In the dynamic world of forex trading, understanding the Smart Money Concept (SMC) and how to identify order blocks is a game-changing skill that can dramatically improve your trading outcomes. Order blocks, a key component of SMC, are significant price levels where large institutional traders (the “smart money”) place their orders, creating areas of high liquidity and potential market reversals. This comprehensive guide, tailored for those seeking a regulated forex broker, will teach you how to identify order blocks in forex within the context of SMC, providing you with the tools to make more informed trading decisions and potentially increase your profitability.

To identify order blocks in forex using the Smart Money Concept, traders need to analyze price action, recognize key support and resistance levels, and look for specific candlestick patterns that indicate institutional order placement. By learning how to find order blocks in forex charts through the lens of SMC, you’ll gain a competitive edge in predicting market movements and planning your trades with greater precision.

In this article, we’ll dive deep into the world of order blocks as part of the Smart Money Concept, exploring their significance, characteristics, and the most effective strategies to spot them on your charts. Whether you’re a novice trader or an experienced professional looking to refine your skills, this guide will equip you with the knowledge and techniques to master order block identification in the forex market using SMC principles.

Read More: Identify liquidity in forex

Understanding Smart Money Concept and Order Blocks in Forex

What Is the Smart Money Concept?

The Smart Money Concept (SMC) is a trading approach that focuses on identifying and following the actions of institutional traders, often referred to as “smart money.” This concept is based on the idea that large financial institutions, with their vast resources and market influence, leave footprints in the market that astute traders can identify and capitalize on.

What Are Order Blocks in SMC?

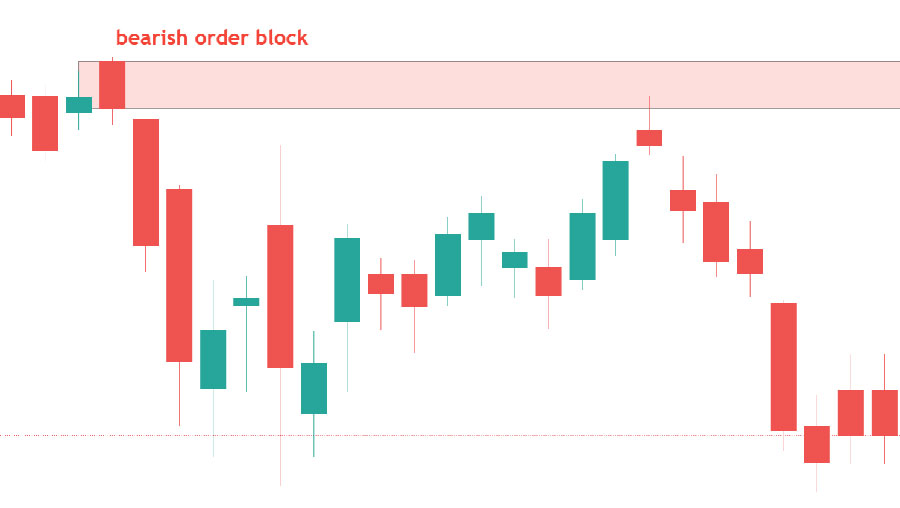

Order blocks are a fundamental component of the Smart Money Concept. They represent significant price levels where large institutional traders place their orders. These blocks are essentially areas of high liquidity that often act as turning points in the market. Understanding and identifying order blocks is crucial for retail traders to align their strategies with the ‘smart money’ and potentially improve their trading results.

Read More: Daily Bias Trading Strategy

The Importance of Order Blocks in SMC Forex Trading

- Market Structure: Order blocks help define the overall market structure, indicating key support and resistance levels.

- Price Reversals: They often signal potential price reversals, offering valuable entry and exit points for trades.

- Liquidity Zones: Order blocks represent areas of high liquidity, which can lead to significant price movements.

- Risk Management: Identifying order blocks allows traders to place more accurate stop-loss and take-profit orders.

- Institutional Insight: Order blocks provide insight into the actions of large institutional traders.

Key Characteristics of Order Blocks in SMC

To effectively identify order blocks in forex using the Smart Money Concept, it’s essential to recognize their distinctive features:

- Strong Price Rejection: Order blocks often show a strong rejection of price, indicated by long wicks on candlesticks.

- Volume Spikes: Increased trading volume is frequently observed around order blocks.

- Rapid Price Movement: Following an order block, prices tend to move quickly in the opposite direction.

- Multiple Timeframe Confluence: Strong order blocks are visible across multiple timeframes.

- Retest Behavior: Prices often return to test the order block level before continuing in the new direction.

- Imbalance in Supply and Demand: Order blocks represent areas where there is a significant imbalance between buyers and sellers.

How to Identify Order Blocks in Forex Using SMC: Step-by-Step Guide

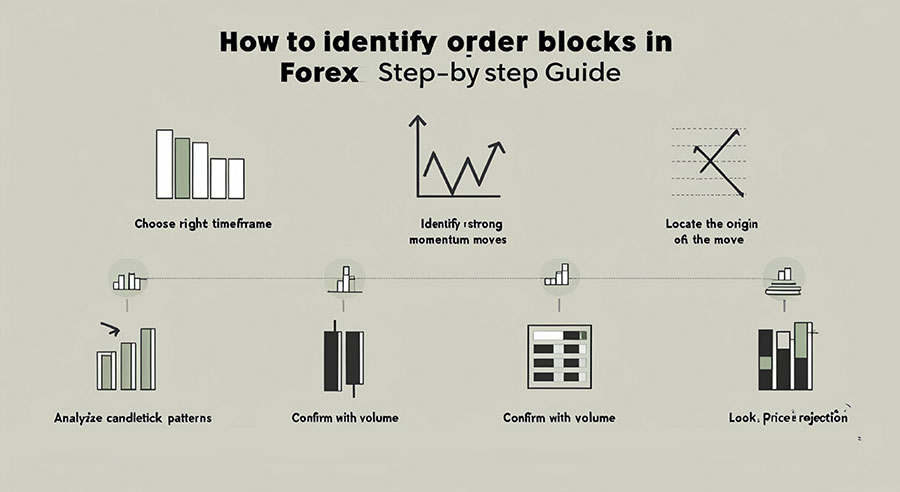

Step 1: Choose the Right Timeframe

Begin by selecting an appropriate timeframe for your analysis. While order blocks can be identified on any timeframe, starting with higher timeframes (4H, Daily, Weekly) can help you spot more significant blocks that align with institutional trading.

Step 2: Identify Strong Momentum Moves

Look for areas on the chart where price shows strong momentum in either direction. These rapid price movements often precede the formation of order blocks and indicate smart money activity.

Step 3: Locate the Origin of the Move

Trace back to find the origin of the strong momentum move. This area is likely to contain an order block where institutional orders were placed.

Step 4: Analyze Candlestick Patterns

Pay attention to specific candlestick patterns that often indicate order blocks in SMC:

- Engulfing patterns

- Pin bars

- Inside bars

- Dojis

Step 5: Confirm with Volume

Check the volume indicator to confirm increased trading activity around the potential order block. Higher volume supports the significance of the block and suggests institutional involvement.

Step 6: Look for Price Rejection

Identify areas where price shows strong rejection, often visible as long wicks on candlesticks. These rejections signify the presence of large orders from smart money players.

Step 7: Observe Subsequent Price Action

Monitor how price behaves after the potential order block. A quick reversal or continuation in the opposite direction supports the validity of the block and confirms smart money influence.

Advanced Techniques to Find Order Blocks in Forex Using SMC

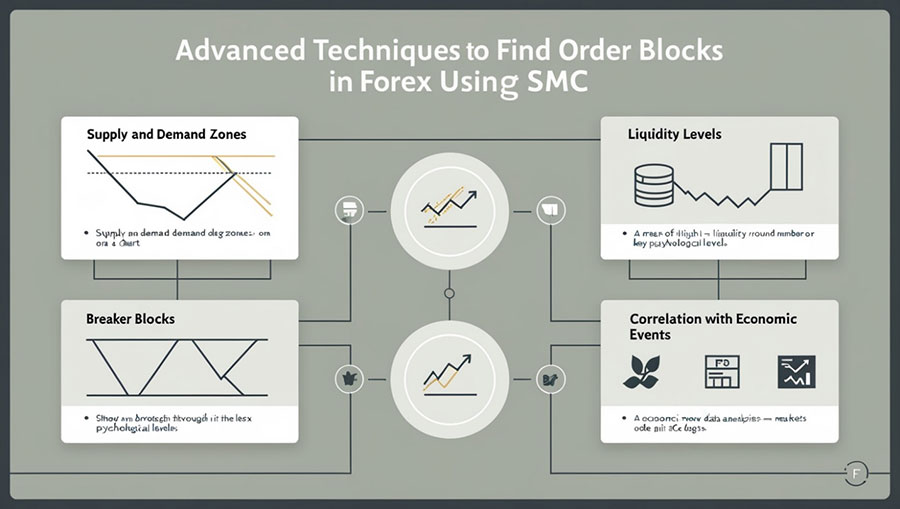

1. Supply and Demand Zones

Incorporate supply and demand analysis to enhance your order block identification within the SMC framework. Supply zones often coincide with bearish order blocks, while demand zones align with bullish order blocks.

2. Liquidity Levels

Identify areas of high liquidity where smart money is likely to place large orders. These areas often correspond with key psychological price levels or round numbers.

3. Breaker Blocks

Look for breaker blocks, which are a type of order block in SMC that occur when price breaks through a significant level and then returns to retest it.

4. Correlation with Economic Events

Pay attention to major economic events and news releases. Smart money often positions itself ahead of these events, creating order blocks.

5. Order Flow Analysis

Incorporate order flow analysis techniques to gain deeper insights into institutional order placement and enhance your ability to identify order blocks.

Read More: Identify Imbalance in Forex

Common Mistakes to Avoid When Identifying Order Blocks in SMC

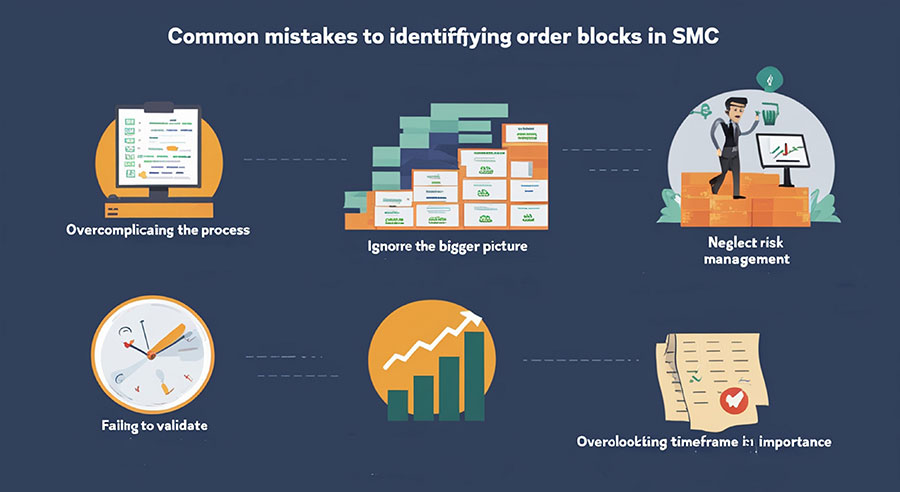

- Overcomplicating the Process: Don’t rely on too many indicators. Focus on price action and volume as per SMC principles.

- Ignoring the Bigger Picture: Always consider the overall market context and trend when identifying order blocks.

- Failing to Validate: Always seek confirmation from multiple factors before trading based on an order block.

- Neglecting Risk Management: Even with accurate order block identification, always use proper risk management techniques.

- Overlooking Timeframe Importance: Remember that order blocks on higher timeframes generally carry more weight in SMC.

Incorporating Order Blocks into Your SMC Trading Strategy

1. Entry Strategies

Use order blocks to fine-tune your entry points. Look for retracements to order block levels for potential trade entries in the direction of the overall smart money flow.

2. Exit Strategies

Identify opposing order blocks to set realistic take-profit levels. These areas are likely to cause price reactions and potential reversals.

3. Stop Loss Placement

Place stop-loss orders beyond the order block to allow for normal market fluctuations while protecting your position.

4. Trend Confirmation

Use order blocks to confirm the strength and direction of trends. Multiple broken order blocks in one direction indicate a strong trend and smart money commitment.

5. Range Trading

Identify order blocks at the edges of ranging markets to spot potential breakout or reversal points where smart money might be accumulating positions.

Tools and Indicators to Enhance Order Block Identification in SMC

While price action is the primary tool for identifying order blocks in SMC, certain indicators can provide additional confirmation:

- Volume Indicator: Confirms increased trading activity around order blocks.

- Moving Averages: Help identify overall trend direction and potential areas for order blocks.

- Bollinger Bands: Can highlight areas of price expansion and contraction, often coinciding with order blocks.

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions that may align with order blocks.

- Order Block Indicator: Some custom indicators are designed specifically to highlight potential order blocks on charts based on SMC principles.

The Psychology of Trading Order Blocks in SMC

Understanding the psychological aspects of order block trading within the Smart Money Concept can improve your decision-making:

- Patience: Wait for clear order block formations and confirmations before entering trades.

- Discipline: Stick to your trading plan and avoid impulsive decisions based on emotions.

- Confidence: Develop trust in your ability to identify and trade order blocks through practice and experience.

- Adaptability: Be prepared to adjust your strategy as market conditions change.

- Institutional Thinking: Try to think like institutional traders when analyzing the market.

Combining Order Blocks with Other SMC Trading Concepts

Enhance your trading strategy by integrating order block analysis with other powerful SMC concepts:

- Institutional Candles: Identify and use institutional candles in conjunction with order blocks for stronger trade signals.

- Fair Value Gaps: Combine fair value gap analysis with order blocks to identify high-probability trade setups.

- Liquidity Runs: Understand how liquidity runs relate to order blocks and use this knowledge to anticipate market moves.

- Wyckoff Method: Incorporate Wyckoff accumulation and distribution patterns to complement your order block analysis.

Backtesting and Practicing Order Block Identification in SMC

To master the skill of identifying order blocks in forex using the Smart Money Concept:

- Use historical data to backtest your order block identification skills within the SMC framework.

- Practice on demo accounts before risking real capital.

- Keep a trading journal to track your progress and refine your technique.

- Regularly review and analyze your trades to improve your order block identification accuracy.

- Study institutional trading patterns to better understand how smart money operates in the market.

Conclusion

Mastering the art of identifying order blocks in forex using the Smart Money Concept can significantly enhance your trading performance and give you a competitive edge in the market. By understanding the characteristics of order blocks within the SMC framework, implementing effective identification techniques, and integrating this knowledge into your overall trading strategy, you’ll be better equipped to make informed trading decisions that align with institutional movements.

Remember that successful order block trading in SMC requires patience, practice, and continuous learning. As you gain experience, you’ll develop a keen eye for spotting these crucial price levels and using them to your advantage.

Stay disciplined, manage your risk effectively, and always be open to refining your approach. With dedication and consistent application of the principles outlined in this guide, you’ll be well on your way to becoming a skilled order block trader in the forex market, capable of identifying and capitalizing on smart money movements.

How does the concept of ‘trapped traders’ relate to order blocks in SMC?

In the Smart Money Concept, ‘trapped traders’ refer to retail traders who enter positions at unfavorable prices, often due to FOMO (Fear of Missing Out) or poor analysis. Order blocks can create scenarios where these traders become trapped, as smart money manipulates price to trigger stop losses or force unfavorable exits. Understanding this relationship can help traders identify potential order blocks and anticipate subsequent price movements driven by the smart money capitalizing on these trapped positions.

Can order blocks in SMC be used effectively in short-term trading strategies like scalping?

While order blocks are often associated with longer-term trading due to their significance in higher timeframes, they can be adapted for short-term strategies like scalping. In scalping, traders can look for micro order blocks on lower timeframes (1-minute, 5-minute charts) that align with larger order blocks on higher timeframes. This multi-timeframe approach can provide scalpers with high-probability entry and exit points. However, it requires quick decision-making and a deep understanding of order block dynamics in rapidly changing market conditions.

How do institutional traders typically manage their positions around order blocks?

Institutional traders often use order blocks as key levels for position management. They may scale into positions at these levels, adding to their trades as price reacts to the order block. They also use these levels to set stop losses and take profits. Understanding this behavior can help retail traders anticipate potential price movements. For example, if price approaches a significant order block but fails to break through, it might indicate that institutions are defending their positions, potentially leading to a reversal. However, it’s important to note that institutional strategies are complex and can vary, so this understanding should be used in conjunction with other analysis techniques.

2 Responses

Super interessant und sehr gut geschrieben!

Bleib dran, deine Beiträge machen einen Unterschied.

Ich wünsche dir viel Erfolg und freue mich auf mehr!

Very nice post. I just stumbled upon your weblog and wished to mention that I have

really loved browsing your weblog posts. In any case I’ll be

subscribing for your feed and I hope you write once more soon!