What is the hidden key to forex trading success? The answer lies in mastering Mitigation Order Blocks. In the fast-paced and often unpredictable world of forex trading, understanding advanced concepts can provide a significant edge over competitors. A mitigation block is a critical market phenomenon that occurs when there is a failure to form a new swing high or low due to the presence of an order block. This failure creates an opportunity for traders who, especially when working with a broker for forex, can recognize these patterns and act accordingly.

Essentially, a mitigation block represents a point where market dynamics shift, often leading to substantial price movements. When traders identify a mitigation block, they can anticipate potential reversals or continuations in the market, allowing them to make more informed trading decisions. Understanding this concept is vital for anyone looking to navigate the complexities of the forex market effectively.

This article will explore the concept of Mitigation order Blocks in detail, explaining their definition, mechanics, and types. By the end, you will understand how to effectively leverage Mitigation order Blocks to enhance your trading strategies and improve your overall outcomes in the forex market. By mastering this concept, you can significantly increase your chances of success, turning potential market pitfalls into profitable trading opportunities.

What is a Mitigation Block in Forex?

A mitigation block in forex is a fascinating market phenomenon that plays a crucial role in price action and liquidity dynamics. Contrary to common misconception, a mitigation block is not a tool or strategy, but rather a market behavior that savvy traders can identify and exploit. Understanding this concept is essential for traders aiming to navigate the complexities of the forex market effectively.

Definition

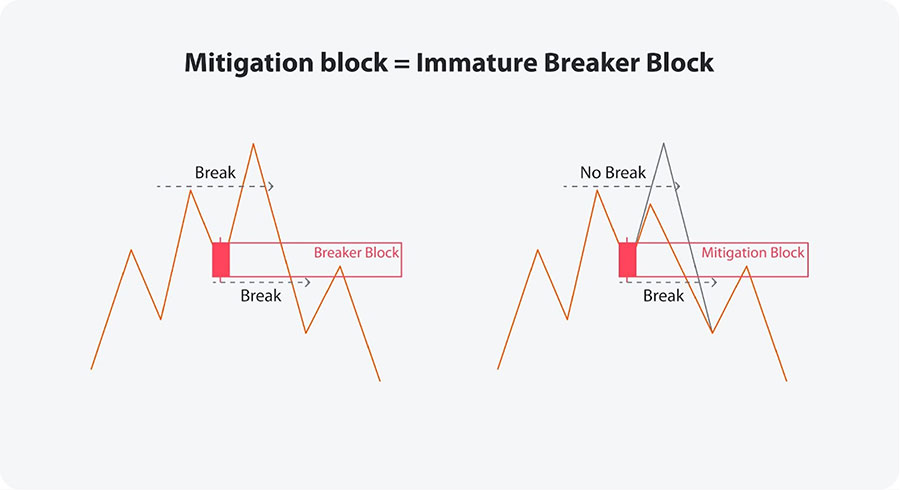

A mitigation block in forex occurs when there’s a failure to form a new swing high or low in the market due to an order block. This failure creates a unique opportunity for traders who understand how to read and react to these market conditions. The ability to identify Mitigation order Blocks can significantly enhance a trader’s decision-making process, allowing for more strategic entries and exits.

The Mechanics of Mitigation order Blocks

To fully grasp how Mitigation order Blocks function, it’s important to break down the mechanics involved. Understanding these mechanics can help traders anticipate market movements and make informed trading decisions.

- An order block prevents price from forming a higher high (in a bearish scenario) or a lower low (in a bullish scenario).

- This failure creates a liquidity void as price moves in the opposite direction.

- Price then retraces to fill 50-60% of this liquidity void.

- The previously violated low (or high) serves as a reference point, which we call the mitigation block.

By understanding these steps, traders can better position themselves to capitalize on opportunities presented by Mitigation order Blocks. Each step reflects the underlying psychology of market participants, making it crucial to consider not just the technical aspects but also the emotional responses that drive market movements.

Types of Mitigation order Blocks in Forex

There are two primary types of Mitigation order Blocks in forex trading, each offering unique insights into market behavior and potential trading opportunities. Recognizing these types can enhance a trader’s strategy and improve decision-making.

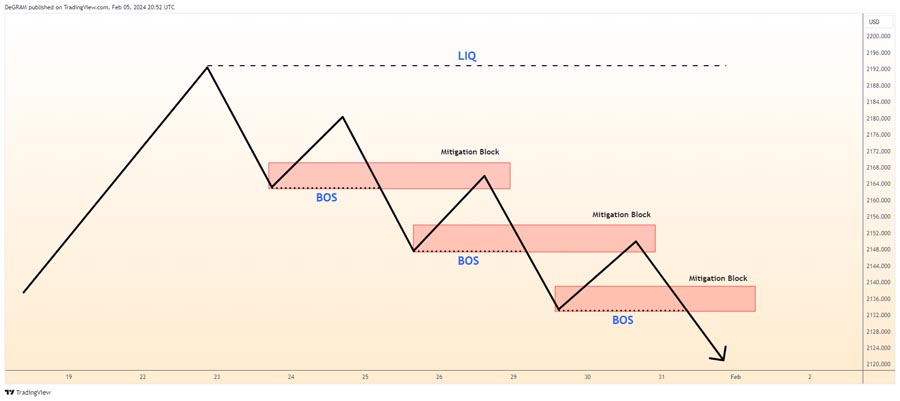

1. Bearish Mitigation Block

A bearish mitigation block in forex is characterized by a specific sequence of market events. Understanding this sequence is vital for traders looking to identify potential selling opportunities.

- Price fails to collect buy-side liquidity on previous highs due to an order block or rejection block.

- This results in a lower high being formed.

- Price is pushed down to collect sell-side liquidity on the nearest previous low, forming a lower low.

- Price then pulls back up to fill the created liquidity void.

- The previously violated low serves as a reference point for the pullback.

Key Point: Traders can use the previously violated low as an entry point, often aligning with the 50% Fibonacci retracement level (equilibrium) for added confluence. This confluence can provide additional confirmation for entering a trade, increasing the likelihood of success.

Read More: Mitigated and Unmitigated Order Blocks in Forex Trading

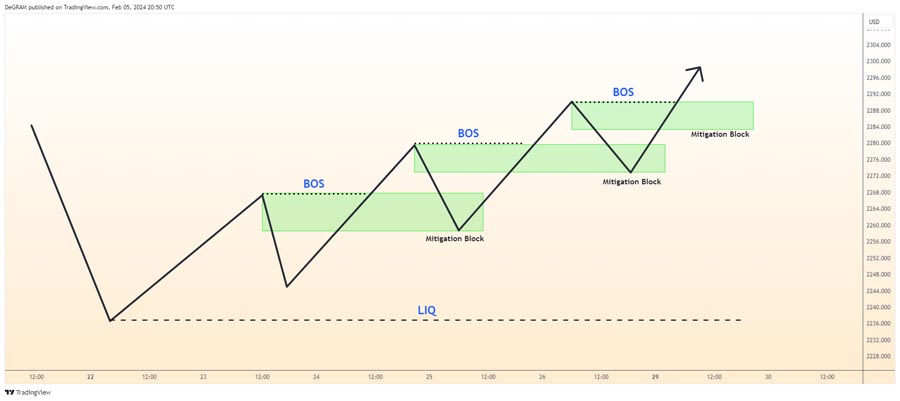

2. Bullish Mitigation Block

A bullish mitigation block in forex follows a similar but opposite pattern. Understanding this pattern is essential for traders looking for buying opportunities.

- Price fails to collect sell-side liquidity on previous lows due to an order block or rejection block.

- This results in a higher low being formed.

- Price is pushed up to collect buy-side liquidity on the nearest previous high, forming a higher high.

- Price then pulls back down to fill the created liquidity void.

- The previously violated high serves as a reference point for the pullback.

Key Point: Traders can use the previously violated high as an entry point, again often aligning with the 50% Fibonacci retracement level for confluence. This strategic alignment with Fibonacci levels can further enhance the probability of a successful trade.

How to Identify and Trade Mitigation order Blocks

Identifying Mitigation order Blocks requires a keen eye for price action and an understanding of market structure. Here’s a step-by-step guide to spotting and trading Mitigation order Blocks effectively:

- Identify the Order Block: Look for areas where price has been strongly rejected, forming an order block. This is where significant buying or selling pressure has occurred.

- Observe the Failure Swing: Watch for price failing to make a new high (for bearish blocks) or new low (for bullish blocks). This failure indicates a potential reversal or retracement.

- Track the Liquidity Grab: Notice price moving to take out the nearest swing low (for bearish blocks) or swing high (for bullish blocks). This movement often signifies a liquidity hunt.

- Wait for the Retracement: Look for price to retrace and fill 50-60% of the created liquidity void. This is where traders often look for entry points.

- Prepare for Entry: Use the previously violated low (for bearish blocks) or high (for bullish blocks) as your potential entry point. This reference point is critical for setting your trades.

- Confirm with Fibonacci: Apply Fibonacci retracement tools to confirm if the mitigation block aligns with the 50% retracement level. This additional layer of confirmation can enhance your trading strategy.

- Execute the Trade: Enter the trade at the mitigation block level, setting your stop loss beyond the recent swing point and your take profit at the next significant level. Proper risk management is essential here.

Advanced Strategies for Trading Mitigation order Blocks

Once you’ve mastered the basics of Mitigation order Blocks, you can incorporate more advanced strategies to refine your trading:

- Multiple Timeframe Analysis: Combine mitigation block analysis across different timeframes to increase the probability of successful trades. Look for alignment between higher and lower timeframe Mitigation order Blocks for stronger signals.

- Volume Confirmation: Use volume indicators to confirm the strength of the move creating the mitigation block. Higher volume during the initial move can indicate a stronger likelihood of the mitigation block holding.

- Combining with Other Technical Indicators: Integrate mitigation block analysis with other technical indicators such as RSI, MACD, or Moving Averages for additional confirmation of potential trades. This holistic approach can provide a more comprehensive view of market conditions.

- Order Flow Analysis: Incorporate order flow analysis to gain deeper insights into the buying and selling pressure around Mitigation order Blocks, helping you make more informed trading decisions. Understanding order flow can reveal the intentions of market participants.

Common Pitfalls in Trading Mitigation order Blocks

While Mitigation order Blocks can be powerful tools for forex traders, there are several common mistakes to avoid:

- Overtrading: Not every mitigation block will result in a profitable trade. Be selective and wait for high-probability setups. Impulsive trading can lead to unnecessary losses.

- Ignoring the Broader Market Context: Mitigation order Blocks should be considered within the larger market structure and prevailing trends. Always assess the overall market conditions before making trading decisions.

- Neglecting Risk Management: Always use appropriate stop losses and position sizing, regardless of how convincing a mitigation block setup may appear. Risk management is the backbone of sustainable trading.

- Failing to Confirm: Relying solely on Mitigation order Blocks without seeking confirmation from other technical or fundamental factors can lead to suboptimal results. Always look for additional confirmation to validate your trading decisions.

The Psychology Behind Mitigation Block Trading

Understanding the psychological aspects of trading Mitigation order Blocks is crucial for consistent success. Here are some key psychological factors to consider:

- Patience: Waiting for the perfect mitigation block setup requires discipline and patience. Rushing into trades can lead to mistakes and missed opportunities.

- Confidence: Developing confidence in your ability to identify and trade Mitigation order Blocks comes with practice and experience. Building this confidence is essential for executing your trading plan effectively.

- Emotional Control: The ability to stick to your trading plan and not be swayed by emotions when trading Mitigation order Blocks is essential. Emotional trading can cloud judgment and lead to poor decision-making.

- Continuous Learning: The forex market is always evolving, and so should your understanding of Mitigation order Blocks and their applications. Stay informed about market trends and continuously seek to improve your trading skills.

OpoFinance Services: Elevating Your Mitigation Block Trading

At OpoFinance, we understand the importance of advanced trading concepts like Mitigation order Blocks. As an ASIC-regulated broker, we’re committed to providing our clients with the tools and knowledge needed to excel in forex trading.

- Advanced charting tools for identifying Mitigation order Blocks

- Multi-timeframe analysis capabilities

- Real-time market data for informed decision-making

- Risk management features to protect your capital

Moreover, our innovative social trading service allows you to connect with experienced traders who have mastered mitigation block strategies. You can learn from their approaches, share insights, and even automatically replicate their trades if you choose. This community aspect can enhance your learning and provide valuable support.

Conclusion

In conclusion, mastering Mitigation order Blocks is an essential skill for any forex trader looking to gain a competitive edge in the market. Throughout this article, we have explored what Mitigation order Blocks are, their mechanics, and the two primary types—bearish and bullish Mitigation order Blocks. Understanding these concepts not only enhances your technical analysis but also deepens your comprehension of market psychology and the behavior of other traders.

Mitigation order Blocks serve as critical indicators of potential price reversals or continuations, providing invaluable insights into market dynamics. By identifying these blocks, traders can position themselves advantageously, making informed decisions that align with market movements. The ability to recognize when price fails to create new highs or lows due to the influence of order blocks can significantly improve entry and exit strategies, ultimately leading to more successful trades.

Furthermore, incorporating Mitigation order Blocks into your trading strategy allows for a more nuanced approach to risk management. By understanding where to place stop-loss orders and take-profit targets in relation to these blocks, traders can enhance their overall risk-reward ratios. This strategic positioning not only protects capital but also maximizes potential gains.

As you continue to develop your trading skills, remember that practice and experience are crucial. Engage with real market scenarios, backtest your strategies, and refine your understanding of Mitigation order Blocks over time. The forex market is constantly evolving, and staying adaptable is key to long-term success.

In summary, mastering Mitigation order Blocks is not just about recognizing patterns; it’s about developing a comprehensive trading strategy that incorporates market psychology, risk management, and technical analysis. By leveraging this knowledge, you can transform potential market pitfalls into profitable opportunities, paving the way for sustained success in your forex trading journey. As you apply these principles, remain vigilant, stay informed, and continue to learn—your growth as a trader is a continuous journey that will ultimately lead to greater proficiency and confidence in the forex market.

How reliable are Mitigation order Blocks as trading signals?

Mitigation order Blocks can be highly reliable when used in conjunction with other technical analysis tools and market context. However, like any trading signal, they are not foolproof. Their reliability increases when confirmed by other indicators, volume analysis, and broader market trends. It’s crucial to use proper risk management techniques and not to rely solely on Mitigation order Blocks for trading decisions.

Can Mitigation order Blocks be used in all market conditions?

While Mitigation order Blocks can occur in various market conditions, they tend to be most effective in trending markets or during periods of clear price direction. In ranging or highly volatile markets, Mitigation order Blocks may be less reliable or harder to identify. It’s important to adapt your strategy to current market conditions and use Mitigation order Blocks as part of a comprehensive trading approach.

How long does it typically take to master trading with Mitigation order Blocks?

The time it takes to master trading with Mitigation order Blocks varies depending on individual learning pace, dedication, and prior trading experience. Generally, traders might start to feel comfortable identifying Mitigation order Blocks within a few months of dedicated study and practice. However, truly mastering their application in live trading conditions can take significantly longer, often a year or more of consistent practice and analysis. Continuous learning and adaptation are key to long-term success with this strategy.