Choosing between ninjatrader vs tradingview is a critical decision for any serious trader in 2025. While TradingView excels as a user-friendly charting and social analysis tool ideal for beginners and multi-asset traders, NinjaTrader is the superior platform for dedicated futures and forex traders who require advanced automation and direct market execution. This guide, relevant for anyone from a novice to a seasoned professional looking for a new online forex broker, will dissect their features, costs, and core functionalities to help you determine which platform aligns with your trading style and goals.

Key Takeaways:

For those needing a quick answer on the TradingView vs NinjaTrader debate, here is a summary of the most critical points that will be explored in detail throughout this article.

- Primary Focus: TradingView is an analysis-first platform, excelling in charting, community features, and broad market coverage. NinjaTrader is an execution-first platform, built for high-performance futures and forex trading with powerful automation.

- User Base: TradingView appeals to a wide audience, from beginners to seasoned analysts who value ease of use and collaborative tools. NinjaTrader targets professional day traders and automated strategy developers.

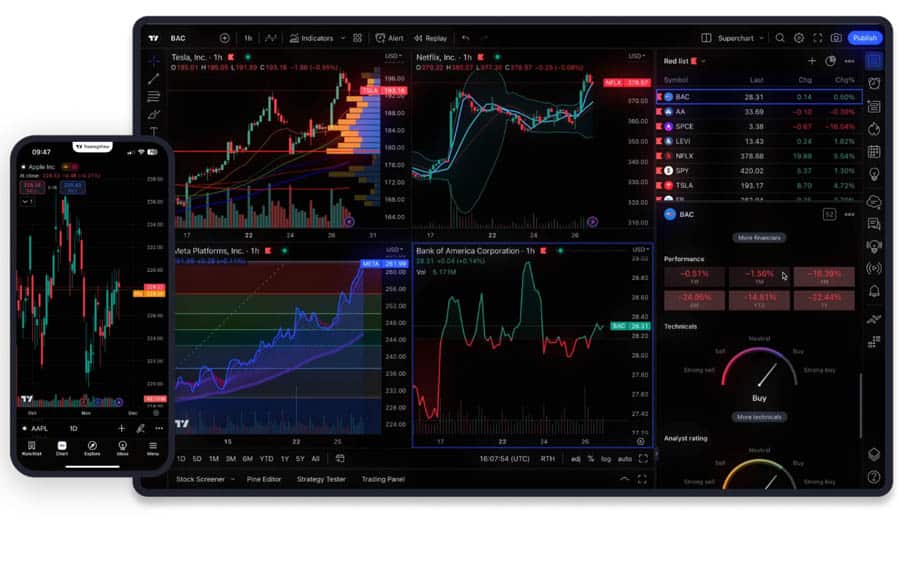

- Platform Type: TradingView is primarily web-based, offering a seamless experience across all devices. NinjaTrader is a downloadable desktop application for Windows, providing robust, high-performance capabilities.

- Cost Structure: TradingView uses a freemium subscription model. NinjaTrader’s software is free for charting and simulation, but live trading requires a subscription or a one-time lifetime license.

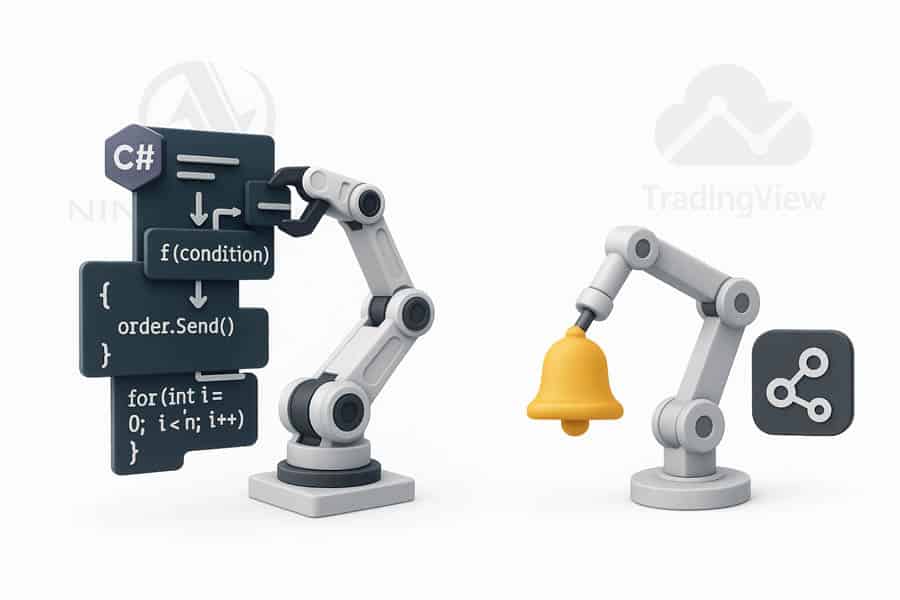

- Automation: NinjaTrader offers more powerful and complex automation through its C#-based NinjaScript. TradingView’s Pine Script is more accessible but less capable for sophisticated automated strategies.

- Broker Integration: TradingView connects with a wider variety of brokers across stocks, crypto, and forex. NinjaTrader provides deeper, more integrated support for a select list of futures and forex brokers.

Quick Comparison Table:

To give you an immediate, at-a-glance understanding of the ninjatrader vs tradingview comparison, this table summarizes their core features. It’s designed to help you make a fast, informed decision before we dive into the detailed analysis.

| Feature | NinjaTrader | TradingView |

|---|---|---|

| Platform Type | Desktop (Windows-based) | Web-based with Desktop & Mobile Apps |

| Primary Focus | Futures & Forex Trading, Automation | Charting, Technical Analysis, Social Trading |

| Ideal User | Active Day Traders, Algo Traders | Beginners, Analysts, Multi-Asset Traders |

| Scripting Language | NinjaScript (C#-based) | Pine Script (Proprietary) |

| Automation | Advanced, robust strategy automation | Alert-based and simpler strategy automation |

| Market Coverage | Futures, Forex, Stocks, CFDs | Global Stocks, Forex, Crypto, Commodities |

| Cost Model | Free for Charting; License for Live Trading | Freemium Subscription Tiers |

| Community Features | Minimal, forum-based | Extensive social network for traders |

| Mobile Support | Limited web-based mobile access | Fully-featured, highly-rated mobile app |

What Is NinjaTrader?

NinjaTrader is a specialized trading platform renowned for its high-performance trade execution and advanced analytical tools, particularly within the futures and forex markets. Launched in 2003, it has established itself as an industry leader for active day traders who demand precision, speed, and deep customization. It operates primarily as a downloadable desktop application, which allows it to leverage local computing resources for complex calculations and fast order routing without the limitations of a web browser.

Platform Overview and Main Focus

The core philosophy of NinjaTrader revolves around providing professional-grade tools for serious traders. Its main focus is not just on charting but on the entire trading lifecycle: analysis, strategy development, backtesting, simulation, and live execution. This makes it an all-in-one solution for those who want to build, test, and deploy automated trading strategies. The platform’s architecture is designed for low-latency trading, which is critical for scalpers and other short-term traders.

Read More: MetaTrader 4 vs MetaTrader 5

Core User Base: Who Uses NinjaTrader?

NinjaTrader’s user base consists primarily of experienced and professional traders. This includes:

- Discretionary Futures Traders: Traders who rely on advanced charting (like order flow and footprint charts) and sophisticated order types (like OCO brackets) to trade futures contracts.

- Automated Strategy Developers: Traders who use NinjaScript to build and deploy “black box” trading bots that execute trades automatically based on predefined rules.

- System Traders: Individuals who follow a strict set of rules for entering and exiting trades and use NinjaTrader’s backtesting and optimization features to refine their systems.

From my experience, traders who choose NinjaTrader are less interested in social collaboration and more focused on developing a robust, personal trading edge through technology.

Supported Markets and Assets

While versatile, NinjaTrader’s strength lies in specific markets. It offers comprehensive support for:

- Futures

- Forex (Foreign Exchange)

- Stocks (primarily through brokers like Interactive Brokers)

- CFDs (Contracts for Difference)

The platform is particularly dominant in the retail futures trading space, offering direct connectivity to data feeds and clearing firms that cater to this market.

What Is TradingView?

TradingView has become a household name in the trading community since its launch in 2011, largely due to its incredibly intuitive, powerful, and accessible charting package. It is a web-based platform at its core, meaning you can access it from any browser without downloading software. This emphasis on accessibility, combined with a vibrant social network, has made it the go-to platform for millions of traders and investors worldwide for analyzing a vast array of markets.

Platform Overview and Main Focus

TradingView’s main focus is to provide the best charting and analysis experience possible. Its HTML5 charts are smooth, responsive, and packed with hundreds of pre-built indicators and drawing tools. The second pillar of its success is its social features. Traders can publish their trade ideas directly on a chart, share their analysis, and follow other traders, creating a collaborative environment for idea generation. While it supports live trading through broker integrations, its primary identity is that of an analytical and social platform, a key point in any TradingView vs NinjaTrader discussion.

Core User Base: Who Uses TradingView?

TradingView caters to a much broader audience than NinjaTrader. Its users include:

- Beginner Traders: The intuitive interface and free plan make it the perfect starting point for those new to technical analysis.

- Technical Analysts: Traders and investors across all asset classes use its powerful charting tools to perform in-depth analysis.

- Multi-Asset Traders: Since it covers everything from stocks and crypto to forex and commodities, it’s ideal for those who monitor different markets.

- Swing Traders and Position Traders: Those who hold positions for days, weeks, or months find its analysis and alert features perfectly suited to their style.

Supported Markets and Assets

TradingView’s market coverage is one of its biggest strengths. It offers data for a massive range of assets from exchanges all over the world, including:

- Global Stocks and ETFs

- Cryptocurrencies

- Forex

- Futures

- Commodities

- Bonds and Economic Data

This extensive coverage makes it an invaluable tool for macroeconomic analysis and for traders looking for opportunities across different asset classes, a clear differentiator in the ninjatrader vs tradingview comparison.

Read More: cTrader vs TradingView

Key Differences: TradingView vs NinjaTrader

Understanding the fundamental distinctions between these two platforms is crucial to deciding which is better, NinjaTrader or TradingView, for your specific needs. Their differences go beyond mere features and touch upon their core design philosophy, accessibility, and intended user.

Platform Type (Web-based vs. Desktop)

The most significant difference is the platform architecture. TradingView is a web-based platform. This means there’s nothing to install; you just log in through your browser. This offers incredible flexibility and ensures your charts, drawings, and settings are synchronized across any device you use, including its excellent mobile and desktop apps. The downside is that it relies on your internet connection and a browser’s resources, which can have limitations.

NinjaTrader, conversely, is a standalone desktop application for Windows. This allows it to harness the full power of your PC for intensive tasks like running complex automated strategies, backtesting over large datasets, and processing tick-by-tick data with minimal latency. The trade-off is a loss of portability and cross-device syncing, as it is primarily tied to the machine it’s installed on.

Learning Curve and Accessibility

TradingView is widely regarded as the more user-friendly platform. Its interface is clean, modern, and intuitive. New users can get started with charting and analysis within minutes, making the learning curve very gentle. This accessibility is a key reason for its massive popularity.

NinjaTrader has a much steeper learning curve. Its interface is denser and more complex, reflecting its professional focus. Setting up data feeds, connecting to a broker, and understanding its advanced features can be intimidating for beginners. However, this complexity unlocks a higher degree of power and customization for those willing to invest the time to learn it.

Community and Social Features

This is an area where the ninjatrader vs tradingview debate has a clear winner. TradingView is built around a massive, active social network. You can follow other traders, see their published ideas on charts, comment, and engage in real-time chat. This collaborative environment is excellent for learning and idea generation.

NinjaTrader has a much more limited community, primarily centered around its user support forum. While the forum is a valuable resource for technical questions and sharing scripts, it lacks the dynamic, social-media-style interaction that defines the TradingView experience.

Charting and Technical Analysis

Both platforms are powerhouses in charting, but they cater to different analytical needs. The choice in the TradingView vs NinjaTrader showdown often comes down to the specific type of analysis a trader performs.

Charting Capabilities and Customization

TradingView’s charts are renowned for being clean, fast, and highly interactive. Customization is straightforward, and the platform offers a vast library of drawing tools. It excels at visual analysis and supports multiple chart layouts, even on its lower-tier plans. My experience has been that for pure, visual charting and trend analysis across multiple timeframes, TradingView feels more fluid and intuitive.

NinjaTrader offers equally powerful charting but with a focus on institutional-grade tools. It provides advanced chart types that are not readily available or as robust on TradingView, such as tick charts, volume-based range bars, and detailed order flow footprint charts. These tools are indispensable for short-term traders analyzing market microstructure. Workspace customization is also a major strength; you can arrange dozens of chart windows and tabs across multiple monitors, a feature limited on TradingView.

Built-in Indicators and Scripting

The scripting languages are a major point of divergence. TradingView uses Pine Script, a proprietary language designed to be relatively easy to learn. There’s a massive community library of free indicators built with Pine Script, and writing simple custom indicators is accessible to non-programmers. However, it operates in the cloud and has resource limitations, which can restrict the complexity of strategies.

NinjaTrader uses NinjaScript, which is built on the C# programming language. This gives it far more power and flexibility. With NinjaScript, you can build virtually any indicator or automated strategy you can imagine, leveraging the full power of your local computer. This makes it the superior choice for developing complex, resource-intensive trading algorithms. The learning curve is significantly steeper, but the potential is nearly limitless.

Experience-Based Tips for Advanced Charting

For a truly advanced workflow, many traders use both. I’ve found it effective to use TradingView for broad market scanning and long-term analysis due to its speed and multi-asset coverage. Once a potential setup in the futures market is identified, I switch to NinjaTrader for a granular view using its order flow charts and for precise trade execution. This hybrid approach leverages the strengths of both platforms, resolving the ninjatrader vs tradingview dilemma by combining them.

Read More: What is NinjaTrader

Order Types and Trade Execution

For an active trader, the ability to execute trades precisely and efficiently is paramount. This is where the platforms’ different philosophies—analysis vs. execution—become most apparent and a key factor in the ninjatrader vs tradingview comparison.

Supported Order Types

TradingView’s order execution capabilities are dependent on the integrated broker. It supports standard order types like market, limit, and stop-loss. However, more advanced orders like trailing stops or OCO (One-Cancels-Other) may not be available with all brokers or may have been added only recently.

NinjaTrader excels in this domain. It offers a comprehensive suite of advanced order types directly within the platform through its Advanced Trade Management (ATM) feature. This allows you to pre-define complex order strategies with multiple profit targets and stop-loss levels (including auto-breakeven and trailing stops) that are managed on your PC. These strategies can be attached to an order with a single click, providing a significant edge in speed and precision for day traders.

Execution Speed and Reliability

NinjaTrader is built for speed. By connecting directly to brokerages and data feeds, it minimizes latency, ensuring orders are filled as quickly as possible. As a desktop application, its stability is dependent on your local machine and internet connection but is generally considered highly reliable for its professional user base.

TradingView acts as an intermediary. When you place a trade, the order is sent from TradingView to your broker. While generally reliable, this introduces an extra step that could potentially add latency. For long-term investors, this is negligible, but for a scalper, milliseconds matter, making NinjaTrader the preferred choice for high-frequency strategies.

Real-World Trading Scenarios

Consider a futures day trader who wants to enter a position with a 10-tick profit target and a 5-tick stop-loss, which automatically moves to breakeven after the price moves 5 ticks in their favor. In NinjaTrader, this entire strategy can be preset in the ATM and executed with one click. To achieve the same in TradingView would require manual management of each leg of the trade, which is far less efficient and more prone to error in fast-moving markets.

Automation and Customization

Automated trading is one of the most significant frontiers in retail trading, and both platforms offer solutions, though they are tailored for different levels of complexity. This is a critical element in deciding which is better, NinjaTrader or TradingView.

Automated Trading Support

TradingView’s automation is primarily driven by its alert system. You can create an alert based on a price level, indicator value, or Pine Script condition. When this alert is triggered, it can send a webhook notification to a third-party service (like a trade execution bot) to place a trade. This is a flexible but somewhat disjointed approach that requires external tools to complete the automation loop.

NinjaTrader offers a fully integrated, end-to-end automation solution. Using NinjaScript, you can build complete trading strategies that analyze the market, manage positions, and execute orders without any external intervention. These strategies run directly on your desktop, giving you full control and high-speed execution. This makes it a professional-grade platform for algorithmic trading.

Custom Indicator Creation

As mentioned earlier, both platforms allow for custom indicator creation. TradingView’s Pine Script and its huge public library make it incredibly easy to find or create simple custom indicators. The barrier to entry is low.

NinjaTrader’s NinjaScript offers unparalleled power. Because it’s based on C#, you can integrate external libraries, create complex user interfaces for your indicators, and perform calculations that would be too resource-intensive for Pine Script. This is for traders who want to build truly unique and proprietary analytical tools.

Backtesting and Strategy Optimization

NinjaTrader provides a far more robust and professional backtesting environment. Its Strategy Analyzer allows you to test automated strategies against historical tick data, providing a highly accurate picture of a strategy’s past performance. It also includes powerful optimization tools (like walk-forward analysis) to find the best input parameters for a strategy without overfitting.

TradingView’s backtesting capabilities are more basic. While useful for getting a general idea of a strategy’s viability, they are not as granular or rigorous as NinjaTrader’s. This makes TradingView suitable for initial strategy validation, while NinjaTrader is the tool for in-depth, professional-grade testing before risking real capital.

Broker Integration and Market Coverage

A trading platform is only as good as the brokers it can connect to and the markets it can access. Here, the ninjatrader vs tradingview choice depends on whether you value breadth or depth of integration.

Supported Brokers and Direct Integration

TradingView supports a large and growing list of brokers, allowing users to trade directly from its charts. This list includes major names in the stock, forex, and crypto brokerage space like Interactive Brokers, OANDA, and TradeStation. This makes it very convenient if you already have an account with a supported broker.

NinjaTrader supports a smaller, more focused list of brokers, with a strong emphasis on those specializing in futures, such as NinjaTrader Brokerage, Interactive Brokers, and Phillip Capital. The integration is often deeper, providing more reliable data and faster execution. Recently, NinjaTrader has also enabled a connection *from* TradingView, allowing users to leverage TradingView’s charts while executing through NinjaTrader’s brokerage infrastructure.

Asset Classes

As covered previously, TradingView offers far broader market coverage. If you trade a diverse portfolio of cryptocurrencies, international stocks, and commodities, TradingView is unquestionably the superior platform for analysis. It consolidates data from hundreds of feeds into one interface.

NinjaTrader is a specialist. Its focus is on providing the best possible experience for futures and forex traders. While you can trade stocks through it, its features are optimized for the leveraged, fast-paced nature of derivatives markets. The debate of TradingView vs NinjaTrader often ends here for traders who exclusively operate outside of futures and forex.

Multi-Broker and Multi-Asset Experience

The experience of trading across multiple assets is smoother on TradingView. You can flip between a chart of Bitcoin, Apple stock, and a crude oil futures contract seamlessly within the same interface. For traders who need a holistic view of the financial landscape, this is a killer feature.

While you can set up NinjaTrader to trade different asset classes, it often requires different data feeds and broker connections, making the experience less integrated than on TradingView.

Pricing and Costs

The cost-benefit analysis is a central part of the ninjatrader vs tradingview comparison. The two platforms have fundamentally different pricing models that appeal to different types of traders and financial commitments.

Free vs. Paid Plans

TradingView operates on a freemium model. Its free plan is surprisingly capable, offering excellent charting with a limited number of indicators per chart and ads. For many beginners, this is sufficient. Its paid plans (Pro, Pro+, and Premium) are offered as monthly or annual subscriptions, unlocking more indicators, more alerts, more charts per layout, and an ad-free experience.

NinjaTrader’s platform is free to use for charting, backtesting, and trade simulation. This is a huge advantage for those wanting to learn and develop strategies without any financial commitment. However, to place live trades, you must purchase a license. This pushes the cost to a later stage in the trader’s journey.

Subscription vs. One-Time License Models

TradingView’s model is a pure subscription. You pay a recurring fee to maintain access to its premium features. This offers flexibility, as you can cancel at any time.

NinjaTrader offers both a subscription option and a one-time lifetime license fee. The lifetime license is a significant upfront investment ($1499 at the time of writing), but for a dedicated trader who plans to use the platform for many years, it can work out to be far more cost-effective than paying a monthly subscription indefinitely. This is a key consideration for serious traders deciding between ninjatrader vs tradingview.

Cost-Benefit Analysis for Different Trader Types

For a beginner or casual trader, TradingView’s subscription model is more approachable. You can start for free and scale up your subscription as your needs grow. The total cost is predictable and spread out over time.

For a serious, well-capitalized trader committed to the profession, NinjaTrader’s lifetime license presents a compelling value proposition. It eliminates recurring platform fees and often provides access to lower commissions through NinjaTrader Brokerage, which can lead to substantial savings over thousands of trades.

Mobile and Device Support

In today’s market, the ability to monitor positions and analyze charts on the go is essential. The platforms’ differing approaches to mobile support is a major factor in the TradingView vs NinjaTrader debate.

Mobile App Quality and Limitations

TradingView offers a best-in-class mobile application for both iOS and Android. The app provides a near-seamless transition from the desktop experience, with fully functional charts, drawing tools, and watchlists. You can conduct serious analysis and manage trades effectively from your phone or tablet.

NinjaTrader does not have a dedicated mobile app. It has focused its development resources on its desktop product. While you can access some functionality through a web-based portal on a mobile device, the experience is clunky and limited compared to TradingView’s native app. For traders who need to manage positions away from their desks, this is a significant drawback.

Desktop vs. Web vs. Mobile Experience

TradingView’s strength is its consistent, synchronized experience across all platforms. The charts and watchlists you set up on your desktop are instantly available on your mobile app. This cross-device synchronization is a massive quality-of-life feature.

The NinjaTrader experience is desktop-centric. The full power of the platform is only accessible on the machine where it is installed. This makes it less suitable for traders who travel frequently or need to be highly mobile.

Cross-Device Synchronization

As mentioned, this is a clear win for TradingView. Its cloud-based nature means everything is always in sync. NinjaTrader, being a local installation, does not offer this kind of native synchronization, which is a key point to consider when weighing ninjatrader vs tradingview.

Alerts and Notifications

A robust alert system is a trader’s best friend, allowing them to step away from the screen without missing opportunities. Both platforms offer alerts, but with different levels of flexibility and limitations.

Types of Alerts

TradingView provides a highly flexible alert system. You can set alerts on price levels, drawing objects (like trend lines), and indicator values. You can even create complex alerts using Pine Script. Notifications can be delivered via pop-ups, email, SMS, and webhook.

NinjaTrader also has a powerful alert system, but it is more technically oriented. Alerts are typically based on indicator conditions created in NinjaScript. While extremely powerful, setting them up can be less intuitive than on TradingView.

Limits and Flexibility

This is a major point of contention in the ninjatrader vs tradingview comparison. TradingView imposes strict limits on the number of active alerts you can have on its free and lower-tier plans. To get a high number of alerts, you must subscribe to its most expensive plans. This can be a significant limitation for active traders who monitor many instruments.

NinjaTrader allows for unlimited alerts. Since the platform runs on your local machine, there are no artificial limits imposed on how many conditions you can monitor. For traders who rely heavily on alerts, this is a decisive advantage for NinjaTrader.

Use Cases for Active Traders

An active trader monitoring 20 different futures contracts for specific volume profile setups would quickly hit the alert limit on a basic TradingView plan. In NinjaTrader, they could set up an unlimited number of custom-coded alerts to monitor these conditions simultaneously without any issue.

Pros and Cons Summary

To consolidate everything we’ve discussed, here is a straightforward summary of the advantages and disadvantages of each platform, helping you make a final decision in the TradingView vs NinjaTrader debate.

Who Should Choose NinjaTrader?

You should choose NinjaTrader if you are:

- A dedicated futures or forex trader.

- An active day trader or scalper who needs fast, precise execution.

- A developer who wants to build and deploy complex automated trading strategies using C#.

- A trader who values advanced tools like order flow charts and unlimited alerts over social features.

- Willing to invest in a lifetime license for long-term cost savings.

Who Should Choose TradingView?

You should choose TradingView if you are:

- A beginner or intermediate trader looking for a user-friendly platform.

- A technical analyst who values superior charting and drawing tools.

- A trader who invests or trades across multiple asset classes like stocks, crypto, and forex.

- Someone who values community interaction and social trading features.

- In need of a high-quality, fully synchronized mobile trading experience.

Opofinance: Your ASIC-Regulated Trading Partner

Enhance your trading experience with Opofinance, a secure and innovative regulated forex broker. Benefit from a suite of powerful tools and platforms designed to give you an edge in the markets.

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the intuitive OpoTrade platform.

- Innovative AI Tools: Leverage our AI Market Analyzer, AI Coach, and 24/7 AI Support for smarter trading decisions.

- Social & Prop Trading: Engage with a community of traders and explore opportunities with our proprietary trading programs.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Take your trading to the next level. Discover the Opofinance advantage today!

Conclusion: Which Is Better for You?

Ultimately, the ninjatrader vs tradingview decision is not about which platform is objectively “best,” but which is best for you. If your priority is world-class charting, social collaboration, and multi-asset analysis in a user-friendly, web-based environment, TradingView is the undisputed champion. However, if you are a serious futures or forex trader demanding institutional-grade execution speed, deep customization, and powerful automation, NinjaTrader provides a professional-grade toolkit that is well worth its steeper learning curve.

Is NinjaTrader completely free to use?

NinjaTrader is free for charting, strategy backtesting, and trade simulation. However, to execute live trades with a broker, you must purchase a license, which can be a monthly subscription or a one-time lifetime payment.

Can I use my TradingView indicators on NinjaTrader?

No, you cannot directly use them. TradingView indicators are written in Pine Script, while NinjaTrader uses NinjaScript (C#). The languages are incompatible, and any indicator would need to be re-coded from scratch to work on the other platform.

Which platform is better for analyzing cryptocurrency?

TradingView is significantly better for analyzing cryptocurrency. It connects to dozens of crypto exchanges, offering a vast selection of trading pairs and superior charting tools specifically for the crypto market.

Does NinjaTrader work on a Mac?

NinjaTrader does not have a native application for macOS. It is a Windows-based program. Mac users would need to use virtualization software like Parallels or a VPS (Virtual Private Server) to run it.

Can I connect the same broker to both platforms?

Yes, in some cases. A broker like Interactive Brokers can be connected to both TradingView and NinjaTrader. This allows traders to use TradingView for analysis and NinjaTrader for execution, or switch between them as needed.