The ICT 2022 Strategy is revolutionizing the world of intraday forex trading with its precision, discipline, and advanced liquidity techniques. Developed by Michael Huddleston in 2022, this strategy has quickly become a favorite among traders who demand a systematic approach to capturing high-probability trades.

In this comprehensive guide, we provide a direct answer to what the ICT 2022 Strategy is, how the ICT 2022 model strategy works, and why it is essential for achieving consistent gains in the forex market. Whether you are a beginner looking for insights from a regulated forex broker or an experienced trader seeking to refine your ICT 2022 trading strategy, this article covers every aspect—from the foundational concepts to the step-by-step implementation and advanced pro tips.

The ICT 2022 Trading Model integrates key principles such as time, price, liquidity, and market structure to deliver up to 50 pips per trade with a favorable risk-reward ratio of 1:3. In this article, you will learn not only the ICT 2022 Entry Techniques that have changed the way traders approach market dynamics but also gain insights into the ICT 2022 Mentorship Program, which further deepens your understanding of this unique strategy. For those who are searching for a trusted forex trading broker, the ICT 2022 strategy offers clarity, precision, and a detailed approach that aligns perfectly with the needs of modern traders.

If you are looking for an edge in your trading performance, read on to discover the complete framework behind the ICT 2022 strategy, learn how to identify liquidity zones, understand critical trading sessions, and apply actionable steps that make the ICT 2022 trading strategy not only accessible but also powerful. This article is designed to ensure that every trader—whether novice or advanced—can benefit from the proven methods and time-tested principles underlying the ICT 2022 model strategy.

What is the ICT 2022 Strategy?

The ICT 2022 Strategy is an innovative, liquidity-focused forex trading approach that integrates time, price, and market structure to identify high-probability trading setups. Introduced by Michael Huddleston in 2022, the strategy revolutionized the traditional trading paradigm by emphasizing the importance of precise timing and liquidity in the forex market. At its core, the ICT 2022 Trading Model aims to pinpoint market entry and exit points using a blend of algorithmic methods and discretionary judgment.

Key characteristics of the ICT 2022 strategy include:

- Time and Price Integration: The strategy places a premium on the precise timing of trades. By synchronizing time and price, traders can capture key moments in the market when price action is at its most decisive.

- Liquidity Targeting: The ICT 2022 Trading Model is designed to exploit liquidity sweeps and fair value gaps (FVGs), providing traders with clear targets where liquidity is pooled. This enables the identification of optimal entry points.

- Market Structure Analysis: By carefully analyzing market trends and structural shifts, the ICT 2022 model strategy guides traders to take positions that align with the prevailing market bias. This systematic approach increases the probability of capturing significant moves.

- High-Reward Setups: With a focus on risk-reward optimization, the ICT 2022 strategy targets setups that can yield up to 50 pips per trade, often with a risk-reward ratio of 1:3 or better.

The ICT 2022 strategy is not just another trading system—it is a complete trading model that provides a roadmap for executing intraday trades with precision. The clear structure and actionable insights make it one of the most sought-after methods in the modern forex trading arena.

Read More: ICT Optimal Trade Entry

Key Components of the ICT 2022 Strategy

To fully appreciate the ICT 2022 Trading Model, it is essential to break down its core components. These building blocks work in unison to create a robust framework that empowers traders to identify, enter, and manage trades effectively.

Time and Price

Time and price are the twin engines that drive the ICT 2022 trading strategy. This component focuses on:

- Precise Timing: The ICT 2022 strategy hinges on the concept that market timing is everything. By analyzing the interplay between time and price, traders can identify moments of market inefficiency where liquidity is ripe for capture.

- Price Action Patterns: The strategy involves studying recurring price action patterns that indicate market reversals, continuation, or exhaustion. Recognizing these patterns allows traders to forecast potential moves with greater accuracy.

- Algorithmic Integration: The ICT 2022 model strategy combines algorithmic insights with manual analysis to pinpoint exact moments for trade entry. This hybrid approach ensures that traders are both systematic and adaptable.

Liquidity

Liquidity is a critical component in the ICT 2022 trading strategy. The method focuses on:

- Identifying Liquidity Pools: Areas with clustered stop-loss orders, previous highs and lows, and fair value gaps are prime targets for liquidity. By identifying these zones, traders can anticipate where the market is likely to move.

- Liquidity Sweeps: The strategy capitalizes on moments when the market aggressively moves to trigger stop-loss orders, known as liquidity sweeps. This phenomenon often leads to rapid price movements that can be exploited for profit.

- Fair Value Gaps (FVGs): These gaps occur when the market moves too quickly, leaving behind an imbalance. Traders using the ICT 2022 trading strategy monitor FVGs as indicators of potential reversals or continuations.

Market Structure

Understanding market structure is paramount to the ICT 2022 Trading Model. Key elements include:

- Trend Analysis: By examining the higher timeframe charts, traders can determine whether the market is in an uptrend, downtrend, or range-bound environment. This higher timeframe analysis sets the stage for determining trade direction.

- Order Blocks: Order blocks represent areas where significant buying or selling has previously occurred. These blocks serve as important markers for potential support and resistance levels.

- Structural Shifts: The ICT 2022 strategy requires traders to be vigilant about shifts in market structure, as these often precede significant price moves. Recognizing these shifts early allows for more timely trade entries.

By integrating these components seamlessly, the ICT 2022 model strategy offers a holistic approach that is both systematic and adaptable, catering to various market conditions and trader preferences.

Trading Sessions and Timeframes

The effectiveness of the ICT 2022 Trading Model hinges on selecting the right trading sessions and timeframes. The strategy is designed to work best during periods of high liquidity and volatility, which are typically concentrated during specific trading sessions.

Key Trading Sessions

- London Session (2:00–5:00 AM EST):

The London session is recognized as a high-volatility period, often referred to as the “kill zone.” During this time, liquidity surges as European traders enter the market, creating ample opportunities for executing the ICT 2022 trading strategy. The combination of high volume and rapid price action makes it an ideal period to target liquidity sweeps. - New York Session (8:00–11:00 AM EST):

The New York session is another critical period, heavily influenced by economic news and market sentiment. This session is characterized by rapid moves and significant reversals, making it perfect for traders applying the ICT 2022 model strategy. The session helps in confirming the daily bias and capturing breakout opportunities.

Recommended Timeframes

To implement the ICT 2022 trading strategy effectively, it is important to use multiple timeframes:

- Daily Charts:

Use daily charts to establish the overall market bias. A careful analysis of the daily chart helps in identifying long-term trends and key support and resistance levels. - 1-Hour Charts:

The 1-hour timeframe is ideal for confirming trends observed on the daily chart. It provides a more granular view of market movements, which is essential for planning precise entries. - 15, 5, 3, and 1-Minute Charts:

For pinpointing exact entry points, lower timeframes such as the 15, 5, 3, and 1-minute charts are crucial. These charts allow traders to observe micro-structure dynamics and execute the ICT 2022 Entry Techniques with high precision.

Session and Timeframe Overview

| Session | Time (EST) | Purpose |

| London Session | 2:00–5:00 AM | High volatility, liquidity sweeps |

| New York Session | 8:00–11:00 AM | News-driven moves, daily bias confirm |

| Daily Timeframe | All day | Establish overall market bias |

| 1-Hour Timeframe | All day | Validate trends and setup analysis |

| Lower Timeframes | 15/5/3/1 minutes | Pinpoint precise entries |

Using these sessions and timeframes, the ICT 2022 strategy maximizes the potential for finding high-probability trades and achieving the desired risk-reward outcomes.

Read More: Fair value gap and order block strategy

Understanding Liquidity in the ICT 2022 Strategy

A deep understanding of liquidity is essential when implementing the ICT 2022 Trading Model. Liquidity drives market movements, and the strategy leverages liquidity to identify key trade setups.

Types of Liquidity

- Previous Day/Week Highs and Lows:

These levels are critical in the ICT 2022 model strategy because they mark zones where significant price action has previously occurred. These zones are often teeming with stop-loss orders, making them prime targets for liquidity sweeps. - Session Highs and Lows:

Each trading session, particularly during the London and New York periods, has its own high and low points where liquidity is concentrated. Recognizing these levels can guide traders in setting up trades that align with market momentum. - Price Gaps:

Price gaps occur when there is a rapid shift in price, often leaving behind a vacuum of orders. These gaps are an essential part of the ICT 2022 Trading Model as they indicate potential areas for reversals or momentum shifts.

Liquidity Sweeps and Fair Value Gaps (FVGs)

- Liquidity Sweeps:

In the ICT 2022 trading strategy, liquidity sweeps occur when the market aggressively moves to trigger clusters of stop-loss orders. These sweeps provide an excellent opportunity to capture a significant move, as the triggered liquidity can propel the price further in the direction of the sweep. - Fair Value Gaps (FVGs):

FVGs represent imbalances in price caused by rapid movements, leaving unfilled orders behind. The ICT 2022 model strategy uses FVGs as a marker for potential trade entries, anticipating that the price will eventually return to fill these gaps.

Liquidity Overview Table

| Liquidity Type | Description |

| Previous Day/Week Highs | Key levels with clustered stop-loss orders |

| Session Highs/Lows | Significant levels during active trading sessions |

| Liquidity Sweeps | Rapid moves that trigger clustered stop-loss orders |

| Fair Value Gaps (FVGs) | Areas of price imbalance signaling potential reversals |

By carefully analyzing these liquidity elements, traders can effectively use the ICT 2022 trading strategy to time entries and exits, thereby maximizing profit potential while minimizing risk.

Implementation Strategy Step-by-Step

Implementing the ICT 2022 Trading Model involves a systematic, step-by-step process. The following detailed guide will help you transition from theory to actionable trading steps, ensuring that you effectively utilize the ICT 2022 model strategy in your daily trading.

Step 1: Establish Higher Timeframe Bias

- Analyze Weekly and Daily Charts:

Begin by examining higher timeframes—such as the weekly and daily charts—to determine the prevailing market trend. Look for key patterns like higher highs and higher lows to establish a bullish bias or lower lows and lower highs for a bearish perspective. - Mark Significant Order Blocks:

Identify and mark critical order blocks, which are zones where significant buying or selling activity has previously taken place. These order blocks provide clues about potential support and resistance levels, forming the foundation for the ICT 2022 strategy.

Step 2: Set Daily Bias

- Daily Chart Confirmation:

Refine your market bias using the daily chart. Monitor important time markers such as the NY Midnight Open (00:00 EST), which often serves as a pivot point. A break below or above a key level can confirm a bearish or bullish bias, respectively. - Align with Higher Timeframe:

Ensure that your daily bias is consistent with the higher timeframe trend. This alignment is crucial to maintain a coherent strategy and to filter out false signals.

Step 3: Identify Liquidity Targets

- Switch to 4-Hour and 1-Hour Charts:

Zoom in on the 4-hour and 1-hour charts to identify liquidity zones. These include previous highs and lows, FVGs, and clusters of stop-loss orders. Use these charts to pinpoint where liquidity is likely to be swept. - Mark Liquidity Zones:

Clearly delineate these zones on your charts, as they will serve as reference points for trade entries. The ability to visualize liquidity is a key element of the ICT 2022 model strategy.

Step 4: Choose the Right Session and Timeframe

- Focus on London and New York Sessions:

The ICT 2022 Trading Model performs best during high-liquidity sessions. Concentrate your trading efforts during the London Session (2:00–5:00 AM EST) and the New York Session (8:00–11:00 AM EST) where volatility is at its peak. - Transition to Lower Timeframes:

For executing precise entries, drop to lower timeframes such as the 15, 5, 3, or 1-minute charts once you have confirmed your bias and identified key liquidity zones.

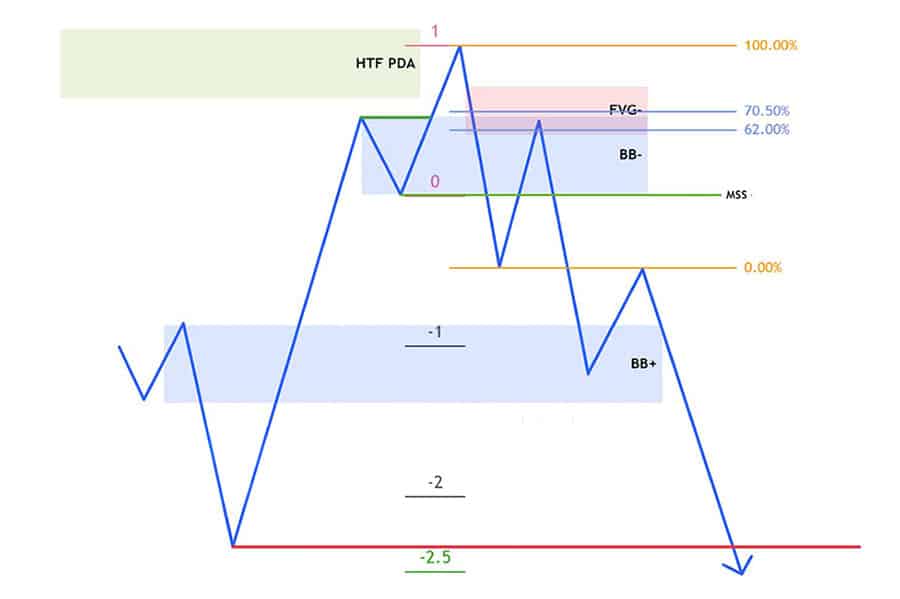

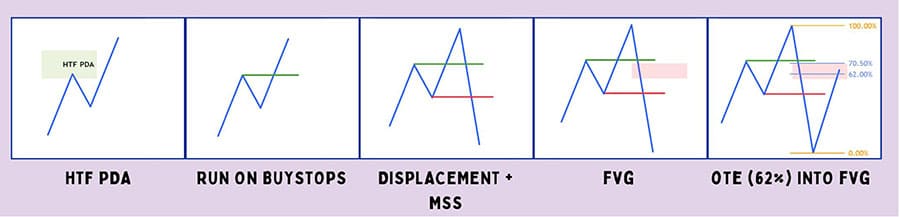

Step 5: Confirm the Trade Setup

- Wait for a Liquidity Sweep:

Before executing a trade, wait for a liquidity sweep to occur. This event is a critical signal that the market is clearing out stop-loss clusters, paving the way for a strong directional move. - Validate with a Displacement Candle:

Look for a displacement candle—often around the 62% Fibonacci retracement level—that confirms the trade setup. This candle acts as a final checkpoint before you enter the market.

Step 6: Execute the Trade

- Entry and Stop-Loss Placement:

Enter the trade once all conditions are met. Place your stop-loss just beyond the last swing point to protect your capital. For example, in a bearish setup, an entry at 1.2020 with a stop at 1.2040 might target a move toward 1.1960. - Set Clear Targets:

Establish clear profit targets based on the next liquidity zone. This ensures that you have a well-defined exit strategy in place.

Step 7: Manage and Exit the Trade

- Partial Profit-Taking:

As the trade moves in your favor, consider taking partial profits to secure gains while allowing the remaining position to run. - Adjust Stop-Loss to Breakeven:

Once your trade has moved a sufficient distance in your favor, adjust your stop-loss to breakeven. This risk management technique protects your capital against sudden reversals. - Monitor for Reversal Signals:

Keep an eye on any signs of reversal, such as opposing price action or weakening momentum. Exit the trade if these signals become apparent.

By following these seven detailed steps, you ensure that each trade executed under the ICT 2022 Trading Model is aligned with both technical and liquidity-based principles, ultimately enhancing your probability of success in the forex market.

Read More: The ICT Turtle Soup Strategy

Best Practices and Tools for Implementation

The ICT 2022 Strategy is most effective when combined with disciplined best practices and robust trading tools. Adopting these practices not only enhances your execution but also ensures that you remain consistent in applying the ICT 2022 model strategy.

Essential Best Practices

- Rigorous Risk Management:

Always implement stop-loss orders and consider partial profit-taking as standard practice. The ICT 2022 trading strategy stresses that protecting capital is paramount. - Routine Chart Analysis:

Regularly update your charts, review liquidity zones, and adjust your bias based on current market trends. This routine keeps you alert to sudden changes in market structure. - Confluence of Indicators:

Use multiple indicators, such as Fibonacci retracement levels, fair value gaps, and momentum oscillators, to confirm trade setups. Confluence increases the reliability of each trade signal.

Recommended Trading Tools

- TradingView:

TradingView’s sophisticated charting tools are essential for implementing the ICT 2022 model strategy. The ICT Master Suite and 2022 Model Entry Strategy indicator available on TradingView offer invaluable assistance in analyzing market trends. - Lux Algos:

For enhanced detection of fair value gaps (FVGs) and liquidity sweeps, Lux Algos is an excellent tool. Its ability to integrate seamlessly with the ICT 2022 trading strategy can improve your entry precision. - ICT Mentorship Program:

For traders seeking deeper insights, the ICT 2022 Mentorship Program provides tailored guidance and expert advice, helping you master the ICT 2022 trading strategy and refine your techniques over time.

These best practices and tools are designed to support every step of your trading journey, making the ICT 2022 model strategy both actionable and scalable across different market conditions.

Pro Tips for Advanced Traders

For advanced traders looking to elevate their game further, here are some pro tips to optimize the ICT 2022 Trading Model:

- Refine Your Entry Techniques:

Continuously backtest and fine-tune your ICT 2022 Entry Techniques. Look for subtle cues in liquidity sweeps and displacement candles to sharpen your timing. - Embrace Advanced Analytics:

Integrate additional technical indicators such as volume analysis, volatility indices, or sentiment indicators to bolster your trade confirmations. - Customize Your TradingView Workspace:

Set up custom alerts and indicators tailored to the ICT 2022 trading strategy. A personalized workspace can help streamline your analysis and execution. - Stay Informed with Global News:

Monitor global economic events and news releases that may impact market liquidity and volatility. A proactive approach to news can help you adjust the ICT 2022 model strategy in real time. - Engage with Trading Communities:

Join forums and mentorship groups to exchange insights and strategies related to the ICT 2022 model strategy. Collaborating with like-minded traders can expose you to new techniques and market perspectives.

These pro tips are designed to help experienced traders fine-tune their strategies and leverage the ICT 2022 trading strategy to its fullest potential.

Opofinance Services

Before wrapping up, it’s important to highlight the exceptional services provided by the ASIC regulated opofinance broker, a trusted name for forex traders worldwide. Their comprehensive suite of services perfectly complements the ICT 2022 Trading Model and can greatly enhance your trading experience. Here’s what sets opofinance apart:

- Advanced Trading Platforms:

Trade effortlessly on industry-leading platforms such as MT4, MT5, cTrader, and OpoTrade, ensuring a seamless and efficient trading experience. - Innovative AI Tools:

Utilize cutting-edge AI Market Analyzer, AI Coach, and AI Support to gain valuable market insights and improve your trading decisions. - Social & Prop Trading:

Engage in secure and flexible social and prop trading, allowing you to learn from and copy strategies from top traders. - Safe and Convenient Transactions:

Enjoy secure deposits and withdrawals with zero fees, including support for crypto payments, ensuring that your funds are managed safely and conveniently.

For traders looking to integrate robust trading technology with the ICT 2022 model strategy, opofinance is an excellent choice. Experience these advantages by visiting opofinance.com today and take your trading to the next level.

Conclusion

In conclusion, the ICT 2022 Strategy is a comprehensive and liquidity-driven approach to forex trading that emphasizes the integration of time, price, and market structure. Developed by Michael Huddleston in 2022, the strategy offers a systematic framework for capturing high-probability trades with a clear focus on liquidity sweeps and fair value gaps. By utilizing key components such as precise timing, robust liquidity analysis, and detailed market structure evaluation, the ICT 2022 Trading Model provides traders with actionable insights and proven techniques for achieving consistent profits.

This strategy is particularly effective during the London and New York sessions, where volatility and liquidity create optimal conditions for trade execution. Through a step-by-step implementation guide, detailed explanations of key components, and advanced pro tips, the ICT 2022 trading strategy empowers traders at all levels to navigate the complex forex landscape with confidence and precision.

Remember, successful trading is built on disciplined execution, rigorous risk management, and continuous learning. The ICT 2022 Mentorship Program and advanced tools like TradingView and Lux Algos can further enhance your trading performance, making it easier to identify and capture high-reward opportunities in today’s dynamic market.

Key Takeaways

- The ICT 2022 Strategy is a robust, liquidity-driven model that integrates time, price, and market structure for high-probability forex trades.

- It emphasizes precise market timing, liquidity sweeps, and fair value gaps, enabling traders to target significant pips with a risk-reward ratio of 1:3.

- Effective implementation requires a step-by-step approach: establishing market bias, identifying liquidity zones, and choosing the right sessions and timeframes.

- Advanced tools and mentorship, along with disciplined risk management, are critical for maximizing the potential of the ICT 2022 trading strategy.

- The opofinance broker offers state-of-the-art platforms, innovative AI tools, and secure transaction methods, making it a top choice for traders looking to optimize their trading strategies.

References: +

What makes the ICT 2022 model strategy different from other forex trading strategies?

The ICT 2022 model strategy stands out due to its unique integration of time and price analysis with liquidity targeting. Unlike many conventional strategies that rely solely on technical indicators, the ICT 2022 Trading Model uses precise liquidity sweeps, fair value gaps, and market structure to pinpoint high-probability trade entries. This comprehensive approach not only increases the chances of success but also provides a systematic framework that adapts to various market conditions.

Can the ICT 2022 trading strategy be applied to other financial markets besides forex?

While the ICT 2022 strategy was originally developed for the forex market, many of its principles—such as liquidity analysis, time and price integration, and market structure evaluation—can be adapted to other financial markets like commodities, indices, and cryptocurrencies. However, traders should tailor the strategy to account for the unique characteristics of each market before applying it.

How do I maintain discipline and consistency when using the ICT 2022 Trading Model in volatile market conditions?

Maintaining discipline is crucial for the success of the ICT 2022 trading strategy. Traders should adhere strictly to their risk management rules, use clear stop-loss orders, and avoid deviating from the established trading plan. Regular backtesting, continuous learning through mentorship programs, and staying informed about global market events can help traders remain consistent, even during periods of high volatility.