In the fast-paced world of forex trading, mastering the best trading strategies for volatile markets is crucial for success. The forex market, with its average daily trading volume of $6.6 trillion as of 2022, is known for its high liquidity and potential for significant price fluctuations. Implementing the right trading strategies for volatile markets can make the difference between profit and loss. For those looking for a broker for forex trading, currency markets can experience rapid movements due to economic data releases, geopolitical events, and shifts in monetary policy.

Volatility in the forex market is often measured by the Average True Range (ATR) indicator. For major currency pairs like EUR/USD, an ATR reading above 100 pips is generally considered high volatility. During major economic events or crises, volatility can spike dramatically. For instance, during the Swiss National Bank’s decision to remove the Swiss Franc’s peg to the Euro in 2015, the EUR/CHF pair moved over 2,000 pips in a single day.

This comprehensive guide explores seven proven forex trading strategies designed to help you navigate and profit from market volatility. Each of these high volatility trading strategies is backed by data and real-world examples to illustrate their effectiveness in volatile market conditions.

Read More: forex fundamental trading strategies

1. Currency Pair Diversification: Spreading Risk Across Markets

Currency pair diversification is a fundamental strategy for managing risk in volatile forex markets. By trading multiple currency pairs, you can potentially offset losses in one pair with gains in another.

Key aspects of currency pair diversification:

- Trade across major, minor, and exotic pairs

- Consider correlations between currency pairs

- Balance high-volatility pairs with more stable ones

Implementing this strategy requires a solid understanding of various currency pairs and their typical behavior during different market conditions.

Diversification in Practice:

Consider the following portfolio allocation based on historical volatility and correlation data:

- 40% in major pairs (e.g., EUR/USD, GBP/USD, USD/JPY)

- 30% in minor pairs (e.g., EUR/GBP, AUD/CAD)

- 20% in commodity currencies (e.g., USD/CAD, AUD/USD)

- 10% in exotic pairs (e.g., USD/SGD, EUR/TRY)

This allocation aims to balance exposure across different economic regions and risk levels. For example, while EUR/USD typically has an average daily range of 70-80 pips, exotic pairs like USD/TRY can move 300-400 pips in a day during volatile periods.

Correlation Consideration:

It’s crucial to understand currency pair correlations when diversifying. For instance:

- EUR/USD and GBP/USD have a strong positive correlation (often above 0.90)

- USD/CHF typically has a strong negative correlation with EUR/USD (often below -0.90)

- AUD/USD and USD/CAD often have a negative correlation due to their commodity-driven nature

By selecting pairs with varying correlations, traders can create a more balanced portfolio that’s resilient to market shocks.

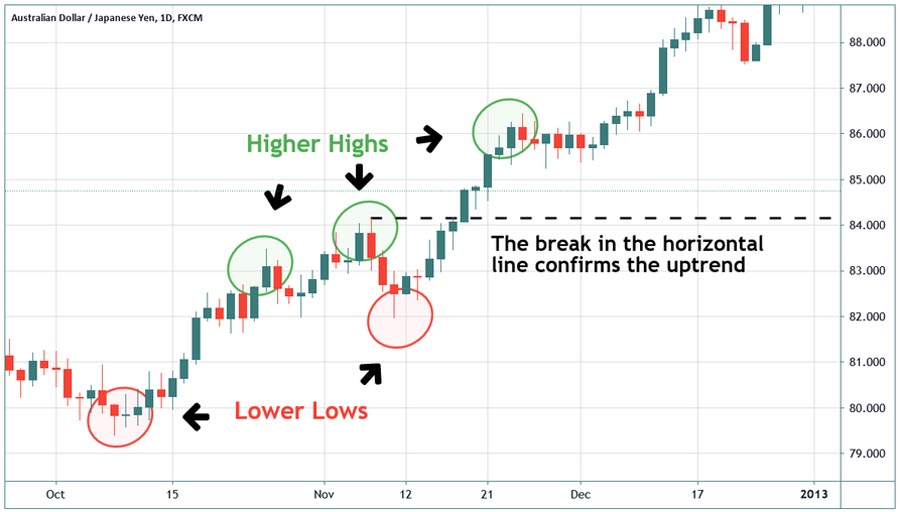

2. Volatility Breakout Strategy: Capitalizing on Strong Moves

The volatility breakout strategy aims to profit from sudden, strong price movements often seen in volatile markets. This approach involves:

- Identifying key support and resistance levels

- Setting entry orders above and below these levels

- Using volatility indicators like Average True Range (ATR) to adjust stop-loss and take-profit levels

Traders using this strategy should be prepared for false breakouts and have a clear plan for managing such scenarios.

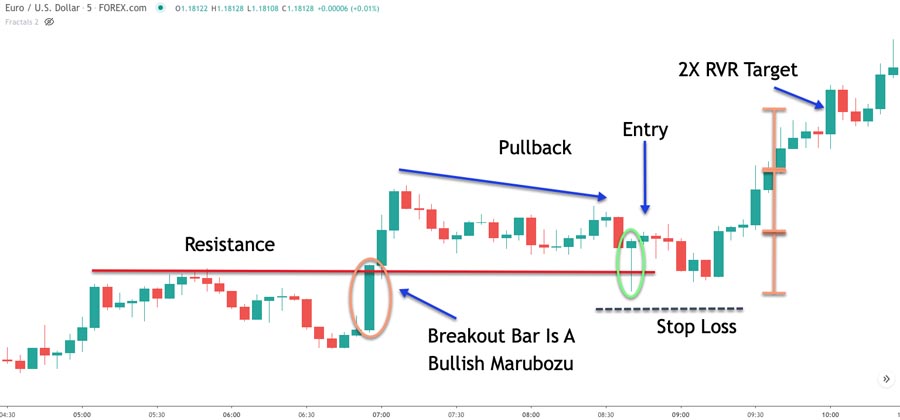

Implementing the Volatility Breakout Strategy:

- Identify the average daily range: For EUR/USD, this might be around 70-80 pips in normal conditions.

- Set breakout levels: Place entry orders 20-30 pips above and below key support and resistance levels.

- Use ATR for stop-loss and take-profit: For example, set stop-loss at 1x ATR and take-profit at 2x ATR.

Real-World Example:

During the Brexit referendum in June 2016, GBP/USD experienced a significant breakout. The pair opened at 1.4947 and dropped to a low of 1.3228 within 24 hours – a move of over 1,700 pips. Traders using a volatility breakout strategy could have captured a substantial portion of this move by:

- Identifying the pre-referendum high of 1.5000 as a key level

- Setting a sell entry order at 1.4900 (100 pips below the high)

- Using a wider stop-loss of 200 pips due to expected high volatility

- Setting a take-profit target of 500 pips

This approach would have yielded a potential 5:1 reward-to-risk ratio on this trade.

Read More: hedging strategies in forex trading

3. Forex Hedging: Protecting Positions in Uncertain Times

Hedging in forex involves taking offsetting positions to protect against adverse price movements. Common hedging strategies include:

- Direct hedging: Opening opposing positions in the same currency pair

- Correlation hedging: Using correlated currency pairs to offset risk

- Options hedging: Utilizing forex options to limit potential losses

While hedging can provide protection, it’s important to consider the costs and potential impact on overall profitability.

Direct Hedging Example:

Suppose you have a long position of 100,000 EUR/USD at 1.2000. To hedge this position, you could:

- Open a short position of 100,000 EUR/USD at the current market price

- This locks in your profit/loss at the current level

- If EUR/USD drops to 1.1900, your long position loses 1,000 USD, but your short position gains 1,000 USD, netting zero

Correlation Hedging:

Using correlated pairs can be more cost-effective than direct hedging. For example:

- Long 100,000 EUR/USD at 1.2000

- Short 75,000 GBP/USD at 1.4000 (assuming a 0.75 correlation)

- If EUR/USD drops 100 pips, GBP/USD is likely to drop around 75 pips, partially offsetting the loss

Options Hedging:

Buying put options can limit downside risk. For instance:

- Long 100,000 EUR/USD at 1.2000

- Buy a 1-month 1.1900 put option for 50 pips premium

- This limits your maximum loss to 150 pips (100 pips move + 50 pips premium), regardless of how far the market falls

Read More: best strategy for cfd trading

4. News Trading: Leveraging Economic Releases

Volatile markets often result from significant economic news releases. The news trading strategy involves:

- Monitoring economic calendars for high-impact events

- Analyzing potential outcomes and market reactions

- Entering trades based on the actual data release and initial market response

This strategy requires quick decision-making and the ability to interpret economic data effectively.

Key Economic Indicators and Their Impact:

- Non-Farm Payrolls (NFP): Released monthly, often causes 50-100 pip moves in EUR/USD within minutes

- Interest Rate Decisions: Can lead to 100-200 pip moves in affected currency pairs

- GDP Data: Quarterly releases can result in 30-70 pip moves

News Trading Approach:

- Straddle Strategy: Place buy and sell stop orders 20-30 pips above and below the current price before the news release

- Set stop-loss at 15-20 pips for each order

- Cancel the untriggered order once one side is activated

- Use a take-profit of 2-3 times the stop-loss distance

Historical Example:

During the March 2020 emergency Fed rate cut (due to COVID-19), EUR/USD moved over 200 pips in less than an hour. Traders using a straddle strategy could have profited regardless of the direction, given the large movement.

5. Range Trading in Volatile Markets

Even in volatile markets, currencies often trade within a range. Range trading strategies involve:

- Identifying support and resistance levels

- Entering buy orders near support and sell orders near resistance

- Using oscillators like RSI or Stochastic to confirm overbought or oversold conditions

Traders should be aware that strong trends can break established ranges, necessitating a quick shift in strategy.

Implementing Range Trading:

- Identify the range: Use recent highs and lows to establish support and resistance levels

- Confirm with technical indicators: RSI below 30 for buying, above 70 for selling

- Set entry orders: Place buy orders 5-10 pips above support, sell orders 5-10 pips below resistance

- Use tight stop-losses: Set stops 15-20 pips below support for longs, above resistance for shorts

- Take profit at the opposite end of the range

Range Trading Example:

Suppose EUR/USD is trading between 1.1800 (support) and 1.1900 (resistance) during a volatile period:

- Place a buy order at 1.1810 with a stop-loss at 1.1790

- Set a take-profit order at 1.1890

- This setup offers a potential 80 pip gain with a 20 pip risk, a 4:1 reward-to-risk ratio

6. Carry Trade Strategy: Profiting from Interest Rate Differentials

The carry trade strategy involves buying high-yielding currencies while selling low-yielding ones. In volatile markets:

- Focus on currencies with stable interest rate outlooks

- Monitor economic indicators that might influence interest rates

- Be prepared to exit quickly if market sentiment shifts

While carry trades can provide steady returns, they can also unwind rapidly in times of high volatility.

Carry Trade Mechanics:

- Identify interest rate differentials: As of 2023, AUD/JPY might offer a positive carry of around 3-4% annually

- Calculate potential return: On a 100,000 AUD/JPY position, this could yield 8-11 pips per day in interest

- Consider leverage: With 10:1 leverage, the annual return could theoretically reach 30-40% (excluding price movements)

Risk Management in Carry Trades:

- Use lower leverage: High leverage can quickly erase interest gains during volatile price movements

- Set wider stop-losses: Account for higher volatility in carry pair currencies

- Monitor economic calendars: Be aware of events that could impact interest rate expectations

Historical Carry Trade Example:

Before the 2008 financial crisis, AUD/JPY was a popular carry trade due to high interest rate differentials (around 7%). However, during the crisis:

- AUD/JPY fell from around 104.00 to 55.00 between July and October 2008

- This 4,900 pip drop would have wiped out years of interest gains for carry traders

- Lesson: Always have an exit strategy and be prepared for rapid unwinds in volatile markets

7. Scalping in Volatile Forex Markets

Scalping aims to profit from small price movements, which can be frequent in volatile markets. This strategy involves:

- Making numerous trades throughout the day

- Utilizing tight stop-loss and take-profit levels

- Focusing on highly liquid currency pairs

Scalping requires intense focus and the ability to make quick decisions based on technical analysis.

Scalping Technique:

- Choose liquid pairs: Focus on major pairs like EUR/USD, GBP/USD, or USD/JPY

- Use small time frames: 1-minute or 5-minute charts are common for scalpers

- Look for quick reversals: Use indicators like Stochastic or RSI to spot overbought/oversold conditions

- Set tight stops and targets: Aim for 5-10 pip profits with 3-5 pip stop-losses

- Manage risk carefully: Limit each trade to 1-2% of your account balance

Scalping in Practice:

During volatile periods, EUR/USD might move 10-15 pips within minutes. A scalping strategy could involve:

- Identifying a short-term trend on a 5-minute chart

- Entering when price pulls back to a moving average (e.g., 10-period EMA)

- Setting a 5 pip stop-loss and 10 pip take-profit

- Aiming to make 10-20 such trades per day

Scalping Considerations:

- Transaction costs: Ensure your broker offers tight spreads (1-2 pips for major pairs)

- Execution speed: Use a broker with fast execution to avoid slippage

- Automated systems: Consider using algorithmic trading systems to execute trades quickly

Conclusion

Navigating volatile markets requires a diverse set of strategies and a solid understanding of market dynamics. By implementing the best trading strategies for volatile markets—currency pair diversification, volatility breakout, forex hedging, news trading, range trading, carry trade, and scalping—you can better manage risk and capitalize on opportunities. Each of these trading strategies for volatile markets has its strengths and weaknesses, and the key to success lies in choosing the right approach based on current market conditions and your trading style. Utilizing high volatility trading strategies will enable you to turn potential challenges into profitable opportunities.

What is the best time to implement a volatility breakout strategy?

The best time to implement a volatility breakout strategy is during major economic news releases or significant geopolitical events that are likely to cause substantial market movements. These events often lead to increased volatility, providing opportunities for traders to capture strong price movements. Monitoring economic calendars and staying updated on global events can help identify optimal times for executing this strategy.

How can I effectively manage the risks associated with the carry trade strategy in volatile markets?

To effectively manage risks associated with the carry trade strategy in volatile markets, consider the following approaches:

Lower Leverage: Use lower leverage to mitigate the impact of adverse price movements.

Diversification: Diversify your carry trade positions across multiple currency pairs with different interest rate differentials.

Wider Stop-Losses: Set wider stop-loss levels to accommodate increased volatility.

Economic Monitoring: Continuously monitor economic indicators and central bank announcements that could affect interest rate expectations and market sentiment.

What are the key factors to consider when choosing currency pairs for scalping in volatile markets?

When choosing currency pairs for scalping in volatile markets, consider the following factors:

Liquidity: Focus on highly liquid currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, to ensure tight spreads and quick execution.

Volatility: Select pairs with sufficient volatility to provide frequent trading opportunities within short time frames.

Spreads and Transaction Costs: Choose brokers that offer tight spreads and low transaction costs to maximize profitability.

Market Hours: Trade during active market hours, such as the London and New York sessions, when liquidity and volatility are highest.