This guide aims to provide a clear and detailed understanding of mitigated and unmitigated order blocks in Forex trading. Mitigated order blocks refer to areas where the price revisits and fulfills previous institutional buy or sell orders, signifying that liquidity in those zones has been absorbed. On the other hand, unmitigated order blocks are created when significant price movements occur without the price returning to fill those orders, leaving zones of unfilled institutional orders that can serve as potential areas for price reversal or continuation. Traders often rely on tools provided by an online forex broker to effectively identify and trade these order blocks.

Understanding the differences between these two types of order blocks is essential for traders looking to develop effective trading strategies. Both mitigated and unmitigated order blocks offer valuable insights into market dynamics, as they reflect the behavior of institutional traders who drive price action. By recognizing the formation, characteristics, and implications of these order blocks, traders can enhance their ability to identify high-probability trade setups, maximize their entries, and manage risks effectively. This article will delve into the intricacies of these order blocks, providing you with the knowledge needed to leverage them in your trading approach.

Characteristics and Formation of Mitigated and Unmitigated Order Blocks

Order blocks are specific price zones where institutional traders place substantial buy or sell orders. Understanding their formation and characteristics is vital for traders to recognize potential trade setups and capitalize on market movements.

Mitigated Order Blocks

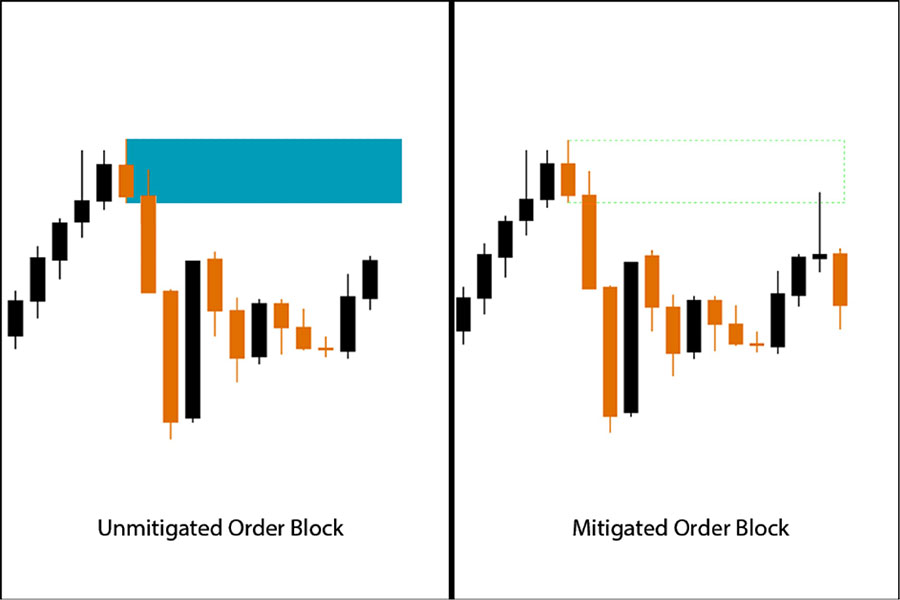

Formation: Mitigated order blocks form after the price revisits and fills the initial orders placed by institutions. These blocks typically emerge near previous support or resistance levels that have been tested and subsequently broken.

- They often appear in areas where the market has previously consolidated, indicating a buildup of orders.

- Once mitigated, these blocks are generally less likely to cause large price movements, as the liquidity has already been absorbed.

Chart Patterns: Mitigated blocks can be identified after periods of price consolidation. They typically coincide with retested support or resistance levels and display a lack of significant price reaction upon subsequent visits. This behavior signals that most of the liquidity has already been absorbed, leading to a more stable price action.

Unmitigated Order Blocks

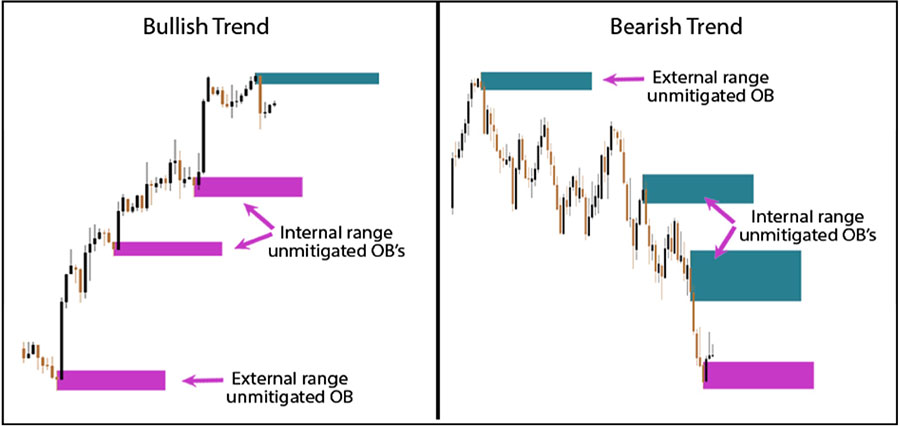

Formation: Unmitigated order blocks form when a significant price move occurs without the price revisiting the original level where institutional orders were placed. The imbalance created by unfilled orders leads to sharp price movements when the market eventually returns to these levels.

- These blocks are typically located at the origin of strong trend movements, making them critical for traders to monitor.

Chart Patterns: Unmitigated order blocks are characterized by sharp price movements away from the order block, without any retests to the area. These zones tend to be highly reactive when revisited, leading to opportunities for strong price reversals. Traders often monitor these areas closely for potential trade entries due to the high probability of price reacting to unfilled institutional orders.

Market Behavior and Implications of Mitigated vs. Unmitigated Order Blocks

Understanding the market behavior surrounding mitigated and unmitigated order blocks can provide valuable insights into potential trading opportunities.

Mitigated Order Blocks

Reduced Significance: Since the liquidity in mitigated order blocks has been absorbed, they become less significant for future price action. Traders often view these areas as unlikely to cause substantial price reactions, which can lead to more predictable trading outcomes.

Confirmation of Trends: When the price revisits and mitigates an order block, it often serves as a confirmation of the prevailing trend. This behavior indicates that the initial momentum was not purely driven by institutional orders but rather backed by broader market consensus, reinforcing the existing trend and providing traders with additional confidence in their positions.

Read More: Mastering Mitigation order Blocks

Unmitigated Order Blocks

High Potential for Reversal or Continuation: Unmitigated order blocks hold the potential for large price reactions when revisited. Since the original institutional orders remain unfilled, a return to these levels often leads to significant price reversals or continuations, presenting lucrative trading opportunities.

Key Trading Opportunities: Traders focus on entries around unmitigated order blocks, anticipating sharp price movements upon revisiting these levels. This can create high-probability trades with favorable risk-reward ratios, allowing traders to capitalize on market inefficiencies.

Trading Strategies Using Mitigated and Unmitigated Order Blocks

Order blocks are not just for identifying potential price movements; they also form the basis of several effective trading strategies. Here’s how you can incorporate these blocks into your trading plan.

Mitigated Order Blocks

Trend Following: Mitigated order blocks are particularly valuable in trend-following strategies. Since these areas have less potential for sharp reversals, traders can use them as confirmation points for entering or continuing a trade within an existing trend. They may act as minor support or resistance, facilitating the continuation of the trend and providing traders with a more stable environment to operate within.

Range Trading: In range-bound markets, mitigated order blocks can serve as minor pivot points for short-term trades. Traders can identify these blocks to execute range trades with relatively low risk, given that significant liquidity has already been absorbed. This approach allows for more predictable outcomes and can be particularly effective in consolidating markets.

Unmitigated Order Blocks

Reversal Trades: Unmitigated order blocks are ideal for catching market reversals. Since they represent areas where large institutional orders have yet to be filled, traders can anticipate strong price reactions when the price revisits these blocks, allowing them to enter reversal trades with precision and confidence.

Breakout Strategies: In trending markets, unmitigated order blocks can also serve as breakout zones. If the price breaks through these areas, it often leads to substantial price movements, making them excellent entry points for breakout trades. Traders can capitalize on the momentum created by the breakout, potentially leading to significant profits.

Risk Management in Mitigated and Unmitigated Order Block Trading

Effective risk management is essential for successfully trading around mitigated and unmitigated order blocks. Each type of block presents different levels of risk and volatility, which must be factored into your trading strategy.

Mitigated Order Blocks

Lower Risk of Volatility: Since mitigated order blocks have already absorbed the liquidity, they generally present a lower risk of sudden price movements. Traders can use these areas to enter trades with confidence that the price action will be more stable, reducing the likelihood of unexpected losses.

Use for Stop Placement: Mitigated order blocks are particularly useful for stop-loss placement. Because they act as minor support or resistance, traders can place stops just beyond these blocks, reducing the likelihood of being stopped out by small price fluctuations. This strategic placement enhances overall risk management.

Unmitigated Order Blocks

Higher Volatility: Due to the unfilled institutional orders, unmitigated order blocks are prone to sudden price spikes, leading to increased volatility. Traders must be cautious when trading around these areas, as the price can react unpredictably, resulting in potential losses if not managed properly.

Cautious Position Sizing: Given the potential for volatility, traders often use smaller position sizes when trading around unmitigated order blocks. Wider stop-loss placements are also recommended to accommodate any potential price swings, ensuring that traders can withstand sudden market movements without incurring significant losses.

Common Mistakes to Avoid When Trading Order Blocks

Trading order blocks can be highly effective, but several common mistakes can undermine a trader’s success. Recognizing and avoiding these pitfalls is crucial for improving your trading strategy and achieving consistent results. Here are some key mistakes to watch out for:

- Ignoring Market Context: One of the most significant errors traders make is neglecting the broader market context. Order blocks should not be analyzed in isolation; they must be considered alongside other factors such as overall market trends, economic news, and geopolitical events. Failing to account for these influences can lead to misinterpretations of order block significance.

- Overtrading on Minor Blocks: Traders often get caught up in the excitement of minor mitigated order blocks, leading to overtrading. While these blocks can provide opportunities, they usually carry less weight than major unmitigated blocks. Focusing too heavily on minor blocks can result in unnecessary losses and increased transaction costs.

- Poor Risk Management: Neglecting to implement effective risk management strategies is a critical mistake. Traders may enter positions without proper stop-loss orders or fail to assess their risk-to-reward ratios adequately. This oversight can lead to significant losses, especially when trading around unmitigated order blocks, which can exhibit high volatility.

- Misjudging Reversal Potential: When trading unmitigated order blocks, traders sometimes misjudge the potential for reversals. Just because an unmitigated block has formed does not guarantee a price reversal upon revisit. Traders should look for additional confirmation signals, such as candlestick patterns or other technical indicators, before entering trades based solely on the presence of an order block.

- Failing to Adapt: The Forex market is dynamic, and strategies that work in one market condition may not be effective in another. Traders often make the mistake of sticking rigidly to a single approach without adapting to changing market conditions. Regularly reviewing and adjusting your strategy based on new information and market behavior is essential for long-term success.

- Overreliance on Order Blocks: While order blocks are valuable tools, relying solely on them can lead to a narrow perspective. Traders should incorporate order block analysis as part of a broader trading strategy that includes other technical indicators, fundamental analysis, and risk management techniques. This holistic approach will provide a more comprehensive view of market conditions.

- Neglecting to Backtest Strategies: Many traders dive into live trading without adequately backtesting their strategies involving order blocks. Backtesting allows you to evaluate how your strategy would have performed in different market conditions, helping you refine your approach and build confidence in your trading decisions.

By being aware of these common mistakes and actively working to avoid them, traders can enhance their ability to effectively utilize order blocks in their trading strategies. This awareness will lead to more informed decisions, better risk management, and ultimately, improved trading performance in the Forex market.

OpoFinance Services: A Broker Tailored for Order Block Traders

When trading mitigated and unmitigated order blocks, having a reliable and fast-executing broker is critical. OpoFinance, a regulated Forex broker under ASIC, stands out as an excellent choice for traders who utilize these strategies.

Why Choose OpoFinance?

- Ultra-Fast Execution: Timing is crucial in order block trading, and OpoFinance provides the speed necessary to execute trades at the right moment, minimizing slippage and maximizing trade efficiency.

- Social Trading Platform: OpoFinance offers an advanced social trading service, allowing you to follow top traders who specialize in mitigated and unmitigated order block strategies. Learn from experienced traders to enhance your own strategies and improve your trading skills through shared insights and techniques.

- ASIC Regulation: OpoFinance operates under stringent ASIC regulations, ensuring a secure and transparent trading environment for all users. This regulatory oversight provides peace of mind, knowing that your funds and personal information are protected.

For traders looking to optimize their approach to order block trading, OpoFinance offers the tools, technology, and reliability to succeed in a competitive market.

Conclusion

In conclusion, understanding mitigated and unmitigated order blocks is vital for any Forex trader aiming to enhance their trading strategy and improve their decision-making process. Mitigated order blocks, characterized by price revisiting and filling previous institutional orders, signify areas where liquidity has been absorbed, making them less likely to cause significant price movements in the future. This understanding allows traders to approach these zones with caution, recognizing that they may not present high-probability trading opportunities.

On the other hand, unmitigated order blocks represent powerful trading opportunities. These blocks, formed when price moves significantly without revisiting the original order levels, indicate an imbalance in the market. When the price eventually returns to these zones, traders can anticipate strong reactions, whether in the form of reversals or continuations. By closely monitoring these unmitigated areas, traders can capitalize on the potential for significant price movements, allowing for favorable risk-reward scenarios.

Incorporating the knowledge of mitigated and unmitigated order blocks into your trading strategy not only enhances your ability to identify potential trade setups but also improves your overall market analysis. By understanding the implications of these order blocks, you can make more informed decisions, manage your risks more effectively, and ultimately increase your chances of success in the Forex market.

As you continue to develop your trading skills, remember that the Forex market is influenced by a myriad of factors, including economic indicators, geopolitical events, and market sentiment. Combining your knowledge of order blocks with a comprehensive understanding of these elements will further empower your trading journey. By leveraging the insights gained from this guide, you can navigate the complexities of Forex trading with greater confidence and precision, positioning yourself for long-term success in this dynamic market.

Can order blocks work in markets outside Forex?

Yes, mitigated and unmitigated order blocks can be applied in various financial markets such as stocks, commodities, and cryptocurrencies, where institutional trading activity plays a significant role. Their principles can be adapted to analyze market behavior across different asset classes.

How do I use unmitigated order blocks to predict reversals?

Unmitigated order blocks serve as prime zones for predicting price reversals due to the unfilled institutional orders left in these areas. When the price revisits these blocks, it often leads to significant market reactions, providing opportunities for reversal trades. Traders can look for confirmation signals, such as candlestick patterns or volume spikes, to enhance their entries.

Is trading around mitigated order blocks less risky?

Generally, yes. Trading around mitigated order blocks tends to be less risky because the liquidity has already been absorbed, leading to more stable price action. However, it is essential to conduct thorough analysis and implement proper risk management techniques, as no trading strategy is entirely without risk.

One Response

Hello kindly I’m your fan and love your explanation. Kindly how can I get that indicator download.