Is your entrepreneurial spirit yearning for a market that never sleeps? Do you, as a business owner or tech-savvy individual, crave a career where global finance is at your fingertips? Then a forex trading career might be your next strategic frontier. But is it genuinely possible to forge a successful forex trading career path in today’s volatile markets? Can forex trading as a career provide the stability and growth you seek?

This comprehensive guide unpacks the world of forex trading, revealing the potential rewards and the critical realities. For those serious about entering this field and exploring a forex trading career path, choosing the right partner is crucial; consider starting your journey with a regulated forex broker to ensure a secure and informed trading experience. Let’s investigate if a forex trading career is the right strategic move for you in 2025.

Understanding Forex Trading for Your Career Path

Before charting a forex trading career path, it is crucial to grasp the fundamentals of this complex market. Forex, or foreign exchange, is the global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with trillions of dollars changing hands daily. Understanding forex trading is the first step in determining if a forex trading career is suitable for you.

What is Forex Trading?

Forex trading involves speculating on the price movements of currency pairs with the goal of making a profit. Unlike stock markets, there is no central exchange; forex trading is conducted electronically over-the-counter (OTC), meaning all transactions occur via computer networks between traders worldwide. Traders buy or sell currencies depending on whether they believe their value will rise or fall relative to another currency. This understanding is fundamental when considering forex trading as a career.

How the Forex Market Works

The forex market operates 24 hours a day, five days a week, spanning across major financial centers globally – from Sydney to New York. This continuous operation allows traders to react to economic, political, and social events whenever they occur, regardless of their geographical location. The market is driven by various factors including economic indicators, geopolitical events, and central bank policies. For anyone considering a forex trading career path, grasping these market dynamics is essential.

Key Concepts in Forex Trading

To navigate the complexities of forex trading as a career, understanding key concepts is essential. These concepts are the building blocks of forex knowledge and are crucial for anyone considering a forex trading career path. Currency pairs are the foundation, representing the exchange rate between two currencies. Leverage is a double-edged sword, amplifying both potential profits and losses by allowing control over large positions with less capital. Margin is the required deposit to maintain leveraged positions, acting as security.

Pips, or percentage in points, are the smallest price increments, measuring profit and loss. Finally, spreads, the difference between ask and bid prices, constitute the primary trading cost and broker revenue. Mastering these concepts is vital for a successful forex trading career.

Read More: The Mindset of a Successful Trader

Is Forex Trading a Viable Career? Exploring Career Viability

The question, “Is forex trading a career?” is frequently asked by aspiring financial professionals. The answer is nuanced. While it presents significant opportunities, it also comes with considerable challenges and risks. Understanding both sides is vital when considering a forex trading career path and assessing if forex trading as a career aligns with your professional goals.

Potential and Opportunities in Forex Trading as a Career

The allure of a forex trading career stems from its numerous potential benefits. Forex trading offers substantial income potential, with successful traders capable of generating significant returns. The flexibility and independence are unmatched, allowing trading from anywhere with internet access and self-set hours. The market’s high liquidity ensures quick, efficient trade execution, minimizing price slippage, and global market access provides diverse trading opportunities across numerous currency pairs. These opportunities make a forex trading career path an attractive option for those seeking financial independence and dynamic work environments.

Challenges and Risks of a Forex Trading Career Path

Despite its potential, a forex trading career is fraught with challenges and risks that must be carefully considered. The forex market is inherently volatile and unpredictable, exposing traders to rapid, significant losses. Mastering forex demands a steep learning curve, encompassing technical and fundamental analysis, risk management, and trading psychology. The emotional and psychological stress from market volatility and risk management is considerable, requiring discipline and resilience. While entry can be with minimal capital, sustainable income generation often requires a substantial initial investment. Furthermore, the presence of unregulated brokers necessitates choosing a regulated forex broker to safeguard investments. Being aware of these pitfalls is crucial for anyone planning to pursue forex trading as a career.

Debunking Myths about Forex Trading Careers

Misconceptions about forex trading as a career are common. It’s important to separate fact from fiction to have a clear understanding of what this career path truly entails. Forex trading is often mistakenly seen as a get-rich-quick scheme, but in reality, it demands skill, strategy, discipline, and consistent effort, not luck. Another myth is the necessity of a finance degree; while helpful, dedication to learning and skill development are more critical for a forex trading career path. Lastly, forex trading is sometimes likened to gambling, but successful trading relies on informed decisions based on analysis and strategy, rather than chance, making forex trading as a career a profession based on skill and knowledge.

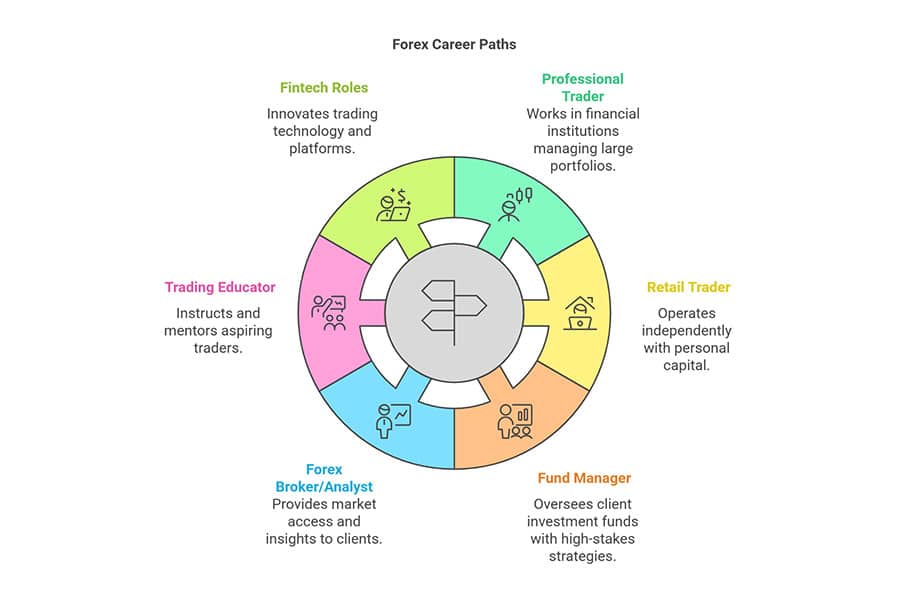

Exploring Forex Trading Career Paths: Diverse Roles in the Forex World

A forex trading career is not limited to just one role, offering diverse paths each with unique responsibilities and opportunities. Exploring these forex trading career paths can help align your skills and aspirations with the right role in the forex industry.

Professional Trader (Institutional Trading Career Path)

Professional traders in a forex trading career path often work within established financial institutions, managing significant capital and executing trades on a larger scale. This forex trading career path is for those seeking structured environments and team collaboration.

Role: Professional traders work for financial institutions such as banks, hedge funds, and investment firms, managing large portfolios and executing trades for the institution or clients. Responsibilities include analyzing markets, strategizing trades, executing large volumes, managing institutional risk, and offering market insights. Skills Required: Advanced analytical and technical abilities, deep market understanding, sophisticated risk management, and teamwork under pressure are essential for this forex trading career path.

Retail/Independent Trader: A Forex Trading Career as a Career

The forex trading career path of a retail trader offers autonomy and flexibility, ideal for self-directed individuals considering forex trading as a career.

Role: Retail traders operate independently, trading forex with personal capital from any location. Responsibilities involve creating strategies, market analysis, personal account trading, capital management, and continuous skill enhancement. Skills Required: Self-discipline, analytical prowess, risk management skills, emotional control, and a commitment to ongoing learning are crucial for success in forex trading as a career.

Fund Manager/Hedge Fund Trader Career Path in Forex

For a high-stakes forex trading career path, fund and hedge fund management offers significant asset management and growth opportunities. This forex trading career path is for those aiming for high-level financial management.

Role: Fund managers oversee client investment funds, including forex funds. Hedge fund traders utilize complex, higher-risk strategies for substantial returns. Responsibilities include asset management and growth, strategy development, market research, fund risk management, and investor reporting. Skills Required: Extensive market knowledge, advanced strategy development, exceptional risk management, client relations, and performance reporting are necessary for this demanding forex trading career path.

Forex Broker/Analyst Career Path

A forex trading career path can also lead to roles providing essential market access and expertise as brokers or analysts. This is a different facet of a forex trading career, focusing on market infrastructure and analysis.

Role: Forex brokers enable client trading, providing platforms and support. Forex analysts deliver market insights and educational resources. Responsibilities for brokers include client service, platform oversight, and regulatory adherence. Analysts focus on market research, report writing, webinars, and trading recommendations. Skills Required: Brokers need sales and service skills, market knowledge, and regulatory understanding. Analysts require strong analytical and communication skills, and deep market expertise to excel in this forex trading career path.

Trading Educator/Coach: A Rewarding Forex Trading Career

For those passionate about sharing forex knowledge, a forex trading career path as an educator or coach can be very rewarding. This forex trading career path allows you to shape future traders.

Role: Trading educators and coaches instruct individuals in forex trading through courses and personalized coaching. Responsibilities include developing educational content, providing tailored coaching, mentoring students, designing educational strategies, and keeping course material current with market trends. Skills Required: Excellent teaching and communication abilities, deep forex market knowledge, patience, and the capacity to simplify complex concepts are essential for a successful forex trading career path in education.

Fintech Roles in Forex: Innovating Your Forex Trading Career

For individuals with a technology background, a forex trading career path in fintech offers a chance to innovate within trading technology. This forex trading career path is ideal for those who blend tech skills with financial markets.

Role: Fintech professionals in forex create trading platforms and algorithmic systems, driving financial technology advancements. Responsibilities encompass developing and maintaining trading software, creating algorithmic trading strategies, innovating fintech solutions, and ensuring platform security and efficiency. Skills Required: Strong programming skills (Python, Java, C++), financial market knowledge, trading technology understanding, and a drive for fintech innovation are key for this forward-looking forex trading career path.

Read More: Skills needed for forex trading

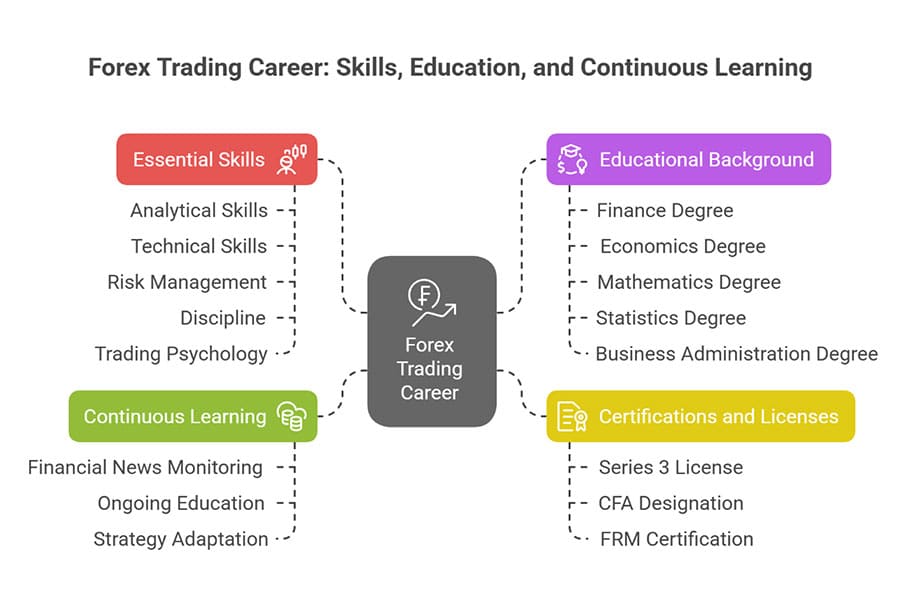

Skills and Qualifications for a Forex Trading Career: Building Your Toolkit

To excel in a forex trading career, a specific skill set and qualifications are vital, forming the foundation for success in this demanding field. Cultivating these is a critical step in any forex trading career path. These skills are essential whether you pursue forex trading as a career independently or within an institution.

Essential Skills for a Forex Trading Career

Certain core skills are indispensable for anyone pursuing forex trading as a career. These skills enable traders to navigate the complexities of the market and make informed decisions. Analytical skills are crucial for interpreting market data and trends. Technical skills are needed for platform proficiency and chart analysis. Risk management is essential for capital protection. Discipline ensures adherence to trading plans, and understanding trading psychology helps manage emotions effectively, all vital for a thriving forex trading career path.

Educational Background and Relevant Degrees for a Forex Trading Career Path

While formal education isn’t always mandatory for a forex trading career path, certain degrees offer a significant advantage. Finance or economics degrees provide a strong base in market principles. Mathematics or statistics backgrounds enhance quantitative analysis skills. Business administration degrees offer broader business acumen beneficial in various forex roles. However, practical experience and continuous learning are equally, if not more, important in a forex trading career.

Certifications and Licenses to Enhance Your Forex Trading Career

Depending on your chosen forex trading career path, especially in institutional settings, certifications and licenses enhance professional credibility and ensure regulatory compliance. The Series 3 license is needed in the U.S. for forex-related roles involving client funds. The CFA designation boosts credibility in finance, particularly for fund management, and the FRM certification is valuable for risk management-focused roles, all adding significant value to a forex trading career.

Importance of Continuous Learning and Market Knowledge for a Forex Trading Career

The forex market’s dynamic nature makes continuous learning essential for a successful forex trading career. Staying updated is crucial for adapting to market changes and maintaining a competitive edge. This involves regularly monitoring financial news, pursuing ongoing education through various resources, and adapting trading strategies to evolving market conditions. Flexibility and a commitment to lifelong learning are key to sustained success in your forex trading career path and when considering forex trading as a career.

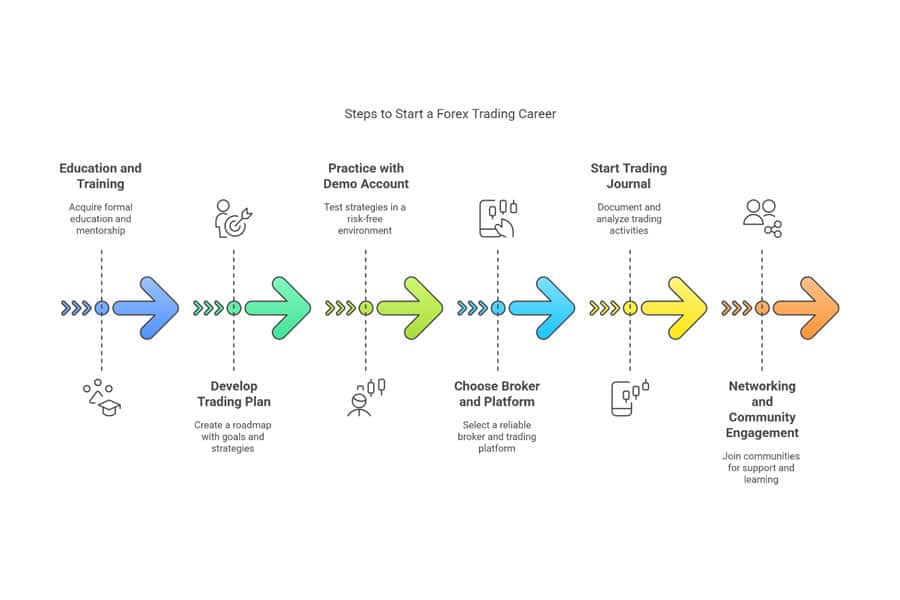

Steps to Start a Forex Trading Career: Your Action Plan

Embarking on a forex trading career requires a structured approach. Here are actionable steps to guide your journey and build a solid foundation for your forex trading career path. These steps are designed to help anyone seriously considering forex trading as a career.

Education and Training for Your Forex Trading Career

A strong educational foundation is the first critical step in your forex trading career path. Begin with formal education in finance or economics. Supplement this with online courses from platforms like Coursera and Udemy, and seek mentorship from experienced traders to gain practical insights. This comprehensive education is crucial for a solid forex trading career.

Develop a Trading Plan and Strategy for Forex Trading as a Career

A well-defined trading plan is your roadmap to success in a forex trading career. Start by defining clear, realistic financial goals and understanding your risk tolerance. Choose a trading style that fits your personality and schedule, such as day trading or swing trading. Then, develop a detailed trading strategy with clear entry and exit rules, risk management protocols, and market analysis techniques. This plan is the backbone of your forex trading career path.

Practice with a Demo Account Before Launching Your Forex Trading Career

Before risking real money, practice with a demo account from a broker for forex trading. This risk-free environment allows you to test strategies, refine your trading plan, and familiarize yourself with trading platforms without financial risk. Use this phase to build confidence and identify areas for improvement, crucial preparation for a forex trading career.

Choose a Broker and Platform for Your Forex Trading Career Path

Selecting the right broker for forex trading and platform is crucial for executing trades efficiently and effectively in your forex trading career path. Your broker is your gateway to the market. Opt for a regulated forex broker from a reputable jurisdiction like ASIC or FCA to ensure fund security and fair practices. Evaluate platforms based on user-friendliness, charting tools, analytical resources, and trading conditions such as spreads and leverage. Consider platforms like MT4, MT5, cTrader, and proprietary options when starting your forex trading career.

Start with a Trading Journal to Track Your Forex Trading Career Progress

Maintain a trading journal to track and analyze your trades. Record entry and exit points, rationale, and emotional states for each trade. Regularly review your journal to identify patterns in your trading, understand your strengths and weaknesses, and continuously refine your strategy for better performance. A trading journal is an indispensable tool for anyone serious about a forex trading career.

Networking and Community Engagement in Your Forex Trading Career

Networking and community engagement are vital for ongoing learning and support in your forex trading career path. Join online trading communities, attend industry events, and seek mentorship to exchange ideas, learn from peers, and stay informed about market trends. These connections can provide invaluable insights and support as you navigate your forex trading career journey and consider forex trading as a career.

Day in the Life of a Forex Trader: A Glimpse into the Routine

Understanding a typical day in the life of a forex trader provides a realistic perspective on this forex trading career. It involves a structured routine of analysis, trading, and continuous learning, essential for anyone considering forex trading as a career.

Typical Daily Routine in a Forex Trading Career

A forex trader’s day often begins with morning market analysis, reviewing overnight global market movements and economic news. Strategy planning follows, setting trading parameters for the day. The trading day involves continuous market monitoring, executing planned trades, and actively managing open positions. Evenings are dedicated to trade review, journaling, and preparation for the next day’s trading session, ensuring continuous improvement and readiness in your forex trading career path.

Market Monitoring and Analysis for a Forex Trading Career

Effective market monitoring and analysis are integral to a forex trading career. Traders must stay informed by regularly checking economic calendars for impactful news releases, utilizing technical analysis tools to identify trends, and conducting fundamental analysis to understand broader economic influences on currency values. These skills are honed over time in a forex trading career path.

Executing Trades and Managing Positions in Your Forex Trading Career

Executing trades and managing positions efficiently are core skills in a forex trading career. Proficiency in using trading platforms for quick trade execution, understanding and using various order types to manage risk, and implementing strict risk management strategies are essential for protecting capital and optimizing trading outcomes in forex trading as a career.

Continuous Learning and Adaptation in a Forex Trading Career Path

In the ever-evolving forex market, continuous learning and adaptation are not optional—they are essential components of a thriving forex trading career. The market demands constant evolution. Successful traders in a forex trading career path commit to ongoing education to enhance their skills, adapt to market changes, and develop psychological resilience to handle market volatility and emotional pressures. This commitment ensures long-term adaptability and success in forex trading as a career.

Read More: How much do prop firm traders make

Salary and Earning Potential in Forex Trading: Understanding the Numbers for Your Career

Earning potential is a key attraction of a forex trading career, but income variability and influencing factors must be well understood for realistic expectations. Assessing salary and earning potential is crucial when considering forex trading as a career.

Income Variability in Forex Trading as a Career

Income in forex trading as a career is variable, not guaranteed. It fluctuates based on trading skill, invested capital, market conditions, and risk management effectiveness. Earnings are performance-based, meaning high profits are possible, but losses are equally likely, necessitating a realistic approach to income expectations when considering forex trading as a career.

Factors Affecting Trader Salary in a Forex Trading Career

Several factors dictate earning potential in a forex trading career. Greater experience and skill typically lead to higher returns. Larger trading capital increases potential profits, but also risk. A robust trading strategy significantly impacts profitability, and overall market conditions can either favor or hinder trading outcomes, influencing trader income in a forex trading career path.

Salary Expectations for Different Forex Career Paths

Salary expectations differ significantly across various forex trading career paths. Institutional traders can expect a $70,000 to $200,000+ annual salary with performance bonuses. Fund and hedge fund managers may reach multi-million dollar incomes based on fund size and returns. Retail traders’ earnings vary widely, from supplementary income to substantial full-time earnings. Forex brokers and analysts typically earn between $50,000 and $150,000, while trading educators and coaches can range from $50,000 to over $200,000, depending on their client base and services, illustrating the diverse income landscape within a forex trading career.

Pros and Cons of a Forex Trading Career: Weighing the Balance

Choosing a forex trading career involves carefully considering both the advantages and disadvantages. A balanced perspective is essential for making an informed career decision.

Advantages

The advantages of a forex trading career path are compelling, offering significant benefits that appeal to many seeking alternative career options.

- Flexibility and Autonomy: Forex trading offers unparalleled flexibility in terms of work hours and location. Traders can work from anywhere and set their own schedules.

- High-Income Potential: The potential for high earnings is a major attraction. Successful traders can generate significant income, surpassing traditional career salaries.

- Intellectual Challenge: Forex trading is intellectually stimulating, requiring continuous learning, analysis, and strategic thinking. It offers a dynamic and engaging work environment.

- Market Accessibility: The forex market is highly accessible, with low barriers to entry. Anyone with an internet connection and capital can start trading.

- Global Opportunities: Forex trading provides exposure to global financial markets and diverse trading opportunities across various currency pairs.

Disadvantages

Despite its allure, a forex trading career path also presents notable disadvantages that should not be overlooked. Understanding these downsides is crucial for realistic career planning.

- High Risk of Loss: The forex market is inherently risky, and traders can experience significant losses. Capital preservation and risk management are critical challenges.

- Market Volatility: High market volatility can lead to rapid and unpredictable price swings, making it challenging to consistently generate profits.

- Emotional Stress: The pressure of managing risk and making quick decisions can be emotionally stressful. Traders must develop emotional resilience to cope with market pressures.

- Long and Irregular Hours: While flexible, successful trading often requires long and irregular hours, especially when monitoring global markets across different time zones.

- Initial Capital Requirement: Generating a sustainable income typically requires a substantial initial capital investment, which can be a barrier for some.

Opofinance Services: Your Partner in Forex Trading Success

For traders looking for a reliable and innovative forex broker, Opofinance stands out as an ASIC-regulated platform designed to enhance your trading journey. Opofinance offers a suite of advanced tools and services tailored to meet the needs of both novice and experienced traders.

Why Choose Opofinance?

- Advanced Trading Platforms: Trade seamlessly on industry-leading platforms including MT4, MT5, and cTrader, alongside the intuitive OpoTrade platform, ensuring you have the tools you need for effective trading.

- Innovative AI Tools: Leverage the power of Artificial Intelligence with Opofinance’s AI Market Analyzer for data-driven insights, AI Coach for personalized trading guidance, and AI Support for instant assistance, giving you a competitive edge in the market.

- Social & Prop Trading: Engage in social trading to learn from and potentially copy successful traders, and explore prop trading opportunities to amplify your trading capital.

- Secure & Flexible Transactions: Enjoy peace of mind with safe and convenient deposit and withdrawal methods, including crypto payments, all with zero fees from Opofinance, ensuring your transactions are both secure and cost-effective.

Ready to Elevate Your Trading Experience? Visit Opofinance today and discover how their advanced platform and innovative tools can support your forex trading career aspirations.

Conclusion: Charting Your Course in Forex Trading

In conclusion, a forex trading career is a path filled with potential for high earnings and flexibility, yet it demands a realistic understanding of its inherent risks and challenges. Success hinges on dedication, continuous education, effective risk management, and disciplined emotional control. For those wondering ” Is forex trading a career?”, the answer is yes, but it requires commitment and resilience.

By understanding the forex market, exploring different career paths, acquiring essential skills, and leveraging the right resources, you can position yourself for a rewarding forex trading career. Whether you aspire to be an independent trader, a fund manager, or a fintech innovator in forex, the journey begins with education, practice, and a commitment to excellence in your chosen forex trading career path. Considering forex trading as a career is a significant decision, and this guide aims to provide clarity and direction.

Key Takeaways

- Forex Trading Career Viability: Forex trading can be a viable and rewarding career, offering high earning potential and flexibility, but it is not without significant risks and challenges.

- Essential Skills: Success requires strong analytical skills, technical proficiency, risk management expertise, discipline, and emotional control.

- Diverse Career Paths: Opportunities range from institutional trading and fund management to retail trading, brokerage, education, and fintech roles.

- Continuous Learning: The forex market demands constant learning and adaptation. Staying updated with market trends and enhancing skills are crucial for long-term success.

- Resource Utilization: Leverage online courses, books, communities, and mentorship programs to support your career development in forex trading.

- Broker Selection: Choosing a regulated forex broker like Opofinance is essential for a secure and efficient trading experience, providing advanced platforms and innovative tools.

What is the minimum capital required to start a forex trading career as an independent trader?

While you can technically start with as little as $100, to realistically generate a sustainable income, a more substantial capital base is advisable. Starting with at least $5,000 to $10,000 allows for better risk management and the ability to withstand market fluctuations. Remember, the capital you start with directly influences the size of positions you can take and, consequently, your potential profits. However, always prioritize trading with capital you can afford to lose.

How long does it typically take to become consistently profitable in forex trading?

Profitability in forex trading is not achieved overnight. It generally takes aspiring traders anywhere from six months to two years of dedicated learning, practice, and consistent effort to become consistently profitable. This timeline varies greatly depending on individual learning speed, dedication, quality of education, and psychological resilience. Consistent profitability requires mastering a robust trading strategy, effective risk management, and emotional discipline, all of which take time to develop and refine.

Are there any specific personality traits that make someone more suitable for a forex trading career?

Yes, certain personality traits can significantly enhance a trader’s likelihood of success. Key traits include discipline, patience, analytical thinking, emotional stability, and adaptability. Disciplined individuals are better at sticking to trading plans; patient traders avoid impulsive decisions; analytical thinkers excel at market analysis; emotionally stable traders manage stress and fear effectively; and adaptable individuals can adjust strategies to changing market conditions. These traits, while beneficial, can also be developed and honed over time with conscious effort and practice.