In the fast-paced world of forex trading, scalping has emerged as a popular strategy for traders seeking to capitalize on small price movements within the shortest timeframes. At the heart of successful scalping lies the ability to quickly identify and act on market momentum – and this is where the Moving Average Convergence Divergence (MACD) indicator truly shines. As a versatile tool that combines trend-following and momentum characteristics, the MACD has become an indispensable asset for scalpers looking to gain an edge in their short-term trading endeavors.

This comprehensive guide is designed to demystify the MACD indicator and its application in scalping strategies. Whether you’re a novice trader just starting with a regulated forex broker or an experienced scalper looking to refine your techniques, you’ll find valuable insights to enhance your trading approach. We’ll delve into the mechanics of the MACD, explore its interpretation in the context of scalping, and provide practical strategies to implement in your trading routine.

By the end of this article, you’ll have a solid understanding of:

- How the MACD indicator works and why it’s particularly suited for scalping

- Effective scalping strategies using MACD signals

- Optimizing MACD settings for short-term trading

- Combining MACD with other technical tools for more robust analysis

- Risk management techniques essential for successful scalping

Moreover, we’ll address common challenges faced by scalpers using the MACD and offer solutions to overcome them. Our goal is to equip you with the knowledge and tools necessary to leverage the MACD indicator effectively in your scalping strategy, potentially boosting your short-term trading profits in the dynamic forex market.

So, whether you’re looking to dive into the world of scalping or aiming to sharpen your existing skills, this guide on using the MACD indicator for scalping is your roadmap to more informed and potentially more profitable forex trading decisions. Let’s embark on this journey to master the art of MACD scalping and unlock new levels of trading success.

Read More: Master the 20 EMA Scalping Strategy

Understanding the MACD Indicator

How the MACD Works

The MACD is calculated using two moving averages of varying lengths:

- The MACD line: This is the difference between a 12-period and 26-period Exponential Moving Average (EMA).

- The signal line: A 9-period EMA of the MACD line.

These lines converge and diverge as price action fluctuates, providing insights into market momentum and potential trend changes.

Interpreting MACD Signals

Identifying buy and sell signals based on crossovers:

- Bullish signal: MACD line crosses above the signal line

- Bearish signal: MACD line crosses below the signal line

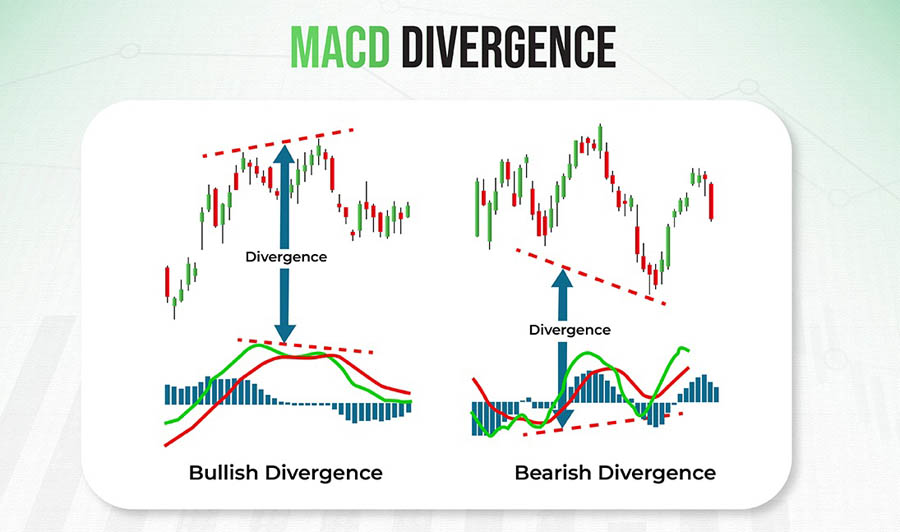

Recognizing divergence between price and the MACD:

- Bullish divergence: Price makes lower lows while MACD makes higher lows

- Bearish divergence: Price makes higher highs while MACD makes lower highs

Divergences can be powerful indicators of potential trend reversals, making them valuable for scalpers looking to capitalize on short-term price movements.

Read More: 7 Proven EMA Scalping Strategies for Forex Success

Using the MACD for Scalping

Scalping with the MACD indicator requires a deep understanding of its nuances and the ability to make split-second decisions. Let’s explore in detail how to effectively use the MACD for scalping, including advanced strategies and practical tips for implementation.

Scalping Strategies Based on the MACD

- Crossover strategies: The MACD crossover is one of the most straightforward signals for scalpers. It occurs when the MACD line crosses above or below the signal line.

- Long entry: Enter a long position when the MACD line crosses above the signal line. This suggests increasing bullish momentum.

- Short entry: Enter a short position when the MACD line crosses below the signal line, indicating growing bearish momentum.

- Exit strategy: For scalping, it’s crucial to exit trades quickly. Consider closing the position when: a) The MACD lines start to converge again b) The price reaches a predetermined target (e.g., 5-10 pips) c) A set time limit is reached (e.g., 2-5 minutes)

Example: On a 1-minute EUR/USD chart, you notice the MACD line crossing above the signal line. You enter a long position at 1.1850. The price quickly moves up, and you exit the trade at 1.1855 when the MACD lines begin to converge, securing a 5-pip profit.

- Divergence trading: MACD divergences can signal potential trend reversals, offering lucrative opportunities for scalpers.

- Bullish divergence: When the price makes lower lows, but the MACD makes higher lows, it suggests a potential upward reversal.

- Bearish divergence: If the price makes higher highs, but the MACD makes lower highs, it indicates a possible downward reversal.

- Entry and exit: Enter the trade when the divergence is confirmed by a MACD crossover. Exit when the price reaches a key resistance/support level or when the MACD lines start to converge.

Example: You spot a bullish divergence on a 5-minute GBP/JPY chart. The price makes a lower low, but the MACD makes a higher low. You wait for the MACD line to cross above the signal line before entering a long position. You exit the trade when the price reaches the next significant resistance level.

- Mean reversion strategies: This strategy is based on the principle that prices tend to return to their average state after extreme movements.

- Overbought conditions: When the MACD histogram reaches extreme positive values, it may indicate an overbought market ripe for a downward correction.

- Oversold conditions: Extremely negative MACD histogram values might suggest an oversold market ready for an upward correction.

- Entry and exit: Enter the trade when the histogram starts to reverse direction from these extreme levels. Exit when the histogram approaches the zero line or crosses it.

Example: On a 3-minute USD/CAD chart, you notice the MACD histogram has reached an extreme positive value. As it begins to decrease, you enter a short position. You close the trade when the histogram approaches the zero line, capturing the short-term price correction.

- Zero-line rejection strategy: This strategy focuses on the MACD line’s interaction with the zero line.

- Bullish setup: When the MACD line bounces upward off the zero line in an uptrend, it can signal a continuation of the bullish momentum.

- Bearish setup: If the MACD line rebounds downward from the zero line in a downtrend, it might indicate ongoing bearish pressure.

- Entry and exit: Enter the trade when the MACD line clearly bounces off the zero line. Exit when the MACD line shows signs of weakening momentum or reversing direction.

Example: In an uptrending 2-minute AUD/USD chart, you see the MACD line approach the zero line and then bounce upward. You enter a long position as the MACD line moves decisively away from the zero line. You exit the trade when the MACD line starts to flatten, suggesting weakening momentum.

Tips for Effective Scalping with the MACD

- Consider other technical indicators: While the MACD is powerful, combining it with other indicators can provide more robust signals and help filter out false positives.

- Support and resistance levels: Use these to identify potential reversal points and set profit targets.

- RSI (Relative Strength Index): Confirm MACD signals with overbought/oversold conditions indicated by the RSI.

- Bollinger Bands: These can help identify market volatility and potential breakout points.

- Volume indicators: Use volume to validate the strength of MACD signals.

Example: You spot a MACD crossover signaling a long entry. Before entering the trade, you confirm that the price is near a strong support level, the RSI is coming out of oversold territory, and there’s increasing volume supporting the move.

- Use proper risk management techniques: Effective risk management is crucial in scalping due to the high frequency of trades and the potential for quick losses.

- Set strict stop-loss levels: Place stop-losses just beyond recent swing highs/lows or at a fixed pip distance (e.g., 5-10 pips).

- Use a favorable risk-reward ratio: Aim for at least a 1:2 risk-reward ratio. For example, if your stop-loss is 5 pips, set your take-profit at 10 pips or more.

- Limit account risk per trade: Never risk more than 1-2% of your account on a single trade.

- Use trailing stops: As the trade moves in your favor, move your stop-loss to lock in profits.

Example: You enter a long trade based on a MACD signal. You set a 7-pip stop-loss and a 14-pip take-profit, maintaining a 1:2 risk-reward ratio. As the trade progresses, you move your stop-loss to breakeven once the price moves 7 pips in your favor.

- Practice and refine your scalping skills: Successful MACD scalping requires practice, patience, and continuous improvement.

- Use a demo account: Start with a demo account to test your MACD scalping strategy without risking real money.

- Keep a detailed trading journal: Record all your trades, including entry/exit points, reasons for the trade, and outcomes. This will help you identify patterns and areas for improvement.

- Analyze your performance regularly: Review your journal weekly or monthly to assess your strategy’s effectiveness and make necessary adjustments.

- Stay informed about market conditions: Be aware of economic news releases and market sentiment that could impact your scalping strategy.

Example: After a month of demo trading, you review your journal and notice that your MACD divergence trades have a higher success rate than your crossover trades. You decide to focus more on divergence strategies and adjust your risk management accordingly.

- Optimize your trading setup: A fast and reliable trading setup is crucial for successful scalping.

- Use a low-latency internet connection: Every millisecond counts in scalping. Ensure your internet connection is fast and stable.

- Choose a broker with fast execution: Look for brokers offering low-latency execution and tight spreads.

- Set up multiple charts: Use a multi-screen setup or split your screen to monitor different timeframes simultaneously.

- Use keyboard shortcuts: Learn and use keyboard shortcuts for quick order placement and management.

Example: You set up three charts for EUR/USD: a 15-minute chart for overall trend direction, a 5-minute chart for your primary analysis, and a 1-minute chart for precise entry and exit timing. You use keyboard shortcuts to quickly place and modify orders based on MACD signals.

By implementing these strategies and tips, you can enhance your scalping performance using the MACD indicator. Remember, successful scalping requires discipline, quick decision-making, and continuous learning. As you gain experience, you’ll develop an intuitive feel for MACD movements and their implications for short-term price action, potentially leading to more consistent profits in your forex scalping endeavors.

Read More: Mastering the 200 EMA Scalping Strategy

Common Pitfalls and How to Avoid Them

Overcoming MACD Scalping Challenges

While the MACD indicator can be a powerful tool for scalping, it’s not without its challenges. Here are some common pitfalls and how to navigate them:

- False signals: In choppy markets, the MACD can generate numerous false signals. Combat this by using additional confirmation tools and being selective with your trades.

- Lagging indicator: Remember that the MACD is based on moving averages, which means it can lag behind price action. Compensate by using faster settings and combining with leading indicators.

- Overtrading: The rapid nature of scalping can lead to overtrading. Stick to your strategy and avoid the temptation to enter every potential setup.

- Neglecting the bigger picture: While focusing on short-term movements, don’t lose sight of larger trends. Regularly zoom out to higher timeframes to maintain perspective.

Enhancing Your MACD Scalping Performance

To take your MACD scalping to the next level, consider these performance-enhancing tips:

- Backtesting and optimization: Regularly backtest your MACD scalping strategy and optimize settings for different market conditions.

- Journaling: Keep a detailed trading journal to track your MACD scalping performance and identify areas for improvement.

- Continuous learning: Stay updated on MACD strategies and forex market dynamics through education and practice.

- Emotional control: Develop a disciplined mindset to stick to your strategy and avoid impulsive decisions based on MACD signals alone.

OpoFinance Services: Your Partner in MACD Scalping

For traders looking to implement MACD scalping strategies, choosing the right broker is crucial. OpoFinance, an ASIC-regulated forex broker, offers a comprehensive suite of services tailored to meet the needs of scalpers and short-term traders.

Key features of OpoFinance for MACD scalping:

- Advanced trading platforms, including MetaTrader 5 (officially featured on the MT5 brokers list)

- Tight spreads and fast execution, essential for successful scalping

- Social trading service, allowing you to learn from and copy successful MACD scalpers

- Safe and convenient deposits and withdrawals

- Regulatory compliance, providing a secure trading environment

By partnering with OpoFinance, you can focus on honing your MACD scalping skills while enjoying the peace of mind that comes with a reputable and well-equipped broker.

Conclusion

Mastering the MACD indicator for scalping can significantly enhance your short-term forex trading success. By understanding the intricacies of MACD signals, implementing effective scalping strategies, and utilizing the right tools and broker services, you can capitalize on rapid market movements and potentially increase your trading profits.

Remember, successful scalping with the MACD requires practice, discipline, and continuous refinement of your approach. Stay focused, manage your risks carefully, and always be prepared to adapt your strategy as market conditions evolve.

Can the MACD indicator be used effectively for scalping in volatile market conditions?

Yes, the MACD can be effective for scalping in volatile markets, but it requires some adjustments:

Use shorter time frames (e.g., 1-minute or 5-minute charts) to capture rapid price movements

Adjust MACD settings for quicker responsiveness (e.g., 5, 13, 3)

Combine MACD with volatility indicators like Average True Range (ATR) for better risk management

Set wider stop-losses to account for increased price swings

Be prepared to exit trades quickly if market conditions become too erratic

Remember, while volatile markets can offer more opportunities, they also come with increased risk. Always prioritize risk management in your scalping strategy.

How does the MACD indicator compare to other momentum oscillators for scalping purposes?

The MACD offers several advantages for scalping compared to other momentum oscillators:

Trend and momentum: MACD provides information on both trend direction and momentum strength

Clear signals: MACD crossovers offer easily identifiable entry and exit points

Divergence detection: MACD excels at showing divergences between price and momentum

Flexibility: It can be used across various time frames and markets

However, other oscillators like RSI or Stochastic may be better for identifying overbought/oversold conditions. Many scalpers use a combination of MACD and other oscillators for a more comprehensive analysis.

Are there any specific currency pairs that work best with MACD scalping strategies?

A: While MACD scalping can be applied to any currency pair, some tend to work better due to their characteristics:

Major pairs (e.g., EUR/USD, GBP/USD): Offer high liquidity and tight spreads, ideal for scalping

Pairs with clear trends: MACD works well with trending markets, so pairs that frequently exhibit strong trends are suitable

Pairs with moderate volatility: Too little volatility limits profit potential, while excessive volatility increases risk

Popular pairs for MACD scalping include:

EUR/USD: High liquidity and often exhibits clear trends

GBP/JPY: Known for its volatility, offering good scalping opportunities

USD/CAD: Often moves in clear trends, suitable for MACD analysis

Always backtest your MACD scalping strategy on different pairs to find those that work best with your specific approach.