Unlock the secrets to successful forex trading by mastering pivot points. Whether you’re a seasoned trader or just starting, understanding using pivot points in forex trading can transform your approach and significantly boost your trading performance. Pivot points are powerful tools that help you predict market movements, identify key support and resistance levels, and make informed trading decisions. In this comprehensive guide, we’ll delve deep into the world of pivot points, exploring their calculation, types, advantages, and how to integrate them into effective trading strategies. Plus, discover why choosing the right regulated forex broker like Opofinance can enhance your trading experience.

Understanding Pivot Points in Forex Trading

Learn the fundamentals of pivot points and their role in forex trading.

What Are Pivot Points?

Pivot points are essential technical indicators used in forex trading to determine potential turning points in the market. They are calculated based on the high, low, and close prices of the previous trading session, providing traders with key levels that can indicate future support and resistance zones. Pivot points are revered for their objectivity and simplicity, making them a staple in many traders’ toolkits.

- Why are pivot points valuable? They offer a clear framework for identifying where the market might change direction, enabling traders to make strategic entry and exit decisions with greater confidence.

How Do Pivot Points Work?

Pivot points function as psychological barriers in the forex market. When the price approaches a pivot level, traders anticipate a potential reversal or continuation of the trend. Here’s how they are typically utilized:

- Support and Resistance Levels: Pivot points help identify where the price might find support (a floor) or resistance (a ceiling), guiding traders on where to place their trades.

- Market Sentiment: By analyzing pivot points, traders can gauge whether the market is leaning bullish or bearish, aiding in trend identification.

- Entry and Exit Points: Pivot points serve as precise markers for placing stop-loss orders, take-profit targets, and determining optimal entry points.

Understanding pivot points equips traders with a strategic edge, allowing them to navigate the volatile forex market more effectively.

Calculating Pivot Points for Forex Trading

Mastering the calculation of pivot points is crucial for leveraging their full potential in your trading strategy. Here’s a step-by-step guide to calculating pivot points for forex trading:

Standard Formula

The most common method for calculating pivot points for forex trading is the standard or floor pivot point formula. This method is widely used due to its simplicity and effectiveness.

- Pivot Point (P) = (High + Low + Close) / 3

Once the pivot point is established, you can derive the support and resistance levels:

- First Resistance (R1) = (2 × P) – Low

- First Support (S1) = (2 × P) – High

- Second Resistance (R2) = P + (High – Low)

- Second Support (S2) = P – (High – Low)

These levels provide critical insights into potential price movements and help traders make informed decisions.

Advanced Calculation Methods

While the standard formula is widely used, there are alternative methods that offer different perspectives and can be tailored to specific trading styles:

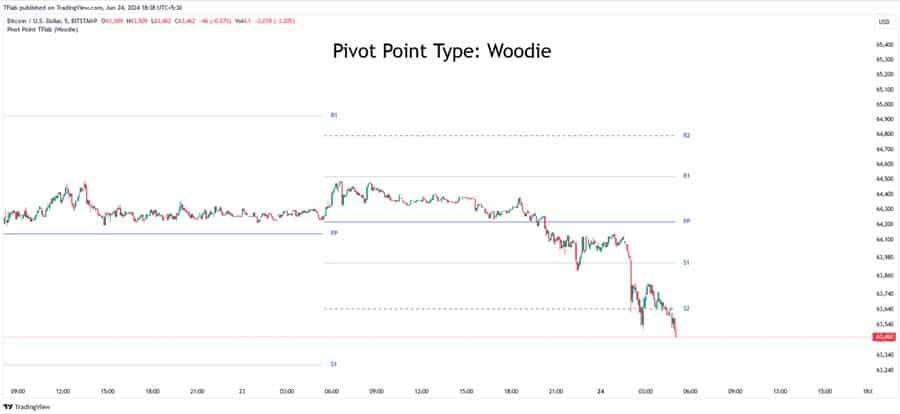

- Woodie’s Pivot Points:

- Description: Focuses more on the current session’s data.

- Advantages: Emphasizes the close price, making it more responsive to recent market movements.

- Application: Ideal for short-term momentum trading, as it reacts more swiftly to recent price changes.

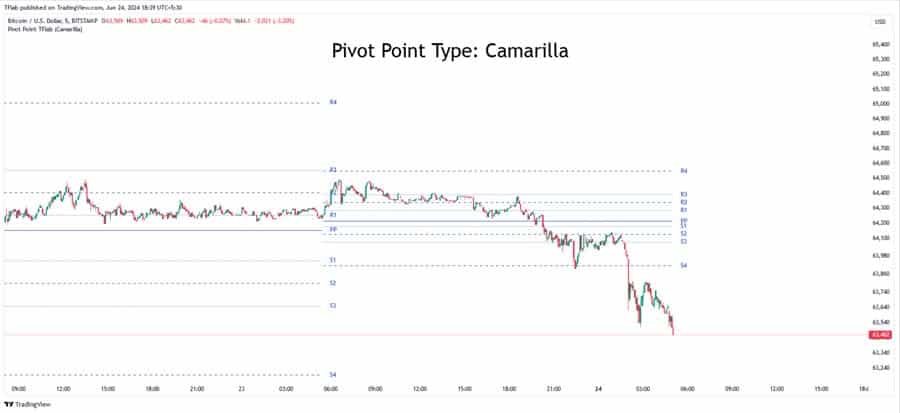

- Camarilla Pivot Points:

- Description: Designed for intra-day trading.

- Advantages: Provides a larger number of support and resistance levels, allowing for more precise trading opportunities.

- Application: Effective for scalping strategies where traders aim to profit from small price movements.

- Fibonacci Pivot Points:

- Description: Integrates Fibonacci retracement levels into the pivot point calculation.

- Advantages: Adds an extra layer of precision by incorporating Fibonacci ratios, enhancing the accuracy of support and resistance levels.

- Application: Ideal for traders who utilize Fibonacci analysis in their strategies, popular among swing traders.

Pro Tip: Experiment with different pivot point calculation methods to find the one that best aligns with your trading style and objectives..

Read More: Master Pivot Point Swing Trading

Types of Pivot Points and Their Applications

Understanding the various types of pivot points and their unique applications can enhance your trading strategy. Here’s an in-depth look at each type:

1. Standard (Floor) Pivot Points

- Description: The traditional method of calculating pivot points using the standard formula.

- Application: Best suited for traders who prefer a straightforward approach to identifying key support and resistance levels.

- Advantages: Simple to calculate and widely recognized, ensuring consistent application across different trading platforms.

Standard pivot points are a reliable choice for both novice and experienced traders seeking to establish clear trading levels.

2. Woodie’s Pivot Points

- Description: A variation that places more emphasis on the closing price.

- Application: Ideal for short-term momentum trading, as it reacts more swiftly to recent price changes.

- Advantages: Provides a more responsive pivot point, which can be beneficial in fast-moving markets.

Woodie’s pivot points offer enhanced sensitivity to recent price action, making them suitable for traders who require timely signals.

3. Camarilla Pivot Points

- Description: Focuses on providing multiple support and resistance levels, offering a broader range of trading opportunities.

- Application: Effective for scalping strategies where traders aim to profit from small price movements.

- Advantages: Offers a comprehensive set of levels, allowing for precise entry and exit points.

Camarilla pivot points are perfect for traders looking to execute quick trades with defined risk-reward ratios.

4. Fibonacci Pivot Points

- Description: Integrates Fibonacci retracement levels into the pivot point calculation.

- Application: Popular among swing traders who utilize Fibonacci analysis in their trading strategies.

- Advantages: Adds an extra layer of precision by incorporating Fibonacci ratios, enhancing the accuracy of support and resistance levels.

Fibonacci pivot points combine the power of pivot points with Fibonacci ratios, providing traders with a nuanced approach to identifying key levels.

Each type of pivot point offers unique strengths, making them suitable for different trading styles and market conditions.

Read More: Most Effective Forex Trading Indicators

Using Pivot Points in Trading Strategies

Incorporate pivot points into your trading strategies for enhanced decision-making.

Incorporating pivot points into your trading strategies can significantly enhance your decision-making process. Here are some effective strategies to consider:

1. Range Trading

Range Trading is ideal for markets that are moving sideways, where prices oscillate between established support and resistance levels.

- Approach:

- Buy Near Support (S1): When the price approaches the first support level, consider entering a long position.

- Sell Near Resistance (R1): When the price nears the first resistance level, consider exiting the long position or entering a short position.

- Confirmation: Use indicators like the Relative Strength Index (RSI) to confirm oversold or overbought conditions before executing trades.

Example of Range Trading

Suppose the EUR/USD pair is trading between S1 at 1.1900 and R1 at 1.2000. A trader might buy at 1.1900 with a stop-loss just below this level and sell at 1.2000 with a take-profit target. If RSI indicates oversold conditions at 1.1900, it reinforces the buy signal, increasing the likelihood of a successful trade.

Range trading with pivot points allows traders to capitalize on predictable price oscillations within a defined range.

2. Breakout Trading

Breakout Trading focuses on capitalizing on price movements that break through established support or resistance levels.

- Approach:

- Buy Above R1: Place buy orders slightly above the first resistance level to catch upward breakouts.

- Sell Below S1: Place sell orders slightly below the first support level to capture downward breakouts.

- Pro Tip: Validate breakout signals using the Moving Average Convergence Divergence (MACD) or Bollinger Bands to ensure the breakout is genuine and not a false signal.

Strategies to Confirm Breakouts

To avoid false breakouts, traders can wait for the price to close beyond R1 or S1 and look for confirmation from volume indicators or trend strength indicators like MACD. For instance, a breakout accompanied by increasing volume suggests strong market participation, making the breakout more reliable.

Breakout trading with pivot points can lead to significant profits when the price moves decisively beyond key levels.

3. Trend Trading

Trend Trading involves following the prevailing market trend and using pivot points to identify optimal entry and exit points.

- Approach:

- Uptrend: Use S1 and S2 as potential entry points for long positions, capitalizing on upward momentum.

- Downtrend: Target R1 and R2 for short positions, leveraging downward momentum.

- Advanced Strategy: Combine pivot points with moving averages to enhance trend analysis and confirm the strength of the trend.

Riding the Trend with Pivot Points

In an uptrend, if the price bounces off S1 and continues upward, it signals the continuation of the trend. Similarly, in a downtrend, breaking below R1 and R2 can confirm the strength of the bearish movement, prompting traders to take short positions.

Trend trading with pivot points allows traders to ride the momentum of the market while using key levels to manage risk and maximize returns.

4. Combining Pivot Points with Other Indicators

Integrating pivot points with other technical indicators can provide more robust trading signals and reduce the likelihood of false signals.

- MACD (Moving Average Convergence Divergence): Helps identify the strength and direction of the trend.

- RSI (Relative Strength Index): Indicates overbought or oversold conditions, complementing pivot point levels.

- Bollinger Bands: Provide insights into price volatility and potential breakout points.

Enhancing Accuracy with Indicator Synergy

For example, a trader might use pivot points to identify key levels and confirm these signals with RSI to ensure the market is not overbought or oversold. If the price approaches a pivot support level and RSI indicates oversold conditions, it strengthens the buy signal, increasing the probability of a successful trade.

By combining pivot points with other indicators, traders can enhance their analysis and make more informed trading decisions.

Read More: Forex Chart Types

Advantages of Using Pivot Points

Pivot points offer numerous benefits that make them an invaluable tool for forex traders. Here are some of the key advantages:

1. Objectivity

Pivot points are mathematically calculated, removing the subjectivity often associated with other technical indicators. This objectivity ensures consistency in identifying support and resistance levels across different trading sessions.

2. Versatility

Pivot points can be applied to various time frames, from intra-day to long-term trading, and are compatible with all currency pairs. This versatility makes them suitable for traders with different strategies and time horizons.

3. Enhancing Trading Strategies

When integrated with other technical tools, pivot points can significantly enhance the effectiveness of trading strategies. They provide clear reference points that can be used alongside indicators like MACD, RSI, and moving averages to validate trading signals.

4. Psychological Significance

Pivot points often coincide with psychological levels where traders tend to place buy and sell orders. This collective behavior can lead to more reliable support and resistance levels, increasing the likelihood of successful trades.

5. Ease of Use

The straightforward calculation and clear interpretation of pivot points make them easy to use, even for novice traders. This accessibility allows traders to quickly incorporate pivot points into their trading routines without extensive training.

Pivot points offer a blend of objectivity, versatility, and simplicity, making them a cornerstone of effective forex trading strategies.

Limitations and Considerations

While pivot points are powerful tools, it’s essential to be aware of their limitations and the factors that can affect their reliability.

1. Potential for False Signals

In highly volatile markets, pivot points can sometimes produce false signals, leading to incorrect trading decisions. Sudden news events or unexpected market movements can cause price to breach pivot levels without sustaining the move.

2. Dependency on Other Indicators

Relying solely on pivot points can be risky. It’s crucial to use them in conjunction with other technical indicators and market analysis tools to confirm trading signals and reduce the likelihood of false alarms.

3. Market Conditions

The effectiveness of pivot points can vary depending on the market conditions. For instance, during trending markets, pivot points might not be as effective as in range-bound markets. Understanding the current market environment is essential for applying pivot point strategies effectively.

4. Limited Predictive Power

While pivot points can indicate potential support and resistance levels, they do not predict the magnitude of price movements or the exact direction. Traders must use additional analysis to determine the strength and potential outcome of price movements around pivot levels.

Being mindful of these limitations and integrating pivot points with a comprehensive trading approach can enhance their effectiveness and minimize potential drawbacks.

Pro Tips for Advanced Traders

Elevate your trading strategies with these pro tips for using pivot points effectively.

For traders looking to elevate their game, here are some advanced tips to maximize the benefits of pivot points in forex trading:

1. Combine Pivot Points with Advanced Indicators

Enhance your pivot point analysis by integrating it with advanced technical indicators such as:

- Ichimoku Clouds: Provides a broader view of support and resistance, trend direction, and momentum.

- Divergence Analysis: Identifies discrepancies between price movements and indicators like RSI or MACD, signaling potential reversals.

2. Optimize Time Frames

Tailor pivot point calculations to suit your trading style:

- Daily Pivot Points: Ideal for short-term trades and day trading strategies.

- Weekly/Monthly Pivot Points: Suitable for swing trading and long-term investment strategies.

Optimizing time frames ensures that pivot points align with your trading objectives and market analysis.

3. Leverage Technology

Utilize advanced trading platforms and tools to streamline pivot point analysis:

- MetaTrader 5 (MT5): Supports pivot point plugins and automated trading strategies, allowing for seamless integration and real-time analysis.

- Trading Bots: Automate pivot point calculations and trade executions based on predefined criteria, enhancing efficiency and reducing manual intervention.

4. Backtest Your Strategies

Before implementing pivot point strategies in live trading, conduct thorough backtesting using historical data. This practice helps you understand the effectiveness of your strategies and make necessary adjustments to improve performance.

5. Stay Informed on Market News

Stay updated with economic events and news that can impact the forex market. Combining pivot point analysis with fundamental analysis ensures a well-rounded approach to trading.

These pro tips can help advanced traders refine their pivot point strategies, leading to more precise and profitable trades.

Opofinance Services: Your Trusted Trading Partner

Choosing the right forex broker is pivotal to your trading success. Opofinance stands out as a premier choice for traders seeking reliability, advanced tools, and exceptional services. Here’s why Opofinance is the ideal partner for your forex trading journey:

- ASIC-Regulated Broker: Trade with confidence knowing that Opofinance is regulated by the Australian Securities and Investments Commission (ASIC), ensuring secure and transparent trading conditions.

- MetaTrader 5 Integration: Access a powerful trading platform that supports pivot point indicators, advanced charting tools, and automated trading capabilities.

- Social Trading Services: Benefit from Opofinance’s social trading platform, allowing you to copy successful traders and learn from their strategies.

- Safe and Convenient Deposits & Withdrawals: Manage your funds effortlessly with a variety of secure and convenient deposit and withdrawal methods.

- Featured on MT5 Brokers List: Recognized officially on the MetaTrader 5 brokers list, affirming Opofinance’s commitment to providing top-tier trading services.

Partner with Opofinance for secure, advanced, and social forex trading solutions.

Ready to elevate your trading experience? Join Opofinance today and take advantage of world-class services designed to support your trading success.

- Secure Trading Environment: Benefit from robust security measures that protect your investments and personal information.

- Comprehensive Customer Support: Access dedicated support teams available to assist you with any trading-related queries.

- Educational Resources: Enhance your trading knowledge with Opofinance’s extensive library of educational materials and resources.

Take Action Now: Open an account with Opofinance today and start trading with a trusted, regulated broker that prioritizes your success.

Conclusion

Pivot points are a cornerstone of forex trading strategies, offering traders an objective and reliable method to identify key support and resistance levels. By understanding using pivot points in forex trading, you can gain valuable insights into market sentiment, anticipate potential price movements, and make informed trading decisions. While pivot points are powerful tools, their true potential is unlocked when combined with other technical indicators and comprehensive market analysis.

Whether you’re a novice seeking to build a solid trading foundation or an experienced trader aiming to refine your strategies, integrating pivot points into your trading arsenal can provide a significant competitive edge. Embrace the strategic advantages of pivot points, stay informed, and continuously adapt your approach to navigate the dynamic forex market successfully.

Key Takeaways

- Objectivity and Consistency: Pivot points offer mathematically derived support and resistance levels, ensuring a consistent framework for trading decisions.

- Versatility Across Time Frames: Applicable to various time frames and currency pairs, pivot points cater to different trading styles and strategies.

- Enhancement of Trading Strategies: When combined with other technical tools like MACD, RSI, and moving averages, pivot points significantly enhance the effectiveness of trading strategies.

- Reliable Trading Partner: Choosing a regulated broker like Opofinance ensures a secure trading environment with advanced tools and exceptional services.

- Advanced Techniques: Utilizing advanced calculation methods and integrating pivot points with other indicators can lead to more precise and profitable trades.

Incorporating pivot points into your forex trading strategy can transform your approach, providing clarity, precision, and increased profitability.

Can pivot points be used for algorithmic trading?

Yes, pivot points can be integrated into algorithmic trading systems. By programming your trading algorithms to recognize and act upon pivot point levels, you can automate trading decisions based on predefined criteria, enhancing efficiency and consistency in your trading strategy.

Algorithmic trading using pivot points allows for rapid and emotion-free execution of trades, ensuring that your strategy is applied consistently without human error.

How often should pivot points be recalculated?

Pivot points are typically recalculated at the start of each new trading session. For day traders, this means recalculating daily, while swing traders might use weekly or monthly pivot points. The frequency depends on your trading style and the time frame you are operating within.

Regular recalculation of pivot points ensures that your trading strategy remains aligned with the latest market conditions and price movements.

Do pivot points work on all currency pairs?

Pivot points are versatile and can be applied to all major and minor currency pairs. However, their effectiveness can vary based on the liquidity and volatility of the specific pair. It’s advisable to backtest pivot point strategies on different currency pairs to determine their reliability.

Testing pivot point strategies across various currency pairs helps identify which pairs respond best to pivot-based trading, allowing you to optimize your trading approach.