Choosing a trading platform is the first critical decision a trader makes. In the ultimate metatrader 5 vs tradingview showdown, the best choice boils down to your primary goal. TradingView is the undisputed champion of charting and analysis, while MetaTrader 5 is an execution powerhouse favored by many a forex broker. This article provides an unbiased, in-depth comparison to help you decide which platform, or combination of platforms, is the perfect fit for your trading strategy in 2025.

Key Takeaways:

- Primary Function: TradingView is primarily for market analysis, social trading, and charting. MetaTrader 5 is built for robust trade execution, automated trading, and deep market access through brokers.

- User Interface: TradingView offers a modern, intuitive, web-based interface that is extremely beginner-friendly. MT5 has a more traditional, dense interface with a steeper learning curve but powerful customization.

- Automated Trading: MT5 is the industry standard for automated trading with its Expert Advisors (EAs) and MQL5 language. TradingView’s Pine Script is simpler for creating alerts but requires third-party tools for full automation.

- Broker Integration: MT5 boasts near-universal support from forex and CFD brokers worldwide. TradingView has a smaller but growing list of directly integrated brokers.

- The Hybrid Strategy: Many professional traders use both platforms. They perform their analysis on TradingView’s superior charts and then place their trades on MT5 for its reliable execution.

MT5 vs TradingView: A Quick Comparison Table

| Feature | MetaTrader 5 | TradingView |

|---|---|---|

| Primary Use | Trade Execution & Automated Trading | Charting, Analysis & Social Trading |

| User Interface | Powerful, classic, steeper learning curve | Modern, intuitive, beginner-friendly |

| Charting Tools | Functional, 38 built-in indicators | Superior, 100+ built-in & 100k+ community indicators |

| Automated Trading | Gold standard (Expert Advisors via MQL5) | Simpler scripting (Pine Script), complex execution |

| Broker Integration | Vast, industry-wide support | Growing, but more limited direct connections |

| Cost | Free (provided by the broker) | Freemium (Free with ads, paid tiers available) |

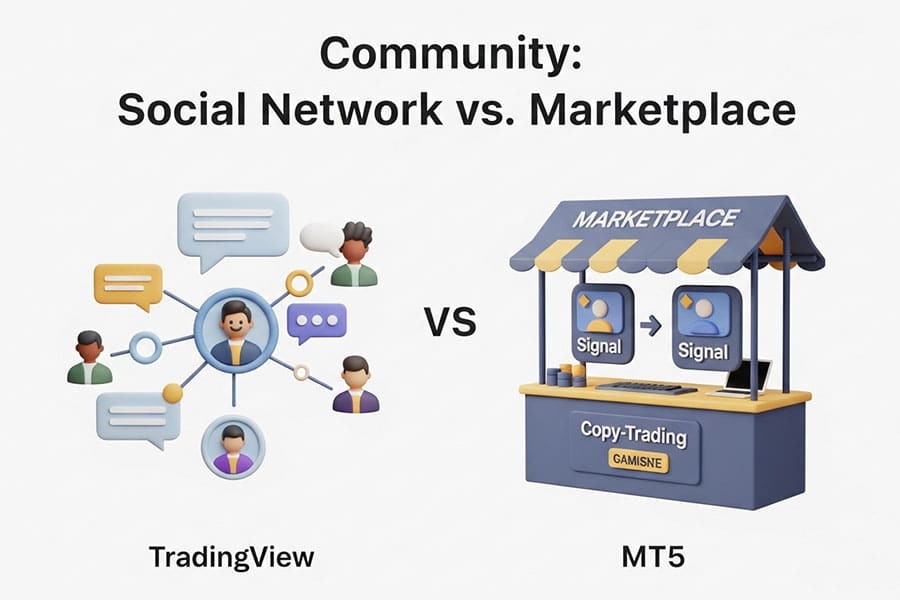

| Community | Marketplace for tools & copy trading | Vibrant social network for ideas & analysis |

User Interface: TradingView’s Simplicity vs MT5’s Power

The first impression of any software is its interface, and this is where the two platforms reveal their different philosophies. Your choice in the tradingview vs mt5 debate might very well start here, based on how you prefer to interact with your trading environment.

TradingView: Modern & Beginner-Friendly

TradingView operates like a modern web application. It’s clean, intuitive, and visually appealing. Everything is accessible from a browser on any operating system, which is a massive plus for flexibility. The charts are smooth, customization is a drag-and-drop affair, and finding tools or indicators feels second nature, even for absolute beginners. The layout is logical and uncluttered, prioritizing the chart itself. This user-centric design is a key reason for its soaring popularity among retail traders.

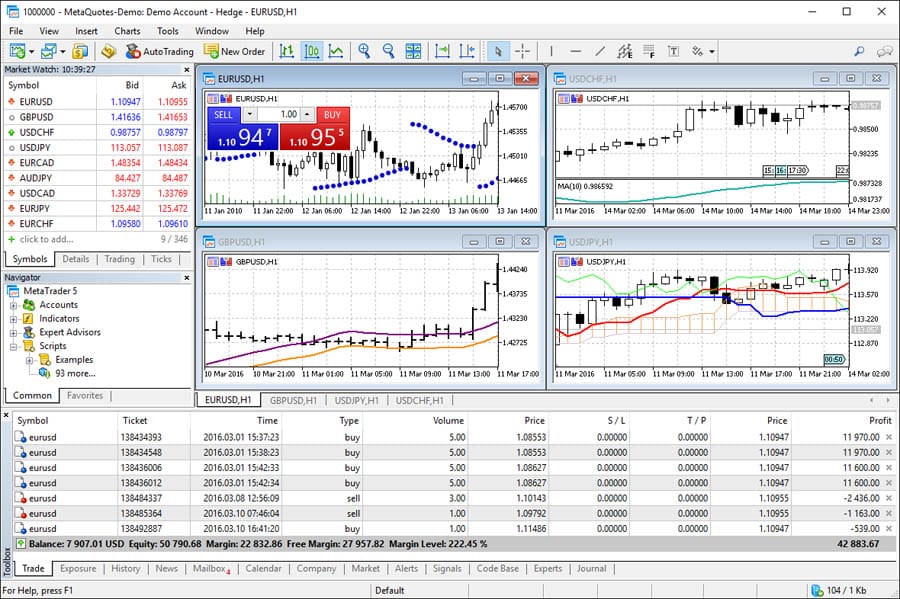

MetaTrader 5: Robust but Steeper Learning Curve

MetaTrader 5, on the other hand, is a classic piece of downloadable software. Its interface is denser and packed with windows for “Market Watch,” “Navigator,” and “Terminal.” While incredibly powerful, it can feel overwhelming for newcomers. The design has not changed significantly over the years, retaining a somewhat dated, early-2000s software aesthetic. However, once you climb the learning curve, you realize that this density is its strength. It provides immediate access to deep functionality, from detailed tick data to your complete trading history and expert advisor logs, all in one screen. It’s an interface built for serious execution, not casual Browse.

Charting & Analysis: TradingView’s Clear Advantage

For technical analysts, the chart is their canvas, and the quality of the tools is paramount. In the comparison of metatrader 5 vs tradingview, TradingView emerges as the undisputed leader in charting and analysis, offering a richer, more flexible, and more collaborative experience.

TradingView: Superior Charts & Indicators

TradingView was built from the ground up to be the ultimate charting tool, and it shows. It offers beautifully rendered HTML5 charts that are smooth and highly interactive. The platform comes with over 100 pre-built indicators and more than 100,000 community-built indicators in its public library. This is an unparalleled resource. The drawing tools are extensive and easy to use, and features like multi-chart layouts (up to 16 charts in one window on premium plans) and Bar Replay for backtesting are executed flawlessly. The ability to save chart layouts and sync them across all devices is a game-changer for traders on the move. When it comes to pure technical analysis, TradingView is in a league of its own.

MetaTrader 5: Functional & Powerful Analysis Tools

This isn’t to say MT5 has poor charting; it is highly functional and sufficient for most professional needs. It comes with 38 built-in indicators, 44 analytical objects, 21 timeframes, and the ability to display an unlimited number of charts. For a standard analysis of support/resistance, moving averages, and key oscillators, MT5 is more than capable. However, it lacks the sheer breadth of indicators and the slick, intuitive user experience of TradingView. Adding custom indicators requires downloading them from the MQL5 marketplace or other sources and installing them manually, a far cry from TradingView’s one-click library access. The debate of mt5 or tradingview for charting is a clear win for the latter.

Automated Trading: MT5’s EAs vs TradingView’s Pine Script

Automated trading is where the scales tip dramatically in favor of MetaTrader 5. While TradingView has scripting capabilities, MT5 was fundamentally built to support sophisticated, server-side trading robots, making it the industry’s gold standard.

MetaTrader 5: The Gold Standard for Trading Bots (EAs)

MetaTrader 5’s strength lies in its MQL5 (MetaQuotes Language 5) and the ecosystem of Expert Advisors (EAs). EAs are trading robots that can perform analysis and execute trades automatically on your behalf, directly on the trading server. MQL5 is a full-fledged, object-oriented programming language that allows for the creation of incredibly complex and nuanced trading strategies. The platform includes a strategy tester that enables comprehensive backtesting of these EAs against historical data, providing detailed performance reports. Furthermore, the MQL5 marketplace is the largest hub for traders to buy, sell, or rent thousands of ready-made EAs and custom indicators. For anyone serious about algorithmic trading, the metatrader 5 vs tradingview decision is simple: MT5 is the professional’s choice.

TradingView: Simpler Scripts, Complex Execution

TradingView uses a proprietary language called Pine Script. It is intentionally designed to be lightweight and much easier to learn than MQL5. Pine Script is excellent for creating custom indicators and setting up complex, multi-conditional alerts. For instance, you could create an alert for when the RSI crosses below 30 and the price is above the 200-period moving average. However, Pine Script cannot execute trades directly on its own. To automate a strategy, you must set up alerts that send a “webhook” notification to a third-party service (like 3Commas or a custom script on a server), which then translates that alert into a trade order with your broker. This process adds layers of complexity and potential points of failure, making it less robust than MT5’s integrated solution.

Broker Integration & Order Execution

A platform is useless without a broker to place trades through. This is another area where the core purposes of the two platforms diverge, significantly impacting the tradingview vs mt5 comparison from a practical standpoint.

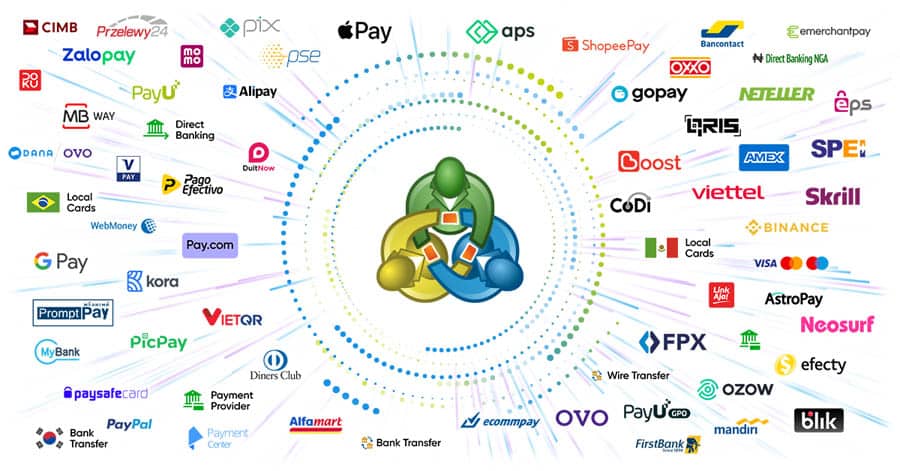

MetaTrader 5: The Industry’s Widest Broker Support

MetaTrader 5 is the undisputed king of broker integration. For decades, the MetaQuotes platform (first MT4, now MT5) has been the default offering for the vast majority of online forex and CFD brokers. A trader can open an account with hundreds, if not thousands, of brokers globally and be confident they will receive MT5 login credentials. This provides traders with immense choice and flexibility. Because MT5 is installed locally and connects directly to the broker’s servers, order execution is typically lightning-fast and stable, which is critical for strategies like scalping where every millisecond counts.

TradingView: Growing List of Direct Broker Connections

TradingView started as a pure analysis platform and has been retrofitting trading capabilities over time. You can now connect a broker account directly within the TradingView interface and trade from your charts. The list of supported brokers is growing and includes many reputable names like FOREX.com, OANDA, and Interactive Brokers. However, this list is a small fraction of the brokers that support MT5. If your preferred online forex broker doesn’t support direct TradingView integration, you’re left using it for analysis only. The execution happens within TradingView’s interface, which is convenient, but the reliability can sometimes depend on the API connection to the broker, which may not be as battle-tested as MT5’s direct link.

Read More: MetaTrader 4 vs MetaTrader 5

Social Trading & Community Features

Modern trading is not a solitary pursuit. Both platforms integrate community features, but they do so with entirely different goals, once again highlighting the core differences in the metatrader 5 vs tradingview matchup.

TradingView: A Social Network for Traders

TradingView is effectively the Facebook or Twitter for traders. It has a built-in social network where users publish their trade ideas, charting analysis, and market commentary. You can follow top traders, engage in discussions, and see real-time analysis from a global community. The “Streams” and “Ideas” tabs are vibrant feeds of educational and actionable content. This collaborative environment is invaluable for learning, finding new opportunities, and gauging market sentiment. It’s a community built around sharing knowledge.

MetaTrader 5: A Marketplace for Copy Trading

MT5’s community features are more transactional and less social. The main feature is its integrated Signals service. Here, you can subscribe to other traders’ strategies and have their trades automatically copied to your own account. It’s a pure copy-trading solution. The MQL5 community website also has forums for technical discussions, primarily centered around MQL5 programming and EA development. It’s a community of developers and users focused on building and using trading tools, rather than sharing public-facing analysis.

Asset & Market Availability

The markets you can access on each platform depend heavily on its architecture. TradingView’s web-based data aggregation gives it a natural edge in breadth, while MT5’s access is determined entirely by the connected broker.

TradingView: Broader Market Access (Stocks, Crypto, Forex)

Because TradingView is first and foremost a data and charting provider, it pulls data from dozens of exchanges and sources. This means you can chart and analyze an enormous range of instruments: global stocks, ETFs, forex pairs, a vast array of cryptocurrencies, futures, and bonds. This makes it an incredibly versatile tool for multi-asset analysis. However, being able to chart an asset is different from being able to trade it. Trading is limited to the offerings of the broker you have connected.

MetaTrader 5: Focused on Forex & CFDs (Broker-Dependent)

MetaTrader 5 does not provide any market data on its own. The assets you can see and trade are determined 100% by the broker for forex trading you are using. The vast majority of brokers offering MT5 specialize in Forex and CFDs (Contracts for Difference) on indices, commodities, and some stocks. While MT5 was designed to be multi-asset and can handle centralized exchange trading (stocks), its primary adoption has been in the decentralized forex and CFD space. So, if you’re looking to trade a niche stock on the NASDAQ, you’re unlikely to find it on a typical MT5 broker’s feed.

Cost & Pricing: Free vs Freemium Model

For many traders, cost is a significant factor. The pricing models for the two platforms are fundamentally different, which can make the mt5 or tradingview choice easier depending on your budget and needs.

Is MetaTrader 5 Free?

Yes, MetaTrader 5 is completely free for the trader. The business model of its creator, MetaQuotes, involves licensing the server software to brokers. The brokers then provide the client-side trading terminal (the MT5 application you use) to their customers for free as part of their service.

Is TradingView Free?

Yes, TradingView has a free plan, but it operates on a “freemium” model. The free version is quite capable but comes with limitations: ads on your charts, a maximum of three indicators per chart, and one saved chart layout. To remove these limitations and unlock advanced features like more indicators, multi-chart layouts, and server-side alerts, you need to subscribe to one of their paid plans (Pro, Pro+, or Premium).

Read More: What is TradingView

The Final Verdict: MT5 or TradingView?

The debate over metatrader 5 vs tradingview is not about finding a single winner. The truth is, the “better” platform is the one that aligns with your specific trading style and needs. It’s a classic case of using the right tool for the right job.

Choose MetaTrader 5 if:

- You are a serious algorithmic trader who wants to build, test, and run complex Expert Advisors (EAs).

- Your primary concern is the speed and reliability of trade execution, especially for scalping or high-frequency strategies.

- You want the widest possible choice of forex and CFD brokers from around the world.

- You prefer a dedicated, downloadable software platform and have mastered its powerful, data-dense interface.

Choose TradingView if:

- You are a technical analyst who prioritizes top-tier charting tools, a vast library of indicators, and a modern user interface.

- You value community and want to share ideas, learn from others, and see what other traders are thinking.

- You need to analyze a wide range of markets, including stocks and crypto, not just forex.

- You prefer a flexible, web-based platform that you can access from any device, anywhere.

The Pro Hybrid Strategy: Using Both Platforms Together

This is the secret that many experienced traders won’t tell you: they don’t choose. They use both. The most effective approach, in my experience, is what I call the “Pro Hybrid Strategy.” You leverage each platform for its greatest strength. You perform all of your detailed charting, market screening, and strategy brainstorming on TradingView, taking advantage of its superior analytical tools and community insights. Once you have identified a high-probability trade setup, you switch over to MetaTrader 5 to execute the trade with precision and speed, managed by the robust and stable connection to your broker. This workflow combines the best of both worlds: world-class analysis and professional-grade execution. This resolves the metatrader 5 vs tradingview dilemma by turning it into a partnership.

Opofinance Services

For traders seeking a regulated and feature-rich environment to deploy their strategies, Opofinance stands out. As an ASIC-regulated broker, it offers a secure and trustworthy trading ecosystem. It brilliantly supports the “Pro Hybrid Strategy” by providing access to the industry’s leading platforms.

- Advanced Trading Platforms: Trade directly on MT4, MT5, cTrader, and the proprietary OpoTrade platform, giving you ultimate flexibility.

- Innovative AI Tools: Gain an edge by utilizing their AI Market Analyzer, AI Coach, and AI-powered support.

- Social & Prop Trading: Engage with the community through social trading or explore proprietary trading opportunities.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments, with zero fees charged by Opofinance.

Elevate your trading by partnering with a broker that provides the best tools for the job. Explore the benefits of Opofinance today.

Conclusion: The Best Tool Depends on the Trader

Ultimately, the metatrader 5 vs tradingview choice is personal. There is no one-size-fits-all answer. MetaTrader 5 is the specialist for execution and automation, a powerful workhorse for getting the job done. TradingView is the master of analysis and community, a beautiful and intuitive canvas for crafting your ideas. The professional trader doesn’t limit their toolbox. They understand the strengths of each platform and use them in concert to create a seamless workflow from idea to execution.

Can I trade stocks directly on MetaTrader 5?

It depends entirely on the broker. While MT5 is capable of handling stock trading on centralized exchanges, most brokers that offer MT5 focus on forex and CFDs on stocks, not the underlying stocks themselves.

Does TradingView have a desktop application?

Yes, TradingView offers a dedicated desktop app for Windows, macOS, and Linux. It provides a slightly faster, more native experience than the browser version, with features like multi-monitor support.

What are the main alternatives to MT5 and TradingView?

Key alternatives include cTrader, known for its modern interface and advanced order types, and NinjaTrader, which is popular among futures traders for its powerful analysis and automation capabilities.

Is Pine Script harder to learn than MQL5?

No, Pine Script is significantly easier to learn than MQL5. It was designed to be simpler and more accessible for traders who are not professional programmers. MQL5 is a more complex, C++ based language designed for building sophisticated, standalone applications.

How do I connect TradingView to a broker that isn’t officially supported?

You can use a third-party trade copier or automation tool. These services use webhooks from TradingView alerts to trigger trades on platforms like MT5. This requires an extra subscription and setup but bridges the gap between the two.