The Ichimoku Cloud swing trading strategy is a powerful technical analysis tool designed to help traders make more accurate decisions by identifying trends, momentum, and key support/resistance levels. This strategy simplifies market analysis by using five distinct indicators within one chart, making it easier for traders to spot high-probability setups and manage risks effectively. Whether you’re a beginner or an experienced trader, mastering the Ichimoku swing trading strategy can enhance your trading precision and profitability.

In this guide, we’ll break down how to implement the Ichimoku Cloud swing trading strategy for better results, covering essential tips that will help you navigate both trending and ranging markets. If you are trading with a regulated forex broker, this strategy can be especially beneficial as it provides clarity in analyzing market trends and optimizing entry and exit points.

Understanding the Ichimoku Cloud Fundamentals

What is the Ichimoku Cloud?

The Ichimoku Cloud, developed by Japanese journalist Goichi Hosoda in the 1960s, is more than just an indicator—it’s a fully-fledged trading system that provides a unique, multi-dimensional view of the markets. This system stands out because it integrates trend-following and momentum indicators with future-looking predictions, giving traders a comprehensive view of market dynamics. Unlike traditional indicators that may focus solely on past price action, the Ichimoku Cloud swing trading strategy projects potential support and resistance levels into the future, offering a distinct advantage in volatile markets. This makes it a particularly useful tool for traders utilizing an online forex broker or those working with a regulated forex broker. Each component of the Ichimoku Cloud plays a role in forming a clear picture of the current and future market landscape, helping traders make well-timed decisions.

Read More: rsi swing trading strategy

The Ichimoku Cloud swing trading strategy consists of five essential components:

1. Tenkan-sen (Conversion Line)

- Calculation: (Highest High + Lowest Low) / 2 over 9 periods

- Purpose: Indicates short-term momentum and is used as a reference for recent price movements.

- Usage: The Tenkan-sen can act as a dynamic support or resistance level, helping traders determine key levels where prices may rebound or face difficulty breaking through. It is particularly helpful in volatile markets.

- This component is crucial for traders who want to capitalize on short-term price shifts, providing a quick reference to momentum changes.

2. Kijun-sen (Base Line)

- Calculation: Similar to the Tenkan-sen, but it calculates the mid-point using the highest high and lowest low over the last 26 periods.

- Purpose: Reflects medium-term momentum, serving as a slower but more reliable trend indicator compared to the Tenkan-sen.

- Usage: The Kijun-sen is commonly used as a trigger line for trades. When the price crosses above or below this line, it can indicate a potential trade entry or exit. This component helps filter out the “noise” of short-term fluctuations, giving traders a better sense of the overall trend.

- Traders often rely on the Kijun-sen to identify significant trend shifts, making it a key decision-making tool in the Ichimoku swing trading strategy.

3. Senkou Span A (Leading Span A)

- Calculation: Calculated by averaging the Tenkan-sen and Kijun-sen, then plotting the result 26 periods ahead.

- Purpose: Forms one edge of the cloud, which represents a zone of potential support or resistance in the future.

- Usage: The space between the Senkou Span A and Senkou Span B creates the “cloud,” which is an integral part of the Ichimoku Cloud system. When the price is above the cloud, it signals an uptrend, while a price below the cloud suggests a downtrend.

- This forward-looking aspect of the Ichimoku Cloud gives traders a unique edge, as it projects future potential levels, helping them anticipate market movements before they happen.

4. Senkou Span B (Leading Span B)

- Calculation: (Highest High + Lowest Low) / 2 over 52 periods, plotted 26 periods ahead, making it a slower and more stable cloud boundary.

- Purpose: Complements Senkou Span A by forming the second edge of the cloud, which provides an additional layer of support or resistance.

- Usage: The wider the distance between Senkou Span A and B, the more volatile the market is considered to be. A narrow cloud indicates a weaker trend, while a thick cloud suggests strong momentum.

- Senkou Span B adds an extra level of confirmation, helping traders better assess the strength and stability of a trend.

5. Chikou Span (Lagging Span)

- Calculation: The current closing price plotted 26 periods behind, effectively showing the relationship between the present and the past.

- Purpose: Confirms the trend and validates potential reversal points by comparing current prices with historical ones.

- Usage: A key function of the Chikou Span is to serve as a trend confirmation tool. When the Chikou Span is above the price from 26 periods ago, it confirms an uptrend, while a position below indicates a downtrend.

- This component is essential for avoiding false signals, as it verifies the legitimacy of potential trend reversals or continuations.

Read More: highest win rate swing trading strategy

The Power of Swing Trading with Ichimoku

Using the Ichimoku Cloud swing trading strategy in your swing trading plan offers several significant benefits that can enhance your trading results, particularly when working with a broker for forex trading:

1. Optimal Time Commitment

- Swing trading with Ichimoku allows for more flexibility compared to day trading. Instead of having to monitor the markets constantly, swing traders can check their trades periodically and adjust their positions accordingly. This is particularly beneficial for traders who have other commitments, such as full-time jobs or personal responsibilities.

- The beauty of the Ichimoku swing trading strategy is that it allows for well-considered, less stressful trades without sacrificing potential profits.

2. Enhanced Signal Quality

- One of the key advantages of using the Ichimoku swing trading strategy is its ability to filter out unnecessary market noise. By using multiple timeframes and cross-checking signals across the components of the system, traders can better identify genuine trading opportunities. The cloud itself acts as a buffer, reducing the risk of false signals by requiring confirmation from various indicators.

- This strategy gives traders clearer, more reliable signals, making it easier to avoid common trading pitfalls like overtrading or reacting to short-term market fluctuations.

3. Comprehensive Market View

- The Ichimoku Cloud system excels at providing a 360-degree view of the market, combining trend analysis, momentum indicators, and support/resistance levels into one cohesive system. This offers a comprehensive understanding of market conditions, allowing traders to make well-rounded, informed decisions. Additionally, the forward-looking nature of the Ichimoku Cloud enables traders to anticipate future price movements, making it easier to plan their trades in advance.

- With its multifaceted approach, the Ichimoku swing trading strategy offers traders a powerful tool for navigating complex market environments, giving them a distinct advantage.

Seven Secrets to Ichimoku Cloud Swing Trading Success

Mastering the Ichimoku Cloud swing trading strategy is a game-changer for traders who want to capitalize on trends and improve their trading accuracy. Below, we unveil the seven essential secrets to achieving success with the Ichimoku swing trading strategy.

Read More: xauusd swing trading strategy

Secret 1: Mastering Cloud Interpretation

The cloud (Kumo) is the core of the Ichimoku Cloud swing trading strategy and serves as the primary analysis tool for traders.

- Cloud Color Analysis

- Green cloud: Signals a bullish sentiment when Senkou Span A is above Span B.

- Red cloud: Indicates a bearish sentiment when Senkou Span B is above Span A.

- Changes in cloud color often precede significant price movements, providing early clues about market shifts.

- Cloud Thickness Significance

- Thick clouds: Represent strong support or resistance levels, reinforcing key market zones.

- Thin clouds: Suggest potential breakout opportunities due to reduced strength in support or resistance.

- Watching changes in cloud thickness can help traders anticipate shifts in trend strength.

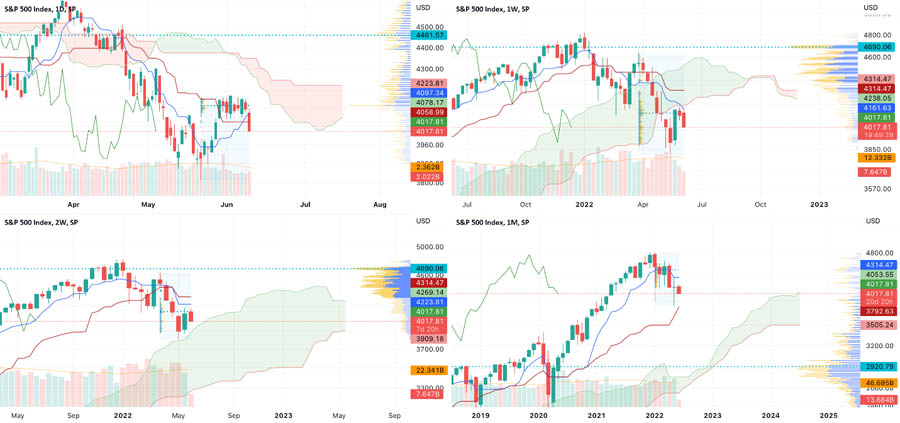

Secret 2: Multiple Timeframe Analysis

A cornerstone of the Ichimoku swing trading strategy is analyzing multiple timeframes to make more informed decisions.

- Weekly Charts

- Identify long-term trends and establish major support and resistance levels.

- Guide your overall trading bias based on the broader market picture.

- Daily Charts

- This is the primary timeframe for swing trading setups.

- Use it to confirm weekly chart analysis and pinpoint potential entry zones.

- 4-Hour Charts

- Fine-tune your entry and exit points by observing shorter-term price movements.

- Confirm shorter-term trend alignment and identify intraday support/resistance.

Secret 3: High-Probability Entry Strategies

Master these entry techniques for higher success rates in swing trading with the Ichimoku Cloud.

- TK Cross Strategy

- Entry Criteria: Tenkan-sen crosses above Kijun-sen, price is above the cloud, and Chikou Span is above price.

- Risk Management: Place stop-loss below the recent swing low or consider the cloud bottom as a secondary stop level.

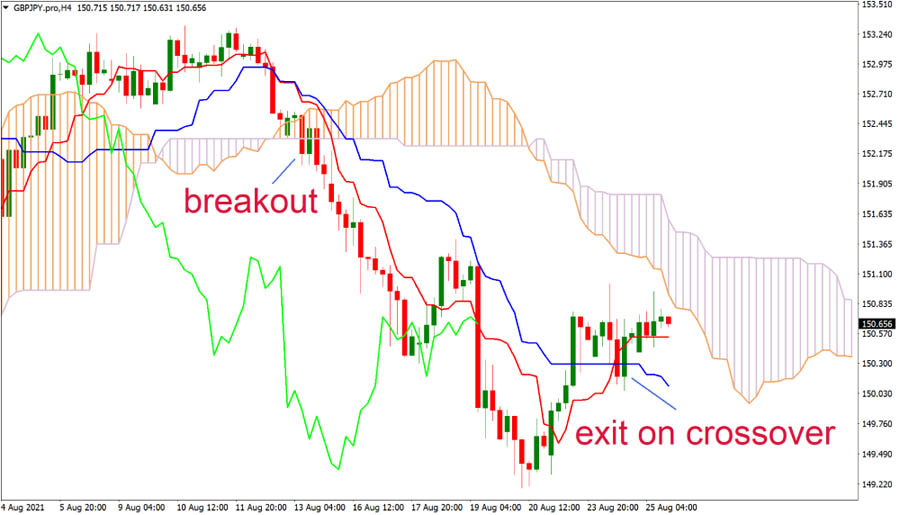

- Cloud Breakout Strategy

- Entry Criteria: Price breaks through the cloud with strong momentum, supported by a cloud color change in the breakout direction.

- Confirmation: Look for a successful retest of the cloud as support or resistance and aligned Tenkan and Kijun sen.

Secret 4: Advanced Risk Management

Proper risk management is key to long-term success in the Ichimoku swing trading strategy.

- Position Sizing

- Use a fixed percentage of risk (typically 1-2% per trade).

- Adjust your position size based on the cloud thickness to manage risk effectively.

- Strategic Stop Loss Placement

- Place technical stop-losses below key support/resistance levels, such as the bottom of the cloud.

- Use time-based stops for trades that are not performing as expected, and adjust stops based on volatility with ATR (Average True Range).

Secret 5: Trade Management Excellence

Effective trade management ensures that you maximize profits and minimize losses.

- Trailing Stop Techniques

- Use the Kijun-sen as a trailing stop, adjusting it based on market volatility to lock in profits.

- This allows you to ride trends while managing risk.

- Scaling Strategies

- Add to positions that show strong momentum and take partial profits at predetermined levels.

- Leaving a portion of your position in play can capitalize on extended market runs.

Secret 6: Understanding Market Context

Adapting to different market conditions is crucial in swing trading with the Ichimoku Cloud.

- Trending Markets

- Focus on trend-following entries, using the cloud as dynamic support or resistance.

- Look for strong cloud color and thickness to confirm trend strength.

- Ranging Markets

- Be more selective with entries in ranging markets, where volatility is lower.

- Watch for signals of range expansion and reduce position sizes if necessary.

Secret 7: Psychological Mastery

Your mindset plays a pivotal role in executing the Ichimoku Cloud swing trading strategy effectively.

- Patience in Setup Development

- Wait for ideal conditions to present themselves, rather than forcing trades.

- Use the waiting period to refine your analysis and prepare for the next opportunity.

- Emotional Control

- Trust in your system and maintain strict risk management at all times.

- Keeping a detailed trading journal can help you stay grounded and learn from your successes and mistakes.

Advantages and Disadvantages of the Ichimoku Cloud Swing Trading Strategy

Key Advantages:

- Comprehensive Analysis

- The Ichimoku Cloud swing trading strategy provides multiple data points for decision-making and offers a visual representation of market dynamics.

- Forward-looking predictions help traders anticipate market movements more effectively.

- Versatility

- This strategy works across various timeframes and instruments, making it adaptable to different market conditions.

- It can also complement other technical indicators, such as RSI or moving averages.

Notable Disadvantages:

- Learning Curve

- The Ichimoku swing trading strategy is a complex system that requires practice to master.

- With multiple components to understand, it can be overwhelming for beginners.

- Lagging Nature

- As the system is based on historical price data, it may delay signals in fast-moving markets.

- It requires confirmation from other tools to avoid false signals.

Opofinance Services for Ichimoku Traders

When implementing your Ichimoku Cloud swing trading strategy, choosing the right broker is crucial. Opofinance, an ASIC-regulated broker, offers:

- Advanced platforms with comprehensive charting tools

- Competitive spreads ideal for swing trading

- Social trading features for strategy sharing

- Safe and convenient deposit/withdrawal methods

- 24/7 expert customer support

As an officially featured broker on the MT5 brokers list, Opofinance provides the ideal environment for executing your Ichimoku Cloud strategy effectively.

Conclusion

The Ichimoku Cloud swing trading strategy provides traders with a comprehensive framework for analyzing markets and executing trades. By mastering the seven secrets outlined in this guide, you can enhance your ability to identify trends, manage risks, and make informed decisions. Implementing the Ichimoku swing trading strategy effectively requires dedication, consistent practice, and a deep understanding of market dynamics. While the strategy may present some challenges, its benefits far outweigh the drawbacks when used as part of a well-rounded trading plan.

Remember, success in swing trading depends not only on mastering the tools like the Ichimoku Cloud but also on maintaining proper risk management, adapting to different market conditions, and continually refining your approach. With patience and perseverance, this strategy can become an invaluable part of your trading toolkit.

Can the Ichimoku Cloud strategy be combined with other technical indicators?

Yes, the Ichimoku Cloud can be effectively combined with other technical indicators such as RSI, MACD, or Fibonacci retracements. However, it’s important to avoid indicator redundancy and keep your analysis clear and focused. The best approach is to use complementary indicators that provide additional insights not already covered by the Ichimoku Cloud.

What is the ideal timeframe for Ichimoku Cloud swing trading?

While the Ichimoku Cloud can be applied to any timeframe, swing traders typically find the most success using daily and 4-hour charts. These timeframes provide a good balance between signal quality and trade frequency. Weekly charts can be used for trend confirmation, while 1-hour charts may help in fine-tuning entries and exits.

How does the Ichimoku Cloud perform in different market conditions?

The Ichimoku Cloud adapts well to various market conditions, but its effectiveness can vary. It performs best in trending markets, providing clear signals and support/resistance levels. In ranging or choppy markets, the strategy may generate more false signals. Traders should adjust their expectations and potentially modify their approach based on prevailing market conditions.