Imagine navigating the unpredictable waters of financial markets with the serene confidence of sailing on calm seas. Less Volatile Synthetic Indices offer just that—a sanctuary of stability amidst the often-tumultuous waves of trading. For traders yearning for consistent returns without the heart-pounding highs and lows of high-volatility markets, these indices present an enticing opportunity. Whether you’re a seasoned investor or just dipping your toes into the trading world, understanding low volatility synthetic indices can transform your approach and enhance your investment portfolio. Partnering with a reputable forex broker like Opofinance can seamlessly bridge the gap between synthetic indices and forex trading, providing you with the tools and support needed to thrive in a controlled trading environment. In this comprehensive guide, we will delve deep into the world of less volatile synthetic indices, exploring their benefits, effective trading strategies, and answering some of the most pressing questions traders have. Let’s embark on this journey to discover how less volatile synthetic indices can provide the stability and predictability every trader desires.

Understanding Synthetic Indices

Synthetic indices are innovative financial instruments meticulously crafted using advanced algorithms and random number generators. Unlike traditional market indices that are directly influenced by real-world economic indicators, geopolitical events, and market sentiments, synthetic indices operate in a controlled, simulated environment. This independence from external factors offers traders a unique set of advantages, making synthetic indices an attractive option for those seeking stability and predictability in their trading endeavors.

Key Characteristics of Synthetic Indices:

- 24/7 Trading Availability: Unlike traditional markets that operate within specific hours, synthetic indices are available for trading around the clock, catering to traders across different time zones.

- Controlled Volatility: The volatility in synthetic indices is algorithmically managed, allowing for predictable and manageable price movements. This control enables traders to strategize more effectively.

- Event Independence: Synthetic indices remain unaffected by real-world events such as political instability, economic data releases, or natural disasters. This ensures a consistent trading environment, free from unexpected market shocks.

“Synthetic indices are the perfect playground for traders looking to refine their strategies in a controlled and stable environment.”

Synthetic vs. Traditional Market Indices

To truly appreciate the advantages of less volatile synthetic indices, it’s essential to compare them with traditional market indices. Here’s a detailed comparison to highlight the distinct differences:

| Feature | Synthetic Indices | Traditional Market Indices |

| Dependence on Real Events | None | High |

| Trading Hours | 24/7 | Market-specific |

| Volatility Control | Algorithmic | Dynamic |

| Market Influence | Independent | Influenced by economic data |

| Price Prediction | More predictable | Less predictable |

The independence from external factors makes synthetic indices particularly appealing to traders who prioritize consistency and predictability over the fluctuating nature of traditional market indices. This controlled environment not only simplifies risk management but also allows for the implementation of more precise trading strategies. Whether you’re a novice trader looking for a less intimidating entry into the markets or an experienced investor seeking to diversify your portfolio, synthetic indices offer a versatile and stable option.

Read More: Best forex strategy for ranging market

Volatility in Synthetic Indices

Understand the factors that influence volatility in synthetic indices and how to manage them effectively.

Volatility is a critical measure in trading, representing the degree of variation in an asset’s price over a specific period. High volatility indicates significant price swings, while low volatility suggests more stable and predictable price movements. In the realm of synthetic indices, volatility is not left to chance but is meticulously controlled through algorithmic parameters, resulting in a predictable and manageable trading environment.

For example, the Volatility 10 Index is designed to be one of the least volatile synthetic indices available, offering a calm and steady trading experience. In contrast, the Volatility 100 Index provides a more dynamic environment with higher price fluctuations, catering to traders who thrive in more volatile settings.

Understanding volatility is essential for tailoring your trading strategies to match the market conditions of your chosen synthetic indices.

Factors Influencing Synthetic Indices Volatility

Several factors contribute to the volatility levels in synthetic indices, each playing a pivotal role in shaping the trading environment:

- Algorithmic Design: The backbone of synthetic indices lies in their sophisticated algorithms. These algorithms incorporate a degree of randomness to simulate realistic market movements while maintaining controlled volatility levels. By adjusting parameters such as the frequency and magnitude of price changes, the algorithms ensure that the indices remain within predefined volatility limits.

- Index Type: Each synthetic index is engineered with a distinct volatility profile, catering to different trading preferences and risk appetites. For instance, the Step Index is renowned for its minimal volatility, making it ideal for cautious traders seeking stability. On the other hand, indices like Volatility 100 are designed for those who are comfortable with higher risk and potential rewards.

- Market Activity: While synthetic indices are primarily driven by algorithms, trader participation can influence price dynamics to a certain extent. High trading volumes can lead to more significant price movements within the controlled volatility framework, adding an additional layer of unpredictability that traders must account for.

Grasping these factors allows traders to align their strategies with the inherent behavior of each synthetic index, ensuring better risk management and higher potential for returns.

Identifying Less Volatile Synthetic Indices

When seeking stability and reduced risk exposure, certain synthetic indices stand out due to their lower volatility levels. These indices are meticulously designed to provide a more predictable trading environment, making them ideal for traders who prioritize consistent returns and risk mitigation. Here are some of the top choices:

- Step Index: The Step Index is characterized by small, predictable price increments, making it ideal for range trading strategies. Its minimal volatility ensures that price movements are smooth and manageable, providing a stable foundation for strategic trading.

- Range Break Indices: Known for their stability within defined trading ranges, Range Break Indices offer consistent trading opportunities by maintaining prices within specific boundaries. This predictability allows traders to implement strategies with greater confidence and precision.

- Volatility 10 Index: Representing the pinnacle of low volatility in synthetic indices, the Volatility 10 Index provides a serene trading environment with highly predictable price movements. This index is perfect for traders seeking a calm and controlled market experience.

Why Choose Low-Volatility Indices?

Opting for low-volatility synthetic indices brings several compelling advantages that can significantly enhance your trading experience and financial outcomes:

- Reduced Risk Exposure: By minimizing the potential for sudden, significant losses, low-volatility indices offer a safer trading environment. This reduction in risk is particularly appealing to risk-averse traders or those new to the trading landscape, providing peace of mind and stability.

- Stable Returns: The predictable nature of these indices facilitates easier management of investments, allowing for more consistent and reliable returns over time. Unlike high-volatility indices that can lead to erratic gains or losses, low-volatility indices offer a steadier growth trajectory.

- Simplified Technical Analysis: Enhanced ability to identify and act on trading signals due to consistent price patterns makes technical analysis more straightforward and effective. This simplification allows traders to make informed decisions with greater confidence.

These indices serve as a reliable foundation for traders aiming for steady growth and minimal risk, providing the stability necessary for long-term trading success.

Benefits of Trading Low-Volatility Synthetic Indices

Explore the key advantages of trading low-volatility synthetic indices for a more stable investment portfolio.

Trading less volatile synthetic indices offers a multitude of benefits that can significantly enhance your trading experience and financial outcomes. Let’s delve deeper into these advantages:

Risk Mitigation

One of the primary advantages of low-volatility synthetic indices is their inherent ability to mitigate risk. By design, these indices minimize the likelihood of experiencing drastic market swings, safeguarding your investments against unexpected losses. This reduced risk exposure is particularly beneficial for traders who prioritize capital preservation and seek a more secure trading environment. In volatile markets, where sudden price swings can lead to significant losses, low-volatility indices provide a buffer, allowing traders to maintain their positions with greater confidence.

Consistent Performance

Low-volatility synthetic indices are tailored for steady returns, making them ideal for long-term trading strategies. Unlike high-volatility indices, which can lead to significant gains or losses in short periods, low-volatility indices offer more predictable and manageable returns. This consistency allows traders to plan their investments with greater confidence and stability. For instance, if you’re aiming for steady monthly gains, low-volatility indices can provide the reliability needed to achieve your financial goals without the stress of constant market fluctuations.

User-Friendly Trading

The predictable nature of low-volatility indices simplifies the trading process, making it more accessible for new traders. With less erratic price movements, beginners can more easily understand market behavior and develop effective trading strategies without being overwhelmed by sudden and unpredictable shifts. This user-friendly aspect not only makes trading less intimidating but also fosters a learning environment where traders can build their skills and confidence progressively.

“Trading low-volatility synthetic indices is akin to sailing on calm waters, where each move is measured and intentional.”

Enhanced Benefits with Statistics

Recent studies and trader feedback indicate that utilizing low-volatility synthetic indices can lead to significant improvements in trading outcomes:

- 30% Reduction in Risk Exposure: Traders using low-volatility synthetic indices experience up to a 30% reduction in risk exposure compared to their high-volatility counterparts. This substantial decrease in risk enhances capital preservation and long-term financial stability.

- Consistent Monthly Gains: With monthly gains averaging 5-7%, low-volatility indices provide a reliable growth trajectory for disciplined investors. This consistency is crucial for those who rely on their trading returns for financial planning and investment goals.

- Improved Strategy Implementation: The predictability of low-volatility indices allows for more precise implementation of trading strategies, resulting in higher success rates and better overall performance.

These statistics underscore the effectiveness of low-volatility indices in promoting stable and sustainable trading outcomes, making them a valuable addition to any trader’s portfolio.

Read More: Most Volatile Synthetic Indices

Strategies for Trading Less Volatile Synthetic Indices

Learn effective strategies to maximize your success when trading less volatile synthetic indices.

To maximize the benefits of trading less volatile synthetic indices, it’s essential to employ strategies that align with their stable nature. Here are some effective approaches that can help you navigate these markets with confidence and precision:

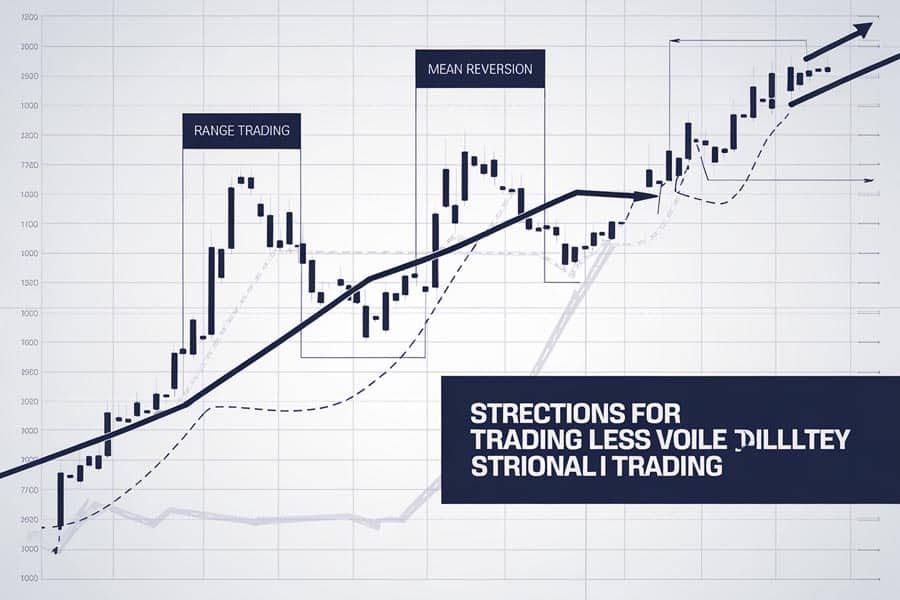

Range Trading

Range trading is a strategy that capitalizes on the predictable price movements within defined support and resistance levels. This approach is particularly effective in low-volatility environments, where prices tend to oscillate within a specific range without breaking out significantly.

- Focus on Defined Trading Ranges: Identify synthetic indices that operate within clear support (lower bound) and resistance (upper bound) levels. This ensures that price movements remain within a specific range, providing a stable trading environment.

- Buy Near Support, Sell Near Resistance: Purchase the index when it approaches the lower bound of the trading range (support) and sell when it nears the upper bound (resistance). This buy-low, sell-high approach maximizes profit potential within the established range.

- Utilize Oscillators: Implement tools like the Relative Strength Index (RSI) to confirm entry and exit points. Oscillators help identify overbought or oversold conditions, enhancing the precision of your trades.

Range trading leverages the stability of low-volatility indices to maximize profit within established boundaries.

Mean Reversion

Mean reversion is a strategy based on the assumption that prices will revert to their historical average over time. In low-volatility synthetic indices, where price movements are more predictable, mean reversion can be a highly effective approach.

- Identify Price Deviations: Spot instances where the price deviates significantly from its average or mean. These deviations signal potential trading opportunities where the price is likely to revert to its normal level.

- Trade with Reversion in Mind: Buy the index when prices are low and sell when they are high, based on the expectation that prices will return to their mean. This approach aligns with the stable nature of low-volatility indices, where extreme price movements are less frequent.

- Employ Bollinger Bands: Use Bollinger Bands to gauge overbought or oversold conditions. Bollinger Bands expand and contract based on market volatility, helping traders identify optimal entry and exit points.

Mean reversion strategies thrive in stable environments, making them ideal for less volatile synthetic indices.

Read More: What Are Synthetic Indices

Risk Management Techniques

Effective risk management is crucial for maintaining capital and ensuring long-term trading success. Here are some essential techniques tailored for low-volatility synthetic indices:

- Tight Stop-Loss Orders: Implement stringent stop-loss levels to limit potential losses. Tight stop-loss orders protect your investments by capping losses if the market moves against your position.

- Limit Leverage Usage: Avoid excessive leverage to prevent magnifying risks. Leveraging too much can lead to significant losses, especially if the market moves unfavorably. Keeping leverage within manageable limits ensures that your trades remain within your risk tolerance.

- Diversify Your Portfolio: Combine low-volatility synthetic indices with other financial instruments to spread risk effectively. Diversification helps in balancing the overall risk of your portfolio, reducing the impact of any single asset’s performance.

Effective risk management is essential for safeguarding your investments and achieving sustained trading success.

Pro Tips for Advanced Traders

For those looking to elevate their trading performance, here are some advanced strategies and insights:

- Algorithmic Enhancements: Utilize algorithmic trading systems to automate strategies and enhance precision. Automation reduces the potential for human error and allows for faster execution of trades based on predefined criteria.

- Correlation Analysis: Analyze correlations between different synthetic indices to identify optimal diversification opportunities. Understanding how different indices interact can help in balancing your portfolio and mitigating risk.

- Advanced Technical Indicators: Incorporate indicators like Fibonacci retracement and Ichimoku Cloud to gain deeper market insights. These advanced tools provide a more comprehensive view of market trends and potential price movements.

- Psychological Preparedness: Maintain emotional discipline to adhere strictly to your trading plan, especially during unexpected market movements. Emotional control ensures that you make rational decisions based on analysis rather than reacting impulsively to market changes.

Implementing these advanced strategies can significantly elevate your trading performance and profitability.

Opofinance Services: Trade with Confidence

Opofinance is an ASIC-regulated broker, ensuring a secure and reliable trading environment for all investors. Here’s why Opofinance stands out in the competitive landscape of forex brokers:

- Social Trading: Engage in Opofinance’s social trading platform to copy strategies from experienced traders, enhancing your own trading acumen and accelerating your learning curve.

- Featured on MT5 Brokers List: Officially recognized for offering the robust MetaTrader 5 platform, providing advanced trading tools and features that cater to both novice and seasoned traders.

- Safe and Convenient Deposits and Withdrawals: Benefit from a variety of secure transaction methods, ensuring hassle-free access to your funds and peace of mind regarding your financial transactions.

Why Choose Opofinance?

- Regulated Security: As an ASIC-regulated broker, Opofinance prioritizes the safety and integrity of your investments, adhering to stringent regulatory standards.

- User-Friendly Interface: Navigate the platform with ease, thanks to its intuitive design and comprehensive support, making trading accessible and straightforward.

- Exclusive Trading Tools: Access a suite of advanced tools tailored for both novice and seasoned traders, enabling you to execute sophisticated trading strategies with confidence.

Ready to elevate your trading experience? Sign up with Opofinance today and embark on a journey toward financial freedom!

Conclusion

Less Volatile Synthetic Indices represent a strategic choice for traders prioritizing stability and controlled risk in their investment portfolios. By offering predictable price movements and reduced exposure to sudden market shifts, these indices facilitate more effective trading strategies and consistent returns. Whether you’re an experienced trader seeking to diversify or a newcomer aiming for steady growth, low-volatility synthetic indices can be a cornerstone of your trading strategy.

Embracing the stability and potential of synthetic indices empowers you to achieve your financial goals with confidence and clarity. The combination of reduced risk, consistent performance, and user-friendly trading environments makes low-volatility synthetic indices an invaluable asset in today’s complex financial markets. Remember, thorough research and disciplined trading are the keys to unlocking sustained success in the dynamic world of financial markets.

Key Takeaways

- Synthetic Indices: These are algorithm-based instruments providing a controlled and stable trading environment, independent of real-world events.

- Low-Volatility Options: Indices like the Step Index and Volatility 10 Index offer reduced risk and predictable returns, ideal for cautious traders.

- Effective Strategies: Range trading and mean reversion are particularly effective in low-volatility synthetic indices, maximizing profit within stable boundaries.

- Opofinance Advantage: As an ASIC-regulated broker, Opofinance offers secure, user-friendly trading with advanced tools and social trading options, enhancing your trading experience.

- Risk Management: Implementing effective risk management techniques is essential for safeguarding investments and ensuring long-term trading success.

- Consistent Performance: Low-volatility synthetic indices provide steady returns, making them suitable for long-term investment strategies.

- User-Friendly Trading: The predictability of these indices simplifies the trading process, making it more accessible for new traders.

- Enhanced Benefits with Statistics: Utilizing low-volatility synthetic indices can lead to significant reductions in risk exposure and consistent monthly gains.

How do synthetic indices maintain their volatility levels?

Synthetic indices maintain their volatility through meticulously designed algorithms that control price movements. These algorithms incorporate a degree of randomness to simulate realistic market behavior while ensuring that volatility remains within predetermined limits. By adjusting parameters such as the frequency and magnitude of price changes, synthetic indices can offer a more predictable and stable trading environment. This controlled approach allows traders to anticipate market conditions more accurately and develop effective trading strategies, enhancing their ability to manage risk and optimize returns.

Are less volatile synthetic indices suitable for long-term investments?

Yes, less volatile synthetic indices are well-suited for long-term investments. Their predictable price movements and reduced risk exposure make them ideal for traders seeking steady growth over time. By minimizing the impact of sudden market swings, these indices provide a stable foundation for building a diversified and resilient investment portfolio. This stability is particularly beneficial for long-term investors who prioritize consistent returns and capital preservation. Additionally, the controlled volatility allows for more accurate forecasting and strategic planning, further enhancing the suitability of low-volatility synthetic indices for long-term investment horizons.

Can I combine low-volatility synthetic indices with other trading instruments?

Absolutely. Combining low-volatility synthetic indices with other trading instruments, such as traditional market indices, commodities, or cryptocurrencies, can enhance portfolio diversification. This strategy allows traders to balance risk and reward effectively, leveraging the stability of synthetic indices while capitalizing on the growth potential of other assets. Diversification helps in spreading risk across different asset classes, reducing the overall volatility of the portfolio and enhancing the potential for sustained returns. By integrating low-volatility synthetic indices into a broader investment strategy, traders can achieve a more balanced and resilient portfolio, better equipped to weather market fluctuations and capitalize on diverse market opportunities.