Are you ready to unlock a powerful tool that can dramatically improve your forex trading strategy? In the thrilling, fast-paced world of forex trading, staying ahead of the curve is not just an advantage—it’s absolutely essential. One of the most invaluable resources that every savvy trader, whether novice or expert, should have in their arsenal is understanding what is economic calendar in forex trading.

Simply put, an economic calendar is your go-to roadmap for understanding and anticipating market-moving events. It’s a vital instrument that outlines upcoming economic announcements, financial releases, and global events that have the potential to send ripples—or tidal waves—through the currency markets. This article will explain in detail what is economic calendar in forex, why it’s so important, and how to use economic calendar in forex effectively to sharpen your trading decisions and potentially boost your profitability. If you are looking for a reliable forex broker to implement these strategies, remember to choose wisely. Let’s dive deep and transform you from a reactive trader to a proactive, informed market participant using the power of the economic calendar.

Introduction to Economic Calendar in Forex Trading

Imagine trying to navigate a busy city without a map or traffic updates. Forex trading without an economic calendar is quite similar – you’re essentially trading blindfolded, vulnerable to unexpected market jolts. But what exactly is this indispensable tool and what purpose does it serve in forex?

Definition and Purpose of an Economic Calendar

At its core, an economic calendar is a comprehensive list of scheduled economic events, announcements, and indicators from around the globe. Think of it as a financial agenda, detailing when key economic data will be released by various countries. This data can range from employment figures and inflation rates to GDP growth and central bank decisions. Each event listed on the calendar has the potential to influence currency valuations and market sentiment.

The primary purpose of using an economic calendar in forex trading is to help traders understand and anticipate potential market volatility. Forex markets are incredibly sensitive to economic news. For instance, a better-than-expected jobs report from the U.S. can strengthen the US dollar, while a surprise interest rate cut by a central bank can weaken its currency. By keeping an eye on the economic calendar, you are essentially getting a heads-up on when such market-moving news is expected. This foresight allows you to:

- Prepare for Volatility: Understand when high-impact events are likely to cause significant price fluctuations.

- Make Informed Decisions: Incorporate economic data into your trading strategies for more reasoned entries and exits.

- Manage Risk: Adjust your risk exposure around major announcements to protect your capital.

- Identify Trading Opportunities: Pinpoint potential trading setups based on expected market reactions to specific data releases.

In essence, an economic calendar empowers you to trade with foresight rather than hindsight. It’s about being prepared, not surprised. Understanding what is economic calendar in forex is the first step to mastering forex trading.

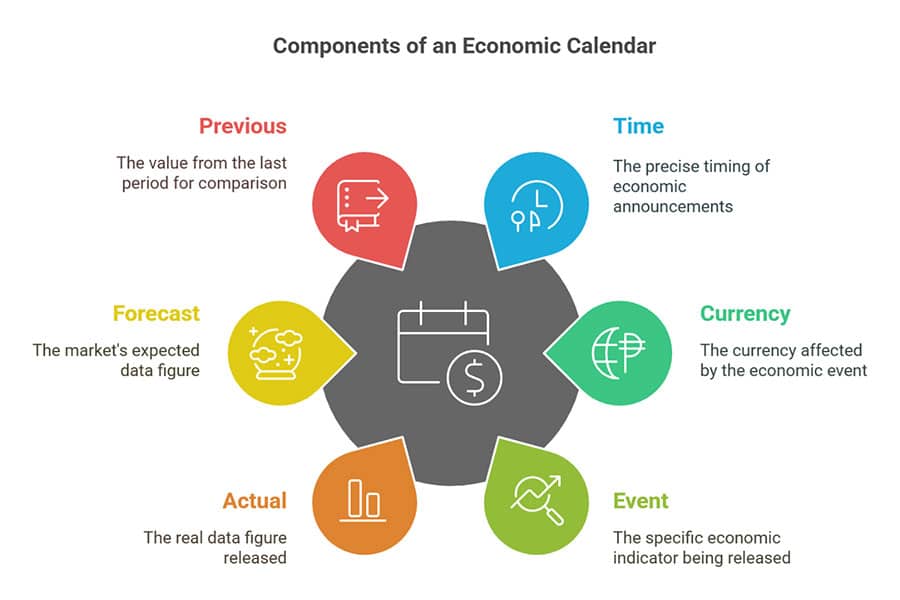

Key Components of an Economic Calendar

To effectively use an economic calendar, you need to understand its key components. Most calendars will typically display the following information for each economic event:

- Time: The exact time of the announcement, usually displayed in your local time zone or a customizable time zone. Accurate timing is crucial as market reactions often occur immediately after the release.

- Currency: The currency that is expected to be affected by the event. For example, U.S. Non-Farm Payrolls (NFP) will primarily impact USD pairs.

- Event: The name of the economic indicator or event, such as “Interest Rate Decision,” “Consumer Price Index (CPI),” or “Gross Domestic Product (GDP).”

- Actual: The actual figure released. This is the real data that gets announced at the specified time.

- Forecast: The consensus market expectation for the data release, usually based on economists’ surveys.

- Previous: The value from the previous period’s release, providing a point of comparison.

- Impact: An indication of the expected market impact of the event, often categorized as low, medium, or high. High-impact events are typically those that can cause the most significant market movements.

Understanding these components allows you to quickly assess which events are most relevant to your trading and how they might influence your positions. Learning how to use economic calendar in forex effectively starts with recognizing these key details.

Read More: News Trading in Forex

How Economic Calendars Work and Market Reactions

Now that you know what is economic calendar in forex trading and its purpose, let’s delve into how it works and why it’s such a critical tool for forex traders. It’s more than just a list of dates; it’s a window into the economic forces that drive currency valuations. Let’s get into economic calendar forex trading explained.

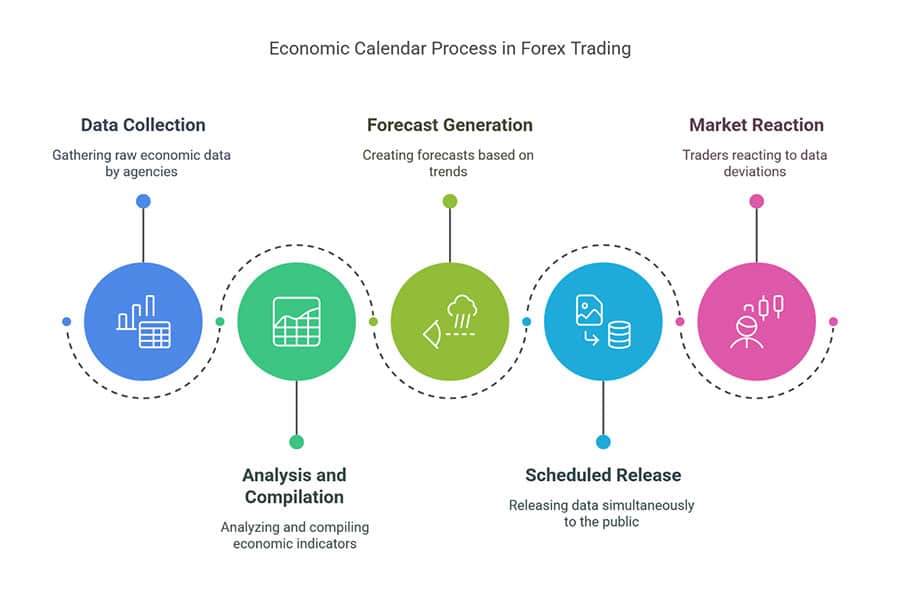

Explanation of Economic Data Releases

Economic data is released according to a pre-set schedule by government agencies, central banks, and statistical organizations around the world. These releases are meticulously planned and anticipated because they provide insights into the economic health of a country or region. The process typically involves:

- Data Collection: Government agencies and organizations collect raw economic data over a specific period (e.g., monthly, quarterly, annually).

- Analysis and Compilation: Economists and statisticians analyze and compile this data to calculate key economic indicators.

- Forecast Generation: Economists and financial institutions create forecasts or expectations for the upcoming data release based on trends, models, and expert opinions. These forecasts are widely circulated among market participants.

- Scheduled Release: The data is released to the public at a predetermined time, as listed on the economic calendar. The release is often simultaneous to ensure fair access to information for all market participants.

The anticipation and subsequent release of this data are what drive much of the short-term volatility in the forex market. Traders attempt to predict the “Actual” figure and position themselves accordingly. If the actual data significantly deviates from the “Forecast,” we often see substantial market movements.

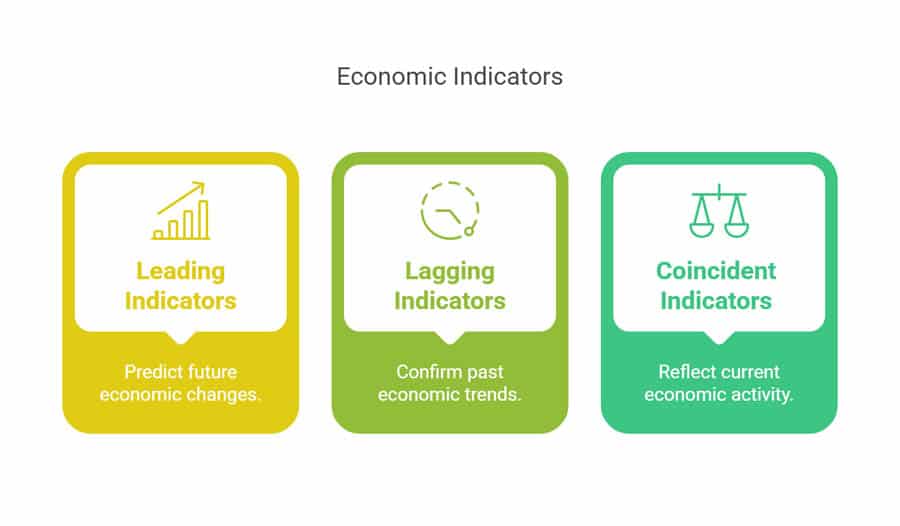

Types of Economic Indicators and Market Impact

Economic indicators are statistics that provide information about the state of an economy. They are crucial for understanding economic calendar forex trading explained. They can be broadly categorized into:

- Leading Indicators: These indicators predict future economic changes. Examples include:

- Purchasing Managers’ Index (PMI): Indicates economic trends in manufacturing and service sectors.

- Consumer Confidence Index (CCI): Measures consumer optimism about the economy.

- Lagging Indicators: These indicators confirm past economic trends. Examples include:

- Unemployment Rate: Percentage of the labor force unemployed.

- Consumer Price Index (CPI): Measures inflation.

- Gross Domestic Product (GDP): Total value of goods and services produced.

- Coincident Indicators: These indicators reflect current economic activity. Examples include:

- Industrial Production: Measures output of industrial sectors.

- Retail Sales: Measures consumer spending.

- Non-Farm Payrolls (NFP): Measures job changes, excluding farm workers.

Each of these indicators offers unique insights into the economic landscape, and understanding them is crucial for interpreting market reactions and mastering how to use economic calendar in forex.

How Forex Markets React to Economic Events

Forex markets react to economic events because these events provide clues about the future direction of an economy and, consequently, its currency. The reactions are driven by:

- Expectations vs. Reality: Market reaction depends on how “Actual” data compares to “Forecast.”

- Positive Surprise: Better-than-expected data strengthens currency.

- Negative Surprise: Worse-than-expected data weakens currency.

- In-Line with Expectations: Muted market reaction.

- Market Sentiment: Economic data shifts market sentiment, impacting investment and currency values.

- Central Bank Policy: Key economic releases influence central bank decisions on interest rates, affecting currency markets.

Understanding these dynamics is key to leveraging the economic calendar for profitable trading. By anticipating market reactions, you can position yourself to capitalize on volatility and potential trends following major economic announcements. This is a core aspect of economic calendar forex trading explained.

Read More: High Volatility News in Forex

Importance of economic calendar in forex trading

Why is the economic calendar so vital for forex traders? It’s simple: it’s a powerful tool that significantly enhances your trading strategy. Understanding the importance of economic calendar in forex trading is crucial for anyone serious about forex.

Making Informed Trading Decisions

In the unpredictable forex market, informed decisions are crucial for success. The economic calendar guides you with data-driven insights, transforming trading from guesswork to a calculated approach by:

- Providing Context: Economic data explains price movements, moving beyond blind reactions.

- Enhancing Analysis: Integrating economic data with technical and fundamental analysis offers a holistic market view for stronger strategies.

- Reducing Emotional Trading: Informed decisions reduce impulsive, emotion-based trades.

For example, a bullish trend might be reinforced by upcoming positive economic data, providing a solid rationale for your trade. This highlights the practical importance of economic calendar in forex trading.

Identifying Market-Moving Events

Some economic events significantly impact markets, causing volatility and creating trading opportunities. The economic calendar helps identify these high-impact events:

- Volatility Indicator: “Impact” rating indicates potential market volatility.

- Strategic Trading Times: Plan trading around high-impact events to capitalize on volatility or avoid risk.

- Examples: NFP, interest rate decisions, GDP, and inflation reports are consistently high-impact.

Knowing about an upcoming Federal Reserve interest rate decision, for instance, allows you to prepare strategies and manage risk, demonstrating the importance of economic calendar in forex trading for strategic planning.

Reducing Trading Risk

Risk management is essential in forex, and the economic calendar is a vital risk management tool. By anticipating volatile periods, it helps you:

- Avoid Unnecessary Exposure: Steer clear of high-volatility periods around major announcements.

- Strategic Position Adjustments: Prepare for different market reactions and adjust positions accordingly.

- Prevent Surprise Losses: Be aware of events that could trigger sudden market spikes, preventing unexpected losses.

If you have open positions during a high-impact CPI release, you can adjust risk parameters or close positions to protect capital, emphasizing the importance of economic calendar in forex trading for risk mitigation.

In summary, the economic calendar empowers smarter trades, capitalizes on opportunities, and manages risk effectively. It’s a key tool for strategic, informed traders, underscoring the overall importance of economic calendar in forex trading success.

How to Use an Economic Calendar Effectively

Having an economic calendar is just the start; effective usage is crucial. To maximize its power, you need a strategic approach. Let’s explore how to use economic calendar in forex effectively to enhance your trading.

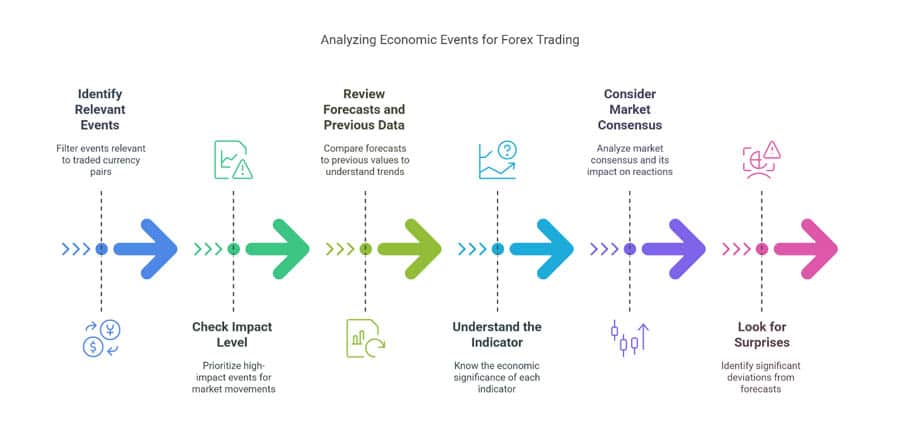

Analyzing Economic Events: A Step-by-Step Guide

Analyzing economic events involves more than a quick glance. Here’s a detailed approach to effectively analyze events from the economic calendar and understand how to use economic calendar in forex:

- Identify Relevant Events: Filter events relevant to your traded currency pairs.

- Check Impact Level: Prioritize high-impact events for significant market movements.

- Review Forecasts and Previous Data: Compare forecasts to previous values to understand expected trends.

- Understand the Indicator: Know what each indicator measures and its economic significance.

- Consider Market Consensus: Forecasts represent market consensus; deviations cause stronger reactions.

- Look for Surprises: Significant deviations from forecasts lead to major market moves.

Following these steps moves you from basic awareness to understanding event implications, mastering how to use economic calendar in forex analysis.

Filtering Events for Focused Trading

An uncluttered economic calendar is essential. Effective use means filtering out noise and focusing on relevant data. Here’s how to use economic calendar in forex filtering effectively:

- Currency Filters: Select currencies relevant to your trading pairs.

- Impact Filters: Focus on high-impact events primarily.

- Country/Region Filters: Filter by geographical areas of interest.

- Event Type Filters: Filter by categories like inflation or employment data.

- Time Zone Adjustment: Set your local time zone for accurate event timing.

Customizing your calendar view streamlines analysis, focusing on events most likely to impact your trades. This is a key aspect of how to use economic calendar in forex efficiently.

Timing Trades Around Economic Releases

Timing is crucial in forex, and economic releases offer both risks and opportunities. Here’s how to use economic calendar in forex for strategic trade timing:

- Post-Release Trading (Common): Wait for data release, then react to market movement:

- Waiting for Confirmation: Observe initial market reaction.

- Identifying Trends: Look for short-term trends after release.

- Entering on Pullbacks or Breakouts: Trade based on technical patterns post-volatility.

- Avoiding Trading During Releases (Risk-Averse): Close positions and avoid trading during high-impact releases for stability.

Be mindful of volatility, wider spreads, and slippage during releases. Effective risk management and stop-loss orders are crucial when trading around these events and mastering how to use economic calendar in forex timing.

Mastering effective economic calendar use comes with practice. Focus on high-impact events, understand forecasts, and observe market reactions to refine your strategies and truly understand how to use economic calendar in forex trading.

Read More: Forex Fundamental Analysis Tools

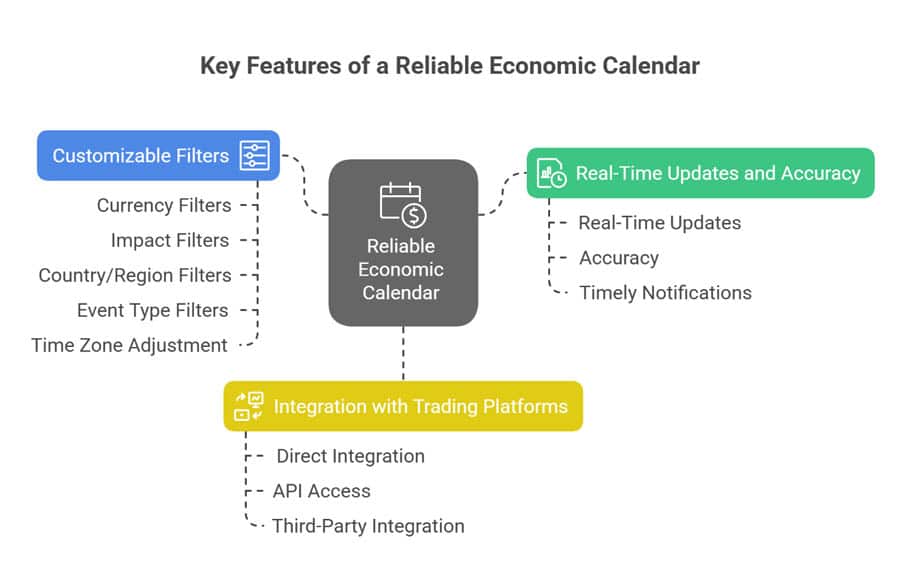

Key Features of a Reliable Economic Calendar

Reliability is paramount when choosing an economic calendar. To truly benefit, ensure your calendar has key features. Let’s explore what to look for in a reliable economic calendar and understand what is economic calendar in forex reliability.

Real-Time Updates and Accuracy

In forex, speed and precision are vital. A reliable economic calendar must provide:

- Real-Time Updates: Instant data updates upon release.

- Accuracy: Data from reputable financial news sources.

- Timely Notifications: Alerts for upcoming high-impact events.

Real-time updates and accuracy are non-negotiable for a trustworthy calendar, underlining what is economic calendar in forex dependability.

Customizable Filters for Personalized Use

Customization is key to efficiency. A good calendar offers robust filtering, including:

- Currency Filters

- Impact Filters

- Country/Region Filters

- Event Type Filters

- Time Zone Adjustment

Customizable filters make the calendar user-friendly and efficient, integral to what is economic calendar in forex usability.

Integration with Trading Platforms

Seamless workflow is a major advantage. Look for calendars offering:

- Direct Integration: Built-in calendars within trading platforms.

- API Access: For advanced, programmatic data access.

- Third-Party Integration: Plugins or widgets for platforms or websites.

Integration simplifies workflow and enhances trading efficiency, a core benefit of what is economic calendar in forex platform synergy.

Prioritize real-time updates, accuracy, customization, and integration when choosing a calendar. These features ensure your economic calendar is a powerful, reliable tool, emphasizing what is economic calendar in forex effective application.

Examples of High-Impact Economic Events

Understanding high-impact events is crucial to leverage the economic calendar. Let’s examine examples of events that move forex markets and illustrate economic calendar forex trading explained through key events.

Non-Farm Payrolls (NFP): The Market Mover

Non-Farm Payrolls (NFP) is a top-tier, monthly U.S. jobs report. Its impact stems from:

- Economic Health Barometer: Key indicator of U.S. economic health.

- US Dollar Influence: Directly impacts USD valuation.

- Market Volatility: Known for high volatility in USD pairs and global markets.

NFP releases are closely watched, creating both opportunities and risks, a prime example of economic calendar forex trading explained by event impact.

Central Bank Interest Rate Decisions

Central bank rate decisions are high-impact due to:

- Currency Valuation Driver: Interest rates are primary currency valuation drivers.

- Economic Policy Signal: Signals central bank economic outlook.

- Global Market Impact: Decisions from major banks have global ripple effects.

Announcements and statements accompanying rate decisions are closely analyzed for future policy clues, illustrating economic calendar forex trading explained by central bank actions.

Consumer Price Index (CPI) and Inflation Data

Inflation data, especially CPI, is high-impact because:

- Inflation Gauge: Key inflation measure for central banks.

- Central Bank Response Trigger: Guides central bank monetary policy.

- Currency and Market Impact: Influences currency values and market volatility.

CPI and other inflation measures are critical, showcasing economic calendar forex trading explained through inflation indicators.

These examples—NFP, rate decisions, CPI—highlight high-impact events. Others include GDP, unemployment, and PMIs. Monitoring your economic calendar for these events enhances your forex strategy, demonstrating practical economic calendar forex trading explained.

Common Mistakes to Avoid When Using an Economic Calendar

Avoid common mistakes to maximize your economic calendar use. Let’s identify pitfalls to sidestep when using the economic calendar and refine how to use economic calendar in forex trading.

Avoiding Overreaction to Low-Impact Events

Treating all events equally is a mistake. Avoid overreacting to low-impact events by:

- Prioritizing High-Impact Events: Focus on significant events.

- Understanding Event Significance: Know which events truly matter for your currencies.

- Avoiding Noise: Don’t get caught in minor data releases.

Focus on quality events to avoid unnecessary trades, crucial for mastering how to use economic calendar in forex wisely.

Mind Time Zones and Schedules

Overlooking time zones and schedules is a critical error. Prevent this by:

- Setting Your Time Zone: Ensure your calendar is in your local time.

- Double-Checking Release Times: Verify times before each session.

- Being Mindful of Daylight Saving Time: Adjust for DST changes.

Accurate timing is essential, particularly for short-term trading around releases, emphasizing how to use economic calendar in forex accurately.

Combining Calendar Data with Technical Analysis

Sole reliance on the calendar is insufficient. Integrate technical analysis by:

- Integrating Technicals: Use charts and indicators to complement calendar analysis.

- Confirming Market Reactions: Use technicals to validate market reactions to data.

- Setting Stop-Losses and Targets: Use technical levels for risk management.

Combine fundamental context from the calendar with technical precision for informed decisions, vital for effective how to use economic calendar in forex strategies.

By avoiding these common mistakes, you improve your economic calendar usage and forex trading performance, refining your understanding of how to use economic calendar in forex effectively.

Tools and Platforms for Economic Calendars

Access to reliable tools is key. Let’s explore platforms for accessing economic calendars and understand what is economic calendar in forex accessibility.

Trading Platforms with Built-in Calendars

Many platforms integrate economic calendars, including:

- MetaTrader 4/5 (MT4/MT5): Popular platforms with basic calendars.

- cTrader: Advanced platform with detailed integrated calendar.

- TradingView: Charting platform with comprehensive economic calendar.

- Broker-Specific Calendars: Proprietary platforms from regulated brokers.

Built-in calendars streamline workflow, making it easier to access event data, a key aspect of what is economic calendar in forex platform integration.

Free vs. Paid Economic Calendar Tools

Choose between free and paid options:

- Free Economic Calendars:

- Pros: Cost-effective, widely available.

- Cons: Fewer customization options, potential delays.

- Examples: ForexFactory, DailyFX, Investing.com, Myfxbook.

- Paid Economic Calendars:

- Pros: Detailed data, advanced customization, real-time accuracy.

- Cons: Costly, may not be necessary for beginners.

- Examples: Bloomberg Terminal, Refinitiv Eikon.

Free calendars suffice for most retail traders, while paid options suit professionals needing advanced features, distinguishing between what is economic calendar in forex tool options.

Mobile Apps for On-the-Go Tracking

Mobile apps offer convenient access:

- Forex Factory Mobile App

- Investing.com App

- Myfxbook App

- Broker-Specific Apps

Mobile apps keep you updated anywhere, essential for monitoring markets on the move, enhancing what is economic calendar in forex mobile utility.

Choose based on needs and budget. Whether built-in, free, or paid, ensure real-time updates, accuracy, and customization for effective trading and understanding what is economic calendar in forex tool selection.

Economic Calendar and Trading Strategies

The economic calendar is central to strategy development. Let’s explore trading strategies incorporating the economic calendar and demonstrate how to use economic calendar in forex strategy.

Scalping Around High-Impact Events

Scalping profits from rapid price moves during high-impact events. Consider:

- High Volatility Focus: Rely on event-driven volatility.

- Fast Execution: Need for rapid entry and exit.

- Tight Spreads: Essential for scalping profits.

- Risk Management: Tight stop-losses are crucial.

Scalping around releases is for experienced traders handling high-speed, high-risk trading, illustrating how to use economic calendar in forex for scalping.

Swing Trading Based on Economic Trends

Swing trading captures medium-term swings based on economic trends. Use the calendar by:

- Identifying Trend-Setting Events: Focus on GDP, inflation, central bank statements.

- Analyzing Long-Term Impact: Consider long-term economic implications.

- Combining with Fundamental Analysis: Support fundamental outlook with economic data.

- Technical Confirmation: Use technicals for swing trade entries.

Swing trading with economic trends is strategic, requiring longer-term perspective and fundamental understanding, demonstrating how to use economic calendar in forex for swing trading.

Risk Management During Volatile Events

Risk management is key, especially during volatile events. Use the calendar to:

- Identify High-Risk Periods: Know when major releases occur.

- Reduce Position Sizes: Limit potential losses before events.

- Widen Stop-Losses (Cautiously): Adjust stops carefully.

- Consider Hedging: For advanced risk protection.

- Avoid Trading if Uncomfortable: Step aside during high volatility.

Proactive risk management using the economic calendar is essential for capital protection, highlighting how to use economic calendar in forex risk management.

Integrating the economic calendar into scalping, swing trading, and risk management enhances trading effectiveness and confidence, demonstrating diverse applications of how to use economic calendar in forex strategies.

Pro Tips for Advanced Traders

Elevate your economic calendar usage with these advanced tips:

- Cross-Currency Analysis

- Event Correlations

- Historical Data Analysis

- Sentiment Analysis

- Multiple Calendar Sources

- Automated Alerts

- Backtesting Strategies

- Stay Updated on Geopolitical Events

These tips refine your strategies and enhance market insights, advancing your understanding of what is economic calendar in forex trading.

Discover Advanced Trading with Opofinance

Looking for a broker for forex trading that empowers you with cutting-edge tools and a secure trading environment? Look no further than Opofinance, an ASIC-regulated broker committed to providing you with an exceptional trading experience.

- Advanced Trading Platforms: Trade on powerful platforms including MT4, MT5, cTrader, and OpoTrade.

- Innovative AI Tools: Utilize AI Market Analyzer, AI Coach, and AI Support.

- Social & Prop Trading: Connect with traders and explore prop trading.

- Secure & Flexible Transactions: Safe deposits and withdrawals, including crypto, with zero fees from Opofinance.

Ready to elevate your trading? Join Opofinance today and experience the difference!

Learn More & Start Trading with Opofinance

Conclusion

In forex trading, knowledge is power, and the economic calendar is your source of market intelligence. Understanding what is economic calendar in forex trading and its effective use is vital for success. This tool provides insights into economic announcements, anticipates volatility, and informs trading decisions. Mastering data interpretation, event filtering, and strategic timing transforms you into an informed trader. Whether scalping, swing trading, or managing risk, the economic calendar is essential. Embrace it to enhance your trading and profitability. Choose a regulated forex broker like Opofinance for a secure, advanced environment. Leverage the economic calendar and unlock your trading potential, solidifying your understanding of what is economic calendar in forex trading and its practical applications.

Key Takeaways

- Economic Calendar Definition: Schedule of market-impacting economic events.

- Importance: Anticipate volatility, inform decisions, manage risk.

- Effective Use: Analyze events, filter, time trades strategically.

- Reliable Calendar Features: Real-time updates, accuracy, customization.

- High-Impact Events: NFP, Rate Decisions, CPI, GDP.

- Common Mistakes: Overreaction, ignoring time zones, neglecting technicals.

- Trading Strategies: Scalping, swing trading, risk management.

Can I rely solely on the economic calendar for my forex trading decisions?

No, do not rely solely on the economic calendar. Use it with technical and fundamental analysis for a balanced approach. The economic calendar provides context, but technical analysis identifies entry/exit points, and fundamental analysis offers broader economic understanding. Combined analysis leads to better trading decisions, beyond just what is economic calendar in forex event awareness.

How far in advance should I check the economic calendar for upcoming events?

Check the economic calendar daily, or at least at the start of each trading session. Review the calendar for the entire day and upcoming days, especially at the start of each week. Advance awareness allows preparation for volatility and strategy adjustments, essential for proactive how to use economic calendar in forex planning.

What does “forecast” mean in an economic calendar and how should I interpret it?

“Forecast” is the market’s consensus expectation for data releases, derived from economist surveys. It’s a benchmark for comparing “actual” data. Market reaction depends on deviation from forecast. Better-than-forecast data can strengthen currency; worse data can weaken it. Understand deviation magnitude and historical reactions to anticipate market moves, deepening your understanding of economic calendar forex trading explained by forecasts.

One Response

The breakdown of ECN vs Standard accounts really highlights the importance of choosing the right type based on one’s trading style. For example, the deep liquidity of an ECN account is ideal for high-frequency traders but may not be necessary for beginners just starting out.