If you’re striving to elevate your trading strategies, understanding the ICT Change in State of Delivery is pivotal. This sophisticated concept, introduced by renowned trader Michael J. Huddleston, revolutionizes how traders interpret market shifts and trends. In essence, it’s about identifying critical points where the market transitions from one phase to another, a skill that can significantly improve trading accuracy. Whether you’re leveraging the services of a regulated forex broker or exploring other trading tools, mastering this concept can be transformative. This guide will dissect the ICT Change in State of Delivery, offer actionable insights, and address frequently asked questions to help you grasp this essential trading technique.

Understanding ICT Change in State of Delivery

What is ICT Change in State of Delivery?

The ICT Change in State of Delivery is an advanced trading concept designed to pinpoint pivotal moments when market dynamics undergo significant shifts. This method focuses on identifying transitions that signal a change in market behavior, often evidenced by alterations in price momentum, trend direction, or volatility. Unlike more straightforward trading indicators, the Change in State of Delivery involves a nuanced analysis of price action and closing patterns to forecast potential market movements.

Recognizing these transitions is crucial for traders seeking to optimize their strategies and capitalize on evolving market conditions. By pinpointing these critical shifts, traders can adjust their positions, manage risk more effectively, and make strategic decisions that align with new market trends. This approach enhances trading precision and offers a strategic edge in volatile or rapidly changing markets.

Key Components of ICT Change in State of Delivery

Market Structure Shifts

A pivotal element in the Change in State of Delivery is understanding market structure shifts. These shifts often signify a broader change in market dynamics, marked by significant breaks through established support or resistance levels. When these levels are breached, it can indicate that the market is transitioning from one trend phase to another. Traders need to monitor such breaks carefully as they can signal the start of a new trend or a reversal of the current trend. Additionally, observing changes in trend lines and significant technical levels provides insight into whether the market is experiencing a fundamental shift or merely a temporary fluctuation.

Liquidity Pools

Liquidity pools are areas where market participants have placed a significant number of stop-loss orders, take-profit targets, or other trades. Markets often gravitate towards these pools to fill orders, which can cause price movements to accelerate as liquidity is absorbed. Identifying these pools and understanding their location helps traders anticipate when the market is likely to experience heightened volatility or a shift in momentum. Recognizing when the market targets these liquidity zones allows traders to adjust their strategies in anticipation of potential market reversals or continuation patterns.

Price Action Patterns

Price action patterns provide critical signals that can indicate a Change in the State of Delivery. Key patterns include strong candle closes, long wicks, or significant changes in candle formation. For example, a series of strong bullish or bearish candles may suggest a trend is strengthening, while a long wick might indicate price rejection at a specific level. Analyzing these patterns helps traders understand market sentiment and potential shifts in supply and demand dynamics. By interpreting these patterns effectively, traders can gain insights into future market behavior and make informed trading decisions based on observed price actions.

Time of Day

The time of day significantly impacts market behavior, with different trading sessions exhibiting varying levels of liquidity and volatility. For instance, major trading hours, such as those overlapping with London and New York sessions, often experience increased market activity and volatility. These periods can lead to more pronounced market shifts and provide traders with opportunities to capitalize on significant changes in price dynamics. Understanding how market behavior varies throughout the day enables traders to time their trades more effectively and align their strategies with prevailing market conditions.

By mastering these components of the ICT Change in State of Delivery, traders can develop a deeper understanding of market transitions and enhance their trading strategies. Recognizing key patterns, liquidity dynamics, and time-related factors allows for more precise predictions and improved trading outcomes. This comprehensive approach to analyzing market shifts ensures that traders are well-equipped to navigate complex market conditions and optimize their trading performance.

Read More: Mastering The ICT 30 Second Model

Essential Strategies for Implementing ICT Change in State of Delivery

1. Analyzing Market Context

Understanding the broader market context is crucial before identifying a change in state. Analyzing higher time frames provides insight into the overall trend and market sentiment, helping traders interpret signals more accurately and avoid misleading indications.

2. Utilizing Multiple Time Frames

Employing multiple time frames in your analysis can enhance accuracy. For instance, you might identify a potential change in state on a shorter time frame while confirming it on a longer time frame. This method ensures a more comprehensive validation of market shifts.

3. Incorporating Technical Indicators

Technical indicators can offer additional confirmation of a change in state. Utilizing tools such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Fibonacci retracement levels can help verify the signals and refine trading strategies.

4. Recognizing Market Sentiment

Market sentiment plays a significant role in trading. By keeping track of news events, economic data releases, and other fundamental factors, traders can better understand the underlying sentiment driving market behavior. Aligning trading strategies with the prevailing sentiment can improve the effectiveness of your trades.

5. Developing a Robust Trading Plan

Creating a detailed trading plan based on the ICT Change in State of Delivery is essential. This plan should outline specific entry and exit points, risk management strategies, and criteria for identifying changes in state. A well-defined plan helps in maintaining discipline and consistency in trading.

6. Continuous Learning and Adaptation

The financial markets are dynamic, and continuous learning is vital. Stay updated with new developments, trading techniques, and market trends. Adapting your strategies based on evolving market conditions and new insights ensures long-term success.

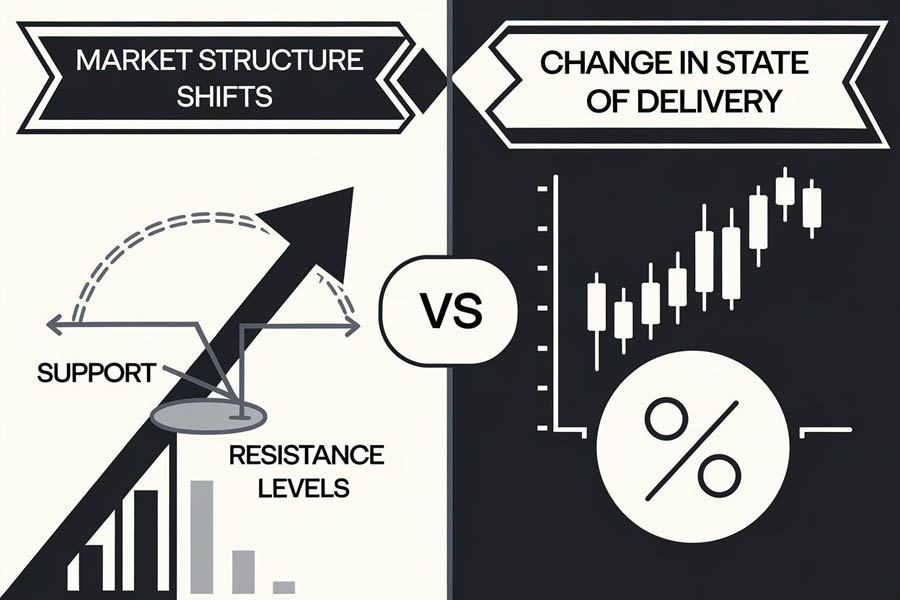

Market Structure Shifts vs. Change in the State of Delivery

Market Structure Shifts

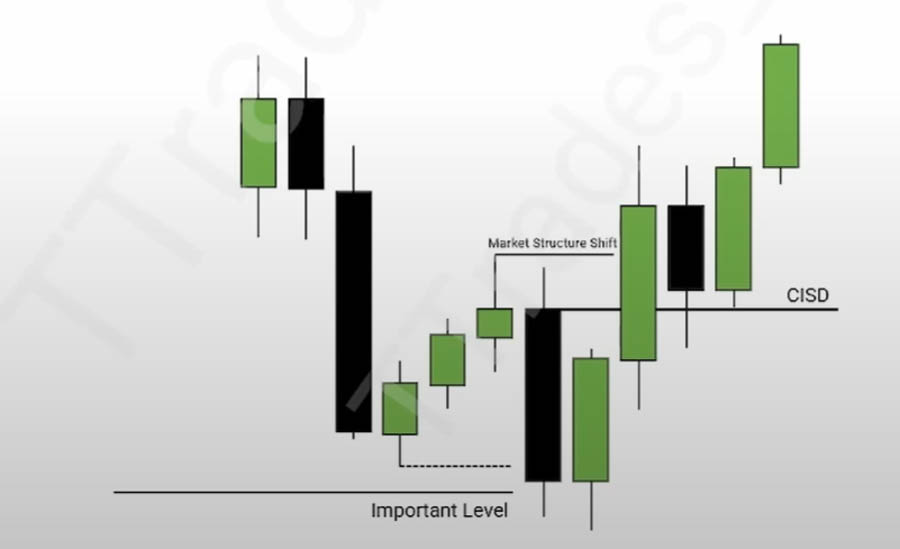

Market Structure Shifts involve significant alterations in the prevailing market trend, signaling a potential reversal or continuation of the current trend. These shifts are typically identified by displacement either above or below key swing highs or lows. For instance, if a market is trending bullishly and suddenly breaks below a critical swing low, it suggests a potential bearish trend might be developing. Similarly, if a market transitions from a bearish trend and surmounts a significant swing high, it could indicate a shift towards a bullish trend.

Understanding Market Structure Shifts is crucial because they represent a fundamental change in market behavior. Traders use these shifts to recalibrate their strategies, such as adjusting stop-loss levels, changing trade entries, or modifying position sizes. A Market Structure Shift can signal the end of one trend phase and the beginning of another, making it a key concept for managing trades and risk effectively. Recognizing these shifts involves analyzing historical price data, trend lines, and key support and resistance levels to make informed trading decisions based on the new market direction.

Change in the State of Delivery

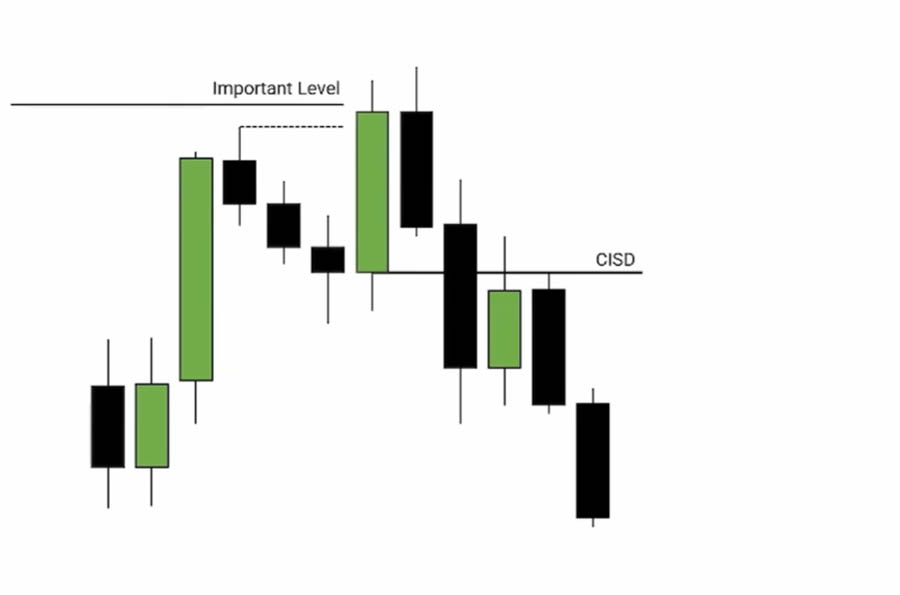

In contrast, the Change in the State of Delivery focuses on the closing prices of up-close candles, offering a more granular approach to identifying market shifts. This concept is based on whether the price closes below the opening price of these up-close candles. An up-close candle, characterized by a close above its open, represents bullish sentiment. When the price closes below the opening price of these candles, it indicates that selling pressure is increasing, thereby validating order blocks and suggesting potential shifts in market sentiment.

Understanding the Change in the State of Delivery involves scrutinizing these closing prices to identify early signals of trend changes. This method is beneficial for predicting market reversals or continuations before they fully manifest. By focusing on how the closing prices interact with previous candle formations, traders can detect subtle shifts in market sentiment that might not be immediately apparent through broader trend analysis alone. This approach allows for more precise timing of trades, potentially improving entry and exit points.

Comparing on a Chart

When comparing the Change in the State of Delivery to Market Structure Shifts on a trading chart, it is often observed that the Change in the State of Delivery occurs before the Market Structure Shift. This means that the Change in the State of Delivery can act as an early indicator of potential market transitions, providing traders with a head start in positioning themselves for upcoming shifts. For example, if a trader identifies a Change in the State of Delivery indicating a potential bearish shift, they might begin adjusting their strategy before the Market Structure Shift confirms a broader trend reversal.

Read More: ICT Breaker Block Vs Mitigation Block

Key Differences and Strategic Implications

- Timing and Precision: The Change in the State of Delivery offers earlier signals than Market Structure Shifts. Traders who can identify these early signals gain a competitive advantage by acting on potential changes before they are fully confirmed by broader market trends.

- Scope of Analysis: Market Structure Shifts provide a macro view of market trends, focusing on significant trend reversals or continuations. In contrast, the Change in the State of Delivery offers a micro view, focusing on specific price action and closing patterns to identify potential shifts.

- Application in Trading Strategies: Traders often use the Change in the State of Delivery to fine-tune their entries and exits, while Market Structure Shifts are used to confirm broader trend changes and adjust overall trading strategies. Combining both concepts can enhance trading precision and risk management.

- Risk Management: By recognizing the Change in the State of Delivery, traders can implement risk management strategies earlier, such as adjusting stop-loss orders or modifying trade sizes. This proactive approach helps in mitigating potential losses and capitalizing on emerging market trends.

Opofinance Services: Why ASIC-Regulated Brokers Matter

When choosing a broker for forex trading, opting for an ASIC-regulated broker like Opofinance offers several advantages. ASIC (Australian Securities and Investments Commission) regulation is a mark of credibility, ensuring that brokers adhere to rigorous financial standards and practices.

Benefits of Using an ASIC-Regulated Broker

- Enhanced Security: ASIC-regulated brokers are subject to stringent regulations designed to protect your funds. This includes maintaining client funds in segregated accounts and adhering to strict financial practices.

- Fair Trading Practices: ASIC-regulated brokers are required to operate transparently and fairly. This includes providing accurate pricing, executing trades efficiently, and avoiding practices that could disadvantage traders.

- Reliable Execution: With strict oversight, ASIC-regulated brokers offer reliable trade execution. This minimizes issues such as slippage and ensures that trades are executed at the intended prices.

- Customer Protection: ASIC regulation includes provisions for investor protection, ensuring that brokers follow ethical practices and provide a safe trading environment.

Opofinance Social Trading Service

Opofinance not only provides the benefits of ASIC regulation but also offers an exceptional social trading service. Social trading allows you to connect with and follow successful traders, replicating their trades in your account. This feature can be particularly advantageous for beginners or those looking to diversify their strategies.

Read More: Understanding And Trading With ICT Breaker Blocks In Forex

Conclusion

Mastering the ICT Change in State of Delivery can significantly enhance your trading approach by providing valuable insights into market transitions. Understanding and applying this concept enables traders to make more informed decisions, potentially improving trading performance and outcomes. Combine this knowledge with comprehensive market analysis, technical indicators, and a well-structured trading plan to optimize your trading strategy.

Embrace the power of ICT Change in State of Delivery and take your trading skills to new heights today.

What is the significance of the ICT Change in State of Delivery in trading?

The ICT Change in State of Delivery is significant because it helps traders identify critical shifts in market behavior, allowing for more precise trade entries and exits. Recognizing these changes can enhance the accuracy of trading strategies and improve overall performance.

How can I identify a change in state on my trading charts?

Identifying a change in state involves looking for specific signals such as breaks of major support or resistance levels, notable price action patterns, and liquidity movements. Observing these factors across multiple time frames can provide additional confirmation.

Can the ICT Change in State of Delivery be applied to all types of trading?

Yes, the ICT Change in State of Delivery is applicable to various types of trading, including forex, futures, and commodities. The principles of recognizing market transitions are universal and can be beneficial in different trading environments.