Intraday scalping is a high-intensity forex trading strategy that involves making multiple trades within a single day to capitalize on small price movements. This technique can yield significant profits for skilled traders who partner with a reliable online forex broker. As a regulated forex broker, we understand the importance of equipping traders with effective strategies to navigate the fast-paced world of forex scalping. In this comprehensive guide, we’ll delve into seven proven intraday scalping strategies that can help you achieve forex trading success.

Intraday scalping strategies are essential tools for forex traders looking to profit from short-term market fluctuations. These strategies involve opening and closing multiple positions within a single trading day, often within minutes or hours. By mastering these techniques, traders can potentially accumulate small gains that add up to substantial profits over time. However, successful scalping requires not only skill and discipline but also the support of a reputable forex trading broker who can provide the necessary tools and execution speed.

Whether you’re a novice trader or an experienced professional looking to refine your skills, these strategies will provide valuable insights to enhance your trading performance. From the one-minute scalping strategy to the price action approach, we’ll explore a range of techniques suitable for different market conditions and trader preferences. Additionally, we’ll discuss essential tips for successful scalping, common pitfalls to avoid, and the importance of choosing the right forex broker for your trading needs.

By the end of this article, you’ll have a solid understanding of intraday scalping strategies and how to implement them effectively in your forex trading journey. Remember, while scalping can be highly profitable, it also carries significant risks. Therefore, it’s crucial to practice proper risk management and continually educate yourself on market dynamics. Let’s dive into the world of intraday scalping and discover how you can leverage these strategies to potentially boost your forex trading success.

What is Intraday Scalping?

Intraday scalping is a trading technique where traders aim to profit from small price movements within a single trading day. Unlike longer-term trading strategies, scalpers focus on making numerous trades, each lasting only a few minutes to a few hours. The goal is to accumulate small profits that add up to substantial gains over time.

Key Characteristics of Intraday Scalping:

- Short time frames: Trades typically last from a few seconds to a few hours.

- High frequency: Scalpers may execute dozens or even hundreds of trades per day.

- Small profit targets: Each trade aims for small gains, often just a few pips.

- Strict risk management: Tight stop-losses are crucial to limit potential losses.

- Quick decision-making: Scalpers must react swiftly to market changes.

7 Proven Intraday Scalping Strategies

1. The One-Minute Scalping Strategy

The one-minute scalping strategy is ideal for traders who thrive on rapid-fire decision-making and constant market engagement. It allows for numerous trades within a single session, often leading to quick accumulation of profits.

Key components:

- Use one-minute charts for detailed analysis: This timeframe provides a granular view of price movements, allowing traders to spot opportunities quickly.

- Focus on highly liquid currency pairs: Pairs like EUR/USD or GBP/USD have high trading volumes, ensuring tight spreads and quick executions, which are vital for scalping.

- Employ technical indicators like EMA and RSI: These tools help identify trends and potential reversal points, guiding entry and exit decisions.

How it works:

- Identify trend direction using 50-period and 100-period EMAs: These moving averages help determine the prevailing market trend. A bullish trend is indicated when the 50-period EMA is above the 100-period EMA, while a bearish trend is the opposite.

- Look for overbought or oversold conditions using RSI: An RSI above 70 suggests overbought conditions, while an RSI below 30 indicates oversold conditions. These signals can guide traders on when to enter or exit trades.

- Enter trades when price action aligns with trend and RSI signals confirm entry points: For example, if the price is above both EMAs and the RSI is approaching 30, it might indicate a buying opportunity.

This strategy requires intense focus and quick reflexes, making it ideal for traders who can handle high-pressure situations and are adept at rapid analysis.

Read More: nasdaq scalping strategy

2. The Momentum Scalping Strategy

Momentum scalping capitalizes on strong price movements, riding the wave of market sentiment for quick profits. This strategy is particularly effective in fast-moving markets where traders can exploit rapid price changes.

Key components:

- Use 5-minute or 15-minute charts: These timeframes capture short-term price movements effectively, making them suitable for identifying momentum.

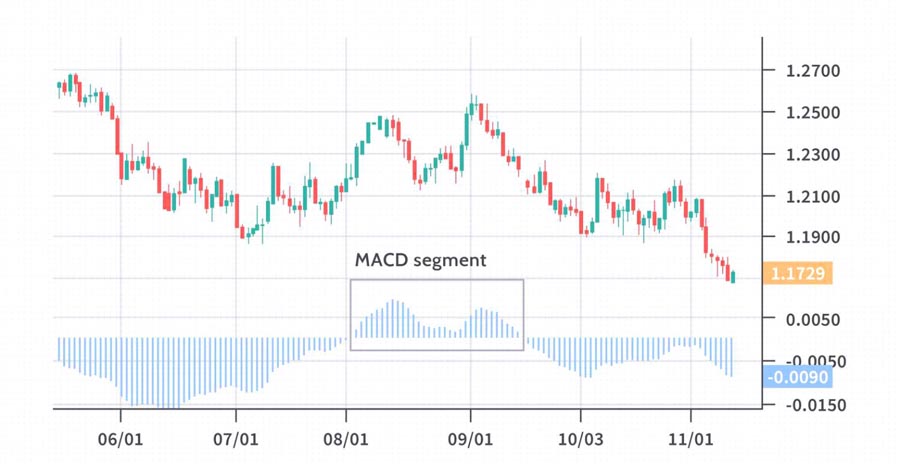

- Employ momentum indicators like MACD: The MACD helps confirm the strength of a trend and can signal potential entry points when crossovers occur.

- Focus on breakouts and strong trends: Identifying breakouts from established support or resistance levels can lead to significant price movements.

How it works:

- Identify potential breakouts using price action and support/resistance levels: Look for areas where the price has previously struggled to move past, as these can indicate strong buying or selling pressure.

- Confirm momentum with MACD crossovers: A bullish crossover (when the MACD line crosses above the signal line) can indicate a strong buy signal, while a bearish crossover suggests selling.

- Enter trades in the direction of the breakout, setting tight stop-losses: This protects against sudden reversals while allowing for quick profit-taking.

This strategy works best in volatile market conditions and requires careful attention to avoid false breakouts that can lead to losses.

3. The Range Trading Scalping Strategy

Range trading is ideal for markets that are moving sideways, allowing scalpers to profit from predictable price oscillations within established boundaries. This strategy is particularly effective in consolidating markets.

Key components:

- Use 15-minute or 30-minute charts: These timeframes help identify ranges effectively and provide a balanced view of price movements.

- Identify clear support and resistance levels: Recognizing these levels is crucial for determining entry and exit points.

- Employ oscillators like Stochastic or RSI: These indicators help confirm overbought and oversold conditions, providing additional entry signals.

How it works:

- Define the trading range by identifying strong support and resistance levels: Establishing these levels allows traders to know where to enter and exit trades.

- Buy near support when oscillators indicate oversold conditions: This strategy capitalizes on potential price rebounds from support levels.

- Sell near resistance when oscillators indicate overbought conditions: This approach anticipates price reversals at resistance levels.

This strategy requires patience and discipline, as traders must wait for price to reach optimal entry points, capitalizing on the predictable nature of range-bound markets.

Read More: RSI Scalping Strategy

4. The News Scalping Strategy

News scalping takes advantage of market volatility surrounding major economic announcements and news events. This strategy can yield swift profits if executed correctly.

Key components:

- Stay informed about upcoming economic releases and news events: Knowing when significant news is scheduled helps traders prepare for potential market movements.

- Use 1-minute or 5-minute charts: These timeframes allow traders to react quickly to price movements following news releases.

- Be prepared for rapid price movements and increased spreads: News events can cause sudden volatility, so traders should be ready for quick decisions.

How it works:

- Identify high-impact news events using an economic calendar: Focus on events that historically cause significant price movements, such as employment reports or central bank announcements.

- Wait for the news release and observe initial market reaction: This step helps gauge market sentiment and direction before committing to a trade.

- Enter trades in the direction of the breakout, using tight stop-losses: Quick entries can capitalize on the initial market reaction, while stop-losses protect against reversals.

This strategy can be highly profitable but also carries significant risk due to extreme volatility during news releases, requiring traders to be agile and decisive.

5. The Fibonacci Retracement Scalping Strategy

Fibonacci retracement levels can provide excellent entry and exit points for scalpers looking to capitalize on price corrections. This strategy combines technical analysis with market psychology.

Key components:

- Use 15-minute or 30-minute charts: These timeframes help identify key retracement levels effectively.

- Draw Fibonacci retracement levels on recent price swings: This technique helps traders identify potential reversal points based on historical price behavior.

- Combine with trend analysis and support/resistance levels for confirmation: This adds an extra layer of validation to trading decisions.

How it works:

- Identify the overall trend using higher timeframes: This ensures that trades are aligned with the broader market direction, increasing the probability of success.

- Draw Fibonacci retracement levels on the most recent price swing: Key levels like 23.6%, 38.2%, and 61.8% often act as reversal points.

- Look for entry opportunities at these key Fibonacci levels, confirming with other technical indicators: This multi-faceted approach enhances the likelihood of successful trades.

This strategy requires a solid understanding of Fibonacci principles and works best in trending markets, providing clear entry and exit signals.

6. The Moving Average Crossover Scalping Strategy

Moving average crossovers can provide clear entry and exit signals for scalpers looking for trend confirmation. This strategy simplifies decision-making by relying on moving averages.

Key components:

- Use 5-minute or 15-minute charts: These timeframes facilitate quick analysis and execution.

- Employ multiple moving averages (e.g., 5-period, 10-period, and 20-period): This technique helps identify trends and potential reversals.

- Focus on quick entries and exits: Scalpers aim to capitalize on small price movements, making speed essential.

Read More: ichimoku scalping strategy

How it works:

- Wait for the shorter-term MA to cross above or below the longer-term MA: This crossover signals a potential change in trend direction.

- Enter trades in the direction of the crossover: Aligning trades with the crossover direction increases the likelihood of success.

- Exit when the MAs cross back or when profit targets are reached: This ensures timely exits to secure gains and limit exposure.

This strategy works well in trending markets but can generate false signals in choppy conditions, requiring traders to remain vigilant.

7. The Price Action Scalping Strategy

Price action scalping relies on reading candlestick patterns and market structure without the use of indicators. This strategy emphasizes the importance of market sentiment and trader psychology.

Key components:

- Use 1-minute or 5-minute charts: These timeframes capture immediate market movements and allow for quick decision-making.

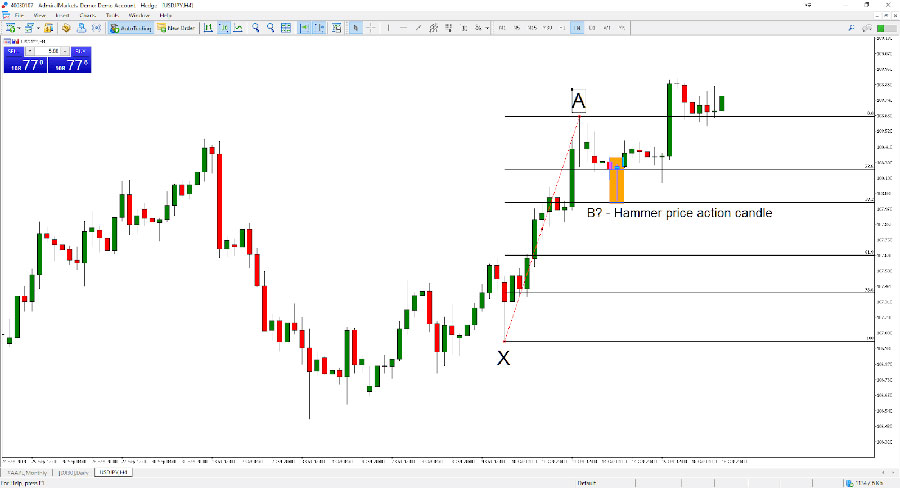

- Focus on candlestick patterns and chart formations: Recognizing patterns like pin bars and engulfing patterns can indicate potential reversals or continuations.

- Combine with support/resistance levels and trend analysis: This comprehensive approach enhances the accuracy of trading decisions.

How it works:

- Identify key support and resistance levels: These levels serve as critical price points for potential trades.

- Look for strong candlestick patterns that indicate potential price reversals or continuations: Patterns can provide insights into market sentiment and help traders anticipate future price movements.

- Enter trades based on pattern confirmation and overall market context: Aligning trades with broader market trends increases the likelihood of successful outcomes.

This strategy requires a deep understanding of price action principles and the ability to read charts quickly and accurately, making it suitable for experienced traders.

Essential Tips for Successful Intraday Scalping

- Practice proper risk management: Never risk more than 1-2% of your account on a single trade.

- Use a reliable trading platform: Choose a broker with low spreads and fast execution.

- Develop a consistent routine: Stick to your trading plan and avoid emotional decision-making.

- Stay informed: Keep up with market news and economic events that could impact your trades.

- Continuously educate yourself: The forex market is always evolving, so never stop learning.

- Maintain a trading journal: Track your trades and analyze your performance regularly.

- Master one strategy before moving to another: Focus on perfecting a single strategy before diversifying.

Common Pitfalls to Avoid in Intraday Scalping

- Overtrading: Don’t feel pressured to be in the market constantly.

- Chasing losses: Stick to your risk management rules, even after a losing streak.

- Ignoring the bigger picture: Always consider higher timeframes for context.

- Neglecting fundamental analysis: While scalping is primarily technical, major news events can still impact your trades.

- Using excessive leverage: High leverage can lead to quick account blowouts.

- Failing to adapt: Be prepared to adjust your strategy as market conditions change.

OpoFinance Services: Your Trusted Partner in Forex Scalping

When it comes to intraday scalping, having a reliable and regulated forex broker is crucial for success. OpoFinance, an ASIC-regulated broker, offers a comprehensive suite of services tailored to meet the needs of scalpers and day traders alike. With low spreads, fast execution, and advanced trading platforms, OpoFinance provides the tools and support necessary for effective scalping strategies.

One standout feature of OpoFinance is its innovative social trading service. This platform allows traders to connect with and learn from experienced professionals, sharing strategies and insights in real-time. For scalpers looking to refine their skills or diversify their approach, social trading can be an invaluable resource, providing a collaborative environment for growth and success in the fast-paced world of forex trading.

Conclusion

Intraday scalping can be a highly profitable trading strategy when executed with skill, discipline, and proper risk management. By mastering the seven proven strategies outlined in this guide and avoiding common pitfalls, you can enhance your forex trading success and achieve your financial goals. Remember that successful scalping requires continuous learning, adaptation, and practice. Stay informed, remain disciplined, and always prioritize risk management in your trading journey.

As you embark on your intraday scalping adventure, consider partnering with a regulated forex broker like OpoFinance to ensure you have the tools, support, and peace of mind necessary for success in the dynamic world of forex trading.

How much capital do I need to start intraday scalping in forex?

The amount of capital required for intraday scalping varies depending on your broker’s minimum deposit requirements and your personal risk tolerance. While it’s possible to start with as little as $100-$500, a more realistic starting capital would be $1,000-$5,000. This allows for better risk management and the ability to withstand potential losses without depleting your account. Remember, it’s crucial to only trade with money you can afford to lose.

Is intraday scalping suitable for part-time traders?

Intraday scalping can be challenging for part-time traders due to its time-intensive nature and the need for constant market monitoring. However, it’s not impossible. Part-time traders can focus on specific trading sessions that align with their schedules or use slightly longer timeframes (e.g., 15-minute charts instead of 1-minute charts). Alternatively, they might consider automated trading systems or copy trading services offered by some brokers. Ultimately, success as a part-time scalper depends on your dedication, skill level, and ability to manage time effectively.

How do I handle slippage when scalping in volatile market conditions?

Slippage can be a significant issue for scalpers, especially during volatile market conditions. To minimize its impact:

Use limit orders instead of market orders when possible.

Trade during periods of high liquidity to reduce the likelihood of slippage.

Avoid trading during major news releases when slippage is more common.

Choose a broker with low latency and fast execution speeds.

Implement a buffer in your profit targets to account for potential slippage.

Consider using guaranteed stop-loss orders, if available, to ensure your position is closed at the specified price.

Remember, while you can’t eliminate slippage entirely, these strategies can help mitigate its effects on your scalping performance.