Ever wondered about copy trading and the real earning potential – not just for the people copying, but for the skilled traders setting the pace? Many see copy trading as a possible fast track to profits, but the truth about how much do copy traders earn (the signal providers whose moves are mirrored) is often unclear and seems complex. The dream of making good money is appealing, but common misunderstandings paint a picture of easy wealth that just doesn’t match reality when discussing how much do copy traders make. This leaves potential signal providers and curious onlookers wondering what the actual financial rewards look like.

This article clears things up, giving you a straightforward look at how signal providers make money, the key things that affect their earnings, the potential (and very unpredictable) financial results, and the risks involved, especially when using an online forex broker. We’ll zone in on the experienced trader being copied, explaining how they get paid.

What is Copy Trading? Unpacking the Basics

Before we get into the money side of things, let’s quickly cover what copy trading is all about and clarify who we’re talking about here. Copy trading is an approach to managing investments that lets people in the financial markets automatically copy the trades opened and managed by another chosen trader. When the signal provider makes a trade (like buying or selling), that same trade happens in the copier’s account, scaled according to the money they’ve put in to copy that trader.

This article zooms in on the earnings potential of the experienced trader whose trades get copied. These folks go by different names on various platforms – Signal Providers, Master Traders, Strategy Providers, or Popular Investors. They’re the ones creating the trading signals everyone else follows. It’s really important to separate their earnings from the potential profits or losses the investors copying them might see. While connected, these are different parts of the copy trading world.

Figuring out how much do copy traders earn means looking closely at how they are compensated. And remember, earnings for these traders vary a lot; they depend heavily on performance, the platform used, the size of their following, and what the market is doing. There’s no guarantee of success, and it always involves serious effort and risk.

How Signal Providers Generate Income

Signal providers – the traders being copied – have a few different ways they might generate revenue. These methods often depend heavily on the specific copy trading platform they use, how successful they are at attracting and keeping copiers, and, of course, making profitable trades. Understanding these income streams is fundamental to grasping how much do copy traders make.

Profit Sharing / Performance Fees

This is often the main way signal providers get paid. With this setup, the trader gets a percentage of the profits they make for the people copying them. If the trades make money for the follower, the signal provider gets a share. On the other hand, if the trades lose money for the copier, the signal provider usually doesn’t earn anything from that copier for that period.

The percentage shared can differ quite a bit between platforms, and sometimes it changes based on the trader’s rank or status on the platform. Common profit-sharing splits might be anywhere from 10% to 30% of the copier’s profits. This system directly links the goals of the signal provider with their followers – affecting how much do copy traders earn based directly on copier success.

Read More: What is Copy Trading in Forex

Platform-Specific Compensation Programs

Many popular copy trading platforms have set up special programs to reward their most successful and followed traders beyond just profit sharing. These programs can offer more reliable or extra income streams. A good example is eToro’s Popular Investor program. This system has different tiers and pays traders based on things like how many copiers they have, their consistency, their risk score, and, very importantly, their Assets Under Copy (AUC) – which is the total amount of money followers have allocated to copy their trades.

Traders in the higher tiers of these programs might get fixed monthly payments and/or a yearly percentage of their AUC, often paid out each month. For instance, top-level investors on some platforms could earn 1.5% or 2% annually on the money copying them. This structure encourages traders not just to be profitable but also to manage risk well and attract a large, steady amount of capital. Knowing about these platform details is vital when assessing how much do copy traders make.

Subscription Fees

Though less common on platforms where copy trading is built-in and profit sharing or AUC models are the norm, some signal providers might charge a subscription fee. In this case, copiers pay a set amount regularly (like monthly or yearly) to get access to the trader’s signals, no matter how profitable the trades are right away. You see this model more often on platforms that mainly act as marketplaces for signals, or when traders offer their services independently through channels like Telegram or their own websites, connecting to brokers through special software links (APIs). This gives the trader a predictable income but means they have to constantly prove their value to keep subscribers paying.

Spread Rebates / Broker Commissions

Some brokers give signal providers kickbacks based on the trading volume their copiers generate. The broker might share a piece of the spread (the difference between the buying and selling price) or give a commission for each trade made by the connected follower accounts. This income depends on the activity level (how much and how often trades happen) generated by the copiers, rather than directly on profits. While it could be good for traders who make lots of trades and have many followers, it can sometimes create a conflict if it encourages trading too much instead of making the best trading decisions. Understanding if this influences how much do copy traders earn on a particular platform is important.

Management Fees (Less Common)

Similar to how traditional investment funds work, some platforms or setups might let signal providers charge a small management fee based on the total Assets Under Management (AUM) or Assets Under Copy (AUC). This is usually a small annual percentage (like 1-2%) of the total money copying the trader, charged regularly. While it’s a similar idea to the AUC payments in some platform programs (like eToro’s), it might be set up as a separate fee in some cases, though it’s less typical in pure copy trading environments compared to performance fees.

Read More: How Much Can a Beginner Forex Trader Make?

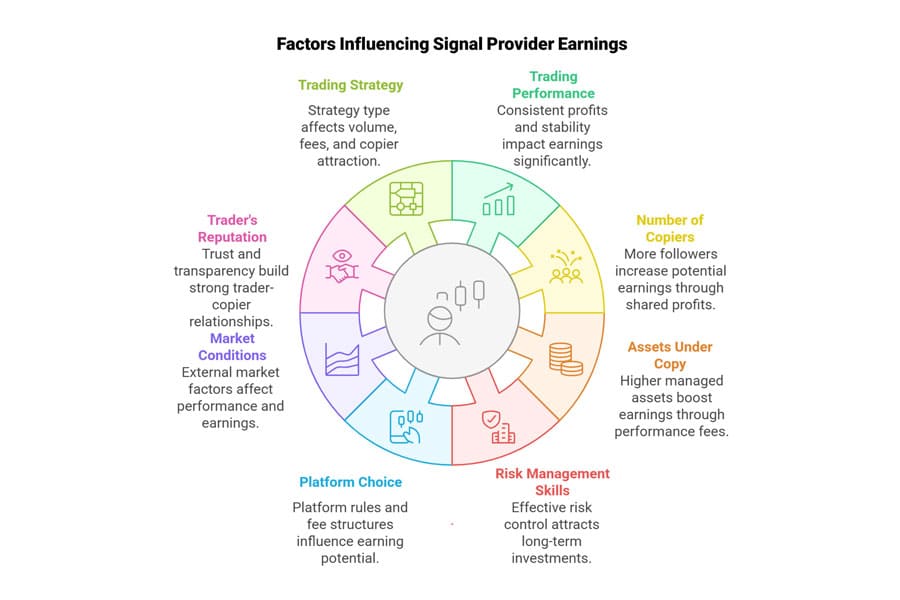

Factors Influencing Signal Provider Earnings

The question of how much do copy traders earn doesn’t have one easy answer because many changing factors affect a signal provider’s income. Success comes from a mix of skill, strategy, platform features, and how the market is behaving. These are the crucial elements that determine how much do copy traders make.

Trading Performance & Consistency

This is the foundation. More than anything else, a signal provider needs to make profits consistently over time. An amazing short-term profit might get some initial buzz, but real, sustainable income comes from showing a track record of reliable profitability and stability. Copiers want steady returns, not just a lucky break. Big returns often mean big risks, which can scare off copiers looking for safer growth. So, showing consistent positive results, even if they’re moderate, is better for long-term earning potential than unpredictable results with big swings. Consistent performance directly affects profit-sharing income and builds the reputation needed to get more copiers and AUC.

Number of Copiers

It makes sense that the more people copying a trader, the higher the potential earnings, especially with models like profit sharing or volume-based rebates. Every new copier adds another potential income source. Building a large group of followers is a major goal for traders wanting to maximize how much do copy traders make.

Assets Under Copy (AUC) / Assets Under Management (AUM)

This is the total amount of money all copiers have assigned to follow a signal provider’s strategy. It’s a super important number, especially for income based on performance fees (a percentage of profits on more money means higher earnings) and AUC-based payment programs (like eToro’s Popular Investor tiers).

A trader could have lots of copiers, but if they each only copy with a small amount, the AUC might stay low. On the flip side, fewer copiers putting in large amounts can lead to a big AUC. Getting a substantial AUC is often the aim for reaching the top earning levels on platforms that reward this directly. The size of AUC is a major factor in determining how much do copy traders earn.

Risk Management Skills

Savvy copiers don’t just look at the returns; they look closely at the risk involved. Signal providers who show solid risk management – using proper stop-losses, managing how much they invest in each trade, keeping losses (drawdowns) under control, and having a clear risk plan – are more likely to attract serious, long-term money. Platforms often show risk scores, and traders with lower, more controlled risk levels are usually preferred, even if their returns aren’t quite as high as the high-risk traders. Good risk management protects money (both the trader’s and the copiers’), builds trust, and helps ensure long-term survival, directly impacting earnings by keeping copiers around and attracting bigger investments.

Platform Choice & Fee Structure

The platform a trader uses really matters. Different platforms (like eToro, Bybit, OKX, AvaTrade, Pepperstone, ZuluTrade, Naga) have different ways of paying traders, different fee percentages, payout schedules, ways of making traders visible, and tools for them to use. Some might focus heavily on profit sharing, while others push AUC-based payments. The platform’s rules for who can be a signal provider (like needing a certain track record, deposit amount, or risk level), how traders get featured, and how fees are calculated all affect earning potential. Picking a platform whose payment structure matches the trader’s style and goals is vital for making the most income. This choice heavily influences how much do copy traders earn.

Market Conditions

Outside factors affect every trader. General market conditions, how much prices are moving (volatility), and overall trends have a big impact on performance. A strategy that does great when the market is moving strongly in one direction might struggle when prices are stuck in a range, and vice versa. Unexpected economic news or global events can dramatically change results. Signal providers have to adapt, but even the best can go through periods of losses due to bad market conditions. This will definitely affect their earnings through lower profit shares and potentially losing copiers.

Trader’s Reputation & Transparency

Trust is key in copy trading. Signal providers who are open about their strategy, their past performance (including losses), and how they handle risk tend to build stronger reputations. Many platforms let traders talk to their copiers, which helps create a community feeling and loyalty. A solid reputation, built over time with consistent performance and clear communication, is very important for attracting and keeping copiers and increasing AUC, thereby affecting potential income.

Trading Strategy & Style

The type of trading strategy used also matters. High-frequency scalping (making lots of quick, small trades) might generate a lot of volume (good for rebate models) but can be affected by how fast trades go through and the costs (spreads). Longer-term swing or position trading strategies might show smoother growth but result in fewer times profit-sharing kicks in. Strategies focused on specific things like crypto, forex, or stock indexes will attract different kinds of copiers and be subject to the ups and downs of those specific markets. The risk vs. reward balance that’s part of the strategy also influences the type and amount of money it attracts.

Potential Earning Ranges: A Reality Check

Talking about potential earnings for signal providers needs to stress that earnings vary hugely. It’s tempting to look for one magic number, but the reality is that how much do copy traders earn covers a huge range, from almost nothing to potentially massive amounts of money for a very small group of top performers.

Read More: Understanding Copy Trading on Opofinance

It’s really important not to make definite income claims. You might see ads hinting at high returns for copiers following top traders, but that doesn’t directly tell you how much do copy traders make themselves. A trader getting a 50% annual return for copiers could be earning a lot if they have millions in AUC and a good fee deal, or relatively little if only a few thousand dollars are copying them. This difference highlights why focusing solely on copier returns doesn’t answer the question accurately.

The vast majority of people trying to become successful signal providers probably earn very little, especially at the start. Building the needed track record, getting a decent number of copiers, and gathering significant Assets Under Copy (AUC) takes a lot of time, skill, and often some luck in getting noticed on the platform. Knowing the average figures for how much do copy traders make would likely reveal modest numbers for most participants.

However, for those who make it to the top levels, the potential can be huge. Platform-specific programs give an idea of this potential. For example, on platforms like eToro, ‘Elite’ or ‘Elite Pro’ Popular Investors managing millions in AUC can earn a significant annual percentage of that AUC (like 1.5% – 2.5%), paid monthly. This is on top of any profits from their own trading money and potentially profit sharing (though the exact structure varies). If a top trader keeps, say, $10 million in AUC and qualifies for a 2% annual AUC payment, that alone is $200,000 a year from the platform. Some platforms might limit the amount eligible for AUC payments, but it shows the scale possible.

Similarly, with a profit-sharing model, a trader with $5 million in AUC who makes a 20% net profit for their copiers in a year ($1 million total copier profit) and gets a 20% performance fee would earn $200,000 from profit sharing that year. Where platforms allow both (AUC payments + Profit Sharing), earnings can get very high.

But these examples are the very top earners. Reaching that level requires outstanding and steady performance, excellent risk management, and the ability to attract and hold onto large amounts of money over long periods. It’s also crucial to remember that losses are a normal part of trading. Periods of losing money will stop profit-sharing income, could reduce AUC-based payments if assets shrink or copiers leave, and hurt the trader’s own funds. So, even for successful traders, income can change a lot from month to month or year to year. The journey to figuring out how much do copy traders earn for oneself is often long and tough.

Becoming a Signal Provider: A Brief Glimpse

Starting out as a signal provider whose trades get copied means meeting certain requirements set by copy trading platforms, along with showing consistent trading skill. While the rules vary, typical requirements often include having a fully verified trading account, putting in a minimum deposit, and having a trading history on the platform for a certain length of time (like several months) that others can check.

Platforms usually set risk limits, looking at potential signal providers’ past drawdowns (peak-to-valley losses), risk score, and how much leverage they use. Following these risk rules is often required to get listed and stay listed. The main thing, though, is building that verifiable track record. Potential copiers need proof of steady performance and smart risk management before they’ll trust you with their money. Being transparent is also key; many platforms encourage or require signal providers to explain their strategy and keep in touch with their followers. This builds trust and loyalty, which are essential for long-term success and ultimately impact how much do copy traders earn.

Risks and Challenges for Signal Providers

While the potential rewards look good, being a signal provider comes with specific risks and big challenges. Understanding these gives a realistic perspective on how much do copy traders earn and the work involved.

The biggest challenge is the constant pressure to perform consistently. Knowing that potentially hundreds or thousands of people’s money depends on your trading decisions puts a lot of mental pressure on you. A losing streak doesn’t just hurt the provider’s own money and income (through less profit share or lower AUC payments); it can also cause copiers to leave in droves, damaging your reputation and future earning potential. This pressure is a key factor affecting not just income, but the sustainability of being a signal provider – a hidden aspect impacting how much do copy traders make.

There’s a deep sense of responsibility when others copy your trades. Even though copiers know the risks, the signal provider often feels responsible for doing well and managing risk carefully. Market risk is always there; even the most solid strategy can lose money during unexpected market moves or changing market types, affecting both personal and copied results.

There’s also risk from the platform itself. Copy trading platforms can change their rules, fees, payment programs, or risk requirements, sometimes without much warning. A change in how the platform decides which traders to show could seriously impact a provider’s ability to get new copiers. Plus, the stability and future of the platform itself is something to consider. Lastly, being a successful signal provider takes a huge time commitment – not just for analyzing markets and making trades, but often for talking with followers, giving updates, and managing their profile on the platform.

Opofinance Services: Elevate Your Trading

For traders thinking about becoming signal providers, or anyone looking for a solid platform for their own trading, checking out a well-regulated broker with lots of features is key. Opofinance, regulated by ASIC (a top-tier regulator), offers a great setup designed for today’s traders.

Here’s what makes Opofinance stand out:

- Advanced Trading Platforms: Pick from popular choices like MT4 and MT5, the detailed cTrader, or the user-friendly OpoTrade platform. There’s something for every trading style.

- Innovative AI Tools: Use the latest technology like the AI Market Analyzer for insights, the AI Coach to help refine your strategy, and AI Support when you need help, giving you an edge.

- Social & Prop Trading: Connect with other traders through social features or look into prop trading opportunities offered directly by the broker.

- Secure & Flexible Transactions: Enjoy safe and easy ways to deposit and withdraw money, including modern choices like crypto payments. Plus, Opofinance doesn’t charge its own fees on these transactions, so more of your money goes towards your trading.

Choosing the right broker is a crucial step. With its strong regulation, variety of platforms, cool tools, and trader-friendly payment policies, Opofinance gives you a good starting point.

Discover the Opofinance advantage today!

Conclusion: The Realistic Outlook

So, how much do copy traders earn? As we’ve seen, the answer is complicated and varies a lot. The main ways signal providers make money come from profit-sharing deals with their copiers and special payment programs from platforms, often linked to Assets Under Copy (AUC). Making significant money really depends on showing consistent, profitable trading results over time, along with skilled risk management to attract and keep a large amount of copier money.

The platform chosen and its specific fee rules also play a key role. While there’s potential for high earnings for a small group of skilled, hard-working, and well-known traders, it’s definitely not a sure thing or an easy path to wealth. It takes amazing skill, ongoing effort, mental strength, and dealing with significant market and platform risks. Understanding how much do copy traders make means appreciating both the potential rewards and the big challenges involved.

Key Takeaways

- Signal providers (the traders being copied) mainly earn via profit sharing (getting a slice of copier profits) and platform payments (often based on Assets Under Copy – AUC).

- Earnings vary hugely, from almost nothing to potentially very large amounts for top performers.

- Key things affecting income are: consistent trading performance, the number of copiers, total AUC, risk management ability, platform choice, market conditions, and reputation. These factors directly influence how much do copy traders earn.

- Top traders on platforms paying based on AUC (like eToro) can earn substantial passive income if they manage large sums, alongside potential profit shares.

- Becoming a successful signal provider means building a proven track record, meeting platform rules, and handling significant pressure and responsibility.

- Losses are a normal part of trading and directly reduce a signal provider’s income and ability to keep copiers.

- The answer to “how much do copy traders make” ultimately depends on individual success in attracting funds and delivering steady, risk-managed returns.

Can copy traders (signal providers) lose their own money even if their copiers profit overall?

Yes, that can happen, although it’s not the usual situation in simple scenarios. Signal providers always risk their own funds when they trade. While copier profits generally mirror the provider’s success, things like ‘high-water marks’ for performance fees could mean a provider doesn’t earn fees until past copier losses are recovered, even if recent trades are profitable. Also, slight differences in the provider’s own account leverage or exact trade entry prices compared to copiers could lead to minor variations. But usually, profitable trades for copiers mean the provider’s underlying strategy was also profitable (before fees).

Are earnings generated as a copy trader (signal provider) subject to income tax?

Yes. Money earned as a signal provider—whether from profit sharing, platform AUC payments, subscriptions, or rebates—is generally considered taxable income. The exact tax rules, rates, and how you need to report it depend entirely on the tax laws in the country where the trader lives. Signal providers should talk to a qualified tax professional in their area to make sure they’re following all the tax rules.

What is the practical difference between copy trading and social trading?

While they often go together, there’s a slight difference. Social trading is the bigger idea that includes sharing trading ideas, strategies, and thoughts about the market within a community or platform (like on forums, message boards, or trader profiles). Copy trading is a specific tool or option often found on social trading platforms, which lets users automatically copy the exact trades of another user (the signal provider) in their own account. So, all copy trading uses social trading features, but not all social trading involves automatically copying trades; sometimes it’s just about discussion and sharing information.