In the fast-paced world of forex trading, staying ahead of the curve is crucial. One of the most powerful tools in a trader’s arsenal is understanding how to trade GDP news in forex markets. Gross Domestic Product (GDP) releases are among the most significant economic indicators that can cause substantial market movements. This comprehensive guide will equip you with the knowledge and strategies needed to capitalize on these high-impact events, whether you’re working with a broker for forex trading or trading independently.

Trading GDP news in forex involves analyzing the economic data release, anticipating market reactions, and executing trades based on the discrepancy between forecasted and actual GDP figures. By mastering this approach, traders can potentially profit from the volatility that often follows these announcements. Whether you’re a novice or an experienced trader, this article will provide valuable insights to enhance your forex trading strategy.

The importance of GDP

The importance of GDP in forex trading cannot be overstated. It serves as a barometer for a country’s economic health, influencing everything from currency values to interest rates. As we delve deeper into this topic, you’ll gain a thorough understanding of how to leverage GDP news to your advantage in the forex market.

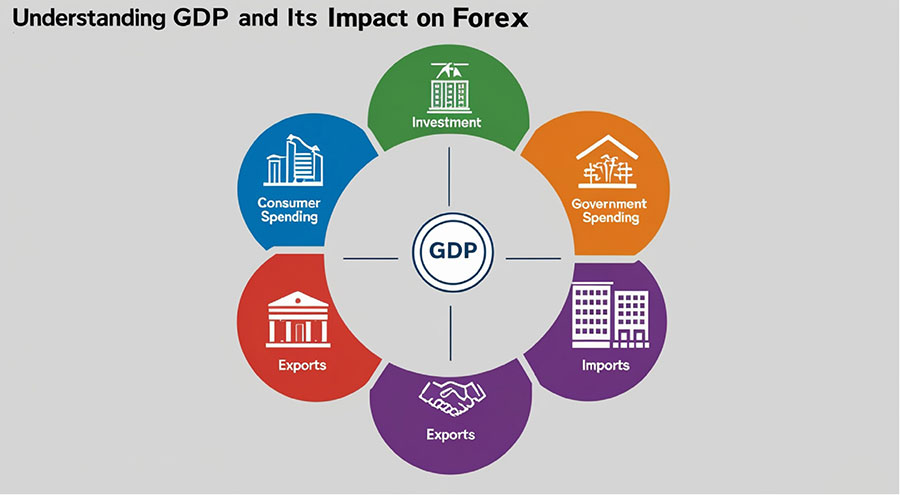

Understanding GDP and Its Impact on Forex

What is GDP?

Gross Domestic Product (GDP) is a comprehensive measure of a country’s economic activity, representing the total value of all goods and services produced over a specific period. GDP figures are crucial indicators of economic health, influencing everything from interest rates to currency values. Traders closely monitor GDP releases as they provide insights into economic performance and potential future trends.

Read More: how to trade nfp news in forex

How GDP Affects Forex Markets

GDP data impacts forex markets significantly, as it reflects the economic strength of a country. Strong GDP growth typically leads to an appreciation of the country’s currency, as it signals a healthy economy with potential for higher interest rates. Conversely, weak GDP growth can result in currency depreciation due to economic instability and lower investor confidence.

GDP is calculated using the following formula:

GDP = C + I + G + (X – M)

Where: C = Consumer Spending I = Business Investment G = Government Spending X = Exports M = Imports

Each component provides valuable insights into different aspects of the economy, allowing traders to gauge overall economic performance and potential future trends.

Key Points to Consider

- Volatility: GDP releases often cause substantial market volatility. Understanding and anticipating these movements can help traders capitalize on short-term price swings.

- Interest Rates: Central banks may adjust interest rates based on GDP data. Higher GDP growth can lead to rate hikes, attracting foreign investment and boosting currency value.

- Market Sentiment: GDP figures influence market sentiment and investor confidence. Positive data can lead to bullish markets, while negative data can trigger bearish trends.

Why GDP Matters in Forex Trading

GDP releases can significantly impact currency values for several reasons:

- Economic strength indicator: A strong GDP growth rate often leads to currency appreciation. Investors are attracted to currencies of countries with robust economic growth, as it suggests potential for higher returns on investments.

- Interest rate implications: Robust GDP growth may prompt central banks to raise interest rates to prevent the economy from overheating. Higher interest rates typically attract foreign capital, leading to increased demand for the domestic currency.

- Market sentiment: GDP figures can influence overall market sentiment towards a country’s economic outlook. Positive GDP data can boost confidence in the economy, leading to increased investment and currency appreciation.

- Policy decisions: GDP data plays a crucial role in shaping monetary and fiscal policies. Central banks and governments use this information to make decisions that can have long-lasting effects on currency values.

- Comparative analysis: Traders often compare GDP growth rates between countries to identify potential currency pair trades. A country with stronger GDP growth may see its currency appreciate against those with weaker growth.

Understanding these impacts allows forex traders to anticipate potential market movements and adjust their trading strategies accordingly.

Read More: how to trade ppi news in forex

Preparing to Trade GDP News

Identifying Key GDP Releases

Not all GDP releases are created equal. Focus on major economies such as:

- United States

- Eurozone

- Japan

- United Kingdom

- China

These countries’ GDP reports tend to have the most significant impact on global forex markets. However, don’t overlook emerging economies, as their GDP releases can also create trading opportunities, especially for currency pairs involving these nations.

Understanding GDP Report Components

A typical GDP report includes:

- Headline GDP growth rate: This is the primary figure that catches immediate attention. It represents the overall growth or contraction of the economy.

- Consumer spending: Also known as personal consumption expenditures, this component often accounts for a significant portion of GDP and provides insights into consumer confidence and economic health.

- Business investment: This includes spending on equipment, structures, and intellectual property. Strong business investment can indicate confidence in future economic growth.

- Government spending: This component covers all government consumption, investment, and transfer payments.

- Net exports: The difference between exports and imports can significantly impact GDP, especially for trade-dependent economies.

- GDP deflator: This measures the level of prices for all new, domestically produced final goods and services in an economy, providing insights into inflation.

Each component can provide valuable insights into economic trends. For instance, strong consumer spending might indicate robust domestic demand, while high business investment could signal confidence in future economic prospects.

Timing is Everything

GDP releases are scheduled events. Mark your calendar with release dates and times for the countries you’re interested in trading. Websites like ForexFactory.com offer economic calendars that can help you stay organized.

Consider the following when preparing for GDP releases:

- Pre-release market sentiment: Gauge market expectations before the release. This can help you anticipate potential market reactions.

- Time zone differences: Be aware of the release times in your local time zone to ensure you’re available to trade if desired.

- Market liquidity: Some GDP releases may occur during less liquid market hours. Be prepared for potentially wider spreads and increased volatility.

- Surrounding economic events: Take note of other significant economic releases or events around the GDP announcement that could influence market reactions.

By thoroughly preparing for GDP releases, you’ll be better positioned to make informed trading decisions when the news breaks.

Seven Powerful Strategies for Trading GDP News

Effectively trading GDP news involves employing strategies tailored to manage volatility and capitalize on market movements. Here are seven strategies to consider:

1. Breakout Strategy

Concept: Trade based on significant support and resistance levels. Place buy stop orders above resistance and sell stop orders below support to capitalize on price movements after the announcement.

Execution: Identify key levels before the release. Place orders slightly above and below these levels to catch price breakouts. Use stop-losses to manage potential false breakouts.

2. Straddle Strategy

Concept: Use pending orders to capture volatility by placing buy stop and sell stop orders at distances above and below the current price. This approach captures price movements in either direction.

Execution: Set orders based on anticipated volatility. Position orders at strategic points to react to market movements following the GDP news. Manage risk with smaller positions and stop-losses.

3. Trend Following

Concept: Align trades with the existing market trend. A positive GDP surprise may strengthen a bullish trend, while a negative surprise could deepen a bearish trend.

Execution: Analyze the market trend before the announcement and enter trades that align with this trend. Use trailing stops to secure profits as the trend develops.

4. Mean Reversion

Concept: Trade against initial price spikes, expecting that prices will revert to the mean after initial volatility.

Execution: Look for signs of overbought or oversold conditions using indicators like Bollinger Bands or RSI after the announcement. Enter trades anticipating a return to average price levels.

5. News Fade

Concept: Trade against the initial market reaction, assuming that the market’s first move may overreact and a reversal is likely.

Execution: Wait for the initial spike or drop and then enter a trade in the opposite direction, anticipating a market correction.

6. Scalping

Concept: Make quick trades to capture small price movements during periods of high volatility following the GDP release.

Execution: Execute multiple trades to take advantage of minor price fluctuations. Use tight stop-losses and be prepared for rapid decision-making.

7. Position Trading

Concept: Take a long-term view based on the broader economic context and the implications of the GDP data.

Execution: Analyze how the GDP data fits into the overall economic picture. Hold positions for days or weeks based on your long-term market outlook.

By employing these strategies, you can effectively navigate the volatility and seize opportunities arising from GDP news releases.

Risk Management Strategies

Setting Stop-Loss and Take-Profit Orders

Risk management is crucial when trading GDP news due to the high volatility involved. Always set stop-loss orders to limit potential losses and take-profit orders to secure profits. This helps you maintain discipline and avoid emotional trading decisions.

Diversifying Your Portfolio

Don’t put all your capital into a single trade or currency pair. Diversify your investments across multiple pairs and asset classes to spread risk. This reduces the impact of any single adverse market movement on your overall portfolio.

Managing Leverage

While leverage can amplify profits, it also increases risk. Use leverage cautiously, especially during high volatility periods like GDP releases. Consider using lower leverage to reduce the risk of significant losses.

Position Sizing

Determine the appropriate position size based on your risk tolerance and the size of your trading account. Avoid overexposure by limiting the amount of capital you allocate to a single trade.

Read More: how to trade cpi news in forex

Common Mistakes to Avoid

Overtrading

Trading too frequently, especially during high volatility periods, can lead to significant losses. Avoid the temptation to enter multiple trades and stick to your trading plan.

Ignoring Economic Calendars

Not keeping track of GDP release dates and other important economic events can lead to missed opportunities and unplanned trades. Use an economic calendar to stay informed and prepared.

Lack of Preparation

Entering trades without adequate research and analysis is a common mistake. Always prepare by analyzing historical data, conducting market analysis, and developing a clear trading plan.

Emotional Trading

Allowing emotions to drive your trading decisions can result in impulsive actions and significant losses. Maintain discipline, stick to your plan, and avoid making decisions based on fear or greed.

Failing to Adjust Strategies

Markets evolve, and what worked in the past may not always be effective. Continuously review and adjust your trading strategies based on current market conditions and performance.

Conclusion

Mastering how to trade GDP news in forex can significantly enhance your trading strategy and potentially lead to substantial profits. By understanding the importance of GDP releases, preparing thoroughly, implementing effective trading strategies, and managing risks, you can navigate these high-impact events with confidence.

Remember, successful GDP news trading requires a combination of technical skill, fundamental analysis, and psychological preparation. Continuously educate yourself on economic trends, practice your chosen strategies, and always prioritize risk management.

As you gain experience, you’ll develop a keen sense for market reactions to GDP news, allowing you to refine your approach and potentially increase your success rate. Stay disciplined, remain patient, and always be ready to adapt to changing market conditions.

With the insights and strategies provided in this guide, you’re now better equipped to tackle GDP news trading in the forex market. Whether you’re looking to capitalize on short-term volatility or incorporate GDP data into your longer-term trading plans, the knowledge you’ve gained here will serve as a valuable foundation for your forex trading journey.

Remember that forex trading, especially around high-impact news events like GDP releases, carries significant risk. Always trade within your means, use proper risk management techniques, and never invest more than you can afford to lose. With dedication, continuous learning, and prudent decision-making, GDP news trading can become a powerful component of your overall forex trading strategy.

What tools can help in trading GDP news effectively?

Using specialized tools can enhance your trading strategy. Economic calendars, news alerts, and trading platforms with real-time data provide essential information and insights, helping you stay ahead of market movements.

How does GDP data compare with other economic indicators?

While GDP is a comprehensive measure of economic activity, other indicators like employment data, inflation rates, and consumer sentiment also play vital roles in forex trading. Understanding the interplay between these indicators can provide a more holistic view of the market.

Can beginners successfully trade GDP news in forex?

Yes, beginners can trade GDP news effectively by starting with a solid understanding of market fundamentals, using demo accounts to practice, and gradually implementing strategies with real funds. Education and experience are key to successful GDP trading.

One Response

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your website to come back down the road. All the best