Leverage can be a trader’s best friend—or worst enemy. The allure of multiplying profits with borrowed capital draws many traders in, but without leverage trading risk management, even small market shifts can wipe out entire accounts. The risks of leverage trading—from sudden margin calls to liquidation—are real and unforgiving. Many traders, especially those new to the market, fail to recognize how quickly over-leveraging can turn into a financial disaster.

Imagine placing a trade with 100:1 leverage, thinking you’re on the path to massive profits. The market moves slightly against you, and before you can react, your position is forcefully liquidated. Your entire balance is gone. Without effective leverage trading risk management, this isn’t a rare scenario—it happens every day. Many traders, even those using a regulated forex broker, overlook the key strategies needed to balance risk and reward. The emotional stress, financial instability, and constant fear of market fluctuations can make trading feel like gambling rather than a structured investment strategy.

The key to success isn’t avoiding leverage—it’s mastering how to manage leverage trading risk effectively. This guide will provide you with a step-by-step approach to:

- Understand leverage mechanics and its real impact on your capital.

- Identify and mitigate the most common risks of leverage trading.

- Implement proven risk management techniques, from stop-loss strategies to position sizing.

By the end of this article, you’ll have the knowledge and tools to trade with confidence, using leverage as an advantage—not a liability. Let’s dive in.

Understanding Leverage in Trading

Leverage is a financial instrument that allows traders to control larger positions with a relatively small amount of capital. In other words, leverage trading risk management involves using borrowed funds to amplify your market exposure. When you understand leverage, you quickly realize that every decision comes with its double-edged sword: the potential for significant gains is always matched by the potential for equally substantial losses.

In leverage trading risk management, a key point is knowing that every trade you make is subject to the risks of leverage trading. This means that your capital can grow exponentially with favorable market moves, but if the market turns against you, the risks of leverage trading become all too apparent. Whether you are trading stocks, forex, or cryptocurrencies, the principles of leverage remain the same: more exposure equals more potential profit, but also more risk.

How Leverage Amplifies Gains and Losses

Leveraged trading magnifies every movement in the market. Consider a scenario where you use a 10:1 leverage ratio. This means that a 1% move in the asset’s price results in a 10% change in your position value. In the realm of leverage trading risk management, this amplification factor is a critical consideration. It illustrates that even a small market fluctuation can have a dramatic impact on your trading outcome.

For example, if you have a capital base of $1,000 and you opt for 10:1 leverage, you can control a $10,000 position. A mere 5% increase in the asset’s value can yield a profit of $500, translating to a 50% return on your initial investment. Conversely, if the asset falls by 5%, you could incur a loss of $500—highlighting the severe risks of leverage trading. This example underlines why comprehensive leverage trading risk management strategies are essential: they serve as your safeguard against the volatility inherent in these markets.

The Importance of Understanding Leverage Trading Risk Management

A deep understanding of leverage trading risk management is paramount. Many traders underestimate the risks of leverage trading until they face significant losses. By internalizing the principles of leverage trading risk management, you can make informed decisions that protect your investments. A thorough grasp of the risks of leverage trading allows you to prepare and respond effectively when market conditions shift unexpectedly. Every trader must learn how to balance the allure of high returns with the disciplined application of risk management strategies.

Key Risks Associated with Leverage Trading

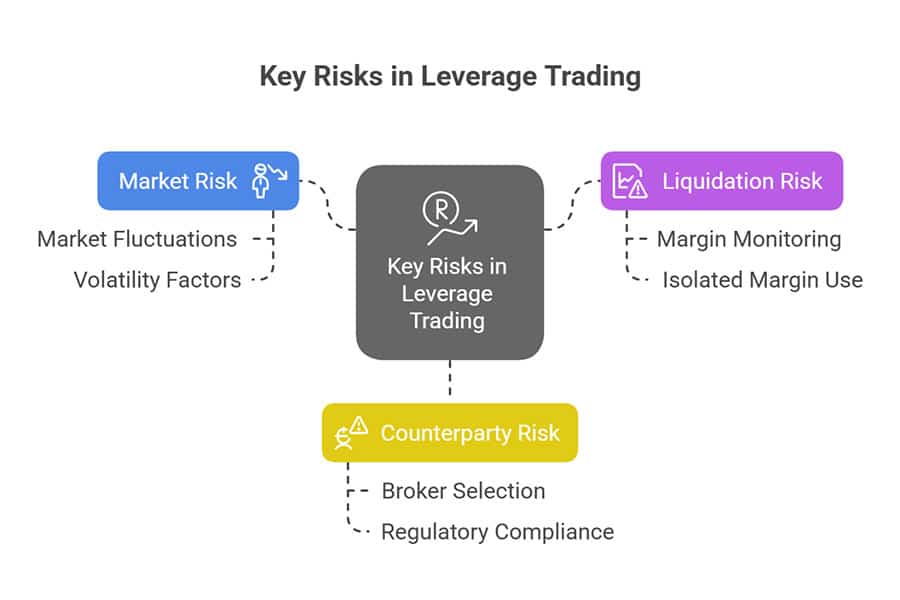

When you engage in leveraged trading, you are exposed to several inherent risks. A critical part of leverage trading risk management is identifying these risks early on and developing strategies to mitigate them. Here, we delve into the primary risks of leverage trading:

Market Risk

Market risk is the possibility of experiencing losses due to unfavorable market movements. In the context of leverage trading risk management, market risk is amplified by the use of leverage. Even slight market fluctuations can lead to disproportionate losses when you are trading on leverage. Economic indicators, geopolitical events, and unexpected news can all contribute to increased volatility. Being aware of these factors is essential for managing the risks of leverage trading effectively.

To mitigate market risk, traders must adopt robust risk management techniques. This includes regularly monitoring market conditions, setting realistic expectations, and understanding that the risks of leverage trading can escalate quickly in volatile environments. Through disciplined market analysis and the use of technical tools, you can better predict market trends and safeguard your positions.

Liquidation Risk

Liquidation risk is a specific danger in leveraged trading that occurs when your account equity falls below the margin requirements, prompting the broker to automatically close your position. This forced closure is a significant concern in leverage trading risk management because it can result in immediate and substantial losses. Liquidation risk is a direct consequence of the risks of leverage trading, and its impact can be both financially and emotionally devastating.

Effective leverage trading risk management involves careful monitoring of your margin levels and using isolated margin where possible. This minimizes the impact of one poor-performing trade on your entire portfolio, thereby reducing the likelihood of liquidation. By understanding and mitigating liquidation risk, you ensure that the risks of leverage trading do not spiral out of control.

Counterparty Risk

Counterparty risk arises when the financial health or operational stability of your broker or trading platform is in question. In the realm of leverage trading risk management, selecting a reputable and well-regulated broker is crucial. If the entity on the other side of your trade faces difficulties, the risks of leverage trading are compounded by the potential loss of your funds or access to the market.

To address counterparty risk, always work with trusted brokers, such as a regulated forex broker, that adhere to strict financial regulations and maintain transparent operations. This approach is a key element of effective leverage trading risk management, ensuring that you are not inadvertently exposed to additional risks beyond those inherent in the market.

Essential Risk Management Strategies

Implementing robust strategies for leverage trading risk management is the cornerstone of protecting your capital. Below are several critical strategies designed to mitigate the risks of leverage trading:

Developing a Comprehensive Trading Plan

A well-defined trading plan is your roadmap for effective leverage trading risk management. This plan should cover:

- Clear Entry and Exit Points: Know exactly when to enter and exit trades.

- Risk Tolerance Levels: Define how much of your capital you are willing to risk on each trade.

- Market Analysis Guidelines: Utilize both technical and fundamental analysis to make informed decisions.

- Contingency Plans: Prepare for unexpected market movements and ensure that you have a strategy to manage adverse outcomes.

A thorough trading plan not only guides your actions but also reinforces your understanding of the risks of leverage trading. By planning meticulously, you reduce uncertainty and enhance your overall leverage trading risk management strategy.

Read More: Overleveraged trading

Utilizing Stop-Loss Orders

Stop-loss orders are indispensable tools in leverage trading risk management. These orders automatically exit a position when the asset price reaches a predetermined level, thereby limiting your potential loss. In the high-stakes arena of leverage trading, stop-loss orders are a critical line of defense against the risks of leverage trading. They ensure that a single trade does not wipe out a large portion of your capital.

By integrating stop-loss orders into your trading plan, you create a buffer against unexpected market movements. This simple yet powerful tool can help you avoid the pitfalls associated with the risks of leverage trading and maintain a disciplined approach to your trades.

Calculating and Monitoring Margin

Margin management is at the heart of leverage trading risk management. Margin is the collateral required to open a leveraged position, and careful calculation is vital. You must monitor your margin continuously to avoid margin calls and the resultant liquidation risk. The risks of leverage trading can escalate quickly if your margin is not maintained at healthy levels.

Effective margin management involves regular checks of your account balance, understanding the margin requirements for your trades, and adjusting your positions accordingly. By doing so, you reduce the chances of facing sudden margin calls, thus mitigating the risks of leverage trading.

Avoiding Crossed Margin

Crossed margin is a scenario where losses in one position can affect your overall account, amplifying the risks of leverage trading. In contrast, using isolated margin confines potential losses to a single trade, which is a fundamental aspect of leverage trading risk management. Isolated margin protects your portfolio by ensuring that one poor-performing trade does not jeopardize your entire capital base.

To manage the risks of leverage trading effectively, always opt for isolated margin when available. This practice minimizes the cascading effects of losses and supports a more controlled trading environment.

Appropriate Position Sizing

One of the cornerstones of leverage trading risk management is proper position sizing. Allocating too much capital to one trade exposes you to the risks of leverage trading in an amplified manner. By determining the appropriate position size, you ensure that no single trade can significantly damage your portfolio.

In practice, this means risking only a small percentage of your total capital on any single trade—a strategy often encapsulated in the 1% rule. This conservative approach is central to effective leverage trading risk management, ensuring that even in the face of adverse market movements, your overall exposure remains limited.

Applying the 1% Rule

The 1% rule is a widely endorsed guideline in leverage trading risk management. It suggests that you should never risk more than 1% of your total trading capital on a single trade. This rule is particularly important when considering the risks of leverage trading, as it helps prevent large, catastrophic losses that can quickly deplete your account. By adhering to the 1% rule, you ensure that each trade contributes to a sustainable trading strategy and that you remain in control, even when market conditions become volatile.

The Role of Leverage Ratios

Understanding Different Leverage Ratios

In the realm of leverage trading risk management, leverage ratios are a critical component. Leverage ratios indicate how much borrowed capital you are using relative to your own investment. Common ratios include 5:1, 10:1, 50:1, and even 100:1. Each ratio comes with its own level of risk—the higher the leverage, the greater the potential impact on your portfolio, and consequently, the risks of leverage trading become more pronounced.

Understanding these ratios is fundamental to effective leverage trading risk management. When you know the specific leverage ratio you are working with, you can adjust your risk management strategies accordingly. This means tailoring your stop-loss orders, position sizing, and margin management practices to align with the particular risks of leverage trading that your chosen ratio introduces.

Implications of Leverage Ratios

- Low Leverage Ratios: These ratios tend to be more conservative and are favored by traders who prioritize safety. While they limit potential gains, they also reduce the risks of leverage trading by minimizing exposure.

- High Leverage Ratios: While offering the potential for substantial profits, high leverage ratios significantly increase the risks of leverage trading. They can lead to rapid gains in favorable conditions, but in adverse market scenarios, they can also precipitate quick and severe losses.

A careful assessment of your personal risk tolerance is necessary when selecting a leverage ratio. This assessment should be an integral part of your overall leverage trading risk management strategy, ensuring that you are not overexposed to the risks of leverage trading.

Tools and Techniques for Effective Risk Management

In today’s digital age, numerous tools and techniques can bolster your leverage trading risk management efforts. These tools help you navigate the volatile landscape and minimize the risks of leverage trading with precision.

Implementing Stop-Loss and Take-Profit Orders

Beyond just setting stop-loss orders, a sophisticated leverage trading risk management strategy often involves the simultaneous use of take-profit orders. Take-profit orders allow you to lock in gains once a predetermined price level is reached. The combination of stop-loss and take-profit orders creates a safety net that can automatically manage your trades, reducing the risks of leverage trading by limiting losses and securing profits.

Diversifying Trading Portfolios

Diversification is a time-tested technique in risk management. When it comes to leverage trading risk management, diversifying your trading portfolio can help cushion the impact of adverse market movements. By spreading your investments across different asset classes, sectors, and instruments, you effectively reduce the risks of leverage trading by avoiding over-concentration in any single asset. This diversified approach means that even if one trade suffers due to the risks of leverage trading, the overall impact on your portfolio is minimized.

Regularly Reviewing and Adjusting Strategies

The financial markets are constantly evolving, and so must your strategies for leverage trading risk management. Regularly reviewing your trading performance, analyzing past trades, and adjusting your approach based on current market conditions are essential steps to mitigate the risks of leverage trading. By maintaining a dynamic strategy, you can adapt to market shifts, thereby ensuring that your risk management measures remain effective over time.

Leveraging Advanced Analytics and Trading Software

Modern trading platforms offer advanced analytics tools that can help you manage the risks of leverage trading more effectively. These tools can analyze market trends, provide real-time risk assessments, and help fine-tune your leverage trading risk management strategies. Utilizing such technology is a smart move for traders who want to stay ahead of the risks of leverage trading.

Pro Tips for Advanced Traders

For traders who are already well-versed in the basics, advanced strategies can further enhance your leverage trading risk management. These pro tips are designed to help you navigate the complexities and fine-tune your approach to mitigate the risks of leverage trading even more effectively.

- Utilize Advanced Charting Tools: Invest in technical analysis software that offers a multi-dimensional view of the market. This will enable you to set more accurate stop-loss orders and predict market trends with greater precision.

- Monitor Volatility Indicators: Use indicators such as the Average True Range (ATR) to gauge market volatility. These tools help you adjust your stop-loss levels and position sizes in line with the risks of leverage trading.

- Dynamic Position Sizing: Instead of sticking to a fixed percentage of your capital, consider adjusting your position sizes dynamically based on the volatility and risk profile of each trade. This advanced approach to leverage trading risk management can be crucial during periods of market turbulence.

- Backtesting and Simulation: Prior to deploying new strategies in a live market, use backtesting tools and simulation platforms. This will allow you to see how your leverage trading risk management strategies perform under various market conditions.

- Maintain Emotional Discipline: Advanced traders know that psychological resilience is as important as technical skill. A disciplined mindset is crucial for managing the risks of leverage trading, ensuring that decisions are based on strategy rather than emotion.

Opofinance: Elevate Your Trading with a Trusted ASIC-Regulated Broker

When it comes to leverage trading risk management, having a trusted, regulated broker by your side can make all the difference. Opofinance, an ASIC-regulated broker, provides traders with a secure and feature-rich trading environment designed to help you manage risk effectively while optimizing your trading potential.

Unlike brokers that push high leverage without proper safeguards, Opofinance combines cutting-edge trading technology with strict regulatory compliance, giving you advanced trading tools in a safe, transparent environment.

Why traders choose Opofinance:

- Advanced trading platforms including MT4, MT5, cTrader, and OpoTrade, giving you access to real-time data, advanced charting, and seamless trade execution.

- AI-powered trading tools such as AI Market Analyzer, AI Coach, and AI Support to help you analyze market trends, refine strategies, and make data-driven decisions.

- Social and prop trading features that allow you to copy successful strategies or trade with institutional-level capital.

- Secure and flexible transactions with zero-fee crypto payments and multiple funding options for smooth deposits and withdrawals.

Opofinance isn’t just about giving you access to the markets—it’s about empowering you with the tools, security, and technology to trade smarter and manage risk effectively.

Start trading with confidence today. Visit opofinance.com and take your trading to the next level.

Conclusion

In summary, mastering leverage trading risk management is not just an academic exercise—it is an essential practice that can determine the success or failure of your trading endeavors. The allure of high returns from leveraged trading is undeniable, but without rigorous risk management, the risks of leverage trading can quickly become overwhelming. From understanding how leverage magnifies both gains and losses to implementing stop-loss orders, managing your margin, and practicing proper position sizing, every aspect of leverage trading risk management is designed to protect your capital.

Remember, the key to effective leverage trading risk management lies in continuous learning and adaptation. As market conditions change, so too must your strategies. By taking a proactive approach, you can harness the potential of leveraged trading while mitigating its inherent risks. Embrace the challenges, stay informed, and let disciplined risk management be your guide in navigating the unpredictable waters of the financial markets.

Key Takeaways

- Leverage Trading Risk Management is fundamental to protecting your capital in high-risk trading environments.

- The amplified nature of leveraged trades means that every market movement has a greater impact, emphasizing the importance of managing the risks of leverage trading.

- Key risks include market volatility, liquidation, and counterparty issues, all of which require proactive management.

- Essential strategies include developing a comprehensive trading plan, using stop-loss orders, careful margin management, and appropriate position sizing.

- Advanced traders can further optimize their leverage trading risk management with dynamic strategies, advanced charting tools, and backtesting.

- Partnering with reputable brokers, like the ASIC regulated opofinance broker, adds another layer of security and advanced features to help manage the risks of leverage trading.

What are some common mistakes that undermine effective leverage trading risk management?

One common mistake is overleveraging, where traders expose themselves to the risks of leverage trading by using high ratios without a clear risk management plan. Additionally, neglecting to use stop-loss orders and not adjusting position sizes according to market volatility can lead to severe losses.

How can I continuously improve my strategies to manage the risks of leverage trading?

Regular performance reviews, backtesting new strategies, and staying updated with market trends are essential. Utilize advanced analytics tools and consider learning from experienced traders who excel in leverage trading risk management to refine your approach.

Why is it important to choose a regulated broker for managing leverage trading risk management?

A regulated broker ensures transparency, accountability, and a higher standard of financial security. This reduces counterparty risk and provides a more stable platform to manage the risks of leverage trading, making it easier to implement robust risk management strategies.