Imagine this: a market locked in a relentless downtrend suddenly flickers with a signal of optimism. A precise and clear indicator emerges, hinting that a reversal could be just around the corner. This is the unmatched potential of the Piercing Line Candlestick Pattern, a powerful technical indicator that can help traders spot bullish reversals with accuracy. For traders navigating unpredictable markets—whether in forex, stocks, or cryptocurrencies—understanding this pattern can mean the difference between sustaining losses and seizing substantial gains.

For those working with a forex trading broker, recognizing and applying the Piercing Line Candlestick Pattern can provide a competitive edge. These patterns often signal the perfect moment to enter or exit trades, enhancing your strategy when working with volatile currency pairs.

The Piercing Line Candlestick Pattern serves as a cornerstone of technical analysis, prized for its ability to reveal significant shifts in market momentum. Recognizing this pattern isn’t merely a skill; it’s a strategy that empowers traders to anticipate and act on pivotal market movements.

This article takes a comprehensive dive into the mechanics and applications of the Piercing Line Candlestick Pattern. You’ll gain actionable insights to integrate it into your trading strategies effectively. From its structural nuances to its broader market implications, we’ll unravel how this pattern can enhance your decision-making, refine your timing, and ultimately boost your profitability.

Whether you’re a beginner learning the ropes or an experienced trader looking to sharpen your edge, the Piercing Line Candlestick Pattern is a tool that belongs in your trading arsenal. Prepare to unlock the secrets of this pattern and harness its potential to navigate the financial markets with greater confidence and precision.

What is the Piercing Line Candlestick Pattern?

The Piercing Line Candlestick Pattern is a prominent two-candlestick formation that traders use to identify potential bullish reversals. It typically emerges at the bottom of a prolonged downtrend, signaling that selling pressure is losing momentum and buyers are beginning to regain control. This shift in sentiment sets the stage for a possible upward price movement, making the pattern a valuable tool in technical analysis for predicting market direction.

This pattern is most commonly observed in candlestick charts for forex, stocks, and other financial instruments, where its appearance often signals a critical turning point in market sentiment. For traders, understanding the Piercing Line Candlestick Pattern meaning can unlock opportunities to enter markets at opportune moments, just as the tide begins to turn.

Read More: Morning Star Candlestick Pattern

Anatomy of the Piercing Line Candlestick Pattern

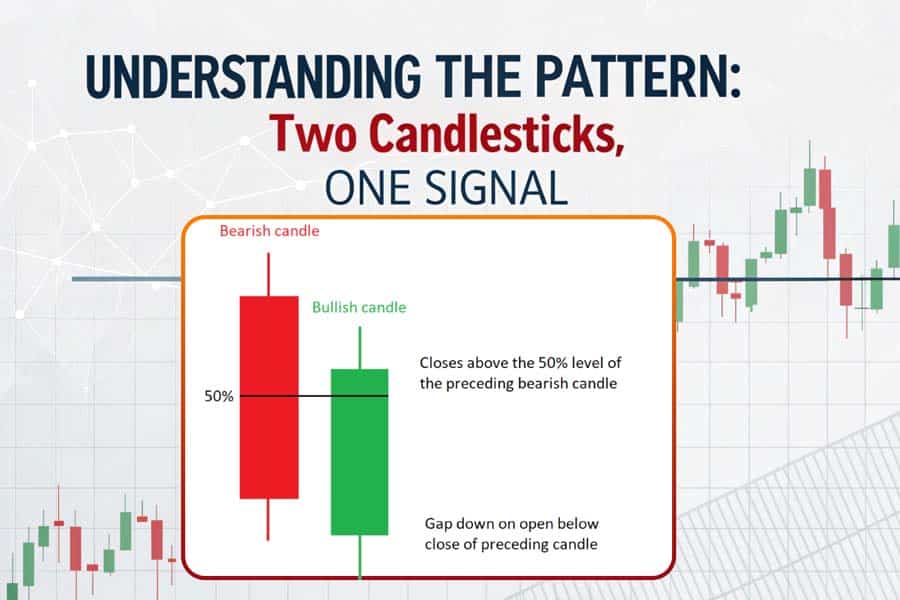

The Piercing Line Pattern is composed of two distinct candlesticks, each playing a vital role in its formation and interpretation. Here’s a breakdown of the key elements:

1. First Candlestick: Bearish Momentum

The first candlestick in this pattern is a long red (bearish) candle. It reflects strong selling pressure, signaling that the prevailing downtrend remains intact. This candlestick sets the psychological backdrop for traders, underscoring fear and uncertainty as sellers dominate the market.

- Significance: This candle establishes the context of a bearish market, emphasizing the urgency for buyers to act.

- Psychological Insight: Sellers are in control, but the market may be oversold, hinting at a potential reversal.

2. Second Candlestick: Bullish Recovery

The second candlestick is a green (bullish) candle. It opens below the previous candle’s low, reflecting the lingering bearish sentiment. However, it closes above the midpoint of the first candlestick, signaling a critical shift in control from sellers to buyers.

- Significance: The strong close above the midpoint suggests growing buyer confidence.

- Psychological Insight: This candle reflects a decisive comeback by the bulls, who overpower the sellers and pave the way for upward momentum.

Key Features of the Piercing Line Candlestick Pattern

The Piercing Line Pattern has several defining characteristics that traders must recognize:

- Location: It forms at the bottom of a downtrend, acting as a potential reversal signal.

- Second Candle’s Close: The second candlestick must close above the midpoint of the first candle. Without this feature, the pattern loses its reliability as a reversal signal.

- Volume Confirmation: High trading volume during the formation of the second candlestick reinforces the pattern’s validity, as it reflects genuine market interest and participation.

This combination of features ensures that the Piercing Line Candlestick Pattern example is a reliable indicator of market sentiment reversal, making it a critical tool for traders aiming to capitalize on changing trends.

By mastering the nuances of this pattern, traders can gain a clearer understanding of when to anticipate market reversals and how to adjust their strategies accordingly. The Piercing Line Candlestick Pattern is more than just a signal—it’s a roadmap for navigating the complexities of market sentiment shifts.

Importance of the Piercing Line Candlestick Pattern

The Piercing Line Candlestick Pattern is far more than a visual formation on a chart. It encapsulates the psychological tug-of-war between buyers and sellers, making it an indispensable tool for traders looking to predict bullish reversals effectively. Understanding its significance equips traders to capitalize on market shifts with precision, enabling informed and profitable decisions.

Discover how the Piercing Line Candlestick Pattern signals potential market reversals and enhances trading strategies.

1. Signals the End of a Downtrend

One of the primary functions of the Piercing Line Pattern is its ability to indicate the potential conclusion of a downtrend.

- Why It Matters: This transition from bearish to bullish sentiment offers traders early insights into possible price recovery.

- Example: If the market is entrenched in a long downtrend, the pattern’s appearance signals an opportunity to exit short positions or enter long trades before prices climb further.

This characteristic makes it a valuable ally for traders seeking to minimize risks associated with sustained downtrends.

2. Confirms Buyer Dominance

The defining feature of the pattern—where the second candlestick closes above the midpoint of the first—emphasizes a surge in buyer confidence.

- Impact on Market Sentiment: This close above the midpoint reflects a decisive shift in control from sellers to buyers, setting the stage for upward momentum.

- Strategic Insight: Traders can use this confirmation to time their entries better, as it signifies that buyers are likely to drive prices higher in the short term.

By recognizing this pivotal moment, traders gain clarity on when the market’s tide is turning in favor of the bulls.

3. Offers High-Probability Trading Opportunities

The Piercing Line Pattern is not just a standalone signal. When combined with other technical indicators, it becomes a high-probability tool for identifying optimal trade setups.

- Using RSI: If the Relative Strength Index (RSI) confirms oversold conditions alongside the pattern, it strengthens the reversal signal.

- Using Moving Averages: Alignment with moving averages can validate trend shifts, adding further confidence to the pattern’s implications.

- Volume Confirmation: High trading volume during the second candlestick bolsters the credibility of the signal, making it a more robust indicator for initiating long positions.

- Real-World Example: A trader notices the Piercing Line Candlestick Pattern at the bottom of a downtrend. When the RSI simultaneously shows oversold conditions and volume spikes during the second candlestick, it becomes a powerful cue to go long.

Why the Piercing Line Pattern is Indispensable

This pattern bridges the gap between technical analysis and market psychology, offering traders a deeper understanding of how sentiment shifts unfold. Its utility extends across forex, stocks, and cryptocurrency markets, ensuring it remains a core component of any trader’s toolkit.

By leveraging the Piercing Line Candlestick Pattern, traders can confidently navigate volatile markets and seize high-probability opportunities.

Read More: Dark Cloud Cover Candlestick Pattern

How to Identify the Piercing Line Candlestick Pattern

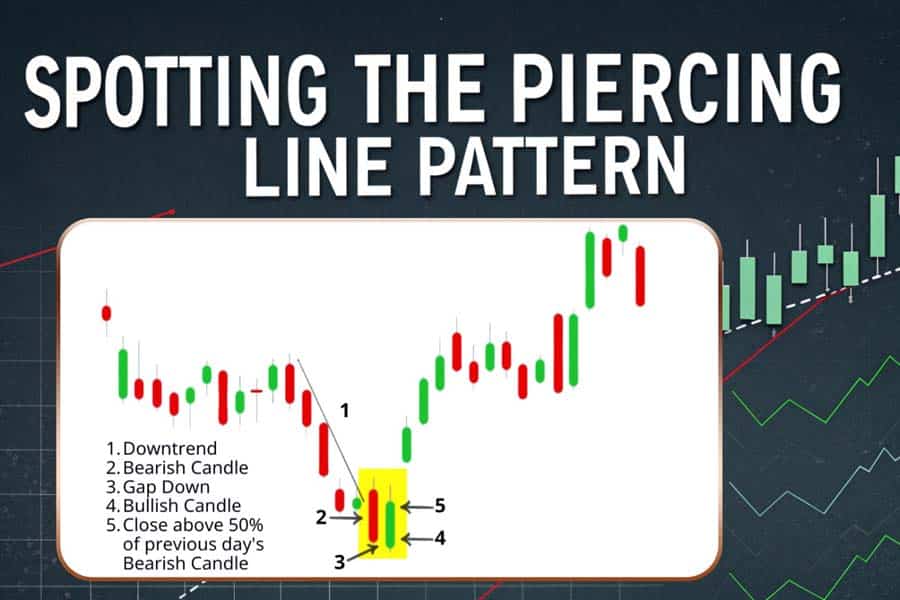

Spotting the Piercing Line Candlestick Pattern accurately is crucial for leveraging its potential as a bullish reversal indicator. Mastering the identification process can significantly enhance your trading strategy, allowing you to capitalize on emerging opportunities with confidence. Follow these steps to ensure precision when identifying this pattern:

Learn the essential steps to accurately identify the Piercing Line Candlestick Pattern and capitalize on market opportunities.

Step 1: Observe the Downtrend

The Piercing Line Pattern is a reversal signal, making its context within the chart paramount.

- Key Requirement: Ensure the market is in a clearly defined downtrend before the pattern appears. Without this prerequisite, the signal loses its reliability.

- Why It Matters: A persistent downtrend sets the stage for this pattern to mark a pivotal shift in sentiment from bearish to bullish.

Example: In forex trading, when a currency pair has been steadily declining over several days, spotting this pattern could indicate a reversal.

Step 2: Recognize the Two-Candlestick Formation

The pattern comprises two distinct candlesticks, each revealing crucial details about market sentiment.

- First Candlestick:

- Appearance: A long red (bearish) candle.

- Significance: Represents strong selling pressure, highlighting the continuation of the downtrend.

- Second Candlestick:

- Appearance: A green (bullish) candle that opens below the previous day’s low.

- Close Position: Must close above the midpoint of the first candlestick.

Why This Matters: The second candlestick’s behavior signals a reversal in momentum, with buyers reclaiming control from sellers.

Step 3: Confirm with Volume

Volume acts as a confirmation tool that strengthens the pattern’s reliability.

- What to Look For:

- Increased trading volume during the formation of the second candlestick.

- This indicates strong buyer interest, enhancing the likelihood of a sustained bullish reversal.

- Real-World Application:

- If the volume spikes significantly alongside the appearance of the Piercing Line Pattern, it validates the signal, giving traders more confidence in their decision-making.

Pro Tip: Use Technical Tools to Validate the Pattern

To ensure accuracy when identifying the Piercing Line Candlestick Pattern, consider integrating technical tools like:

- Moving Averages: To verify the downtrend and assess potential upward momentum.

- Relative Strength Index (RSI): To confirm oversold conditions that align with the pattern’s emergence.

- Support Levels: If the pattern forms near a key support level, it becomes an even stronger reversal signal.

By following this step-by-step guide and incorporating volume and technical confirmations, you can reliably spot the Piercing Line Candlestick Pattern in real-time, maximizing your ability to capitalize on bullish reversals across forex, stocks, or cryptocurrency markets.

Read More: Harami Candlestick Pattern

Pro Strategies for Using the Piercing Line Candlestick Pattern

Unlock advanced strategies for utilizing the Piercing Line Candlestick Pattern in your trading approach.

The Piercing Line Candlestick Pattern is a powerful tool for spotting bullish reversals, but its true potential is unlocked when integrated with other trading techniques and strategies. Here’s a detailed breakdown of how to maximize its effectiveness:

1. Use with Momentum Indicators

Combining the Piercing Line Pattern with momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help validate the strength of the reversal signal.

- RSI Confirmation:

- If the RSI moves out of an oversold zone (typically below 30) while the Piercing Line Pattern forms, it adds credibility to the bullish reversal signal.

- For instance, in forex trading, if the USD/JPY pair forms this pattern and the RSI rises from 28 to 35, it signals that the bearish momentum is weakening.

- MACD Crossovers:

- Look for a bullish crossover in the MACD (where the MACD line crosses above the signal line).

- This confirms that the market momentum is shifting in favor of buyers.

Why This Matters: Momentum indicators act as an additional layer of confirmation, reducing the likelihood of false signals.

2. Employ Support and Resistance Levels

Support and resistance levels play a vital role in the reliability of the Piercing Line Pattern.

- Identify Key Support Zones:

- The effectiveness of the pattern increases when it forms near a significant support level.

- For example, if the EUR/USD pair forms a Piercing Line Pattern at a long-standing support level, it suggests a strong reversal potential.

- Combine with Fibonacci Retracements:

- Use Fibonacci retracement levels to identify areas of confluence. A Piercing Line Pattern forming near a 61.8% retracement level is particularly significant.

- Volume Confirmation at Support:

- Increased volume at the support zone where the pattern forms strengthens its validity, as it indicates heightened buyer interest.

Why This Matters: Aligning the Piercing Line Pattern with strong support levels improves its success rate, allowing traders to make more confident entries.

3. Practice Proper Risk Management

Effective risk management is critical for capitalizing on the Piercing Line Pattern while minimizing potential losses.

- Set Stop-Loss Orders:

- Place your stop-loss just below the low of the second candlestick in the Piercing Line Pattern.

- This limits your risk in case the market doesn’t follow through on the bullish reversal.

- Determine Position Sizing:

- Use a risk-to-reward ratio of at least 1:2. For every dollar risked, aim to make two dollars in potential profit.

- Adjust position sizes based on your account balance and risk tolerance.

- Trail Your Stops:

- As the price moves in your favor, adjust your stop-loss to lock in profits while allowing for market fluctuations.

Why This Matters: Managing risk ensures that even if a trade does not succeed, your overall portfolio remains protected.

4. Use in Conjunction with Trend Analysis

Understanding the larger trend context is crucial when applying the Piercing Line Pattern.

- Identify the Primary Trend:

- If the pattern appears in a downtrend within a larger bullish trend, it may indicate a continuation of the primary trend rather than a full reversal.

- Pair with Moving Averages:

- Use moving averages (e.g., 50-day or 200-day) to identify the overall trend.

- A Piercing Line Pattern forming above a rising moving average provides a stronger bullish signal.

Why This Matters: Contextualizing the Piercing Line Pattern within the broader trend helps avoid entering trades against the market direction.

5. Combine with Multiple Time Frame Analysis

Using multiple time frames provides a comprehensive view of the market and strengthens your decision-making process.

- Higher Time Frame Confirmation:

- Check for the Piercing Line Pattern on higher time frames (e.g., daily or weekly charts) to confirm its significance.

- Lower Time Frame Entries:

- Use lower time frames (e.g., 15-minute or 1-hour charts) to refine your entry points and optimize your risk-to-reward ratio.

Why This Matters: Multi-time frame analysis allows you to align your trades with both short-term and long-term market dynamics.

6. Backtest and Analyze Historical Performance

Before fully integrating the Piercing Line Pattern into your strategy, test its effectiveness on historical data.

- Conduct Backtesting:

- Analyze charts across various markets (forex, stocks, or cryptocurrencies) to identify past instances of the pattern.

- Note the success rate and conditions that led to profitable trades.

- Adjust for Market Conditions:

- Tailor your use of the Piercing Line Pattern based on the market you’re trading. For example, its performance may vary between highly volatile crypto markets and steady forex pairs.

Why This Matters: Backtesting provides confidence and helps fine-tune your approach for different trading environments.

By integrating the Piercing Line Candlestick Pattern with these advanced strategies, you can significantly enhance its reliability and profitability. Whether you’re trading forex, stocks, or cryptocurrencies, these pro tips will ensure that you maximize your edge while keeping risk under control.

Examples of the Piercing Line Candlestick Pattern in Action

Real-world examples provide practical insights into how the Piercing Line Candlestick Pattern works across different markets. Understanding these scenarios helps traders recognize the pattern and capitalize on potential opportunities.

1. Stock Market Example: Apple Inc. (AAPL)

- Scenario: Apple’s stock was in a minor downtrend after disappointing earnings results.

- Piercing Line Formation:

- Day 1 (Bearish Candle): The price closed significantly lower, indicating bearish momentum.

- Day 2 (Bullish Candle): The next day’s candle opened below the previous day’s low but closed above the midpoint of the bearish candle.

- Interpretation: This pattern indicated that buyers were regaining control, leading to a price recovery over the next several trading sessions.

- Outcome: Traders who entered a long position at the close of the bullish candle saw a 5% gain in the following week.

2. Forex Market Example: EUR/USD Pair

- Scenario: The EUR/USD currency pair was in a declining trend due to negative economic data from the Eurozone.

- Piercing Line Formation:

- Day 1 (Bearish Candle): The pair formed a long bearish candlestick as selling pressure intensified.

- Day 2 (Bullish Candle): The next candle opened below the bearish candle’s low but rallied to close above its midpoint.

- Interpretation: This pattern suggested a potential reversal as traders anticipated a pullback in the downtrend.

- Outcome: The pair gained 50 pips in the next trading session, offering a profitable opportunity for swing traders.

Key Observations Across Markets

- Forex: The Piercing Line Pattern in forex trading is highly responsive to volume and momentum indicators like RSI or MACD, making it a reliable reversal tool.

- Stocks: In the stock market, aligning the pattern with support and resistance levels increases its success rate, often leading to significant price movements.

- Cryptocurrencies: Although not covered in this set of examples, the pattern is equally effective in crypto markets, where high volatility makes reversal signals crucial.

By studying these examples, traders can see how the Piercing Line Candlestick Pattern operates in different trading environments and learn to apply it effectively in their strategies.

Opofinance: A Trusted Trading Platform

Opofinance is a leading ASIC-regulated broker offering a secure and user-friendly platform for forex, stock, and cryptocurrency trading. Known for its robust security features, MT5 integration, and social trading services, Opofinance is a top choice for traders seeking reliable tools and a safe trading environment.

Key Features of Opofinance

ASIC Regulation for Security

Opofinance is ASIC-regulated, ensuring transparency and protection for your investments, with stringent financial standards for enhanced security.

MT5 Platform Access

Opofinance provides access to MT5, an advanced trading platform that supports automated trading, real-time data, and in-depth market analysis.

Safe Deposit and Withdrawal Methods

Opofinance offers secure payment options, ensuring that your deposits and withdrawals are processed safely and efficiently.

Social Trading

Opofinance’s social trading feature lets traders follow successful strategies, making it ideal for beginners looking to learn from experienced traders.

User-Friendly Trading Tools

Opofinance combines powerful trading tools with a simple interface, making it easy to track markets and execute trades, both on desktop and mobile devices.

Opofinance is the perfect platform for traders seeking a secure, advanced, and accessible trading environment. Explore more at Opofinance.

Conclusion: Mastering the Piercing Line Candlestick Pattern

The Piercing Line Candlestick Pattern is an invaluable tool for any trader looking to identify bullish reversals with precision. This powerful pattern signals a shift in market sentiment, offering traders a clear indication that the downtrend may be coming to an end, and a potential upward trend is on the horizon.

By mastering the Piercing Line Pattern and incorporating it into your trading strategy, you can take advantage of market reversals and position yourself for potential gains. Whether you combine it with momentum indicators like RSI or MACD, or you use it in conjunction with support and resistance levels, this pattern enhances your ability to make well-informed trading decisions.

As always, successful trading involves a comprehensive approach, where risk management is key. Placing stop-loss orders and ensuring proper risk-to-reward ratios will help safeguard your capital.

Incorporating the Piercing Line Candlestick Pattern into your arsenal, along with other technical analysis tools, can significantly boost your trading effectiveness and bring you closer to consistent profitability.

How does the Piercing Line Pattern differ from the Bullish Engulfing Pattern?

While both patterns signal bullish reversals, the Piercing Line Pattern requires the second candle to close above the midpoint of the first, whereas the Bullish Engulfing Pattern completely engulfs the first candle.

Is the Piercing Line Pattern reliable in forex trading?

Yes, the Piercing Line Pattern is highly reliable in forex trading, especially when confirmed with indicators like RSI or MACD and validated by higher trading volume.

Can I use the Piercing Line Pattern in volatile markets?

Absolutely. The Piercing Line Pattern works well in volatile markets, including cryptocurrencies and forex, as it provides clear reversal signals amidst price fluctuations.