In the fast-paced world of trading, understanding the subtle signals of the market can be the difference between success and missed opportunities. Among the most powerful tools in a trader’s arsenal is the Marubozu candlestick—a seemingly simple pattern that holds the key to unlocking clear, decisive market movements. Whether you’re a seasoned trader or just starting out, the Marubozu offers unparalleled insight into when buyers or sellers are in full control, driving the price in a strong, unstoppable direction. For those looking to leverage such powerful patterns, working with a trusted broker for forex can significantly enhance your trading experience and provide the necessary tools to act on these market signals.

But what makes the Marubozu so crucial? And how can recognizing this pattern elevate your trading strategy?

Stay with us, and uncover the power behind the Marubozu. You won’t want to miss how this simple yet powerful candlestick can revolutionize the way you approach the markets.

Partnering with a regulated forex broker can significantly elevate your trading strategies. With access to invaluable resources, cutting-edge tools, and expert support, you’ll be well-equipped to make informed decisions and navigate the market with confidence.

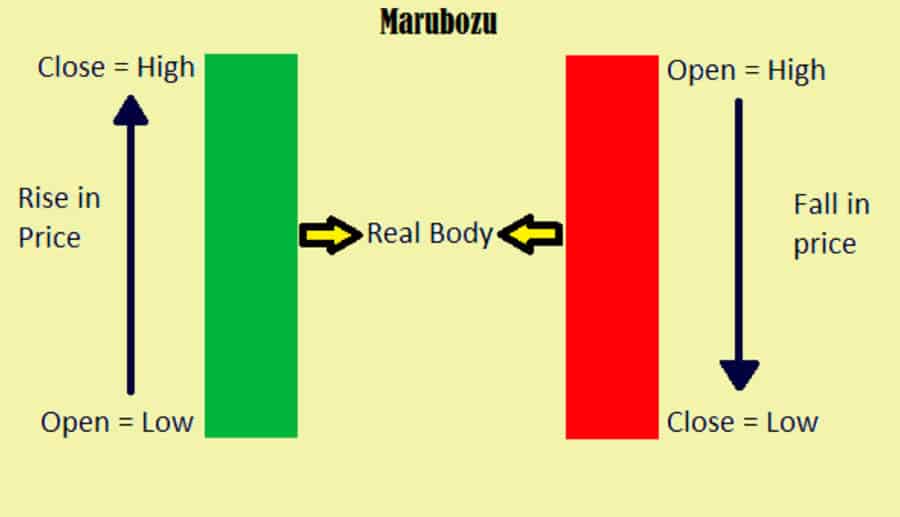

Understanding the Marubozu Candlestick Pattern

The Marubozu candlestick pattern consists of three powerful types:

1. Marubozu Open Candle

This candle features a solid body with no shadow on the opening price side and a small shadow on the closing price side. It signals strong momentum out of the gate, indicating that prices took a clear direction immediately after the market opened.

2. Marubozu Close Candle

This variation has no shadow on the closing price side and a small wick on the opening price side. It underscores a strong finish, showing that prices closed near their highs or lows, suggesting a trend with staying power and limited risk of a reversal.

3. Marubozu Full Candle

The defining trait of this candle is its complete body with no shadows on either end. It reflects decisive price action throughout the trading session, providing a clear-cut indication of sustained market sentiment in one direction.

By incorporating these patterns into your trading toolkit, you can better read the market’s pulse, refine your technical analysis, and improve the precision of your trading decisions, leading to more consistent results.

How to Spot the Marubozu Candlestick Pattern?

Here’s how you can spot a Marubozu and use it to your advantage:

1. Examine the Opening and Closing Prices

A Marubozu appears when the opening and closing prices are near the extremes of the trading session (highs or lows). This signals that the market moved in a single direction with conviction, without much hesitation or retracement. It is a clear indicator of which side—buyers or sellers—held the upper hand during that timeframe. However, this pattern proves to be more reliable during periods of high volatility, such as market openings, earnings announcements, or other events that cause significant price movements.

2.Assess the Length of the Candlestick

A longer candlestick body typically indicates stronger momentum. However, if the candlestick’s body is unusually short, or if there are small wicks on both sides, it might signal a false Marubozu. Always compare the candlestick to those around it; an isolated Marubozu without strong confirmation from previous or following candles may not be trustworthy. To avoid being misled, it is crucial to identify fake Marubozu patterns, which frequently occur during low-volume sessions or when wicks are present but disregarded.

3.Check for Confirmation from Volume or Other Indicators

A Marubozu pattern should be confirmed by high trading volume or align with broader market trends. If the candlestick appears during low volume or shows no alignment with previous price action, it could be a false signal.

4.Watch for Reversal or Continuation Context

Marubozu patterns often indicate strong directional momentum, but their significance can vary depending on the trend. For example, a bullish Marubozu after a downtrend may signal a reversal, while in an uptrend, it’s likely just a continuation signal. Always consider the broader market context before acting on a single pattern.

Read More: Doji Candlestick Pattern

Opening Marubozu Candle

The Opening Marubozu candlestick is a distinct pattern that signals significant market movement right out of the gate during a specific trading session. Mastering the nuances of this pattern is crucial for traders aiming to anticipate market trends within a given timeframe.

A bullish Opening Marubozu forms when the opening price marks the session’s lowest point, indicating strong upward momentum and a clear push by buyers throughout the trading period. Conversely, a bearish Opening Marubozu emerges when the opening price represents the session’s highest point, signaling substantial selling pressure and downward momentum.

This pattern provides key insights into market sentiment and direction at the outset of a trading session, whether it spans a day, week, or any other defined period.

The Opening Marubozu occurs when prices make a sharp, one-way move immediately after the market opens, reflecting strong sentiment and momentum. However, while this pattern often acts as an early indicator of market direction, it is not without its pitfalls.

Read More: Unlocking the Strongest Candlestick Patterns

One of the main challenges associated with this pattern is the risk of false signals, often created by market makers or large institutional players. These entities may engineer a head fake by initiating a strong early move to lure inexperienced traders into premature entries or exits. This creates the illusion of robust momentum, only to reverse sharply later in the session. Such whipsaw movements can catch traders off guard, leading to unanticipated losses.

As a result, while the Opening Marubozu is a valuable tool for gauging initial market sentiment, traders should handle it with caution. It is imperative to confirm the pattern using additional indicators, such as volume analysis or support and resistance levels, and to consider the broader market context. Doing so can help traders steer clear of market traps and minimize the risk of falling victim to manipulative price actions or false breakouts.

Closing Marubozu Candle

The Closing Marubozu candlestick pattern is a strong trading signal, defined by a closing price that coincides with the highest point of the session in an uptrend or the lowest point in a downtrend. This formation conveys a strong and unwavering market sentiment that lasts until the trading session concludes.

What makes this pattern particularly significant is the complete absence of a wick at the closing end, showcasing the overwhelming control of either buyers (in the case of a bullish Closing Marubozu) or sellers (in a bearish situation) throughout the entire session, with little to no resistance.

For traders looking for reliable signals, the Closing Marubozu is invaluable. Following an extended trend, its appearance often suggests a continuation of the current trend or may indicate an impending reversal, all depending on the broader market landscape and accompanying indicators. To leverage this pattern effectively, thorough analysis is crucial, as its meanings can shift based on market structure and volume dynamics. Embracing this knowledge can enhance your trading strategies and decision-making.

Read More: Engulfing Candlestick Pattern

How to Trade the Marubozu Candlestick Pattern?

The Marubozu candlestick is a powerful signal of market momentum, whether bullish or bearish. To trade it successfully, you need to understand how to spot the pattern, confirm the trend, and manage risk effectively. Here’s how to leverage both bullish and bearish Marubozu patterns in your trading strategy.

Bullish Marubozu

- Spot the Pattern:

Look for a strong green Marubozu after a downtrend, signaling a potential reversal. Alternatively, during an uptrend, the pattern marks a breakout above resistance, indicating a strong continuation of the trend.

- Entry Strategy:

Enter the trade by placing a buy order immediately after the next candle opens. This allows you to ride the momentum from the bullish move set by the Marubozu. Alternatively, wait for the price to break above the Marubozu’s high, confirming that the bullish trend is continuing.

- Stop Loss:

Set a stop-loss just below the low of the Marubozu candle to protect your position from a market reversal. This provides a safety buffer while minimizing potential losses if the market turns against you. - Take-Profit Target:

Target the next major resistance level for your profit-taking. However, always stay alert for signs of a trend reversal and be ready to exit early if necessary.

- Trade Management:

Hold your position as long as the candles continue closing near their highs, with little or no upper wick. This confirms that the bulls are in control, and the trend is likely to continue.

By following these steps, you can effectively capitalize on the bullish Marubozu pattern, stay aligned with the market momentum, and manage risk to lock in the best possible returns.

Bearish Marubozu

- Spot the Pattern:

A strong red Marubozu indicates that sellers are in control, signaling a strong downward move. This often occurs after an uptrend, suggesting a potential trend reversal or a continuation of the downtrend.

- Confirm the Trend:

Look for a second bearish Marubozu or confirmation from an indicator like the MACD crossing below the zero line to confirm the downward momentum.

- Entering the Trade:

Open a small short position (e.g., 0.01 lots) based on the analysis. Set a stop-loss above the high of the Marubozu candle (e.g., 115.320) to manage risk. - Managing Risk:

As with bullish trades, ensure you use proper position sizing and limit your risk to 1-2% of your capital. Place a take-profit order at the next support level or key price targets.

By applying these strategies, you can take full advantage of the bearish Marubozu pattern while managing your risk appropriately.

Opofinance Services

Opofinance is an advanced trading platform designed to provide traders with powerful tools to analyze markets and execute trades efficiently. Fully regulated by ASIC (Australian Securities and Investments Commission), Opofinance offers a secure and transparent environment for all users, ensuring compliance with high industry standards.

Key Features and Services of Opofinance:

ASIC Regulation:

Opofinance is fully regulated by ASIC, providing traders with a safe and transparent environment to execute trades. This regulation ensures that users can trade with confidence, knowing that the platform adheres to strict financial guidelines.

Social Trading:

With Social Trading, traders can follow and copy strategies of successful professional traders. This feature is particularly useful for beginners or those looking to leverage the expertise of seasoned traders to improve their trading performance.

Competitive Spreads and Low Commissions:

Opofinance offers highly competitive spreads and low commission fees, allowing traders to execute trades with minimal costs and maximizing profitability.

Diverse Deposit and Withdrawal Methods:

The platform supports a wide range of deposit and withdrawal options, including bank transfers, credit/debit cards, and online payment methods, making it easier and faster for traders to manage their funds.

24/7 Customer Support:

Opofinance provides 24/7 customer support to assist traders with any questions or issues, ensuring a seamless and hassle-free trading experience.

By choosing Opofinance, traders can access advanced trading tools, leverage social trading, and benefit from competitive costs and a regulated environment, all while ensuring they are supported at every step of their trading journey.

“Unlock Your Trading Potential Today!”

Click on this website down below and start trading smarter. Access real-time data, expert analysis, and cutting-edge tools to boost your trading success. Don’t wait—sign up now and get a head start on your financial journey!

Conclusion:

The Marubozu candlestick pattern is a powerful tool for traders, providing clear signals about market sentiment and momentum direction. Whether bullish or bearish, the pattern reveals strong buying or selling pressure, allowing traders to make more informed decisions. By learning to identify the Marubozu and understanding its various forms—such as the Opening, Closing, and Full Marubozu—traders can better navigate both upward and downward trends. To maximize its effectiveness, it’s crucial to incorporate additional technical indicators and apply sound risk management practices. With the support of advanced tools and resources, such as those offered by Opofinance, traders can sharpen their skills and confidently execute strategies, ultimately enhancing their profitability and market insight.

How trustworthy is the Marubozu pattern?

The Marubozu pattern’s reliability depends on a few things, like which way the market is trending and how much trading is happening (volume).

Can Marubozu candles be part of other patterns?

Yes, they can. Marubozu candles often show up in bigger patterns, like ones that signal a reversal (engulfing) or a breakout.

What tools work well with Marubozu candles?

You can use tools like moving averages, RSI (Relative Strength Index), and volume indicators to better understand and confirm what the Marubozu pattern is showing.