Are you ready to elevate your forex trading game? Discover how to trade NFP news in forex with the help of a forex broker and unlock the potential for substantial profits. This comprehensive guide will equip you with the knowledge and strategies you need to navigate the volatile waters of Non-Farm Payroll (NFP) releases like a pro.

Trading NFP news in forex can be both exhilarating and challenging. The Non-Farm Payroll report, released monthly by the U.S. Bureau of Labor Statistics, is one of the most significant economic indicators for forex traders. It has the power to create massive market movements, offering lucrative opportunities for those who know how to capitalize on them.

To trade NFP news in forex successfully, you need a combination of market knowledge, technical analysis skills, and a robust trading strategy. This article will provide you with actionable insights on how to trade NFP in forex, helping you make informed decisions and potentially boost your trading profits.

Understanding NFP and Its Impact on Forex Markets

Before diving into trading strategies, it’s crucial to understand what NFP is and why it’s so important. The Non-Farm Payroll report provides data on the number of jobs added or lost in the U.S. economy, excluding farm workers and a few other job categories. This information is a key indicator of economic health and can significantly influence currency values, especially the U.S. dollar.

When NFP numbers deviate from expectations, forex markets can experience sudden and dramatic price movements. These volatile conditions create opportunities for savvy traders but also increase risk for the unprepared.

Read More: how to trade ppi news in forex

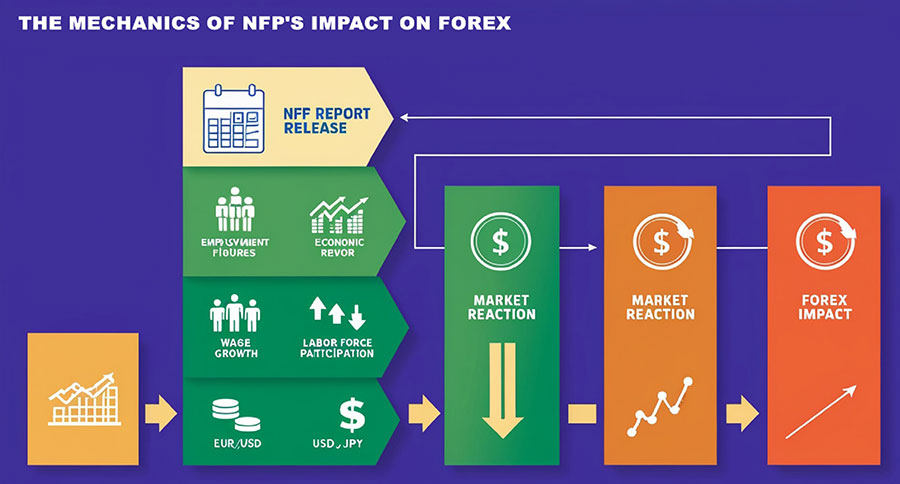

The Mechanics of NFP’s Impact on Forex

- Economic Indicator: NFP is a leading indicator of economic health. Strong job growth typically signals a robust economy, which can lead to currency appreciation.

- Interest Rate Expectations: Employment data influences the Federal Reserve’s monetary policy decisions. Higher employment may lead to interest rate hikes, potentially strengthening the USD.

- Market Sentiment: NFP releases can shift overall market sentiment, affecting risk appetite and safe-haven flows.

- Volatility Spike: The immediate aftermath of an NFP release often sees increased market volatility, creating both opportunities and risks for traders.

Preparing for NFP Trading

1. Stay Informed

Keep track of economic calendars and forecasts. Knowing when the NFP report will be released and what analysts are expecting can give you a crucial edge. Reliable sources for economic calendars include:

- ForexFactory

- Investing.com

- FXStreet

2. Analyze Historical Data

Study past NFP releases and their impact on currency pairs. This can help you identify patterns and potential trade setups. Pay attention to:

- The magnitude of price movements

- The duration of market reactions

- Any recurring patterns in different currency pairs

3. Choose Your Currency Pairs

While NFP primarily affects USD pairs, its influence can ripple through the entire forex market. Focus on major pairs like EUR/USD, USD/JPY, and GBP/USD for maximum liquidity. Consider these factors when selecting pairs:

- Liquidity

- Typical volatility during NFP releases

- Your familiarity with the pair’s behavior

4. Set Up Your Charts

Prepare your technical analysis tools. Many traders use a combination of support and resistance levels, moving averages, and momentum indicators to guide their decisions. Essential chart setups include:

- Multiple timeframe analysis (e.g., 1-hour, 15-minute, and 5-minute charts)

- Key support and resistance levels clearly marked

- Relevant technical indicators (e.g., RSI, MACD, Bollinger Bands)

Read More: how to trade FOMC news in forex

Strategies for Trading NFP News in Forex

1. Breakout Trading

This strategy involves placing orders above and below key support and resistance levels before the NFP release. When the news breaks, you can potentially profit from the ensuing price movement.

How to implement:

- Identify key support and resistance levels

- Place pending orders (buy stop and sell stop) above and below these levels

- Set appropriate stop losses and take profit levels

- Be prepared to manage your trade actively as the market reacts to the news

2. Fade the Initial Move

Sometimes, the market’s initial reaction to NFP data is exaggerated. Experienced traders may look to trade against this initial move, betting on a reversal.

Considerations:

- Wait for signs of exhaustion in the initial move

- Look for reversal candlestick patterns or divergences in momentum indicators

- Use tight stop losses, as the market can be unpredictable

- Be prepared to exit quickly if the trade doesn’t work out

3. Wait and See

For risk-averse traders, waiting until the initial volatility subsides before entering a trade can be a prudent approach. Look for clear trend formations or reversal patterns before committing.

Benefits:

- Reduced risk of getting caught in false breakouts

- Clearer market direction after initial volatility settles

- Opportunity to analyze the market’s reaction to the news

4. News Straddle

This strategy involves placing pending orders on both sides of the market before the news release. It aims to capture profits regardless of which direction the market moves.

Implementation steps:

- Place a buy stop order above the current price

- Place a sell stop order below the current price

- Set appropriate stop losses for both orders

- Be prepared to manage multiple positions if both orders are triggered

5. Scaling In

Instead of entering a full position at once, consider scaling into your trades. This can help manage risk in the face of NFP-induced volatility.

How it works:

- Enter with a smaller position size initially

- Add to your position as the market moves in your favor

- Adjust stop losses as you scale in to protect profits

Advanced NFP Trading Techniques

1. Correlation Trading

NFP data doesn’t just affect USD pairs. By understanding currency correlations, you can find additional trading opportunities.

Example: If USD strengthens against EUR, it might also strengthen against CHF due to the high correlation between EUR/USD and USD/CHF.

2. Option Strategies

For more sophisticated traders, using forex options can provide ways to profit from NFP volatility while limiting risk.

Strategies to consider:

- Straddles

- Strangles

- Butterfly spreads

3. Algorithmic Trading

Develop or use automated trading systems that can execute trades based on pre-defined criteria during NFP releases.

Benefits:

- Removes emotional decision-making

- Can react faster than manual trading

- Allows for backtesting and optimization

Read More: how to trade cpi news in forex

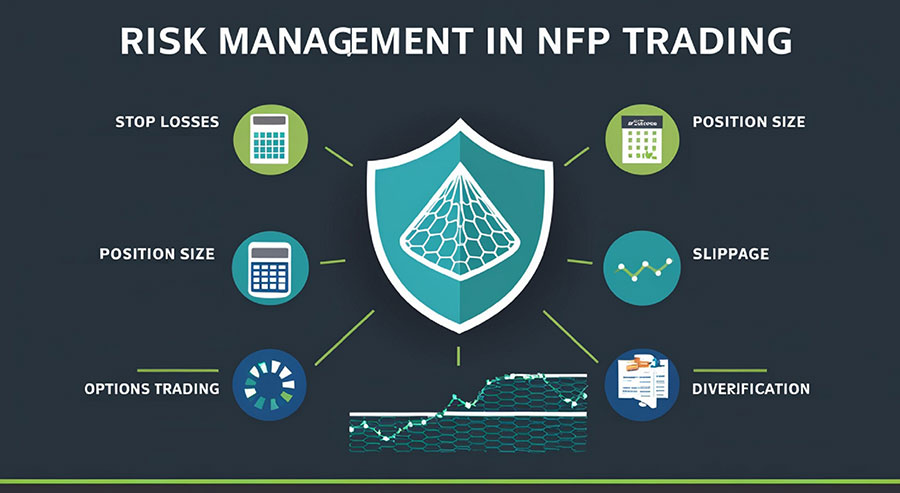

Risk Management: The Key to Successful NFP Trading

Trading NFP news in forex can be highly profitable, but it’s not without risks. Implementing robust risk management strategies is crucial:

1. Use Stop Losses

Always set stop-loss orders to protect your capital from unexpected market moves. Consider using guaranteed stop losses if your broker offers them, as they protect against slippage.

2. Control Your Position Size

Don’t risk more than you can afford to lose. Many experienced traders limit their risk to 1-2% of their account balance per trade. Use a position size calculator to determine the appropriate lot size based on your risk tolerance.

3. Be Mindful of Slippage

During NFP releases, slippage can be significant. Account for this when placing your orders by:

- Using limit orders instead of market orders when possible

- Being prepared for wider spreads

- Considering the use of guaranteed stop losses

4. Consider Using Options

Forex options can provide a way to limit your downside risk while maintaining upside potential. Learn about different option strategies that can be applied to NFP trading.

5. Diversify Your Approach

Don’t rely on a single strategy or currency pair. Diversifying your NFP trading approach can help spread risk and increase your chances of success.

Psychological Aspects of NFP Trading

Trading during high-impact news events like the Non-Farm Payroll (NFP) report poses psychological challenges. Here are essential tips to maintain a healthy mindset:

- Manage Expectations

- Recognize Variability: Not every NFP trade will be profitable. Set realistic profit targets and accept losses as part of the trading process.

- Accept Losses: Understand that losses are inevitable. Accepting this helps to reduce frustration and focus on long-term success.

- Stay Disciplined

- Follow Your Trading Plan: Stick to your predefined strategy and avoid making impulsive decisions based on emotions.

- Avoid Emotional Decisions: Emotional reactions can lead to inconsistent trading. Rely on your plan to guide your trades.

- Practice Patience

- Selective Trading: Don’t feel pressured to trade every NFP release. Wait for setups that match your strategy to improve your chances of success.

- Assess Market Conditions: Ensure your trades align with broader market trends or technical signals.

- Maintain Emotional Control

- Manage Excitement and Anxiety: The excitement of NFP can lead to overtrading. Stay calm and objective to prevent impulsive actions.

- Develop Coping Strategies: Use techniques like mindfulness or breaks to manage stress and maintain focus.

- Continuous Learning

- Review Your Trades: Analyze both successful and unsuccessful trades to understand what worked and what didn’t.

- Refine Your Approach: Use insights from your reviews to improve your strategy and trading skills.

By following these tips, you can better handle the psychological pressures of NFP trading and enhance your overall performance.

Tools and Resources for NFP Trading

To enhance your NFP trading experience, consider utilizing these tools and resources:

- Economic Calendars: Stay updated on NFP release dates and other important economic events.

- News Feeds: Access real-time news updates to stay informed about market-moving events.

- Trading Journals: Keep detailed records of your NFP trades to analyze and improve your performance.

- Risk Management Calculators: Use these tools to determine appropriate position sizes and risk levels.

- Backtesting Software: Test your NFP strategies on historical data to gauge their effectiveness.

- Trading Communities: Join forex forums or social trading platforms to share insights and learn from other traders’ experiences with NFP trading.

Common Pitfalls to Avoid in NFP Trading

While NFP trading can be highly rewarding, it’s important to be aware of common mistakes that traders often make:

- Overtrading: Don’t feel compelled to trade every NFP release. Quality setups are more important than quantity.

- Neglecting Risk Management: Always prioritize protecting your capital over chasing profits.

- Ignoring the Bigger Picture: While NFP is important, don’t forget to consider other fundamental and technical factors.

- Emotional Trading: Let your strategy guide your decisions, not your emotions.

- Lack of Preparation: Always do your homework before the NFP release. Understand market expectations and potential scenarios.

Conclusion

Learning how to trade NFP news in forex can significantly enhance your trading performance. By understanding the importance of the Non-Farm Payroll report, preparing thoroughly, implementing effective strategies, and managing your risks, you can potentially capitalize on one of the forex market’s most influential events.

Remember, successful NFP trading requires patience, discipline, and continuous learning. Start by paper trading or using small position sizes to gain experience without risking significant capital. As you become more comfortable with NFP-induced market movements, you can gradually increase your exposure.

Embrace the challenge, stay informed, and always prioritize risk management. With practice and persistence, you can turn NFP releases into profitable trading opportunities and take your forex trading to the next level.

By mastering the art of trading NFP news in forex, you’ll be well-equipped to navigate one of the most exciting and potentially rewarding aspects of the forex market. Stay committed to your education, remain adaptable, and never stop refining your approach. With time and experience, you can develop the skills and confidence needed to thrive in the dynamic world of NFP forex trading.

Remember, the forex market is constantly evolving, and so should your trading strategies. Keep learning, stay updated with market trends, and always be open to new ideas and techniques. Your journey in mastering NFP trading is an ongoing process, but with dedication and the right approach, you can achieve consistent success in the forex market.

Is it necessary to trade every NFP release?

No, it’s not necessary to trade every NFP release. Sometimes, market conditions or personal circumstances may not be favorable. It’s better to wait for high-probability setups than to force trades.

Can I use the same NFP trading strategy every month?

While having a consistent approach is important, it’s also crucial to adapt to changing market conditions. What works in one NFP release may not be as effective in another. Always be prepared to adjust your strategy based on current market dynamics.

How long do NFP-induced market movements typically last?

The immediate impact of NFP news can last anywhere from a few minutes to several hours. However, if the data significantly deviates from expectations, it can influence market trends for days or even weeks.