In the fast-paced world of Forex trading, one method has consistently stood out as an effective way to capitalize on short-term market movements: the multi-timeframe scalping strategy. This advanced trading strategy allows traders to make well-timed, precision-based decisions by analyzing price movements across multiple timeframes. By looking at the market from different perspectives—typically short, medium, and long-term timeframes—traders can increase their chances of identifying profitable opportunities while avoiding false signals.

The key to success with this strategy is ensuring alignment across different timeframes to confirm trend strength and timing for entries and exits. This article will break down exactly how to implement a multi-timeframe scalping strategy, the tools and indicators you’ll need, and why choosing the right online Forex broker, like OpoFinance, is essential for success. Scalping requires quick decision-making, and without a reliable broker, even the best strategies can fall short.

What is the Multi-Timeframe Scalping Strategy?

The multi-timeframe scalping strategy is a short-term trading approach that involves analyzing multiple charts over various timeframes to confirm trends and pinpoint precise entry and exit points. It’s primarily used in Forex trading, though it can be applied to other markets, such as stocks or cryptocurrencies. The goal of this strategy is to confirm market signals by observing how trends are developing across several timeframes. This gives the trader a clearer picture of where the market is likely to head in the short term, making their trades more accurate and reducing the risks of relying on signals from a single timeframe.

Key Timeframes in Multi-Timeframe Scalping

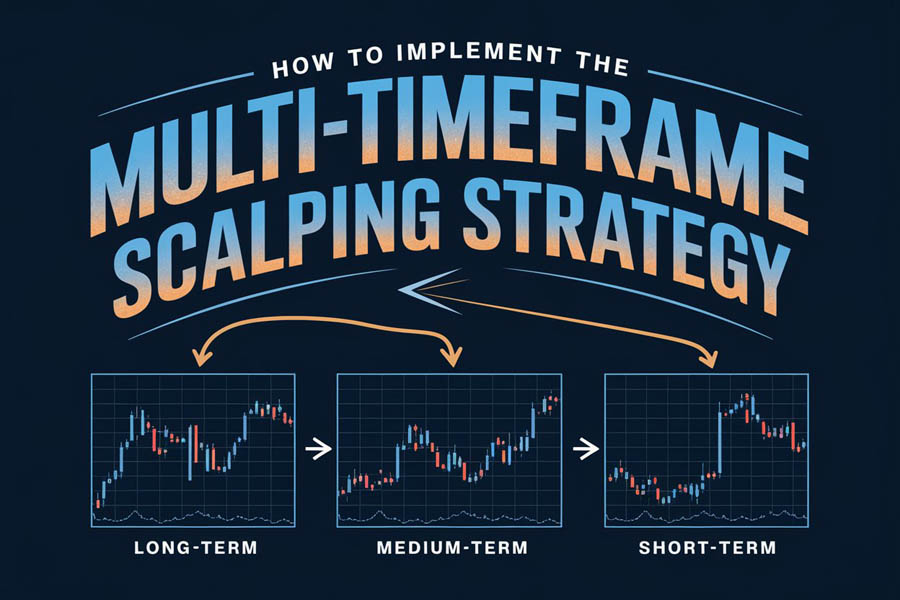

When implementing this strategy, traders typically rely on three key timeframes:

- Long-term trend (e.g., 15-minute chart): Used to identify the overall market direction. This helps determine whether the market is trending upward, downward, or sideways.

- Medium-term trend (e.g., 5-minute chart): This timeframe acts as a filter, confirming that the current market movement aligns with the long-term trend. If both timeframes agree on the trend, it strengthens the signal.

- Short-term trend (e.g., 1-minute chart): This is where scalpers pinpoint exact moments for entry or exit. Timing is everything when scalping, and the short timeframe provides the real-time data necessary for swift execution.

By combining insights from these three timeframes, traders can make high-probability trades that align with both short-term price movements and the broader market trend.

“Scalping with multiple timeframes is about stacking the odds in your favor by confirming trends and signals before entering a trade, thereby increasing your chances of success.”

Read More: Stochastic Oscillator for Scalping

Why Use the Multi-Timeframe Scalping Strategy?

The multi-timeframe scalping strategy offers several advantages that make it particularly appealing for traders seeking short-term gains. Below are the most significant reasons why traders opt for this strategy:

1. Improved Accuracy

Relying solely on one timeframe for trading decisions can result in false signals and premature trades. The multi-timeframe approach allows traders to confirm trends and signals by analyzing how they play out on different timeframes. This reduces the risk of entering trades based on temporary price fluctuations, ensuring you are trading in the direction of the dominant trend.

2. Quick Profits with Minimized Risk

By identifying trades that align across multiple timeframes, scalpers can quickly capitalize on short-term price movements with a higher probability of success. The strategy minimizes risk because traders are more selective about when to enter trades, waiting for confirmation from at least two or more timeframes.

3. Scalability and Flexibility

This strategy is ideal for both new and experienced traders. It works well with small trading accounts, allowing traders to make several trades throughout the day while maintaining tight stop-loss orders to protect their capital. Additionally, experienced traders can adapt this method for higher timeframes if they prefer fewer, more substantial trades over the course of a day or week.

How to Implement the Multi-Timeframe Scalping Strategy

Implementing the multi-timeframe scalping strategy is a detailed process that requires focus, precision, and a clear understanding of market behavior. The goal is to identify high-probability trades by using several timeframes to confirm trends and signals. Each step plays a crucial role in ensuring that your trades align with the broader market direction, minimizing risk while maximizing potential profits. Below is a detailed breakdown of how to effectively use this strategy to your advantage.

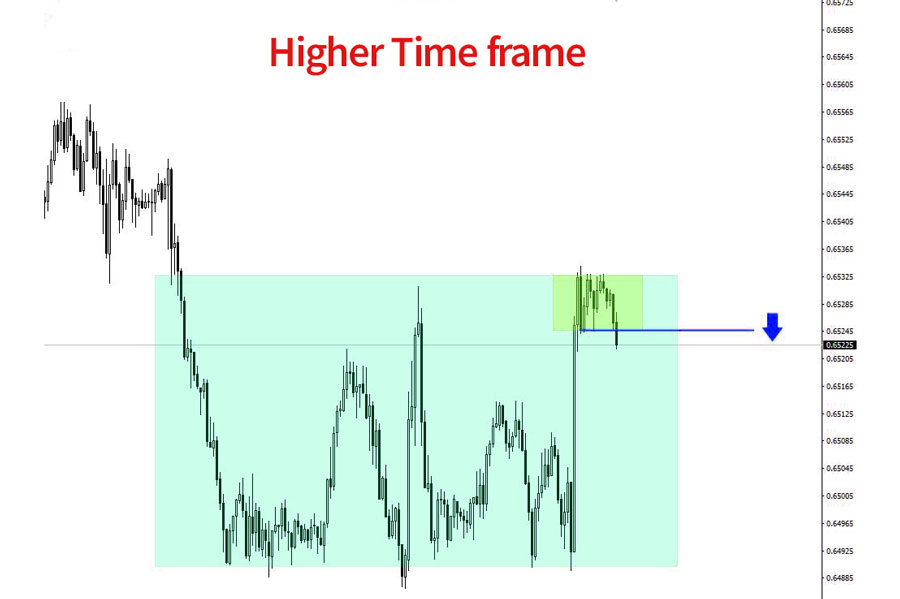

Step 1: Identify the Main Trend on the Long-Term Timeframe

The first and most critical step is to analyze the long-term timeframe, which is typically the 15-minute chart for scalpers. This timeframe helps you get a clearer picture of the broader market trend, allowing you to determine whether the market is in an uptrend, downtrend, or moving sideways. By focusing on the long-term trend, you’re filtering out a lot of the “noise” that can occur in shorter timeframes.

It’s essential to always trade in the direction of the main trend. This fundamental step ensures that you are not going against the prevailing market forces, which increases the probability of your trade’s success. For instance, if the 15-minute chart shows a strong uptrend, you’ll only be looking for buying opportunities when you shift to shorter timeframes. Similarly, if the chart shows a downtrend, you’ll focus solely on shorting opportunities.

One key aspect to remember is that you should never make trading decisions based solely on the long-term chart. The goal here is to use it as a guiding framework for the rest of your strategy. You’ll need additional confirmation from the medium and short-term charts before entering a trade.

“Never trade against the main trend. It is always safer and more profitable to follow the direction of the dominant market force.”

Read More: 7 Best Time Frames for Scalping

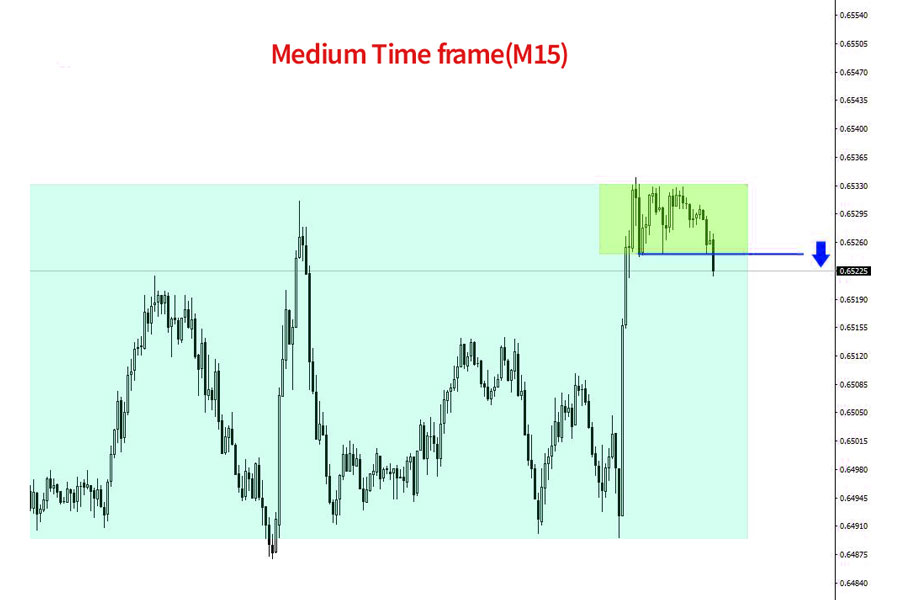

Step 2: Confirm Market Direction on the Medium-Term Timeframe

Once you have established the main trend using the long-term timeframe, the next step is to confirm the market direction on the medium-term timeframe, which is usually the 5-minute chart. This step acts as a filter to ensure that the market is continuing in the same direction as observed on the 15-minute chart.

For example, if the 15-minute chart indicates an uptrend, the 5-minute chart should ideally also show signs of an uptrend or, at the very least, not contradict the long-term trend. If both the long-term and medium-term timeframes show alignment, it’s a strong signal that the market trend is solid, and you can prepare to enter a trade on the short-term chart.

At this stage, some traders also use technical indicators like moving averages, Bollinger Bands, or trendlines to further confirm the direction of the market. For example, a common technique is to use a 21-period Exponential Moving Average (EMA) to see if the price is above or below the average, further confirming the trend’s strength. If the price is consistently trading above the 21-period EMA on the 5-minute chart, it’s a signal that the uptrend is likely to continue.

It’s crucial to avoid trading if the medium-term timeframe contradicts the long-term trend. In such cases, it’s best to wait for clearer signals before making any moves. Trading when the timeframes are out of sync increases the likelihood of entering a trade at the wrong time and getting caught in a market pullback or price reversal.

“Using the medium-term timeframe as a filter for your trades ensures that you’re not relying on just one timeframe to make your decisions. Confirmation is key to increasing trade accuracy.”

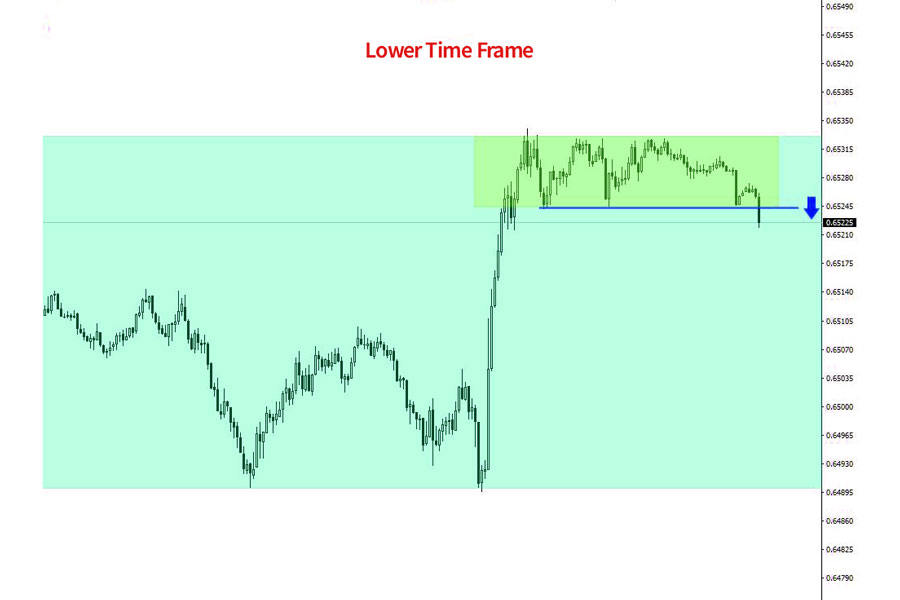

Step 3: Pinpoint Your Entry and Exit Points on the Short-Term Timeframe

Once you’ve established that both the long-term and medium-term timeframes are aligned, you can now move to the short-term timeframe, typically the 1-minute chart. This is where the magic happens. The short-term timeframe allows you to pinpoint the exact moment to enter or exit the trade with precision.

Scalpers often use the 1-minute chart to monitor real-time price action and look for specific candlestick patterns or technical indicators that signal the ideal entry point. For instance, moving average crossovers, support and resistance levels, and reversal candlesticks like hammers or shooting stars can all be used to identify potential trade setups.

Another popular technique at this stage is to use oscillators like the Relative Strength Index (RSI) or the Stochastic Oscillator. These tools help traders determine whether the market is overbought or oversold, which can signal an impending reversal. If the RSI falls below 30, for instance, it might indicate that the market is oversold and due for a reversal, signaling a potential buy opportunity. Similarly, if the RSI climbs above 70, the market may be overbought, suggesting a sell opportunity.

Once you’ve identified a strong signal on the 1-minute chart that aligns with the trends observed on the longer timeframes, you can confidently enter your trade. However, you must immediately set a tight stop-loss order to protect your position. Scalping is all about making small, frequent profits, so keeping your losses minimal is essential for long-term success.

Finally, when it comes to exiting your trade, you should rely on the short-term chart as well. Keep an eye on reversal patterns, breaks of support or resistance levels, or moving average crossovers that might indicate a change in market direction. As soon as you see the first sign of reversal, exit your trade to lock in profits. Scalping is about speed, so don’t hesitate to close out your position when the market starts to turn.

“Precision and timing are everything in scalping. The short-term timeframe is where you identify your entry and exit points, but you must always be prepared to act quickly.”

Read More: The Ultimate Guide to Divergence Scalping

Step 4: Manage Your Trade and Adjust as Needed

After entering the trade, managing it effectively is just as important as identifying the right entry point. Many traders make the mistake of not adjusting their trade plan as the market evolves. To manage your trade well, you need to continually monitor price action on the short-term timeframe and be ready to adjust your stop-loss or take-profit orders as necessary.

Some scalpers also implement a trailing stop-loss to lock in profits as the trade moves in their favor. A trailing stop follows the price as it rises, ensuring you don’t miss out on gains if the market continues to move in the same direction.

It’s also wise to keep an eye on the long-term and medium-term timeframes while the trade is active. If you notice that these timeframes start to show signs of a potential trend reversal, it may be a good idea to exit the trade early to minimize risk.

“Effective trade management ensures that you don’t let winning trades turn into losers. Adjust your stops and keep an eye on multiple timeframes to stay ahead of the market.”

Tools and Indicators to Enhance the Multi-Timeframe Scalping Strategy

While analyzing price action is the cornerstone of multi-timeframe scalping, technical indicators can help confirm trends and entry points. Below are some of the most popular indicators that complement this strategy.

1. Moving Averages (MA)

Moving averages are essential in helping traders smooth out price data and identify potential entry points. Most scalpers use exponential moving averages (EMA) with different timeframes—such as the 21-period and 8-period EMAs—to filter out short-term noise. When the faster EMA crosses the slower one, it can signal a strong buying or selling opportunity.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. When applied across multiple timeframes, it helps identify overbought or oversold conditions, signaling potential market reversals. Typically, an RSI below 30 indicates a market is oversold, while an RSI above 70 suggests it is overbought.

3. Stochastic Oscillator

The Stochastic Oscillator measures the closing price relative to the high-low range over a specified period. This indicator is particularly useful for identifying overbought and oversold levels in shorter timeframes. In scalping, it helps traders identify potential entry points when the market momentum is likely to shift.

4. Fibonacci Retracement Levels

Fibonacci retracement levels can be used to find potential support and resistance levels where price might reverse. By applying Fibonacci levels across multiple timeframes, traders can identify key areas where the price might bounce, offering potential trading opportunities.

“Combining price action with technical indicators ensures that your entries and exits are not only based on market trends but also supported by statistical data.”

Risk Management in Multi-Timeframe Scalping

Like any trading strategy, risk management is crucial to success in multi-timeframe scalping. Here are some best practices:

1. Use Tight Stop-Loss Orders

In scalping, the goal is to capture small profits over several trades, which means minimizing losses is essential. Tight stop-loss orders help protect your capital by automatically closing a trade if the market moves against you.

2. Limit Your Trading Sessions

Scalping can be intense, and overtrading is a common mistake. Set limits on how many trades you’ll take in a day or how long your trading sessions will last. This helps avoid emotional trading, which often leads to poor decisions.

3. Risk-Reward Ratio

Even though scalping often aims for small profits, maintaining a favorable risk-reward ratio is essential. Aim for at least a 1:2 risk-reward ratio, meaning you’re willing to risk $1 for every $2 you aim to gain.

OpoFinance: The Ideal Broker for Multi-Timeframe Scalping

When implementing a strategy as fast-paced as scalping, having a reliable regulated Forex broker is essential. OpoFinance, an ASIC-regulated broker, is the perfect choice for traders using the multi-timeframe scalping strategy. ASIC-regulation ensures that OpoFinance adheres to the highest standards of transparency and security, offering traders a safe environment for their trading activities.

Key Features of OpoFinance:

- Fast Trade Execution: With scalping, every second counts. OpoFinance offers low-latency trading platforms that ensure your trades are executed at the best possible prices.

- Tight Spreads: Scalpers benefit from tight spreads as they execute multiple trades in a short period. OpoFinance offers competitive spreads, allowing you to maximize your profits.

- Social Trading: OpoFinance provides a social trading service where you can follow and copy the trades of experienced traders. This is a great option for novice traders or those looking to diversify their strategies.

- 24/7 Support: Whether you’re trading during peak hours or after markets close, OpoFinance offers round-the-clock support to ensure your trades run smoothly.

By choosing OpoFinance, you’re not just picking a broker—you’re choosing a partner dedicated to enhancing your trading success.

Conclusion: Why Multi-Timeframe Scalping is the Strategy of Choice for Forex Traders

The multi-timeframe scalping strategy stands out as an effective, precision-based approach for traders looking to make quick, consistent profits in the Forex market. By confirming market trends across several timeframes, you can minimize risk while maximizing the chances of successful trades.

Implementing this strategy requires practice, patience, and, most importantly, the right tools. With a reliable regulated broker like OpoFinance, you can execute your trades seamlessly, benefiting from tight spreads, fast execution, and top-tier customer support.

Whether you’re new to scalping or a seasoned trader looking to refine your strategies, using multi-timeframe analysis in Forex can significantly improve your trading outcomes.

How many timeframes should I use for scalping?

Ideally, you should use three timeframes—typically the 1-minute, 5-minute, and 15-minute charts. These give you a comprehensive view of the market’s short, medium, and long-term trends, allowing you to make precise entries and exits.

Can I use multi-timeframe scalping with other trading strategies?

Yes, you can combine multi-timeframe scalping with other strategies like trend following or breakout trading. This allows you to confirm signals across various timeframes, increasing the likelihood of successful trades.

How important is having a fast Forex broker for scalping?

Master the multi-timeframe scalping strategy to boost profits in Forex. Learn the best practices, tools, and how an ASIC-regulated broker like OpoFinance can enhance your success.