Forex trading can be a lucrative venture, but for those trading with small accounts, it poses unique challenges and opportunities. Effective strategies tailored to smaller accounts can significantly enhance the likelihood of success. This article explores the best forex trading strategies for small accounts, emphasizing risk management, high-probability setups, and consistent learning. Partnering with a trusted online forex broker can further support traders in implementing these strategies effectively.

Challenges of Trading with a Small Account

Limited Capital and Margin Requirements

One of the primary challenges when trading with a small account is the limitation of capital. Limited funds mean limited margin, which restricts the size and number of trades you can place. This constraint requires traders to be more selective and strategic about their trading decisions. The smaller your account, the less margin you have to work with, which limits your trading power. Therefore, it’s crucial to manage your available capital efficiently and avoid over-leveraging, which can lead to substantial losses.

Importance of Risk Management

With limited capital, risk management becomes paramount. Small accounts cannot withstand large losses, so protecting your capital through strict risk management practices is essential. This includes using stop-loss orders, maintaining a positive risk-reward ratio, and limiting the amount of capital risked per trade. Effective risk management helps ensure that a few bad trades won’t deplete your account, allowing you to stay in the game longer and giving your trading strategies a chance to prove their profitability over time.

Strategies for Small Accounts

Focus on Lower Time Frames

Trading on lower time frames can be highly effective for small accounts due to the frequent opportunities to enter and exit the market, allowing traders to capitalize on short-term price movements. Two popular strategies for trading on lower time frames are day trading and scalping.

Read More: Ict Trading Breaker Block vs Order Block

Day Trading

Day Trading Overview

Day trading involves buying and selling within the same trading day, capitalizing on small price movements. Small accounts benefit from this short-term strategy by avoiding overnight positions. Day traders focus on liquid pairs like EUR/USD, GBP/USD, and USD/JPY.

Key Considerations for Day Trading

- Volatility and Liquidity: Target high-volatility, high-liquidity pairs for ample trading opportunities.

- Technical Indicators: Use indicators like Moving Averages, RSI, and Bollinger Bands for entry and exit points.

- News and Economic Events: Monitor economic calendars for market-moving events.

- Discipline and Patience: Stick to your trading plan and avoid impulsive decisions.

Advantages of Day Trading for Small Accounts

- Reduced Overnight Risk: No exposure to overnight price movements.

- Frequent Opportunities: Many trading chances for small accounts to grow quickly.

Scalping

Scalping Overview

Scalping involves numerous small trades, held for seconds to minutes, to profit from tiny price changes. This strategy requires quick decision-making and often uses leverage.

Key Considerations for Scalping

- High-Frequency Trading: Execute many trades within short time frames.

- Technical Analysis: Rely on technical analysis and indicators like MACD and Stochastic Oscillator.

- Tight Spreads: Focus on pairs with tight spreads to minimize costs.

- Risk Management: Use tight stop-loss orders to limit losses.

Advantages of Scalping for Small Accounts

- Small Capital Requirements: Suitable for limited funds.

- Quick Profit Realization: Rapid profit accumulation reduces market exposure.

Trade with Micro Lots

Minimizing Risk with Smaller Trade Sizes

Trading micro lots (1,000 units) reduces risk compared to standard lots (100,000 units). This allows entry with smaller capital and limits potential losses.

Key Benefits of Trading with Micro Lots

- Lower Risk Exposure: Limits risk per trade, aiding account management.

- Greater Flexibility: Adjust position sizes based on market conditions.

- Easier Diversification: Spread trades across multiple pairs, reducing the impact of any single trade.

Implementing Micro Lot Trading

- Calculate Position Sizes: Determine size based on account balance and risk tolerance.

- Use Leverage Cautiously: Avoid excessive leverage to minimize losses.

- Monitor Trading Costs: Be aware of spreads and commissions impacting profitability.

Prioritize High-Probability Setups

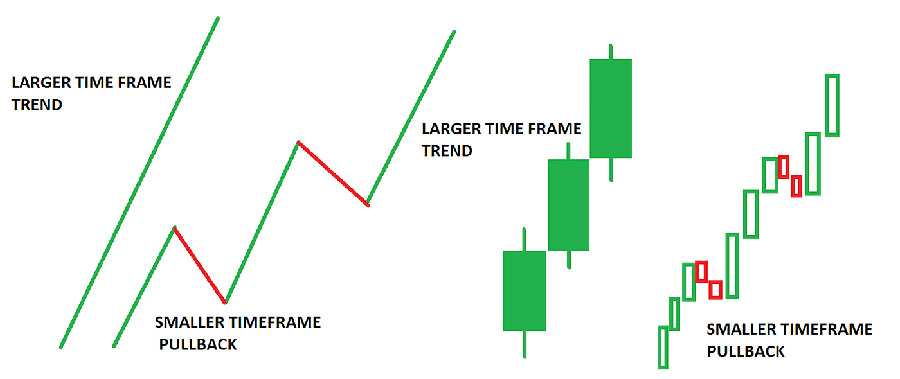

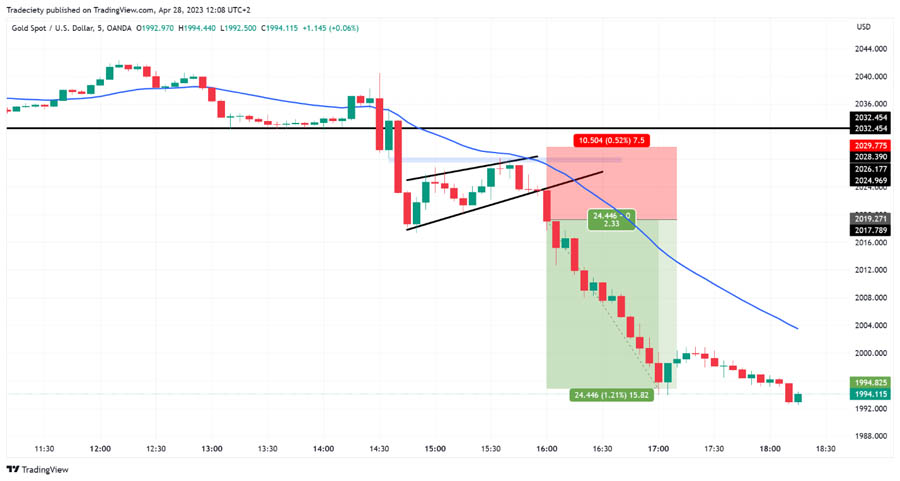

Technical Analysis and Price Action

Focus on high-probability setups to increase the likelihood of success. Use technical analysis and price action to identify clear signals and patterns.

Key Considerations for High-Probability Setups

- Technical Indicators: Use Moving Averages, RSI, MACD, and Fibonacci retracement levels.

- Chart Patterns: Identify patterns like head and shoulders, double tops, and flags.

- Support and Resistance Levels: Look for key levels where price action reacts.

- Market Trends: Trade with the trend using trend-following indicators.

Advantages of Prioritizing High-Probability Setups

- Increased Confidence: Higher confidence in trades reduces emotional decisions.

- Better Risk Management: Clear entry and exit points aid in setting stop-loss and take-profit levels.

Patience and Waiting for the Right Opportunity

Avoiding Overtrading

Patience is crucial for small accounts. Avoid overtrading by waiting for high-quality setups, which can reduce significant losses and protect the account.

Key Considerations for Avoiding Overtrading

- Trading Plan: Stick to your plan and avoid emotional decisions.

- Quality Over Quantity: Focus on high-quality trades rather than the number of trades.

- Emotional Control: Avoid trading out of boredom or frustration.

- Market Conditions: Avoid trading in low volatility or high uncertainty periods.

Advantages of Patience and Waiting for the Right Opportunity

- Reduced Risk: Protect capital by avoiding unnecessary trades.

- Improved Performance: Patience and discipline can enhance overall profitability.

By incorporating these strategies, traders with small accounts can navigate the forex market more effectively, managing risk and increasing their chances of success.

Read More: Maximize Your $100 Forex Account: The Ultimate Guide to Choosing the Perfect Lot Size

Risk Management for Small Accounts

Effective risk management is crucial for forex traders with small accounts. Limited capital requires stringent measures to protect against significant losses and ensure long-term success. This section explores key risk management strategies to help small account traders preserve their capital and optimize their trading performance.

Strict Stop-Loss Orders

Protecting Your Capital

A stop-loss order is a pre-set level at which a trade will automatically close to prevent further losses. For small accounts, using strict stop-loss orders is essential to protect against substantial drawdowns. Setting stop-loss levels helps traders limit losses on each trade and ensures that no single trade can significantly impact the overall account balance.

Key Considerations for Stop-Loss Orders

- Appropriate Placement: Place stop-loss orders at strategic levels based on technical analysis, such as just below support levels for long positions or above resistance levels for short positions.

- Adjusting Stops: Adjust stop-loss levels as the trade moves in your favor to lock in profits and reduce potential losses.

- Discipline: Always adhere to your stop-loss orders and avoid moving them further away to give a losing trade more room to recover.

Advantages of Using Stop-Loss Orders

- Capital Preservation: Stop-loss orders help preserve capital by limiting losses on each trade.

- Emotional Control: Pre-setting stop-loss levels reduces emotional decision-making and helps traders stick to their trading plan.

- Consistent Risk Management: Consistently using stop-loss orders promotes disciplined trading and long-term success.

Positive Risk-Reward Ratio

Maximizing Potential Profits

A positive risk-reward ratio means that the potential profit on a trade is greater than the potential loss. For example, a 2:1 risk-reward ratio implies that for every dollar risked, the trader aims to make two dollars in profit. Maintaining a positive risk-reward ratio is critical for small accounts to ensure that profits outweigh losses over time.

Key Considerations for Risk-Reward Ratio

- Set Profit Targets: Establish clear profit targets based on technical analysis and market conditions.

- Calculate Risk-Reward Before Entry: Always calculate the risk-reward ratio before entering a trade to ensure it meets your criteria.

- Adhere to Ratios: Stick to trades that offer favorable risk-reward ratios and avoid those that do not meet your criteria.

Advantages of a Positive Risk-Reward Ratio

- Enhanced Profitability: A positive risk-reward ratio increases the likelihood of net profitability over a series of trades.

- Risk Management: Focusing on favorable risk-reward ratios helps manage risk and protect capital.

- Strategic Trading: Encourages strategic and disciplined trading decisions.

Position Sizing

Limiting Risk Per Trade

Position sizing involves determining the number of units to trade based on account size and risk tolerance. For small accounts, it’s essential to limit the amount of capital risked per trade to prevent significant losses. A common rule of thumb is to risk only 1-2% of the total account balance on any single trade.

Key Considerations for Position Sizing

- Calculate Position Size: Use position sizing formulas or calculators to determine the appropriate trade size based on risk tolerance and stop-loss levels.

- Adjust for Volatility: Consider market volatility when determining position sizes, as higher volatility may require smaller positions to manage risk effectively.

- Consistent Application: Apply position sizing consistently across all trades to maintain a disciplined approach to risk management.

Advantages of Proper Position Sizing

- Risk Control: Limiting risk per trade helps protect the overall account balance and ensures longevity in the market.

- Emotional Stability: Smaller positions reduce emotional stress and help traders stick to their trading plan.

- Long-Term Success: Consistent position sizing promotes sustainable trading practices and long-term profitability.

Diversification

Spreading Risk Across Trades

Diversification involves spreading risk across multiple trades and currency pairs to reduce the impact of any single trade on the overall account. For small accounts, diversification can help mitigate risks and enhance the potential for steady returns.

Key Considerations for Diversification

- Multiple Currency Pairs: Trade multiple currency pairs to avoid concentration risk in a single pair.

- Different Strategies: Use different trading strategies or time frames to diversify risk.

- Monitor Correlations: Be aware of correlations between currency pairs to ensure true diversification and avoid exposure to similar risks.

Advantages of Diversification

- Risk Reduction: Diversification reduces the impact of adverse movements in any single trade or currency pair.

- Stable Returns: A diversified approach can lead to more stable returns and lower volatility in the account balance.

- Opportunity Maximization: Diversifying across multiple pairs and strategies increases the number of trading opportunities.

Emotional Control and Discipline

Maintaining a Steady Mindset

Emotional control and discipline are vital for successful risk management. Small account traders must manage emotions such as fear and greed, which can lead to impulsive decisions and increased risk.

Key Considerations for Emotional Control

- Stick to Your Plan: Adhere strictly to your trading plan and avoid making decisions based on emotions.

- Mindfulness Practices: Incorporate mindfulness or stress-reduction techniques to maintain emotional balance.

- Review and Reflect: Regularly review trades and reflect on emotional triggers to improve discipline and control.

Advantages of Emotional Control

- Consistent Trading: Emotional control leads to consistent trading practices and better adherence to risk management strategies.

- Reduced Mistakes: Managing emotions helps reduce impulsive decisions and trading mistakes.

- Long-Term Success: Emotional stability is crucial for long-term trading success and sustainability.

Read More: How much can I make with $100 in Forex ?

Continuous Learning and Improvement

Adapting and Evolving Strategies

Continuous learning and improvement are essential for small account traders to stay competitive and effective in the forex market. This involves regularly updating knowledge, refining strategies, and adapting to changing market conditions.

Key Considerations for Continuous Learning

- Educational Resources: Utilize educational resources such as books, courses, webinars, and articles to enhance trading knowledge.

- Backtesting and Practice: Regularly backtest strategies and practice on demo accounts to refine techniques and build confidence.

- Community Engagement: Engage with trading communities, forums, and mentors to gain insights and share experiences.

Advantages of Continuous Learning

- Enhanced Skills: Continuous learning improves trading skills and knowledge, leading to better decision-making.

- Adaptability: Staying informed and adaptable helps traders respond effectively to market changes.

- Increased Confidence: Ongoing education and practice build confidence and competence in trading.

By implementing these risk management strategies, traders with small accounts can better protect their capital, manage risk, and enhance their chances of long-term success in the forex market.

Additional Considerations for Small Accounts

Develop a Trading Plan and Stick to It

Defining Your Strategy and Rules

Developing a trading plan is essential for success in forex trading. A trading plan outlines your strategy, entry and exit rules, risk management parameters, and overall trading goals. Sticking to your trading plan helps ensure consistency and discipline, reducing the likelihood of emotional and impulsive trading decisions.

A well-defined trading plan should include specific criteria for entering and exiting trades, risk management guidelines, and performance evaluation metrics. By following a trading plan, traders can stay focused and disciplined, increasing their chances of success.

Practice on a Demo Account

Building Confidence and Refining Strategies

Before risking real money, it’s crucial to practice on a demo account. A demo account allows traders to test their strategies and build confidence in a risk-free environment. This practice helps traders refine their approach and identify any weaknesses in their strategy before trading with real capital.

Using a demo account provides an opportunity to gain practical experience and develop a deeper understanding of market dynamics. By practicing on a demo account, traders can improve their skills and increase their chances of success when trading with real money.

Conclusion

Navigating forex trading with a small account is challenging but achievable with strategic approaches and discipline. Focusing on lower time frames like day trading and scalping helps capitalize on short-term opportunities while minimizing risks. Trading with micro lots enhances flexibility and risk management. Emphasizing high-probability setups, patience, and avoiding overtrading are crucial for sustained profitability.

- Effective Risk Management: Successful forex trading for small accounts relies on stringent risk management. Implementing stop-loss orders, maintaining a favorable risk-reward ratio, and using proper position sizing safeguard capital and support growth. Diversifying trades across currency pairs reduces risk and enhances stability.

- Continuous Learning and Discipline: Continuous learning and emotional discipline are vital for forex competitiveness. Updating knowledge, refining strategies, and staying adaptable build trader confidence and skills. Disciplined execution of plans minimizes emotional decisions and improves consistency.

- last Conclusion: Forex trading success with a small account demands strategic planning, disciplined execution, and ongoing education. Following these strategies and mastering risk management techniques empower traders to navigate effectively, protect capital, and achieve sustainable growth.

What is the best forex trading strategy for small accounts?

The best forex trading strategy for small accounts depends on individual preferences and risk tolerance. However, strategies such as day trading, scalping, and using micro lots are often effective for small accounts. These strategies allow for quick profit realization, minimized risk, and greater flexibility in trade sizes.

How can I manage risk effectively with a small forex trading account?

Effective risk management is crucial for small forex trading accounts. This includes using strict stop-loss orders, maintaining a positive risk-reward ratio, and limiting the amount of capital risked per trade. By following these risk management practices, traders can protect their capital and increase their chances of long-term success.

Is it possible to make a consistent profit with a small forex trading account?

Yes, it is possible to make a consistent profit with a small forex trading account. Success requires discipline, a well-defined trading plan, effective risk management, and continuous learning. By following these principles and focusing on high-probability setups, traders can achieve consistent profitability even with a small account.