Effective ICT risk management is an indispensable component for anyone looking to achieve long-term success in trading. But what exactly is ICT risk management, and why is it so critical? At its core, ICT risk management encompasses a series of strategies and practices designed to safeguard your trading capital from potential losses and mitigate the risks associated with market volatility. This approach is essential for traders who want to maintain financial stability and protect their investments over time.

In the world of trading, whether you’re working with a forex trading broker, an online forex broker, or another trading platform, implementing robust risk management strategies can significantly influence your success. For instance, if you’re utilizing a regulated forex broker, you might benefit from additional safeguards and advanced tools that enhance your ability to manage risk effectively. Understanding and applying ICT risk management techniques can help you navigate the unpredictable nature of financial markets, avoid substantial losses, and make informed trading decisions.

In this article, we will explore the fundamental principles of ICT risk management and how they can be applied to improve your trading performance. We will examine key concepts such as setting appropriate risk levels, avoiding overtrading, managing leverage, and controlling emotions. By integrating these strategies into your trading plan, you can better protect your capital, optimize your trading results, and achieve sustainable profitability. Whether you are a novice trader or an experienced professional, mastering these risk management techniques will provide you with a solid foundation for navigating the complexities of trading and enhancing your overall success.

The Significance of ICT Risk Management

ICT risk management involves a systematic approach to mitigating potential losses in trading activities. It is not just about preventing losses but also about ensuring that your trading practices are sustainable over the long term. Proper risk management allows traders to withstand market fluctuations, avoid significant financial setbacks, and maintain a stable trading career.

System Accuracy vs. Risk Management

System accuracy is a critical aspect of trading systems, but it should not be the sole focus of your trading strategy. Many traders concentrate on achieving high accuracy rates with their systems, believing that this will guarantee profitability. However, a high-accuracy system does not necessarily translate to financial success if risk management practices are inadequate.

Key Insight: Disciplined money management is essential for protecting your trading account from severe losses. Even if your trading system has a lower accuracy rate, effective risk management can help you remain profitable by controlling potential losses and maintaining a balanced approach.

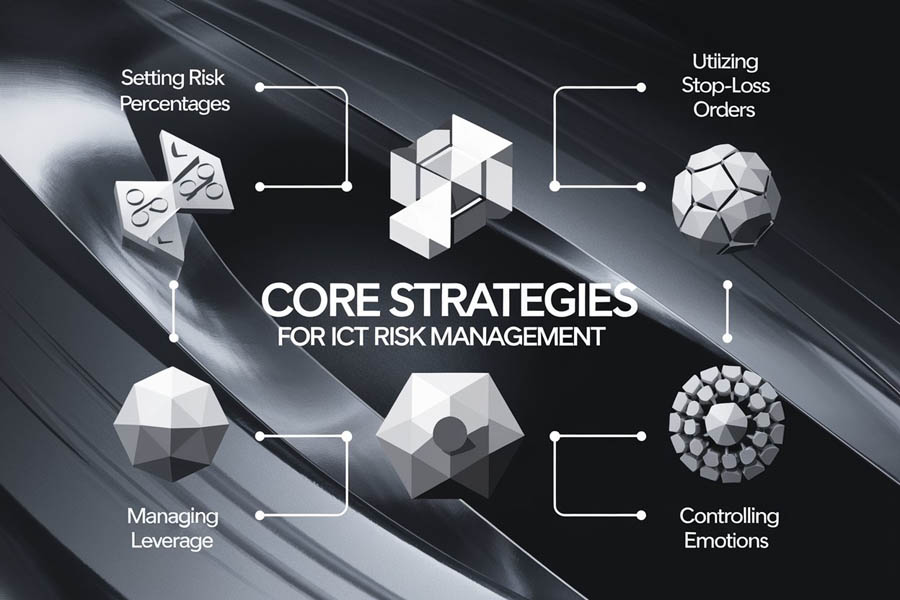

Core Strategies for Effective ICT Risk Management

1.Setting Risk Percentages

Risk percentage is a fundamental concept in ICT risk management. It involves determining the proportion of your trading capital that you are willing to risk on each trade. This percentage varies among traders, but a common guideline is to risk no more than 2% of your total equity on a single trade. This approach helps in managing risk and ensures that no single trade can significantly impact your overall capital.

Example: Suppose your trading capital is $10,000. By risking 2% per trade, you would allocate $200 as the maximum risk for each trade. This method helps in spreading risk across multiple trades, preventing substantial losses from any single position.

Note: The right risk percentage is a personal choice and should align with your individual risk tolerance, trading style, and market conditions. It is important to adjust this percentage based on your comfort level and trading strategy.

2.Utilizing Stop-Loss Orders

Stop-loss orders are essential tools for managing risk. These orders automatically close a trade when the price reaches a predetermined level, helping to limit potential losses. By setting stop-loss orders, you can ensure that your trades are closed before they result in excessive losses.

Example: If you purchase a stock at $50 and set a stop-loss order at $45, the position will be automatically closed if the stock price falls to $45. This prevents further losses and helps in managing your trading risk effectively.

Benefits: Stop-loss orders help in protecting your capital and reducing emotional stress by providing a predefined exit strategy. They are especially useful in volatile markets where prices can change rapidly.

Read More: Mastering ICT Stop Runs

3.Avoiding Overtrading

Overtrading is a common issue among traders and can lead to significant losses. Overtrading occurs when traders take excessive positions or trade too frequently, often driven by emotions or the desire to recover losses. This practice can erode capital and lead to poor decision-making.

Strategy: To avoid overtrading, establish a clear trading plan with specific criteria for entering and exiting trades. Be prepared for losing streaks and avoid making impulsive decisions based on short-term market movements. It is also helpful to set trading limits and stick to them.

Emotional Control: Managing emotions is crucial for avoiding overtrading. Develop a disciplined trading routine and take regular breaks to maintain a balanced perspective. Emotional control helps in making rational decisions and adhering to your trading plan.

4.Managing Leverage

Leverage amplifies both potential gains and losses, making it a double-edged sword in trading. Proper leverage management involves using it strategically to enhance your trading potential while controlling risk. Excessive leverage can lead to significant losses, so it is important to use it within your risk tolerance.

Example: If you use 10x leverage, a 1% movement in the market will result in a 10% gain or loss. Ensure that your leverage levels align with your overall risk management strategy and that you have sufficient capital to cover potential losses.

Leverage Management: Effective leverage management involves setting limits on the amount of leverage you use and adjusting it based on market conditions and your trading strategy. This approach helps in maximizing returns while minimizing risk.

5.Controlling Emotions

Emotional control is a fundamental aspect of ICT risk management. Trading can be stressful, and emotions such as fear and greed can lead to impulsive decisions and poor risk management. Developing strategies to manage emotions is essential for maintaining a disciplined trading approach.

Strategies for Emotional Control:

- Establish a Trading Plan: Create a comprehensive trading plan with clear rules for entry, exit, and risk management. Adhering to this plan helps in making objective decisions.

- Set Realistic Goals: Set achievable trading goals and avoid setting targets based solely on emotions or short-term market movements.

- Practice Mindfulness: Engage in mindfulness techniques to maintain focus and reduce emotional stress during trading.

Practical Money Management Strategies

Flatline Equity Drawdown

Minimizing drawdown is crucial for protecting your trading capital. Effective money management strategies aim to keep drawdowns within acceptable limits, ensuring that your equity remains stable. Drawdown refers to the reduction in your trading account value from its peak to its trough.

Strategies for Minimizing Drawdown:

- Diversify Your Trades: Spread your risk across different assets and trading strategies to reduce the impact of individual losses.

- Adjust Risk Levels: Regularly review and adjust your risk levels based on market conditions and your trading performance.

Hypothetical Examples

Exploring hypothetical scenarios can provide valuable insights into various money management approaches. By analyzing different risk percentages and their potential outcomes, you can better understand the impact of your trading decisions.

Example: Consider two traders with different risk percentages. Trader A risks 1% per trade, while Trader B risks 5%. Over a series of trades, Trader A is less likely to experience significant losses compared to Trader B, who may face larger drawdowns due to higher risk levels.

Balancing Risk and Reward

Balancing risk and reward involves evaluating the potential gains against possible losses for each trade. This balance helps in making informed decisions and protecting your equity.

Example: If a trade offers a potential reward of 3:1 (reward-to-risk ratio), it means that for every dollar risked, the potential reward is three dollars. Aim for trades with favorable risk-reward ratios to enhance your overall profitability.

Leverage Control

Strategically using leverage ensures that it enhances your trading potential without exposing you to excessive risk. Proper leverage management involves setting limits on leverage and adjusting it based on market conditions.

Example: If you use 2x leverage, a 5% market movement will result in a 10% gain or loss. Ensure that your leverage levels are appropriate for your risk tolerance and trading strategy.

Read More: Mastering ICT Smart Money Reversal

Insights from ICT Risk Management Strategies

Patience and Discipline

One of the most critical aspects of ICT risk management is cultivating patience and discipline. Traders who adopt a position trading approach must prepare themselves for extended periods of drawdowns and avoid making impulsive decisions based on short-term market movements. By adhering to a disciplined strategy, you can maintain a consistent risk level and avoid the pitfalls of emotional trading. Patience in waiting for the right setups and discipline in sticking to your predefined risk parameters are essential for managing risk effectively over the long term.

Effective Risk Allocation

Risk allocation is a fundamental component of effective risk management. It is recommended to allocate only a small percentage of your trading capital to each trade—commonly around 2%. This practice helps in managing drawdowns and protects your capital from significant losses. By employing a regulated forex broker, you gain access to advanced tools and features that aid in precise risk allocation, enhancing your ability to manage each trade within your comfort zone.

Higher Time Frame Analysis

Analyzing higher time frames is essential for understanding long-term market trends and making informed trading decisions. Higher time frames, such as weekly and monthly charts, provide a broader perspective on market movements and potential trade setups. This analysis helps in identifying significant trends and setting realistic expectations for your trades. By aligning your trades with these longer-term trends, you can better manage your risk and improve the likelihood of success.

Setting Realistic Expectations

Position trading and ICT risk management are not about achieving immediate gains. Instead, they focus on steady, long-term profitability. Understanding that position trading involves fewer trades but potentially larger profits helps set realistic expectations. This approach prevents the frustration of chasing quick wins and promotes a more sustainable trading strategy. By setting achievable goals and managing your trades with a long-term perspective, you can better handle the inherent risks of trading.

Sound Money Management Practices

Effective money management is crucial for maintaining a balanced approach to risk. This includes setting appropriate risk levels, managing drawdowns, and avoiding excessive leverage. Using hypothetical examples to understand different money management strategies can provide valuable insights into their potential impact on your trading capital. Proper money management helps in balancing risk and reward, ensuring that your trading capital is protected while still allowing for growth opportunities.

Managing Drawdowns and Over-leveraging

Handling drawdowns and avoiding over-leveraging are key to sustaining your trading capital. Over-leveraging can amplify losses, leading to significant financial setbacks. Conversely, managing drawdowns ensures that you can endure a series of losses without depleting your trading account. Implementing effective risk management strategies, such as limiting leverage and controlling exposure, helps in mitigating these risks and maintaining financial stability.

Tailoring Strategies to Individual Needs

Every trader has unique risk tolerances and personality traits that influence their trading style. Recognizing these individual differences and tailoring your risk management strategies accordingly is crucial for success. By aligning your approach with your personal risk tolerance and emotional control, you can create a more effective and personalized risk management plan. This customization helps in managing risk in a way that suits your individual needs and trading preferences.

Read More: Master ICT High-Probability Scalping

OpoFinance: A Premier Choice for Forex Trading

When selecting a broker for forex trading, OpoFinance stands out as a top choice. As an ASIC-regulated forex broker, OpoFinance offers a secure and transparent trading environment that adheres to stringent regulatory standards. Their advanced risk management features and innovative social trading services provide valuable tools for traders looking to optimize their strategies.

OpoFinance Services

- Regulated Forex Broker: OpoFinance is regulated by ASIC, ensuring a high level of security and trustworthiness. This regulatory oversight provides traders with peace of mind, knowing that their investments are protected.

- Social Trading: OpoFinance offers social trading services that allow you to follow and replicate the trading strategies of successful traders. This feature not only enhances your trading experience but also provides additional layers of risk management and strategic insight.

Benefits: By partnering with OpoFinance, you gain access to advanced tools and features designed to support effective risk management and enhance your trading performance. Their regulated environment and social trading services make them a valuable choice for traders seeking to improve their risk management strategies.

Conclusion

Effective ICT risk management is fundamental for achieving long-term success in trading. By adopting strategies such as setting appropriate risk levels, using stop-loss orders, avoiding overtrading, managing leverage, and controlling emotions, you can protect your capital and enhance your trading performance. Leveraging the benefits of a regulated forex broker like OpoFinance can further support your risk management efforts and optimize your trading results. Mastering these principles will help you navigate the complexities of the trading world and achieve sustainable profitability.

How can I determine the right risk percentage for my trades?

The appropriate risk percentage depends on your individual risk tolerance, trading strategy, and market conditions. While the 2% rule is a common guideline, you should adjust this percentage based on your comfort level and trading style. Consider experimenting with different risk levels in a demo account to find what works best for you.

What strategies can help manage emotions during trading?

To manage emotions, establish a clear trading plan with predefined rules for entry, exit, and risk management. Set realistic goals and avoid making decisions based solely on emotions or short-term market movements. Practicing mindfulness and taking regular breaks can also help maintain a balanced perspective and reduce emotional stress.

How often should I review my risk management strategies?

Regularly review your risk management strategies, ideally on a quarterly basis or after significant market events. This ensures that your approach remains effective and aligned with current market conditions. Adjust your strategies as needed based on your trading performance and evolving market trends.

What are the benefits of using social trading services?

Social trading services allow you to follow and replicate the strategies of successful traders. This can provide valuable insights and enhance your trading performance by leveraging the expertise of experienced traders. Social trading also offers an additional layer of risk management and strategic guidance.