In the dynamic world of forex trading, staying ahead of the curve is essential for success. Enter the ICT Market Maker Sell Model (MMSM), a revolutionary strategy that’s transforming how traders approach the market. Developed by the Inner Circle Trader (ICT), this innovative model offers a fresh perspective on market dynamics and equips traders with powerful tools to identify high-probability selling opportunities. Partnering with a trusted forex broker can further enhance your ability to execute this strategy effectively, ensuring you stay competitive in the ever-evolving forex landscape.

The ICT Market Maker Sell Model is a comprehensive framework that focuses on understanding and exploiting the behavior of large institutional players, also known as market makers. By aligning their trading decisions with these influential entities, retail traders can significantly enhance their chances of success in the forex market.

In this article, we’ll dive deep into the ICT Market Maker Sell Model, exploring its core principles, key components, and practical applications. Whether you’re a seasoned trader looking to refine your strategies or a newcomer eager to gain an edge in the forex market, this guide will equip you with valuable insights to elevate your trading game.

Understanding the ICT Market Maker Sell Model

What Is the ICT Market Maker Sell Model?

The ICT Market Maker Sell Model is a sophisticated trading approach that aims to identify and capitalize on selling opportunities in the forex market. It’s based on the premise that large institutional players, or market makers, have a significant impact on price movements and often leave behind detectable patterns and behaviors.

Key Components of the Model

- Order Flow: Understanding how large orders from institutional players affect market dynamics.

- Price Action: Analyzing candlestick patterns and chart formations to identify potential selling points.

- Market Structure: Recognizing key levels, trends, and potential reversal zones.

- Liquidity: Identifying areas of high liquidity where market makers are likely to execute large sell orders.

- Time Factors: Considering important time zones and market sessions for optimal trade execution.

How the Model Works

The ICT Market Maker Sell Model operates on the principle that market makers often create false breakouts and manipulate price action to accumulate positions before making significant moves. By understanding these tactics, traders can:

- Identify potential selling zones

- Anticipate price reversals

- Enter trades with better risk-reward ratios

- Align their positions with institutional money flow

The Phases of the ICT Market Maker Sell Model

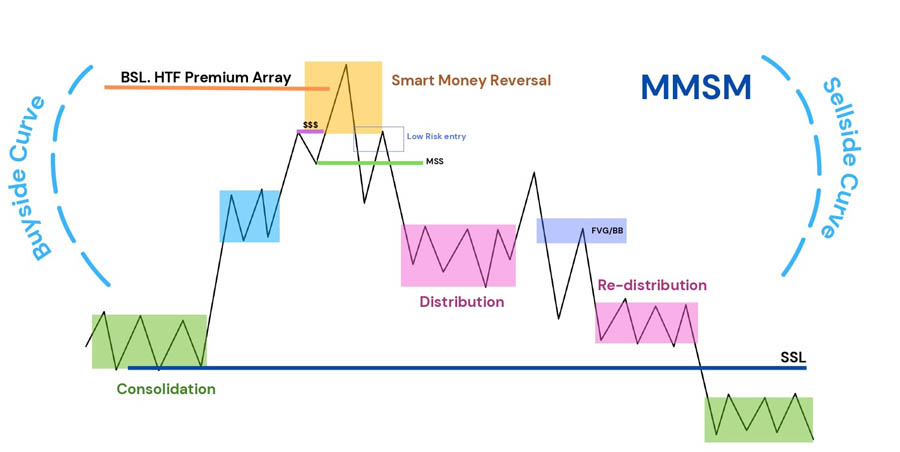

The MMSM consists of three main phases, each with its own characteristics and implications for traders:

1. Buy Program (Net Long)

This phase includes:

- Original Consolidation: Engineers Pending SSL (Sell Stop Limit) > Pending BSL (Buy Stop Limit).

- Accumulation: Buy Orders exceed Sell Orders through accumulation at discount market.

2. Smart Money Reversal (SMR)

This phase utilizes an Institutional Reference Point for one or multiple purposes:

- Mitigation of Long positions

- Rebalancing an Old Imbalance (Sell-Side Imbalance, Buy-Side Inefficiency)

- Buy-Side Liquidity Raid where:

- Limit Orders in the form of Buy stops (protecting long positions) are paired with Institutional Short orders / Long exit liquidity.

- Limit Orders in the form of Buy orders (interest of selling below a specific level) are paired with Institutional Short orders / Long exit liquidity.

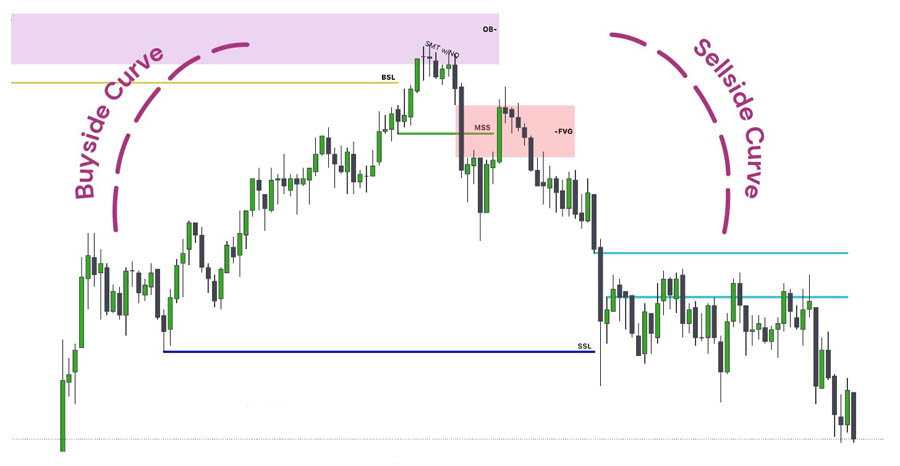

At the Reference Point, expect a Market Structure Shift / Market Structure Break, indicating a change from Buy Program to Sell Program.

3. Sell Program (Net Short)

This phase consists of:

- Distribution (1st leg): Sell Orders exceed Buy Orders

- Redistribution (2nd leg): Sell Orders continue to exceed Buy Orders

- Terminus / Completion: Orders added to Institutional Positions during hedging and SMR are now paired with the Original Consolidation Liquidity

Implementing the ICT Market Maker Sell Model

To effectively implement the MMSM, traders should focus on identifying the following crucial elements:

- HTF IOF (Higher Time Frame Institutional Order Flow): Should be Bearish

- Analyze higher time frames (e.g., daily, weekly, or monthly charts) to determine the overall institutional order flow.

- Look for clear bearish trends or patterns on these larger time frames.

- Identify key resistance levels where institutional selling pressure is likely to be strong.

- Pay attention to major swing highs and lows on the higher time frames, as these often represent important institutional reference points.

- Use tools like volume profile or order flow analysis to confirm bearish institutional activity on the higher time frames.

- DOL (Direction of Liquidity): Should be Lower

- Assess the overall direction of liquidity in the market, which should be moving lower for the sell model.

- Look for accumulation of sell-side liquidity below key support levels.

- Identify areas where stop losses of long positions are likely to be clustered.

- Pay attention to round numbers or psychologically significant price levels where liquidity tends to concentrate.

- Use order flow tools to visualize the depth of the order book and confirm the presence of significant sell-side liquidity.

- Initial Curve: Buy Program with Accumulation / Re-Accumulation

- Recognize that before a significant sell-off, there’s often an initial buy program where institutions accumulate their positions.

- Look for periods of consolidation or sideways price action, which may indicate accumulation or re-accumulation phases.

- Identify bullish price action that may be deceptive, potentially luring retail traders into long positions.

- Pay attention to subtle changes in volume and price action that might suggest institutional accumulation is taking place.

- Use tools like volume profile or market profile to identify areas of high volume node (HVN) where accumulation might be occurring.

When all these factors align, it creates a high-probability setup for the ICT Market Maker Sell Model:

- The bearish HTF IOF provides the overall context and direction for the trade.

- The lower DOL confirms that there’s significant liquidity below the current price, which institutions may target.

- The initial buy curve with accumulation or re-accumulation suggests that institutions are positioning themselves for a potential sell-off.

When operating in a Higher Time Frame Bearish Order Flow, the expectation is that price will respect HTF Bearish PDAs (Premium and Discount Areas). After identifying the draw, traders should look for a major Institutional move.

The Sell Model’s primary purpose is to deliver price efficiently to the HTF Draw while generating Liquidity Pools below the marketplace during the Buy Curve. These pools, created by protective sell stops under old lows, will later be used to pair Institutional Orders post-SMR.

Read more: Mastering the ICT Market Maker Model

To capture parts of the move, traders should aim to align with the Order Flow.

Entry Models

Once the Smart Money Reversal has been identified (through Market Structure Shift or Market Structure Break), traders can apply one of the following entry models:

- 2022 Model:

- This model focuses on identifying key institutional levels and order blocks.

- Look for a break of structure followed by a retest of the broken level.

- Enter the trade when price reacts at the retest level, confirming the new trend direction.

- Use tight stop losses placed above/below the retest level.

- OFED (Order Flow Entry Decision):

- This model is based on reading real-time order flow and volume.

- Identify areas of high volume and potential institutional interest.

- Look for sudden increases in selling pressure at key levels.

- Enter trades when there’s a clear imbalance between buy and sell orders, favoring the sell-side.

- Use order flow tools to gauge the strength of the selling pressure and adjust your position size accordingly.

- Breaker + Fair Value Gap:

- Identify a significant breaker block, which is a former support/resistance level that has been broken.

- Look for a Fair Value Gap (FVG) near the breaker block. An FVG is an area on the chart where price has moved so quickly that it’s left an imbalance.

- Wait for price to retrace to the FVG and react at the breaker block level.

- Enter the trade when price shows rejection from the breaker block, with the FVG acting as additional confirmation.

- Place your stop loss above the breaker block and FVG zone.

When applying these entry models, it’s crucial to:

- Always align your trades with the higher time frame trend and institutional order flow.

- Use multiple time frame analysis to confirm your entry points.

- Practice proper risk management by using appropriate position sizing and stop loss placement.

- Be patient and wait for all components of your chosen entry model to align before entering a trade.

Remember, mastering these entry models requires practice and experience. It’s recommended to backtest and paper trade these strategies before applying them to live markets. Additionally, continuously refine your approach based on market conditions and your own trading performance.

Advanced Techniques in the ICT Market Maker Sell Model

Utilizing Fair Value Gaps

Fair Value Gaps (FVGs) are areas on the chart where price has moved rapidly, leaving behind an imbalance. These gaps often act as magnets for price, providing excellent opportunities for sell trades.

Implementing Breaker Blocks

Breaker blocks are significant support or resistance areas that, when broken, often lead to strong momentum in the opposite direction. Identifying these blocks can help traders anticipate potential selling opportunities.

Read more: Mastering the ICT New York Open Strategy

Leveraging Optimal Trade Entry (OTE)

The Optimal Trade Entry concept involves identifying precise entry points where the risk-reward ratio is most favorable. This often occurs at the confluence of multiple technical factors.

Risk Management in the ICT Market Maker Sell Model

Effective risk management is crucial when implementing the ICT Market Maker Sell Model. Consider the following strategies:

- Position Sizing: Limit each trade to a small percentage of your total trading capital.

- Stop Loss Placement: Set stop losses above key structural levels to avoid premature exits.

- Multiple Time Frame Analysis: Confirm selling opportunities across different timeframes for higher probability trades.

- Correlation Awareness: Be cautious when taking multiple sell positions in correlated currency pairs.

Common Pitfalls to Avoid

While the ICT Market Maker Sell Model can be highly effective, traders should be aware of potential pitfalls:

- Overtrading: Avoid the temptation to take every potential sell signal.

- Ignoring Fundamental Factors: While the model is primarily technical, major economic events can still impact price movements.

- Lack of Patience: Wait for all components of the model to align before entering a trade.

- Emotional Trading: Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

Enhancing Your ICT Market Maker Sell Model Strategy

Incorporating Sentiment Analysis

Complement your technical analysis with market sentiment data to gauge overall selling pressure in the market. Tools like the Commitment of Traders (COT) report can provide valuable insights into institutional positioning.

Utilizing Algorithmic Trading

Consider developing or using algorithmic trading systems that can automatically identify and execute trades based on the ICT Market Maker Sell Model criteria. This can help remove emotional bias and ensure consistent application of the strategy.

Continuous Education and Refinement

The forex market is constantly evolving, and so should your trading approach. Stay updated with the latest developments in the ICT Market Maker Sell Model through:

- Online courses and webinars

- Trading forums and communities

- Backtesting and forward testing new ideas

- Regular review and analysis of your trading performance

Read more: Mastering the ICT London Open Strategy

OpoFinance Services: Your Trusted ASIC-Regulated Broker

Before we conclude, let’s take a moment to highlight a reputable broker that can support your ICT Market Maker Sell Model trading journey. OpoFinance, an ASIC-regulated broker, offers a range of services tailored to meet the needs of both novice and experienced forex traders.

With OpoFinance, you’ll benefit from:

- Tight spreads and competitive pricing

- Advanced trading platforms compatible with algorithmic trading

- Robust risk management tools

- Excellent customer support

- Educational resources to enhance your trading skills

As an ASIC-regulated broker, OpoFinance provides a secure and transparent trading environment, ensuring that your funds and personal information are protected. Whether you’re just starting out with the ICT Market Maker Sell Model or looking to take your trading to the next level, OpoFinance offers the tools and support you need to succeed in the forex market.

Conclusion

The ICT Market Maker Sell Model represents a paradigm shift in forex trading, offering traders a unique perspective on market dynamics and institutional behavior. By understanding and applying this model, traders can significantly enhance their ability to identify high-probability selling opportunities and improve their overall trading performance.

Remember, success with the ICT Market Maker Sell Model requires dedication, continuous learning, and disciplined application of its principles. As you integrate this approach into your trading strategy, remain patient, manage your risks effectively, and always stay attuned to the ever-changing market conditions.

Whether you’re a seasoned professional or just beginning your forex journey, the ICT Market Maker Sell Model provides a powerful framework for navigating the complexities of currency trading. By mastering this approach and combining it with sound risk management and ongoing education, you’ll be well-equipped to thrive in the dynamic world of forex trading.

How does the ICT Market Maker Sell Model differ from traditional technical analysis?

The ICT Market Maker Sell Model goes beyond traditional technical analysis by focusing on the behavior and intentions of large institutional players. While it incorporates elements of technical analysis, such as price action and chart patterns, it places a greater emphasis on order flow, liquidity pools, and market structure. This approach aims to align retail traders with the “smart money” movements, potentially offering more accurate and profitable selling opportunities than conventional technical indicators alone.

Can the ICT Market Maker Sell Model be applied to other financial markets besides forex?

While the ICT Market Maker Sell Model was primarily developed for the forex market, its core principles can be adapted to other financial markets where large institutional players have significant influence. This includes markets such as stocks, commodities, and even some cryptocurrency pairs. However, it’s important to note that the specific dynamics and liquidity characteristics of each market may require adjustments to the model’s application. Traders interested in using this approach in other markets should thoroughly backtest and adapt the strategy to ensure its effectiveness in their chosen asset class.

How long does it typically take to become proficient in using the ICT Market Maker Sell Model?

The time it takes to become proficient in using the ICT Market Maker Sell Model can vary greatly depending on individual factors such as prior trading experience, dedication to learning, and natural aptitude. Generally, traders should expect to spend several months studying the model’s concepts, practicing its application, and refining their skills before achieving consistent results. Some traders may grasp the basics within a few weeks, while others might take six months to a year to feel truly comfortable with the approach. Continuous learning, regular practice, and patience are key to mastering this advanced trading strategy.