ICT Premium and Discount zones are foundational concepts within the world of trading, offering traders a powerful framework to identify when an asset is either overvalued or undervalued. In simple terms, ICT Premium zones refer to price levels that exceed the fair market value, often signaling an ideal moment to sell, while ICT Discount zones highlight price levels that fall below the fair market value, suggesting a prime opportunity to buy. Understanding and effectively utilizing these zones, especially when working with a trusted forex broker, is crucial for making informed and strategic trading decisions, allowing traders to capitalize on market movements.

In this article, we will delve deep into the mechanics of ICT Premium and Discount zones, exploring how to accurately identify them, the role they play in different market conditions, and how to integrate these concepts into a robust trading strategy. We will also discuss common pitfalls to avoid and provide actionable insights to enhance your trading success. Whether you’re a novice or an experienced trader, mastering ICT Premium and Discount zones can significantly boost your trading performance.

Understanding ICT Premium and Discount Zones

Defining Premium and Discount: A Simple Example

To grasp the concept of ICT Premium and Discount, let’s consider an example. Imagine you’re looking to buy a car with a market value of $120,000. This value represents the car’s fair or basic value.

- Premium is the price you pay above this basic value. For instance, if the car costs $130,000, the extra $10,000 is the premium.

- Discount is the price you pay below the basic value. If the car costs $110,000, the $10,000 less than the market value represents the discount.

Naturally, you would prefer to buy the car at a discount rather than at a premium. Similarly, in trading, a trader aims to buy assets at a discount (below their fair value) and sell them at a premium (above their fair value).

The Role of ICT Premium and Discount in Trading

In trading, the concepts of ICT Premium and Discount are used to identify optimal entry and exit points within a price range. These zones are particularly useful in trending markets, where they help traders determine whether to enter a long or short position.

- ICT Premium Zone: This zone is utilized primarily in a bearish trend. It represents a price level above the 50% retracement level of a significant price range, indicating a potential sell opportunity.

- ICT Discount Zone: This zone is used mainly in a bullish trend. It represents a price level below the 50% retracement level of a significant price range, indicating a potential buy opportunity.

By understanding and identifying these zones, traders can improve their decision-making process and increase their chances of making profitable trades.

Fibonacci Settings for Identifying ICT Premium and Discount Zones

Setting Up Fibonacci Retracement Levels

To accurately identify ICT Premium and Discount zones, traders commonly use the Fibonacci retracement tool. Here’s how you can set up your Fibonacci retracement levels to spot these zones:

- Start: This is the beginning of the price range, either at the Swing High (for bearish trends) or Swing Low (for bullish trends).

- 0.5 (50% Retracement): This level marks the midpoint of the range, acting as a boundary between the premium and discount zones.

- End: This is the end of the price range, either at the Swing Low (for bearish trends) or Swing High (for bullish trends).

| 1 | Start |

| 0.5 | 50% Retracement |

| 0 | End |

What is the ICT Premium Zone?

The ICT Premium Zone is where traders look to execute sell trades in a bearish market. This zone is identified by drawing the Fibonacci retracement tool from the Swing High to the Swing Low of a significant price range.

- Above 50% Retracement Level: The area above the 50% retracement level is considered the premium zone. When the price enters this zone, it indicates a potential opportunity for traders to sell after confirming signals like the ICT Market Structure Shift.

What is the ICT Discount Zone?

Conversely, the ICT Discount Zone is where traders look to execute buy trades in a bullish market. This zone is identified by drawing the Fibonacci retracement tool from the Swing Low to the Swing High of a significant price range.

- Below 50% Retracement Level: The area below the 50% retracement level is considered the discount zone. When the price enters this zone, it signals a potential buying opportunity, again after confirmation through tools like the ICT Market Structure Shift.

Trading ICT Premium and Discount Zones

The Importance of Range High and Low

The effectiveness of ICT Premium and Discount zones is rooted in the range defined by the high and low points of the price movement. These ranges help traders determine where to expect premiums and discounts.

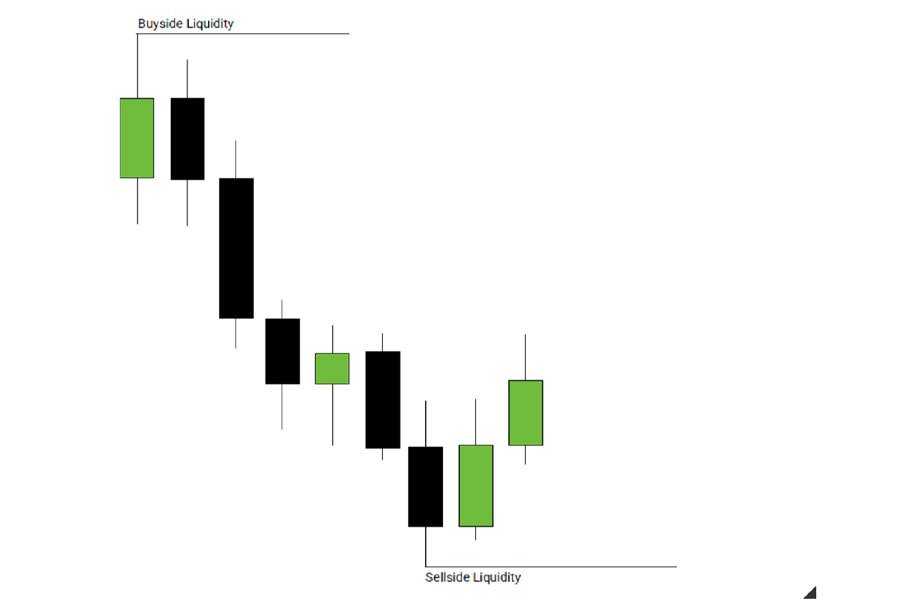

An easy way to visualize a range is to identify areas where sell-side and buy-side liquidity are resting. By using tools like the Gann Box or Fibonacci retracement from the high to the low, traders can mark out the middle of the range (0.5) to distinguish between the premium (top 50%) and discount (bottom 50%) zones.

Why Trade in the Premium and Discount Zones?

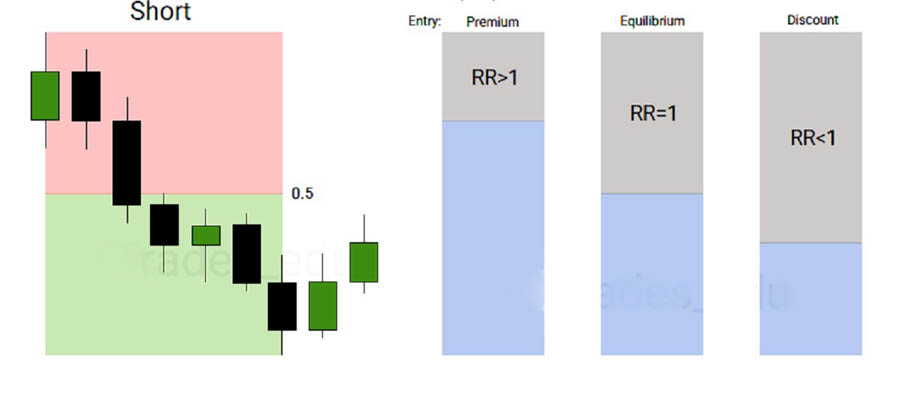

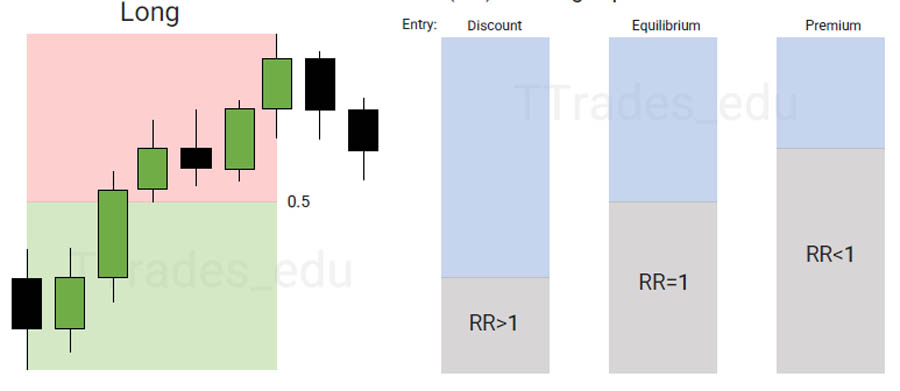

- Short Positions in the Premium Zone: Trading short positions in the premium zone offers a better reward-to-risk ratio than trading at the equilibrium (0.5) or in the discount zone. This is because prices in the premium zone are considered overvalued, increasing the likelihood of a downward correction.

- Long Positions in the Discount Zone: Similarly, long positions in the discount zone provide a better reward-to-risk ratio than buying at equilibrium or in the premium zone. Prices in the discount zone are considered undervalued, increasing the potential for a price rise.

Maximizing the Potential of ICT Premium & Discount Zones

ICT Premium and Discount zones are vital components of a successful trading strategy, but relying solely on these zones without additional context can lead to suboptimal outcomes. These zones represent areas where prices are either above (premium) or below (discount) their fair market value, providing traders with opportunities to buy low and sell high. However, to truly maximize their potential, these zones should be integrated into a comprehensive trading plan that includes other ICT concepts, such as market structure analysis, liquidity zones, and risk management.

For instance, identifying a premium zone might suggest a selling opportunity, but this alone does not guarantee that the price will reverse. Traders should seek confirmation through additional signals, such as a break of structure or a market structure shift, which indicates a change in the trend. By combining these insights with other analytical tools, traders can significantly improve the accuracy of their entries and exits, thereby enhancing their overall trading performance.

Adapting ICT Premium and Discount Zones After a Break of Structure

In the dynamic environment of financial markets, price structures are continually evolving. Therefore, ICT Premium and Discount zones must be frequently re-evaluated, especially following a break of structure. A break of structure occurs when the price moves beyond a significant level, such as a previous high or low, indicating a potential shift in the market trend.

- In a bearish trend, if the price breaks below a previous low and establishes a new low, the old premium zone becomes less relevant. To adapt to the new market conditions, traders should redraw the Fibonacci retracement from the latest swing high to the new swing low. This new premium zone will help identify where the price is likely to encounter resistance, making it a potential area to consider for selling.

- Conversely, in a bullish trend, when the price breaks above a previous high and forms a new high, the discount zone needs to be updated. In this case, traders should draw the Fibonacci retracement from the latest swing low to the new swing high. The new discount zone will indicate where the price might find support, presenting an opportunity to buy.

Read more: Mastering ICT Weekly Profiles

Re-evaluating these zones after every significant price movement ensures that traders are always operating within the most relevant and accurate price ranges. This approach allows them to adapt quickly to changing market conditions, maintain a strategic edge, and make more informed trading decisions.

Common Pitfalls in Trading ICT Premium and Discount Zones

Over-Reliance on Fibonacci Retracement

While Fibonacci retracement is a valuable tool for identifying ICT Premium and Discount zones, relying too heavily on it without considering other market factors can lead to missed opportunities or false signals.

For instance, if the price is in a premium zone but the overall market sentiment is strongly bullish, the price may continue to rise instead of declining. Therefore, traders should always combine Fibonacci analysis with other tools and indicators to get a more comprehensive view of the market.

Ignoring Market Sentiment

Market sentiment is a critical factor in determining the effectiveness of ICT Premium and Discount zones. Ignoring sentiment can lead to poor trading decisions. For example, in a highly bullish market, prices may remain in the premium zone for an extended period before any correction occurs.

To mitigate this risk, traders should incorporate sentiment analysis, news events, and economic data into their trading strategies to complement their technical analysis.

Poor Risk Management

Risk management is essential when trading ICT Premium and Discount zones. Without proper risk controls, such as setting stop-loss orders or avoiding excessive leverage, traders expose themselves to significant losses.

A sound risk management strategy involves defining clear stop-loss levels based on the identified premium or discount zones. This helps protect against unexpected market reversals and preserves capital for future trades.

Read more: Mastering ICT Liquidity Pool Trading

Integrating ICT Premium and Discount Zones into Your Trading Plan

Developing a Comprehensive Trading Plan

To effectively trade ICT Premium and Discount zones, it’s essential to incorporate these concepts into a well-rounded trading plan. This plan should outline:

- Criteria for identifying premium and discount zones using tools like Fibonacci retracement.

- Additional confirmation signals, such as ICT Market Structure Shift, that you will use to validate trades.

- Risk management strategies, including stop-loss levels and position sizing.

Backtesting and Continuous Improvement

Before applying your trading plan to live markets, it’s crucial to backtest your strategy using historical data. This process allows you to evaluate the performance of your strategy and make necessary adjustments.

Backtesting helps identify potential flaws and areas for improvement, increasing your confidence and the likelihood of success when trading in real-time markets.

Continuous Learning and Adaptation

The financial markets are dynamic, and your trading strategies should be too. Continuous learning and adaptation are essential for maintaining an edge in the market. Stay updated on the latest developments in ICT Trading Strategies, market trends, and new trading tools.

Regularly review and update your trading plan to incorporate new insights or changes in market conditions. Flexibility and a willingness to learn will help you navigate the ever-evolving trading landscape effectively.

Read more: Mastering the IPDA Trading Strategy

OpoFinance Services: Your Trusted Partner in Forex Trading

When trading ICT Premium and Discount zones, having a reliable broker is critical. OpoFinance offers a range of services tailored to the needs of both beginner and experienced traders. As an ASIC-regulated broker, OpoFinance ensures a secure and transparent trading environment, allowing you to trade with confidence.

Why Choose OpoFinance?

- ASIC Regulation: OpoFinance is regulated by the Australian Securities and Investments Commission (ASIC), ensuring the highest standards of compliance and security.

- Advanced Trading Tools: Access cutting-edge trading platforms and tools, including customizable charts, advanced order types, and automated trading options.

- Comprehensive Education: OpoFinance offers educational resources and tutorials to help you master ICT Trading Strategies and other essential trading concepts.

- Exceptional Customer Support: Benefit from round-the-clock customer support, with knowledgeable representatives ready to assist you with any queries.

Whether you’re trading Forex, stocks, or cryptocurrencies, OpoFinance provides the resources and support you need to succeed in today’s fast-paced markets.

Conclusion: Mastering ICT Premium and Discount Zones for Better Trading Decisions

Understanding and utilizing ICT Premium and Discount zones can significantly enhance your trading strategy. By identifying these zones and combining them with other ICT concepts, traders can improve their entry and exit decisions, leading to more profitable trades. However, it’s essential to remember that these zones should not be used in isolation. A comprehensive trading strategy that includes risk management, market sentiment analysis, and continuous learning will help you navigate the markets successfully.

Can I trade using only ICT Premium and Discount zones?

No, while ICT Premium and Discount zones are powerful tools, they should be used in conjunction with other trading concepts and strategies, such as market structure analysis and risk management, to enhance accuracy and effectiveness.

How do I identify ICT Premium and Discount zones?

You can identify these zones using the Fibonacci retracement tool. The area above the 50% retracement level is the premium zone, while the area below the 50% retracement level is the discount zone.

Do ICT Premium and Discount zones work in all markets?

Yes, ICT Premium and Discount zones can be applied to various markets, including Forex, stocks, and cryptocurrencies, as long as price data is available on a chart.

One Response

Comment download indicator ???