What if you could discover the blueprint for a forex strategy with highest win rate that not only delivers exceptional winning percentages but also translates into sustainable profitability? The answer is within reach. In this in-depth guide, we break down the elements that make up the highest win rate trading strategy and explain why a high win rate alone isn’t enough for success.

By understanding and implementing a forex trading strategy with high win rate alongside robust risk management, precise entry/exit signals, and solid market analysis, you can potentially improve your trading results dramatically. If you’re partnering with a reputable regulated forex broker or an experienced online forex broker, you can leverage advanced platforms and cutting-edge tools to execute your strategy with confidence.

This article offers fresh, unique insights into building a successful forex trading system. We explore key components, advanced techniques, and actionable tips that cater to modern market dynamics while staying true to the fundamentals of a profitable strategy.

Understanding Win Rates in Forex Trading

To build a forex strategy with highest win rate, it’s essential to first grasp what win rate means in the context of trading. This section sets the stage by exploring the definition, calculation, and significance of win rate, as well as the inherent limitations of relying solely on this metric.

Definition of Win Rate and Its Calculation

A forex strategy with highest win rate starts by understanding the concept of win rate. Win rate is calculated as the percentage of winning trades over the total number of trades executed. For instance, if you take 100 trades and 70 of them are profitable, your win rate is 70%.

Win Rate = (Number of Winning Trades / Total Number of Trades) x 100%

Why Win Rate Alone Is Not Enough

Even the highest win rate trading strategy can be misleading if considered in isolation. A high win rate may give a false sense of security if the profits from winning trades do not sufficiently outweigh the losses incurred. Profitability depends on several other factors, including:

- The risk-reward ratio of each trade.

- Market conditions and volatility.

- The frequency and consistency of winning trades.

Therefore, while win rate is an important metric, it must be evaluated alongside other performance measures.

Factors Influencing a Strategy’s Win Rate

The win rate in forex trading is influenced by a range of factors. Understanding these variables can help you refine your approach and adapt your forex trading strategy with high win rate to real market conditions.

- Market Volatility: High volatility can create more opportunities but also increases the risk of false signals.

- Time Frame: Short-term strategies like scalping may yield high win rates but require intense focus.

- Trading Style: Systematic and algorithm-based trading might generate consistent win rates compared to discretionary trading.

- Risk Management: Consistent stop-loss placement and proper position sizing are essential.

- Market Conditions: Trending versus range-bound markets can significantly impact performance.

Read More: How to Make Consistent Profits in Forex Trading

The Relationship Between Win Rate, Risk-Reward Ratio, and Trade Frequency

A successful forex trading strategy with high win rate must consider more than just the percentage of wins. This section explains how win rate interplays with risk-reward dynamics and the frequency of trades to build a balanced and effective trading strategy.

Understanding Win Rate in Context

A strategy with a high win rate may appear ideal, but its effectiveness is measured by more than just the percentage of winners. High-frequency strategies, such as scalping, can deliver impressive win rates by capturing small price movements; however, a single loss can sometimes offset multiple wins.

To truly gauge the performance of a trading system, one must consider:

- Risk-Reward Ratio: A balanced ratio ensures that the gains from winning trades exceed the losses from the few unsuccessful ones.

- Trade Frequency: The number of trades executed plays a crucial role; fewer but higher-quality trades may result in better overall profitability.

Win Rate vs. Risk-Reward Ratio

The risk-reward ratio measures how much you stand to gain compared to what you risk on each trade. A system with a high win rate might have a low risk-reward ratio, meaning each win contributes a small profit while losses can be relatively larger. Conversely, a strategy with a lower win rate might offer a higher reward-to-risk ratio, making it more profitable over time.

Impact of Trade Frequency

Trade frequency is another critical factor that shapes your overall success. Some high win rate strategies offer limited opportunities, making each trade crucial. This difference is often seen when comparing:

- High-Frequency Trading: Systems operating on very short time frames offer numerous small wins, but require rapid decision-making and high transaction volumes.

- Low-Frequency Trading: Strategies that generate fewer setups but potentially higher returns per trade, often suitable for swing or position trading.

Balancing these factors is key when developing a robust highest win rate trading strategy that performs well across various market conditions.

Key Components of High Win Rate Forex Strategies

Crafting a forex strategy with highest win rate involves integrating several foundational elements. This section provides context for the building blocks necessary to create a trading plan that not only wins frequently but also manages risk effectively.

Clear Entry and Exit Signals

The cornerstone of any high win rate strategy lies in clear and actionable entry and exit signals. This involves:

- Identifying precise technical or fundamental triggers for entering a trade.

- Establishing predefined stop-loss and take-profit levels to minimize emotional interference.

- Utilizing indicators such as moving averages, RSI, and candlestick patterns to confirm signals.

Strict Risk Management

Without strict risk management, even the best strategies can falter. Effective risk management includes:

- Risking only a small percentage of your account per trade (typically 1-2%).

- Always using stop-loss orders to protect your capital.

- Adjusting your position size based on market volatility to ensure consistency.

Robust Backtesting and Real-Time Testing

Validating your approach through comprehensive backtesting and forward testing ensures that your strategy stands up to real market conditions. Testing over different market cycles helps refine the system and build confidence.

Psychological Discipline

Maintaining discipline is paramount. Emotions can undermine even the most promising strategies, so cultivating patience and strict adherence to your plan is essential.

Read More: High Reward Low Risk Forex Trading Strategies

Popular High Win Rate Forex Strategies

Below is a detailed exploration of four popular forex strategies known for their high win rates. Each strategy is explained in depth with practical rules for entry, exit, and the signals to watch for. The following sections offer a clear, step-by-step guide that is both practical and actionable.

Scalping on Lower Time Frames

Overview:

Scalping is a fast-paced trading strategy designed for lower time frames, such as 1-minute or 5-minute charts. It focuses on capturing small price movements to accumulate profits quickly. This approach can achieve a high win rate when executed with precision.

Entry Rules:

Signal Identification: Start by using two exponential moving averages (EMAs), such as the 5-period and the 15-period EMAs. When the shorter EMA crosses above the longer EMA, this signals a potential buy opportunity. Conversely, a bearish signal occurs when the shorter EMA crosses below the longer EMA. Confirm this signal with the Relative Strength Index (RSI) set to 14, ensuring that the market is neither overbought nor oversold.

Trigger for Entry: Once the crossover is confirmed and the RSI aligns with the expected market condition, enter the trade immediately. The decision should be based on strong momentum visible in the price action.

Exit Rules:

Stop-Loss: For every trade, set a tight stop-loss just a few pips below the entry price for long trades or above for short trades. This minimizes exposure to sudden market reversals.

Take-Profit: Establish a clear profit target, typically between 5 to 10 pips per trade, to maintain a favorable risk-reward ratio.

Signal to Exit: Monitor for an opposing crossover or a clear reversal in the RSI. If such signals emerge, exit the trade promptly to lock in gains and limit potential losses.

Practical Considerations:

Scalping requires intense concentration and rapid decision-making. It is best practiced during periods of low volatility and avoided during major news events that could lead to unexpected market spikes. It is advisable to test this strategy in a demo environment before applying it in live trading.

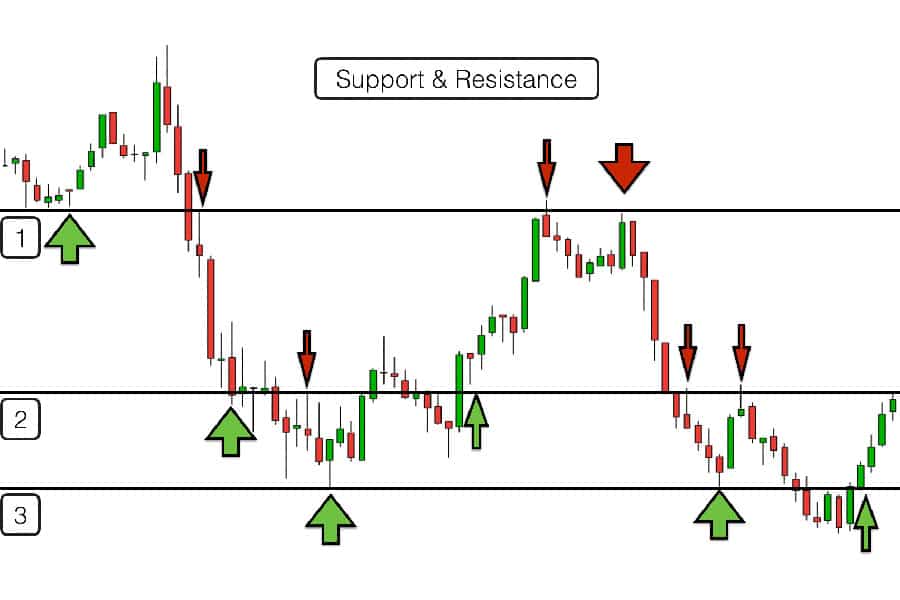

Support and Resistance Trading

Overview:

Support and resistance trading relies on the identification of key price levels where the market tends to reverse or consolidate. This strategy is effective across various time frames and can yield a high win rate when these levels are accurately identified and confirmed by market behavior.

Entry Rules:

Signal Identification: Identify strong support and resistance zones using historical price data. Look for clear candlestick reversal patterns such as pin bars or engulfing candles, which indicate potential reversals at these levels. Additionally, a surge in trading volume can serve as a strong confirmation of the impending reversal.

Trigger for Entry: Enter a long trade when the price bounces off a well-defined support level and a bullish reversal pattern forms. Similarly, initiate a short trade when the price is rejected at a resistance level, as evidenced by a bearish reversal pattern.

Exit Rules:

Stop-Loss: For long positions, set a stop-loss just below the identified support level. For short positions, position the stop-loss slightly above the resistance level.

Take-Profit: Define your profit target by calculating a risk-reward ratio typically between 1.5:1 and 2:1 based on the distance between your entry and stop-loss levels.

Signal to Exit: Watch the market for any signs that the support or resistance level has broken, or for a reversal pattern that indicates the current move may be losing momentum. Exiting the trade at these points helps to protect gains and minimize losses.

Practical Considerations:

To increase accuracy, confirm support and resistance levels across multiple time frames. Employing trailing stops can further safeguard profits if the market continues to move favorably. Patience is essential in waiting for strong confirmation signals before executing a trade.

Moving Average Crossover Strategy

Overview:

The moving average crossover strategy is a trend-following method that utilizes the interaction between two moving averages. This strategy is particularly effective in trending markets and is known for its simplicity and high win rate when market conditions are favorable.

Entry Rules:

Signal Identification: Utilize two moving averages, such as the 50-period and 200-period EMAs. A bullish crossover occurs when the 50-period EMA crosses above the 200-period EMA, indicating upward momentum. A bearish crossover, where the 50-period EMA crosses below the 200-period EMA, signals downward momentum.

Trigger for Entry: After the crossover is confirmed, enter a long position in the case of a bullish signal and a short position for a bearish signal. Ensure that the market momentum supports the direction of the crossover.

Exit Rules:

Stop-Loss: For long trades, place a stop-loss a few pips below the recent swing low; for short trades, position it above the recent swing high. This protects against sudden reversals.

Take-Profit: Set a profit target based on the recent price range or use a fixed risk-reward ratio, such as 1:2 or 1:3, to determine your exit point.

Signal to Exit: Exit the trade when an opposite crossover occurs or if price action suggests a trend reversal through patterns like lower highs or higher lows.

Practical Considerations:

Avoid using the moving average crossover strategy in sideways or choppy markets, as false signals can lead to frequent whipsaws. Combining this strategy with additional confirmation indicators like the MACD or RSI can improve reliability. Regular adjustments to moving averages may be necessary to align with current market volatility.

Price Action and Candlestick Patterns

Overview:

Price action trading is centered on interpreting the natural movement of price without relying heavily on technical indicators. This strategy emphasizes reading candlestick patterns and chart formations to gauge market sentiment, making it a favorite among traders seeking clarity and transparency in their decision-making process.

Entry Rules:

Signal Identification: Focus on recognizing specific candlestick patterns such as pin bars, engulfing candles, or inside bars that suggest a market reversal or continuation. These patterns become even more significant when they occur near key support or resistance levels.

Trigger for Entry: For a long trade, enter when a bullish reversal pattern, such as a bullish engulfing candle, forms at a strong support level. Conversely, for a short trade, initiate the position when a bearish reversal pattern emerges at a prominent resistance level.

Exit Rules:

Stop-Loss: Set the stop-loss just below the low of the bullish pattern for long trades or above the high of the bearish pattern for short trades. This placement ensures that minor fluctuations do not prematurely close a potentially profitable trade.

Take-Profit: Determine the take-profit level by identifying the next significant support or resistance level, or by employing a predetermined risk-reward ratio such as 1:2.

Signal to Exit: Monitor for subsequent candlestick formations that indicate a potential reversal or a significant loss of momentum. Exiting the trade at this point helps secure profits and reduce exposure to a reversal.

Practical Considerations:

Price action trading requires a deep understanding of market context and the ability to read charts accurately. It is recommended to practice extensively in a demo environment to sharpen your skills in identifying high-probability setups. Consistent monitoring and patience are essential, as this strategy relies on waiting for clear, unambiguous signals before making a trade.

By following these detailed rules for entry, exit, and signal confirmation, traders can implement these popular strategies with greater precision. Each method is designed to be practical and actionable, ensuring that you have a robust framework in place to achieve a high win rate while effectively managing risk.

Read More: Backtesting a Trading Strategy

Advanced Techniques to Enhance Strategy Win Rates

For traders seeking to push beyond the basics, this section delves into advanced techniques that can further refine your forex trading strategy with high win rate. These methods focus on precision, technology, and nuanced market analysis.

Multi-Time Frame Analysis

By analyzing multiple time frames, you can validate your trade signals more effectively. For example, confirming a buy signal on a 15-minute chart with the broader trend on a 1-hour chart can lead to more reliable entries.

Diversification Across Currency Pairs

Instead of relying on a single currency pair, diversifying your trades can help mitigate risk. Trading across several liquid pairs provides more opportunities and reduces exposure to the volatility of one market.

Utilizing Advanced Charting Tools

Advanced charting tools and technical indicators can reveal subtle market patterns that traditional analysis might miss. Leveraging these tools gives you a technological edge in executing a highest win rate trading strategy.

Integrating Fundamental Analysis

Combining technical signals with a strong understanding of economic news, geopolitical events, and central bank policies can significantly enhance your strategy’s robustness. This holistic approach ensures your trades are well-rounded and adaptable.

Partial Profit Taking and Trailing Stops

Securing profits along the way is crucial. Partial profit taking and the use of trailing stops allow you to lock in gains while still giving your trades room to grow, thereby bolstering your overall win rate.

Balancing Win Rate with Profitability

A high win rate is enticing, but it must be balanced with overall profitability to create a sustainable trading strategy. This section explains how to harmonize win rate, risk management, and profit margins to ensure lasting success.

Risk-Reward Ratio and Profitability

The risk-reward ratio is crucial for translating a high win rate into consistent profits. A balanced ratio ensures that the cumulative gains from winning trades outweigh the occasional losses.

Managing Drawdowns

Protecting your capital is as important as chasing high win rates. Consistent stop-loss discipline and risk management prevent small losses from becoming detrimental.

Market Adaptability

No single strategy works perfectly in every market condition. Adaptability is key, whether the market is trending or range-bound. Adjust your approach to maintain a stable forex trading strategy with high win rate over time.

Pro Tips for Advanced Traders

For traders who have already laid the groundwork, these pro tips offer advanced insights to further refine your approach and push your forex strategy with highest win rate to the next level.

Refine Entry Timing

Use multi-time frame analysis to pinpoint the perfect entry moments, minimizing risk and maximizing gains.

Optimize Exit Strategies

Utilize trailing stops and adjust your exit points as market momentum builds, ensuring you capture as much profit as possible.

Leverage Automation

Automated trading systems help remove emotional bias from your decisions, ensuring that your strategy is executed consistently.

Maintain a Detailed Trading Journal

Documenting every trade allows you to analyze performance, learn from mistakes, and refine your strategy over time.

Continuously Educate Yourself

The forex market is constantly evolving. Staying updated with new tools, strategies, and market insights is crucial for long-term success.

Opofinance Services

In your journey to develop a forex strategy with highest win rate, partnering with the right broker can make a significant difference. This section explains how Opofinance offers state-of-the-art tools and services designed to empower your trading.

- Advanced Trading Platforms: Trade seamlessly on MT4, MT5, cTrader, and OpoTrade.

- Innovative AI Tools: Utilize AI Market Analyzer, AI Coach, and AI Support for real-time market insights.

- Social & Prop Trading: Engage with a community of traders and explore prop trading opportunities.

- Secure & Flexible Transactions: Enjoy safe deposits and withdrawals, including crypto payments, with zero fees.

Ready to experience a revolutionary trading journey? Start Trading with Opofinance today and harness the power of a true forex trading strategy with high win rate.

Conclusion

Developing a forex strategy with highest win rate is about more than accumulating wins—it’s about striking a balance between frequent successes and sustainable profitability. This article has explored the critical components, market factors, and advanced techniques that contribute to creating a successful trading system.

Whether you favor scalping, support/resistance trading, moving average crossovers, or pure price action, the key is to maintain discipline, manage risks effectively, and continually adapt to the changing market landscape. By integrating these principles with robust tools and partnering with a reliable broker, you can build a strategy that not only wins frequently but also stands the test of time.

Remember, the journey to a highest win rate trading strategy involves continuous learning, refinement, and a commitment to disciplined trading. Stay focused, remain adaptive, and let your strategy evolve as the markets do.

Key Takeaways

Summarizing the core insights from our exploration, here are the essential points to remember:

- Win rate is a vital metric but must be balanced with risk-reward ratios and overall trade management.

- Clear entry and exit signals, paired with strict risk management, are the foundation of any high win rate strategy.

- Advanced techniques like multi-time frame analysis, diversification, and automation enhance your performance.

- Maintaining psychological discipline and continuous education is key for a sustainable forex strategy with highest win rate.

- Partnering with a reputable, regulated forex broker provides the necessary tools and support for long-term success.

What is the ideal timeframe for executing a forex strategy with highest win rate?

The ideal timeframe depends on your trading style and risk appetite. Short-term timeframes, such as 1- to 5-minute charts, often yield high win rates through scalping; however, they require rapid decision-making. Conversely, longer timeframes provide more stable signals and can be easier to manage for swing traders.

How can I optimize risk management for a forex trading strategy with high win rate?

To optimize risk management, focus on setting tight stop-loss orders, using proper position sizing, and adjusting your risk-reward ratio according to market conditions. Regular backtesting and a detailed trading journal can help identify areas for improvement.

Can a highest win rate trading strategy be adapted for highly volatile markets?

Yes, but it requires additional filters such as volatility-based position sizing, wider stop-loss settings, and the integration of both technical and fundamental analysis. Adaptability is key to maintaining high win rates during periods of market turbulence.