Unlock the secrets to forecasting forex price movements and elevate your trading strategy to new heights. Predicting forex price movement is not just a skill; it’s an essential cornerstone for any trader aiming to achieve consistent success in the volatile currency markets. In an arena where every second counts and market conditions can shift rapidly, understanding how to accurately predict price movements can make the difference between profit and loss. This comprehensive guide delves deep into the art and science of forex price movement prediction, offering actionable insights, advanced techniques, and expert strategies to enhance your trading performance.

Introduction: The Critical Role of Predicting Forex Price Movement in Trading Success

In the fast-paced world of forex trading, the ability to predict forex price movement is paramount. Imagine being able to anticipate market shifts before they happen, allowing you to make informed trading decisions that maximize profits and minimize risks. This capability is what sets successful traders apart from the rest. Predicting forex price movements involves analyzing a myriad of factors that influence currency values, from economic indicators and geopolitical events to market sentiment and technical patterns.

Choosing a regulated forex broker is the first step toward harnessing these predictive strategies effectively. A reliable broker provides the tools, resources, and security necessary to implement your trading strategies with confidence. In this article, we will explore various methods to forecast currency exchange rates, including fundamental analysis, technical analysis, sentiment analysis, quantitative analysis, intermarket analysis, and wave and pattern analysis. Additionally, we will offer advanced tips for seasoned traders and highlight the importance of risk management in your trading endeavors. By the end of this guide, you’ll have a robust understanding of predicting forex price movement and apply these insights to achieve trading success.

Fundamental Analysis: The Foundation of Predicting Forex Price Movement

Fundamental analysis is the bedrock upon which many traders build their strategies for predicting forex price movement. This method involves evaluating economic, social, and political factors that might influence a currency’s value. By understanding the underlying economic conditions, traders can make informed predictions about future price movements.

Understand the key economic indicators that influence forex price movements.

1. Key Economic Indicators

Economic indicators are crucial in gauging the health and direction of an economy, directly impacting forex price movements. Some of the most significant indicators include:

- Gross Domestic Product (GDP): GDP measures the total economic output of a country. A growing GDP signifies a robust economy, which typically strengthens the national currency as it attracts foreign investment.

- Employment Rates: High employment levels indicate economic stability and consumer confidence, leading to increased demand for the currency.

- Inflation Rates: Moderate inflation suggests a stable economy, while hyperinflation or deflation can lead to currency depreciation.

Pro Tip: Stay updated with economic calendars to monitor the release of these indicators. Unexpected changes can create significant volatility, presenting both opportunities and risks for traders.

2. Government Monetary and Fiscal Policies

Government policies play a pivotal role in shaping economic conditions and, consequently, forex price movements.

- Monetary Policy: Central banks influence interest rates and money supply. An increase in interest rates can attract foreign investors seeking higher returns, thereby strengthening the currency.

- Fiscal Policy: Government spending and taxation policies affect economic growth. Expansionary fiscal policies can stimulate growth but may lead to inflation, impacting currency value.

Understanding the interplay between these policies allows traders to anticipate changes in currency strength and adjust their strategies accordingly.

3. Geopolitical Events and Market Expectations

Geopolitical stability is a key determinant of a currency’s strength. Events such as elections, trade negotiations, and conflicts can cause significant fluctuations in forex price movements.

- Trade Agreements: Positive trade relations can enhance a country’s economic prospects, boosting its currency.

- Political Unrest: Instability can erode investor confidence, leading to currency depreciation.

Market expectations about future events also influence current price movements. Traders who can accurately assess how these events will impact the economy can better predict forex price movements.

Don’t let unexpected geopolitical events catch you off guard—stay informed and ready to act!

Technical Analysis: Unlocking Forex Price Movement Prediction Techniques

While fundamental analysis provides a macroeconomic perspective, technical analysis delves into price charts and historical data to forecast future forex price movements. This method is particularly popular among traders who rely on patterns and trends to make trading decisions.

Common Technical Tools for Predicting Forex Price Movement

- Moving Averages (MA): Moving averages smooth out price data to identify trends. A rising MA indicates an upward trend, while a declining MA suggests a downward trend.

- Bollinger Bands: These bands measure market volatility. When prices approach the upper band, the market may be overbought; nearing the lower band could indicate an oversold condition.

- Fibonacci Retracements: This tool identifies potential support and resistance levels based on the Fibonacci sequence. Traders use these levels to predict price reversals and continuation patterns.

Smart Money Concepts

Understanding smart money concepts involves tracking the activities of institutional investors and large financial players who have the resources and information to influence market movements.

- Institutional Trading Patterns: Large trades by institutions can signal upcoming market trends. Identifying these patterns helps predict significant price movements.

- Order Flow Analysis: Monitoring the flow of buy and sell orders provides insights into market sentiment and potential price movements. A surge in buy orders may indicate an impending price increase.

- Liquidity Pools: Institutions often target specific price levels where liquidity is high to execute large trades without causing significant price changes. Recognizing these liquidity pools can help anticipate price movements.

Pro Tip: Use volume analysis and order flow tools to follow institutional activity effectively, giving you a competitive edge in predicting price movements.

Sentiment Analysis: Gauging the Human Element in Forex Price Movement

Sentiment analysis focuses on the psychological aspects of trading, assessing the collective mood and behavior of market participants. Understanding market sentiment can provide valuable clues about future forex price movements.

Key Sentiment Tools

- Commitment of Traders (COT) Reports: These reports reveal the positioning of different trader categories, such as commercial and non-commercial traders. A high net long position by non-commercial traders may indicate bullish sentiment.

- News Impact: Significant news events can rapidly shift market sentiment. Economic reports, political announcements, and global events often trigger swift price reactions.

- Social Media Sentiment: Platforms like Twitter and trading forums offer real-time insights into trader sentiment. Analyzing social media trends can help identify emerging market biases.

Understanding the Impact of News and Social Media

News and social media can significantly influence market dynamics by shaping trader perceptions and reactions. For instance, positive economic news can boost confidence in a currency, while negative news may lead to panic selling.

By staying attuned to sentiment indicators and understanding their implications, traders can better anticipate market movements and adjust their strategies accordingly.

Harness the power of collective sentiment to stay ahead in the forex game!

Quantitative Analysis: Leveraging Data for Predicting Forex Price Movement

Quantitative analysis employs mathematical models and statistical techniques to forecast forex price movements. This method is favored by traders who rely on data-driven strategies to make informed decisions.

Utilize quantitative analysis to leverage data-driven forex price movement predictions.

Statistical Models and Machine Learning

- Regression Analysis: This statistical method examines the relationship between different variables to predict future price movements. By analyzing historical data, traders can identify patterns and correlations that inform their forecasts.

- Machine Learning (ML) and Artificial Intelligence (AI): Advanced ML algorithms can process vast datasets to uncover hidden patterns and make precise predictions. AI-driven models continuously learn and adapt, improving their forecasting accuracy over time.

Developing Quantitative Trading Strategies

Quantitative trading strategies are built on backtested data to ensure their effectiveness. By simulating trades based on historical data, traders can evaluate the performance of their strategies before deploying them in live markets.

Pro Tip: Incorporate machine learning tools into your quantitative analysis to enhance the precision and adaptability of your forex price movement predictions.

Intermarket Analysis: Understanding Market Relationships to Forecast Forex Price Movement

Intermarket analysis explores the relationships between different financial markets to predict forex price movements. By understanding how various markets influence each other, traders can gain a comprehensive view of the economic landscape.

Correlations Between Forex and Commodities

- Gold and Oil Prices: Commodities like gold and oil often have a strong correlation with currency values. For example, rising oil prices can strengthen currencies of oil-exporting countries.

- Commodity Demand: The demand for commodities can impact inflation rates and economic growth, thereby influencing forex price movements.

Impact of Stock Indices and Bond Yields

- Stock Indices: Equity markets provide insights into investor confidence and risk appetite. A rising stock index may indicate a bullish market sentiment, strengthening the associated currency.

- Bond Yields: Differences in bond yields between countries can affect currency valuations. Higher bond yields attract foreign investment, leading to currency appreciation.

Using Intermarket Analysis for Predicting Market Shifts

By analyzing intermarket relationships, traders can identify potential market shifts and adjust their strategies accordingly. For instance, a decline in stock indices coupled with rising bond yields might signal a shift towards a stronger currency.

Pro Tip: Regularly monitor intermarket indicators to gain a holistic understanding of market dynamics and enhance your forex price movement predictions.

Wave and Pattern Analysis: Decoding Market Movements for Forex Prediction

Wave and pattern analysis involves identifying recurring price formations and market cycles to predict future forex price movements. This method is rooted in the belief that markets move in predictable patterns that can be analyzed and anticipated.

Elliott Wave Theory

Elliott Wave Theory posits that market prices move in a series of waves, reflecting investor sentiment and psychology. By identifying these wave patterns, traders can forecast potential price movements and trends.

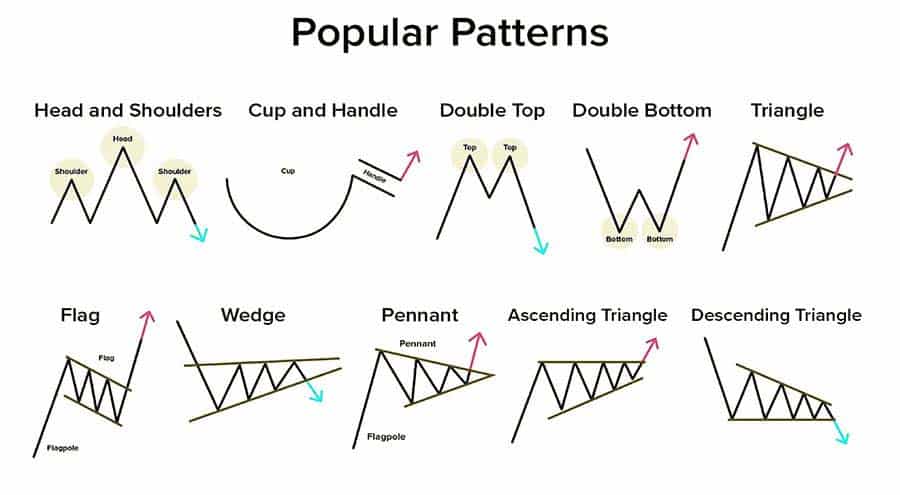

Chart Patterns

- Head and Shoulders: This pattern indicates a potential reversal in trend. A head and shoulders top suggests a bearish reversal, while an inverse pattern signals a bullish reversal.

- Flags and Triangles: These continuation patterns signal the continuation of the prevailing trend. Flags indicate brief consolidations, while triangles suggest impending breakouts.

Harmonic Patterns

Harmonic patterns, such as Gartley and Bat, combine Fibonacci retracements with specific price movements to predict future trends. These patterns offer precise entry and exit points for traders looking to capitalize on price reversals.

Pro Tip: Combine wave and pattern analysis with other technical indicators to validate your predictions and improve trading accuracy.

Combining Multiple Analysis Methods: A Holistic Approach to Predicting Forex Price Movement

Relying on a single method for predicting forex price movement can limit your trading success. Integrating fundamental, technical, and sentiment analysis provides a comprehensive view of the market, enhancing prediction accuracy and reliability.

Benefits of Integrating Multiple Analysis Methods

- Enhanced Accuracy: Combining different analytical approaches reduces the likelihood of false signals and improves prediction precision.

- Comprehensive Insights: A holistic strategy considers various market factors, offering a more complete understanding of potential price movements.

How Smart Money Insights Enhance Prediction Accuracy

Understanding the behavior of institutional traders, or “smart money,” can provide valuable insights into market trends. By analyzing institutional activity, traders can anticipate significant price movements and align their strategies accordingly.

Steps to Develop a Holistic Trading Strategy

- Combine Fundamental and Technical Analysis: Use economic indicators to identify long-term trends and technical tools to time your trades.

- Incorporate Sentiment Analysis: Assess market mood to confirm the direction of your trades.

- Utilize Quantitative Models: Apply statistical and machine learning models to refine your predictions.

- Implement Risk Management: Protect your capital by managing risks effectively.

Pro Tip: Regularly review and adjust your integrated strategy based on market conditions and new insights to maintain its effectiveness.

Risk Management: The Safety Net of Predicting Forex Price Movement

Predicting forex price movements is valuable, but managing risks is crucial for long-term success. Effective risk management strategies protect your capital and ensure sustainable trading practices.

Protect your investments with robust risk management strategies.

Essential Risk Management Tools

- Position Sizing: Determine the appropriate size of each trade to avoid overexposure. Proper position sizing helps maintain a balanced portfolio and limits potential losses.

- Stop-Loss Orders: Set predefined exit points to automatically close losing trades. Stop-loss orders prevent significant losses by limiting the downside of unfavorable market movements.

- Diversification: Spread your investments across multiple currencies and strategies. Diversification reduces the impact of a single adverse event on your overall portfolio.

Balancing Risk-Reward Ratios

Maintaining an optimal risk-reward ratio is essential for maximizing profitability while minimizing risks. Aim for a higher potential reward compared to the risk taken on each trade to ensure overall positive returns.

Pro Tip: Continuously evaluate and adjust your risk management strategies based on your trading performance and market conditions to maintain their effectiveness.

Protect your hard-earned capital with robust risk management and trade with confidence!

Tips for Different Types of Traders: Maximizing Prediction Benefits

Forex traders come in various styles, each with unique approaches and timeframes. Understanding how to leverage predicting forex price movement can significantly enhance each trader’s performance. Here are tailored tips for different types of traders:

Day Traders

Benefits from Prediction: Day traders thrive on quick decision-making and capitalize on short-term price movements within the same trading day. Accurate predictions allow them to enter and exit trades with precision, maximizing profits and minimizing risks associated with intraday volatility.

When to Predict: For day traders, predictions should be part of their daily routine. Conducting predictions at the start of the trading day helps outline potential opportunities and risks. Additionally, real-time adjustments based on live market data throughout the day are crucial to respond to rapid price changes.

Additional Tips: Utilize high-frequency indicators like moving averages and the Relative Strength Index (RSI) to capture swift market changes. Staying informed about daily economic news and events that can impact intraday movements is essential for making timely and accurate predictions.

Swing Traders

Benefits from Prediction: Swing traders focus on medium-term movements, holding positions for several days or weeks. Predicting these movements helps them ride significant trends, maximizing gains from substantial price swings.

When to Predict: Swing traders should perform comprehensive analysis at the end of each week to plan for the upcoming trading period. Mid-week reassessments based on new data allow them to adjust positions as necessary, ensuring their strategies remain aligned with market developments.

Additional Tips: Combining multiple indicators, such as MACD and Fibonacci retracements, strengthens prediction accuracy. Managing emotions and maintaining discipline is crucial to avoid overtrading based on predictions, ensuring consistent performance over time.

Scalpers

Benefits from Prediction: Scalpers aim to profit from numerous quick trades that capitalize on small price shifts. Accurate predictions of these micro-movements enable them to execute trades efficiently, maximizing their profit potential.

When to Predict: Scalpers should analyze potential micro-movements before the market opens to identify scalping opportunities. Continuous monitoring and real-time prediction adjustments are essential to respond to fleeting price changes effectively.

Additional Tips: Leveraging technology, such as automated trading systems, can enhance the speed and accuracy of scalping strategies based on predictions. Focusing on highly liquid currency pairs ensures quick order executions and minimizes slippage, crucial for successful scalping.

Position Traders

Benefits from Prediction: Position traders hold positions for extended periods, from weeks to months. Predicting long-term trends supports their strategy by providing insights into sustained market movements, allowing for strategic planning of entry and exit points.

When to Predict: Position traders should conduct in-depth predictions at the beginning of each month or quarter to guide their long-term trading decisions. Periodic reviews in line with significant economic or geopolitical developments help them adjust their strategies as needed.

Additional Tips: Focusing on major currency pairs that exhibit stable long-term trends provides more reliable predictions. Patience and discipline are key, as adhering to long-term strategies without being swayed by short-term market noise ensures consistent success.

No matter your trading style, harness the power of prediction to stay ahead and achieve your trading goals!

Opofinance Services: A Trusted ASIC-Regulated Forex Broker

When it comes to trading, having a reliable partner is essential. Opofinance stands out as an ASIC-regulated forex broker, providing a secure and convenient platform for traders. Here’s why Opofinance is the ideal choice for your forex trading needs:

Why Choose Opofinance?

- Social Trading Service: Learn from and copy successful traders, leveraging their expertise to enhance your trading performance.

- Safe Deposits and Withdrawals: Enjoy fast and secure transactions with multiple convenient methods.

- MT5 Integration: Access advanced trading features through the MetaTrader 5 platform, offering superior charting tools and automated trading capabilities.

- Regulation: ASIC certification ensures transparency, security, and compliance with stringent financial standards.

Exclusive Benefits of Opofinance

- Featured on MT5 Brokers List: Gain access to a platform trusted by traders worldwide, known for its reliability and comprehensive features.

- Safe and Convenient Methods: Seamlessly manage your funds with secure deposit and withdrawal options tailored to your needs.

- Advanced Social Trading: Engage with a community of traders, share strategies, and benefit from collective insights to refine your trading approach.

Start your trading journey with a trusted broker like Opofinance today! Sign up now and experience unparalleled trading services.

Don’t miss out on the opportunity to trade with a broker that prioritizes your success and security!

Conclusion: Your Path to Mastery in Predicting Forex Price Movement

Predicting forex price movement is both an art and a science, requiring a deep understanding of various analytical methods and the ability to adapt to ever-changing market conditions. By leveraging fundamental analysis, technical analysis, sentiment analysis, quantitative analysis, intermarket analysis, and wave and pattern analysis, you can develop robust strategies that enhance your trading performance. The key to success lies in combining these methods, managing risks effectively, and continuously refining your approach based on market evolution.

Embrace the comprehensive strategies outlined in this guide, and take your forex trading to new heights. With dedication, discipline, and the right tools, mastering the prediction of forex price movements is within your reach.

Key Takeaways

- Understand Economic Indicators: Fundamental analysis provides the macroeconomic context essential for predicting forex price movements.

- Master Technical Tools: Utilize moving averages, Bollinger Bands, and Fibonacci retracements to identify patterns and trends.

- Incorporate Sentiment Insights: Assess trader psychology and market sentiment to gauge potential market directions.

- Adopt Advanced Strategies: Leverage quantitative models and intermarket relationships to enhance forecasting accuracy.

- Partner with a Reliable Broker: Choose an ASIC-regulated broker like Opofinance for secure and efficient trading.

- Implement Effective Risk Management: Protect your capital with position sizing, stop-loss orders, and diversification strategies.

- Combine Multiple Analysis Methods: Integrate fundamental, technical, and sentiment analysis for a holistic trading approach.

- Tailor Strategies to Your Trading Style: Apply specific prediction techniques and tips suited to your trading type for optimal results.

How Can I Improve My Forex Price Prediction Skills?

Improving your ability to predict forex price movements involves a combination of education, practice, and the use of advanced analytical tools. Start by mastering fundamental and technical analysis to build a strong analytical foundation. Incorporate sentiment analysis to understand market psychology and use quantitative models to enhance precision. Additionally, practicing on demo accounts allows you to refine your strategies without risking real capital. Continuously stay updated with market news and trends, and consider leveraging machine learning tools to analyze vast datasets for more accurate predictions.

What Are the Most Effective Forex Price Movement Prediction Techniques?

The most effective techniques for predicting forex price movements combine multiple analytical approaches. Technical analysis tools like moving averages and Bollinger Bands are essential for identifying trends and patterns. Fundamental analysis provides insights into economic indicators and geopolitical events that influence currency values. Sentiment analysis gauges market mood and trader behavior, while quantitative models and machine learning offer data-driven predictions. Integrating these techniques ensures a comprehensive understanding of the market, enhancing prediction accuracy and trading success.

Can Predicting Forex Prices Guarantee Profits?

While accurately predicting forex price movements can significantly improve your trading performance, it does not guarantee profits. Forex markets are inherently unpredictable and influenced by numerous factors, including sudden geopolitical events and unexpected economic shifts. However, by combining multiple analytical methods, implementing effective risk management strategies, and staying disciplined in your trading approach, you can increase your chances of making profitable trades. It’s important to understand that no prediction method is foolproof, and maintaining a balanced perspective on potential risks and rewards is crucial for long-term success.