GBP/USD scalping is a fast-paced forex trading strategy that aims to profit from small price movements in the British Pound/US Dollar currency pair over very short time frames. This article reveals seven powerful GBP/USD scalping strategies that can help traders maximize their profits in the forex market, typically holding positions for just a few minutes or even seconds. These strategies include momentum scalping, range scalping, news scalping, trend-following scalping, breakout scalping, reversal scalping, and grid scalping.

For traders looking to implement these strategies effectively, choosing a reliable online forex broker is crucial. A regulated forex broker can provide the necessary tools, tight spreads, and fast execution required for successful scalping. As we delve into the world of GBP/USD scalping, we’ll cover everything from basic concepts to advanced techniques, helping both novice and experienced traders refine their approach to this exciting trading style.

Understanding GBP/USD and Scalping

What is GBP/USD?

GBP/USD, also known as “Cable,” represents the exchange rate between the British Pound and the US Dollar. It’s one of the most actively traded currency pairs in the forex market, known for its liquidity and volatility. The pair’s nickname “Cable” dates back to the mid-19th century when the exchange rate was transmitted between London and New York via a transatlantic cable.

Key characteristics of GBP/USD:

- High liquidity: Ensures easy entry and exit from positions

- Significant daily range: Often moves 100-150 pips per day

- Influenced by economic data from both the UK and US

- Sensitive to political events, especially those related to Brexit

Defining Scalping in Forex

Scalping is a trading strategy that aims to profit from small price movements within very short timeframes. Scalpers typically open and close multiple positions throughout the day, sometimes holding trades for just a few minutes or even seconds. This high-frequency trading style requires quick decision-making, precise execution, and a deep understanding of market dynamics.

Key aspects of scalping:

- Multiple trades per day (sometimes hundreds)

- Small profit targets (usually 5-15 pips per trade)

- Tight stop-losses to minimize risk

- Reliance on technical analysis and price action

- Requires high concentration and discipline

Why Scalp GBP/USD?

- High liquidity ensures quick execution of trades

- Minimal slippage during entry and exit

- Ability to handle larger position sizes

- Significant volatility provides numerous trading opportunities

- Regular price fluctuations create frequent profit potential

- Ideal for traders who thrive in fast-paced environments

- Well-established economic indicators for both currencies

- Regular releases of high-impact economic data

- Predictable periods of increased volatility

- 24-hour market access during weekdays

- Flexibility to trade during preferred hours

- Opportunities to capitalize on different market sessions

- Tight spreads offered by most brokers

- Lower transaction costs compared to less liquid pairs

- Increased potential for profitability on small price movements

Key Components of a Successful GBP/USD Scalping Strategy

Technical Analysis Tools

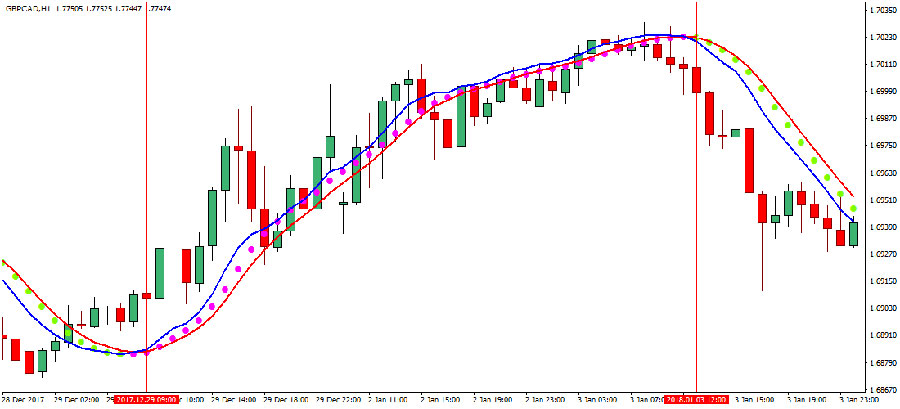

Moving Averages

Moving averages help identify trends and potential support/resistance levels. They smooth out price data to create a single flowing line, making it easier to spot trends.

Popular combinations for scalping include:

- 5 and 10-period EMAs (Exponential Moving Averages)

- Faster-moving, more responsive to recent price changes

- Ideal for very short-term trend identification

- 20 and 50-period SMAs (Simple Moving Averages)

- Slower-moving, helps identify broader trends

- Useful for confirming the overall market direction

How to use:

- Look for crossovers between shorter and longer-term MAs

- Use MA slopes to gauge trend strength

- Watch for price bounces off MAs acting as dynamic support/resistance

Read More: eur usd scalping strategy

Bollinger Bands

Bollinger Bands indicate overbought and oversold conditions, helping scalpers identify potential reversals. They consist of a middle band (usually a 20-period SMA) and upper and lower bands set 2 standard deviations away from the middle band.

Key applications:

- Trade bounces off the outer bands

- Look for breakouts when the bands squeeze together

- Use in conjunction with other indicators for confirmation

Relative Strength Index (RSI)

The RSI measures momentum and can signal potential entry and exit points for scalping trades. It oscillates between 0 and 100, with readings above 70 considered overbought and below 30 oversold.

Scalping strategies with RSI:

- Look for divergences between RSI and price

- Use RSI to confirm trends (e.g., bullish above 50, bearish below)

- Combine with support/resistance levels for higher-probability trades

MACD (Moving Average Convergence Divergence)

MACD helps identify trend direction and strength, crucial for scalping decisions. It consists of two lines: the MACD line and the signal line, along with a histogram.

MACD scalping techniques:

- Trade signal line crossovers

- Look for divergences between MACD and price

- Use histogram changes to gauge momentum shifts

Stochastic Oscillator

This indicator can help scalpers spot potential reversals and overbought/oversold conditions. It compares the closing price to the price range over a specific period.

Stochastic scalping strategies:

- Look for crossovers in overbought/oversold territories

- Use divergences to identify potential trend reversals

- Combine with trend analysis for more accurate entries

Price Action Analysis

Support and Resistance Levels

Identifying key support and resistance levels is crucial for setting entry and exit points in scalping trades. These levels represent areas where price has historically had difficulty breaking through.

Tips for identifying support/resistance:

- Look for areas of price congestion

- Use round numbers (e.g., 1.3000, 1.3500)

- Consider previous day’s high and low

Candlestick Patterns

Recognizing patterns like doji, engulfing, and pinbars can provide valuable insights for short-term trades.

Key candlestick patterns for scalping:

- Doji: Indicates indecision, potential reversal

- Engulfing: Strong reversal signal

- Pinbars: Shows rejection of certain price levels

Trend Lines

Drawing accurate trend lines can help scalpers identify the overall market direction and potential breakout points.

Trend line scalping strategies:

- Trade bounces off trend lines

- Look for breakouts when price pierces a trend line

- Use multiple timeframes for more accurate trend identification

Chart Patterns

Patterns such as triangles, flags, and head and shoulders can offer clues about short-term price movements.

Common chart patterns for scalping:

- Triangles: Trade breakouts from consolidation

- Flags: Capitalize on brief pauses in strong trends

- Head and Shoulders: Potential reversal pattern

Read More: usd jpy scalping strategy

News and Economic Calendar Awareness

Staying informed about economic releases and news events affecting the UK and US economies is essential for GBP/USD scalpers.

Key economic indicators to watch:

- Interest rate decisions

- GDP reports

- Employment data (Non-Farm Payrolls for US, Claimant Count for UK)

- Inflation reports (CPI, PPI)

Tips for news scalping:

- Be aware of scheduled release times

- Avoid trading immediately before high-impact news

- Consider widening stop-losses during news events

7 Powerful GBP/USD Scalping Strategies

1. Momentum Scalping

This strategy involves riding short-term trends by entering trades in the direction of strong price movements.

Key steps:

- Identify a strong move using momentum indicators (e.g., RSI or MACD)

- Enter the trade in the direction of the momentum

- Set a tight stop-loss and take-profit levels

- Exit quickly if the momentum shows signs of weakening

Example setup:

- Use 5-minute chart

- Enter when RSI crosses above 70 (for buys) or below 30 (for sells)

- Place stop-loss 5-10 pips away

- Target 10-15 pips profit

2. Range Scalping

Range scalping capitalizes on periods when GBP/USD is trading within a defined range.

Key steps:

- Identify a clear trading range using support and resistance levels

- Buy near support and sell near resistance

- Use tight stop-losses just outside the range

- Take profits quickly as price approaches the opposite end of the range

Example setup:

- Use 1-minute or 5-minute chart

- Confirm range with at least two touches of support and resistance

- Enter within 5 pips of support/resistance

- Place stop-loss 5-10 pips outside the range

- Target 50-70% of the range width for profit

3. News Scalping

This high-risk, high-reward strategy involves trading during major economic releases affecting GBP/USD.

Key steps:

- Identify important upcoming news events

- Wait for the news release and observe the initial market reaction

- Enter trades in the direction of the initial move

- Use wider stop-losses due to increased volatility

- Take profits quickly as the initial surge often retraces

Example setup:

- Focus on high-impact news events

- Use 1-minute chart

- Wait for a clear directional move after the news

- Enter in the direction of the move

- Use a 20-30 pip stop-loss

- Target 30-50 pips profit

4. Trend-Following Scalping

This strategy aims to capture small gains by trading in the direction of the overall trend.

Key steps:

- Identify the prevailing trend using longer-term moving averages

- Look for short-term pullbacks or consolidations

- Enter trades in the direction of the main trend when price resumes its movement

- Set stop-losses below recent swing lows (for uptrends) or above swing highs (for downtrends)

Example setup:

- Use 15-minute chart for trend identification (50 EMA)

- Switch to 5-minute chart for entries

- Enter when price bounces off the 50 EMA

- Place stop-loss below/above the recent swing low/high

- Target 15-20 pips profit

Read More: RSI Scalping Strategy

5. Breakout Scalping

Breakout scalping involves trading when price breaks out of established support or resistance levels.

Key steps:

- Identify key support and resistance levels

- Wait for a convincing breakout (often confirmed by increased volume)

- Enter trades in the direction of the breakout

- Place stop-losses just below the breakout level

- Take profits at the next significant support/resistance level

Example setup:

- Use 5-minute chart

- Identify strong support/resistance levels

- Enter 5-10 pips beyond the breakout level

- Place stop-loss 10-15 pips behind the entry

- Target the next major support/resistance level

6. Reversal Scalping

This strategy aims to capture profits from short-term price reversals.

Key steps:

- Identify potential reversal points using overbought/oversold indicators (e.g., RSI, Stochastic)

- Look for confirming candlestick patterns (e.g., pin bars, engulfing patterns)

- Enter trades against the previous short-term trend

- Set tight stop-losses above/below the reversal point

- Take profits quickly as reversals can be short-lived

Example setup:

- Use 1-minute or 5-minute chart

- Look for RSI above 70 or below 30

- Confirm with bearish/bullish candlestick pattern

- Enter at the close of the confirming candle

- Place stop-loss beyond the reversal candle’s high/low

- Target 10-15 pips profit

7. Grid Scalping

Grid scalping involves placing multiple buy and sell orders at predetermined price levels.

Key steps:

- Identify a trading range for GBP/USD

- Place evenly spaced buy orders below the current price and sell orders above

- As price moves, some orders will be triggered while others remain open

- Manage risk by limiting the total number of open positions

- Close profitable trades quickly and adjust the grid as needed

Example setup:

- Use 15-minute chart to identify a 50-pip range

- Place buy and sell orders every 10 pips within the range

- Set 10-pip stop-loss and 20-pip take-profit for each order

- Limit total risk to 2% of account balance

- Adjust grid levels every 4 hours or when range shifts

Developing Your GBP/USD Scalping Strategy

Choose Your Timeframe

Most GBP/USD scalpers focus on 1-minute to 5-minute charts. Select a timeframe that matches your trading style and allows you to react quickly to market changes.

Considerations for timeframe selection:

- 1-minute charts: Highest number of signals, but more noise

- 5-minute charts: Clearer trends, fewer false signals

- 15-minute charts: Good for identifying broader market context

Set Clear Entry and Exit Rules

Develop specific criteria for entering and exiting trades. This may include:

- Technical indicator signals

- Price action patterns

- Support/resistance levels

- Time-based exits

Example rule set:

- Entry: RSI crosses above 70 on 5-minute chart

- Stop-loss: 10 pips below entry

- Take-profit: 15 pips above entry

- Time-based exit: Close trade after 15 minutes if neither stop-loss nor take-profit hit

Implement Proper Risk Management

- Use tight stop-losses to limit potential losses

- Maintain a favorable risk-reward ratio (e.g., 1:2 or 1:3)

- Limit the percentage of your account risked per trade (e.g., 1% or less)

- Consider using a trailing stop to protect profits

Risk management example:

- Account size: $10,000

- Risk per trade: 1% ($100)

- Stop-loss: 10 pips

- Position size calculation: $100 / (10 pips * $10 per pip) = 1 mini lot

Practice and Refine

- Start with a demo account to test your strategies

- Keep a detailed trading journal to track your performance

- Regularly review and adjust your approach based on results

Key metrics to track:

- Win rate

- Average win vs. average loss

- Largest drawdown

- Profit factor (gross profit / gross loss)

Common Pitfalls to Avoid in GBP/USD Scalping

- Overtrading: Avoid the temptation to trade every small movement

- Set a maximum number of trades per day

- Take breaks to maintain focus

- Ignoring Transaction Costs: Factor in spreads and commissions when calculating potential profits

- Ensure your average win exceeds the round-trip cost of each trade

- Emotional Trading: Stick to your predefined strategy and avoid impulsive decisions

- Use a trading plan to guide your decisions

- Take breaks after consecutive losses

- Neglecting Market Context: Be aware of larger trends and potential market-moving events

- Review higher timeframes before scalping

- Stay informed about major economic releases

- Inadequate Technology: Ensure you have a reliable internet connection and trading platform

- Use a backup internet connection

- Consider a VPS for more stable trading conditions

- Lack of Adaptability: Be prepared to adjust your strategy as market conditions change

- Regularly review and optimize your approach

- Have multiple strategies for different market conditions

- Overleverage: Use appropriate position sizing to manage risk effectively

- Never risk more than 1-2% of your account on a single trade

- Consider reducing position sizes during volatile periods

- Ignoring Correlation: Be aware of correlated pairs and their potential impact on GBP/USD

- Monitor related pairs like EUR/USD and USD/JPY

- Be cautious of taking multiple positions in correlated pairs

OpoFinance Services: Your Partner in GBP/USD Scalping Success

When it comes to executing your GBP/USD scalping strategy, choosing the right broker is crucial. OpoFinance, an ASIC-regulated broker, offers a range of features tailored to meet the needs of scalpers:

- Lightning-fast execution speeds

- Tight spreads on GBP/USD and other major pairs

- Advanced charting tools and technical indicators

- Negative balance protection for risk management

- 24/7 customer support

One standout feature of OpoFinance is its innovative social trading service, which allows traders to follow and copy the strategies of successful GBP/USD scalpers. This can be an excellent way for beginners to learn from experienced traders or for seasoned scalpers to diversify their approach.

Conclusion

Mastering GBP/USD scalping requires dedication, practice, and a solid understanding of market dynamics. By implementing the strategies outlined in this guide and staying disciplined in your approach, you can potentially capitalize on the numerous opportunities presented by this popular currency pair.

Remember that successful scalping is as much about risk management as it is about identifying profitable trades. Continual learning, adaptability, and emotional control are key to long-term success in the fast-paced world of forex scalping.

As you embark on your GBP/USD scalping journey, consider leveraging the tools and services offered by regulated brokers like OpoFinance to enhance your trading experience. With the right strategy, mindset, and resources, you’ll be well-equipped to navigate the exciting challenges of GBP/USD scalping.

How much capital do I need to start scalping GBP/USD?

While it’s possible to start with a small account, a recommended minimum for GBP/USD scalping is around $1,000 to $5,000. This allows for proper risk management and the ability to withstand potential losing streaks. However, it’s crucial to only trade with money you can afford to lose.

What is the best time of day to scalp GBP/USD?

The optimal time for GBP/USD scalping is typically during the London and New York session overlap, from 8:00 AM to 12:00 PM EST (13:00 to 17:00 GMT). This period often sees the highest liquidity and volatility, providing numerous opportunities for scalpers.

Can I use automated trading systems for GBP/USD scalping?

Yes, automated trading systems or Expert Advisors (EAs) can be used for GBP/USD scalping. However, it’s crucial to thoroughly backtest and forward test any automated strategy before using it with real money. Additionally, even with automated systems, human oversight is essential to adapt to changing market conditions.

One Response

Great web site. A lot of helpful info here. I?¦m sending it to some buddies ans additionally sharing in delicious. And naturally, thanks in your sweat!