In the ever-evolving world of forex trading, staying ahead of the curve is not just an advantage—it’s a necessity. Enter the ICT Quarterly Theory, a revolutionary approach that’s transforming how traders analyze and predict market movements. This sophisticated strategy, developed by the enigmatic Inner Circle Trader (ICT), offers a comprehensive framework for decoding long-term market cycles and making informed trading decisions. As forex traders continually seek reliable methods to navigate the complexities of currency markets, the ICT Quarterly Theory has emerged as a powerful tool in their arsenal. Whether you’re an experienced forex trading broker or a novice trader looking to refine your skills, understanding this theory can significantly enhance your trading strategy and potential for profit.

What is ICT Quarterly Theory?

The ICT Quarterly Theory is a multifaceted market analysis framework that goes beyond simple yearly divisions. At its core, it recognizes the fractal nature of time in financial markets, applying cyclical concepts across multiple timeframes. This theory posits that market behavior follows predictable patterns that repeat at various scales, from yearly cycles down to micro-sessions lasting mere minutes.

Key Components of ICT Quarterly Theory

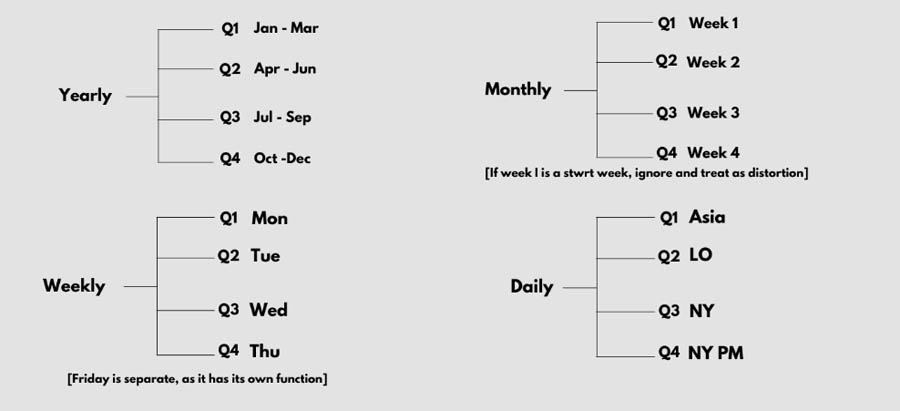

- Fractal Time Divisions: The theory divides trading time into quarters at various levels – yearly, monthly, weekly, daily, and even down to micro-sessions. This fractal approach allows traders to identify patterns and potential market moves across different timeframes.

- True Opens: These are specific opening times that serve as critical reference points for each cycle. True Opens are the cornerstone of the theory, providing traders with key levels to base their trading decisions on.

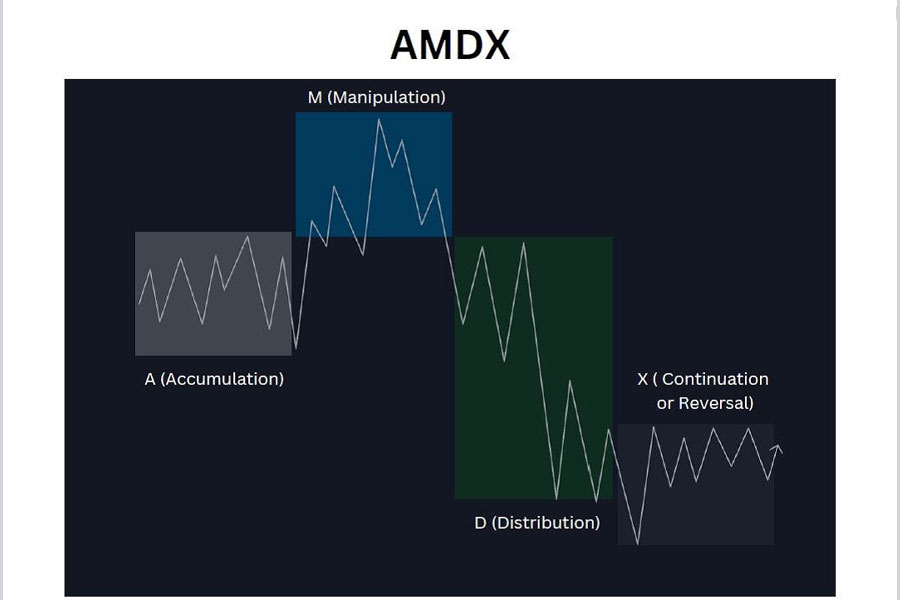

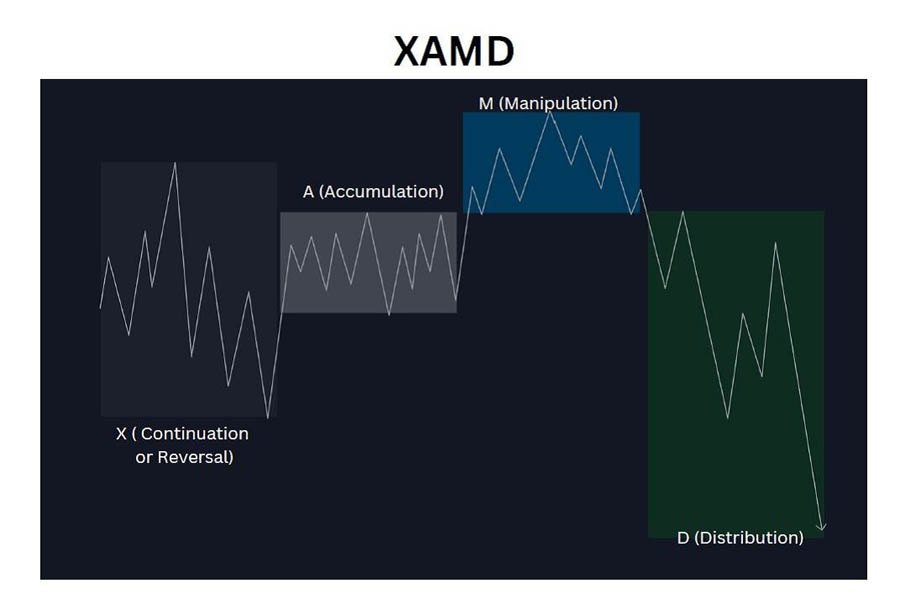

- AMD-X and X-AMD Principles: These algorithmic patterns describe the typical sequence of market phases: Accumulation, Manipulation, Distribution, and Continuation/Reversal (X). Understanding these patterns is crucial for anticipating market moves.

- Liquidity Concepts: The theory emphasizes the importance of understanding how market liquidity affects price movements at different time scales. This includes recognizing how large institutional traders manipulate price to induce liquidity.

Read More: Mastering ICT Weekly Profiles

How ICT Quarterly Theory Works

The ICT Quarterly Theory operates on the premise that market movements follow fractal patterns across different time scales. Here’s a detailed breakdown of the key cycles:

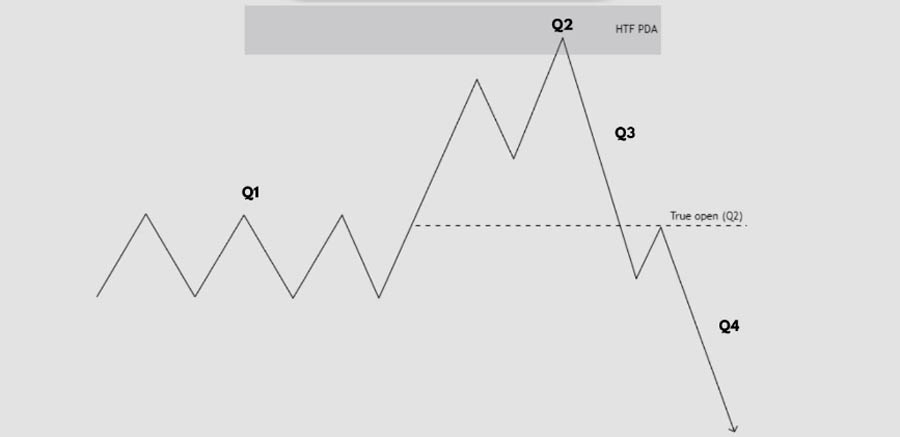

- Yearly Cycle: The trading year is divided into four quarters of three months each, mirroring financial quarters. Each quarter is believed to have distinct characteristics that influence trading patterns.

- Monthly Cycle: This consists of four weeks, starting from the first full week of the month. The theory suggests that monthly price action often follows a predictable pattern within these four quarters.

- Weekly Cycle: Interestingly, the ICT Quarterly Theory focuses on Monday to Thursday, with Friday having a specific function outside the main cycle. This unique approach to weekly analysis sets it apart from traditional forex trading strategies.

- Daily Cycle: Each trading day is divided into four 6-hour quarters, corresponding to major global trading sessions: Asian, London, New York AM, and New York PM.

- Session Cycles: Within each major trading session, the theory identifies four 90-minute quarters. These provide a more granular view of intraday price movements.

- Micro Cycles: For even more precise analysis, 90-minute periods are further divided into 22.5-minute quarters, known as micro-sessions.

The theory suggests that each cycle, regardless of its timeframe, has its own rhythm of accumulation, manipulation, distribution, and potential reversal or continuation phases. By understanding these rhythms, traders can make more informed decisions about market entries, exits, and overall strategy.

Read More: Mastering ICT Monthly Profiles

Benefits of Implementing ICT Quarterly Theory

- Enhanced Market Insight: Traders gain a deeper understanding of market cycles at multiple time scales, allowing for more comprehensive analysis.

- Improved Trade Timing: By recognizing “True Opens” and cycle phases, traders can better time their entries and exits, potentially increasing profitability.

- Strategic Trade Planning: The theory allows for more effective planning across different timeframes, from long-term position trades to intraday scalping.

- Psychological Edge: Understanding market maker manipulation patterns can help traders maintain discipline and avoid common pitfalls.

- Holistic Market View: The fractal nature of the theory helps traders see the bigger picture while also focusing on immediate trading opportunities.

Practical Application of ICT Quarterly Theory

Identifying Cycle Phases and True Opens

To effectively apply the ICT Quarterly Theory, traders should:

- Learn to recognize the AMD-X or X-AMD patterns within each cycle. This involves studying price action to identify accumulation, manipulation, distribution, and continuation/reversal phases.

- Identify True Opens for each timeframe. For example, the Yearly True Open is the first Monday of April, while the Daily True Open is at midnight (00:00).

- Use True Opens as reference points for potential trade setups. These levels often act as pivotal points where price action can change direction.

Adapting Trading Strategies

Once cycle phases and True Opens are identified, traders can:

- Buy below True Opens in bullish cycles and sell above True Opens in bearish cycles. This approach aligns trades with the overall market direction.

- Anticipate manipulation phases (also known as Judas Swings) following accumulation periods. These phases often trap retail traders on the wrong side of the market.

- Align trades with the distribution phase, which is often the easiest to trade as the market direction becomes more apparent.

- Use the understanding of micro cycles to fine-tune entry and exit points within larger trading strategies.

Combining with Other Technical Analysis Tools

While the ICT Quarterly Theory is comprehensive, it can be enhanced by combining it with:

- Premium-Discount Arrays (PDAs) for respective timeframes. These help identify key support and resistance levels.

- Traditional technical analysis tools like trend lines, moving averages, and oscillators.

- Order flow analysis to confirm liquidity events and institutional participation.

Read More: Mastering ICT Trend Reversal

Advanced Concepts in ICT Quarterly Theory

Liquidity Engineering

A critical aspect of the ICT Quarterly Theory is understanding how large market participants engineer liquidity. This involves:

- Identifying areas where stop losses are likely to be clustered.

- Recognizing price levels where limit orders accumulate.

- Anticipating how these liquidity pools will be targeted during different cycle phases.

Intermarket Analysis

The theory can be applied across different financial markets, allowing traders to:

- Identify correlations between forex pairs and other asset classes.

- Anticipate currency movements based on commodities or equity market cycles.

- Develop comprehensive trading strategies that account for global market interactions.

Algorithmic Adaptation

As markets evolve, so do the algorithms that drive them. Advanced practitioners of ICT Quarterly Theory continuously:

- Refine their understanding of how algorithms interpret and react to market data.

- Adapt their strategies to account for changes in market microstructure.

- Develop quantitative models that incorporate ICT principles.

Common Misconceptions about ICT Quarterly Theory

- It’s Only for Long-Term Trading: While the theory provides insights into long-term trends, it’s equally applicable to short-term trading, down to intraday timeframes.

- All Quarters Function Identically: Each quarter has a specific role in the AMD-X or X-AMD cycle, and understanding these nuances is crucial for successful application.

- It’s a Standalone Strategy: The theory works best when integrated with other analysis methods and proper risk management techniques.

- It Guarantees Profits: Like any trading approach, ICT Quarterly Theory is a tool that requires skill, experience, and disciplined application to be effective.

Challenges in Applying ICT Quarterly Theory

- Complexity: Understanding the fractal nature of time and multiple cycle interactions can be challenging, especially for novice traders.

- Dynamic Market Conditions: While the theory provides a framework, markets can deviate from expected patterns due to unforeseen events or shifts in global economic conditions.

- Timeframe Coordination: Aligning analysis across multiple timeframes requires practice and a keen eye for detail.

- Data Interpretation: Accurately identifying cycle phases and True Opens requires skill and experience, which can only be developed through consistent practice and analysis.

Enhancing Your Trading with ICT Quarterly Theory

To maximize the benefits of ICT Quarterly Theory:

- Master Fractal Time Concepts: Dedicate time to understanding how different timeframes interact and influence each other. This may involve studying advanced mathematics and chaos theory.

- Practice Identifying True Opens: Develop the skill to quickly recognize these crucial reference points across all timeframes. Consider creating custom indicators or alerts to assist with this process.

- Study AMD-X and X-AMD Patterns: Learn to anticipate market phases based on these algorithmic principles. Keep a trading journal to document observed patterns and their outcomes.

- Develop a Holistic Trading Plan: Integrate ICT Quarterly Theory into a comprehensive trading strategy that includes risk management, position sizing, and clear entry/exit criteria.

- Continuous Learning: Stay updated on market developments and refinements to the theory. Engage with trading communities and educational resources to deepen your understanding.

The Future of ICT Quarterly Theory in Forex Trading

As the forex market evolves, the application of ICT Quarterly Theory is likely to see further refinements and adaptations:

- Integration with Machine Learning: Advanced algorithms may be developed to identify cycle phases and True Opens with greater accuracy, potentially automating aspects of the analysis process.

- Adaptation to High-Frequency Trading: As markets become increasingly dominated by algorithmic trading, the theory may evolve to account for ultra-short-term cycles and microstructure impacts.

- Incorporation of Alternative Data: Future iterations of the theory may integrate non-traditional data sources, such as social media sentiment or satellite imagery, to enhance predictive capabilities.

- Regulatory Considerations: As financial regulations evolve, the application of ICT Quarterly Theory may need to adapt to new market structures and trading rules.

- Cross-Asset Application: While primarily used in forex, the theory’s principles may find broader application across various financial instruments and asset classes.

OpoFinance Services: Empowering Traders with Advanced Tools

When it comes to implementing sophisticated strategies like the ICT Quarterly Theory, having a reliable and innovative broker is essential. OpoFinance, an ASIC-regulated forex broker, stands out as a premier choice for traders seeking to elevate their trading experience. With a commitment to providing cutting-edge tools and a secure trading environment, OpoFinance empowers traders to execute their strategies with confidence.

One of OpoFinance’s standout features is its robust social trading platform. This innovative service allows traders to connect, share insights, and even copy trades from successful investors. For those looking to implement ICT Quarterly Theory, the social trading platform offers a unique opportunity to learn from experienced traders who may already be applying these advanced concepts in their trading strategies.

By choosing OpoFinance, traders gain access to:

- Advanced charting tools compatible with ICT Quarterly Theory analysis

- Competitive spreads and fast execution for precise entry and exit points

- A regulated and secure trading environment

- Educational resources to enhance understanding of complex trading theories

- The social trading platform for collaborative learning and strategy sharing

With OpoFinance, traders can confidently explore and apply the ICT Quarterly Theory, knowing they have the support of a trusted, regulated broker committed to their success.

Conclusion

The ICT Quarterly Theory represents a paradigm shift in forex trading analysis, offering a multidimensional approach to understanding market cycles and institutional behavior. By providing a structured framework for analyzing market movements across various timeframes, it equips traders with a powerful tool for navigating the complexities of currency markets.

The theory’s emphasis on fractal time divisions, True Opens, and cyclical market phases offers traders a unique perspective that goes beyond traditional technical analysis. Its holistic approach to market dynamics can potentially lead to more informed trading decisions and improved risk management.

However, it’s crucial to remember that mastering the ICT Quarterly Theory requires dedication, continuous learning, and adaptive application. Success with this approach demands not only a deep understanding of its principles but also the ability to integrate it with sound risk management practices and a comprehensive grasp of market fundamentals.

As the forex market continues to evolve, staying ahead requires embracing innovative methodologies and perspectives. The ICT Quarterly Theory offers just that – a sophisticated lens through which to view market movements and make informed trading decisions. Whether you’re a seasoned professional or an aspiring trader, incorporating these concepts into your trading approach could be the key to unlocking new levels of market insight and trading success.

Remember, while the ICT Quarterly Theory provides a powerful framework, it’s not a guarantee of trading success. It should be viewed as one component of a comprehensive trading strategy, complemented by continuous education, disciplined practice, and prudent risk management. As you integrate this theory into your trading approach, remain flexible and open to refining your understanding as markets change and new insights emerge.

In the dynamic world of forex trading, those who can adapt and apply advanced concepts like the ICT Quarterly Theory may find themselves better equipped to navigate market complexities and capitalize on trading opportunities across all timeframes.

How does ICT Quarterly Theory account for unexpected market events?

While ICT Quarterly Theory provides a framework for understanding long-term market cycles, it’s not immune to the impact of unexpected events. The theory emphasizes flexibility and adaptability. When unforeseen circumstances arise, traders are encouraged to reassess their quarterly predictions and adjust their strategies accordingly. The theory can still provide valuable context for understanding how these events might influence broader market trends within the quarterly framework. It’s important to remember that the theory is a tool for analysis, not a crystal ball, and should be used in conjunction with real-time market information and risk management strategies.

Can ICT Quarterly Theory be applied to other financial markets besides forex?

Although primarily developed for the forex market, the principles of ICT Quarterly Theory can be adapted to other financial markets with some modifications. The concept of institutional manipulation and cyclical market behavior is relevant across various asset classes. However, traders should be cautious and thoroughly backtest the theory’s application in other markets, as the specific patterns and timelines may differ due to varying market structures and liquidity profiles. For instance, stock markets may have different cyclical behaviors influenced by quarterly earnings reports, while commodity markets might be more affected by seasonal patterns. Adapting the theory to these nuances requires careful study and observation of each market’s unique characteristics.

How often should I review and adjust my ICT Quarterly Theory-based trading plan?

It’s recommended to review your ICT Quarterly Theory-based trading plan at least at the start of each new quarter. This allows you to assess the accuracy of your previous predictions and make necessary adjustments for the upcoming quarter. Additionally, conducting a mid-quarter review can help fine-tune your strategy based on how the market is conforming to or deviating from expected patterns. Regular review ensures your trading plan remains aligned with current market conditions and the theory’s principles. However, it’s crucial to strike a balance between being responsive to market changes and avoiding overreaction to short-term fluctuations. Remember, the strength of the ICT Quarterly Theory lies in its long-term perspective, so frequent minor adjustments should be made cautiously and with a view to the broader market context.