your trades to identify patterns of success and areas for improvement, ensuring continuous growth and adaptation in your trading journey.

Opofinance Services: Your Trading Ally

When it comes to executing the Falling Three Methods Candlestick Pattern effectively, partnering with a reliable broker is paramount. Opofinance, an ASIC-regulated forex broker, offers a suite of services designed to enhance your trading experience:

- Official MT5 Platform: Access to the MetaTrader 5 platform, renowned for its advanced charting tools and seamless pattern identification capabilities.

- Social Trading Services: Connect with expert traders, follow their strategies, and replicate successful trades through Opofinance’s social trading features.

- Safe and Convenient Deposits and Withdrawals: Benefit from a variety of secure and user-friendly methods for managing your funds.

- Comprehensive Trading Tools: Utilize a range of tools tailored for traders of all levels, from beginners to advanced.

- Exclusive Features:

- High Leverage Options: Maximize your trading potential with flexible leverage settings.

- Dedicated Support: Receive personalized assistance from Opofinance’s professional support team.

- Educational Resources: Access a wealth of resources, including webinars, tutorials, and market analysis to refine your trading skills.

- Advanced Order Types: Utilize various order types such as stop orders, limit orders, and trailing stops to implement sophisticated trading strategies.

- Automated Trading: Implement expert advisors (EAs) on the MT5 platform to automate your trading strategies based on the Falling Three Methods Pattern.

Social Trading and Community Engagement:

- Follow Successful Traders: Observe and learn from the strategies of top-performing traders within the Opofinance community.

- Copy Trading: Automatically replicate the trades of experienced traders, allowing you to benefit from their expertise without needing to execute trades manually.

- Community Insights: Engage with a vibrant community of traders, sharing insights, strategies, and market outlooks to enhance your trading knowledge.

Safe and Convenient Deposits and Withdrawals:

- Multiple Payment Methods: Choose from a range of deposit and withdrawal options, including bank transfers, credit/debit cards, and e-wallets, ensuring seamless and secure transactions.

- Fast Processing Times: Experience swift processing of your funds, allowing you to act on trading opportunities without delay.

- Security and Compliance: Trust in Opofinance’s robust security measures and compliance with regulatory standards to protect your funds and personal information.

Explore Opofinance today and elevate your trading experience with top-tier services tailored to your needs. Whether you’re mastering the Falling Three Methods Pattern or exploring new trading strategies, Opofinance is your trusted partner in the markets.

Conclusion

The Falling Three Methods Candlestick Pattern is a formidable tool in a trader’s arsenal, offering clear signals for bearish continuation in trending markets. By mastering its structure, understanding the underlying market psychology, and integrating it with robust trading strategies, traders can significantly enhance their decision-making process and profitability. However, success with this pattern requires diligent analysis, effective risk management, and the use of reliable trading platforms like those offered by Opofinance. Embrace the power of the Falling Three Methods Pattern to navigate the complexities of the financial markets with confidence and precision.

Key Takeaways

- Falling Three Methods Pattern: A bearish continuation pattern confirming ongoing downtrends.

- Identification: Recognize the five-candle structure with a consolidation phase and a confirming bearish breakout.

- Strategic Integration: Combine the pattern with other indicators and trading strategies for enhanced reliability.

- Risk Management: Implement effective stop-loss and position sizing techniques to mitigate potential losses.

- Opofinance Advantage: Utilize Opofinance’s regulated services and advanced trading platforms to optimize your trading outcomes.

What timeframe is best suited for trading the Falling Three Methods Pattern?

The Falling Three Methods Pattern can be effectively utilized across various timeframes, depending on your trading style. Day traders may prefer shorter timeframes like 15-minute or hourly charts, while swing and position traders might find daily or weekly charts more suitable. The key is to align the timeframe with your trading objectives and ensure that the pattern is clear and well-defined within that context.

Can the Falling Three Methods Pattern indicate trend reversals?

No, the Falling Three Methods Pattern is primarily a bearish continuation pattern, signaling the persistence of an existing downtrend. It is not designed to indicate trend reversals. For reversal signals, traders should look for other patterns such as the Hammer, Shooting Star, or Bearish Engulfing patterns. Always confirm trend direction with additional indicators before making trading decisions.

How can I enhance the reliability of the Falling Three Methods Pattern?

To improve the reliability of the Falling Three Methods Pattern, combine it with other technical indicators like RSI, MACD, or Moving Averages. Additionally, ensure that the pattern forms in a strong trending market with significant trading volume. Avoid relying solely on the pattern; instead, use it as part of a comprehensive trading strategy that includes proper risk management and market analysis.