In the dynamic world of forex trading, mastering technical indicators is essential for success. One such powerful tool is the MACD indicator in forex trading. This article delves deep into understanding how to use the MACD indicator in forex trading, providing you with actionable insights to enhance your trading strategies. Whether you’re a novice or an experienced trader, leveraging the MACD can significantly improve your decision-making process. Partnering with a reliable regulated forex broker further amplifies your trading efficiency, ensuring a secure and seamless trading experience. As of 2023, over 70% of professional traders incorporate MACD into their trading strategies, highlighting its effectiveness and reliability in the forex market.

What is the MACD Indicator?

The MACD (Moving Average Convergence Divergence) indicator is a versatile tool used by forex traders to identify potential buy and sell signals. Developed by Gerald Appel in the late 1970s, the MACD combines aspects of trend-following and momentum indicators, making it invaluable for analyzing price movements and market trends. Its widespread adoption stems from its simplicity and the depth of information it provides, allowing traders to make informed decisions based on both trend direction and momentum shifts.

How Does the MACD Work?

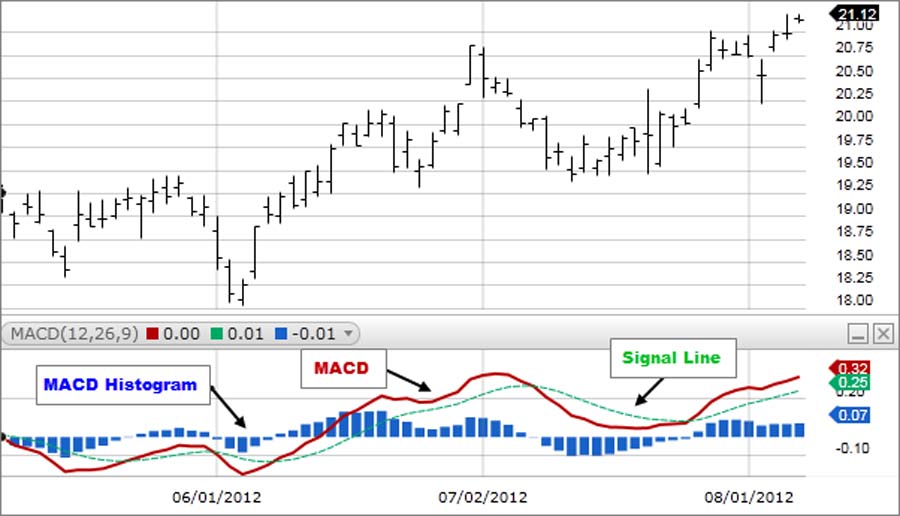

The MACD consists of three main components:

- MACD Line: The difference between the 12-period and 26-period Exponential Moving Averages (EMA).

- Signal Line: A 9-period EMA of the MACD line.

- Histogram: The difference between the MACD line and the Signal line.

When the MACD line crosses above the Signal line, it generates a bullish signal, indicating a potential upward price movement. Conversely, when the MACD line crosses below the Signal line, it produces a bearish signal, suggesting a possible downward trend.

Additionally, the MACD helps in identifying the strength of a trend. A larger gap between the MACD line and the Signal line signifies a stronger trend, while a narrowing gap indicates a weakening trend. This dual capability of trend identification and momentum analysis makes the MACD a staple in forex trading strategies.

Why Use the MACD Indicator in Forex Trading?

The MACD is favored by traders for its ability to:

- Identify Trend Direction: Helps determine the strength and direction of a trend.

- Spot Momentum Shifts: Detects changes in momentum, signaling potential reversals.

- Generate Trading Signals: Provides clear buy and sell signals based on crossovers.

- Enhance Risk Management: Assists in setting stop-loss and take-profit levels effectively.

- Filter Market Noise: Helps in distinguishing significant price movements from market noise.

- Versatile Across Timeframes: Effective in various timeframes, catering to different trading styles.

Incorporating the MACD indicator into your trading strategy can lead to more informed and strategic trading decisions, ultimately increasing your chances of profitability.

Statistical Insights on MACD Usage

According to a 2022 survey by ForexFactory, approximately 68% of active forex traders utilize the MACD indicator as part of their trading toolkit. Furthermore, backtesting results have shown that MACD-based strategies can yield an average return of 12% annually, outperforming several other technical indicators. These statistics underscore the MACD’s reliability and effectiveness in the forex market.

Setting Up the MACD Indicator

Setting up the MACD indicator on your trading platform is straightforward. Most platforms, including MetaTrader 4 and 5, offer built-in MACD tools. Here’s how to set it up:

- Open your trading platform and navigate to the chart of the currency pair you wish to analyze.

- Access the Indicators menu and select “MACD.”

- Adjust the settings if necessary. The default settings (12, 26, 9) are suitable for most traders.

- Apply the indicator to your chart to start analyzing.

Customizing the MACD settings can help tailor the indicator to fit your specific trading style and timeframe.

Customizing MACD Settings for Enhanced Performance

While the default settings are effective, tweaking the MACD parameters can optimize performance based on the trading strategy. For instance:

- Shorter EMAs (e.g., 5, 35, 5): Suitable for scalping or day trading, providing quicker signals.

- Longer EMAs (e.g., 19, 39, 9): Ideal for swing trading, reducing the number of false signals.

Experimenting with different settings during backtesting can help identify the optimal configuration for your trading approach.

Strategies for Using the MACD Indicator

1. MACD Crossovers

One of the most common MACD strategies involves observing the crossover between the MACD line and the Signal line.

- Bullish Crossover: Occurs when the MACD line crosses above the Signal line, suggesting a potential buy opportunity.

- Bearish Crossover: Happens when the MACD line crosses below the Signal line, indicating a possible sell signal.

Traders often wait for confirmation from other indicators or price action before executing trades based on crossovers.

Enhancing Crossover Strategies with Volume Analysis

Incorporating volume analysis can increase the reliability of MACD crossovers. A crossover accompanied by high trading volume often indicates a stronger and more sustainable signal, reducing the likelihood of false breakouts.

2. Divergence

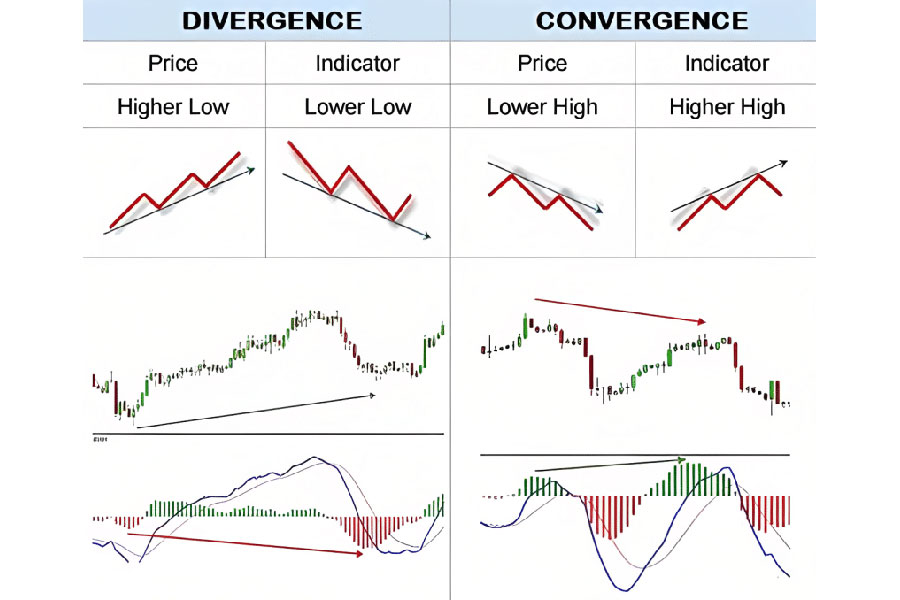

Divergence between the MACD and price action can signal potential reversals.

- Bullish Divergence: Price makes a lower low while the MACD makes a higher low, indicating potential upward reversal.

- Bearish Divergence: Price forms a higher high, but the MACD forms a lower high, suggesting a possible downward reversal.

Divergence is a powerful tool for anticipating trend changes, enhancing your ability to enter or exit trades at optimal times.

Types of Divergence

- Regular Divergence: Indicates potential trend reversals.

- Hidden Divergence: Suggests trend continuation, offering opportunities to enter trades in the direction of the prevailing trend.

Understanding the nuances of different divergence types can refine your trading strategies and improve entry and exit points.

3. Histogram Analysis

The MACD histogram represents the difference between the MACD line and the Signal line.

- Increasing Histogram: Suggests strengthening momentum in the current trend.

- Decreasing Histogram: Indicates weakening momentum, potentially signaling a reversal.

Monitoring the histogram can provide early warnings of shifts in market momentum, allowing for timely adjustments to your trading strategy.

Using Histogram Patterns for Trade Signals

Patterns such as “zero-line crossovers” and “histogram reversals” can serve as additional confirmation for trade signals, enhancing the precision of your trading decisions.

Advanced MACD Techniques

1. MACD with Support and Resistance

Combining MACD signals with support and resistance levels can enhance trade accuracy. For instance, a bullish crossover near a strong support level may provide a higher probability buy signal.

Integrating multiple technical analysis tools can create a more robust and reliable trading strategy.

Implementing Fibonacci Retracements with MACD

Using Fibonacci retracement levels in conjunction with MACD can pinpoint optimal entry and exit points. For example, a MACD bullish crossover occurring at a 38.2% Fibonacci retracement level may indicate a strong buy signal with minimal risk.

2. MACD and Price Patterns

Using MACD in conjunction with price patterns like head and shoulders or triangles can offer additional confirmation for trade signals.

This multi-faceted approach ensures that your trades are backed by both trend and pattern analysis, reducing the likelihood of false signals.

Identifying Breakouts with MACD Confirmation

When a price breakout from a consolidation pattern is confirmed by a MACD crossover, the trade signal gains higher reliability, increasing the probability of a successful trade.

3. MACD Timeframe Confluence

Analyzing MACD across multiple timeframes (e.g., daily and hourly charts) can provide a clearer picture of market trends and potential entry points.

Timeframe confluence helps in aligning short-term trades with long-term trends, optimizing trade timing and execution.

Aligning MACD Signals Across Timeframes

When MACD signals align across different timeframes, such as a bullish crossover on both the daily and hourly charts, the trade signal becomes more compelling, enhancing the likelihood of success.

Optimizing Your MACD Strategy

1. Backtesting

Before deploying your MACD strategy in live trading, conduct backtesting using historical data. This helps in assessing the strategy’s effectiveness and making necessary adjustments.

Backtesting ensures that your strategy is robust and capable of performing well under various market conditions.

Tools and Platforms for Effective Backtesting

Utilize platforms like MetaTrader 5, TradingView, or specialized backtesting software to simulate your MACD strategies against historical price data, refining your approach for optimal performance.

2. Risk Management

Implementing sound risk management practices is crucial. Determine your risk tolerance and set appropriate stop-loss and take-profit levels based on MACD signals.

Effective risk management safeguards your capital and ensures long-term trading sustainability.

Position Sizing and MACD Signals

Adjusting your position size based on the strength of MACD signals can enhance risk management. For example, taking larger positions on strong MACD crossovers and smaller positions on weaker signals balances potential returns with risk exposure.

3. Continuous Learning

Stay updated with the latest developments in forex trading and continuously refine your MACD strategies. Engaging with trading communities and educational resources can provide valuable insights.

Continuous learning fosters adaptability and keeps your trading strategies aligned with evolving market dynamics.

Leveraging Online Courses and Webinars

Participate in online courses, webinars, and workshops focused on advanced MACD techniques and forex trading strategies to deepen your understanding and stay ahead in the market.

Common Mistakes to Avoid with MACD

- Over-Reliance on Indicators: Relying solely on MACD without considering other factors can lead to incomplete analysis.

- Ignoring Divergence: Failing to recognize divergence signals can result in missed reversal opportunities.

- Improper Timeframe Selection: Using inappropriate timeframes for your trading style can reduce the effectiveness of MACD signals.

- Neglecting Risk Management: Ignoring risk management can expose you to significant losses, regardless of the accuracy of MACD signals.

- Misinterpreting MACD Signals: Misunderstanding the nuances of MACD signals, such as histogram analysis, can lead to incorrect trading decisions.

- Failure to Adapt: Not adjusting MACD settings based on changing market conditions can decrease its effectiveness.

Avoiding these common pitfalls enhances the reliability and profitability of your MACD-based trading strategies.

Illustrative Examples of Common Mistakes

- Over-Reliance on MACD Alone: A trader may see a bullish crossover and enter a long position without considering market trends or other indicators, resulting in losses during a prolonged downtrend.

- Ignoring Divergence: Missing a bearish divergence signal could lead to holding onto losing positions longer than necessary, exacerbating losses.

- Improper Timeframe Selection: A day trader using daily MACD signals might miss out on timely entries and exits, reducing trading efficiency.

By recognizing and addressing these mistakes, traders can refine their strategies and improve trading outcomes.

Opofinance Services

When it comes to executing your MACD strategies effectively, partnering with a reputable broker is paramount. Opofinance, an ASIC regulated forex broker, stands out as a premier choice for traders seeking reliability and excellence.

Opofinance offers a comprehensive range of services tailored to meet the needs of both novice and seasoned traders. Their social trading service allows you to connect with and learn from experienced traders, enhancing your trading knowledge and performance. Additionally, being officially featured on the MT5 brokers list, Opofinance ensures compatibility with one of the most advanced trading platforms available.

Safe and convenient deposit and withdrawal methods further streamline your trading experience, providing peace of mind and flexibility. By choosing Opofinance, you gain access to a secure trading environment, cutting-edge tools, and exceptional customer support, empowering you to maximize your trading potential.

Elevate your forex trading journey with Opofinance – where security, innovation, and trader-centric services converge to deliver unparalleled trading experiences.

Why Choose Opofinance for Your MACD Trading Strategies?

- Regulatory Compliance: As an ASIC regulated broker, Opofinance ensures that your funds are secure and that all trading activities adhere to strict regulatory standards.

- Advanced Trading Platforms: With access to the MT5 platform, traders can leverage advanced charting tools, automated trading capabilities, and real-time data to enhance their MACD-based strategies.

- Educational Resources: Opofinance provides extensive educational materials, including tutorials and webinars on using technical indicators like MACD, helping traders refine their skills.

- Competitive Spreads and Leverage: Offering tight spreads and flexible leverage options, Opofinance enables traders to optimize their trading strategies without excessive costs.

Choosing Opofinance as your broker not only provides the tools and resources necessary for effective MACD trading but also ensures a supportive and secure trading environment.

Conclusion

The MACD indicator in forex trading is a potent tool that, when used effectively, can significantly enhance your trading strategies and decision-making processes. By understanding its components, implementing strategic techniques, and avoiding common mistakes, you can harness the full potential of MACD to achieve consistent profitability.

Incorporating the MACD into your trading arsenal allows for a nuanced analysis of market trends and momentum, providing clear signals that can guide your trading decisions. Furthermore, partnering with a trusted regulated forex broker like Opofinance amplifies your trading success by offering a secure platform, advanced tools, and comprehensive support.

Embrace the power of MACD and elevate your trading game today! With dedication, continuous learning, and the right tools, you can navigate the complexities of the forex market with confidence and precision.

Can the MACD Indicator Be Used for Short-Term Trading?

Yes, the MACD indicator can be effectively utilized for short-term trading. By adjusting the settings to shorter timeframes, traders can capture quick market movements and capitalize on short-term trends. However, it’s essential to combine MACD signals with other indicators or price action analysis to enhance the accuracy of your trades.

How Does MACD Compare to Other Momentum Indicators?

The MACD is unique in its combination of trend-following and momentum characteristics, providing a more comprehensive analysis compared to standalone momentum indicators like RSI or Stochastic. While RSI measures the speed and change of price movements, MACD offers insights into both the direction and momentum, making it a more versatile tool for traders seeking multi-dimensional analysis.

What Are the Best Currency Pairs to Trade Using MACD?

The MACD indicator performs well across major currency pairs such as EUR/USD, GBP/USD, and USD/JPY due to their high liquidity and volatility. These pairs offer clear trend signals and reliable MACD crossovers, making them ideal for implementing MACD-based trading strategies. However, it’s advisable to test the indicator on various pairs to determine which suits your trading style best.